Mid

Diunggah oleh

Sdspl DelhiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Mid

Diunggah oleh

Sdspl DelhiHak Cipta:

Format Tersedia

CUSTOMER COPY

BANK COPY

Your Branch Category:

Your Branch Category:

MOST IMPORTANT DOCUMENT

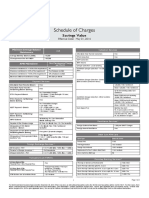

The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So, we wish to begin this new relationship with a promise of transparency. We request you to go through the charges related to your account before you sign up. ACCOUNT TARRIF STRUCTURE - PRIME ACCOUNTS (SALARY) (Please tick applicable product)

a) Zero Balance Facility i.e. Nil Balance requirement Minimum Free Services b) Online Fund Transfers (NEFT) c) SMS Alerts, Monthly E-statement, Quarterly Physical Statements to track your account d) One Free Multi City Cheque Book per quarter e) 5 transactions per month on any other bank ATM f) Internet Banking and Mobile Banking Service Fee Type Fee Average Quarterly Account Usage Charges Balance (AQB) Requirement Non Maintenance Charges Monthly Free Transaction Limits Cash Transactions (Deposit/Withdraw al) Fees Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Fees Debit Card Type Issuance Fees Debit Card Fees Annual Fees Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Nil Nil Nil Nil Salary Power Plus (SAPPL) Nil Easy Access Salary (SAPPR) Nil Prime Salary (SAPPM)

MOST IMPORTANT DOCUMENT (TYPE III) - PRIME SALARY (SAPPL/SAPPR/SAPPM)

The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So we wish to begin this new relationship with a promise of transparency. We request you to go through the charges related to your account before you sign up. ACCOUNT TARRIF STRUCTURE - PRIME ACCOUNTS (SALARY) (Please tick applicable product)

a) Zero Balance Facility i.e. Nil Balance requirement Minimum Free Services b) Online Fund Transfers (NEFT) c) SMS Alerts, Monthly E-statement, Quarterly Physical Statements to track your account d) One Free Multi City Cheque Book per quarter e) 5 transactions per month on any other bank ATM f) Internet Banking and Mobile Banking Service Fee Type Fee Average Quarterly Account Usage Charges Balance (AQB) Requirement Non Maintenance Charges Monthly Free Transaction Limits Cash Transactions (Deposit/Withdraw al) Fees Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Fees Debit Card Type Issuance Fees Debit Card Fees Annual Fees Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Semi Urban/Rural: First10 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Metro/Urban: First 5 transactions or `10 lakhs whichever is earlier Nil Nil Nil Nil Salary Power Plus (SAPPL) Nil Easy Access Salary (SAPPR) Nil Prime Salary (SAPPM)

Beyond free transaction limits, a fee of `4/1000 or `100 whichever is higher will be levied Visa Classic International Free `100 Visa Classic International Free `100 (waived if total purchase transactions in the year exceed `15000) Titanium Rewards Free Free

Beyond free transaction limits, a fee of `4/1,000 or `100 whichever is higher will be levied Visa Classic International Free `100 Visa Classic International Free `100 (waived if total purchase transactions in the year exceed `15,000) Titanium Rewards Free Free

Upgrade Debit Card Issuance/Annual (Titanium Rewards) Fees

NA `500/`300

Upgrade Debit Card Issuance/Annual (Titanium Rewards) Fees

NA `500/`300

Terms for Personal Accident Insurance cover benefit on your Debit Card:

Terms for Personal Accident Insurance cover benefit on your Debit Card:

The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence only if there have been at least 2 salary credits and at least one successful purchase transaction on your card within 6 months (within 3 months if you have opted for Titanium Rewards Card) prior to the occurrence of the incident. The incidence has to be reported within 60 days of occurrence.

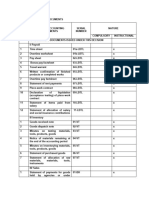

IMPORTANT TERMS & CONDITIONS:

All important charges pertaining to your salary savings account are mentioned above. However, this list is not exhaustive and you may visit our website www.axisbank.com to view the other charges which are applicable All accounts have a four quarterly billing cycle in a year - 15th Mar.-14th Jun., 15th Jun.-14th Sep., 15th Sep.-14th Dec. and 15th Dec.-14th Mar. However Cash Transactions will be billed monthly i.e. 15th Mar.-14th Apr. and so on Service Taxes as applicable will be levied on all fees The Bank can at its sole discretion discontinue any service partially/completely or change Fees without any notice. All revision in fees will be displayed on the Notice Board of the branches of Axis Bank and also on our website www.axisbank.com Savings Account under Salary power scheme is a special account offered to customers with regular direct salary credits coming into this account. In case, the monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under the said Account stands withdrawn and account shall be treated as Normal Savings Account under standard charge structure and Average Quarterly Balance (AQB) is required to be maintained, and all charges shall be levied as applicable to Normal Savings Accounts. Moreover the Know Your Customer must be complied with as per Normal Savings Bank Account and documents are to be submitted, failing which there would be a credit freeze marked on the said account. The features of Normal Savings Bank Account and charge structure are available on banks website www.axisbank.com.

