Draft Memo Relating To Amendments To Municipal Laws-Ghmc

Diunggah oleh

Durga Bose GandhamJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Draft Memo Relating To Amendments To Municipal Laws-Ghmc

Diunggah oleh

Durga Bose GandhamHak Cipta:

Format Tersedia

Salient features of Amendments to the Greater Hyderabad Municipal Corporation Act, 1955 through Act No 15 of !"1# 1 !

# + 5 Meeting of the Corporation shall be held at least once in three months. $Section %% &c'( Minutes of the proceedings at every meeting of the Corporation shall be signed by the presiding authority after completion of the meeting. $Section %% &n'( Minutes of the meeting of the Standing Committee shall be signed by the presiding authority after the completion of the meeting $Section 9) &1' &*'( It shall be competent for the Commissioner to make a contract not involving an expenditure exceeding rupees fifty lakhs. $Section 1!+ &c'( It shall be competent for the Standing Committee to sanction works contract involving an expenditure exceeding rupees fifty lakhs but not exceeding rupees two hundred lakhs. &Section 1!+,A' The common seal of the Corporation shall be affixed in the presence of the Commissioner or his nominee to every contract and such contract shall be signed by the Commissioner in token of the same being sealed in his presence. $Section 1!5 &!'( The Corporation is competent to approve a project in respect of works contract involving an expenditure exceeding rupees two hundred lakhs but not exceeding rupees five hundred lakhs. $Section 1!9 &b'( here the Corporation approve the project! the estimated cost of which exceeds rupees five hundred lakhs! the report shall be submitted to the "overnment for sanction. $Section 1!9 &c'( The provision relating to pre#$ualification of tenders to be invited for works costing rupees fifty lakhs or more is omitted. %Section 1!9,A' &very contract or other instrument relating to the ac$uisition of immovable property shall be executed by the Commissioner! shall have the common seal of the Corporation affixed thereto in the presence of two officers nominated by the Commissioner and shall also have the signature of the said two officers. $Section 1+- &5'( The lease period of immovable property shall not exceed twenty five years. $Section 1+% &#'( The Corporation shall levy property tax on vacant lands at half percent %'.(' percent) of the estimated capital value of the lands. $Section 199 &#'( The annual rental value of lands and buildings shall be fixed notwithstanding anything contained in the *ndhra +radesh ,uildings %-ease! .ent and &viction) Control *ct! /01'. $Section !1! &1' &a'(

9 1"

11 1! 1#

draft memo relating to amendments to Municipal Laws - GHMC 14-8-2013

1+

here a building is constructed or reconstructed or some structures are raised unauthori2edly! it shall be competent to the assessing authority to levy property tax on such building or structure with a penalty as specified hereunder till such unauthori2ed construction is demolished or regulari2ed without prejudice to any proceedings which may be instituted in respect of such unauthori2ed construction. * separate receipt for the penalty levied collected shall be issued. a) 3pto ten percent violation of permissible setbacks only in respect of floors permitted in a sanctioned plan More than ten percent violation of permissible setbacks only in respect of floors permitted in a sanctioned plan 3nauthori2ed floors over the permitted floors in a sanctioned plan Total unauthori2ed construction Twenty five percent of property tax as penalty 4ifty percent of property tax as penalty 5undred percent of property tax as penalty 5undred percent of property tax as penalty $Section !!",A &1'(

b)

c) d)

15

-evy and collection of penalty on unauthori2ed construction shall not be construed as regulari2ation of such unauthori2ed construction or re#construction. $.ro/iso under Section !!",A &1'( +enalty leviable under Section 66'#* %/) shall be determined and collected by such authority and in such manner as may be prescribed. The penalty so payable shall be deemed to be the +roperty tax due. $Section !!",A &!'( * person primarily liable for payment of property tax in respect of a building or structure shall be liable for payment of penalty levied under sub#section %/) of Section 66'#* $Section !!",A &#'( here any property has been inadvertently omitted from the assessment records or inade$uately or improperly assessed relating to any tax or a clerical or arithmetical error is committed in the records maintained in relation to such assessment! Commissioner may assess or reassess or correct such errors! as the case may be. here the aforesaid action involves increase in assessment! an opportunity shall be given to the affected person before taking any action to show cause against such assessment. $Section !!5 &+' &i'( Such assessment or reassessment or correction of records can be taken up with retrospective affect up to five half years immediately preceding the current half year. $Section !!5 &+' &ii'( The provision stipulating that the Corporation shall take into consideration the rent component of cost of living index prevailing at the time of preparation of new assessment books is omitted. $Section !!- &+'( The proviso under sub#section %7) of Section 661 stipulating that where the value of the land on which buildings constructed for purposes of choultry! hotels!

draft memo relating to amendments to Municipal Laws - GHMC 14-8-2013

1-

1)

1%

19

!"

