Uk Unit III Cse Split Up

Diunggah oleh

Sun Uday SunudayDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Uk Unit III Cse Split Up

Diunggah oleh

Sun Uday SunudayHak Cipta:

Format Tersedia

1

UNIT III Replacement and Maintenance Analysis Depreciation Evaluation of Public alternatives Inflation Adjusted Decisions

UNIT III

2 MARKS

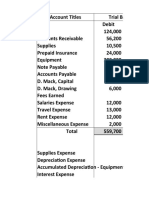

1. WRITE SHORT NOTES ON DEPRECIATION? (Dec 2012), (April2012) Depreciation is a term used in accounting, economics and finance to spread the cost of an asset over the span of several years. In simple words we can say that depreciation is the reduction in the value of an asset due to usage, passage of time, wear and tear, technological outdating, depletion, inadequacy, rot, rust, decay or other such factors. In accounting, depreciation is a term used to describe any method of attributing the historical or purchase cost of an asset across its useful life, roughly corresponding to normal wear and tear.It is of most use when dealing with assets of a short, fixed service life, and which is an example of applying the matching principle per generally accepted accounting principles. Depreciation in accounting is often mistakenly seen as a basis for recognizing impairment of an asset, but unexpected changes in value, where seen as significant enough to account for, are handled through writedowns or similar techniques which adjust the book value of the asset to reflect its current value. Therefore, it is important to recognize that depreciation, when used as a technical accounting term, is the allocation of the historical cost of an asset across time periods when the asset is employed to generate revenues. This process of cost allocation has little or no direct relationship to the market value or current selling price of the asset, it is simply the recognition that a portion of the asset's cost--the portion that will never be recuperated through re-sale or disposal of the asset--was "used up" in the generation of revenues for that time period. 2.DEFINE DEPRECIATION? "Depreciation may be defined as the permanent continuous diminution in the quality, quantity or value on an asset." (By Pickles) "Depreciation is the gradual permanent decrease in the value of an asset from any cause." (By Carter) "Depreciation may be defined as a measure of the exhaustion of the effective life of an asset from any cause during a given period." (By Spicer & Pegler) Depreciation is the diminution in intrinsic value of an asset due to use and/or the lapse of time." (By Institute of Cost and Management Accountants, England) 3. WHAT IS SALVAGE VALUE? Salvage value is the estimated value of an asset at the end of its useful life. In accounting, the salvage value of an asset is its remaining value after depreciation. This is also known as residual value or scrap value. It is the net cash inflow that occurs when the asset is liquefied at the end of its life. Salvage value can be negative if the residual asset requires special treatment to terminatefor example, used nuclear materials or CRT's containing lead. 4. WRITE SHORT NOTE ON CHARACTERISTICS OF DEPRECIATION? Characteristics of Depreciation: 1. Depreciation is charged in case of fixed assets only. e.g., building, plant and machinery, furniture etc. There is no question of depreciation in case of current assets - such as stock, debtors, bills receivable etc.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

2. Depreciation causes perpetual, gradual and continual fall in the value of assets. 3. Depreciation occurs till the last day of the estimated working life of the asset. 4. Depreciation occurs on account of use of asset. In certain cases, however, depreciation may occur even if the assets are not used, e.g., leasehold, property, patent, copyright etc. 5. Depreciation is a charge against revenue of an accounting period. 6. Depreciation does not depend on fluctuations in market value of assets (see difference between depreciation and fluctuation page). 7. The amount of depreciation of an accounting year cannot be determined precisely - it has to be estimated. In certain cases, however, it may be ascertained exactly, e.g., leasehold property, patent right, copyright etc. 8. Total depreciation of an asset cannot exceed its depreciable value (cost less scrap value). 5. WRITE SHORT NOTE ON DEPRECIATION IN ACCOUNTING? A company needs to report depreciation accurately in its financial statements in order to achieve two main objectives: 1. Matching its expenses with the income generated by means of those expenses, and 2. Ensuring that the asset values in the balance sheet are not overstated. (An asset acquired in Year 1 is unlikely to be worth the same amount in Year 5.) Depreciation is an estimated or expected view of the decline in value of an asset. For example, an entity may depreciate its equipment by 15% per year. This rate should be reasonable in aggregate (such as when a manufacturing company is looking at all of its machinery), and consistently employed. However, there is no expectation that each individual item declines in value by the same amount, primarily because the recognition of depreciation is based upon the allocation of historical costs and not current market prices. Accounting standards bodies have detailed rules on which methods of depreciation are acceptable, and auditors will express a view if they believe the assumptions underlying the estimates do not give a true and fair view. 6. WHAT ARE THE BASIC FACTORS OF DEPRECIATION DETERMINATION? For calculation depreciation the basic factors are: 1. The original cost of the asset. 2. The estimated working life of the asset or the number of years the asset is expected to last. 3. The estimated residual or scrap value at the end of its life. It is the value which the asset will fetch when discarded as useless. 4. The amount to be spent periodically for repairs and renewals. If the repairs necessary to keep the asset in a proper state of efficiency are regularly carried out, the life of the asset is prolonged and the amount of annual depreciation is proportionately lowered. 5. The possibility of the asset becoming obsolete. If there are great chances of improvements being made in a particular asset on account of inventions, higher depreciation should be written off such an asset. 6. WHAT ARE THE SEVERAL METHODS OF ACCOUNTING DEPRECIATION FUNDS? (Apr 2011) 1.Straight-Line Depreciation 2. Declining balance method 3. Sum-of-the-years-digits methods of depriciation 4. Sinking fund method of depreciation 5. Service output method of depriciation

