JHF - Notes

Diunggah oleh

manujplamootilHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

JHF - Notes

Diunggah oleh

manujplamootilHak Cipta:

Format Tersedia

The mere fact that the properties were not separately entered by the coparcener in the book of account

or that he did not maintain a separate account of earnings from these properties would not deprive the properties of their character of self acquired properties. AIR 1976 SC 1715. Where ancestral property which is sold in execution of decree against the karta is subsequently acquired by a coparcener with the aid of his own funds, the property would be treated as the self acquired property of the coparcener. Revappa case AIR 1960 Mys 97. The burden of proving that any particular property is joint family property is on person who on first instance claims it as so. AIR 1960 SC 335. Only after the possession of adequate nucleus is shown, the onus shifts on to the person who claims the property as self acquired, affirmatively to make out that the property was acquired without any aid from the joint family estate. AIR 1969 SC 1076. One of the tests in determination of the adequacy of the nucleus is the income which yields. AIR 1984 SC 1171. Where the manager of HUF claims that what is acquired is his separate property he should prove that he acquired it with his separate funds. AIR 1961 SC 1268, AIR 1969 SC 1076. Where there is an acquisition by the manager in his own name and there is no independent source of income, the presumption arises that the new acquisition was joint family property. AIR 1954 SC 379, AIR 1959 SC 906. If the admissions are made by a member, then the onus shifts on him to prove that what he admitted is not true. AIR 1961 SC 1268. The principle of Mitakshara Law that sons have independent co-parcenary rights in the ancestral estate and that father is subject to their control in he alienation of family property has been almost destroyed by the principle which has been established by the decisions that sons cannot setup their rights against their fathers alienation for an antecedent debt or against his creditors remedies for their debts, if not tainted with immorality, though not incurred for the family necessity or benefit. AIR 1952 SC 170. The concurrence of all the adult members is conclusive presumption of law. AIR 1951 Mys 38.FB. The settled law through decisions of Privy council and various High courts is that A sale or mortgage of fa mily property by the managing member is valid on the ground of justifying family necessity where it is: (a) For the payment of decree debts and other debts binding on the family. (b) To pay off the claims of Govt on account of Land Revenue, cesses, taxes and other dues. (c) For the payment of rents due to the landlord or the payment of decrees for arrears of rent obtained by land lord against family. (d) For the maintenance of members of the family. (e) For the purpose of defraying the expenses of the first marriage of the co-parcener and of daughters born in the family. (f) For the expenses of the necessary family ceremonies including funeral and annual shradha. (g) For the expenses of necessary litigation in connection with the recovery or protection of the joint estate or the establishment of adoption of his minor son. (h) For the expenses of defending the head of the family or any member against a serious criminal charge. (i) For the purpose of carrying on an ancestral trade or business. (j) To raise money to avert a sale or destruction of the whole or any part of the family property. (k) For the expenses of necessary repairs to the family residential house or family properties and for the protection of fields and lands belonging to the family from floods etc., Managers discretion regarding legal necessity or benefit of the estate can be subjected to judicial review. AIR 1964 SC 1385. It is not open for a coparcener to sue for injunction restraining the manager from alienating on the ground that it is not for legal necessity or benefit. B.C.Ray, Justice however observed that injunction may be granted in case of waste or ouster. Sunil kumar case: AIR 1988 SC 576.

Gift by a manager even of a small extent of Joint family property to a relative out of love and affection is void as it is not a gift for pious purposes ( i.e religious and charitable purposes ) within the meaning of that expression in Hindu Law. Guramma v/s Mallappa AIR 1964 SC 510. see also AIR 1967 SC 569. A gift to a concubine or stranger is void. AIR 1980 SC 253. In Krishnamurthy v/s Abdul khadar case AIR 1956 Mys 14 Where the property is acquired by the managing member and all the members of the family are in possession of the family property, it could very well be presumed that the new acquisition is family property. Hindu Law:- Husband, wife and children living together constitute joint family. Property acquired by members of such joint family is presumed to be joint family property or coparcenary property not withstanding fact that it was acquired without the aid of ancestral nucleus, unless contrary is proved. Parties by their conduct and treatment of property in their hands, can impress self acquired property with character of joint family property with character of joint family property. Krishnamurthy case before KHC reported in 2005(3) KarLJ 420.

