Gauravjwal Kundu-PRN18-Zeus Asset Management

Diunggah oleh

gauravjwalDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Gauravjwal Kundu-PRN18-Zeus Asset Management

Diunggah oleh

gauravjwalHak Cipta:

Format Tersedia

SAPM Prof.

Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

Zeus Asset Management

1 Introduction and methodologies used

Four mutual funds operated by Zeus Asset Management, viz. Zeus Equity Fund, Zeus Bond Fund, Zeus Balanced Fund and Zeus International Fund, have been evaluated for their risk return characteristics by comparing them with suitable benchmark indices. The tools used for evaluation include: Graphical performance summaries Information Ratio Sharpe Ratio Jensens Alpha Sortino Ratio Value at Risk

The R PerformanceAnalytics library has been used for evaluations (Peter Carl and Brian G. Peterson (2013). PerformanceAnalytics: Econometric tools for performance and risk analysis. R package version 1.1.0.) For brevity, formulae for calculations have not been mentioned (except for Information Ratio) since they have been covered in class.

2 Graphical performance summaries

Graphical performance summaries have been depicted below. Data sets under consideration include the entire period of the respective funds operations. Note: Since we are dealing with graphical summaries, returns are taken as monthly figures and not annualized, unless explicitly mentioned.

Figure 1: Risk Return scatter of Zeus funds and benchmark indices. The dotted lines indicate points along which Sharpe Ratios are one, two and three

Page 1 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

Page 2 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

Figure 2: Cumulative Returns and Drawdowns of Zeus funds, compared to benchmark indices.

Figure 3: Histograms of monthly returns for various Zeus Funds. Value-at-Risk lines are included.

2.1 Inferences from graphical summaries

In terms of absolute returns, the Zeus Equity, Balanced and Bond funds have been outperformed by their benchmark indices. In terms of risk-adjusted returns, one measure of which is the Sharpe Ratio, only the Zeus Equity fund has managed to outperform its benchmarks. The remaining Zeus funds have inferior performances in terms of risk adjusted returns. Most Zeus funds, along with their benchmarks, cluster around the Sharpe Ratio=1 line. The returns charts indicate that most Zeus funds closely mirror the returns of their benchmarks, however absolute returns are found lagging. Draw-downs in the cases of Zeus funds are lower than the respective benchmarks most of the time, which may appeal to the more risk averse among investors. Page 3 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

Histograms are negatively skewed past zero which indicates positive returns most of the time. The Zeus international Fund has very high volatility of returns and poor performance. However it should be noted that it is a relatively newer fund when compared to the other three Zeus funds.

3 Sharpe Ratios

The Sharpe Ratio, which is a measure of risk adjusted Fund returns over the risk free rate, has been calculated and results are depicted below.

Annualised Sharpe Ratios

Zeus Equity Fund Lipper Growth Index S&P 500 Index Zeus Balanced Fund Lipper Balanced Index Zeus Bond Fund Lehman Brothers Aggregate Index MSCI Index Zeus International Fund 0 0.115 0.027 0.2 0.4 0.6 0.8 1 1.2 0.691 0.747 0.723 0.862 0.932 0.922 1.073

Figure 4: Sharpe Ratios of Zeus Funds and their benchmarks.

We see that except for Zeus Equity, all other Zeus funds have inferior risk-adjusted performance compared to their benchmarks.

4 Information Ratios

The information ratio is a measure of the consistency of returns of portfolio as well as the magnitude, when compared to a benchmark fund or index. William Sharpe now recommends the Information Ratio over the original Sharpe Ratio as a measure of fund performance (Sharpe, W.F., The Sharpe Ratio, Journal of Portfolio Management, Fall 1994, 49-58.). The Information Ratio is calculated as follows:

or

Where Ra is the portfolio return, Rb is the benchmark return. Information Ratios for various Zeus Funds are depicted below:

Page 4 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

Information Ratios

-1.263 -0.731 -0.319 0.796 -1.5 -1 -0.5 0 0.5 1 1.5

Zeus Equity vs S&P 500 Zeus Balanced vs Lipper Balanced

Figure 5: Information Ratios of Zeus Funds.

