Decision of The European Central Bank

Diunggah oleh

acandenauerDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Decision of The European Central Bank

Diunggah oleh

acandenauerHak Cipta:

Format Tersedia

EN

ECB-PUBLIC

DECISION OF THE EUROPEAN CENTRAL BANK of 4 February 2014 identifying the credit institutions that are subject to the comprehensive assessment (ECB/2014/3)

THE GOVERNING COUNCIL OF THE EUROPEAN CENTRAL BANK,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 127(6) thereof, Having regard to Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions1, and in particular Article 4(3) and Article 33(3) and (4) thereof, Having regard to the proposal from the Supervisory Board,

Whereas: (1) From 3 November 2013, in view of the assumption of its supervisory tasks, the European Central Bank (ECB) may require the national competent authorities and the persons referred to in Article 10(1) of Regulation (EU) No 1024/2013 to provide all relevant information for the ECB to carry out a comprehensive assessment, including a balance-sheet assessment, of the credit institutions of the participating Member States. The ECB is required to carry out such an assessment at least in relation to the credit institutions not covered by Article 6(4) of Regulation (EU) No 1024/2013. (2) On 23 October 2013, the ECB published the names of institutions included in the comprehensive assessment as well as an initial overview of the key features of the comprehensive assessment. (3) Based on the criteria referred to in Article 6(4) of Regulation (EU) No 1024/2013, the ECB has identified credit institutions in respect of which it intends to carry out a comprehensive assessment, including a balance-sheet assessment, in accordance with Article 33(4) of Regulation (EU) No 1024/2013. In applying the above criteria, the ECB has taken into account possible changes that may occur at any time owing to the dynamics of the activities of credit institutions and the resulting

1

OJ 287, 29.10.2013, p. 63.

ECB-PUBLIC consequences for the total value of their assets. As a result, it has included credit institutions that currently do not meet the criteria for significance but may do so in the near future and should be subject therefore to the comprehensive assessment. The ECB will therefore undertake a comprehensive assessment with respect to credit institutions, financial holding companies or mixed financial holding companies the total value of whose assets exceeds EUR 27 billion. Notwithstanding the above criteria, the ECB will also undertake the comprehensive assessment with respect to the three most significant institutions in each of the euro area Member States. The identification of credit institutions on which the ECB intends to carry out comprehensive assessments is without prejudice to the final assessment of the criteria that is based on the specific methodology included in the framework referred to in Article 6 of Regulation (EU) No 1024/2013. (4) The credit institutions and the national competent authorities are required to supply all relevant information for the ECB to carry out the comprehensive assessment in accordance with Article 33(4) of Regulation (EU) No 1024/2013. (5) The ECB may require the national competent authorities and the persons referred to in Article 10(1) of Regulation (EC) No 1024/2013 to provide all relevant information for the ECB to carry out such a comprehensive assessment. (6) Members of the Supervisory Board, staff of the ECB and staff seconded by participating Member States are subject to professional secrecy requirements set out in Article 37 of the Statute of the European System of Central Banks and of the European Central Bank and relevant Union law. In particular, the ECB and national competent authorities are subject to the provisions regarding the exchange of information and professional secrecy set out in Directive 2013/36/EU of the European Parliament and of the Council2,

HAS ADOPTED THIS DECISION:

Article 1 Entities subject to the comprehensive assessment 1. The entities listed in the Annex shall be subject to the comprehensive assessment to be carried out by the ECB by 3 November 2014. 2. In accordance with Article 33(4) of Regulation (EU) No 1024/2013, the national competent authority responsible for the supervision of a credit institution listed in the Annex shall submit all information of relevance to the comprehensive assessment that the ECB requests in relation to that credit institution. The national competent authority shall verify the information as it deems

2

Directive 2013/36/EU of the European Parliament and of the Council on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (OJ L 176, 27.6.2013, p. 338).

ECB-PUBLIC appropriate for the exercise, including, when necessary, on-site inspections and, if appropriate, with the involvement of third parties. 3. The national competent authority responsible for supervision of subsidiaries in a group that is subject to consolidated supervision within the SSM shall be in charge of this verification for the subsidiaries authorised in its Member State.

Article 2 Investigatory powers In accordance with Article 33(3) and (4) of Regulation (EU) No 1024/2013, the ECB may exercise its investigatory powers in respect of the credit institutions identified in the Annex.

Article 3 Entry into force This Decision shall enter into force on 6 February 2014.

Done at Frankfurt am Main, 4 February 2014.