!1

lodges and cinema theatres increases and the income on the property does not increase the average rental value shall be fixed with reference to the income on the property is omitted. $Section !!- &+'( !! !# !+ * new assessment book shall be prepared at least once in five years. $Section !!-,A &1'( The detailed procedure for preparation of new assessment book is stipulated in sub#sections %6) and %8) of Section 661#*. $Section !!-,A &!' and &#'( *ll the taxes and dues to the Corporation including the property tax shall be liable to be recovered by way of attachment and sale of immovable property as may be prescribed. &.ro/iso under Section !#%' * rebate of five percent of property tax shall be given in respect of assessments where property tax for the entire current financial year is paid before 8' th *pril of the year notwithstanding the service of bill or demand notice. $Section !-+ &#' Service of notice of demand as contemplated in Section 619 is dispensed with since Section 619 is omitted. &Section !-%' Service of bill is sufficient for distraint of movable properties as per the procedure prescribed in Section 610. $Section !-9 &1'( * simple interest at the rate of two percent per month shall be charged incase of failure to pay property tax by the end of the month of :une for the first half year and by the end of the month of ;ecember for the second half year. < 0irst pro/iso to Section !-9 &!'( The Commissioner may prosecute the defaulter for on non#payment of property tax before the competent court if the distraint of the defaulter=s property is impracticable. $Section !-9 &#'( The following limitations are provided for recovery of property tax or any sum due to the Corporation1 $Ne2 Section !)%,A &1'( i. ii. iii. #1 ;istraint Suit # # upto a period of three years # upto a period of six years upto a period of nine years +rosecution

!5

!!) !%

!9

#"

It shall be the duty and responsibility of the Commissioner to place before the Standing Committee a list of arrears due to the Corporation which if no action is taken within the period specified in sub#section %/) of Section 6>9#* are likely to be time#barred! at least one year before the expiry of the said period stating the reasons for the delay in the recovery of such amount and re$uesting instructions of the Standing Committee in this matter. $Ne2 Section !)%,A &!'( *n officer or employee of the Corporation entrusted with the collection of sums due to the Corporation is liable for the loss! waste or misapplication of any money or other property owned by the Corporation! if such loss! waste or misapplication is a direct conse$uence of his neglect or misconduct and a suit for compensation

draft memo relating to amendments to Municipal Laws - GHMC 14-8-2013

#!

may be instituted against him by the Standing Committee with the previous sanction of the "overnment or by the "overnment. $Ne2 Section !%1,A &1'( ## The power entrusted to ;irector of Municipal *dministration to reassess the property tax where it is noticed that the property tax is under#valued is deleted by omitting Section 696#*. &Section !%!,A' *ny person or any body who undertakes construction or development of any land in contravention of the statutory master plan or without permission! approval! or sanction or in violation of such permission! approval or sanction shall be punished with the fine which shall be levied as provided in Schedules 3 and ? of the *ct read with Section (01 of the *ct. < Section +-1 &+'(

#+

draft memo relating to amendments to Municipal Laws - GHMC 14-8-2013

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

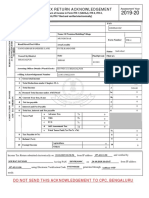

- Indian Income Tax Return Acknowledgement for AY 2019-20Dokumen1 halamanIndian Income Tax Return Acknowledgement for AY 2019-20Sourav KumarBelum ada peringkat

- Ey Doing Business in Russia 2021 Ver2Dokumen182 halamanEy Doing Business in Russia 2021 Ver2Sergey MasloveBelum ada peringkat

- Ra Bill 01 To 11Dokumen7 halamanRa Bill 01 To 11Sarthak EnterprisesBelum ada peringkat