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

7. WRITE SHORT NOTES ON REPLACEMENT AND MAINTENANCE ANALYSIS? Organizations providing goods/services use several facilities like equipment and machinery which are directly required in their operations. In addition to these facilities, there are several other items which are necessary to facilitate the functioning of organizations. All such facilities should be continuously monitored for their efficient functioning; otherwise, the quality of service will be poor. Besides the quality of service of the facilities, the cost of their operation and maintenance would increase with the passage of time. Hence, it is an absolute necessity to maintain the equipment in good operating conditions with economical cost. In certain cases, the equipment will be obsolete over a period of time. If the firm wants to be in the same business competitively, it has to take decision on whether to replace the old equipment or to retain it by taking the cost of maintenance and operation into account. There are two basic reasons for considering the replacement of equipment physical impairment of the various parts or obsolescence of the equipment. Physical impairment refers only to changes in the physical condition of the machine itself. This would lead to a decline in the value of the service rendered, increased operating cost, increased maintenance cost or a combination of these. Obsolescence is due to improvement of the tools of production, mainly improvement in technology. Sometimes, the capacity of existing facilities may be inadequate to meet the current demand. Under such situation, the following alternatives will be considered. Replacement of the existing equipment with a new one. Augmenting the existing one with additional equipment. 8. WHAT ARE THE DIFFERENT TYPES OF REPLACEMENT PROBLEM? Replacement study can be classified into two categories: Replacement of assets that deteriorate with time (Replacement due to gradual failure, or wear and tear of the components of the machines). This can be further classified into the following types: Determination of economic life of an asset. Replacement of an existing asset with the new asset. Simple probabilistic model for assets which fail completely (replacement due to sudden failure). 9. HOW WILL YOU DETERMINE OF ECONOMIC LIFE OF AN ASSET? Any asset will have the following cost components: Capital recovery cost (average first cost), computed from the first cost (purchase price) of the machine. Average operating and maintenance cost (O & M cost) Total cost which is the sum of capital recovery cost (average first cost) and average maintenance cost. It is clear that the capital recovery cost (average first cost) goes son decreasing with the life of the machine and the average operating and maintenance cost goes on increasing with the life of the machine. From the beginning, the total cost continues to decrease upto a particular life and then it starts increasing. The point where the total cost is minimum is called the economic life the machine. If the interest rate is more then zero percent, then we use interest formulas to determine the economic life

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

The replacement alternatives can be evaluated based on the present worth criterion and annual equivalent criterion. Average total cost= First cost (FC) +Summation of maintenance cost/ Replacement Period Total annual equivalent cost= [Cumulative sum of present worth as of beginning of year1 Operation and maintenance costs + First cost Present worth as of beginning of year1 of salvage value] * (A/P, 15%, n) 10.WRITE SHORT NOTES OR OBJECTIVES ON EVALUATION OF PUBLIC ALTERNATIVES. (April2011) In evaluating alternatives of private organizations, the criterion is to select the alternative with the maximum profit. The profit maximization is the main goal of private organizations while providing goods/services as per specifications to their customers. But the same criterion cannot be used while evaluating public alternatives. Examples of some public alternatives are constructing bridges, roads, dams, establishing public utilities, etc. The main objective of any public alternative is to provide goods/services to the public at the minimum cost. In this process, one should see whether the benefits of the public activity are at least equal to its costs. If yes, then the public activity can be undertaken for implementation . Otherwise, it can be cancelled. This is nothing but taking a decision based on Benefit-Cost ratio(BC) given by Equivalent benefits BC ratio= --------------------------Equivalent costs The benefits may occur at different time periods of the public activity. For the purpose of comparison, these are to be converted into a common time base (present worth or future worth or annual equivalent). Similarly, the costs consist of initial investment and yearly operation and maintenance cost. These are to be converted to a common time base as done in the equivalent benefits. Now the ratio between the equivalent benefits and equivalent costs is known as the Benefit-Cost ratio. If this ratio is at least one, the public activity is justified; otherwise, it is not justified. Let Bp = present worth of the total benefits Bf = future worth of the total benefits Ba = annual equivalent of the total benefits P = initial investment Pf = future worth of the initial investment Pa = annual equivalent of the initial investment C = yearly cost of operation and maintenance Cp = present worth of yearly cost of operation and maintenance Cf = future worth of yearly cost of operation and maintenance Bp Bf Ba BC ratio = ---------- = --------- = ---------P+CpPf+CfPa+C 11. WHAT ARE THE TYPES OF REPLACEMENT ANALYSIS?

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

For the actual replacement analysis: given that you have a piece of equipment and want to figure out whether or not you should replace it, you will analyze the old equipment (called the Defender) versus the best new machine option (called the Challenger). Very critical to these types of problems is that you know how to find the book value of an asset by using depreciation, can differentiate book value and market value, and can identify a sunk cost. Sunk cost: something you paid in the past, and should not be considered any longer (i.e. the amount I paid for car maintenance last year should not factor in when I consider paying for an overhaul now versus trading in for a new car) Market Value: selling price of the asset in the marketplace, or what you can actually get for the asset (should already by determined) The challenger and defender can always be considered to have different lives (unless explicitly told otherwise in a problem statement) so, you will want to use the annual worth methodin fact, repeatability really doesnt apply to the defender because you cant repeat having it, its not something new you are buying at the same price again, so just stay away from present worth method here. Now for the most part you are simply going to be doing after-tax incremental analysis with two options: keep the defender or sell it and buy the challenger.

11 MARKS

1. EXPLAIN THE REASONS OR CAUSES OF DEPRECIATION? The main causes of depreciation may be divided into two categories, namely: 1. Internal Cause and 2. External Causes Internal Causes: Depreciation which occurs for certain inherent normal causes, is known as internal depreciation. The main causes of internal depreciation are: Wear and Tear: Some assets physically deteriorate due to wear and tear in use. More and more use of an asset, the greater would be the wear and tear. Physical deterioration of an asset is caused from movement, strain, friction, erasion etc. An obvious example of this is motor car which rapidly wears out. Other assets like this are building, plant, machinery, furniture, etc. The wear and tear is general but primary cause of depreciation. Depletion: Some assets declines in value proportionate to the quantum of production, e.g. mine, quarry etc. With the raising of coal from coal mine the total deposit reduces gradually and after sometime it will be fully exhausted. Then its value will be reduced to nil. External Causes: Depreciation caused by some external reasons is called external depreciation. The main external causes are as follows: Obsolescence: Some assets, although in proper working order, may become obsolete. For example, old machine becomes obsolete with the invention of more economical and sophisticated machine whose productive capacity is generally larger and cost of production is therefore less. In order to survive in the competitive market the manufacturers must must install new machines replacing the old ones. Again, it may happen that the articles