[signed]

The President of the ECB Mario DRAGHI

ECB-PUBLIC Annex INSTITUTIONS INCLUDED IN THE COMPREHENSIVE ASSESSMENT

Belgium AXA Bank Europe SA Belfius Banque SA Dexia NV

1

NRW.Bank SEB AG Volkswagen Financial Services AG of Argenta Banken WGZ Bank AG Westdeutsche GenossenschaftsZentralbank Wstenrot & Wrttembergische AG with regard to Holding of Wstenrot Bank AG Pfandbriefbank and Wstenrot Bausparkasse AG

Investar (Holding Verzekeringsgroep) KBC Group NV

The Bank of New York Mellon SA

Germany Aareal Bank AG Bayerische Landesbank Commerzbank AG DekaBank Deutsche Girozentrale Deutsche Apotheker- und rztebank eG Deutsche Bank AG DZ Bank AG Genossenschaftsbank HASPA Finanzholding HSH Nordbank AG Hypo Real Estate Holding AG IKB Deutsche Industriebank AG KfW IPEX-Bank GmbH Landesbank Baden-Wrttemberg Landesbank Berlin Holding AG Landesbank Hessen-Thringen Girozentrale Landeskreditbank Frderbank Baden-WrttembergDeutsche Zentral-

Estonia AS DNB Bank AS SEB Pank Swedbank AS

Ireland Allied Irish Banks plc Merrill Lynch International Bank Limited Permanent tsb plc. The Governor and Company of the Bank of Ireland Ulster Bank Ireland Limited

Greece Alpha Bank, S.A. Eurobank Ergasias, S.A. National Bank of Greece, S.A. Piraeus Bank, S.A.

Landwirtschaftliche Rentenbank Mnchener Hypothekenbank eG Norddeutsche Landesbank-Girozentrale

Spain Banco Bilbao Vizcaya Argentaria, S.A. Banco de Sabadell, S.A. Banco Financiero y de Ahorros, S.A. Banco Mare Nostrum, S.A. Banco Popular Espaol, S.A. Banco Santander, S.A. Bankinter, S.A. 4

The assessment methodology for this group will take due account of its specific situation and in particular the fact that an extensive assessment of its financial position and risk profile was already carried out within the framework of the plan initiated in October 2011 and approved by the European Commission on 28 December 2012.

ECB-PUBLIC Caja de Ahorros y M.P. de Zaragoza, Aragn y Rioja Caja de Ahorros y Pensiones de Barcelona Caja Espaa de Inversiones, Salamanca y Soria, CAMP Cajas Rurales Unidas, Sociedad Cooperativa de Crdito Catalunya Banc, S.A. Kutxabank, S.A. Liberbank, S.A. MPCA Ronda, Antequera y Jan NCG Banco, S.A. Cdiz, Almera, Mlaga, Banca Popolare di Sondrio, Societ Cooperativa per Azioni Banca Popolare di Cooperativa per Azioni Credito Emiliano S.p.A. Iccrea Holding S.p.A Intesa Sanpaolo S.p.A. Mediobanca - Banca di Credito Finanziario S.p.A. UniCredit S.p.A. Unione Di Banche Italiane Societ Cooperativa Per Azioni Veneto Banca S.C.P.A. France Banque Centrale Clearnet) BNP Paribas C.R.H. - Caisse de Refinancement de lHabitat Groupe BPCE Groupe Crdit Agricole Groupe Crdit Mutuel HSBC France La Banque Postale BPI France (Banque Publique dInvestissement) RCI Banque Socit de Financement Local Socit Gnrale Luxembourg Banque et Caisse Luxembourg d'Epargne de l'Etat, Latvia ABLV Bank, AS AS SEB banka Swedbank de Compensation (LCH Cyprus Bank of Cyprus Public Company Ltd Co-operative Central Bank Ltd Hellenic Bank Public Company Ltd Russian Commercial Bank (Cyprus) Ltd Vicenza Societ

Banco Popolare - Societ Cooperativa

Banque PSA Finance

Clearstream Banking S.A. Italy Banca Carige S.P.A. - Cassa di Risparmio di Genova e Imperia Banca Monte dei Paschi di Siena S.p.A. Banca Piccolo Credito Valtellinese, Societ Cooperativa Banca Popolare Dell'Emilia Romagna - Societ Cooperativa Banca Popolare Di Milano - Societ Cooperativa A Responsabilit Limitata Precision Capital S.A. (Holding of Banque Internationale Luxembourg and KBL European Private Bankers S.A.) RBC Investor Services Bank S.A. State Street Bank Luxembourg S.A. UBS (Luxembourg) S.A.

Malta Bank of Valletta plc HSBC Bank Malta plc 5

ECB-PUBLIC Netherlands ABN AMRO Bank N.V. Bank Nederlandse Gemeenten N.V. Coperatieve Centrale Boerenleenbank B.A. ING Bank N.V. Nederlandse Waterschapsbank N.V. The Royal Bank of Scotland N.V. SNS Bank N.V. RaiffeisenCases in which one or more of the three most significant credit institutions in a participating Member State are subsidiaries of banking groups already included in the list above: Malta Deutsche Bank (Malta) Ltd Nordea Bank Finland Abp OP-Pohjola Group

Austria BAWAG P.S.K. Bank fr Arbeit und Wirtschaft und sterreichische Postsparkasse AG Erste Group Bank AG Raiffeisenlandesbank Obersterreich AG Raiffeisenlandesbank AG Niedersterreich-Wien

Slovakia Slovensk sporitea, a.s. Veobecn verov banka, a.s. Tatra banka, a.s.