JOINT HINDU FAMILY PROPERTY Mitakshara divides property into tow classes, namely, apratibandha daya or unobstructed heritage, and sapritibanda daya or obstructed heritage. Property in which a person acquires an interest by birth is called unobstructed heritage, because the accrual of the right to it is not obstructed by the existence of the owner. The right to it arises from the mere fact of their birth in the family, and they become coparceners with their paternal ancestor in such property immediately on their birth, ancestral property is unobstructed heritage. All properties inherited by a Hindu male from a direct male ancestor, not exceeding three degrees higher to him is called apratibandha daya. Property, right to which accrues not by birth but on the death of the last owner without leaving male issue, is called obstructed heritage. It is called obstructed, because the accrual of the right to it is obstructed by the existence of the owner. Thus the property which devolves on parents, brothers, nephews, uncles, etc., upon the death of the last owner, is obstructed heritage. These relations do not take a vested interest in the property by birth. Their right to it arises for the first time on the death of the owner. Coparceners can restrain the holder of sapratibandha daya from alienating it, while in case of apratibandha daya its holder, so long as he is living, has absolute rights of alienation over it: he may gift it inter inter vivos or by will, he may sell it or mortgage. Unobstructed heritage devolves by survivorship, obstructed heritage, by succession. The distinction between obstructed and unobstructed heritage is peculiar only to Mitakshara School. According to Dayabhaga, all heritages are obstructed, for, according to the doctrines of that school, no person, not even a son, takes an interest by birth in the property of another. Dayabhaga does not recognise the principle of survivorship. Joint Family Property The Joint Hindu family is purely a creature of Hindu law, and those who own it are called coparceners. Property jointly acquired by the members of a joint family with the aid of ancestral

property is joint family property. The Hindu joint family property is like a big reservoir in which property flows in from various sources and from which all members of joint family drew out to fulfill their multifarious needs. The joint family property may flow into it from various sources. Property according to the Hindu law, may be divided into two classes, namely :1 Ancestral Property All property inherited by a Hindu male from his father, father's father, or father's father's father, is ancestral as regards his male male issue, even enough it was inherited by him after his death of a life-tenant. A father cannot change the character of joint family property into absolute property of his son by merely marking a will and bequeathing it or part of it to the son as if it was the self-acquired property of the father. In the hands of the son the property will be ancestral property and the natural or adopted son of that son will take interest in it and be entitled to it by survivorship as joint family property. Where a number of sons inherit their father's self-acquired property, they hold it as joint family property if at the time of his death they are living as members of a joint family. In Atar Singh v. Thakar Singh it was stated that judgment that unless the lands came by descent from a lineal male ancestor in the male line, they are not deemed ancestral in Hindu Law. Property acquired by a father by adverse possession would not be ancestral property in his hands and his sons would not take interest in it by birth. In a case the Privy Council held that a maternal uncle is not an ancestor, and it has accordingly been held that property inherited from a maternal uncle is not ancestral property. In Chelikani Venkayyamma v. Venkatar Amanayyamma the property which had descended from the maternal grand-father to his two grandsons. On the death of one of the grandson the widow of the deceased claimed to recover a moiety of the estate from the surviving grandson(Brother). The question was whether the property of the maternal grandfather descended, on the death of his daughter, to her two sons jointly with benefit of survivorship. Their Lordships decided that the estate was governed by the rule of survivorship, and the claim of the widow was, therefore negatived. This decision of the court was criticsed. In Muhammad Husain Khan v. Babu Kishva Nandan Sahai one G inherited certain property from his maternal grandfather J. Under a will made by G the property which G inherited from his maternal grandfather was to go to his son B and on the death the property was to vest in B's widow, Giri Bala. During the life time of B, in an execution of a money decree against him the said property was sold. B then brought a suit, claiming possession of the property. The validity of the will executed by G is challenged on the ground that the testator had no authority to dispose of the property, as it belonged to a Hindu coparcenary consisting of himself and his son. In their Lordships' opinion the estate which was inherited by G, from his maternal grandfather cannot be held to be ancestral property in which his son had an interest jointly with him. G consequently had full power of disposal over that estate, and the devise made by him in favour of his daughter-in-law could not be challenged by his son or any other person. ON the death of her husband, the devise in her favour came into operation and she became the absolute owner of the village property, as of the remaining estate ; and the sale of that village in execution proceedings against her husband could not adversely affect her title. Property inherited by a person from collaterals, such as a brother, uncle, etc, or property inherited by him from a female is his separate property. The share which a coparcener obtains on partition of ancestral property is ancestral property as regards his male issue. If the

