A Readers Guide To Taxes, Investments, Common Questions & Advice From Experts

Diunggah oleh

ARCEditorJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

A Readers Guide To Taxes, Investments, Common Questions & Advice From Experts

Diunggah oleh

ARCEditorHak Cipta:

Format Tersedia

2

0

1

4

2

0

1

4

A Supplement to The Abilene Reflector-Chronicle January 2014

A Readers Guide to Taxes, Investments,

Common Questions & Advice from experts

2 Tax and Investment Guide, January 2014 www.abilene-rc.com

BarrEtt tax and accOunting

P.O. BOx 323, 201 n. BuckEYE avE.

aBilEnE, kS 67410

PhOnE: 785.263.2228

E-mail: Barrtax@att.nEt

G. Randall BaRRett Over 20 Years Experience

Tim Horan Refector-Chronicle

Paul Brunson at the H&R Block offce on East 14th Street.

Tsunami maybe coming Jan. 31

Understanding

Affordable

Health Care Act

By PAUL BRUNSON

H&R Block

In the past few years, it

seems that every tax sea-

son has been different for

both the taxpayer and the

tax preparer. Congress and

the IRS continue to change

the rules each year, but

neither seems concerned

about how their actions im-

pact the average American

citizen.

Last year, Congress

didnt pass the tax laws

for 2012 until Jan. 2, 2013.

The result was a disaster

for both the IRS and tax

preparation companies to

implement in a matter of

weeks, while the taxpay-

ers had to wait to fle and

delayed the receipt of their

tax refunds by months in

some cases.

This year, the IRS has

blamed the three-week

government shutdown in

October 2013 for delay-

ing their programming

and testing for the new tax

season, even though the

changes were dramatically

fewer and there should have

been no last-minute delays.

However, the landscape is

set and now, Friday, Jan.

31, the IRS will begin re-

ceiving electronically fled

tax returns. Most software

preparation companies, in-

cluding H&R Block have

been open since Jan. 6 to

prepare tax returns and

then hold them at our host

until the IRS is ready to

receive them. Most people

and even employers have

delayed getting out their

W 2s and coming in to

have their taxes prepared

because they thought they

had to wait. The result is

going to be a tsunami of

taxpayers coming all at

once wanting to do their

taxes on or after Jan. 31.

The good news is that

once the IRS receives the

tax returns and begins to

process them, we should

not see any delays in get-

ting refunds out the door to

the taxpayer. After the IRS

acknowledges the receipt

of the tax return, the tax-

payer can expect to receive

their refund in eight to 23

days. After the initial rush,

the refunds will probably

be processed closer to the

shorter timeline.

The MAJOR change this

year that adds complex-

ity to the return process is

the implementation of the

Affordable Care Act (aka

Obamacare). Congress and

the Obama administration

passed this law several

years ago, but the impact

is just beginning to be felt

and it has become a part

of the tax return process.

Depending upon whether

the taxpayer and/or de-

pendents have adequate

health insurance as de-

fned by the new law, one

is REQUIRED to purchase

health insurance or be

charged a penalty, which

the administration defned

as a tax before the Supreme

Court. Since Congress has

the constitutional right to

tax, the Court determined

that the tax element over-

rode the issue of whether

the individual mandate to

require every person to

purchase health insurance

was constitutional.

While many dates and

deadlines are continuing to

be changed by the adminis-

tration that were defned in

the law, the current position

is that if anyone does NOT

have health insurance that

meets the ACA standard

by March 31, 2014, that

taxpayer will be required

to pay a tax when he/she

fles their 2014 tax return

by April 15, 2015. The

taxpayer will be paying

an additional tax as well

as their individual income

tax balance due or their

refund will be reduced by

the amount of the health

care tax. It is important to

understand that the tax will

be due and the individual

would still choose to have

NO health insurance cov-

erage. If, however, the

taxpayer goes into the fed-

eral or state exchange and

purchases health insurance

at a potentially subsidized

price by March 31, 2014,

they can avoid the tax pen-

alty.

Because of the prob-

lems with the healthcare.

gov website rollout, there

may be extensions on

these dates, but one cannot

count on the extra time. At

the present time, Kansas

has no state exchange and

Kansas taxpayers must use

the federal healthcare.gov

website.

