General Knowledge Today - 139

Diunggah oleh

niranjan_meharJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

General Knowledge Today - 139

Diunggah oleh

niranjan_meharHak Cipta:

Format Tersedia

Articles from General Knowledge Today

Shadow Banking

2012-02-22 11:02:28 Suresh Soni

What is Shadow Banking: If we go to read the Wikipedia page on Shadow Banking, we shall have a dismal picture as they have been related to the "sub prime crisis" of the previous decade. It has been defined over there as follow: " Shadow financial system consists of non-depository banks and other financial entities (e.g., investment banks, hedge funds, money market funds and insurers) that grew in size dramatically after the year 2000 and play an increasingly critical role in lending businesses the money necessary to operate" We all can understand from the media reports & news frequently appearing in newspapers that Government of India's approach to achieve 100% Financial Inclusion has not yielded much desired results. Along with the another reasons, there is a fundamental flaw in the approach of the Government. This fundamental flaw is to force the mainstream commercial banks to serve the poor, (means rural poor). But practically, most of the commercial banks have no interest, skills and capabilities to serve the poor families belonging to rural areas due to an array of reasons such as lack of financial viability, absence of the employees who understand the needs of poor families earning less than some 60-70 thousand per year. Besides, the commercial banks are not likely to prefer to extend unsecured credit to the poor. Shadow Banking in Indian Context: He we talk about an alternative to the commercial banking system. This alternative banking system can be referred to as 'shadow banking' systems, which are already in place in India and working effectively. In Indian Context, Shadow Banking includes non-banking financial companies (NBFCs) focused on serving low-income families and small businesses (like kirana shop owners, truck drivers, tailors, repair shops, agriculturists), MFIs, chit funds, credit cooperatives, etc. But in India, the alternative delivery systems need to be strengthened. There should be collaboration between the mainstream banking system with alternative delivery systems for last-mile delivery of financial services, particularly credit delivery to the poor.

Challenge of Regulation of Shadow Banking System in India: In India, the most important regulatory challenge is to ensure greater consistency in regulation of similar instruments and institutions performing similar activity to prevent or contain regulatory arbitrage. In the case of systemically important non-deposit taking NBFCs (NBFCs-ND-SI), a gradually calibrated regulatory framework in the form of capital requirements, exposure norms, liquidity management, asset liability management and reporting requirements has been extended, which has limited the space for regulatory arbitrage as also their capacity to leverage. Given the increasing significance of the sector, the supervisory regime for the systemically important NBFCs will need to be strengthened further for a more robust assessment of the underlying risks. Usha Thorat Committee on Shadow Banking A Working Group under the former Deputy Governor, Smt. Usha Thorat on NBFCs has, inter alia, examined the issues related to the regulatory gaps and arbitrage opportunities that exist in the system, and has given recommendations for addressing these issues as well as for enhanced disclosure requirements and improved supervisory practices, etc.

Anda mungkin juga menyukai

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDokumen4 halamanMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharBelum ada peringkat

- Wand Hare 2015Dokumen11 halamanWand Hare 2015niranjan_meharBelum ada peringkat

- Rls AlgorithmDokumen15 halamanRls Algorithmniranjan_meharBelum ada peringkat

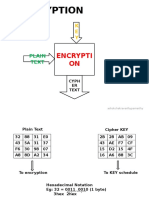

- Aes Encryption: Encrypti ONDokumen12 halamanAes Encryption: Encrypti ONniranjan_meharBelum ada peringkat

- Original Image To Be SelectedDokumen5 halamanOriginal Image To Be Selectedniranjan_meharBelum ada peringkat

- Without Applying Induction Motor Voltage SagDokumen4 halamanWithout Applying Induction Motor Voltage Sagniranjan_meharBelum ada peringkat

- Brahma Kadi GinaDokumen4 halamanBrahma Kadi GinaAswith R ShenoyBelum ada peringkat

- Stores - ObsDokumen4 halamanStores - Obsniranjan_meharBelum ada peringkat

- Mysteries of The Sacred Universe - An OverviewDokumen11 halamanMysteries of The Sacred Universe - An Overviewniranjan_mehar100% (2)

- Detailed Project Report Solar PVDokumen19 halamanDetailed Project Report Solar PVbakoolk100% (3)

- The Importance of Hard Work in SuccessDokumen1 halamanThe Importance of Hard Work in Successniranjan_meharBelum ada peringkat

