Merchant Banking

Diunggah oleh

Shashank ShekharHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Merchant Banking

Diunggah oleh

Shashank ShekharHak Cipta:

Format Tersedia

INTRODUCTION TO MERCHANT BANKING: Merchant Banking Business is an omnibus term covering a variety of services offered to the corporate customers

for establishing new companies and commissioning projects, undertaking modernization/expansion/diversification of existing units, amalgamation and merger of companies, etc. in brief any services rendered for any related job right from incorporation of the company till the implementation of the project can be undertaken under merchant banking services.

TYPES OF ACTIVITIES a) b) c) d) e) f) g) h) i) j) Project Appraisal Syndication of loan Issue Management Underwriting of issues Corporate counseling Mergers, amalgamations and acquisitions Bankers to the issue Investment counseling Portfolio Management services Registrar and transfer agent services.

PROJECT APPRAISAL is the process of examining the technical, commercial, financial and economic viability of a project to ensure that it generates sufficient returns on the resources invested in it. Under this service project report will be prepared for the company, including finalization of capital structure. SYNDICATION OF LOAN- estimating the projects financial needs and structuring these into short and long term finance and equity capital to ensure ideal financial base and undertaking syndication of financial

assistance, i.e., negotiating for assistance from financial institutions and commercial banks, including preparation of detailed application forms. Arranging for raising foreign exchange loans and external commercial borrowings for import of capital goods/components at attractive and competitive terms, through Indian/foreign banks and external agencies. ISSUE MANAGEMENT assisting companies in arriving at quantum and nature of issue and obtaining consent/clearance from various statutory authorities, preparing draft prospectus, obtaining approval from appropriate authorities, etc. Assisting companies in tying up underwriting arrangements for the issue, appointing other intermediaries like brokers, bankers, advertising agents, Registrar to the issue, co-ordination of activities of these agencies and institutions for the successful flotation of the issue. Assisting in listing the securities in stock exchange, finalizing basis of allotment, arranging for refund, handling investors complaints, etc. UNDERWRITING OF ISSUES- in order to ensure full subscription or the stipulated minimum subscription of 90% of the offer, Companies enter into an agreement with financial institutions, banks, brokers and merchant bankers to underwrite the issue amount, i.e., requiring the latter to procure subscription from investors up to a specified sum or in the event of failure to do so, subscribe to the securities not taken up by the investors. Merchant Banker can underwrite issues and assist companies in tying up underwriting from other underwriters. CORPORATE COUNSELLING rendering assistance to corporate clients on various aspects of business operations particularly in the areas of financial planning, restructuring capital, performance budgeting, liquidity

management, other aspects of financial management and monitoring systems. MERGERS/ACQUISITIONS OR AMALGAMATIONS some companies desire to restructure themselves in order to effectively meet competitions by adding synergies through a process of merger, acquisition or amalgamation. Merchant Banker provides all requisite guidance and services, for restructuring, to prepare due diligence, obtain necessary clearance from statutory bodies like SEBI, ROC etc, as per the statutory and legal stipulations, for the process of merger, acquisition or amalgamation. BANKERS TO THE ISSUE collection of subscription money/application money for an issue from the investors, giving acknowledgement, proper accounting of the money received, sending reports/certificates to issuing company and registrars, informing collection details, etc. INVESTMENT COUNSELLING assisting individuals as well as firms, companies, trusts and funds (gratuity, superannuation, provident/pension fund) and associations in the choice of shares and stocks for investment depending upon the needs of the investor with proper blend of high yield and high growth shares on the one hand and the entitlements pertaining to tax and investment incentives, on the other. PORTFOLIO MANAGEMENT assisting firms, trusts, funds and associations and individual residents and non-residents in managing their portfolio investment by acting as agents in acquiring securities, shares and debentures, planning a basket of scripts in their portfolio by judicious selection after evaluating current and future returns and after providing for elements of risk and uncertainty; reviewing the mix of portfolio continuously to maximize returns and minimize risks in consultations with and after approval by the principals.