While these issues have

added additional com-

plexities at tax time, H&R

Block staff is trained and

ready to help you through

your normal tax prepara-

tion as well as providing

you individualized guid-

ance in going through the

new minefeld of Obam-

acare. H&R Block has

found that a large percent-

age of taxpayers who at-

tempt to prepare their own

taxes make errors and, in

fact, leave over $1 billion

on the table. We encour-

age you to take advantage

of our expertise at H & R

Block and let us help you

get your part of the $1 bil-

lion back this year.

www.abilene-rc.com Tax and Investment Guide, January 2014 3

206 N.W. 2nd, Abilene, Kansas

785-263-3111

COOK REAL ESTATE COOK REAL ESTATE

Serving Abilene

& the Surrounding Area

Give us a call today!

team to help you with one

of your most

important investments...

ANewHome.

Trust the

Becky Schwab

Owner/Broker

Yvette Ebright

Realtor

Shelly Crane

Realtor

Revisiting some basic investment strategies

BY PATTI OMALLEY-

WEINGARTNER

Benjamin F. Edwards & Co.,

Member SIPC

In light of the recent

market volatility, it seems

like a good time to review

some basic tenets of suc-

cessful investing:

Dollar Cost Averaging

If a person were to invest

the same fxed amount of

money every week, month

or year in a given stock or

mutual fund over time, a

phenomenal truth will soon

become evident: The aver-

age cost per share will be

less than the average price

per share. Given the nor-

mal historical volatility

of prices, i.e. their rise and

fall in prices, that set dollar

amount invested will buy

more shares when the price

is lower and fewer shares

when the price is higher.

If you are in the accumu-

lation stage of life, it is a

good practice to set aside a

certain percentage of your

earnings regularly (weekly,

monthly, quarter, etc.). You

can establish a periodic in-

vestment plan that would

automatically buy shares

of a stock or mutual fund

on a regular basis thus tak-

ing advantage of the bene-

ft of dollar cost averaging,

i.e. buying more shares

per dollar invested when

prices are lower, and buy-

ing fewer shares per dollar

when prices are higher.

However, dollar cost av-

eraging does not assure a

proft and does not protect

against losses in a declin-

ing market.

Dividend Reinvestment

Plans Under such a

plan, distributed dividends

would be used to buy ad-

ditional shares of the same

stock rather than be paid

out as cash. Many bro-

kerage companies have

such plans for which they

charge no commissions.

The more shares you

have, the more dividends

youll get. The more divi-

dends you get, the more

new shares you would buy.

This process would con-

tinue and there would be

ever more shares, paying

out ever more dividends,

purchasing even more

shares, etc. A sweet deal,

especially at times like

these when cash taken and

deposited in savings or

money market accounts

are paying historically

low rates on balances. A

program such as dividend

reinvestment is akin to

dollar cost averaging and

might make sense for long

term investors looking to

accumulate and grow their

assets or wealth. Keep in

mind that not all compa-

nies are paying dividends,

as companies are under no

obligation to do so.

Compounding Weve

all heard the answer to the

question, What would

one penny, a single cent,

be worth if it doubled ev-

ery day for a month? The

answer is $5,368,709.12!

And that is achieved

through the miracle of

compounding. Of course

there is no known invest-

ment that will double your

money every day, but there

is a simple formula for

determining how long it

would take to double your

money at a given rate of re-

turn: The Rule of 72. The

Rule of 72 simply states

that if you know the annual

percentage rate of return

you can earn, that number

divided into 72 will tell

you how long it would take

to double your money.

For example, if you

could earn 3 percent on a

certifcate of deposit, di-

viding that percentage, 3,

into 72, gives the answer

of 24 years. Conversely,

if you had a given amount

of money to invest and

wanted to know what rate

of return you would need

Tim Horan Refector-Chronicle

The staff at the Benjamin F. Edwards & Co., in the newly remodeled offce at the corner of Buckeye Ave. and Third Street (from

left) Brian Williams, Patricia OMalley-Weingartner, Donna Nanninga and Marcella Cobb.

