Chapter 8

Diunggah oleh

John FrandoligHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 8

Diunggah oleh

John FrandoligHak Cipta:

Format Tersedia

Chapter 8: An Economic Analysis of Financial Structure

I. Basic Facts about the Financial Structure Throughout the World a. Sources of External Funds i. Bank loans made up primarily of loans from depository institutions. ii. Non-bank loans primarily loans by other financial intermediaries. iii. Bonds marketable debt securities, such as corporate bonds and commercial paper. iv. Stock new issues of new equity b. Stocks are not the most important source of external financing for businesses. i. Bonds are more important part of financing than stocks c. Issuing marketable debt and equity securities is not the primary way in which businesses finance their operations. d. Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets. e. Financial intermediaries, particularly banks, are the most important source of external funds used to finance businesses. f. The financial system is among the most heavily regulated sectors of the economy. g. Only large, well-established corporations have easy access to securities markets to finance their activities. h. Collateral is a prevalent feature of debt contracts for both households and businesses i. Collateral: property that is pledged to a lender to guarantee payment in the event that the borrower is unable to make debt payments. 1. Secured debt vs. Unsecured debt i. Debt contracts typically are extremely complicated legal documents that place substantial restrictions on the behavior of the borrower. i. Restrictive covenants Transaction costs a. Economies of Scale i. The reduction in transaction costs per dollar of investment as the size of the transactions increases. ii. Mutual fund financial intermediary that sells shares to individuals and then invests the proceeds in bonds or stocks. 1. Diversified portfolios b. Expertise i. Financial intermediaries are also better able to develop expertise to lower transaction costs. ii. Ability to provide costumers with liquidity services easier for customers to conduct transactions.

II.

III.

IV.

Asymmetric Information: Adverse Selection and Moral Hazard a. Adverse selection i. Before the transaction ii. Potential band credit risks are the ones who most actively seek out loans b. Moral hazard i. After the transaction occurs ii. The lender runs the risk that the borrower will engage in activities that are undesirable form the lenders point of view because they make it less likely that the loan will be paid back. c. Agency theory: the analysis of how asymmetric information problems affect economic behavior. The Lemons Problem: How Adverse Selection Influence Financial Structure a. George Akerlof lemons in used car market i. Price must reflect the average quality of the cars in the market ii. Adverse Selection b. Lemons problem arises in the securities market c. Explains why marketable securities are not the primary source of financing for businesses in any country in the world. Also why stocks are not the most important source of financing for American businesses. d. Tools to help solve adverse selection problems i. Private Production and Sale of Information 1. Private companies collect and produce information that distinguishes good from bad firms and then sell it. a. Standard and Poors, Moodys, and Value Line 2. Free-rider problem: when people who do not pay for information take advantage of the information that other people have paid for. a. Prevents the market from producing enough information to eliminate all the asymmetric information that leads to adverse selection. ii. Government Regulation to Increase Information 1. Government could produce information for the public and make it free. 2. Also could regulate securities markets in a way that encourages firms to reveal honest information about themselves so that investors can determine how good or bad the firms are a. SEC iii. Financial Intermediation 1. Financial intermediaries become experts in producing information about firms so that it can sort out good credit risk from bad ones 2. Avoids free-rider problem by primarily making private loans rather than by purchasing securities that are traded in the open market. 3. The larger and more established a corporation is, the more likely it will be to issue securities to raise funds. iv. Collateral and Net Worth

V.

VI.