The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence only if there have been at least 2 salary credits and at least one successful purchase transaction on your card within 6 months (within 3 months if you have opted for Titanium Rewards Card) prior to the occurrence of the incident. The incidence has to be reported within 60 days of occurrence.

IMPORTANT TERMS & CONDITIONS:

All important charges pertaining to your salary savings account are mentioned above. However, this list is not exhaustive and you may visit our website www.axisbank.com to view the other charges which are applicable All accounts have a four quarterly billing cycle in a year - 15th Mar.-14th Jun., 15th Jun.-14th Sep., 15th Sep.-14th Dec. and 15th Dec.-14th Mar. However, Cash Transactions will be billed monthly i.e. 15th Mar.-14th Apr. and so on Service Taxes as applicable will be levied on all fees The Bank can at its sole discretion discontinue any service partially/completely or change Fees without any notice. All revision in fees will be displayed on the Notice Board of the branches of Axis Bank and also on our website www.axisbank.com Savings Account under Salary power scheme is a special account offered to customers with regular direct salary credits coming into this account. In case, the monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under the said Account stands withdrawn and account shall be treated as Normal Savings Account under standard charge structure and Average Quarterly Balance (AQB) is required to be maintained, and all charges shall be levied as applicable to Normal Savings Accounts. Moreover the Know Your Customer must be complied with as per Normal Savings Bank Account and documents are to be submitted, failing which there would be a credit freeze marked on the said account. The features of Normal Savings Bank Account and charge structure are available on banks website www.axisbank.com.

Customer Name:

FOR OFFICE USE ONLY

Primary Holder Signature:

Customer Name:

FOR OFFICE USE ONLY

Primary Holder Signature:

Bar Code

LC Code

Signature

Joint Holder Signature:

Bar Code

LC Code

Signature

Joint Holder Signature:

Anda mungkin juga menyukai

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountDari EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountPenilaian: 2 dari 5 bintang2/5 (1)

- MITCs AND FEESDokumen5 halamanMITCs AND FEESLoesh WaranBelum ada peringkat

- Citi Banks Credit NormsDokumen6 halamanCiti Banks Credit NormsAshutosh TripathiBelum ada peringkat

- Citibank Credit CardDokumen6 halamanCitibank Credit CardgjvoraBelum ada peringkat

- Most Important Terms and ConditionsDokumen5 halamanMost Important Terms and ConditionsaavisBelum ada peringkat

- PDS Revision Eng & BM Online (Final)Dokumen6 halamanPDS Revision Eng & BM Online (Final)Faiziya BanuBelum ada peringkat

- Axis Bank savings account chargesDokumen6 halamanAxis Bank savings account chargesArnab Nandi100% (1)

- Product Disclosure Sheet: What Is This Product About?Dokumen6 halamanProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919Belum ada peringkat

- Savings AccountDokumen27 halamanSavings AccountkjlgururajBelum ada peringkat

- Kokan BankDokumen20 halamanKokan BankramshaBelum ada peringkat

- SAVE MONEY WITH BANK SAVINGS ACCOUNTSDokumen11 halamanSAVE MONEY WITH BANK SAVINGS ACCOUNTSপ্রিয়াঙ্কুর ধরBelum ada peringkat

- TNC MitcDokumen2 halamanTNC Mitcashok9702Belum ada peringkat

- Most Important Terms & ConditionsDokumen93 halamanMost Important Terms & Conditionslancy_dsuzaBelum ada peringkat

- Fees and Charges GuideDokumen3 halamanFees and Charges GuideShashank AgarwalBelum ada peringkat

- Yes Bank - Schedule of Charges - Savings Select AccountDokumen2 halamanYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMEBelum ada peringkat

- HCBC CC InfoDokumen5 halamanHCBC CC Infooninx26Belum ada peringkat

- CD PremiumDokumen1 halamanCD PremiumnelzonpouloseBelum ada peringkat

- Module 10 (Abhishek)Dokumen12 halamanModule 10 (Abhishek)abhishek gautamBelum ada peringkat

- HSBC Credit Card T&C SummaryDokumen10 halamanHSBC Credit Card T&C SummaryMohit AroraBelum ada peringkat

- FAQs For External Renewal Update ENGDokumen11 halamanFAQs For External Renewal Update ENGwinminh 198Belum ada peringkat

- 2014sep11 2014oct10Dokumen3 halaman2014sep11 2014oct10Karen JoyBelum ada peringkat

