1702-RT June 2013 Schedules 10 To 13

Diunggah oleh

Gkt MarcosJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

1702-RT June 2013 Schedules 10 To 13

Diunggah oleh

Gkt MarcosHak Cipta:

Format Tersedia

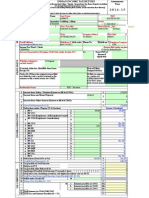

Annual Income Tax Return 1702-RT

Page 7 - Schedules 10 & 11

0 0 0

June 2013

BIR Form No.

Taxpayer Identification Number (TIN) 0

Registered Name Schedule 10 - BALANCE SHEET Assets

1702-RT06/13P7

1 Current Assets 2 Long-Term Investment 3 Property, Plant and Equipment Net 4 Long-Term Receivables 5 Intangible Assets 6 Other Assets 7 Total Assets (Sum of Items 1 to 6) Liabilities and Equity 8 Current Liabilities 9 Long-Term Liabilities 10 Deferred Credits 11 Other Liabilities 12 Total Liabilities (Sum of Items 8 to 11) 13 Capital Stock 14 Additional Paid-in Capital 15 Retained Earnings 16 Total Equity (Sum of Items 13 to 15) 17 Total Liabilities and Equity (Sum of Items 12 & 16)

11

Schedule 11

(On column 3 enter the amount of capital contribution and on the last column enter the percentage this represents on the entire ownership.)

Stockholders

Partners

Members Information (Top 20 stockholders, partners or members) TIN Capital Contribution

REGISTERED NAME

% to Total

Annual Income Tax Return

Page 8 - Schedules 12 & 13

0 0 0 Taxpayer Identification Number (TIN) 0

1702-RT

June 2013

BIR Form No.

Registered Name

1702-RT06/13P8

Schedule 12 - Supplemental Information (Attach additional sheet/s, if necessary)

I) Gross Income/ Receipts Subjected to Final Withholding

A) Exempt

B) Actual Amount/Fair Market Value/Net Capital Gains

C) Final Tax Withheld/Paid

1 Interests 2 Royalties 3 Dividends

4 Prizes and Winnings

II) Sale/Exchange of Real Properties

A) Sale/Exchange #1

B) Sale/Exchange #2

5 Description of Property (e.g., land, improvement, etc.) 6 OCT/TCT/CCT/Tax Declaration No. 7 Certificate Authorizing Registration (CAR) No. 8 Actual Amount/Fair Market Value/Net Capital Gains 9 Final Tax Withheld/Paid

III) Sale/Exchange of Shares of Stock

10 Kind (PS/CS) / Stock Certificate Series No. 11 Certificate Authorizing Registration (CAR) No. 12 Number of Shares 13 Date of Issue (MM/DD/YYYY) 14 Actual Amount/Fair Market Value/Net Capital Gains 15 Final Tax Withheld/Paid

IV) Other Income (Specify)

A) Sale/Exchange #3

B) Sale/Exchange #4

A) Other Income #1

B) Other Income #2

16 Other Income Subject to Final Tax Under Sections 57(A)/127/others of the Tax Code, as amended

(Specify)

17 Actual Amount/Fair Market Value/Net Capital Gains 18 Final Tax Withheld/Paid 19 Total Final Tax Withheld/Paid (Sum of Items 1C to 4C, 9A,9B,15A,15B,18A &18B) Schedule 13- Gross Income/Receipts Exempt from Income Tax 1 Return of Premium

(Actual Amount/Fair Market Value)

I) Personal/Real Properties Received thru Gifts, Bequests, and Devises 2 Description of Property (e.g., land, improvement, etc.) 3 Mode of Transfer (e.g. Donation) 4 Certificate Authorizing Registration (CAR) No. 5 Actual Amount/Fair Market Value II) Other Exempt Income/Receipts 6 Other Exempt Income/Receipts Under Sec. 32 (B) of the Tax Code, as amended (Specify) 7 Actual Amount/Fair Market Value/Net Capital Gains

A) Personal/Real Properties #1

B) Personal/Real Properties #2

A) Other Exempt Income #1

B) Other Exempt Income #2

8 Total Income/Receipts Exempt from Income Tax (Sum of Items 1, 5A, 5B, 7A & 7B)

Anda mungkin juga menyukai

- For BIR Use Only Annual Income Tax ReturnDokumen7 halamanFor BIR Use Only Annual Income Tax ReturndignaBelum ada peringkat

- BIR Form 1702-ExDokumen7 halamanBIR Form 1702-ExShiela PilarBelum ada peringkat