Zeus Bond vs Lehman Aggregate Zeus International vs MCSI

We see that except for the International Fund (which does marginally better), all other Zeus funds have been outperformed by their benchmark indices.

5 Value at Risk

The VaR is an estimate of the how much of the investment a fund would stand to lose if it takes losses (95% percent of the time). Lower VaRs are better since they indicate that there is a probability of losing a lower amount of money in case the fund takes hits.

Value at Risk

MSCI Index Zeus International Fund Lipper Balanced Index Zeus Balanced Fund Lehman Brothers Aggregate Index Zeus Bond Fund Lipper Growth Index S&P 500 Index Zeus Equity Fund 0% 1% 2% 3% 3.54% 4% 5% 6% 7% 8% 1.47% 1.22% 3.81% 4.46% 2.78% 2.98% 5.80% 7.54%

Figure 6: VaR as a percentage of fund value. Lower is better.

Page 5 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

We see that with Zeus Equity and Zeus Bond, the Value at Risk is slightly lower (better) than the benchmark, whereas with Zeus balanced it is slightly worse. The Zeus International has a much higher value at risk, given its very volatile performance.

6 Jensens Alpha

The Jensens Alpha is a measure of fund returns over the benchmark asset and the risk free rate. It is the intercept of the regression equation in the CAPM model after accounting for systematic risk. Values calculated are depicted below:

Jensen's Alpha

-1.50% 0.41% -0.89% 5.87%

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

Zeus Equity vs S&P 500 Zeus Balanced vs Lipper Balanced

Figure 7: Jensen's Alpha

Zeus Bond vs Lehman Aggregate Zeus International vs MCSI

We see that most Zeus funds have fared poorly. The 5.87% figure may seem rather good for the Zeus international fund. However one must consider that the performance of its benchmark has been very poor; below the risk free rate in fact. Therefore this metric must not be viewed in isolation and must be considered only when benchmark returns have exceeded the risk free rate. For information, Zeus fund Betas have been calculated and given below. We can confirm close comovements between Zeus funds and their benchmarks.

Fund & Benchmark Zeus Equity vs. S&P 500 Zeus Bond vs. LehBro Index Zeus Balanced vs. Lipper Balanced Index Zeus International vs. MCSI Index Beta 0.8758 0.8645 1.0065 1.0879

Page 6 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

7 Sortino Ratios

The Sortino Ratio is similar to the Sharpe ratio. Except that it only considers the downside deviation as a measure of volatility. The standard deviation of only the negative returns is used as the denominator term. This based on the reasoning that funds which have high volatility are not strictly risky if the swings are all on the positive side. However, a fund with lower volatility may be worse off if its returns are mostly negative. The Sortino ratios are depicted below.

Sortino Ratios

MSCI.Index Zeus.International.Fund Lipper.Balanced.Index Zeus.Balanced.Fund Lehman.Brothers.Aggregate.Index Zeus.Bond.Fund Lipper.Growth.Index S...P.500.Index Zeus.Equity.Fund 0.00 0.10 0.20 0.30 0.40 0.50 0.3502 0.3525 0.3273 0.4628 0.4639 0.5214 0.60 0.0769 0.0422 0.4224

Figure 8: Sortino Ratios of Zues Funds and their benchmarks. Minimum acceptable returns taken as the risk-free rate.

Here too, we see that except for Zeus Equity, all other Zeus Funds have been underperforming. We see no major differences in the characteristics of the ratios when compared to the Sharpe Ratios. This indicates that in spite of underperforming, Zeus funds provide no noticeable benefits against down-side risks.