Basic

trends

for successful

investing

See Basic, Page 7

Annuities

College Funding

Retirement Planning

Stocks & Options Strategies

Mutual Funds

IRAs & ROTH IRAs

Insurance Products

Tax-Managed investments

NO BANK GUARANTEE NOT FDIC INSURED MAY LOSE VALUE

Securities & Advisory Services offered through Investment Professionals, Inc.,

a Registered Broker Dealer & R.I.A. Member FINRA & SIPC

112 North Main Hope, KS 67451

Tel 785-366-7225 Fax 785-366-7333

dan.cook@invpro.com

Dan Cook

Financial Consultant

Solomon

126 W. Main

(785) 655-2941

Abilene

501 N. Cedar

(785) 263-1332

Salina

605 Magnolia

(785) 827-3600

There is still time to fund

Your 2013 IRA

or Education Savings Account!

Call us today for details.

Tim Horan Refector-Chronicle

Bryce Koehn in the Edward Jones offce on North Broadway.

By BRYCE C. KOEHN

Edward Jones

You need to save and in-

vest as much as possible to

pay for the retirement life-

style youve envisioned.

But your retirement in-

come also depends, to a

certain degree, on how

your retirement funds are

taxed. And thats why you

may be interested in tax di-

versifcation.

To understand the con-

cept of tax diversifcation,

youll need to be familiar

with how two of the most

important retirement-sav-

ings vehicles an IRA

and a 401(k) are taxed.

Essentially, these accounts

can be classifed as either

traditional or Roth.

When you invest in a tradi-

tional IRA or 401(k), your

contributions may be tax

deductible and your earn-

ings can grow tax deferred.

With a Roth IRA or 401(k),

your contributions are not

deductible, but your dis-

tributions can potentially

be tax free, provided you

meet certain conditions.

(Keep in mind, though,

that to contribute to a Roth

IRA, you cant exceed des-

ignated income limits.

Also, not all employers

offer the Roth option for

401(k) plans.) Of course,

Use Tax diversifcation to help manage retirement income

tax free sounds better

than tax deferred, so you

might think that a Roth op-

tion is always going to be

preferable. But thats not

necessarily the case. If you

think your tax bracket will

be lower in retirement than

when you were working, a

traditional IRA or 401(k)

might be a better choice,

due to the cumulative tax

deductions you took at a

higher tax rate.

But if your tax bracket

will be the same, or higher,

during retirement, then the

value of tax-free distribu-

tions from a Roth IRA or

401(k) may outweigh the

benefts of the tax deduc-

tions youd get from a tra-

ditional IRA or 401(k). So

making the choice between

traditional and Roth

could be tricky. But heres

the good news: You dont

necessarily have to choose,

at least not with your IRA.

Thats because you may be

able to contribute to both a

traditional IRA and a Roth

IRA, assuming you meet

the Roths income guide-

lines.

This allows you to beneft

from both the tax deduc-

tions of the traditional IRA

and the potential tax-free

distributions of the Roth

IRA. And once you retire,

this tax diversifcation

can be especially valuable.

Why? Because when

you have money in differ-

ent types of accounts, you

gain fexibility in how you

structure your withdraw-

als and this fexibility

can help you potentially

increase the amount of

your after-tax disposable

income.

If you have a variety of

accounts, with different tax

treatments, you could de-

cide to frst make your re-

quired withdrawals (from a

traditional IRA and 401(k)

or other employer-spon-

sored plan), followed, in

order, by withdrawals from

your taxable investment

accounts, your tax-de-

ferred accounts and, fnal-

ly, your tax-free accounts.

Keep in mind, though, that

you may need to vary your

actual sequence of with-

drawals from year to year,

depending on your tax situ-

ation.

For example, it might

make sense to change the

order of withdrawals, or

take withdrawals from

multiple accounts, to help

reduce taxes and avoid

moving into a different tax

bracket.

Clearly, tax diversifca-

tion can be benefcial. So

after consulting with your

tax and fnancial advisors,

consider ways of allocat-

ing your retirement plan

contributions to provide

the fexibility you need

to maximize your income

during your retirement

years.

Edward Jones, its em-

ployees and fnancial advi-

sors cannot provide tax or

legal advice. You should

consult your attorney or

qualifed tax advisor re-

garding your situation.