1. Reduces the consequences of adverse selection because it reduces the lenders losses in the event of a default 2. Net worth (equity capital): the difference between a firms assets (what it owns or is owed) and its liabilities (what it owes). How Moral Hazard Affects the Choice Between Debt and Equity Contracts a. Equity contracts (common stock) claims to a share in the profits and assets of a business. i. Principal-agent problem: the managers in control (the agents) may act in their own interest rather than in the interest of the stockholder-owners (the principals) because the managers have less incentive to maximize profits than the stockholder-owners do. b. Preventing the Principal-agent Problem i. Production of Information Monitoring 1. Auditing the firm frequently and checking on what the management is doing. a. Costly state verification makes the equity contract less desirable, and explains why equity is not a more important element in our financial structure. ii. Government Regulation to Increase Information iii. Financial Intermediation 1. Venture capital firm: firms that pool the resources of their partners and use the funds to help budding entrepreneurs start new businesses. a. Firm receives an equity share in the new business. b. Equity in the firm is not marketable to anyone except the venture capital firm. iv. Debt contracts 1. It is a contractual agreement by the borrower to pay the lender fixed dollar amounts at periodic intervals. How Moral Hazard Influences Financial Structure in Debt Markets a. Solving Moral Hazard in Debt Contracts i. Net Worth and Collateral 1. If borrowers have more skin in the game because they have higher net worth or pledge collateral, they are likely to take less risk at the lenders expense. 2. Incentive-compatible: it aligns the incentives of the borrower with those of the lender. 3. The greater the borrowers net worth and collateral pledged, the greater the borrowers incentive to behave in the way that the lender expects and desires, the smaller the moral hazard problem in the debt contract. ii. Monitoring and Enforcement of Restrictive Covenants 1. Four types of restrictive covenants: a. Covenants to discourage undesirable behavior b. Covenants to encourage desirable behavior

c. Covenants to keep collateral valuable d. Covenants to provide information iii. Financial Intermediation 1. Make private loans not traded so that no one else can free-ride on the intermediarys monitoring and enforcement of the restrictive covenants.

Anda mungkin juga menyukai

- FIN2339 CH8-An Economic Analysis of Financial StructureDokumen9 halamanFIN2339 CH8-An Economic Analysis of Financial StructureJasleen GillBelum ada peringkat

- Tutorial 6 QuestionsDokumen6 halamanTutorial 6 QuestionsNguyễn Vĩnh TháiBelum ada peringkat

- 3.1. Basic Puzzles About Financial Structure Around The WorldDokumen75 halaman3.1. Basic Puzzles About Financial Structure Around The WorldNhatty WeroBelum ada peringkat

- Overview of Market Participants and Financial InnovationDokumen5 halamanOverview of Market Participants and Financial InnovationLeonard CañamoBelum ada peringkat

- Tutorial 6 QuestionsDokumen5 halamanTutorial 6 QuestionsĐỗ Minh HuyềnBelum ada peringkat

- Money and Banking Chapter 8Dokumen3 halamanMoney and Banking Chapter 8Gene'sBelum ada peringkat

- Solution: SAMPLE PAPER-2 (Solved) Business Studies Class - XIDokumen10 halamanSolution: SAMPLE PAPER-2 (Solved) Business Studies Class - XIPabitra Kumar BalaBelum ada peringkat

- C. "In The Absence of Asymmetric Information, The Lemons Problem Goes Away". Discuss Any FOUR (4) Tools Which Can Reduce This ProblemDokumen3 halamanC. "In The Absence of Asymmetric Information, The Lemons Problem Goes Away". Discuss Any FOUR (4) Tools Which Can Reduce This ProblemShi ManBelum ada peringkat

- Chapter 7 Why Do Financial Institutions ExistDokumen10 halamanChapter 7 Why Do Financial Institutions ExistJay Ann DomeBelum ada peringkat

- Chapter 7Dokumen45 halamanChapter 7tientran.31211021669Belum ada peringkat

- FIN2339 - Ch2 QuestionsDokumen5 halamanFIN2339 - Ch2 QuestionsJasleen GillBelum ada peringkat

- Tutorial 1 QuestionsDokumen8 halamanTutorial 1 QuestionsHuế HoàngBelum ada peringkat

- The Role of Financial Intermediaries: Lecture No 2 Banking Techniques and OperationsDokumen19 halamanThe Role of Financial Intermediaries: Lecture No 2 Banking Techniques and OperationsRoxana RusenBelum ada peringkat

- Financial InstitutionsDokumen17 halamanFinancial InstitutionsNikolaiBelum ada peringkat

- International BankingDokumen9 halamanInternational Bankingshahd naserBelum ada peringkat

- FIN111 Spring2015 Tutorials Tutorial 5 Week 6 QuestionsDokumen3 halamanFIN111 Spring2015 Tutorials Tutorial 5 Week 6 QuestionshaelstoneBelum ada peringkat