coparcener dies without leaving male issue, it passes to his heirs by succession. Accumulations of income of ancestral property, property purchased or acquired out of income proceeds of sale of ancestral property and property purchases out of such proceeds are ancestral property. In C.N. Arunachala Mudaliar v. C.A. Muruganatha Mudaliar case, Issue was whether property obtained by a gift or will from paternal ancestor are to be regarded as ancestral or self-acquired properties. In this case there were allegation that there were joint property of a family consisting of himself, his father and his brothers and that he was entitled in low to one-third share in the same. Plaintiff and his brother, are both sons are from first wife of their father, who predeceased her husband. The father assert an exclusive title to the joint family property denying any right of his sons. Father claimed that some of the property is his self acquired property and other properties were self-acquired property of his father and he got them under a will executed by his father. In connection to this case the court referred the case of Ram Balwant v. Rani Kishori. In this case the Lordship held that chap.1,Sec.1 verse 47of Mitakshara contained only moral or religious precepts while those in S.5, verses 9 and 10 embodied rules of positive law. It was held that the father of a joint family governed by Mitakshara law has full and uncontrolled powers of disposition over his self acquired immovable property and his male issue could not interfere with these rights in any way. Further in Muddan Gopal v. Ram Buskh it was held that a Mitakashara father is not only competent to sell his self-acquired immovable property to a stranger without the concurrence of his sons. While referring another case Sital v. Madho and Bawa Misser v. Rajah Bishen where it was held that a Mitakshara father can make a gift of his self acquired property to one of his sons to the detriment of another and he can make even an unequal distribution amongst his heirs. Going through above cases court concluded that a property gifted by a father to his son could not become ancestral property in the hands of the donee simply by reason of the fact that the donee got it from his father or ancestor. On reading the will as a whole the court held that it becomes clear that the testator intended the legatees to take the properties in absolute right as their own self-acquisition without being fettered in any way by the rights of their sons and grandsons. Son takes at his birth in the ancestral property is wholly independent of his father. He does not claim through the father, and, therefore, a transfer is allowed by law, cannot affect the interest of the son in the property. However, the father has a special power of disposal of ancestral property for certain purposes. The father has the power of making within reasonable limits gifts of ancestral movable property without the consent of his sons. A Hindu father of other managing member has power to make a gift within reasonable limits of ancestral immovable property for pious purposes. A member of a joint family cannot dispose of by will a portion of the property even for charitable purposes and even if the portion of the property bears a small proportion to the entire estate. 2 Separate Property Property acquired in any of the following ways is the separate property of the acquirer; it is called 'self acquired' property. Following are the some examples of Separate Property :1 Obstructed Heritage 2 A gift of a small portion of ancestral movable made through affection by a father to his male issue is his separate property. 3 Property granted by Government to a member of a joint family. 4 Ancestral property lost to the family, and recovered by member without the assistance of joint family property.

5 Income of separate property 6 Property obtained as his share on partition by a coparcener who has no male issue 7 Property held by sole surviving Coparcenar when there is no widow in existence who has power to adopt. 8 Separate earnings of a member of a joint family. 9 Gains of learning. In Dipo v. Wassan Singh, plaintiff sued to recover possession of the properties which belonged to her brother, who died. She claimed to be the nearest heir. The defendants the sons of paternal uncle contest that they were preferential heirs according to custom, as the whole of the land was ancestral in the hands of the deceased. The court said that properties in the hands of deceased are properties which originally belonged to his ancestors. But deceased was the last male holder of the property and he had no male issue. There was no surviving member of a joint family, be it a descendant or otherwise, who could take the property by survivorship. Property inherited from paternal ancestors is, of course, ancestral property' as regards the male issue of the propositus, but, it is his absolute property and not ancestral property as regards other relations. It was held that the defendants were collaterals of deceased and as regards them the property was not 'ancestral property' and hence the plaintiff was the preferential heir.

Classification of property:..Property according to the Hindu Law may be divided as[1] Joint Hindu Family Property, and [2]Separate property. The Joint Family Property may be further divided as [1]Ancestral property,and [2]Separate property of its coparcenary members thrown into the common stock of coparcenary of all. Property jointly acquired by the members of a joint family with the aid of ancestral property is also joint family property. The term "Joint Family Property" is synonymous with "coparcenary property" Separate property means self acquired property. The property self acquired by lineal ancestral shall be called "ancestral property "but it shall not be called legally as of necessity a "coparcenary property".So property inherited from father or from grand father or from great grand father shall be called ancestral but still property inherited from father in hands of son shall not be called coparcenary property but only personal property of the son inheriting it. In old law barring STRIDHAN ladies did not inherit property.The succession was to devolved from one male to other down the line. There were two schools of succession [1]Dayabhag [2]Mitakshra. In Dayabhag property was to devolve in every case from father to son and the devolution was absolute. But by Mitakshra School a concept was developed that if a property is begetted by great grand father and is inherited by grand father who leaves it to be inherited by father then all sons of such father acquire a right in the property by birth. Thus a property acquired by great grand father in the hands of father is not his personal property but he owns it in jointness of his sons,as sons acquire rights in such a property by birth.The father has

right of managing that property as KARTA[manager]. On passing Of Hindu Succession Act the concept of coparcenary was kept intact. But in case a coparcener dying intestate his share was recognized to devolve upon his mother,widow,sons and daughters.But coparcenary was kept intact to be formed between only[the father and sons]. But later on many states amended this provision and laid that for formation of a coparcenary daughters would be treated as if they were also born as son and their right would be at par with sons.Many states did not amend then center it self amended recognizing daughters at par with sons for purposes of forming coparcenary.