8 Conclusions

Except for the International Fund, all other Zeus funds have been underperforming with respect to the markets. Fund Managers have the potential to improve returns while maintaining risk profiles. Of serious concern is the Zeus Balanced fund, which is being outperformed by the market on both risk and return measures. The relationship led fund management style, which has served to satisfy large clients may not serve so well in the general fund scenario. The perception within Zeus of being a conservative establishment which is less risky in comparison to others is not backed up by the combined risk-return metrics. Performance management based on the metrics depicted above need to be urgently established and these should serve as the voice of the customer within the company.

Page 7 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

9 Appendix

9.1 Risk Free Rate

The Returns of US treasury Bills for the period from 1989 to 1987 were considered in calculating the risk free rate. The Annual Risk Free Rate thus calculated is 5.213%

9.2 Table of annualized fund returns, standard deviations

Annualized Annualized Annualized Return Std Dev Sharpe (Rf=5.21%) Zeus.Equity.Fund S...P.500.Index Lipper.Growth.Index Zeus.Bond.Fund Lehman.Brothers.Aggregate.Index Zeus.Balanced.Fund Lipper.Balanced.Index Zeus.International.Fund MSCI.Index Treasury.Bills 16.26% 17.24% 15.45% 8.16% 8.82% 11.66% 12.48% 5.80% 6.96% 5.21% 0.097 0.123 0.103 0.039 0.044 0.083 0.079 0.162 0.134 0.004 1.073 0.922 0.933 0.691 0.747 0.723 0.863 0.027 0.115 -0.286

9.3 R script for calculations

PerformanceAnalytics Library v1.1 on R v3.0.2.

Page 8 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

library("PerformanceAnalytics") #read timeseries data rt1<-read.zoo("Zeus Asset Management.csv",header=T,sep=",",na.strings="NA",format="%d-%m%Y") #remove portfolios not under study rt1<-rt1[,c(-10,-11,-12,-13)] #find out risk free rate (in each period, ie monthly) RfR_mo<-as.numeric(Return.annualized(rt1[,"Treasury.Bills"],scale=12)/12) #by month #find annualised returns rt1_returns<-table.AnnualizedReturns(rt1[,,],scale=12,Rf=RfR_mo) #Annualized Returns #sortino ratio, not annualized, against risk free rate rt1_sortino<-SortinoRatio(rt1,MAR=RfR_mo) #Sharpe ratio, not annualized, against risk free rate rt1_sharpe<-SharpeRatio(rt1,RfR_mo,FUN="StdDev") #standard deviations (non annualized) rt1_sd<-t(sapply(as.list(as.data.frame(rt1)),sd,na.rm=T)) #use below command if you want each stddev stored in separate variable # for (i in 1:ncol(rt1)){assign(paste("sd_",names(rt1)[i]),sd(rt1[,i],na.rm=T))} #create a list of columns in returns table for each Zeus portfolio and its benchmark benchmarks<-list(eq=c(1,2),bnd=c(4,5),blc=c(6,7),int=c(8,9)) #jensens alpha, not annualized rt1_jalpha<-vector() for(i in seq_along(benchmarks)) { ra<-benchmarks[[i]][1] rb<-benchmarks[[i]][2] rows<-complete.cases(rt1[,ra],rt1[,rb]) rt1_jalpha[i]<-CAPM.jensenAlpha(rt1[rows,ra],rt1[rows,rb],Rf=RfR_mo) } rt1_jalpha<-t(rt1_jalpha) colnames(rt1_jalpha)<-names(benchmarks) rm(ra,rb,rows) #Information Ratio rt1_ir<-vector() for (i in seq_along(benchmarks)){ ra<-benchmarks[[i]][1] rb<-benchmarks[[i]][2] rt1_ir[i]<-InformationRatio(rt1[,ra,drop=F],rt1[,rb,drop=F],scale=12) } rt1_ir<-t(rt1_ir) colnames(rt1_ir)<-names(benchmarks) rm(ra,rb,i) #Value at risk rt1_var<-as.matrix(VaR(rt1[,c(1:9)])) #charting ##Performance Summary charts