- An Analysis of Government Subsidies in India A Case Study of Uttar PradeshDokumen353 halamanAn Analysis of Government Subsidies in India A Case Study of Uttar PradeshDhairya JainBelum ada peringkat

- FABM2 - Q1 - Module 5 - Analysis and Interpretation of Financial StatementsDokumen37 halamanFABM2 - Q1 - Module 5 - Analysis and Interpretation of Financial StatementsHanzel NietesBelum ada peringkat

- MEHTA, Hetav, Economics, Q4Dokumen9 halamanMEHTA, Hetav, Economics, Q4Hetav MehtaBelum ada peringkat

- MACTAN-CEBU INTERNATIONAL AIRPORT AUTHORITY v. CITY OF LAPU-LAPUDokumen78 halamanMACTAN-CEBU INTERNATIONAL AIRPORT AUTHORITY v. CITY OF LAPU-LAPUroy rebosuraBelum ada peringkat

- How To Prepare For A Transfer Pricing AuditDokumen7 halamanHow To Prepare For A Transfer Pricing Auditmejocoba82Belum ada peringkat

- Assesment of Jewels & JewelleryDokumen41 halamanAssesment of Jewels & Jewellerykhushic2401Belum ada peringkat

- Schedule of Rates (SOR) Tender No. Agl/231/Steel Valves/04-17Dokumen1 halamanSchedule of Rates (SOR) Tender No. Agl/231/Steel Valves/04-17Tejash NayakBelum ada peringkat

- STATEMENT OF ACCOUNT RevisedDokumen2 halamanSTATEMENT OF ACCOUNT RevisedJose VillarealBelum ada peringkat

- Business Tax Chapter 6 ReviewerDokumen4 halamanBusiness Tax Chapter 6 ReviewerMurien LimBelum ada peringkat

- Foucault, M - Power - Knowledge (Pantheon, 1980)Dokumen281 halamanFoucault, M - Power - Knowledge (Pantheon, 1980)leofeuc100% (2)

- Junos Security Cli ReferenceDokumen1.750 halamanJunos Security Cli ReferenceKhalid DesokiBelum ada peringkat

- The Sales of Goods Act, Cap.214 R.E 2002Dokumen37 halamanThe Sales of Goods Act, Cap.214 R.E 2002Baraka FrancisBelum ada peringkat

- 01 - Lorenzo V PosadasDokumen21 halaman01 - Lorenzo V PosadasRaymond ChengBelum ada peringkat

- Wealth DynamX Blueprint To Financial FreedomDokumen10 halamanWealth DynamX Blueprint To Financial FreedomJoseAlicea0% (1)

- View FileDokumen2 halamanView FileKenny XBelum ada peringkat

- Voltas Case StudyDokumen26 halamanVoltas Case StudyVarsha MalviyaBelum ada peringkat

- Reviewer For CpaleDokumen41 halamanReviewer For Cpalehello kitty black and whiteBelum ada peringkat

- v11 n1 Article8Dokumen24 halamanv11 n1 Article8Farapple24Belum ada peringkat

- ABM APPLIED ECONOMICS 12 - W6 - Mod6Dokumen20 halamanABM APPLIED ECONOMICS 12 - W6 - Mod6ely san100% (1)

- Tax by ItemDokumen18 halamanTax by ItemBrooke ReaBelum ada peringkat

- Accenture Fin ModelDokumen14 halamanAccenture Fin ModelShashi BhushanBelum ada peringkat

- VAT Final Covering FA 2020Dokumen67 halamanVAT Final Covering FA 2020Sohag Khan100% (2)

- Partnership Accounting Multiple ChoiceDokumen3 halamanPartnership Accounting Multiple ChoiceFreann Sharisse AustriaBelum ada peringkat

- Payslip 4Dokumen1 halamanPayslip 4ahmad zakwanBelum ada peringkat

- 15th-DGF-Proceedings - As-Of-30-Nov - 15 Years of DecentralizationDokumen28 halaman15th-DGF-Proceedings - As-Of-30-Nov - 15 Years of DecentralizationRuby GarciaBelum ada peringkat

- Local Tax - SyllabusDokumen8 halamanLocal Tax - Syllabusmark_aure_1Belum ada peringkat

- Project IN Mathematics 6: Ibalon Central SchoolDokumen3 halamanProject IN Mathematics 6: Ibalon Central SchoolNeptuneBelum ada peringkat