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

produced by old machine are no longer saleable in the market on account of change of habit and taste of the people. In such a case the old machine, although in good working condition, must be discarded and the new one purchased. Efflux of Time: Some assets diminish in value on account of sheer passage of time, even though they are not used e.g., leasehold property, patent right, copyright etc. Suppose we take a lease of a house for 10 years for $10,000. Its annual depreciation will be $1,000 (10,000/10), irrespective of the the whether the house has been used or not. Because with the end of lease after 10 years, the house will go out of possession. Accident: Assets may be destroyed by abnormal reasons such as fire, earthquake, flood etc. In such a case the destroyed asset must be written off as loss and a new one purchased. 2. EXPLAIN THE NEED FOR DEPRECIATION OR REASONS FOR CALCULATING DEPRECIATION. The Need for depreciation arises for the following reasons: 1. Ascertainment of True Profit or Loss: Depreciation is a loss. So Unless it is considered like all other expenses and losses, true profit or loss cannot be ascertained. In other words, depreciation must be considered in order to into out true profit or loss of a business. 2. Ascertainment of True Cost of Production: Goods are produced with the help of plant and machinery which incurs depreciation in the process of production. This depreciation must be considered as a part of the cost of production of goods. Otherwise, the cost f production would be shown less than the true cost. Sales price is fixed normally on the basis of cost of production. So, if the cost of production is shown less by ignoring depreciation, the sale price will also be fixed at low level resulting in a loss to the business. 3. True Valuation of Assets: Value of assets gradually decreases on account of depreciation, if depreciation is not taken into account, the value of asset will be shown in the books at a figure higher than its true value and hence the true financial position of the business will not be disclosed through balance sheet. 4. Replacement of Assets: After sometime an asset will be completely exhausted on account of use. A new asset must then be purchased requiring a large sum of money. If the whole amount of profit is withdrawal from business each year without considering the loss on account of depreciation, necessary sum may not be available for buying the new asset. In such a case the required money is to be collected by introducing fresh capital or by obtaining loan or by selling some other assets. This is contrary to sound commerce policy. 5. Keeping Capital Intact: Capital invested in buying an asset, gradually diminishes on account of depreciation. If loss on account of depreciation is not considered in determining profit or loss at the year end, profit will be shown more. If the excess profit is withdrawal, the working capital will gradually reduce, the business will become weak and its profit earning capacity will also fall. 3. EXPLAIN THE DIFFERENT METHODS OF DEPRICIATION OR TOOLS OR TECHNIQUES METHODS TO IDENTIFY DEPRECIATION OF AN ASSET? (Dec12)/ (April2010) There are several methods for calculating depreciation, generally based on either the passage of time or the level of activity (or use) of the asset.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

1.STRAIGHT-LINE DEPRECIATION: Straight-line depreciation is the simplest and most-often-used technique, in which the company estimates the salvage value of the asset at the end of the period during which it will be used to generate revenues (useful life) and will expense a portion of original cost in equal increments over that period. The salvage value is an estimate of the value of the asset at the time it will be sold or disposed of; it may be zero or even negative. Salvage value is scrap value, by another name. Let P=first cost of the asset F=salvage value of the asset N=life of the asset Bt=book value of the asset and end of the period t, Dt=depreciation amount for the period t. Formula: Dt=(P-F)/n Bt=Bt-1-Dt=P-t*[(P-F)/n] 2. DECLINING BALANCE METHOD: Depreciation methods that provide for a higher depreciation charge in the first year of an asset's life and gradually decreasing charges in subsequent years are called accelerated depreciation methods. This may be a more realistic reflection of an asset's actual expected benefit from the use of the asset: many assets are most useful when they are new. One popular accelerated method is the declining-balance method. Under this method the Book Value is multiplied by a fixed rate. Let P=first cost of the asset F=salvage value of the asset N=life of the asset ; Bt=book value of the asset at the end of the period t K=a fixed percentage Dt=depreciation amount at the end of the period t. The formula for depreciation and book values are as follows: Dt=k*Bt-1 Bt=Bt-Dt=Bt-1-k*Bt-1 =(1-K)*Bt-1 The formula for depreciation and book value in terms of P are as follows: Dt=K(1-K)t-1*p Bt=(1-K)t*p While availing income-tax exception for the depreciation amount paid in each year, the rate K is limited to at the most 2/n,If this rate is used, then the corresponding approach is called double declining balance method of depreciation. 3. SUM-OF-THE-YEARS-DIGITS METHODS OF DEPRICIATION: Sum-of-Years' Digits is a depreciation method that results in a more accelerated write-off than straight line, but less than declining-balance method. Under this method annual depreciation is determined by multiplying the Depreciable Cost by a schedule of fractions. Sum of the years=1+2+3+4+5+6+7+8 =36=n (n+1)/2

