Alternative Methods of Trade Financing

Diunggah oleh

rahulramgoolam291193Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Alternative Methods of Trade Financing

Diunggah oleh

rahulramgoolam291193Hak Cipta:

Format Tersedia

International Trade Financing DFA2137(3)

Alternative Methods of Trade Financing

Apart from the traditional trade financing instruments, other methods of financing international trade exist and these are described below:

A.

Pre-Shipping Financing

Pre-shipment finance for exporters is the finance required to bring an export transaction to the point of shipment either to manufacture, process, or purchase merchandise and commodities for shipment overseas. In some instances, the exporters position may be sufficiently liquid for the funds to be provided from working capital, or local suppliers of the export goods may extend credit. In many other instances, the exporter will look to a bank to provide finance. Preshipment financing can take in the form of short-term loans, overdrafts and cash credits.

B.

Post-Shipping Financing

If the buyer pays for goods with the order, the exporter does not require finance after shipment of the goods. However, where a period elapses after the goods have been shipped and before payment is made by the buyer, or by an overseas bank under a DC (issued on application by the buyer), the exporter or some party must provide finance for that period. This finance is known as post-shipment finance and is usually provided by the exporters bank. A major consideration in post-shipment finance is the fact that interest charges arise.

The bank providing post-shipment finance, by negotiating a sight or term drawing under a documentary credit, or by purchasing or advancing against a documentary bill, or by way of trade finance, or discounting a bill, will charge interest. The exporter must pay or otherwise provide for this interest. Thus, it is usual for the exporter to charge interest to the buyer for the credit terms extended and generally this is provided for in the price of the goods exported.

Prepared by Kamal Iyaroo

International Trade Financing DFA2137(3)

Apart from interest charges, the bank may also charge commission rendering post-shipment finance quite expensive.

C.

Buyers Credit

On arrangements usually initiated by the supplier, and subject to a full investigation, a financial institution in the suppliers country makes a loan for the period required and in the currency agreed on, direct to the buyer for the balance of the amount owing to the supplier after initial payments at or before shipment as agreed has been made. The loan is used to pay the supplier, and from then he has no further interest in the transaction; he has received payment in full without recourse. The importers liability is to the financial institution providing the loan, and repayments are made in accordance with the loan agreement signed by the two parties. The rate of interest on the loan is set out in the loan agreement.

D.

Suppliers Credit

The term supplier credit is applied in circumstances where the supplier provides the finance for the period required either from his own resources, or by borrowing in his own name. Arrangements for payment by buyers under medium and long-term contracts vary considerably. Generally they provide for a deposit to be paid when the order is placed and a further part payment on shipment. The remaining payments are spread at regular intervals over the term for which credit is granted. Bills of exchange at varying usances (time allowed for settlement) may be drawn on the buyer by the exporter for installments, promissory notes may be issued by the buyer, or the buyer may make clean payments as installments fall due.

E.

Confirming Houses

Confirming houses are financial institutions providing an additional avenue of finance for the small to medium business sector or supplementing facilities provided by prime lenders such as

Prepared by Kamal Iyaroo

International Trade Financing DFA2137(3)

banks and merchant banks. This finance is usually in the form of cash or, for imports, letter of credit establishment facilities.

Confirming houses are principally engaged in financing the movement of goods (be it export/import related) and provide up to 180 days finance on a transaction by transaction basis within a pre-arranged facility.

Confirming houses are basically secondary providers of trade finance. They charge a fee in addition to interest costs and out of pocket expenses. In all, these costs will usually make usage of a confirmers line of credit more expensive than that of a bank.

It is not uncommon for confirming/trade finance to be confused with factoring. The main difference is:

Confirming provides a customer with front-end financing either by way of letters of credit or cash.

Factoring provides a customer with rear-end financing by purchasing its debtors.

F.

Accounts Receivable Financing

Accounts receivable financing involves lending against the security of a companys receivables. Funds are generally advanced up to a maximum of 70% of the outstanding eligible receivables. Receivables are considered ineligible by the lender if they have been outstanding beyond a given number of days (usually 90 days), or if any doubts exists as to their value. The company retains responsibility for managing and collecting its receivables and continues to bear the cost of any bad debts.

Accounts receivable financing is commonly used to meet short term funding requirements, but in some cases it is provided as an ongoing working capital facility.

Prepared by Kamal Iyaroo

International Trade Financing DFA2137(3)

G.