REGISTRAR AND TRANSFER AGENT SERVICES collecting the application from bankers, scrutinizing, coding and verifications of applications, finalizing the basis of allotment of securities in consultation with stock exchange, finalizing the list of persons entitled to allotment of securities processing and dispatching allotment letters, refund orders or certificates and other related documents in respect of an issue, attending to complaints of applicants. Transfer agency work involves carrying out transfer work in respect of securities after complying with stipulated formalities/procedures. Preparation and printing of dividend warrants and dispatching them to shareholders. ESSENTIAL REQUIREMENTS OF PUBLIC ISSUE: In a public issue, securities/shares are offered to the public at large by means of a PROSPECTUS (Prospectus is a document inviting offers from the public for subscription to the shares/security issued). Normally securities offered by way of a public issue are listed on the stock exchange. One of the requirements of the listing as per Rule 19 (2) (b) of Securities Contract (Regulation) Rules 1957 is that at least 25% of each class or a kind of securities issued by the company is offered to the public for subscription. As per Ministry of Finance, Stock Exchange Division guidelines, the subscription list for Public issue must be kept open for a minimum period of 3 days and for a maximum period of 21 working days where the issue is not underwritten and for a maximum of 10 working days where the issue is underwritten.

Application for securities/shares in a public issue is to be made for a minimum amount of Rs.2000 irrespective of the size of the premium, inclusive of application money, allotment and calls. The minimum application money payable shall not be less than 25% of the issue price. The minimum number of instruments for which an application has to be made shall also be not less than the marketable lot. In the event of oversubscription, the basis of allotment of security to the applicants is decided after getting the approval of the Principal Stock Exchange.

Guidelines relating to the eligibility of bodies corporate for public issues:i) the body corporate has a track record of dividend payment for at least 3 years out of the immediately preceding 5 years, ii) in respect of body corporate making offer for the first time to the public of equity or any security convertible at a later date into equity if a public financial institution or a scheduled commercial bank has appraised the project to be financed through the proposed offer to the public and iii) The apprising agency referred to is part financing such project by way of loan or equity participation to the extent of 10% of the project cost. iv) Anybody corporate which has its securities listed on any stock exchange and whose equity capital will after any offer to the public of equity or any security convertible at a later date into equity become more than 5 times equity capital prior to such offer shall

have to satisfy either the eligibility criteria as per clause (i) or clause (ii) before it can make such a public issue. v) vi) For NBFCs a minimum track record of 2 years operations or Who have been granted registration as a NBFC by the RBI or as an intermediary by SEBI vii) A housing finance company which is eligible for refinancing by the NHB shall be eligible to make an issue of securities to public, subject to eligibility criteria mentioned above.

MANAGEMENT OF PUBLIC ISSUE PROCEDURE Board meeting, Annual General Meeting, Extra ordinary General Meeting Notice period of 21 days Special resolutions for public issues(Section 81 (1A) for further issue of capital Memorandum and Articles of Association (MAA) to Regional Stock Exchange and the stock Exchanges where listing is proposed. Comments of Stock Exchanges on MAA Provisional listing in case of non-amended MAA AGM/EGM resolution and Form 23 to be filed with Roc. Appointment of Lead Managers, Co-managers, Advisors and Consultants. Call for quotations/budget from Printers, Registrars to the issue, Ad agencies. Finalize and appoint Printers, Registrars and Ad Agencies.

Check points for appointment of Registrars to the issue - Registration with SEBI, Hardware, Man-power, Network of Rep.offices/agents, Communication systems, Location of facilities, past record, Investor grievances. Check points for appointment of Advertising agency - ask for 3 4 agencies to make their presentation & decide about the ad agency, Adequate and skilled/experienced staff, Studio facilities, PR with Press, Infrastructure facilities and co-ordination, Track record. Who can underwrite? - FIs like IDBI, ICICI, LIC, GIC, Commercial Banks, Investment companies or trusts, Merchant Bankers authorized by SEBI, Mutual Funds, and Members of recognized Stock Exchanges. Maximum underwriting by Merchant Bankers 5 times of their net worth. Decide the Bankers to the issue who are authorized by SEBI. Decide about the refund bankers. Decide underwriting pattern. Draft Prospectus to be prepared as per Schedule II of Companies Act taking into consideration SEBI Guidelines and SEBI clarification Series on Disclosure and Investor Protection. Prepare of draft statutory advertisement as per Section 66 of the Act and send to Stock Exchanges for approval. Collect documents which are required to be filed with ROC.