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

The rate of depreciation charge for the first year is assumed as the highest and then it decreases. The rates of depreciation for the years 1-8, respectively are as follows: 8/36, 7/ 36, 5/36, 4/36, 3/36,2/36,1/36 For any year; the depreciation is calculated by multiplying the corresponding rate of depreciation with (P-F) Dt=Rate*(P-F) Bt=Bt-1-Dt The formula for Dt and Bt for a specific year t are as follows: n t +1 Dt = ------------- x P-F n(n+1)/2 Dt = (P-F) (n-t)/n)(n-t+1)/(n+1)+F 4. SINKING FUND METHOD OF DEPRICIATION: In this method of depreciation, the book value decreases at increasing rates with respect to the life of the asset Let P=first cost of the asset F=salvage value of the asset n=life of the asset i=rate of return compounded annually a=the annual equivalent amount Bt=the book value of the asset at the end of the period t, and Dt=the depreciation amount at the end of the period t The loss in the value of the asset (P-F)is made available an the form of cumulative depreciation Amount at the end of the life of the asset by setting up an equal depreciation amount(A)at the end of each period during the lifetime of the asset. A=(P-F)*[A/F,i,n] The fixed sum depreciated at the end of every time period earns an interest at the rate of i% compounded annually, and hence the actual depreciation amount will be in increasing manner with respect to the period. A generalized formula for Dt is Dt=(P-F)*(A/F,i,n)*(F/P,i,t-1) The formula to calculate the book value at the end of period t is Bt=p-(P-F) (A/F,i,n) (F/A,i,t) The above two formulae are very useful if we have to calculate Dt and Bt for any specific period. if we calculate Dt and Bt for all the periods, then the tabular approach would be better. 5.SERVICE OUTPUT METHOD OF DEPRICIATION:

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

In some situations, it may not be realistic to compute depreciation based on time period. in such cases, the depreciation is computed based on service rendered by an asset Let P=first cost of the asset F=salvage value of the asset X=maximum capacity of service of the asset during its lifetime x=quantity of service rendered in a period Then, the depreciation is defined per unit of service rendered: Depreciation/unit of service= (P-F)/X Depreciation of x units of service in a period =P-F(x)/X 4. EXPLAIN STRAIGHT LINE METHOD Fixed installment method is also know as straight line method or original cost method. Under this method the expected life of the asset or the period during which a particular asset will render service is the calculated. The cost of the asset less scrap value, if any, at the end f its expected life is divided by the number of years of its expected life and each year a fixed amount is charged in accounts as depreciation. The amount chargeable in respect of depreciation under this method remains constant from year to year. This method is also know as straight line method because if a graph of the amounts of annual depreciation is drawn, it would be a straight line. Formula: The following formula or equation is used to calculate depreciation under this method: Annual Depreciation = [(Cost of Assets - Scrap Value)/Estimated Life of Machinery] Scope of Application: On account of the above mentioned advantages and disadvantages of fixed installment method, it is generally applied in case of those assets which have small value or which do not require many repairs and renewals for example copyright, patents, short leases etc.

Example for straight line method: On 1st January 1991 X purchased a machinery for $21,000. The estimated life of the machine is 10 years. After it its break up value will be $1,000 only. Calculate the amount of annual depreciation according to fixed installment method (straight line method or original cost method) and prepare the machinery account for the first three years. Machinery Account Debit Side Credit Side $ $ 1991 To Bank account 21,000 1991 By Depreciation account 2,000 Jan. 1 Dec. 31 1991 By Balance c/d 19,000 Dec.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

10

31 21,000 1992 Jan. 1 To Balance b/d 19,000 1991 Dec. 31 1991 Dec. 31 By Depreciation account 21,000 2,000

17,000

15,000 1993 Jan. 1 To Balance b/d 17,000 1991 Dec. 31 1991 Dec. 31 By Depreciation account

15,000 2,000

By Balance c/d

15,000

17,000

17,000

Advantages of straight line method: Over the period of useful life of the fixed asset, the total burden of depreciation and repairs cost s are disproportional over the effective life on the asset. Using this straight line basis of depreciation, the burden will be light in the initial period and will be heavy in later stage of the useful life of the fixed assets. Any additions of fixed assets item will need to be computed separately Value of asset appear to be zero but asset is still in existence even after its useful life. Simple depreciation method to use This method is useful for assets having small intrinsic value like furniture & fittings, patents, trade mark where the depreciation can be written off within their estimated , legal or commercial life. Disadvantage straight line method: Straight line basis of depreciation is not a suitable method for assets like Plant and machinery as depreciation is constant while the repairs on such assets will be heavy in later years. 5. EXPLAIN DIMINISHING VALUE METHOD Diminishing balance method is also known as written down value method or reducing installment method. Under this method the asset is depreciated at fixed percentage calculated on the debit balance of the asset which is diminished year after year on account of depreciation. Scope of Application:

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

11

Diminishing balance method of depreciation is most suited to plant and machinery where additions and extensions take place so often and where the question of repairs is also very important. Written down value method or reducing installment method does not suit the case of lease, whose value has to be reduced to zero. Advantages of written down value method: Amount charged to the profit & loss account towards depreciation and repairs will remain more or less uniform year after year Any addition of fixed asset, there is no need to have fresh calculation unless the purchase is made in the middle of the year Simple to use Disadvantages of written down value method: Interest lost due to the capital investment in the asset is not taken into account Book value of the asset cannot be brought down to zero Though this method charges uniformly to the profit & loss account year on year, in many cases, this may not happen either due to low rate of depreciation or due to excessively repair charges in later stages. Example for diminishing balance method: On 1st January, 1994, a merchant purchased plant and machinery costing $25,000. It has been decided to depreciate it at the rate if 20 percent p.a. on the diminishing balance method (written down value method). Show the plant and machinery account in the first three years. Plant and Machinery Account Debit Side Credit Side Date $ Date $ 1994 To Cash 25,000 1994 By Depreciation 5,000* Jan. 1 Dec. 31 " By Balance c/d 20,000 25,000 1995 Jan. 1 To Balance b/d 20,000 1995 Dec. 31 " By Depreciation 25,000 4,000**

By Balance c/d

16,000 20,000

20,000 1996 Jan. 1 To Balance b/d 16,000 1996 Dec. 31 By Depreciation

3,200***

By Balance c/d 16,000

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

12,800 16,000

DEPARTMENT OF CSE

12

Formula or equation for the depreciation calculation may be written as follows: *First year: 25,000 20% = 5000 **Second Year: (25000 - 5000) 20% = 4,000 ***Third Year: [25000 - (5,000 + 4,000)] 20% = 3,200 6. EXPLAIN ANNUITY METHOD According to this method, the purchase of the asset concerned is considered an investment of capital, earning interest at certain rate. The cost of the asset and also interest thereon are written down annually by equal installments until the book value of the asset is reduced to nil or its bread up value at the end of its effective life. The annual charge to be made by way of depreciation is found out from annuity tables. The annual charge for depreciation will be credited to asset account and debited to depreciation account, while the interest will be debited to asset account and credited to interest account.