Invoice Discounting

Invoice Discounting offers an invoice purchasing facility providing working capital by virtue of the financier purchasing and discounting the trade debtors of incorporated businesses. In essence Invoice Discounting offers a stable long-term source of short-term finance linked to a companys receivables rather than to the value of its fixed assets or the strength of its balance sheet. Invoice Discounting effectively accelerates a companys cash flow cycle by providing almost immediate funding against receivables which are then collected under normal trade terms, e.g. 30 to 90 days.

Invoice Discounting is an alternative to overdraft or other working capital funding. The main difference between Invoice Discounting and a standard overdraft facility is that the level of funding available under Invoice Discounting is controlled by the amount of trade debtors purchased, within a facility limit. With Invoice Discounting therefore, the availability of funds is dependent on sales achieved and is thus responsive to any seasonality and/or growth in the customers business.

Prepared by Kamal Iyaroo

Anda mungkin juga menyukai

- Explaining the 3 Main Financing Options of an Export OrderDokumen8 halamanExplaining the 3 Main Financing Options of an Export OrderDiana SumailiBelum ada peringkat

- Purpose of FinanceDokumen10 halamanPurpose of FinanceManjith BoloorBelum ada peringkat

- Factoring, Forfaiting & Bills DiscountingDokumen3 halamanFactoring, Forfaiting & Bills DiscountingkrishnadaskotaBelum ada peringkat

- Unit Iv Regulatory Framework & Taxation: Cross Border TransactionsDokumen34 halamanUnit Iv Regulatory Framework & Taxation: Cross Border TransactionsRavi PrabuBelum ada peringkat

- Types of Factoring and How it Differs from LoansDokumen4 halamanTypes of Factoring and How it Differs from LoansSunaina Kodkani100% (1)

- Chapter - 1: MeaningDokumen84 halamanChapter - 1: MeaningManoj KumarBelum ada peringkat

- Assignment OF M.F.I.S: Topic: Financial ServicesDokumen11 halamanAssignment OF M.F.I.S: Topic: Financial ServicesmeghukhandelwalBelum ada peringkat

- Short Term and Loans Term Loans To Business FirmsDokumen10 halamanShort Term and Loans Term Loans To Business FirmsAli Asad BaigBelum ada peringkat

- Post ShipmentDokumen3 halamanPost ShipmentBhanu MehraBelum ada peringkat

- Unit 3 Financial Credit Risk AnalyticsDokumen14 halamanUnit 3 Financial Credit Risk Analyticsblack canvasBelum ada peringkat

- Factoring 1Dokumen21 halamanFactoring 1Sudhir GijareBelum ada peringkat

- International Banking and Foreign ExchangeDokumen11 halamanInternational Banking and Foreign ExchangePrateek JainBelum ada peringkat

- Factoring and ForfaitingDokumen3 halamanFactoring and ForfaitingSushant RathiBelum ada peringkat

- Factoring & ForfaitingDokumen2 halamanFactoring & ForfaitingYashBelum ada peringkat

- Post Shipment FinanceDokumen4 halamanPost Shipment FinanceambrosialnectarBelum ada peringkat

- Long Term Finance Short Term FinanceDokumen15 halamanLong Term Finance Short Term FinanceGangadhar MamadapurBelum ada peringkat

- Week 10 Trade Financing ImportersDokumen14 halamanWeek 10 Trade Financing ImportersJ DreamerBelum ada peringkat

- Pre ShipmentDokumen8 halamanPre ShipmentRajesh ShahBelum ada peringkat

- Running FinanceDokumen10 halamanRunning FinanceAnum Zahra100% (1)

- CBM AssignmentDokumen6 halamanCBM AssignmentNimit BhatiaBelum ada peringkat

- Module 2.docxDokumen5 halamanModule 2.docxsatyam2800rBelum ada peringkat

- Trade 4Dokumen5 halamanTrade 4krissh_87Belum ada peringkat

- Working Capital ManagementDokumen4 halamanWorking Capital ManagementSundeep SinghBelum ada peringkat

- AniketDokumen5 halamanAniketAjay PrajapatiBelum ada peringkat

- Latter of Credit and Other FinaciDokumen57 halamanLatter of Credit and Other FinaciHaresh RajputBelum ada peringkat

- Loans and Advances E-Question BankDokumen46 halamanLoans and Advances E-Question Bankshamar debnathBelum ada peringkat

- Factoring, Forfaiting, and Payment Methods ExplainedDokumen4 halamanFactoring, Forfaiting, and Payment Methods ExplainedAmruta TurméBelum ada peringkat