PRICING OF ISSUE: Company in consultation with the merchant banker to the issue and lead book runner decides upon the issue price. If issue is a fixed price issue, then it is disclosed in the draft prospectus, but if it is issue through book

building route, then the company specifies only the floor price and the cap price before the issue is made open for subscription. Such notification is done through advertisements. The floor and cap prices are not mentioned in the red herring prospectus filed with the SEBI. SEBI has not suggested any formulae for the price fixation or for the fixation of floor and cap price. It only wants disclosure and transparency in the offer document so that investors can make informed decision. The company is to justify the price to prospective investors so long as investors are convinced by the price they will subscribe to the issue.

PRIVATE PLACEMENT AND PUBLIC ISSUE: Companies may offer securities privately without inviting public subscription. Under the scheme, securities are offered to a group of people viz., friends and relatives of Directors and shareholders, employees, business associates, promoters/FIIs etc., of the company. Unsubscribed portion of the securities issued on rights basis may also be offered on private placement. Also sometimes, companies arrange for private placement of debentures with investment institutions. Private placement by a listed company is referred as preferential allotment. When a listed company offers securities through this route to Qualified Institutional Buyers, it is referred as Qualified Institutions Placement (QIP). 1. Advantages of private placement: - Higher valuation - Stocks offered to a select set of investors - Quicker funds flow - Lower cost of raising resources

- It is free from lock-in as per the guidelines of SEBI. SEBI pricing norms for the private placement of equity capital-preferential issue pricing is as under: - The average weekly high or low during the preceding 6 months Or - Average weekly high or low during the preceding 2 weeks whichever is higher. Public issue securities/shares are offered to the public at large by means of a prospectus. At least 25% of each class or a kind of securities issued by the Company is offered to the public for subscription. In the event of oversubscription, the basis of allotment of security to the applicants is decided after getting the approval of the Principal Stock Exchange.

IPO COLLECTION / REFUND (Action Plan): On closure of subscription, bankers to the issue should collect application forms from all the collecting centers with confirmation that they do not have any application pending with them. Bank to reconcile the amount realized/or to realized(ASBA) from the bank statement received by the bankers to the issue with the applications received and settle with them discrepancies in the amount collected or any other matter. Bank to file 3 day post issue monitoring report with SEBI within 3 working days from the due date.

They have to work out alternative proposals of allotment with the assistance of registrars to the issue. Take care of requirement of payment of consolidated stamp duty for issue of share certificates. They have to arrange for placing order for continuous stationery printing for printing certificates, refund orders, allotment advice-cum-call money notices, etc. Place order with stationery suppliers for supply of envelopes required for sending refund orders, certificates or allotment letters etc. Fix meeting of the Board of Directors for allotment of shares. Forward copies of the approved basis of allotment to the stock exchange with whom the shares of the company are to be listed. Obtain permission of the postal department for bulk dispatching refunds order, allotment advice etc.

DRAFT PROSPECTUS: A Draft Prospectus is a document containing complete details about the company as well as the ensuing issue of new securities. Prospectus is issued by a company before the issue of new securities for raising capital. It must contain the information to have proper disclosure as per the provision of regulators like SEBI. A prospectus contains the details about the past, present and expectation about the future of the company. The information contained in this document becomes a basis for investment decision. Draft prospectus must be filed with SEBI at least 21 days prior to filling such a document with ROC.

Coverage of draft prospectus Cover page Risk factors Introduction of issuing company Legal details Regulatory disclosures Cover page of the d.p. contains details like name and address of the issuing company. Details about merchant banker, lead banker, issue size, type of securities being offered, issue price in case of fixed price issue and band in case of book built issue. Credit rating or grading of the issue, details about listing, risk factor. Etc. Risk factors mention is mandatory. All factors internal and external risk factors associated with functioning of the company is required to be provided to investors to enable them make informed decision and it also helps in meeting the DIP guidelines as laid down by SEBI. Introduction about the issuing company about the sector, industry, functioning of the company, etc. Past and present position of promoter, financial details like summary of consolidated financial statement, operating and financial data, capital structure, etc. Legal details like pending litigations against the company, promoter group, holding company and subsidiary company. Legal implications of government approval or disapproval for the projects of the company and its implications.

Regulatory disclosure contains details about the listing agreement, agreement with depository, filing of the offer document with SEBI and ROC, due diligence by the company, fee/charges to be paid to different intermediaries to the public issue, details of the previous issues by the company if any.

Red herring prospectus is an offer document/prospectus, which does not contain details of either issue price or number of shares being offered through book building. An Abridged Prospectus contains all details of the prospectus/red herring prospectus in summarized form. This must accompany the application form for issue.