Example for annuity method: A firm purchased a 5 years' lease for $40,000 on first January. It decides to write off depreciation on the annuity method. Presuming the rate of interest to be 5% per annum. Show the lease account for the first 3 years. Calculations are to be made to the nearest dollar. Annuity Table Amount required to write off $1 by the annuity method. Years 3% 3.5% 4% 4.5% 5% 3 4 5 6 7 0.353530 0.269027 0.218355 0.184598 0.160506 0.359634 0.272251 0.221418 0.187668 0.163544 0.360349 0.275490 0.224627 0.190762 0.166610 0.363773 0.278744 0.227792 0.193878 0.169701 0.367209 0.282012 0.230975 0.197017 0.172820

8 0.142456 0.145477 0.148528 0.151610 0.154722 Solution: According to the annuity table given above, the annual charge for depreciation reckoning interest at 5 percent p.a. would be: 230975 40,000 = $9,239 Lease Account Debit Side Credit Side Date $ Date $ 1st 1st Year Year Jan. 1 To Cash 40,000 Dec. By Depreciation 9,239 31 Dec. To Interest 2,000 By Balance c/d 32,761 31

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

13

42,000 2nd Year Jan. 1 To Balance b/d Dec. 31 To Interest 2nd Year Dec. 31

42,000

32,761 1,638

By Depreciation By Balance c/d

9,239 25,160

34,399 3rd Year Jan. 1 To Balance b/d Dec. 31 To Interest

34,399

25,160 1,258

Dec. 31

By Depreciation By Balance c/d

9,239 17,179

26,418 3rd Year Jan. 1 To Balance b/d

26,418

17,170

Advantages: 1. This method takes interest on capital invested in the asset into account. 2. It is regarded as most exact and precise from the point of view of calculations; and is therefore most scientific. Disadvantages: 1. The system is complicated. 2. The burden on profit and loss account goes on increasing with the passage of time whereas the amount of depreciation charged each year remains constant. The amount of interest credited goes on diminishing as years pass by, the ultimate consequence being that the net burden on profit and loss account grows heavier each year. 3. When the asset requires frequent additions and extensions, the calculation have to be changed frequently, which is very inconvenient. Scope of Application: This method is best suited to those assets which require considerable investment and which do not call for frequent additions e.g., long lease. 7. EXPLAIN SINKING FUND DEPRECIATION.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

14

Depreciation fund method is also know as sinking fund method or amortization fund method. Under this method, a fund know as depreciation fund or sinking fund is created. Each year the profit and loss account is debited and the fund account credited with a sum, which is so calculated that the annual sum credited to the fund account and accumulating throughout the life of the asset may be equal to the amount which would be required to replace the old asset. In order that ready funds may be available at the time of replacement of the asset an amount equal to that credited to the fund account is invested outside the business, generally in giltedged securities. The asset appears in the balance sheet year after year at its original cost while depreciation fund account appears on the liability side.

The amount of annual depreciation to be provided for by the depreciation fund method will be ascertained from sinking fund table. Sinking Fund Table Annual sinking fund installment to provide $1. Years 3% 3.5% 4% 4.5% 5% 3 4 5 6 7 8 0.323540 0.239027 0.188350 0.154598 0.130506 0.112446 0.321934 0.237251 0.186481 0.152668 0.128544 0.110477 0.320349 0.235490 0.184627 0.150762 0.126610 0.108528 0.318773 0.233741 0.182792 0.148878 0.124701 0.106610 0.317208 0.232012 0.180975 0.147017 0.122820 0.104722

Example: On 1st January, 1990 a four years lease was purchased for $20,000 and it is decided to make provision for the replacement of the lease by means of a depreciation fund, the investment yielding 4 percent per annum interest. Show the necessary ledger account. Solution: To get $1 at the end of 4 years at 4 percent an annual investment of $2,35,490 is necessary. Therefore, for $20,000 an annual investment of $4,709.80 i.e., 2,35,490 20,000 will be necessary. Lease Account 1990 1990 Jan.1 To Cash 20,000 Dec. By Depreciation fund 20,000 31 Depreciation Fund Account 1990 Dec. By P & L account 31 1991 Jan. 1 Dec.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

1990 Dec. 31 1991 Dec. 31

To Balance c/d

4,709.80

4,709.80

To Balance c/d

9607.99

By Balance c/d By Depreciation fund investment

4709.80 188.39

DEPARTMENT OF CSE

15

31 " 9607.99 1992 Dec. 31 1992 Jan. 1 Dec. 31 " 14702.11 1993 Dec. 31 1993 Jan. 1 Dec. 31

By P&L account

4709.80 9607.99

To Balance c/d

14702.11

By Balance b/d By Depreciation fund investment By P & L account

9607.99 384.32 4709.80 14702.11

To Lease account

20,000

By Balance b/d By Depreciation fund investment By P & L

14702.11 588.9 4,709.80 20,000

20,000 Depreciation Fund Account 1990 Dec. To Cash 31 1991 Jan. 1 Dec. 31 Dec. 31