Page 9 of 10

SAPM Prof. Chakrabarty Gauravjwal Kundu, PRN-18, MBA-14, Symbiosis Institute of Operations Management 10th January 2014

charts.PerformanceSummary(rt1[,c(1,2,3,10)],Rf=RfR_mo,main="Performance Summary Equity",wealth.index=T) windows() charts.PerformanceSummary(rt1[,c(4,5,10)],Rf=RfR_mo,main="Performance Summary Bond",wealth.index=T) windows() charts.PerformanceSummary(rt1[,c(6,7,10)],Rf=RfR_mo,main="Performance Summary Balanced",wealth.index=T) windows() charts.PerformanceSummary(rt1[,c(8,9,10)],Rf=RfR_mo,main="Performance Summary International",wealth.index=T) windows() chart.RiskReturnScatter(rt1[,c(1:10)],Rf=RfR_mo) windows() chart.Histogram(rt1[,1],main="Zeus Equity monthly returns histogram",methods=c("add.normal","add.risk","add.rug")) windows() chart.Histogram(rt1[,4],main="Zeus Bond monthly returns histogram",methods=c("add.normal","add.risk","add.rug")) windows() chart.Histogram(rt1[,6],main="Zeus Balanced monthly returns histogram",methods=c("add.normal","add.risk","add.rug")) windows() chart.Histogram(rt1[,8],main="Zeus International monthly returns histogram",methods=c("add.normal","add.risk","add.rug")) #View calculated performance measures View(rt1_returns) #Annualized Returns from portfolios View(rt1_ir) #Information Ratio View(rt1_jalpha) #Jensen's Alpha View(rt1_sharpe) #Sharpe Ratio View(rt1_sortino) #Sortino Ratio View(rt1_var) #Value at risk #print performance measures in console rt1_returns rt1_ir rt1_jalpha rt1_sharpe rt1_sortino rt1_var

- Zeus

Zeus

Zeus

Zeus

Page 10 of 10

Anda mungkin juga menyukai

- Zeus Asset Management Case Week 5Dokumen8 halamanZeus Asset Management Case Week 5Johanlee1992Belum ada peringkat

- Navigating Complex Waters: Advanced Strategies in Portfolio ManagementDari EverandNavigating Complex Waters: Advanced Strategies in Portfolio ManagementBelum ada peringkat

- Zeus Case StudyDokumen10 halamanZeus Case StudyWangJiaPeng100% (1)

- Zeus Case StudyDokumen7 halamanZeus Case StudyBobYuBelum ada peringkat

- Zeus Asset Management Inc. - Team 1 - Investment ManagementDokumen4 halamanZeus Asset Management Inc. - Team 1 - Investment ManagementVvb SatyanarayanaBelum ada peringkat

- Zeus Asset Management SubmissionDokumen5 halamanZeus Asset Management Submissionxirfej100% (1)

- Alpha: How To Use Alpha With Mutual FundsDokumen17 halamanAlpha: How To Use Alpha With Mutual FundsshafeeksngsBelum ada peringkat

- Portfolio Performance Measures Course Code: DFI 354 Submitted To: Dr. Winnie Nyamute Presented byDokumen12 halamanPortfolio Performance Measures Course Code: DFI 354 Submitted To: Dr. Winnie Nyamute Presented byChristopher KipsangBelum ada peringkat

- CMSR - Mutual Funds:Equity ShareDokumen5 halamanCMSR - Mutual Funds:Equity Shareprarthana rameshBelum ada peringkat

- Mutual FundDokumen33 halamanMutual FundGaurav SolankiBelum ada peringkat

- BetaDokumen11 halamanBetaDrishty BishtBelum ada peringkat

- Private Equity FundDokumen19 halamanPrivate Equity FundClint AyersBelum ada peringkat