Letter of Offer is issued by the company at the time of rights issue.

DISCLOSURES to be specified in prospectus and reports to be set out therein are specified in Part I and II of Schedule II of Companies Act 1956. SEBI is issuing from time to time operational guidelines/modifications in guidelines governing issue management and other related activities to all Registered Merchant Bankers under RMB(DIP) series covering guidelines for disclosures and investor protection and RMB (GI) series covering guidelines of general instructions.

These Guidelines encompass various aspects of issue of securities by Corporate bodies both through public and rights issue. The offer document should contain all such disclosures before submitting to SEBI. ROLES AND RESPONSIBILITIES OF LEAD MANAGER: All issues should be managed by at least one merchant banker functioning as the lead merchant banker. Every lead merchant banker shall before taking up the assignment relating to an issue, enter into an agreement with such body corporate setting out their mutual rights, liabilities and obligations relating to such issue, in particular to disclosures, allotment and refund. Taking into account the magnitude of work involved in large issue and also to control the expenditure of floating issue, SEBI has restricted the number of lead managers. In case the size of the issue is more than Rs.50 crores, lead managers can be more than 3 as may be agreed by SEBI. The Lead Managers are free to negotiate the fee with the issuer company. The fee agreed upon between the Lead Manager and the issuer company should be disclosed in the memorandum of understanding to be filed with SEBI, along with other offer document. Lead Manager should ensure that the intermediaries being appointed are registered with SEBI, wherever required. Before advising the Issuer on the appointment of other intermediaries, the lead manager shall independently assess the capability and the capacity of the various intermediaries to handle the Issue. Whenever required, the Issuer shall be advised by the lead manager to enter into a memorandum of understanding with the intermediaries concerned.

CO-MANAGERS: A person/body engaged by a company for assisting lead managers in various issue management functions such as tying up underwriting, syndication, marketing, procurement, etc., is called Co-manager to the issue. They should have at least category II SEBI registration for this purpose. Lead Managers should ensure that the number of co-managers to an issue does not exceed the number of led managers to the said issue and that number of advisors to the issue is only one.

UNDERWRITERS: Underwriter is a person/body who enters into an agreement with or without conditions to subscribe to the securities of a body corporate, when the existing shareholders of the such body corporate or the public do not subscribe to the securities offered to them, at a predetermined commission. The Merchant Banker should possess at least category III SEBI registration for underwriting any issue. FIs, banks, merchant bankers, stock brokers can be Underwriters. Lead Manager to the issue to negotiate with the prospective Underwriters about the amount they propose to underwrite.

REGISTRARS: A person/body appointed by a company to carry on the activities of processing the applications for the purpose of allotment, determining the basis of allotment of securities in consultation with the stock exchange, finalizing the list of persons entitled to allotment of securities and processing/dispatching allotment letters, refund orders or certificates and other related documents in respect of an issue is called Registrar to the Issue. He should be registered with SEBI. Normally wherever lead manager is the sole/one of the lead managers, he

cannot act as Registrar to the said issue. However, SEBI may not object to a lead manager acting as Registrar to an issue where the post issue responsibilities rest with another lead manager provided the former is registered with SEBI for both the functions.

BROKERS: are members of a recognized Stock Exchange who are authorized to deal in securities on the floor of the Stock Exchange. The company, in consultation with the Lead Managers to the issue, should appoint brokers for the issue at every center where stock exchange are located and enter into an agreement with the brokers and obtain their consent to act as such.

BANKERS TO ISSUE: Banks which are authorized by the company to accept the application money in a Capital issue are called Bankers to the Issue. The names of these Banks will be mentioned in the Prospectus as Bankers to the Issue. They should be registered with SEBI for this purpose.

REFUND BANKER: instruments in the form of cheques made payable at par in favour of unsuccessful applicants and to whom lesser numbers of shares than the numbers of shares applied for is allotted are called refund orders and the drawee Bank of such ROs is called Refund Banker.