In Mitakshra Law the property is divided into two classes, unobstructed heritage or (apratibandh daya) and obstructed heritage (sapratibandh daya).1 The property in which the son, grandson and great grandson have a birth right is called unobstructed heritage which means that without any obstruction the male issue has a right by birth. Therefore, by way of a necessary corollary, the son (which expression includes a grand son and great grandson) can restrain the father from alienating the property for any purpose not recognized by Hindu Law. The right of the son to the property arises from the mere fact of his birth in the family, and he becomes coparcener with his father in ancestral property by birth. But property, the right to which accrues not by birth but on the death of the last owner without leaving male issue is called obstructed heritage. It is called obstructed heritage, because the accrual of the right to it is obstructed by the existence of the owner. 2 The unobstructed heritage devolves by the rule of survivorship; the obstructed heritage by succession. In Dayabagh Law the distinction between unobstructed and obstructed heritage does not exist as in the principle of birth right of a son is not recognized and whole of the property devolves by succession on the demise of the father. But in Dayabagh law also the brothers or uncle and nephew or cousins would hold the property as coparcenary property but this interest in the coparcenary property is a defined share and not a fluctuating interest as it exists in Mitakshra Law. Under Mitakshra Law a property inherited from ones father, fathers father or fathers fathers father is called ancestral property. The term in its technical sense, is applied to property which descends upon one person in such a manner that his male issue gets certain right as against him.3 But where property has been inherited from a collateral relations, as brother, sister, nephew, uncle, cousin or

These terms are explained in Mitakshra thus: the wealth of the father or of the paternal grandfather he come the property of his sons or his grandsons in right of their being his sons or his grandsons and that is an inheritance not liable to obstruction. But property devolves on parents or uncles, brothers or the rest, on the demise of the owner, if there he no male issue, and thus the actual existence of a son, and survival of the owner are independents to the succession; and on their ceasing the property devolves on the succession in right of his being uncle or brother this is an inheritance subject to obstruction, cited in Mayne, supra n.1 at p.285

2

Mulla supra n. 3, at p. 323.

Mayne, supra n. 1 at p. 538

maternal grand parents or maternal relations, it is not ancestral in his hands in relation to his male issue in which he would acquire a birth right. Under Dayabagh Law a son does not get a birth right in the joint family property but like Mitakshra Law, in Dayabagh Law also property inherited from a father, grandfather or great grandfather is ancestral property and held in defined shares by the coparceners as joint family property. In contrast with the doctrine of aggregate ownership or community of ownership of Mitakshra Law, the coparceners in Dayabagh family hold the property in fractional ownership or quasi severality. The property whether coparcenary or self acquired, in Dayabagha Law, goes by succession after the death of the coparcener. In Dayabagha Law, a daughter or a widow is also a coparcener and inherits the property in the absence of a son. The only difference between a male and a female coparcener was that the property in the hands of a female coparcener was her limited estate and after her death the property passed not to her heirs, but to the next heir of the male from whom she inherited.

(Classification of property.) Coparcenary property may be divided into (i) ancestral property (ii) separate property of a coparcener thrown into common stock. (iii) separate or self acquired property.

The joint family property developers by survivorship and not by succession. In this property the male issues of the coparceners acquired an interest by birth. The self acquired property thrown into common stock may become joint family property if the acquirer voluntarily abandons all separate claims upon it. A clear intention to waive his separate rights must be established. The separate property exclusively belongs to the acquirer. No other member not even his male issue, acquires any interest in it by birth. He may sell it or alienate it by a deed or will. The property acquired in the following way may be regarded as ancestal property:(i) Property inherited from paternal ancestors: (Ancestral property.) The property inherited by any male Hindu from his father, fathers father and fathers fathers father is ancestral property and the only persons who are entitled to an interest in it by birth are his son, sons son it becomes his