- M204-19 Vishakha KateDokumen8 halamanM204-19 Vishakha KatevishakhaBelum ada peringkat

- The Concept of Forfeiting in Export Finance: You Are HereDokumen3 halamanThe Concept of Forfeiting in Export Finance: You Are HereAmit AgrawalBelum ada peringkat

- Export FinanceDokumen8 halamanExport FinanceMushiur RahmanBelum ada peringkat

- Meaning of Borrowing CostDokumen5 halamanMeaning of Borrowing CostRituBelum ada peringkat

- Packing Credit: Report SubtitleDokumen5 halamanPacking Credit: Report SubtitleSaikumar BommaBelum ada peringkat

- Everything You Need to Know About Pre-Shipment and Post-Shipment FinanceDokumen2 halamanEverything You Need to Know About Pre-Shipment and Post-Shipment Financehsaxena97Belum ada peringkat

- FactoringDokumen32 halamanFactoringkalyaniduttaBelum ada peringkat

- Assignment 1 Budgeting For International OperationsDokumen4 halamanAssignment 1 Budgeting For International OperationsNiya ThomasBelum ada peringkat

- Yeasin LawDokumen10 halamanYeasin LawSifatShoaebBelum ada peringkat

- Itab RevieweerDokumen13 halamanItab RevieweerAra PanganibanBelum ada peringkat

- Financial ManagementDokumen18 halamanFinancial ManagementindhumathigBelum ada peringkat

- Note Mate:: Working Capital OodusDokumen7 halamanNote Mate:: Working Capital Oodusdon faperBelum ada peringkat

- Debtors Financing-Factoring: Swayam Siddhi College of MGMT & ResearchDokumen15 halamanDebtors Financing-Factoring: Swayam Siddhi College of MGMT & Researchpranjali shindeBelum ada peringkat

- Understanding Trade Finance Letter of CreditDokumen2 halamanUnderstanding Trade Finance Letter of CreditSudershan ThaibaBelum ada peringkat

- Fee Based Services11Dokumen14 halamanFee Based Services11nikhild77Belum ada peringkat

- Export Credit InsuranceDokumen6 halamanExport Credit InsuranceGeorgeBelum ada peringkat

- Understanding Note Date Agencies and Their Role in Debt EvaluationDokumen7 halamanUnderstanding Note Date Agencies and Their Role in Debt Evaluationdon faperBelum ada peringkat

- Factoring and Forfaiting ExplainedDokumen30 halamanFactoring and Forfaiting ExplainedSuman AcharyaBelum ada peringkat

- Credit Rating:: Working Capital LoansDokumen7 halamanCredit Rating:: Working Capital Loansdon faperBelum ada peringkat

- Fact FofeitDokumen34 halamanFact Fofeitmrchavan143Belum ada peringkat

- Objectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcDokumen8 halamanObjectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcRekha SoniBelum ada peringkat

- Note Mate:: Working Capital MattersDokumen7 halamanNote Mate:: Working Capital Mattersdon faperBelum ada peringkat

- Import FinancingDokumen11 halamanImport FinancingDheeraj rawatBelum ada peringkat

- Loan RestructuringDokumen22 halamanLoan RestructuringNazmul H. PalashBelum ada peringkat

- NOTESDokumen8 halamanNOTESShruthi sBelum ada peringkat

- Sources of funds-CHAPTER 2Dokumen30 halamanSources of funds-CHAPTER 2SojinBelum ada peringkat

- Forfeiting vs Factoring: Key Differences in International Trade ReceivablesDokumen3 halamanForfeiting vs Factoring: Key Differences in International Trade ReceivablesjosetonyeduthanBelum ada peringkat

- Factoring in Finance ArrangementsDokumen9 halamanFactoring in Finance Arrangementsduncanmac200777Belum ada peringkat

- Funded & Non-Funded FacilitiesDokumen3 halamanFunded & Non-Funded Facilitiesbhavin shahBelum ada peringkat

- Factoring and IngDokumen7 halamanFactoring and IngAnsh SardanaBelum ada peringkat

- Guía Examen Final - Admin PDFDokumen12 halamanGuía Examen Final - Admin PDFVanessaBelum ada peringkat

- Foreign Exchange Operations in Commercial BanksDokumen16 halamanForeign Exchange Operations in Commercial BanksTara Gilani67% (3)

- Airport Check-In and Security Screening Use Case DiagramDokumen22 halamanAirport Check-In and Security Screening Use Case DiagramWaleed KhanBelum ada peringkat