ROLE OF COMMERCIAL BANKS IN IPO: 1. Before taking up the assignment relating to an IPO, enter into an agreement with the company setting out their mutual rights, liabilities and obligations relating to such issue, in particular to disclosures, allotment and refund. 2. Preparation of Offer document in consultation with the company. 3. Ensure that the offer document for the issue of securities contains the disclosure requirements as specified by SEBI from time to time for issue of securities. Also to ensure that the offer document provides a true, correct and fair view of the state of affairs of the company which are adequate for the investors to arrive at a well-informed investment decision. 4. Shall submit draft of the offer document to SEBI six weeks before the issue is scheduled to open for subscription. The observations, or comments or modifications if any, made by SEBI within 3 weeks of receipt of such draft, shall be complied with by the Merchant Bankers. The Merchant Banker shall thereafter submit to SEBI the offer document containing the modification suggested by SEBI. 5. The merchant banker shall submit along with the draft of the offer document a due diligence certificate to SEBI in the form already specified by SEBI. 6. The merchant banker shall be responsible for ensuring compliance with SEBI Rules, Regulations and Guidelines and requirements of other laws for the time being in force.

7. Lead Manager should ensure that the intermediaries like Bankers to the Issue, Co-managers, Advisors, Registrars, etc. being appointed are registered with SEBI, wherever required.

8. Lead Manager should ensure that bankers to a public issue designate at least 30 mandatory collection centers, which should invariably include the places where stock exchanges have been established. 9. Post-issue obligations of Lead Manager include submitting stipulated Reports to SEBI, maintaining close co-ordination with the Registrars to the Issue to monitor the flow of applications, closure date and other matters till the basis of allotment is finalized. 10.Any omission or commission on the part of any such intermediaries noticed should be reported to SEBI. 11.Lead manager shall be responsible for ensuring dispatch of refund orders/allotment letters/certificate by registered post only. 12.Lead manager shall submit following additional documents to concerned stock exchanges; i) Letter indicating the observations on the draft offer document by SEBI. ii) Certificate from lead manager reporting positive compliance by the company of requirements on guidelines for Disclosure and Investor Protection issued by SEBI.

ROLE OF BANKERS IN PRIVATE PLACEMENT OF DEBT OR EQUITY: Under section 81of the Companies Act, 1956, a private placement is defined as an issue of

shares or of convertible securities by a company to a select group of persons. An offer of securities to more than 50 persons is deemed to be a public issue under the Act. In private placement, resources are raised privately through arrangers (merchant banking intermediaries) who place securities with a limited number of investors such financial institutions, corporates and high not worth individuals. Corporates access the private placement market because of its certain inherent advantages like cost and time effective method of raising funds. The RBI has already issued guidelines to Banks on their non-SLR securities under private placement to lay down policy like cap on unrated issues on private placement basis. The private placement market in India is largely confined to financial companies and central PSUs and state level undertakings. Most of the resources from the market are raised by way of debt, with a majority of issues carrying AAA or AA rating.

ACTIVITIES IN CASE OF PUBLIC ISSUE: public issue is one of the mega events of the issuing company. It includes a massive amount of work in the procedural and legal aspects. In general, issue-related activities are classified into the following three groups; Pre issue Activities During the issue activities Post-issue activities.

PRE-ISSUE ACTIVITIES a company planning to raise funds either through a public issue or rights issue is required to complete certain activities before the issue is made open for subscription. These include the following: Appointment of Merchant Banker as Lead Manager to issue Appointment of Book Running Lead Manager Appointment of Broker to issue/syndicate members Appointment of Registrar and Transfer agent to issue Appointment of Banker to issue Fixing collection centers/bidding centres Agreement with underwriter or syndicate member to act as underwriters Deciding about the pricing of the issue Preparation of Draft Prospectus/Draft offer Document/Letter of Offer/Red Herring Prospectus Filing the Draft Offer Document with SEBI Filing the Offer Document with Stock Exchange Application to Stock Exchange for listing of Securities Application to Depository for dematerialization of securities Advertisement for the issue Filing the Prospectus/Offer Document with ROC Printing and distribution of application forms Opening of the issue. DURING THE ISSUE ACTIVITIES once issue is open for subscription, it is the responsibility of the BRLM to continuously collect information about the subscription of the issue. This information helps the company in taking decisions

about the extension of the opening of the issue. BRLM also ensures the proper functioning of the book building either manually or on-line.