4709.80

1990 Dec. 31 1991 Dec. 31

By Balance c/d

4709.80

To Balance b/d To Depreciation fund To Cash

4709.80 188.39 4,709.80

By Balance c/d

9,607.99

9,607.99 1992 Jan. 1 Dec. 31 1992 Dec. 31

9,607.99

To Balance b/d To Depreciation fund

9,607.99 384.32

By Balance c/d

14,702.11

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

16

Dec. 31 1993 Jan. 1 Dec. 31 Dec. 31

To Cash

4709.80

14,702.11 588.9 4709.80

1993 Dec. 31

By Cash

20,000.00

20,000

20,000

Note: The cash installment at the end of the last year will not be invested because there is no point in buying the investment and selling them on the same date. Advantages of Depreciation Fund Method Or Sinking Fund Method: The most important advantages of this method is that it makes available a sum of money for the replacement of the asset, which has become useless. If separate provision was not made, the sum required to purchase the new asset will have to be drawn from the business which might effect the financial position of the concern adversely. Disadvantages of the Depreciation Fund Method Or Sinking Fund Method: 1. The burden on profit and loss account goes on increasing as years pass by since the amount of depreciation every year remains same but the amount spent on repairs goes on increasing as the asset becomes old. 2. It can also be said that the work of investing money is complicated. 3. Prices of securities may fall at the time when they are to be realized as a result of which loss may have to be suffered. Scope of Application: This method is found suitable wherever it is desired not only to charge depreciation but also to replace the asset as happens in the case of plant and machinery and other wasting assets. 8. CLASSIFY MAINTENANCE OR TYPES OF MAINTENANCE ANALYSIS Types of Maintenace Maintenance operations have been categorized based on their frequency and their motivating factors. Four of the most common designations are described below - predictive, preventative, corrective and fault-finding. Predictive maintenance involves a series of steps prior to actually performing maintenance. It begins with sampling physical data over time, such as vibration or particulate matter in oil. Analysis is then performed on the collected data to create an appropriate maintenance schedule, and maintenance is performed according to the schedule. This type of maintenance analysis works well for mechanical systems because the failure modes are well understood. Additionally there is historical data useful for creating and validating performance and maintenance models for mechanical systems. Preventative maintenance refers to maintenance performed when a system is functioning properly to prevent a later failure. Generally, it is performed on a regular basis and the maintenance will be performed regardless of whether functionality or performance is degraded. The frequency of the maintenance is generally constant, and

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

17

is usually based on the expected life of the components being maintained, but there is not necessarily any monitoring occurring at the same time (as there would be in predictive maintenance). One common example is lubrication of mechanical systems after a certain number of operating hours. Another is replacement of lightning arresters in jet engines after a certain number of lightning strikes. Corrective maintenance refers to maintenance done to correct a problem when something has failed, or is failing. The need for corrective maintenance can be beneficial or detrimental depending on the product and the profit model used during the design phase of the product. On the most obvious level, corrective maintenance is detrimental to operation because it means that something failed, and the system is (probably) not available during the time needed to perform the maintenance. On the other hand, it may be that the economics and planned functionality of a system are such that using a cheaper, replaceable device for which failure is anticipated, makes sense. Failure-finding maintenance involves checking a (quiescent) part of a system to see if it is still working. This is most often performed on portions of a system dedicated to safety -- protective devices. This is an important type of maintenance check to perform because failures in safety systems can have more catastrophic effects, if other parts of the system fail. 9) EXPLAIN THE TYPES AND ADVANTAGES OF MAINTENANCE ANALYSIS. MAINTENANCE TYPES: 1. BREAKDOWN MAINTENANCE: Characteristics of Break-down Maintenance System: * No services except occasional lubrication unless failure occurs * No maintenance men on regular basis * Maintenance done by sub-contractors * No organised efforts to find out reasons * No stock of spares * No budget * No records * Initially it looks economical * Problems in case of B/D - Who is to do repair? - From where to get parts? - How do we pay for them? - Who is to go to buy parts? Results of Breakdown Maintenance System: * Increased Down Time * Increased costs & Pressures 2. ROUTINE MAINTENANCE A procedure followed regularly i.e.,., A cyclic operation recurring periodically. maintenance engineering and management Advantages 1. Simple to establish & follow 2. Little or no clerical work 3. High degree of prevention by intercepting developing faults.

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

18

A more advanced stage of routine maintenance calls for 'service instructions on a pre-printed schedule and checklists'. Examples: * Check all compressors first on Mondays. * Lubricate completely two machines daily. Disadvantages * Routine maintenance may not provide the service specified by the manufacturer * We may ignore information regarding preceding breakdowns * Service required for a machine at different frequencies may be ignored * All similar machines may be serviced at same frequency irrespective of working hours. 3. PLANNED MAINTENANCE In this type of service, the emphasis is placed on the machines. What does the manufacturer prescribe? Is the unit utilised for two, or three shifts per day? Is it working under normal load? Are the conditions as good as those envisaged by the manufacturer? Do we allow for extra attention owing to corrosion-including conditions? Characteristics of Planned Maintenance * Instructions are more detailed than in routine maintenance maintenance engineering and management * Calls for differently timed service for the same unit * Schedule is drawn with dates * Need for establishing the work-load for the crew * Entails considerable planning effort, faithful implementation and recording * Initial list of planned maintenance will be in detail and Advantages of Planned Maintenance * Will take into consideration the changes in conditions of use and increased wear of parts * Inspections, replacement of parts and adjustments are included in the overall plan * Detailed instructions reduce the chance of missing any activity. Unforeseen work is greatly reduced * Provides as much attention as the equipment requires - to the best judgement and ability of the planner 4. PREVENTIVE MAINTENANCE System which strives to reduce the likelihood of failures. To achieve prevention of break-downs Planned service is carried out with the explicit additional objective of detecting wear points and ensuring perfect functioning by replacing parts which could still be used were it not for the assurance that is required. Occasional use of statistical analysis/methods for determining life expectancies of parts. The system employs Measuring & Inspection Devices. This phase is Predictive maintenance. Preventive Maintenance System is more expensive due to more of planning and replacement of parts before failing. PM increases reliability PM reduces total work-load PM reduces total down time PM reduces unplanned work

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

19

PM reduces total maintenance cost Preventive maintenance could be grouped as under: - Fixed-time Maintenance - Condition-based Maintenance - Opportunity Maintenance maintenance engineering and management CORRECTIVE MAINTENANCE: Services carried out to restore an item to an acceptable working condition. Services arising out of - Break-downs - Malfunctioning & - Deteriorating conditions PRODUCTIVE MAINTENANCE An effort to set up the function on a planned and measured production pattern. The output relates to the number of servicing tasks completed, e.g., lubrication, inspection, overhaul, etc. Originally used in USA. TOTAL PRODUCTIVE MAINTENANCE (TPM) Efforts with the total participation of employees. Used in Japan. 10. EXPLAIN INFLATION ADJUSTED DECISION OR REAL RATE OF RETURN A measure of return that accounts for the return period's inflation rate. Inflation-adjusted return reveals the return on an investment after removing the effects of inflation. It is calculated as follows