Invest

now

to pay

for

retirement

4 Tax and Investment Guide, January 2014 www.abilene-rc.com

www.abilene-rc.com Tax and Investment Guide, January 2014 5

307 N Cedar (785) 263-1740 Abilene

DAvID E. BurrIs

Accounting Tax Preparation

Individual Corporate

Over 30 Years Experience

785-263-4080 208 NE 14th Street, Abilene, KS 67410

OBTP#B13696 2013 HRB Tax Group, Inc.

help + health = helpth

SM

Help understanding

health insurance.

The Affordable Care Act has made health care a tax issue. And

no one knows taxes like we do. When you prepare and file

your taxes with H&R Block, our tax professionals can walk you

through a Tax and Health Care Review to help you understand

the full tax implications of your health care decision.

Its free. Its friendly. Its helpth

SM

. Make your appointment today.

By ANITA K. MILLER

Ameriprise Financial Services

Some investors wonder

if it makes sense for them

to invest in a company be-

cause they like the prod-

ucts or services it offers.

This question often stems

from their familiarity with

the famous investment

principle of legendary

fund manager Peter Lynch,

which is, Invest in what

you know.

The answer? It depends.

Although it can be fun

and interesting to track the

ups and downs of a com-

pany that makes or pro-

vides something you love,

its not necessarily wise

to put your money on the

line. Choosing where to

invest can be complicated

and when youre consider-

ing investing in a specifc

stock, there are several fac-

tors to consider.

First, its a good idea to

know whether the company

has solid fnancials, good

leadership and enough new

products or services on the

horizon to remain competi-

tive. Be prepared to invest

some time getting answers

to these questions because

it may involve looking at

analyst reports and com-

pany quarterly and annual

earnings releases.

It may be helpful to track

the stock youre consid-

ering for a period of time

to see how wildly it may

swing or if its fairly steady.

While it may match the ups

and downs of the S&P 500,

dig into any other factors

that might cause that spe-

cifc companys stock to

rise or fall. Perhaps one of

the supplies used to make

their most popular prod-

uct can be in short supply

based on agricultural pat-

terns or transportation bar-

riers. Be cautious if these

types of hiccups appear to

happen frequently and im-

pact the companys stock

negatively.

If the outcome of your re-

search is favorable, it still

doesnt mean the stock is

necessarily a good buy.

You should also know

where the companys stock

falls relative to future earn-

ings. For example, does it

appear to be low or high?

In addition, you should

assess whether or not that

stock is a good ft for your

overall portfolio. For ex-

ample, determine if this

particular stock will con-

tribute to the diversifca-

tion of your portfolio,

which may help you better

weather the markets ups

and downs. Diversifcation

involves having the right

blend of stocks, bonds,

mutual funds, and CDs to

help provide for more con-

sistent performance under

a wide range of economic

conditions.

As an alternative, you can

look at whether the compa-

nys stock is part of a well-

diversifed mutual fund,

which will give you some

ownership in the company

while helping to reduce

your risk exposure. Again,

you want to make sure that

the investment you select

is in line with your goals,

risk tolerance and time ho-

rizon.

Because of the amount

of time it can take to weed

though all this information

and the level of industry

knowledge required to un-

derstand it, consider work-

ing with a fnancial pro-

fessional to discuss your

interests before you invest.

He or she can help you

identify the merits of such

an investment and how it

fts into your overall fnan-

cial strategy.

Anita K. Miller, CFP,

CRPC is a Financial Ad-

visor and CERTIFIED

FINANCIAL PLANNER

practitioner with Amer-

iprise Financial Services,

Inc. in Abilene. She spe-

cializes in fee-based fnan-

cial planning and asset

management strategies and

has been in practice for 14

years. To contact her, you

may access her website at

www.ameripriseadvisors.

Investing for fun

Courtesy photo

Angela M. Holt (left) and Anita K. Miller at, Ameriprise Financial Services, Inc. 101 S. Buckeye

Ave.

Invest

in what

you know.

6 Tax and Investment Guide, January 2014 www.abilene-rc.com

Jaderborg Accounting, Inc.