POST ISSUE ACTIVITIES once the issue has been closed, the following activities are completed: Scrutiny of the application forms Deciding cut-off price in case of book built issue Finalizing on basis of allotment for each category in consultation with stock exchange officials Preparation of Confirmatory Allotment Note by the registrar to issue Sending an advise to depository for the credit to the Beneficiary Account of successful applicants by the registrar to issue Printing of refund order and dispatch by registrar to issue Listing of securities Preparation of a list of shareholders by registrar to issue Filing due diligence by the Lead Manager. Intermediaries in raising the Funds in a public issue, rights issue or private placement, a company uses the services of many intermediaries these intermediaries are facilitating agents, who perform functions on behalf of the company. Intermediaries also act as facilitating agents for the smooth functioning of issue-related activities. These intermediaries should have a valid registration with SEBI: Merchant Banker to the issue

Book Running Lead Manager Syndicate Members Registrar to the issue Banker to the issue Auditor of the company Underwriter to the issue A Merchant Banker is someone, who has expert knowledge of all the issuerelated activities and formalities. A merchant banker completes all the issuerelated activities on behalf of the issuing company. A merchant banker must have a valid registrar with SEBI. When there are more than one merchant bankers to an issue, then there is proper division of work and responsibility among all the merchant bankers. Book Running Lead Manager is a Merchant Banker appointed by the company to maintain bidding for the issue. He is the final authority to run the book for bidding when issue is open. He is facilitated by the syndicate member for maintaining the book building process. Syndicate members enter the bids received in the central system of BRLM. Syndicate Member is like a broker, who helps in proper marketing of the issue. He arranges to distribute the application forms and receives bids from applicants, which are ultimately passed on to the BRLM or entered in an online book building system. A syndicate member also acts as an underwriter if such agreement has been made between the company and the syndicate member.

Registrar to the issue is an agency having a valid registration with SEBI to function its role. He performs activities like maintaining the record of applicants, preparation of CAN and refund order. He is also responsible for the dispatch of the CAN and refund order, as well as informs the Depository to credit the account successful applicants. He prepares the final list of shareholders of the company. Banker to the issue is authorized to collect the application money from different collections center and make an FDR of the money so received. Auditor of the company is to ensure that the company fulfills all legal and procedural guidelines and prepare a due diligence certificate for the issue. Underwriter to the issue is an agency or individual who enters into an agreement with the company. This agreement is to ensure the full subscription of the public/rights issue. Through this agreement, the company secures 100 per cent subscription of public/rights issue as it results into a contractual binding on the underwriter to make good the deficiency in the subscription of public/rights issue. If the company fails to secure 100 per cent subscription from public, then the underwriter subscribes for the shares to make it 100 per cent subscribed. The underwriter should have a valid registration with SEBI. Such agreement is meant for conditional subscription. The underwriter is to subscribe only if it remains undersubscribed. For taking this responsibility, he receives a commission.

Anda mungkin juga menyukai

- Order No TakerDokumen168 halamanOrder No TakerShashank ShekharBelum ada peringkat

- Housing Loan Interest Certificate for Nisha SharmaDokumen1 halamanHousing Loan Interest Certificate for Nisha SharmaShashank ShekharBelum ada peringkat

- JAIIB Accounts MODULE - CDokumen149 halamanJAIIB Accounts MODULE - CShashank Shekhar100% (1)

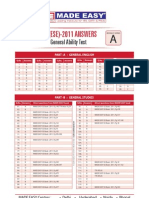

- (WWW - Entrance Exam - Net) GS SET ADokumen1 halaman(WWW - Entrance Exam - Net) GS SET AShashank ShekharBelum ada peringkat

- New Pattern Prelims 2011 PaperDokumen48 halamanNew Pattern Prelims 2011 Papershilpa_2405Belum ada peringkat

- IntroductionDokumen35 halamanIntroductionShashank ShekharBelum ada peringkat

- Rates For Advertisements ON All India Radio: With Effect From April 2008Dokumen44 halamanRates For Advertisements ON All India Radio: With Effect From April 2008Shashank ShekharBelum ada peringkat

- Xcelsius Essentials - SGTDokumen63 halamanXcelsius Essentials - SGTJesus SanchezBelum ada peringkat

- Business Statistics Course OutlineDokumen5 halamanBusiness Statistics Course OutlineShashank Shekhar100% (1)

- AST 0043024 XT ORNL Astrophysics 0611Dokumen2 halamanAST 0043024 XT ORNL Astrophysics 0611Shashank ShekharBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 18th SCM New Points 1 JohxDokumen55 halaman18th SCM New Points 1 JohxAnujit Shweta KulshresthaBelum ada peringkat