- Tutorial For Financial Markets & Institutions An Economic Analysis of Financial StructureDokumen3 halamanTutorial For Financial Markets & Institutions An Economic Analysis of Financial StructureHi I'm ConyBelum ada peringkat

- Report in Fm1 PDFDokumen36 halamanReport in Fm1 PDFQuennie Guy-abBelum ada peringkat

- Bài Tập Và Đáp Án Chương 1Dokumen9 halamanBài Tập Và Đáp Án Chương 1nguyenductaiBelum ada peringkat

- FIM Group Assignmen FinalDokumen9 halamanFIM Group Assignmen FinalEndeg KelkayBelum ada peringkat

- Part 1. Questions For Review: Tutorial 1Dokumen25 halamanPart 1. Questions For Review: Tutorial 1TACN-4TC-19ACN Nguyen Thu HienBelum ada peringkat

- Solutions For End-of-Chapter Questions and Problems: Chapter OneDokumen14 halamanSolutions For End-of-Chapter Questions and Problems: Chapter Onejl123123Belum ada peringkat

- CH 1Dokumen5 halamanCH 1bsodoodBelum ada peringkat

- FIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemDokumen2 halamanFIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemGene'sBelum ada peringkat

- Bài Tập InvestmentDokumen22 halamanBài Tập InvestmentQuyên NguyễnBelum ada peringkat

- FRM Part 1 - Test ID - 0004 - Questions - 30Dokumen11 halamanFRM Part 1 - Test ID - 0004 - Questions - 30Kamal BhatiaBelum ada peringkat

- Chapter 1Dokumen34 halamanChapter 1sahumonikaBelum ada peringkat

- FMT Homework W1Dokumen9 halamanFMT Homework W1Hằngg ĐỗBelum ada peringkat

- Basics of Financial Markets and Institutions Mid Term SuggestionDokumen6 halamanBasics of Financial Markets and Institutions Mid Term SuggestionN HasibBelum ada peringkat

- BANKING Reviewer (Securities and Insurance Operations)Dokumen6 halamanBANKING Reviewer (Securities and Insurance Operations)Arianne JhadeBelum ada peringkat

- Asignación 1 (RMF FM)Dokumen14 halamanAsignación 1 (RMF FM)Elia SantanaBelum ada peringkat

- Chapter 1 HomeworkDokumen3 halamanChapter 1 HomeworkJulia McwilliamsBelum ada peringkat

- Chapter 2 PDFDokumen9 halamanChapter 2 PDFarwa_mukadam03Belum ada peringkat

- Chapter 8 An Economic Analysis of Financial StructureDokumen14 halamanChapter 8 An Economic Analysis of Financial Structurecoldpassion100% (2)

- Tutorial 2 Answer Scheme ECO531Dokumen6 halamanTutorial 2 Answer Scheme ECO5312019489528Belum ada peringkat

- List & Explain The Nature of Risk Associated With Financial Services CompaniesDokumen28 halamanList & Explain The Nature of Risk Associated With Financial Services Companiesroupesh21Belum ada peringkat

- Computer Presentation 02Dokumen17 halamanComputer Presentation 02fahim khanBelum ada peringkat

- Security SupplementDokumen40 halamanSecurity SupplementNader HatoumBelum ada peringkat

- Tute 1 QuestionsDokumen5 halamanTute 1 QuestionsHiền NguyễnBelum ada peringkat

- Chapter 2 HWDokumen4 halamanChapter 2 HWFarah Nader GoodaBelum ada peringkat

- Financial Markets (Chapter 5)Dokumen3 halamanFinancial Markets (Chapter 5)Kyla DayawonBelum ada peringkat

- Mid Term Exam MCQs For 5530Dokumen6 halamanMid Term Exam MCQs For 5530Amy WangBelum ada peringkat

- FRM Test 04 AnsDokumen16 halamanFRM Test 04 AnsKamal BhatiaBelum ada peringkat

- Saunders & Cornnet Solution Chapter 1 Part 1Dokumen5 halamanSaunders & Cornnet Solution Chapter 1 Part 1Mo AlamBelum ada peringkat