Tax Tip:

2014 tax planning is extremely important

407 NE 14

th

, Abilene 785-479-6519

Accounting, Payroll, Tax Preparation & QuickBooks Training

Sandy D. Jaderborg, EA

Sponsored by:

due to the Affordable Care Act along

with expired deductions and credits.

Tim Horan Refector-Chronicle

The Dickinson County Community Foundation and President Kristine Meyer will be celebrating

the 15th anniversary of the Foundation in 2014.

By KRISTINE MEYER

President Community

Foundation

For 15 years, the Commu-

nity Foundation of Dick-

inson County has worked

hand-in-hand with donors

and their professional ad-

visors to create legacies

that provide effective so-

lutions to complex issues,

fulflling visions of a stron-

ger community.

A wellness program to

keep children healthy, af-

terschool youth programs,

community gardens and

walking trails, histori-

cal preservation efforts,

arts and theatre education,

food assistance for hungry

families these programs,

and many more, have been

funded by donors whose

generosity will live on

forever in the vitality and

beauty of Dickinson Coun-

ty.

During tax season, we

know that local philanthro-

pists are thinking about

how to link their charitable

interests with their ideal

deductions, says Kristine

Meyer, Foundation presi-

dent. A planned gift or

bequest to the Community

Foundation of Dickinson

County can achieve both.

Because community

foundations like ours fund

local charities, churches,

schools, parks, and many

other causes, we really are

driven by our donors in-

terests. That means your

contributions can do ex-

actly what you want them

to do, right here in your

hometown.

Local philanthropists Joe

and June Nold chose the

Community Foundation as

a resource for their chari-

table giving, precisely be-

cause of its fexibility and

regional focus.

We knew the Commu-

nity Foundation could best

handle our very specifc

charitable goals, com-

mented Joe. June added,

It seemed like a good

place to put in some mon-

ey to affect the way things

were going to be done in

the community. If you

like where you live, you

have got to do your best to

make it grow.

The long-term goal of a

community foundation is

to build permanent funds

supported by many do-

nors.

Offering a wide range of

fund options, the Commu-

nity Foundation of Dickin-

son County has the poten-

tial to accept a variety of

assets, such as land, grain

and other commodities,

IRAs, insurance plans, se-

curities and more.

We understand that ev-

ery donor has unique phil-

anthropic goals and ob-

jectives, Meyer remarks.

Drawing on our experi-

ence and creativity, and

in close partnership with

your fnancial advisor,

we can help you design a

planned giving solution

that addresses your specif-

ic needs both charitable

and fnancial.

The Community Foun-

dation currently stewards

nearly $8 million in chari-

table assets the result of

contributions from fami-

lies, individuals, and busi-

nesses that care about our

community. Established

in 1999, the Foundation

makes charitable giving

easy, fexible, and effec-

tive.

For more information,

call 785-263-1863, or visit

www.communityfounda-

tion.us.

Local charitable giving benefts everybody

Working

hand-in-hand

with donors

www.abilene-rc.com Tax and Investment Guide, January 2014 7

8rIan 1 Tajrhman kganry

1O4 hw 8rd Sl.

Abilene KS, O741O

Bus. (785) 2O82512

Monday Friday 8.8O AM 5.8O FM

BETTER SERVICE... BETTER

VALUE

CALL FOR A NO-OBLIGATIONFREE QUOTE.

785.263.1863

Your Charitable

Giving Resource

www.communityfoundation.us

Developing a retirement funding strategy

By CORY POWELL

Farm Bureau Agent

I am proud to be part of

this thriving community

and welcome the oppor-

tunity to introduce my-

self to you. My team of

professionals and I look

forward to delivering on

our promise: helping you

protect whats most impor-

tant. You can count on our

experience and resources

to help determine the in-

surance and fnancial strat-

egies that can best meet

your needs and objectives.

Let me share some infor-

mation about myself:

I am a graduate of the

American College with a

degree in fnancial services

specialist. I joined Farm

Bureau Financial Services

in 1999.

Different stages of life

bring about different pri-

orities and opportunities

and retirement is no excep-

tion. With people spending

more time in retirement

and the uncertainty of So-

cial Security, theres never

been a better time to re-

view your retirement fund-

ing strategies.