- Stock Selection - 1Dokumen10 halamanStock Selection - 1AnuyneBelum ada peringkat

- Sharpe RatioDokumen2 halamanSharpe RatioJithesh GopidasBelum ada peringkat

- Why CAGR Is Often BetterDokumen17 halamanWhy CAGR Is Often BetterPrince AdyBelum ada peringkat

- Indian Streams Research Journal: Risk-Return Analysis of Selected Bse Sensex StocksDokumen14 halamanIndian Streams Research Journal: Risk-Return Analysis of Selected Bse Sensex StocksSujay VeeraBelum ada peringkat

- How Enhanced Strategies Can Help Equity AllocationDokumen5 halamanHow Enhanced Strategies Can Help Equity AllocationJoshua DormanBelum ada peringkat

- How To Pick An Investment Fund: WWW - Moneytothemasses - Com Facebook - Com / Moneytothemasses at Money 2 ThemassesDokumen4 halamanHow To Pick An Investment Fund: WWW - Moneytothemasses - Com Facebook - Com / Moneytothemasses at Money 2 Themassesdr_jrcBelum ada peringkat

- Roll No MBA05006039 (Priyanka Revale)Dokumen83 halamanRoll No MBA05006039 (Priyanka Revale)Veeresh NaikarBelum ada peringkat

- Mutual Fund RatiosDokumen9 halamanMutual Fund RatiosAamir Ali ChandioBelum ada peringkat

- Mutaul Fund PresentationDokumen28 halamanMutaul Fund PresentationAshwani MittalBelum ada peringkat

- BetaDokumen14 halamanBetaDrishty BishtBelum ada peringkat

- Chapter 6Dokumen53 halamanChapter 6Naeemullah baigBelum ada peringkat

- DK 33Dokumen12 halamanDK 33Drishty BishtBelum ada peringkat

- FXCM - Online Currency Trading Free $50,000 Practice AccountDokumen3 halamanFXCM - Online Currency Trading Free $50,000 Practice Accountanilnair88Belum ada peringkat

- DrssDokumen13 halamanDrssDrishty BishtBelum ada peringkat

- Data AnanysisDokumen14 halamanData AnanysisDrishty BishtBelum ada peringkat

- Investment and Performance ManagementDokumen19 halamanInvestment and Performance ManagementBhagvanji HathiyaniBelum ada peringkat

- Risk and Return Analysis of Equity Shares With Special Reference To Select Mutual Fund Companies (Using Capital Asset Pricing Model)Dokumen8 halamanRisk and Return Analysis of Equity Shares With Special Reference To Select Mutual Fund Companies (Using Capital Asset Pricing Model)Tanmaya BiswalBelum ada peringkat

- Investments Chapter 5Dokumen11 halamanInvestments Chapter 5b00812473Belum ada peringkat

- CH 07Dokumen33 halamanCH 07Nguyen Thanh Tung (K15 HL)Belum ada peringkat

- MF Comparison & Important RatiosDokumen22 halamanMF Comparison & Important RatiosSantanu MukherjeeBelum ada peringkat

- Risk-Return Trade-OffDokumen4 halamanRisk-Return Trade-OffLea AndreleiBelum ada peringkat

- Week07 Workshop AnswersDokumen10 halamanWeek07 Workshop Answersneok30% (1)

- Common Methods For Measuring Risk in InvestmentsDokumen6 halamanCommon Methods For Measuring Risk in Investmentsselozok1Belum ada peringkat

- Comparison of The RatiosDokumen3 halamanComparison of The RatiosChristopher KipsangBelum ada peringkat

- Ratios in Mutual FundsDokumen6 halamanRatios in Mutual FundsAnshu SinghBelum ada peringkat

- Portfolio Analysis ToolsDokumen6 halamanPortfolio Analysis Toolsrupesh_kanabar1604100% (5)