- Saving AccountDokumen29 halamanSaving AccountramshaBelum ada peringkat

- Current AccountDokumen21 halamanCurrent AccountSan Awale33% (3)

- Bank of BarodaDokumen99 halamanBank of BarodaYash Parekh100% (2)

- Deposit Schemes: Savings Plus AccountDokumen17 halamanDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraBelum ada peringkat

- Askari Bank provides corporate, retail and Islamic banking servicesDokumen7 halamanAskari Bank provides corporate, retail and Islamic banking servicesSabih TariqBelum ada peringkat

- Barclaycard Business Terms andDokumen24 halamanBarclaycard Business Terms andJosh ClarkeBelum ada peringkat

- Minimum Payment Due $332.46Dokumen4 halamanMinimum Payment Due $332.46Anonymous ZgROrLNLCjBelum ada peringkat

- Features of All Types of AccountsDokumen113 halamanFeatures of All Types of AccountsNahid HossainBelum ada peringkat

- Value Plus Current AccountDokumen5 halamanValue Plus Current AccountmalikzaidBelum ada peringkat

- HSBC Savings AccountDokumen3 halamanHSBC Savings AccountLavanya VitBelum ada peringkat

- Soth Indian Bank Final ProjectDokumen62 halamanSoth Indian Bank Final ProjectManisha ShivhareBelum ada peringkat

- VN 04 Credit Cards FaqDokumen5 halamanVN 04 Credit Cards FaqdhakaeurekaBelum ada peringkat

- PDS Credit Card Auto Balance ConversionDokumen4 halamanPDS Credit Card Auto Balance ConversionErda Wati Mohd SaidBelum ada peringkat

- 47-Corporate Salary Package - CSPDokumen3 halaman47-Corporate Salary Package - CSPmevrick_guyBelum ada peringkat

- Citigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeDokumen1 halamanCitigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeNikhil RaviBelum ada peringkat

- CUB Credit Card T&CDokumen7 halamanCUB Credit Card T&CPushpa RajBelum ada peringkat

- 2018 FRM CandidateGuideDokumen14 halaman2018 FRM CandidateGuideSagar SuriBelum ada peringkat

- 20140118053700Dokumen3 halaman20140118053700Jalal GogginsBelum ada peringkat

- HSBC BankDokumen40 halamanHSBC BankPrasanjeet PoddarBelum ada peringkat

- My Productdisclosure SheetDokumen8 halamanMy Productdisclosure SheetNesa rachenamotyBelum ada peringkat

- Schedule of Charges: Savings ValueDokumen2 halamanSchedule of Charges: Savings ValueNavjot SinghBelum ada peringkat

- PNC - Consumer Schedule of Service Charges and FeesDokumen4 halamanPNC - Consumer Schedule of Service Charges and FeesblarghhhhBelum ada peringkat

- Capital One credit card terms summaryDokumen5 halamanCapital One credit card terms summaryAlex LagunesBelum ada peringkat

- Yes Private Credit Card MITC PDFDokumen8 halamanYes Private Credit Card MITC PDFkiran saiBelum ada peringkat

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredDokumen6 halamanNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Chapter 3 - Retail DepositsDokumen115 halamanChapter 3 - Retail Depositssudpost4uBelum ada peringkat

- Types of AccountsDokumen7 halamanTypes of AccountsAnna LeeBelum ada peringkat

- Du Bill 09305426 Aug 2011Dokumen8 halamanDu Bill 09305426 Aug 2011Syira Lola0% (1)

- In Digismart Most Important Terms and ConditionsDokumen4 halamanIn Digismart Most Important Terms and Conditionskanagu12Belum ada peringkat

- in-rewardscard-most-important-terms-and-conditionsDokumen4 halamanin-rewardscard-most-important-terms-and-conditionsHichem BarkatiBelum ada peringkat

- Jan 28-Feb 24, 2010: Account ActivityDokumen3 halamanJan 28-Feb 24, 2010: Account ActivityAna OdenBelum ada peringkat

- Bank Statement 4Dokumen4 halamanBank Statement 4Jardan Nelli86% (7)

- STMNT 112013 9773Dokumen3 halamanSTMNT 112013 9773redbird77100% (1)

- PAY YOUR CREDIT CARD BILL ON TIMEDokumen75 halamanPAY YOUR CREDIT CARD BILL ON TIMEjamin2020Belum ada peringkat

- Sib GssaDokumen16 halamanSib GssaVibha PorwalBelum ada peringkat

- Product Disclosure SheetDokumen4 halamanProduct Disclosure SheetCY TBelum ada peringkat

- Citibank - CREDITCARD CONDITIONSDokumen8 halamanCitibank - CREDITCARD CONDITIONSkrishna_1238Belum ada peringkat

- DLW Purchase OrdersDokumen26 halamanDLW Purchase OrdersSdspl DelhiBelum ada peringkat