Also, a simple approximation for inflation-adjusted return is given by subtracting the inflation rate from the rate of return. Inflation-adjusted return: Also referred to as real rate of return, this form of return accounts for inflation and provides what an investor is going to earn keeping inflation into consideration. And it is suggested that if an investment instrument does not earns a return at par with likely rate of inflation in future course, it hardly makes sense to deploy money towards it. And with rate of inflation in a country like India standing at approximately 10% on an year-to-year basis, any instrument or asset with less than 10% return should not qualify for investment. Bank fixed deposits that on an average provide a pre-tax rate of return of 9.5% p.a in the current scenario when the CPI inflation for the month of November stands at 11.24% yields negative real rate of return.

Real rate of return or inflation adjustment

The real rate of return formula is the sum of one plus the nominal rate divided by the sum of one plus the inflation rate which then is subtracted by one. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation. The nominal rate is the stated rate or normal return that is not adjusted for inflation. The rate of inflation is calculated based on the changes in price indices which are the price on a group of goods. One of the most commonly used price indices is the consumer price index(CPI). Although the consumer price

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE DEPARTMENT OF CSE

20

index is widely used, a company or investor may want to consider using another price index or even their own group of goods that relates more to their business when calculating the real rate of return. For quick calculation, an individual may choose to approximate the real rate of return by using the simple formula of nominal rate - inflation rate. Example of Real Rate of Return Formula An example of the real rate of return formula would be an individual who wants to determine how much goods they can buy at the end of one year after leaving their money in a money market account that earns interest. For this example of the real rate of return formula, we must assume that the individual wants to purchase the exact same goods and same proportion of goods that the consumer price index uses considering that it is used often to measure inflation. For this example of the real rate of return formula, the money market yield is 5%, inflation is 3%, and the starting balance is $1000. Using the real rate of return formula, this example would show

which would return a real rate of 1.942%. With a $1000 starting balance, the individual could purchase $1,019.42 of goods based on today's cost. This example of the real rate of return formula can be checked by multiplying the $1019.42 by (1.03), the inflation rate plus one, which results in a $1050 balance which would be the normal return on a 5% yield. INFLATION ADJUSTMENT For some program areas, cost estimates, which provide the basis for the amount of financial assurance required, must be increased annually to account for inflation. Programs requiring inflation adjustments include: Industrial and Hazardous Waste Municipal Solid Waste Underground Injection Control Wells Used Oil Recycling Class A or B Petroleum-Substance Contaminated Soil Storage, Treatment, and Reuse Facilities Scrap Tire Sites Public Drinking Water Systems and Utilities Radioactive Material - Burial Radioactive Waste - Low Level Near-Surface Land Disposal If applicable, the inflation adjustment must be made using an inflation factor derived from the most recent annual Implicit Price Deflator for Gross National Product published by the United States Department of Commerce. The preliminary and final inflation factors are generally available by the first week of February and April of each year, respectively. Once the cost estimate has been adjusted, then you must ensure that your financial assurance mechanism dollar amount sufficiently covers the revised cost estimate.

(UNIT III COMPLETED) 11 MARK UNIVERSITY QUESTIONS

1. 2. 3. 4. Explain replacement and maintenance analysis. (Dec2012) (Refer P.No: 3 &17) Explain the causes of inflation. (Dec2012, April 2010) (Refer P.No:54, Unit I ) Explain the methods of providing depreciation. (April2012) ( Refer P. No: 7) Explain inflated adjusted decisions. (April2012) ( Refer P. No: 19)

DEPARTMENT OF CSE

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

21

5. Explain the advantages of maintenance analysis. (April2010 ( Refer P. No: 19) 6. Explain the causes of depreciation. (April2010) ( Refer P. No: 5) 7. Explain the types of replacement analysis. (April2010) ( Refer P. No: 5 )

SRI MANAKULA VINAYAGAR ENGINEERING COLLEGE

DEPARTMENT OF CSE

Anda mungkin juga menyukai

- Land Development Strategic Plan For Lands Owned By... Olume 3 2015Dokumen372 halamanLand Development Strategic Plan For Lands Owned By... Olume 3 2015Sun Uday SunudayBelum ada peringkat

- Sheriff of Nottingham Tuckbox v1.0Dokumen1 halamanSheriff of Nottingham Tuckbox v1.0Sun Uday SunudayBelum ada peringkat

- 12th Computer Science Question Bank Vol-I&Vol-2 EMDokumen124 halaman12th Computer Science Question Bank Vol-I&Vol-2 EMSun Uday SunudayBelum ada peringkat

- Mini Declaration TrackerDokumen1 halamanMini Declaration TrackerSun Uday SunudayBelum ada peringkat

- Setup - General Rules - General Rules - : - Player ActionsDokumen1 halamanSetup - General Rules - General Rules - : - Player ActionsSun Uday SunudayBelum ada peringkat

- Sheriff of Nottingham-Reglas EspanolDokumen16 halamanSheriff of Nottingham-Reglas EspanolSun Uday SunudayBelum ada peringkat

- Sheriff of Nottingham Layout v1Dokumen5 halamanSheriff of Nottingham Layout v1Sun Uday SunudayBelum ada peringkat

- INDIA Ministry of STATE - Wikipedia, The Free EncyclopediaDokumen9 halamanINDIA Ministry of STATE - Wikipedia, The Free EncyclopediaSun Uday SunudayBelum ada peringkat

- 11 Lookout TowerDokumen10 halaman11 Lookout TowerSun Uday SunudayBelum ada peringkat

- Cicil 131 To 179Dokumen272 halamanCicil 131 To 179Sun Uday SunudayBelum ada peringkat