absolute property. (ii) Property inherited from maternal grand father: Privy Council held in Venkayyamma V. Venkataramanayyama (1902) that the property inherited by two brothers from their maternal grand-father was joint property. But ancestral property. As per decision of Madras High Court the maternal uncle is not an ancestor and that property inherited from a maternal uncle is not ancestral property. (iii) Property inherited from females and collaterals: Property inherited from collaterals i.e. from brother, uncle etc. or property inherited from a female such mother, is not an ancestral property and it must be regarded as separate property. (iv) Share on partition: Share allotted to a coparcener on partition of ancestral property is ancestral property as regards his male issue. If the coparcener dies without any male issue other relations take it as separate property. (v) Gift or will by paternal ancestors: Where a Hindu makes a gift of his separate or self acquired property to his son or bequeaths it by will, it is ancestral property according to Calcutta But according to the High Courts of Madras, Bombay and Allahabad it depends on the intention of the donor and in the absence of language clearly indicating the testators intention that the property be ancestral it should be presumed that such property is self-acquired. (vi) Accretions: Accumulations of income of ancestral property and property purchases out of such income is regarded as ancestral property. (iii) Gift:- A small portion of ancestral moveables made by the father through affection. (iv) Corody:- If some property is granted by Government to per texts of a joint family, it becomes his separate property. As per texts the gift of land or Nibandha is to made by the King himself other than Kings. Hence the office of heriditary priest

or yajman vriti is a Nibandha. (v) Property lost to the famil: (vi) Income of separate property and purchases made with such income constitute separate property. (vii) In the absence of any male issue, property obtained by a coparcener on partition becomes his separate property. (viii) Where there is no widow with power to adopt, property held by the sole surviving coparcener becomes his separate property. (ix) All acquisitions made by means of learning are separate property of the acquirer as per provisions of Hindu Gains of Learning Act, 1930.

Anda mungkin juga menyukai

- Joint Family Property Case LawDokumen19 halamanJoint Family Property Case Lawharsh vardhanBelum ada peringkat

- Joint Family - Mitakshara SchoolDokumen29 halamanJoint Family - Mitakshara Schoolsushmita singhBelum ada peringkat

- 215036-Tanvi Anand-Family Law II - Difference Between Family Property and Self Acquired Property PDFDokumen13 halaman215036-Tanvi Anand-Family Law II - Difference Between Family Property and Self Acquired Property PDFTanviBelum ada peringkat

- Joint Family - Mitakshara SchoolDokumen28 halamanJoint Family - Mitakshara SchoolHarshini ReddyBelum ada peringkat

- Joint and Separate PropertyDokumen6 halamanJoint and Separate PropertyBob MarleyBelum ada peringkat

- ALIENATION OF HINDU COPARCENARY PROPERTYDokumen25 halamanALIENATION OF HINDU COPARCENARY PROPERTYrajesh_k69_778949788Belum ada peringkat

- Aligarh Muslim University: Malappuram Centre, KeralaDokumen16 halamanAligarh Muslim University: Malappuram Centre, KeralaVaibhav ChaudharyBelum ada peringkat

- Joint Family - Mitakshara SchoolDokumen28 halamanJoint Family - Mitakshara Schoolharshad nickBelum ada peringkat

- How Can and Cannot Claim Ancestral Property: International Journal of LawDokumen3 halamanHow Can and Cannot Claim Ancestral Property: International Journal of LawJugheadBelum ada peringkat

- Hindu LawDokumen17 halamanHindu LawSundeep RauBelum ada peringkat

- Hindu Undivided FamilyDokumen15 halamanHindu Undivided Familytanyaverma2589Belum ada peringkat

- HUF Property (Self-Acquired or Joint)Dokumen4 halamanHUF Property (Self-Acquired or Joint)Ahkam Khan100% (1)

- Classification of PropertyDokumen15 halamanClassification of PropertyAYUSHI TYAGIBelum ada peringkat

- Law of Succession and InheritanceDokumen10 halamanLaw of Succession and InheritanceNidhi gargBelum ada peringkat

- dr.Dokumen6 halamandr.sharang IngawaleBelum ada peringkat

- Alienation of Joint Hindu PropertyDokumen21 halamanAlienation of Joint Hindu PropertyLaura MullenBelum ada peringkat

- Important DecisionDokumen231 halamanImportant Decisionshekhawatr100% (2)

- Family LawDokumen10 halamanFamily LawAiman Kulsoom RizviBelum ada peringkat

- Coparcener Rights to Challenge Alienation (35 charactersDokumen24 halamanCoparcener Rights to Challenge Alienation (35 charactersAnnai SagayamBelum ada peringkat

- Mitakshara Classification of Property Obstructed' and "Unobstructed" HeritagesDokumen32 halamanMitakshara Classification of Property Obstructed' and "Unobstructed" Heritageskahar karishmaBelum ada peringkat

- 2024031443Dokumen8 halaman2024031443Gur Meet SinghBelum ada peringkat

- Classification of Hindu PropertyDokumen16 halamanClassification of Hindu PropertyHarendra TeotiaBelum ada peringkat

- Case Law (Paventhan 131902004)Dokumen2 halamanCase Law (Paventhan 131902004)Rajalakshmi TNBelum ada peringkat

- Coparcener Right To Challenge AlienationDokumen23 halamanCoparcener Right To Challenge AlienationAnnai SagayamBelum ada peringkat

