Premium Paid Certificate: Date: 09-JAN-2014

Diunggah oleh

kumber_singh5069Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Premium Paid Certificate: Date: 09-JAN-2014

Diunggah oleh

kumber_singh5069Hak Cipta:

Format Tersedia

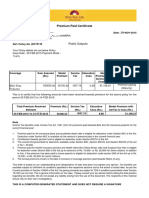

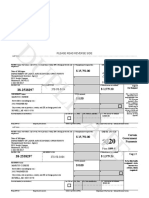

Premium Paid Certificate

Mr Vaibhav Mishra Ref: Policy No. 004341520 Your Policy details are as below Policy Issue Date : 21-AUG-2010 Payment Mode : Monthly Date : 09-JAN-2014

Coverage BSLI Dream Endowment Plan Enhanced Sum Assured

Face Amount Modal (Rs.) Premium (Rs.) 304000.00 2096000.00 669.16 331.87

Coverage Status Premium paying (regular) Premium paying (regular)

This is to certify that the following amounts have been received towards premium for the above policy for the period 01-APR-2000 to 09-JAN-2014.

Effective Date of Deposit 21-AUG-2010 11-OCT-2010 08-NOV-2010 08-DEC-2010 08-FEB-2011 10-MAR-2011 08-APR-2011 13-APR-2011 09-MAY-2011 08-JUN-2011 08-JUL-2011 21-AUG-2011 09-SEP-2011 08-OCT-2011 11-NOV-2011 08-DEC-2011 09-JAN-2012 08-FEB-2012 09-MAR-2012 09-APR-2012 08-MAY-2012 08-JUN-2012 09-JUL-2012 21-AUG-2012

Premium (Rs.) 2,002.06 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,000.99 1,001.07 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,000.95 1,001.03

08-SEP-2012 08-OCT-2012 08-NOV-2012 08-DEC-2012 08-JAN-2013 08-FEB-2013 08-MAR-2013 08-APR-2013 08-MAY-2013 08-JUN-2013 11-JUL-2013 21-AUG-2013 09-SEP-2013 09-OCT-2013 08-NOV-2013 09-DEC-2013 Total Received Note

1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,001.03 1,000.99 1,001.07 1,001.03 1,001.03 1,001.03 1,001.03 41,042.15

Income Tax Benefits under the Income Tax Act ,1961 for premiums paid towards Birla Sun Life Insurance products for the current financial year: 1. 2. 3. 4. 5. For Flexi Secure life Retirement (Pension) Plan: Under Section 80 CCC (1), Contribution made to pension fund upto a maximum of Rs. 1,00,000/-. For Critical illness rider under Section 80D for individual and HUF upto a maximum of Rs. 15,000/- and for senior citizens aged 65 years above Rs. 20,000/-. For all other products: Under Section 80C, annual premium only to the extent of 20% of the face amount of the policy subject to maximum of Rs. 1,00,000/-. The overall limit prescribed for Section 80C, Section 80CCC and Section 80CCD is Rs. 1,00,000/-. For Health related policies and/or health related riders - The premium paid by you up to Rs.15,000 (Rs.20,000 for senior citizens) per annum to insure yourself and/or spouse and dependent children , is eligible for tax benefit under Section 80D of the Income Tax Act, 1961. Additionally, the premium paid by you, upto Rs.15000 (Rs.20,000 for senior citizens), to insure your parent(s) , is eligible for tax benefit under Section 80D of the Income Tax Act, 1961. The above benefits may change as per the extant tax laws.

This letter is based on our understanding of current tax laws prevailing in India. These laws are subject to change and any such change could have a retrospective effect. This letter should not be construed as tax, legal or investment opinion from us. For specific suitability, you are requested to consult your tax advisor.

THIS IS A COMPUTER GENERATED STATEMENT AND DOES NOT REQUIRE A SIGNATURE

Anda mungkin juga menyukai

- 401(k) Plans Made Easy: Understanding Your 401(k) PlanDari Everand401(k) Plans Made Easy: Understanding Your 401(k) PlanBelum ada peringkat

- Premium Paid Certificate DetailsDokumen2 halamanPremium Paid Certificate DetailsGuy LoveBelum ada peringkat

- 1865362Dokumen1 halaman1865362Bhavesh ParekhBelum ada peringkat

- Premium Paid Certificate: Date: 25-MAR-2011Dokumen2 halamanPremium Paid Certificate: Date: 25-MAR-2011sivasivaniBelum ada peringkat