- TeluguvDokumen1 halamanTeluguvniranjan_meharBelum ada peringkat

- ChakraDokumen15 halamanChakraniranjan_meharBelum ada peringkat

- Mantralu in TeluguDokumen69 halamanMantralu in Teluguniranjan_mehar80% (5)

- TeluguDokumen1 halamanTeluguniranjan_meharBelum ada peringkat

- Aditya HrudayamDokumen4 halamanAditya HrudayamTarani TempalleBelum ada peringkat

- Different Gayatri MantrasDokumen2 halamanDifferent Gayatri Mantrasniranjan_meharBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- DuPont Profitability ModelDokumen1 halamanDuPont Profitability ModelcwkkarachchiBelum ada peringkat

- Bank Trade Program OverviewDokumen8 halamanBank Trade Program OverviewSuryaBelum ada peringkat

- Journal EntryDokumen8 halamanJournal EntryAnklesh kumar GuptaBelum ada peringkat

- IA2 Chapter 20 ActivitiesDokumen13 halamanIA2 Chapter 20 ActivitiesShaina TorraineBelum ada peringkat

- CementDokumen7 halamanCementannisa lahjieBelum ada peringkat

- 14 - SHE SBP BPSquestDokumen16 halaman14 - SHE SBP BPSquestbrentdumangeng01Belum ada peringkat

- Application of Money - Time RelationshipsDokumen8 halamanApplication of Money - Time RelationshipsMahusay Neil DominicBelum ada peringkat

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dokumen6 halamanHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryBelum ada peringkat

- ManagementDokumen195 halamanManagementFahad KhalidBelum ada peringkat

- The Fall of Barings BankDokumen4 halamanThe Fall of Barings BanksomyasaranBelum ada peringkat

- MFRS 102Dokumen17 halamanMFRS 102Ethan Ong0% (1)

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Dokumen11 halamanExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Dabur Financial ModelDokumen44 halamanDabur Financial Modelpallavi thakurBelum ada peringkat

- Chapter 11 SolutionsDokumen9 halamanChapter 11 Solutionsbellohales0% (2)

- SABV Topic 5 QuestionsDokumen5 halamanSABV Topic 5 QuestionsNgoc Hoang Ngan NgoBelum ada peringkat

- Case - Assessing Martin Manufacturing's Current Financial PositionDokumen3 halamanCase - Assessing Martin Manufacturing's Current Financial PositionM B Hossain Raju100% (4)

- The Market Profiling GuideDokumen119 halamanThe Market Profiling Guide960804326100% (1)

- Exam #1 ReviewDokumen5 halamanExam #1 ReviewThùy DươngBelum ada peringkat

- Amfi PPT-1Dokumen209 halamanAmfi PPT-1Nilesh TodarmalBelum ada peringkat

- FAC3702 Question Bank 2015Dokumen105 halamanFAC3702 Question Bank 2015Itumeleng KekanaBelum ada peringkat

- Sap Ag: A Case Study On The Effect of Improving A Company's Capital StructureDokumen3 halamanSap Ag: A Case Study On The Effect of Improving A Company's Capital StructureSajjad AhmadBelum ada peringkat

- ERPM 1st UnitDokumen4 halamanERPM 1st UnitRamesh babuBelum ada peringkat

- DrillDokumen5 halamanDrillMarjorie Kate PagaoaBelum ada peringkat

- FUNDSROOM Geeta FinalDokumen8 halamanFUNDSROOM Geeta Finalgeetagorai121Belum ada peringkat

- Introducción A Las Finanzas Corporativas: Tarea Capítulos 10, 11 y 13Dokumen15 halamanIntroducción A Las Finanzas Corporativas: Tarea Capítulos 10, 11 y 13gerardoBelum ada peringkat

- Tamim Fund Global High Conviction - Summary 2021Dokumen3 halamanTamim Fund Global High Conviction - Summary 2021dkatzBelum ada peringkat

- Ortha, George II O. Corporation and Securities LawDokumen2 halamanOrtha, George II O. Corporation and Securities LawCinja ShidoujiBelum ada peringkat

- Chapter 10 OutlineDokumen13 halamanChapter 10 OutlineAndrew TatisBelum ada peringkat

- International Capital MarketsDokumen11 halamanInternational Capital MarketsAmbika JaiswalBelum ada peringkat

- Bank Interview QuestionsDokumen2 halamanBank Interview QuestionsShathish GunasekaranBelum ada peringkat