- Hindu Law Partition RightsDokumen9 halamanHindu Law Partition Rightsaditya yadavBelum ada peringkat

- Hindu Joint FamilyDokumen32 halamanHindu Joint FamilyGaurav GhugeBelum ada peringkat

- Persons Final ExamDokumen28 halamanPersons Final ExamAnonymous FXhZbcfeGBelum ada peringkat

- Family Law 2 ProjectDokumen7 halamanFamily Law 2 ProjectRATHLOGICBelum ada peringkat

- Client Counseling:: Chanakya National Law University, PatnaDokumen8 halamanClient Counseling:: Chanakya National Law University, PatnaNAYAN SINGHBelum ada peringkat

- Doctrine of Accretions and Self-Acquired PropertyDokumen2 halamanDoctrine of Accretions and Self-Acquired PropertyAyush PandeyBelum ada peringkat

- Concept of Joint Hindu FamilyDokumen14 halamanConcept of Joint Hindu FamilyAnushka SharmaBelum ada peringkat

- AlienationsDokumen25 halamanAlienationsAnam KhanBelum ada peringkat

- Family Law II notesDokumen4 halamanFamily Law II notesDeepak KumarBelum ada peringkat

- A Study On Coparceners Right To Relinquish Interest in PropertyDokumen5 halamanA Study On Coparceners Right To Relinquish Interest in PropertyAmitabh MehataBelum ada peringkat

- Family Law2 NotesDokumen15 halamanFamily Law2 NotesboscoxtremeBelum ada peringkat

- Classification of Hindu PropertyDokumen15 halamanClassification of Hindu Propertymoinuddin ansariBelum ada peringkat

- Family Law-Ii Project On Maintenance Under Hndu Law SUBMITTED TO: Professor Kahkashan Y. DanyalDokumen10 halamanFamily Law-Ii Project On Maintenance Under Hndu Law SUBMITTED TO: Professor Kahkashan Y. DanyalRoopali Gupta100% (1)

- Case Digest Week 11Dokumen37 halamanCase Digest Week 11Vincent Francis Bien SantiagoBelum ada peringkat

- Property LawDokumen14 halamanProperty Lawsumit ghaiBelum ada peringkat

- Hindu Coparcenary Family LawDokumen10 halamanHindu Coparcenary Family LawRHEABelum ada peringkat

- Family Law II Succession Modified 5Dokumen91 halamanFamily Law II Succession Modified 5Harshal TholiaBelum ada peringkat

- Family Law AssignmentDokumen8 halamanFamily Law AssignmentKaran Singh ChawlaBelum ada peringkat

- Case Summary - FLDokumen2 halamanCase Summary - FLIshtiyaq xBelum ada peringkat

- Alok SirDokumen18 halamanAlok SirSurya Dev Singh BhandariBelum ada peringkat

- Family LawDokumen163 halamanFamily LawShivangi BajpaiBelum ada peringkat

- Adopted child's right to represent adopting parent in inheritanceDokumen3 halamanAdopted child's right to represent adopting parent in inheritanceAnonymous 3u8SzAk4Belum ada peringkat

- Hindu Joint Family Structure and RightsDokumen9 halamanHindu Joint Family Structure and RightsSHIVANSHI SHUKLABelum ada peringkat

- Alienation of PropertyDokumen17 halamanAlienation of Propertysarthak mohan shukla100% (1)

- Mansha Garg JLSRDokumen13 halamanMansha Garg JLSRRahul P VinishBelum ada peringkat

- Family AssignmentDokumen4 halamanFamily Assignmentgauri sharmaBelum ada peringkat

- Family Law SWM 4 Alienation of PropertyDokumen16 halamanFamily Law SWM 4 Alienation of PropertyHasrat KaurBelum ada peringkat

- SSRN 2465531Dokumen8 halamanSSRN 2465531Anonymous 8GvuZyB5VwBelum ada peringkat

- B. Institution of HeirsDokumen4 halamanB. Institution of HeirsHannah PlopinioBelum ada peringkat

- Presentation Family LawDokumen19 halamanPresentation Family LawNitasha thakurBelum ada peringkat

- Compiled Assignments in Succession Atty. LardizabalDokumen90 halamanCompiled Assignments in Succession Atty. LardizabalPAULAMIKHAELA ARIASBelum ada peringkat

- Understanding Coparcenary and Joint FamilyDokumen3 halamanUnderstanding Coparcenary and Joint FamilyDevesh SawantBelum ada peringkat

- Family LawDokumen18 halamanFamily Lawharsha jeswaniBelum ada peringkat

- Name:Raj Vardhan Agarwal Course: Bba LLB (H) BATCH:2017-2022 Family Law IiDokumen6 halamanName:Raj Vardhan Agarwal Course: Bba LLB (H) BATCH:2017-2022 Family Law Iiraj vardhan agarwalBelum ada peringkat