- Amalgmation, Absorbtion, External ReconstructionDokumen9 halamanAmalgmation, Absorbtion, External Reconstructionpijiyo78Belum ada peringkat

- G) KFN /fi6 A) +S LJK - ) If0F: Ljlgodfjnl, @) &Dokumen16 halamanG) KFN /fi6 A) +S LJK - ) If0F: Ljlgodfjnl, @) &Dhurba KarkiBelum ada peringkat

- Mila Exam LegalDokumen2 halamanMila Exam LegalSarmila ShanmugamBelum ada peringkat

- 8 Types of Failure in A ChristianDokumen7 halaman8 Types of Failure in A ChristianKarl Jason JosolBelum ada peringkat

- TVM - Time Value of Money ProblemsDokumen1 halamanTVM - Time Value of Money ProblemsperiBelum ada peringkat

- Anti-Communist Myths DebunkedDokumen168 halamanAnti-Communist Myths DebunkedSouthern Futurist100% (1)

- Introduction To Ultrasound: Sahana KrishnanDokumen3 halamanIntroduction To Ultrasound: Sahana Krishnankundu.banhimitraBelum ada peringkat

- CA 101 Lecture 8Dokumen22 halamanCA 101 Lecture 8Johnpatrick DejesusBelum ada peringkat

- Paper On Society1 Modernity PDFDokumen13 halamanPaper On Society1 Modernity PDFferiha goharBelum ada peringkat

- Print: A4 Size Paper & Set The Page Orientation To PortraitDokumen1 halamanPrint: A4 Size Paper & Set The Page Orientation To Portraitnitik baisoya100% (2)

- Dr. M. Kochar vs. Ispita SealDokumen2 halamanDr. M. Kochar vs. Ispita SealSipun SahooBelum ada peringkat

- Tax RTP May 2020Dokumen35 halamanTax RTP May 2020KarthikBelum ada peringkat

- Advanced VocabularyDokumen17 halamanAdvanced VocabularyHaslina ZakariaBelum ada peringkat

- Pieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Dokumen9 halamanPieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Scribd Government DocsBelum ada peringkat

- Kashmir Highway sports club membership formDokumen2 halamanKashmir Highway sports club membership formSarah HafeezBelum ada peringkat

- QSPOT571423: Create Booking Within 24 HoursDokumen2 halamanQSPOT571423: Create Booking Within 24 HoursNaimesh TrivediBelum ada peringkat

- Case Digests - Simple LoanDokumen14 halamanCase Digests - Simple LoanDeb BieBelum ada peringkat

- Black SupremacistDokumen7 halamanBlack SupremacistJoMarie13Belum ada peringkat

- Leagues of Local GovernmentunitsDokumen3 halamanLeagues of Local GovernmentunitsLumalabang Barrista100% (1)

- Bolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFDokumen368 halamanBolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFSolBelum ada peringkat

- MC - Form MC:F002 - Tenant Interview v1.1 (18 Oct 2019)Dokumen8 halamanMC - Form MC:F002 - Tenant Interview v1.1 (18 Oct 2019)Rohit DeshpandeBelum ada peringkat

- The Moral Logic of Survivor's GuiltDokumen5 halamanThe Moral Logic of Survivor's GuiltKeyton OwensBelum ada peringkat

- Alphabet of Sirach: LilithDokumen2 halamanAlphabet of Sirach: LilithNyx Bella Dark100% (1)

- Declining Balance Depreciation Alpha 0.15 N 10Dokumen2 halamanDeclining Balance Depreciation Alpha 0.15 N 10Ysabela Angela FloresBelum ada peringkat

- Blaw 1000 ReviewerDokumen10 halamanBlaw 1000 ReviewerKyla FacunlaBelum ada peringkat

- Chemistry Presentation Week2Dokumen17 halamanChemistry Presentation Week2Mohammad SaadBelum ada peringkat

- 232 Sumifru (Phils.) Corp. v. Spouses CerenoDokumen2 halaman232 Sumifru (Phils.) Corp. v. Spouses CerenoHBBelum ada peringkat

- Wells Fargo Statement - Sept 2021Dokumen6 halamanWells Fargo Statement - Sept 2021pradeep yadavBelum ada peringkat

- Breach of Contract of Sales and Other Special LawsDokumen50 halamanBreach of Contract of Sales and Other Special LawsKelvin CulajaraBelum ada peringkat