- Fu Interest Free Loan AgreementDokumen2 halamanFu Interest Free Loan AgreementMuhammad ArslanullahBelum ada peringkat

- Credit q2Dokumen15 halamanCredit q2angel diazBelum ada peringkat

- ENTREP 4 HandoutsDokumen23 halamanENTREP 4 HandoutsMae-ann Enoc SalibioBelum ada peringkat

- Digital Finance Promissory NoteDokumen5 halamanDigital Finance Promissory NoteJL RangelBelum ada peringkat

- (Lehman) O'Kane Turnbull (2003) Valuation of CDSDokumen19 halaman(Lehman) O'Kane Turnbull (2003) Valuation of CDSGabriel PangBelum ada peringkat

- Virginia Henry BillieBMO Harris Bank StatementDokumen4 halamanVirginia Henry BillieBMO Harris Bank StatementQuân NguyễnBelum ada peringkat

- Umesh Bajaj REPORT1Dokumen63 halamanUmesh Bajaj REPORT1Harapalsinh DarabarBelum ada peringkat

- Derivatives (Fin402) : Assignment: EssayDokumen5 halamanDerivatives (Fin402) : Assignment: EssayNga Thị NguyễnBelum ada peringkat

- Banksters Gangsters Traitors V3Dokumen188 halamanBanksters Gangsters Traitors V3John@spiritusBelum ada peringkat

- Risk Management Full NotesDokumen40 halamanRisk Management Full NotesKelvin Namaona NgondoBelum ada peringkat

- EMI Calculator V2Dokumen6 halamanEMI Calculator V2Km DelhiBelum ada peringkat

- Family Loan AgreementDokumen4 halamanFamily Loan Agreementshrutika agarwalBelum ada peringkat

- Project Based Learning PMP & CCP: Raising Rent or SellingDokumen1 halamanProject Based Learning PMP & CCP: Raising Rent or SellingKen LouieBelum ada peringkat

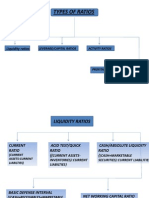

- Types of Financial Ratios ExplainedDokumen9 halamanTypes of Financial Ratios Explainedangelohero6643Belum ada peringkat

- A Web Based Application For Automating Bank Loan Eligibility Using Machine LearningDokumen43 halamanA Web Based Application For Automating Bank Loan Eligibility Using Machine LearningPatrick NgaboBelum ada peringkat

- Risk Management in PNB for Working Capital and Term LoansDokumen7 halamanRisk Management in PNB for Working Capital and Term LoansArshdeepBelum ada peringkat

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDokumen14 halamanYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSanaka LogesBelum ada peringkat

- Fairer Simpler Banking - Fact SheetDokumen5 halamanFairer Simpler Banking - Fact SheetAustralianLaborBelum ada peringkat

- Discount Market IntroductionDokumen2 halamanDiscount Market IntroductionsadathnooriBelum ada peringkat

- IBC Question PDFDokumen8 halamanIBC Question PDFAvdhesh SinghBelum ada peringkat

- Chapter 9 LiabilitiesDokumen10 halamanChapter 9 LiabilitiesMarine De CocquéauBelum ada peringkat

- Moody's Qualifie Maurice de "Upper - Middle Income"Dokumen4 halamanMoody's Qualifie Maurice de "Upper - Middle Income"L'express MauriceBelum ada peringkat

- India Daily 22082022 BKDokumen71 halamanIndia Daily 22082022 BKRohan RustagiBelum ada peringkat

- Understanding Business Structures: Sole Trader, Partnership, Private & Public CompaniesDokumen6 halamanUnderstanding Business Structures: Sole Trader, Partnership, Private & Public CompaniesMai HươngBelum ada peringkat

- 2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemDokumen4 halaman2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemRaghuBelum ada peringkat

- Unit I Commercial BanksDokumen63 halamanUnit I Commercial BanksJoseph AnbarasuBelum ada peringkat

- Loan Guidelines Us BankDokumen12 halamanLoan Guidelines Us BankcraigscBelum ada peringkat

- ARDCIBANK INC A RURAL BANK - HTMDokumen2 halamanARDCIBANK INC A RURAL BANK - HTMJim De VegaBelum ada peringkat

- GenMath Q2Act4 Wk6Dokumen2 halamanGenMath Q2Act4 Wk6Dynah Janine SemanaBelum ada peringkat