- Life Insurance PremiumDokumen1 halamanLife Insurance PremiumSufiyan Kazi0% (3)

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Dokumen6 halamanLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenBelum ada peringkat

- Birla Sun Life PremiumDokumen1 halamanBirla Sun Life PremiumBALAJI NAIK MudavatuBelum ada peringkat

- Taxation Law ProjectDokumen15 halamanTaxation Law Projectraj vardhan agarwalBelum ada peringkat

- Income Tax Deductions FY 2016Dokumen13 halamanIncome Tax Deductions FY 2016Nishant JhaBelum ada peringkat

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDokumen4 halamanFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiBelum ada peringkat

- Tax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreDokumen5 halamanTax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreAjay MagarBelum ada peringkat

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Dokumen5 halamanTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgBelum ada peringkat

- Deductions On Section 80CDokumen12 halamanDeductions On Section 80CViraja GuruBelum ada peringkat

- How To Save Tax For FY 2013 14Dokumen42 halamanHow To Save Tax For FY 2013 14duderamBelum ada peringkat

- Tax SavingsDokumen32 halamanTax Savingsh946073000850% (2)

- Shreha Shah (Ba LLB Vii)Dokumen7 halamanShreha Shah (Ba LLB Vii)Shreha VlogsBelum ada peringkat

- Tax Deductions under Sections 80C to 80U from Gross Total IncomeDokumen19 halamanTax Deductions under Sections 80C to 80U from Gross Total IncomeShamrao GhodakeBelum ada peringkat

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Dokumen28 halamanModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyBelum ada peringkat

- CMA-How To Save Tax 2013-14Dokumen37 halamanCMA-How To Save Tax 2013-14sunilsunny317Belum ada peringkat

- Life Insurance PremiumDokumen1 halamanLife Insurance Premiumpratik satputeBelum ada peringkat

- Tax Planning For Year 2010Dokumen24 halamanTax Planning For Year 2010Mehak BhargavaBelum ada peringkat

- Tax Certificate - 008857356 - 161253Dokumen1 halamanTax Certificate - 008857356 - 161253gaurav sharmaBelum ada peringkat

- Premium Paid Certificate for Platinum Plus Life InsuranceDokumen1 halamanPremium Paid Certificate for Platinum Plus Life InsurancenovalhemantBelum ada peringkat

- Presented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDokumen22 halamanPresented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDhruv singhBelum ada peringkat

- A Guide To Income Tax Benefits For Senior CitizensDokumen18 halamanA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalBelum ada peringkat

- Income Tax ConsultationDokumen15 halamanIncome Tax Consultation21BCO058 Tharun B KBelum ada peringkat

- Notes To Investment Proof SubmissionDokumen10 halamanNotes To Investment Proof SubmissionVinayak DhotreBelum ada peringkat

- Income Tax RulesDokumen4 halamanIncome Tax RulesvenkatanagachandraBelum ada peringkat

- Income Tax KnowledgeDokumen5 halamanIncome Tax KnowledgeAbhishekBelum ada peringkat

- Income Tax ProjectDokumen6 halamanIncome Tax Projectdipmoip2210Belum ada peringkat

- Indian Tax Structure ExplainedDokumen7 halamanIndian Tax Structure ExplainedHarshita MarmatBelum ada peringkat

- IT Assignment 2Dokumen7 halamanIT Assignment 2Srinivasulu Reddy PBelum ada peringkat

- Guideline On ITDokumen19 halamanGuideline On ITmikekikBelum ada peringkat

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDokumen8 halamanDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaBelum ada peringkat

- 2023 PDF1681368243183Dokumen2 halaman2023 PDF1681368243183RpPaBelum ada peringkat

- 1 .Income Tax On Salaries - (01.06.2015)Dokumen57 halaman1 .Income Tax On Salaries - (01.06.2015)yvBelum ada peringkat

- Investment Declaration Form11-12Dokumen2 halamanInvestment Declaration Form11-12girijasankar11Belum ada peringkat

- IT Calculator 14 15 Taxguru - inDokumen16 halamanIT Calculator 14 15 Taxguru - inanirbanpwd76Belum ada peringkat

- Budget Synopsis 2015-16 PDFDokumen12 halamanBudget Synopsis 2015-16 PDFBhagwan PalBelum ada peringkat

- ItfjfygjDokumen3 halamanItfjfygjKrishna GBelum ada peringkat

- Financial Year vs Assessment Year - What is the differenceDokumen15 halamanFinancial Year vs Assessment Year - What is the differencemaruthappan sundaramBelum ada peringkat