- Organisation of Mutual FundDokumen4 halamanOrganisation of Mutual Fundanil ranaBelum ada peringkat

- Abstract The Research Article Is Titled As Comparative Study On Performance of SelectedDokumen3 halamanAbstract The Research Article Is Titled As Comparative Study On Performance of SelectedKumar ankitBelum ada peringkat

- 07 Introduction To Risk, Return, and The Opportunity Cost of CapitalDokumen12 halaman07 Introduction To Risk, Return, and The Opportunity Cost of Capitalddrechsler9Belum ada peringkat

- Riddhi Dhumal, Alka Parmar, Dr. Divyang Joshi EcheDokumen9 halamanRiddhi Dhumal, Alka Parmar, Dr. Divyang Joshi EcheSamra Saquib ImaanBelum ada peringkat

- Financial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreDokumen6 halamanFinancial Analysis On Mutual Fund Schemes With Special Reference To SBI Mutual Fund CoimbatoreCheruv SoniyaBelum ada peringkat

- Risk and Company InvestmentDokumen11 halamanRisk and Company InvestmenttruthoverloveBelum ada peringkat

- A Study On Portfolio Management and EvualtionDokumen13 halamanA Study On Portfolio Management and EvualtionSRI laxmanBelum ada peringkat

- Rupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHDokumen5 halamanRupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHJinesh ShahBelum ada peringkat

- Wealth Management Assignment 9: Guest Lecture SummaryDokumen2 halamanWealth Management Assignment 9: Guest Lecture SummaryDarshan ShahBelum ada peringkat

- Grable, J. E., & Chatterjee, S. (2014) - The Sharpe Ratio and Negative Excess Returns The Problem and Solution. Journal of Financial Service Professionals, 68 (3), 12-13.Dokumen3 halamanGrable, J. E., & Chatterjee, S. (2014) - The Sharpe Ratio and Negative Excess Returns The Problem and Solution. Journal of Financial Service Professionals, 68 (3), 12-13.firebirdshockwaveBelum ada peringkat

- Calculation of Sharpe RatioDokumen23 halamanCalculation of Sharpe RatioVignesh HollaBelum ada peringkat

- Portfloio by Mansi Gupta - PPTMDokumen10 halamanPortfloio by Mansi Gupta - PPTMMansi GuptaBelum ada peringkat

- Alternative To The Sharpe RatioDokumen4 halamanAlternative To The Sharpe RatioalypatyBelum ada peringkat

- High Liquidity AssetsDokumen7 halamanHigh Liquidity AssetsKrisshna Kumar ChandrasekaranBelum ada peringkat

- Comparative Study of Market Volatilty On Equity and Debt Fund InvestmentDokumen23 halamanComparative Study of Market Volatilty On Equity and Debt Fund InvestmentGaneshBelum ada peringkat

- HSBC Msci Russia Capped Ucits Etf: Key Investor InformationDokumen2 halamanHSBC Msci Russia Capped Ucits Etf: Key Investor InformationsigurddemizarBelum ada peringkat

- Investment Analysis and Portfolio Management: Mutual FundsDokumen32 halamanInvestment Analysis and Portfolio Management: Mutual FundsAsim JavedBelum ada peringkat

- Solution Manual For Fundamentals of Investment Management 10th Edition by HirtDokumen21 halamanSolution Manual For Fundamentals of Investment Management 10th Edition by HirtBriannaPerryjdwr100% (38)

- 3.HF Risk MNGTDokumen15 halaman3.HF Risk MNGTsashaathrgBelum ada peringkat

- Analyse Mutual Fund Portfolio - 7 Important ParametersDokumen3 halamanAnalyse Mutual Fund Portfolio - 7 Important Parametersdvg6363238970Belum ada peringkat

- 6 Basic Financial Ratios and What They RevealDokumen6 halaman6 Basic Financial Ratios and What They RevealtthorgalBelum ada peringkat