- AppliedDokumen1 halamanAppliedSdspl DelhiBelum ada peringkat

- Economy Vacuum ChamberDokumen8 halamanEconomy Vacuum ChamberSdspl DelhiBelum ada peringkat

- Broad Functional Spec PTDokumen2 halamanBroad Functional Spec PTSdspl DelhiBelum ada peringkat

- Vminutes of Meeting Held On Dated 31St MayDokumen1 halamanVminutes of Meeting Held On Dated 31St MaySdspl DelhiBelum ada peringkat

- AppliedDokumen1 halamanAppliedSdspl DelhiBelum ada peringkat

- Essays in Babylonian LiteratureDokumen1 halamanEssays in Babylonian LiteraturejoefromkokomoBelum ada peringkat

- Claim Form Motor VehicleDokumen2 halamanClaim Form Motor VehicleSdspl DelhiBelum ada peringkat

- Eletronic Clearance Pro de DuralDokumen15 halamanEletronic Clearance Pro de DuralanupkallatBelum ada peringkat

- This Is A Summarised and Simplified Version of The Reserve Bank of IndiaDokumen338 halamanThis Is A Summarised and Simplified Version of The Reserve Bank of IndiaRohan VermaBelum ada peringkat

- Clough Flyer Session 1 14-15 - 2Dokumen5 halamanClough Flyer Session 1 14-15 - 2api-265732507Belum ada peringkat

- Cash Items ReviewerDokumen49 halamanCash Items ReviewerlalalalaBelum ada peringkat

- TOEIC Versi 1 - 2Dokumen23 halamanTOEIC Versi 1 - 2Cindy Agustin67% (3)

- CibDokumen6 halamanCibAriful Haque SajibBelum ada peringkat

- Elements of an ObligationDokumen13 halamanElements of an ObligationmehBelum ada peringkat

- Internship Report of SSGCLDokumen42 halamanInternship Report of SSGCLanon_682890591Belum ada peringkat

- PDF Document11Dokumen18 halamanPDF Document11amar maneBelum ada peringkat

- Idos V CaDokumen10 halamanIdos V CaMicah Clark-MalinaoBelum ada peringkat

- Caop HandbookDokumen39 halamanCaop HandbookAkram NiaziBelum ada peringkat

- Jitendra Singh Project ReportDokumen92 halamanJitendra Singh Project ReportAkanksha RaniBelum ada peringkat

- BankingDokumen17 halamanBankingAdolfo CámaraBelum ada peringkat

- Internship Report (BOP)Dokumen48 halamanInternship Report (BOP)Qasim Munawar100% (1)

- Branch Handover ChecklistDokumen3 halamanBranch Handover ChecklistPraneet T100% (4)

- Prospectus of Beacon PharmaDokumen104 halamanProspectus of Beacon Pharmaaditto smgBelum ada peringkat

- US Meadows Fee Sched & Payment FormDokumen1 halamanUS Meadows Fee Sched & Payment Formanysia0Belum ada peringkat

- RP Super Capsule 2024Dokumen85 halamanRP Super Capsule 2024brayten.hazemBelum ada peringkat

- Pentagon - IDBI 000569 - NovDokumen58 halamanPentagon - IDBI 000569 - NovnaniBelum ada peringkat

- Bajaj Allianz General Insurance Company LTD.: Contact No: 0/1800-103-3999 EmailDokumen2 halamanBajaj Allianz General Insurance Company LTD.: Contact No: 0/1800-103-3999 EmailANKIT SHARMA100% (1)

- Accounts of Blind PersonsDokumen8 halamanAccounts of Blind PersonshvenkiBelum ada peringkat

- Sap Portfolio ProjectDokumen19 halamanSap Portfolio Projectapi-487587792Belum ada peringkat

- HDFC Bank Opening Savings Account Project ReportDokumen85 halamanHDFC Bank Opening Savings Account Project ReportHarminder Singh40% (5)

- Icici Settlement LetterDokumen3 halamanIcici Settlement LetterSHAWBelum ada peringkat

- Index: S No. Particulars Page NoDokumen23 halamanIndex: S No. Particulars Page NoshagunBelum ada peringkat

- List of Accounting DocumentsDokumen3 halamanList of Accounting DocumentsKhánh HuyềnBelum ada peringkat

- Cryptarith 1Dokumen24 halamanCryptarith 1Subhendu Ghosh0% (2)

- Insta Pay Fact SheetDokumen2 halamanInsta Pay Fact SheetStella DimitrivBelum ada peringkat

- Sop Accounts Payables Axiom EasyDokumen16 halamanSop Accounts Payables Axiom EasyRiskyKurniasih100% (1)

- Bpi V Iac 164 Scra 630 August 19,1988Dokumen5 halamanBpi V Iac 164 Scra 630 August 19,1988Romarie AbrazaldoBelum ada peringkat