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDokumen4 halamanIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaBelum ada peringkat

- Tax Certificate - of Anjali Lalwani PDFDokumen2 halamanTax Certificate - of Anjali Lalwani PDFBasant GakhrejaBelum ada peringkat

- 5 Tax-Planning Tips For Salaried People: Share ThisDokumen3 halaman5 Tax-Planning Tips For Salaried People: Share ThisPriya DubeyBelum ada peringkat

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDokumen19 halamanIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharBelum ada peringkat

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDokumen1 halamanThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantBelum ada peringkat

- Presentation For Viva: Siddhesh Dhotre HPGD/JL20/1852Dokumen16 halamanPresentation For Viva: Siddhesh Dhotre HPGD/JL20/1852SIDDHESHBelum ada peringkat

- BudgetDokumen21 halamanBudgetshweta_narkhede01Belum ada peringkat

- Analysis of Tax05Dokumen19 halamanAnalysis of Tax05kharemixBelum ada peringkat

- Individual Txation FY 203 24Dokumen44 halamanIndividual Txation FY 203 24Smarty ShivamBelum ada peringkat

- ITR SectionsDokumen6 halamanITR SectionsRohan SharmaBelum ada peringkat

- Save Income Tax on Salary of Rs. 1 MillionDokumen7 halamanSave Income Tax on Salary of Rs. 1 MillionMohit SahniBelum ada peringkat

- ITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsDokumen4 halamanITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsSANDEEP SAHUBelum ada peringkat

- How To Calculate Income TaxDokumen4 halamanHow To Calculate Income TaxreemaBelum ada peringkat

- DT AmendmentsDokumen39 halamanDT AmendmentsMurali GopalakrishnaBelum ada peringkat

- Section 80C To 80U 1Dokumen41 halamanSection 80C To 80U 1karanmasharBelum ada peringkat

- Filing Late Tax Returns: Penalties, Implications and ExceptionsDokumen7 halamanFiling Late Tax Returns: Penalties, Implications and ExceptionsBhupendra SharmaBelum ada peringkat

- Taxation LawDokumen20 halamanTaxation LawAnjana P NairBelum ada peringkat

- Maulana Azad National Urdu University: CircularDokumen4 halamanMaulana Azad National Urdu University: CircularDebasish BiswalBelum ada peringkat

- Income Tax Law & PracticeDokumen29 halamanIncome Tax Law & PracticeMohanBelum ada peringkat

- Ugcnetchemicalsience 2011 ModelpaperDokumen32 halamanUgcnetchemicalsience 2011 ModelpaperSwapna PagareBelum ada peringkat

- Chem Model p1Dokumen21 halamanChem Model p1amcbdhll100% (2)

- AptitudeDokumen5 halamanAptitudeKamaraj MuthupandianBelum ada peringkat

- 3-Natural Products ChemistryDokumen23 halaman3-Natural Products Chemistrykumber_singh5069Belum ada peringkat

- PericyclicsDokumen28 halamanPericyclicsEdward PittsBelum ada peringkat

- FUNCTIONAL GROUP INTERCONVERSIONS GUIDEDokumen6 halamanFUNCTIONAL GROUP INTERCONVERSIONS GUIDEJulia MaramatBelum ada peringkat

- Common ReagentsDokumen5 halamanCommon Reagentskumber_singh5069Belum ada peringkat

- Organic Photochemistry Reaction Control & Side ReactionsDokumen38 halamanOrganic Photochemistry Reaction Control & Side ReactionslsueyinBelum ada peringkat

- DMF Basics Under GDUFADokumen44 halamanDMF Basics Under GDUFAkumber_singh50690% (1)

- Stability StudiesDokumen26 halamanStability Studieskumber_singh5069Belum ada peringkat

- ch20 Amines Part2Dokumen7 halamanch20 Amines Part2kumber_singh5069Belum ada peringkat

- For CRD LabelDokumen2 halamanFor CRD Labelkumber_singh5069Belum ada peringkat

- Answer Key of June 2013 Csir ChemistryDokumen1 halamanAnswer Key of June 2013 Csir Chemistrykumber_singh5069Belum ada peringkat

- Chem 215 Myers: Birch ReductionDokumen7 halamanChem 215 Myers: Birch ReductionPrasanna AndojuBelum ada peringkat

- Chemical Science June 2013 PaperDokumen46 halamanChemical Science June 2013 Paperkumber_singh5069Belum ada peringkat