- Gat PreparationDokumen21 halamanGat PreparationHAFIZ IMRAN AKHTERBelum ada peringkat

- Chapter 7Dokumen18 halamanChapter 7dheerajm88Belum ada peringkat

- Uganda Bureau of Statistics Census of Business Establishments, 2010/11 Report OnDokumen169 halamanUganda Bureau of Statistics Census of Business Establishments, 2010/11 Report OnCano KaluBelum ada peringkat

- International Marketing - ChinaDokumen10 halamanInternational Marketing - ChinaNaijalegendBelum ada peringkat

- 8508Dokumen10 halaman8508Danyal ChaudharyBelum ada peringkat

- Respond To Business OpportunitiesDokumen21 halamanRespond To Business OpportunitiesRissabelle CoscaBelum ada peringkat

- StartUp India - Case AnalysisDokumen3 halamanStartUp India - Case AnalysisIrshad AzeezBelum ada peringkat

- Super Injunction BookDokumen3 halamanSuper Injunction BookReckless Kobold0% (1)

- Uy Balance SheetDokumen8 halamanUy Balance SheetMary Louise CamposanoBelum ada peringkat

- Donner Company 2Dokumen6 halamanDonner Company 2Nuno Saraiva0% (1)

- Scarcity and ChoiceDokumen4 halamanScarcity and ChoicearuprofBelum ada peringkat

- 5-Minute Chocolate Balls PDFDokumen10 halaman5-Minute Chocolate Balls PDFDiana ArunBelum ada peringkat

- Appendix 8 - Instructions - RAPALDokumen1 halamanAppendix 8 - Instructions - RAPALTesa GDBelum ada peringkat

- Capital StructureDokumen44 halamanCapital Structure26155152Belum ada peringkat

- Indifference CurveDokumen16 halamanIndifference Curveএস. এম. তানজিলুল ইসলামBelum ada peringkat

- Ans Mini Case 2 - A171 - LecturerDokumen14 halamanAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Bradford Snell The Street Car ConspiracyDokumen4 halamanBradford Snell The Street Car ConspiracyDaniel DavarBelum ada peringkat

- Case Study-1 SHEENADokumen2 halamanCase Study-1 SHEENARushikesh Dandagwhal100% (1)

- PGM-199 R1Dokumen5 halamanPGM-199 R1Faraz Ali Khan0% (1)

- EnglishtoMath##1Dokumen8 halamanEnglishtoMath##1zubairBelum ada peringkat

- Rufino Tan Vs Ramon Del RosarioDokumen1 halamanRufino Tan Vs Ramon Del RosarioJocelyn MagbanuaBelum ada peringkat

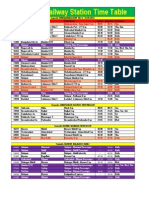

- Solapur Railway Station Time TableDokumen2 halamanSolapur Railway Station Time TableAndrea Lopez33% (3)

- ARIIX Enrollment & Auto Delivery Options (US & Canada)Dokumen10 halamanARIIX Enrollment & Auto Delivery Options (US & Canada)ARIIX GlobalBelum ada peringkat

- Walt Disney Company PDFDokumen20 halamanWalt Disney Company PDFGabriella VenturinaBelum ada peringkat

- TWSS CFA Level I - Planner and TrackerDokumen6 halamanTWSS CFA Level I - Planner and TrackerSai Ranjit TummalapalliBelum ada peringkat

- Ch.10 - The Statement of Cash Flows - MHDokumen59 halamanCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- FM 8th Edition Chapter 12 - Risk and ReturnDokumen20 halamanFM 8th Edition Chapter 12 - Risk and ReturnKa Io ChaoBelum ada peringkat

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDokumen24 halamanPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidBelum ada peringkat

- Cheque and Its TypesDokumen2 halamanCheque and Its Typesdevraj subediBelum ada peringkat

- Corporate FinanceDokumen11 halamanCorporate Financemishu082002100% (2)