- SSLC Civics and Geography Eng Binder1Dokumen14 halamanSSLC Civics and Geography Eng Binder1Sun Uday SunudayBelum ada peringkat

- Resistance Matrix RethemeDokumen2 halamanResistance Matrix RethemeSun Uday SunudayBelum ada peringkat

- RulebookDokumen16 halamanRulebookSun Uday SunudayBelum ada peringkat

- Sheriff of Nottingham - Declaration and Score TrackerDokumen2 halamanSheriff of Nottingham - Declaration and Score TrackerSun Uday SunudayBelum ada peringkat

- Coup Rebellion G54 Anarchy Player Aid v1.0Dokumen1 halamanCoup Rebellion G54 Anarchy Player Aid v1.0Sun Uday SunudayBelum ada peringkat

- Xavier University 2015-2016 Annual ReportDokumen148 halamanXavier University 2015-2016 Annual ReportSun Uday SunudayBelum ada peringkat

- Coup Restructure - Davide L Rizzo 2020Dokumen6 halamanCoup Restructure - Davide L Rizzo 2020Sun Uday SunudayBelum ada peringkat

- Coup Reform-Resistance v.7Dokumen4 halamanCoup Reform-Resistance v.7Sun Uday SunudayBelum ada peringkat

- Uk Unit I Cse Split UpDokumen69 halamanUk Unit I Cse Split UpSun Uday SunudayBelum ada peringkat

- TISS Annual Report Highlights Construction Grants AccreditationDokumen161 halamanTISS Annual Report Highlights Construction Grants AccreditationSun Uday SunudayBelum ada peringkat

- Uk Unit II Cse Split UpDokumen29 halamanUk Unit II Cse Split UpSun Uday SunudayBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Entrepreneurship and Enterprise Development Final ExamDokumen3 halamanEntrepreneurship and Enterprise Development Final ExammelakuBelum ada peringkat

- Reflective Essay - Pestle Mortar Clothing BusinessDokumen7 halamanReflective Essay - Pestle Mortar Clothing Businessapi-239739146Belum ada peringkat

- Strategic Financial Management 1 70Dokumen70 halamanStrategic Financial Management 1 70Tija NaBelum ada peringkat

- Halbwachs Collective MemoryDokumen15 halamanHalbwachs Collective MemoryOana CodruBelum ada peringkat

- Bangkok Capital City ThailandDokumen1 halamanBangkok Capital City ThailandCorina Taraș-LunguBelum ada peringkat

- Mountanium Perfumes Website LaunchDokumen39 halamanMountanium Perfumes Website LaunchHaritaa Varshini Balakumaran0% (1)

- CadburyDokumen40 halamanCadburyAshutosh GoelBelum ada peringkat

- Bankruptcy PredictionDokumen33 halamanBankruptcy PredictionRagavi RzBelum ada peringkat

- Master Chef Employment Agmt (14 Pages)Dokumen14 halamanMaster Chef Employment Agmt (14 Pages)Jonny DuppsesBelum ada peringkat

- Investors PerceptionDokumen30 halamanInvestors PerceptionAmanNagaliaBelum ada peringkat

- AL-MADINAH UNIVERSITY 3RD CONVOCATION CEREMONYDokumen2 halamanAL-MADINAH UNIVERSITY 3RD CONVOCATION CEREMONYMuhd FawwazBelum ada peringkat

- Part 1 Building Your Own Binary Classification ModelDokumen6 halamanPart 1 Building Your Own Binary Classification ModelWathek Al Zuaiby38% (13)

- Workplace Solutions for Communication, Conflict and Values IssuesDokumen12 halamanWorkplace Solutions for Communication, Conflict and Values Issuesz3flyer0% (1)

- Periodic inventory method accounting entriesDokumen9 halamanPeriodic inventory method accounting entriesnicole bancoroBelum ada peringkat

- Tourism Operations) - TerminologiesDokumen12 halamanTourism Operations) - Terminologiesriskyfrisky100% (2)

- VcoDokumen61 halamanVcoJivithra ParamasiumBelum ada peringkat

- OPIM 101 Midterm Exam QuestionsDokumen12 halamanOPIM 101 Midterm Exam Questionsjoe91bmw0% (1)

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDokumen8 halamanTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotBelum ada peringkat

- Trial Balance Accounting RecordsDokumen8 halamanTrial Balance Accounting RecordsKevin Espiritu100% (1)

- University of Caloocan City: College of Business and AccountancyDokumen20 halamanUniversity of Caloocan City: College of Business and AccountancyDezavelle LozanoBelum ada peringkat

- Two Pesos v. Taco CabanaDokumen2 halamanTwo Pesos v. Taco CabanaNenzo Cruz100% (1)

- Arta Melina Samosir's ResumeDokumen1 halamanArta Melina Samosir's ResumeNyonk OnleehBelum ada peringkat

- Fashion Marketing & Management PortfolioDokumen70 halamanFashion Marketing & Management PortfolioMyleka Gantt100% (2)

- India Strategy 4qfy17 20170410 Mosl RP Pg292Dokumen292 halamanIndia Strategy 4qfy17 20170410 Mosl RP Pg292Saurabh KaushikBelum ada peringkat

- ARIA Telecom Company - DialerDokumen9 halamanARIA Telecom Company - DialerAnkit MittalBelum ada peringkat

- When Barry Met SammyDokumen3 halamanWhen Barry Met SammyJahanzaib JavaidBelum ada peringkat

- Taxation Management AssignmentDokumen12 halamanTaxation Management AssignmentJaspreetBajajBelum ada peringkat

- Asturias Sugar Central, Inc. vs. Commissioner of CustomsDokumen12 halamanAsturias Sugar Central, Inc. vs. Commissioner of CustomsRustom IbanezBelum ada peringkat

- Priya ResumeDokumen3 halamanPriya Resumesunnychadha0548Belum ada peringkat

- StarbucksDokumen9 halamanStarbucksMeenal MalhotraBelum ada peringkat