By analyzing your cur-

rent situation, I can help

you identify a fnancial

plan that is in sync with

your goals and desires for

the future. Together, we

can develop a retirement

funding strategy through

this simple 5-step process:

1. Identify whats impor-

tant;

2. Assess your expenses

and income sources;

3. Identify risks and de-

termine how to manage

them;

4. Develop strategies for

how and when to tap into

income sources;

5. Review your retire-

ment income distribution

strategy annually.

How you spend your time

and energy is yours to de-

termine, but remember its

never to late to take charge

of your fnancial future.

As you near retirement,

Im sure youre excited

about the prospect of hav-

ing more time to enjoy the

things that matter most to

you.

If youre like most soon-

to-be-retirees youve

thought many times about

the freedom that comes

with doing what you want,

when you want. Admit it:

youve already commit-

ted yourself to visits with

friends or family, a vaca-

tion, seeing the grandchil-

dren more, etc.

Retirement IRAs

If you chose to retire

today, would you have

enough income to main-

tain your standard of liv-

ing for 20, 30 or more

years? Even if you already

have a 401(k) or other tax-

advantaged savings plan,

you may want to consider

the benefts of investing in

an IRA now.

There are several advan-

tages to an IRA:

Help supplement your

retirement income;

Earnings are com-

pounded and accumulated

tax-deferred;

You can roll money

from a qualifed retirement

plan into an IRA without

tax consequences;

All or part of your con-

tributions may be tax de-

ductible;

You can control and

have access to your funds;

Whatever your specifc

goals and tolerance for

risk, I can help you cus-

tomize IRA investment

or retirement strategies.

Please contact my offce to

set up an appointment.

CORY POWELL

Basic

Continued from Page 3

to earn in order to double

your investment in 10

years, you would simply

divide the amount of mon-

ey, for instance $10,000,

into 72, and the answer is

7.2 percent.

You should note that this

rule of thumb does not

consider the potential im-

pact of taxes or infation.

While none of these strat-

egies can guarantee that

you will make money as

an investor, being aware

of them could help you

make more informed deci-

sions on where, or how, to

put your hard-earned sav-

ings or investment dollars

to work.

Also, remember that all

investments are subject to

risk, including the possible

loss of principal.

You should not construe

this information as ren-

dering tax or legal advice.

Therefore, you should

consult your tax advisor in

order to understand the tax

consequences of any prod-

uct or service.

Analyze

your current

situation

All New

Abilene-RC.Com

View us in Feburary

8 Tax and Investment Guide, January 2014 www.abilene-rc.com

Avoiding an audit

Wouldnt it be nice if the

IRS released its secret formu-

la for how it selects individual

tax returns for audit? That

way, wed do everything we

could to stay under the radar

and not be selected for further

review.

Fewer than 1 percent of tax

returns are audited, which is

good news for all. But theres

no way to guarantee youll be

exempt from the IRS prying

eyes, so all you can do is take

the proper precautions and

hope for the best.

MoneyTalkNews.com dis-

cusses red fags that may

trigger an audit and how to

avoid them. Look for these

tips throughout the Taxes and

Investments guide.

Shady preparers

If you dont prepare your

own return or take advantage

of the free help that is avail-

able if you make $52,000 or

less, chances are you will en-

trust someone else with your

information to prepare your

return. Just make sure the in-

dividual is legitimate, or you

may end up in the IRS hot

seat.

How do you spot a shady

preparer? If they make ridicu-

lous claims, like guaranteeing

that all of their clients will get

refunds, you defnitely want

to seek other options.

Business or hobby?

Have you been in business

for at least three years and

your tax return still refects

a loss? Chances are the IRS

may view your business ac-

tivity as a hobby, which is an-

other red fag.

And if you used a Schedule

C to claim your losses instead

of incorporating, that also in-

creases your chances of being

placed under a microscope by

the IRS.

So, what are you to do if

your business is really losing

money because its a startup

or as a result of economic

conditions? Take the deduc-

tions you are entitled to, but

maintain adequate documen-

tation to substantiate your

claims.

Too much generosity

Perhaps 2013 was the year

of giving, and you doled out

large sums of cash that were

disproportionate to your in-

come? Your actions may

raise a few eyebrows at Uncle

Sams headquarters.