- Air 1957 A.p.434Dokumen4 halamanAir 1957 A.p.434SimranBelum ada peringkat

- Inheritance Laws in an Islamic Society: Islamic Cultures Are Distinct in EverywayDari EverandInheritance Laws in an Islamic Society: Islamic Cultures Are Distinct in EverywayBelum ada peringkat

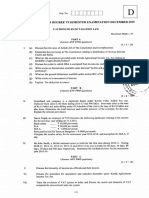

- Principles of Taxation Law 2015 DecDokumen1 halamanPrinciples of Taxation Law 2015 DecmanujplamootilBelum ada peringkat

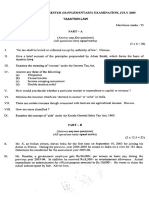

- Principles of Taxation Law 2007 MayDokumen1 halamanPrinciples of Taxation Law 2007 MaymanujplamootilBelum ada peringkat

- Principles of Taxation Law 2005 JulyDokumen2 halamanPrinciples of Taxation Law 2005 JulymanujplamootilBelum ada peringkat

- Scanned by CamscannerDokumen6 halamanScanned by CamscannermanujplamootilBelum ada peringkat

- Phil of RightDokumen2 halamanPhil of RightmanujplamootilBelum ada peringkat

- Principles of Taxation Law 2005 DecDokumen1 halamanPrinciples of Taxation Law 2005 DecmanujplamootilBelum ada peringkat

- S. Jagannath Vs Union of India & Ors On 11 December, 1996Dokumen57 halamanS. Jagannath Vs Union of India & Ors On 11 December, 1996manujplamootilBelum ada peringkat

- Introduction to Environmental LawDokumen18 halamanIntroduction to Environmental LawManu J PlamootilBelum ada peringkat

- Aggregation of IncomeDokumen36 halamanAggregation of IncomemanujplamootilBelum ada peringkat

- Environment LawDokumen17 halamanEnvironment LawmanujplamootilBelum ada peringkat

- Open Course SDE VSem Human Rights in IndiaDokumen73 halamanOpen Course SDE VSem Human Rights in IndiamanujplamootilBelum ada peringkat

- Format Written StatementDokumen2 halamanFormat Written StatementmanujplamootilBelum ada peringkat

- Erg LosDokumen22 halamanErg LosmanujplamootilBelum ada peringkat

- Drafting & PleadingDokumen13 halamanDrafting & PleadingmanujplamootilBelum ada peringkat

- HJ Law 0390000710Dokumen14 halamanHJ Law 0390000710manujplamootilBelum ada peringkat

- JHF & CoparcenaryDokumen13 halamanJHF & CoparcenarymanujplamootilBelum ada peringkat

- 138Dokumen43 halaman138manujplamootilBelum ada peringkat

- A Path Not TakenDokumen25 halamanA Path Not TakenmanujplamootilBelum ada peringkat

- The Rights of Women As CoparcenarsDokumen6 halamanThe Rights of Women As CoparcenarsmanujplamootilBelum ada peringkat

- UNCLOS Summary TableDokumen3 halamanUNCLOS Summary Tablecmv mendoza100% (3)

- Bali RoachDokumen35 halamanBali RoachmanujplamootilBelum ada peringkat

- The Law of The Sea NotesDokumen4 halamanThe Law of The Sea Notesmanujplamootil75% (4)

- What Are The Characteristic Features of A Hindu Coparcenary? (7 Features)Dokumen7 halamanWhat Are The Characteristic Features of A Hindu Coparcenary? (7 Features)manujplamootilBelum ada peringkat

- Hindu Undivided FamilyDokumen3 halamanHindu Undivided FamilymanujplamootilBelum ada peringkat

- Colourable LegislationDokumen5 halamanColourable LegislationmanujplamootilBelum ada peringkat

- Hindu Undivided FamilyDokumen3 halamanHindu Undivided FamilymanujplamootilBelum ada peringkat

- Anbsphindu Joint Family SetupDokumen6 halamanAnbsphindu Joint Family SetupmanujplamootilBelum ada peringkat

- My Arguments - AdulteryDokumen2 halamanMy Arguments - AdulterymanujplamootilBelum ada peringkat

- Chapter VI Put Forward Exception To This General RuleDokumen2 halamanChapter VI Put Forward Exception To This General RulemanujplamootilBelum ada peringkat

- Chapter 7 Engineering EconomicsDokumen19 halamanChapter 7 Engineering EconomicsharoonBelum ada peringkat

- Dissertation Report On Comparative Study of Education LoanDokumen56 halamanDissertation Report On Comparative Study of Education LoanVi Pin SinghBelum ada peringkat