- Financial Institutions Management - Solutions - Chap001Dokumen10 halamanFinancial Institutions Management - Solutions - Chap001Samra AfzalBelum ada peringkat

- Problems of Raising FinanceDokumen14 halamanProblems of Raising FinanceOKhwanambobi Lucas WafulaBelum ada peringkat

- Fianacial MarketsDokumen53 halamanFianacial MarketsMostafa ElgendyBelum ada peringkat

- TRUE-FALSE STATEMENTS Black - True And: Chapter 1 Introduction To Financial Management Answer KeyDokumen4 halamanTRUE-FALSE STATEMENTS Black - True And: Chapter 1 Introduction To Financial Management Answer KeyMary Angeline LopezBelum ada peringkat

- Supplier of Fund Intermediaries Uses of Fund: JANUARY 2013Dokumen5 halamanSupplier of Fund Intermediaries Uses of Fund: JANUARY 2013amirulfitrieBelum ada peringkat

- Credit Management TaskDokumen4 halamanCredit Management TaskEmaazBelum ada peringkat

- Debt Markets Black Book RevisedDokumen63 halamanDebt Markets Black Book RevisedPrasad Naik100% (1)

- FINS 3616 Tutorial Questions-Week 1Dokumen5 halamanFINS 3616 Tutorial Questions-Week 1Alex WuBelum ada peringkat

- Solution Manual For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo ErhemjamtsDokumen24 halamanSolution Manual For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo ErhemjamtsAngelaWilsonjnaf95% (40)

- Fin515-Week 1 HomeworkDokumen4 halamanFin515-Week 1 Homeworkwhi326Belum ada peringkat

- Bonds Decoded: Unraveling the Mystery Behind Bond MarketsDari EverandBonds Decoded: Unraveling the Mystery Behind Bond MarketsBelum ada peringkat

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingDari EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingBelum ada peringkat

- Chapter 3: Working With Financial Statements: Cash Flow and Financial Statements: A Closer LookDokumen5 halamanChapter 3: Working With Financial Statements: Cash Flow and Financial Statements: A Closer LookJohn FrandoligBelum ada peringkat

- Chapter 2Dokumen7 halamanChapter 2John FrandoligBelum ada peringkat

- Chapter 8: Stock ValuationDokumen9 halamanChapter 8: Stock ValuationJohn FrandoligBelum ada peringkat

- Chapter 2: An Overview of The Financial SystemDokumen3 halamanChapter 2: An Overview of The Financial SystemJohn FrandoligBelum ada peringkat

- Chapter 5: Introduction To The Valuation - The Time Value of MoneyDokumen2 halamanChapter 5: Introduction To The Valuation - The Time Value of MoneyJohn FrandoligBelum ada peringkat

- Chapter 1 FInanceDokumen4 halamanChapter 1 FInanceJohn FrandoligBelum ada peringkat

- Chapter 5: Introduction To Risk, Return and The Historical RecordDokumen5 halamanChapter 5: Introduction To Risk, Return and The Historical RecordJohn FrandoligBelum ada peringkat

- Chapter 3 NotesDokumen4 halamanChapter 3 NotesJohn FrandoligBelum ada peringkat

- Chapter 9: The Capital Asset Pricing ModelDokumen6 halamanChapter 9: The Capital Asset Pricing ModelJohn FrandoligBelum ada peringkat

- The Unfinished Nation - Chapter 23Dokumen2 halamanThe Unfinished Nation - Chapter 23John Frandolig100% (1)

- Chapter 2 - Hardware BasicsDokumen5 halamanChapter 2 - Hardware BasicsJohn FrandoligBelum ada peringkat

- SSRN Id2298565Dokumen63 halamanSSRN Id2298565soumensahilBelum ada peringkat

- UntitledDokumen1.156 halamanUntitledPatience AkpanBelum ada peringkat

- UTI - Systematic Investment Plan (SIP) New Editable Application FormDokumen4 halamanUTI - Systematic Investment Plan (SIP) New Editable Application FormAnilmohan SreedharanBelum ada peringkat

- Introduction To InvestmentDokumen63 halamanIntroduction To InvestmentKOUJI N. MARQUEZBelum ada peringkat