According to IRS Publica-

tion 526, charitable deduc-

tions are limited to 50 percent

of your adjusted gross in-

come, with 20 and 30 percent

limitations applied in some

cases. And if your individual

contributions are $250 or

more, you must keep a bank

record showing the donation

or a document that includes

your name, the date the gift

was given and the amount.

Cash earners beware

If you are employed in a po-

sition that works for tips, such

as a bartender or restaurant

server, it is important to un-

derstand that all tips received

must be reported as income; it

is against the law to do oth-

erwise.

While it may be possible to

understate income, the IRS

has a certain threshold that it

expects servers to meet, and

any amount substantially less

may raise a high level of con-

cern, and possibly trigger an

audit.

Typographical errors

Didnt double-check your

tax return for accuracy? The

IRS may be coming for you if

mistakes are present.

Common audit fags in-

clude incorrect Social Secu-

rity numbers and employer

identifcation numbers, trans-

posed fgures and mathemati-

cal errors on the face of the

return. Word to the wise: Re-

view your return carefully to

ensure that the information

you plan to submit matches

the corresponding tax docu-

ments, as a simple mistake

can land you on the audit list.

Unreported income

What the IRS has on fle

should match the face of your

return, so refrain from omit-

ting any form of income that

you earned. And dont as-

sume that because the compa-

ny didnt give you a W-2 or a

1099 statement, youre off the

hook, because it more than

likely wrote off the expense.

Having a hard time retriev-

ing the documents? Give the

company a ring. Still no luck?

Call the IRS and Im almost

certain theyd be happy to as-

sist.

Tax credits

Unfortunately, shady tax

professionals can use tax

credits to make good on

fraudulent promises. For in-

stance, improper use of the

Earned Income Tax Credit

amounts to more than $10 bil-

lion a year. The Wall Street

Journal says: The EITCs

complex rules help lead to

high error rates by taxpayers

and even paid preparers. Its

also vulnerable to fraudulent

claims, despite some elabo-

rate safeguards that have been

built in over the years. The

Journal also says: The IRS

said in [a] statement Monday:

Every year, the IRS con-

ducts 500,000 EITC audits as

part of a broader enforcement

strategy, and EITC claims are

twice as likely to be audited

as other tax returns.

Of course, its OK to claim

credits that you are indeed eli-

gible for, but be sure to read

the IRS guidance to ensure

you qualify.

High income

Making more money may

cause problems, at least from

an audit risk perspective.

CNBC says:

People who earn more than

$1 million a year are more

than 12 times more likely to

be audited than people who

earn $200,000 or less. About

one of every eight tax flers

making $1 million or more

were audited in 2011 - double

the rate of 2009.

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Lecture 6 Clarkson LumberDokumen8 halamanLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Review of Researched Literature About Saving MoneyDokumen6 halamanReview of Researched Literature About Saving MoneyKing Solomon100% (2)

- The Rights and Priveleges of Teachers in The Philippines13Dokumen21 halamanThe Rights and Priveleges of Teachers in The Philippines13Glena Bilda Barrameda100% (1)

- No Broad Level Report Options Available For Report Execution Tcode in SAPDokumen48 halamanNo Broad Level Report Options Available For Report Execution Tcode in SAPpankajsri68100% (1)

- Financial ManagementDokumen254 halamanFinancial Managementkimringine50% (2)

- Samsonite - BUY (Bargain Luggage) 20200320 PDFDokumen12 halamanSamsonite - BUY (Bargain Luggage) 20200320 PDFStuart RosenzweigBelum ada peringkat

- Percentage Tax Rates and Requirements Review QuestionsDokumen23 halamanPercentage Tax Rates and Requirements Review QuestionsDanzen Bueno Imus0% (1)

- Daily UnionDokumen16 halamanDaily UnionARCEditorBelum ada peringkat

- Progress 2014 - BusinessDokumen10 halamanProgress 2014 - BusinessARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Progress 2014 - CivicDokumen6 halamanProgress 2014 - CivicARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen14 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen10 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen14 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditor0% (1)

- Progress 2014 - CommunityDokumen6 halamanProgress 2014 - CommunityARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Progress 2014 - TourismDokumen6 halamanProgress 2014 - TourismARCEditorBelum ada peringkat