- Poa - Edu Loan1Dokumen3 halamanPoa - Edu Loan1Anand JoshiBelum ada peringkat

- Hba Go RevisedDokumen72 halamanHba Go RevisedErSATHISHKUMARBelum ada peringkat

- Session 2-3 Interest Rate RiskDokumen79 halamanSession 2-3 Interest Rate RiskGodfrey MacwanBelum ada peringkat

- The Global Financial Crisis Project SynopsisDokumen11 halamanThe Global Financial Crisis Project Synopsisdevarakonda shruthiBelum ada peringkat

- Civil Law Concepts of Property ClassificationDokumen220 halamanCivil Law Concepts of Property ClassificationRalph Honorico100% (1)

- Bolbok Tuy Final EditDokumen202 halamanBolbok Tuy Final EditJewel higuitBelum ada peringkat

- Comparative Analysis of HDFC Bank and its Competitors' Products and ServicesDokumen93 halamanComparative Analysis of HDFC Bank and its Competitors' Products and ServicesDevdutt Raina100% (1)

- A STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIADokumen98 halamanA STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIAShanu shriBelum ada peringkat

- IELTS Reading Classification QuestionDokumen6 halamanIELTS Reading Classification Questionedscott66Belum ada peringkat

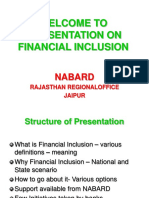

- Financial Inclusion Presentation on Expanding AccessDokumen26 halamanFinancial Inclusion Presentation on Expanding AccessOsama100% (2)

- Florida Real Estate ContractDokumen10 halamanFlorida Real Estate ContractlostvikingBelum ada peringkat

- Credit AppDokumen1 halamanCredit Appautoheim59Belum ada peringkat

- D9Dokumen11 halamanD9Saida MolinaBelum ada peringkat

- Guide to IPO Requirements and ProcessDokumen27 halamanGuide to IPO Requirements and ProcessJagadeesh YathirajulaBelum ada peringkat

- Borrowed Fund-Long Term Source of FinanceDokumen13 halamanBorrowed Fund-Long Term Source of FinanceAizaz AlamBelum ada peringkat

- Indian Succession ActDokumen10 halamanIndian Succession ActajapBelum ada peringkat

- Temp 2022 03 31 1RS8107641C 3103U38 20220331203833Dokumen11 halamanTemp 2022 03 31 1RS8107641C 3103U38 20220331203833Dr DNACEBelum ada peringkat

- Patricia Boone, Patricia Boone Mandolyn Boyd Mary Jordan Mary McBride Arthaway McCullough Constance McFarland Eugene Paine Bernice Paine Mary Spratt Peggy Washington v. Citigroup, Inc. Citifinancial Inc. Associates First Capital Corporation Associates Corporation of North America Paul Spears D. Lavender Michelle Easter John Does 1-50 Citifinancial Corporation, 416 F.3d 382, 1st Cir. (2005)Dokumen14 halamanPatricia Boone, Patricia Boone Mandolyn Boyd Mary Jordan Mary McBride Arthaway McCullough Constance McFarland Eugene Paine Bernice Paine Mary Spratt Peggy Washington v. Citigroup, Inc. Citifinancial Inc. Associates First Capital Corporation Associates Corporation of North America Paul Spears D. Lavender Michelle Easter John Does 1-50 Citifinancial Corporation, 416 F.3d 382, 1st Cir. (2005)Scribd Government DocsBelum ada peringkat

- Commercial Banking System & Role of RBIDokumen3 halamanCommercial Banking System & Role of RBIPrashant AhujaBelum ada peringkat

- Accounting/Series 4 2011 (Code30124)Dokumen16 halamanAccounting/Series 4 2011 (Code30124)Hein Linn Kyaw100% (1)

- Mba Dissertation On Banking SecurityDokumen78 halamanMba Dissertation On Banking Securitychada12345Belum ada peringkat

- 1Dokumen4 halaman1Rohan ShresthaBelum ada peringkat

- Lending Guidelines For Motorcycle Loan 2024Dokumen1 halamanLending Guidelines For Motorcycle Loan 2024Arnel AycoBelum ada peringkat

- Analysis of Residential Mortgage-Backed Securities: Chapter SummaryDokumen26 halamanAnalysis of Residential Mortgage-Backed Securities: Chapter SummaryasdasdBelum ada peringkat

- SWOT John DeereDokumen77 halamanSWOT John DeereSébastien BoreBelum ada peringkat

- Chapter-5 - Financial Aspect RevisedDokumen17 halamanChapter-5 - Financial Aspect RevisedCM Lance75% (4)

- Collateral ContractsDokumen5 halamanCollateral ContractsMuhamad Taufik Bin SufianBelum ada peringkat