Raiffeisen Zentralbank sterreich AG sterreichische Volksbanken-AG together with credit institutions affiliated in accordance with Article 10 of Regulation (EU) No 575/20132

Portugal Banco BPI, SA Banco Comercial Portugus, SA Caixa Geral de Depsitos, SA Esprito Santo Financial Group, SA

Slovenia Nova Kreditna Banka Maribor d.d. Nova Ljubljanska banka d. d., Ljubljana SID - Slovenska izvozna in razvojna banka, d.d., Ljubljana Finland Danske Bank Oyj

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ L 176, 27.6.2013, p. 1).

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Burisma Holdings Accounting LedgerDokumen26 halamanBurisma Holdings Accounting LedgerJohnSolomon95% (21)

- (IS O 139 16: 199 6) Engl Ish Vers Ion of DIN EN ISO 13916Dokumen7 halaman(IS O 139 16: 199 6) Engl Ish Vers Ion of DIN EN ISO 13916Louise FernandoBelum ada peringkat

- Fakture - Obracuni 2014Dokumen78 halamanFakture - Obracuni 2014svetlanaBelum ada peringkat

- Allin 1Dokumen6 halamanAllin 1MisbahBelum ada peringkat

- Chhattisgarh VillageDokumen61 halamanChhattisgarh Villagekrishnanvr4uBelum ada peringkat

- T24 System Build - Core V1.0Dokumen30 halamanT24 System Build - Core V1.0Quoc Dat TranBelum ada peringkat

- Felbermayr LTM 1250-6.1Dokumen24 halamanFelbermayr LTM 1250-6.1Alex MosuBelum ada peringkat

- Pencarian Kurs Bank Indonesia Berdasarkan TanggalDokumen2 halamanPencarian Kurs Bank Indonesia Berdasarkan TanggalSanjaya ForceBelum ada peringkat

- World Countries - Country Capitals and Currency PDFDokumen6 halamanWorld Countries - Country Capitals and Currency PDFAbhi RamBelum ada peringkat

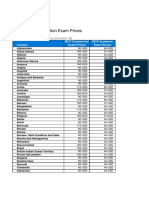

- Microsoft Certification Exam Voucher PricesDokumen12 halamanMicrosoft Certification Exam Voucher PricesJackie ZhanBelum ada peringkat

- The European Free Trade Association (EFTA) : Petre Ionut Alexanudru Marketing, 3 Year, Group 1751 Petreionut95@gmailDokumen5 halamanThe European Free Trade Association (EFTA) : Petre Ionut Alexanudru Marketing, 3 Year, Group 1751 Petreionut95@gmailAntonia Michaela IonBelum ada peringkat

- Lehman Brothers Annual Report 2007Dokumen124 halamanLehman Brothers Annual Report 2007highfinance94% (16)

- All Country Currency Name ListDokumen13 halamanAll Country Currency Name ListLakshmi TBelum ada peringkat

- European Union: in A NutshellDokumen2 halamanEuropean Union: in A NutshellAurcus JumskieBelum ada peringkat

- Greek Debt CrisisDokumen12 halamanGreek Debt Crisisjimmy_bhavanaBelum ada peringkat

- Din en 10132-4Dokumen14 halamanDin en 10132-4Guilherme MendesBelum ada peringkat

- DATE: 8th June SR - No. Name Phone NoDokumen39 halamanDATE: 8th June SR - No. Name Phone NokirtiBelum ada peringkat

- From Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeeDokumen19 halamanFrom Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeePrajwal AlvaBelum ada peringkat

- Intrastat Threshold TableDokumen1 halamanIntrastat Threshold TableJulian LiciBelum ada peringkat

- GBP Stands For - Google SearchDokumen1 halamanGBP Stands For - Google SearchThiago Lins CostaBelum ada peringkat

- InforeuroDokumen1 halamanInforeuroOffice CifinBelum ada peringkat

- Unit Converter SheetDokumen3 halamanUnit Converter SheetAjitesh YelisettyBelum ada peringkat

- Country, Capital, CurrencyDokumen2 halamanCountry, Capital, Currencyarun xornorBelum ada peringkat

- Industrial Production Up by 0.4% in Euro AreaDokumen6 halamanIndustrial Production Up by 0.4% in Euro AreaDartonni SimangunsongBelum ada peringkat

- TW Disbursement TrackerDokumen253 halamanTW Disbursement TrackerRohit GabaBelum ada peringkat

- Lucrarea 1Dokumen10 halamanLucrarea 1Maricica GrecuBelum ada peringkat

- En-27721-1991-Head Config and GaugingDokumen2 halamanEn-27721-1991-Head Config and GaugingmetropodikasBelum ada peringkat

- Statistical Tables Hypostat 2020Dokumen90 halamanStatistical Tables Hypostat 2020Ahmad Jawad HassaanBelum ada peringkat

- Instr Recalled Notes - enDokumen3 halamanInstr Recalled Notes - enDi YungBelum ada peringkat

- European UnionDokumen31 halamanEuropean Unionapi-285187009Belum ada peringkat