- Progress 2014 - Agriculture and ManufacturingDokumen6 halamanProgress 2014 - Agriculture and ManufacturingARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen10 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Soil Tab February 2014Dokumen8 halamanSoil Tab February 2014ARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen10 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Abilene Reflector-ChronicleDokumen8 halamanAbilene Reflector-ChronicleARCEditorBelum ada peringkat

- Abilene Reflector ChronicleDokumen8 halamanAbilene Reflector ChronicleARCEditorBelum ada peringkat

- Valuation ProblemsDokumen2 halamanValuation ProblemsashviniBelum ada peringkat

- BudgetingDokumen2 halamanBudgetingKalsia RobertBelum ada peringkat

- A Primer On Financial StatementsDokumen9 halamanA Primer On Financial StatementsYannis KoutsangelouBelum ada peringkat

- C A S E 6 Guajilote Cooperativo Forestal, Honduras CooperativoDokumen5 halamanC A S E 6 Guajilote Cooperativo Forestal, Honduras CooperativoMasud Rana100% (4)

- Neo Group Offer Document Jul 2012Dokumen347 halamanNeo Group Offer Document Jul 2012suonodimusicaBelum ada peringkat

- Payment of Bonus Act 1965Dokumen11 halamanPayment of Bonus Act 1965KNOWLEDGE CREATORS100% (2)

- 2019 Ncaa Eada Report Kent StateDokumen80 halaman2019 Ncaa Eada Report Kent StateMatt BrownBelum ada peringkat

- Dividend Policy at FPL Group, Inc. (A)Dokumen16 halamanDividend Policy at FPL Group, Inc. (A)Aslan Alp0% (1)

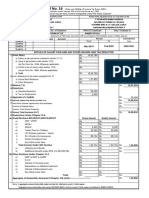

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDokumen3 halamanFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaBelum ada peringkat

- Form ST-105: Indiana Department of RevenueDokumen2 halamanForm ST-105: Indiana Department of RevenueRenn DallahBelum ada peringkat

- Bài tập ôn tập chapter 4 Ms.TrangDokumen8 halamanBài tập ôn tập chapter 4 Ms.TrangNgọc Trung Học 20Belum ada peringkat

- ACC 201 Module Two Short Paper Accounting Cycle StepsDokumen5 halamanACC 201 Module Two Short Paper Accounting Cycle StepsChristian Meese100% (1)

- Final Account of Sole Trading ConcernDokumen7 halamanFinal Account of Sole Trading ConcernAMIN BUHARI ABDUL KHADER50% (2)

- Balance Sheet Component Matching Exercise: Strictly ConfidentialDokumen6 halamanBalance Sheet Component Matching Exercise: Strictly Confidentialanjali shilpa kajalBelum ada peringkat

- 03 MA2 LRP AnswersDokumen34 halaman03 MA2 LRP AnswersKopanang LeokanaBelum ada peringkat

- Responsibility Accounting and Profitability RatiosDokumen13 halamanResponsibility Accounting and Profitability RatiosKhrystal AbrioBelum ada peringkat

- Elements of Financial StatementsDokumen2 halamanElements of Financial StatementsJonathan NavalloBelum ada peringkat

- Reed's Footwear Business PlanDokumen23 halamanReed's Footwear Business PlanSarah Hussain KakalBelum ada peringkat

- Ben Zuccolini - s1101113 - DissertationDokumen155 halamanBen Zuccolini - s1101113 - DissertationMohasifBelum ada peringkat

- FinePlanner WorksheetDokumen132 halamanFinePlanner Worksheetafifah allias0% (1)

- Varroc Engineering - YES SecuritiesDokumen6 halamanVarroc Engineering - YES SecuritiesdarshanmadeBelum ada peringkat

- Đề thi thử Deloitte-ACE Intern 2021Dokumen60 halamanĐề thi thử Deloitte-ACE Intern 2021Tung HoangBelum ada peringkat

- Business Valuation Using Financial Statements (BVFS) Prof. Vaidya Nathan Term 6, February 2022Dokumen242 halamanBusiness Valuation Using Financial Statements (BVFS) Prof. Vaidya Nathan Term 6, February 2022Anurag JainBelum ada peringkat