- Leaflet NewDokumen1 halamanLeaflet Newamitkumar4040Belum ada peringkat

- Oxidation & Reduction ReactionDokumen39 halamanOxidation & Reduction Reactionkumber_singh5069Belum ada peringkat

- Syndicate Bank Admit CardDokumen2 halamanSyndicate Bank Admit Cardkumber_singh5069Belum ada peringkat

- PayrollDokumen3 halamanPayrolldesiree joy corpuz100% (1)

- Tax RatesDokumen2 halamanTax RatesSalma GurarBelum ada peringkat

- Declaration of Loss on Housing Property & IncomeDokumen2 halamanDeclaration of Loss on Housing Property & Incomemansooralikhan ABelum ada peringkat

- AFAB Vat-Zero Rating Application & RequirementsDokumen3 halamanAFAB Vat-Zero Rating Application & RequirementsUnicargo Int'l ForwardingBelum ada peringkat

- Txndetails 101878000509244982Dokumen1 halamanTxndetails 101878000509244982s5t5wffcnfBelum ada peringkat

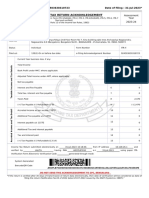

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Dokumen1 halamanIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressBelum ada peringkat

- 2.form of Appeal-ATIRDokumen2 halaman2.form of Appeal-ATIRwasim nisar0% (1)

- PLDT 2307 July 2021 Front CorrectedDokumen1 halamanPLDT 2307 July 2021 Front CorrectedChristopher AbundoBelum ada peringkat

- Payslip 2023 May (City Government of TAGUIG)Dokumen1 halamanPayslip 2023 May (City Government of TAGUIG)Meljun CortesBelum ada peringkat

- Individual Income TaxDokumen4 halamanIndividual Income TaxCristopher Romero Danlog0% (1)

- HTP Interim Contact Letter - J305062444Dokumen2 halamanHTP Interim Contact Letter - J305062444Shneur MorozowBelum ada peringkat

- Bill FormetDokumen1 halamanBill Formetshuklavishal135Belum ada peringkat

- BIR guidelines tax compliance candidates political parties contributorsDokumen3 halamanBIR guidelines tax compliance candidates political parties contributorsNikki SiaBelum ada peringkat

- Glowroad Dec'18Dokumen1 halamanGlowroad Dec'18sumit aroraBelum ada peringkat

- Income Tax of IndividualsDokumen23 halamanIncome Tax of Individualspeter banjaoBelum ada peringkat

- Schedule E income and expensesDokumen2 halamanSchedule E income and expensesAhmad GaberBelum ada peringkat

- Calibration Lab Assessment Fee InvoiceDokumen1 halamanCalibration Lab Assessment Fee InvoiceSharad JainBelum ada peringkat

- P9B2005 - Tax Free RenumerationDokumen2 halamanP9B2005 - Tax Free RenumerationDavid SeweBelum ada peringkat

- Form 941 Tax Filing GuideDokumen4 halamanForm 941 Tax Filing GuidegopaljiiBelum ada peringkat

- RR No. 12-13Dokumen2 halamanRR No. 12-13shlm bBelum ada peringkat

- Form No. 16: Part ADokumen7 halamanForm No. 16: Part Ahelpdesk svscenterBelum ada peringkat

- Form 1099GDokumen2 halamanForm 1099GMarcus KreseBelum ada peringkat

- Cir Vs DlsuDokumen2 halamanCir Vs DlsuNLainie Omar50% (2)

- Celine's Accounting ChartDokumen3 halamanCeline's Accounting ChartCeline EvangelistaBelum ada peringkat

- Wasteland Entertainment Pvt. LTD.: Transaction Number Receipt DateDokumen1 halamanWasteland Entertainment Pvt. LTD.: Transaction Number Receipt DateRaghu RamanBelum ada peringkat

- Silver Tech salary slip January 2023Dokumen2 halamanSilver Tech salary slip January 2023Raja BabuBelum ada peringkat

- Chandan Salary SlipDokumen5 halamanChandan Salary SlipSumit BhardwajBelum ada peringkat

- Polycab Cable Price ListDokumen1 halamanPolycab Cable Price ListnavneetBelum ada peringkat

- GST compliant invoice template for textile businessDokumen2 halamanGST compliant invoice template for textile businessAham GtyBelum ada peringkat

- Earnings Rate QTY Amount Deductions: Mailum, Angelyn BDokumen12 halamanEarnings Rate QTY Amount Deductions: Mailum, Angelyn BAndrea Banayat MailumBelum ada peringkat