- Quiz Ak2Dokumen23 halamanQuiz Ak2Andhika YogaraksaBelum ada peringkat

- Day 1Dokumen11 halamanDay 1Abdullah EjazBelum ada peringkat

- Interest Rate and BondDokumen87 halamanInterest Rate and BondLee ChiaBelum ada peringkat

- Chapter 1: A Framework For Financial AccountingDokumen22 halamanChapter 1: A Framework For Financial AccountingGenevieve SaldanhaBelum ada peringkat

- Capital Market Theory: An Overview: Mcgraw-Hill/Irwin Corporate Finance, 7/EDokumen26 halamanCapital Market Theory: An Overview: Mcgraw-Hill/Irwin Corporate Finance, 7/ERazzARazaBelum ada peringkat

- Public Debt Act of 1941: HearingDokumen51 halamanPublic Debt Act of 1941: Hearingguymbula100% (1)

- Capital StructureDokumen16 halamanCapital StructureKimyMalayaBelum ada peringkat

- Corporate Perpetual Bonds Education NoteDokumen6 halamanCorporate Perpetual Bonds Education NoteSam RalstonBelum ada peringkat

- Teachers Savings PatternDokumen60 halamanTeachers Savings PatternAkash Philip MathewBelum ada peringkat

- BUS3026W Objective Test 8 SolutionsDokumen5 halamanBUS3026W Objective Test 8 Solutionsapi-3708231100% (1)

- FIN 205 Tutorial Questions Sem 3 2021Dokumen55 halamanFIN 205 Tutorial Questions Sem 3 2021黄于绮Belum ada peringkat

- ANN Green BoundDokumen20 halamanANN Green BoundChahine BergaouiBelum ada peringkat

- 09 Comm 308 Final Exam (Summer 1 2011) SolutionsDokumen18 halaman09 Comm 308 Final Exam (Summer 1 2011) SolutionsAfafe ElBelum ada peringkat

- FIN 433 - Exam 1 SlidesDokumen146 halamanFIN 433 - Exam 1 SlidesNayeem MahmudBelum ada peringkat

- Bonus Assignment 1Dokumen4 halamanBonus Assignment 1Zain Zulfiqar100% (2)

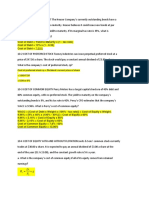

- Henry Has The Following Data For The YeaDokumen3 halamanHenry Has The Following Data For The YeaQueen ValleBelum ada peringkat

- Project Report: A Comparative Study of Performance of Top 5 Mutual Funds in IndiaDokumen40 halamanProject Report: A Comparative Study of Performance of Top 5 Mutual Funds in India68Rohan ChopraBelum ada peringkat

- Corpus Study Rev2Dokumen38 halamanCorpus Study Rev2Chris RamirezBelum ada peringkat

- Cocolife Fixed Income Fund Inc.Dokumen11 halamanCocolife Fixed Income Fund Inc.Ryan Samuel C. CervasBelum ada peringkat

- Dfi 302 Lecture NotesDokumen73 halamanDfi 302 Lecture NotesHufzi KhanBelum ada peringkat

- Assignment FIN205 S2 - 2017Dokumen4 halamanAssignment FIN205 S2 - 2017Japheth CapatiBelum ada peringkat

- Business-Finance-Final Exit-ExamDokumen5 halamanBusiness-Finance-Final Exit-ExamEmarilyn Bayot75% (4)

- Work in Progress ProjectDokumen60 halamanWork in Progress ProjectSaurabh PhaleBelum ada peringkat

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Dokumen17 halamanTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- FINANCE and ACCOUNTING - An Ultimate Book of Accounting Basics and Financial Management. Financial Analysis Have Done Through Latest Financial Statements ... Leading Manufacturing Company FYE DEC 2019Dokumen794 halamanFINANCE and ACCOUNTING - An Ultimate Book of Accounting Basics and Financial Management. Financial Analysis Have Done Through Latest Financial Statements ... Leading Manufacturing Company FYE DEC 2019abhinesh243Belum ada peringkat

- Chapter 22 ArensDokumen12 halamanChapter 22 Arensrahmatika yaniBelum ada peringkat