- 82202BIR Form 1702-MXDokumen9 halaman82202BIR Form 1702-MXRen A EleponioBelum ada peringkat

- 1700 June 2013 Page 3Dokumen1 halaman1700 June 2013 Page 3AdyBelum ada peringkat

- For BIR Annual Income Tax Return Form 1702-MXDokumen9 halamanFor BIR Annual Income Tax Return Form 1702-MXJp AlvarezBelum ada peringkat

- 2011 Itr4 SpecificeDokumen54 halaman2011 Itr4 SpecificeAnand ThackerBelum ada peringkat

- Form26AS TXT File FormatDokumen6 halamanForm26AS TXT File FormatnidhithackerBelum ada peringkat

- Annual Information Return (AIRDokumen8 halamanAnnual Information Return (AIRmamasita25Belum ada peringkat

- Form ITR-1Dokumen3 halamanForm ITR-1Rajeev PuthuparambilBelum ada peringkat

- 1604 CFDokumen6 halaman1604 CFromarcambriBelum ada peringkat

- Monthly Remittance ReturnDokumen1 halamanMonthly Remittance ReturnValerieAnnVilleroAlvarezValienteBelum ada peringkat

- File ITR-1 Form for Individuals with Income from Salary and InterestDokumen6 halamanFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvBelum ada peringkat

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDokumen11 halamanSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranBelum ada peringkat

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDokumen4 halamanMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesBelum ada peringkat

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDokumen69 halamanSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen12 halamanITR-3 Indian Income Tax Return: Part A-GENmehtakvijayBelum ada peringkat

- Bir 1600Dokumen13 halamanBir 1600Adelaida TuazonBelum ada peringkat

- 2551MDokumen4 halaman2551MLecel LlamedoBelum ada peringkat

- For BIR Use Only Annual Income Tax ReturnDokumen12 halamanFor BIR Use Only Annual Income Tax Returnmiles1280Belum ada peringkat

- 2550MDokumen9 halaman2550MAngel AlfaroBelum ada peringkat

- Gross Total Income (1+2+3) 4: System CalculatedDokumen8 halamanGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamBelum ada peringkat

- 2016 Itr4 PR3Dokumen165 halaman2016 Itr4 PR3TejasBelum ada peringkat

- Monthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDDokumen3 halamanMonthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDAbs PangaderBelum ada peringkat

- Upvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshDokumen6 halamanUpvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshShreya AgarwalBelum ada peringkat

- RecoverdDokumen55 halamanRecoverdcmtssikarBelum ada peringkat

- VAT Return Form DetailsDokumen9 halamanVAT Return Form DetailsAdriel Torreda NaturalBelum ada peringkat

- 2550m FormDokumen1 halaman2550m FormAileen Jarabe80% (5)

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Dokumen9 halamanGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresBelum ada peringkat

- BIR Form 2551MDokumen4 halamanBIR Form 2551MJun Casono100% (2)

- Annexure BDokumen10 halamanAnnexure BSushant SaxenaBelum ada peringkat

- For Individual and Other Taxpayers (Other Than Company) : IT-11GADokumen9 halamanFor Individual and Other Taxpayers (Other Than Company) : IT-11GAsojol747412Belum ada peringkat

- Income Tax Payment Challan: PSID #: 20391652Dokumen1 halamanIncome Tax Payment Challan: PSID #: 20391652Tanvir AhmedBelum ada peringkat

- Bir Forms PDFDokumen4 halamanBir Forms PDFgaryBelum ada peringkat

- BIR Form 1600Dokumen39 halamanBIR Form 1600maeshach60% (5)

- ITR-2 Indian Income Tax Return: Part A-GENDokumen12 halamanITR-2 Indian Income Tax Return: Part A-GENMankamesachinBelum ada peringkat

- File ITR-1 online in minutes with pre-filled dataDokumen3 halamanFile ITR-1 online in minutes with pre-filled datathakurrobinBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen7 halamanITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeBelum ada peringkat

- New Form 2550 M - Monthly VAT Return P 1-2Dokumen3 halamanNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Dari EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Belum ada peringkat

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryDari EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryDari EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Miscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryDari EverandMiscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryDari EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryBelum ada peringkat

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryDari EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryDari EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Totalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryDari EverandTotalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryBelum ada peringkat

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryDari EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryDari EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Freight Forwarding Revenues World Summary: Market Values & Financials by CountryDari EverandFreight Forwarding Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryDari EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsDari EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- Freight Transportation Arrangement Revenues World Summary: Market Values & Financials by CountryDari EverandFreight Transportation Arrangement Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryDari EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryBelum ada peringkat

- Fuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryDari EverandFuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryBelum ada peringkat

- Air Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryDari EverandAir Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryBelum ada peringkat

- Cattle Farm Business Plan ExampleDokumen39 halamanCattle Farm Business Plan ExampleHung VuBelum ada peringkat

- Intermediate Accounting 3 Final Exam ReviewDokumen19 halamanIntermediate Accounting 3 Final Exam ReviewMay Ramos100% (2)

- Assignment 1Dokumen21 halamanAssignment 1siddhant jainBelum ada peringkat

- Accounting For Investments: TheoriesDokumen20 halamanAccounting For Investments: TheoriesJohn AlbateraBelum ada peringkat

- 4AC1 02 MSC 20210517Dokumen11 halaman4AC1 02 MSC 2021051788 88Belum ada peringkat

- NeeravDokumen46 halamanNeeravhemuranaBelum ada peringkat

- Consolidations: Chapter-6Dokumen54 halamanConsolidations: Chapter-6Ram KumarBelum ada peringkat

- A. Chart of Accounts: Salaries PayableDokumen12 halamanA. Chart of Accounts: Salaries PayableJerome SerranoBelum ada peringkat

- Cash Flow ExerciseDokumen1 halamanCash Flow ExercisecoeprodpBelum ada peringkat

- Pharmaceutical Repackaging Plant Business PlanDokumen19 halamanPharmaceutical Repackaging Plant Business PlanSheroze MasoodBelum ada peringkat

- Just in TimeDokumen10 halamanJust in TimeDaniela Paoline RomeroBelum ada peringkat

- AFA Tut 2Dokumen16 halamanAFA Tut 2Đỗ Kim ChiBelum ada peringkat

- Supplier Selection Assessment Check List - DBUDokumen26 halamanSupplier Selection Assessment Check List - DBUnathisonsBelum ada peringkat

- KPMG 08 Share-Based Payments Comparison US To IFRSDokumen12 halamanKPMG 08 Share-Based Payments Comparison US To IFRSMary Grace Caguioa AgasBelum ada peringkat

- Accounting For ManagersDokumen14 halamanAccounting For ManagersKabo Lucas67% (3)

- Case 11 Financial ForecastingDokumen9 halamanCase 11 Financial ForecastingFD ReynosoBelum ada peringkat

- Annual Report Highlights Titan Industries' 22% Sales Growth and 57.5% Rise in Net ProfitDokumen24 halamanAnnual Report Highlights Titan Industries' 22% Sales Growth and 57.5% Rise in Net ProfitAkanksha NandaBelum ada peringkat

- Income Statement & Ratio AnalysisDokumen16 halamanIncome Statement & Ratio AnalysisababsenBelum ada peringkat

- Financial Performance Evaluation Using RATIO ANALYSISDokumen31 halamanFinancial Performance Evaluation Using RATIO ANALYSISGurvinder Arora100% (1)

- Business Plan SampleDokumen12 halamanBusiness Plan Sampleyam yam100% (2)

- 7.0 Financial Analysis & Projections: 7.1 Sources & Uses of CapitalDokumen5 halaman7.0 Financial Analysis & Projections: 7.1 Sources & Uses of CapitalRey OñateBelum ada peringkat

- On January 3 2014 Mega Limited Purchased 3 000 Shares 30Dokumen1 halamanOn January 3 2014 Mega Limited Purchased 3 000 Shares 30Let's Talk With HassanBelum ada peringkat

- TCP Financial Analysis Q1Dokumen7 halamanTCP Financial Analysis Q1Dulakshi RanadeeraBelum ada peringkat

- SMCH 16Dokumen20 halamanSMCH 16FratFoolBelum ada peringkat

- Titan Company Annual ReportDokumen4 halamanTitan Company Annual ReportSagnik ChakrabortyBelum ada peringkat

- Financial Planner For OFW and FamilyDokumen27 halamanFinancial Planner For OFW and FamilymoneylifebloodBelum ada peringkat

- Focus On Personal Finance 5th Edition Kapoor Solutions ManualDokumen23 halamanFocus On Personal Finance 5th Edition Kapoor Solutions ManualDeanPetersrpmik100% (16)

- ch08 Loftus 3eDokumen12 halamanch08 Loftus 3eTrinh LêBelum ada peringkat

- Pas 32 PFRS 9Dokumen110 halamanPas 32 PFRS 9Katzkie Montemayor GodinezBelum ada peringkat

- Test Bank With Answers of Accounting Information System by Turner Chapter 10Dokumen25 halamanTest Bank With Answers of Accounting Information System by Turner Chapter 10Ebook free80% (5)