Visit Governmental Affairs On Texas Realtors

Diunggah oleh

1ethel0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

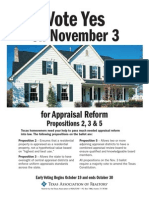

17 tayangan2 halamanThe claim that Propositions 2 and 3 could create a new state tax or raise taxes is absurd. Propositions 2, 3 and 5 actually help ensure fair and uniform tax appraisals for property owners. The amendments will simply require an appraisal district to follow standard appraisal methods.

Deskripsi Asli:

Judul Asli

Visit Governmental Affairs on Texas Realtors

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe claim that Propositions 2 and 3 could create a new state tax or raise taxes is absurd. Propositions 2, 3 and 5 actually help ensure fair and uniform tax appraisals for property owners. The amendments will simply require an appraisal district to follow standard appraisal methods.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

17 tayangan2 halamanVisit Governmental Affairs On Texas Realtors

Diunggah oleh

1ethelThe claim that Propositions 2 and 3 could create a new state tax or raise taxes is absurd. Propositions 2, 3 and 5 actually help ensure fair and uniform tax appraisals for property owners. The amendments will simply require an appraisal district to follow standard appraisal methods.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Visit Governmental Thank you for your email message.

The forwarded email is one that is

Affairs on being distributed throughout the state as part of a deliberate

TexasRealtors.co

misinformation campaign. The information contained in the email is

m

false. The claim that Propositions 2 and 3 could even potentially create a

new state tax or raise taxes is absurd and those spreading this claim are

deliberately preying on the fears of uninformed voters in hopes that they

will not actually read the proposals.

Propositions 2, 3 and 5 actually help ensure fair and uniform tax

appraisals for property owners. Here are brief explanations of what all

three amendments will actually do:

Proposition 2: Homeowners in Texas are well aware of

astronomical increases in appraised values. These increases can

be made ever worse when chief appraisers choose to bypass taxing

a property as homestead, and base their taxes on the “highest and

best use” of the property. Proposition 2 protects homeowners, who

happen live in or near commercial areas, by mandating that their

residence be appraised only as a residence, regardless of what the

highest and best use of the property might be.

Proposition 3: Current law requires that standards and procedures

for the appraisal of property to originate in the county were the tax is

imposed. As a result property owners are often victimized by a

hodgepodge of inconsistent rules and standards throughout the

state. This constitutional amendment corrects this problem by

simply requiring an appraisal district to follow standard appraisal

methods and procedures.

Proposition 5: Appraisal review boards have the responsibility to

resolve disputes between property owners and county appraisal

districts when the taxable value of a property is being challenged.

The property owner is always best served when the review boards

are comprised of members who understand the issues and

complexities of property valuations. Some rural counties have

difficulty finding board members to meet these standards. This

constitutional amendment will simply give these counties the option

to pool together their qualified applicants to better ensure the

property owner that their appraisal appeal is being handled

professionally and timely.

If you need additional background materials to share with other Texas

REALTORS® and consumers, you can access a layman’s explanation

written by Texas Association of REALTORS® staff attorney Gabe Lopez.

You can also download a promotional flier for Props 2, 3 and 5.

Don’t believe us? Read the Houston Chronicle’s endorsement of Props 2,

3 and 5. Read Rep. John Otto’s press release regarding this stealth

misinformation campaign.

You can also read the Texas Legislative Council’s thorough explanation

on all 11 proposed constitutional amendments.

*********************

Mike Barnett

Director of Political Affairs

Texas Association of REALTORS®

1115 San Jacinto Blvd, Suite 200

Austin, Texas 78701

512/971-8338 mobile

512/480-8200 office

800/873-9155 (Toll-free)

mbarnett@TexasRealtors.com

www.TexasRealtors.com

Take advantage of over 50 hours of MCE at the 2009 Texas REALTORS® Convention.

Register online at TexasRealtors.com.

Anda mungkin juga menyukai

- DOJ Nosalek Statement 20240215Dokumen38 halamanDOJ Nosalek Statement 20240215Robert GarciaBelum ada peringkat

- REX Tunney Act Comment United States v. NAR 022021Dokumen21 halamanREX Tunney Act Comment United States v. NAR 022021Robert HahnBelum ada peringkat

- TWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729Dokumen39 halamanTWO FACES: DEMYSTIFYING THE MORTGAGE ELECTRONIC REGISTRATION SYSTEM'S LAND TITLE THEORY (MERS) SSRN-id1684729CarrieonicBelum ada peringkat

- The Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsDokumen34 halamanThe Case Against Allowing Mortgage Electronic Registration Systems, Inc. (MERS) To Initiate Foreclosure ProceedingsForeclosure FraudBelum ada peringkat

- Craigslist ScamsDokumen1 halamanCraigslist ScamsJean-Paul PuryearBelum ada peringkat

- Letter For Register of Deeds Version2Dokumen3 halamanLetter For Register of Deeds Version2Senka1992100% (1)

- 7 Important Things You Should Know About Land: TitlesDokumen11 halaman7 Important Things You Should Know About Land: TitlesKraft DinnerBelum ada peringkat

- Real Estate Principles A Value Approach 5th Edition Ling Solutions ManualDokumen36 halamanReal Estate Principles A Value Approach 5th Edition Ling Solutions Manualelegiastepauleturc7u100% (22)

- Government Affairs Myth BustersDokumen2 halamanGovernment Affairs Myth BustersRamin OstowariBelum ada peringkat

- AHC Eviction Reduction Recommendations FINAL 053023Dokumen54 halamanAHC Eviction Reduction Recommendations FINAL 053023Sean KeenanBelum ada peringkat

- Tar Lawsuit 2023Dokumen35 halamanTar Lawsuit 2023B EricksonBelum ada peringkat

- Landlords & Tenants GuideDokumen132 halamanLandlords & Tenants GuideJessica BrooksBelum ada peringkat

- Failed RemicDokumen13 halamanFailed RemicForeclosure Fraud100% (2)

- Media - Compensation For Loss - Jonathan FlawsDokumen28 halamanMedia - Compensation For Loss - Jonathan FlawsnilereverofBelum ada peringkat

- Cash For KeysDokumen5 halamanCash For KeysRamin OstowariBelum ada peringkat

- Kansas City, MO Tenants Bill of Rights AddendumDokumen3 halamanKansas City, MO Tenants Bill of Rights AddendumPearl Garland MendiaBelum ada peringkat

- 6 Lege Guide SS17 Property RightsDokumen2 halaman6 Lege Guide SS17 Property RightsTPPFBelum ada peringkat

- The Landlord-Tenant GuideDokumen132 halamanThe Landlord-Tenant GuideDustin HumphreysBelum ada peringkat

- SSRN Id2288280Dokumen47 halamanSSRN Id2288280Foreclosure FraudBelum ada peringkat

- MERS, The Unreported Effects of Lost Chain of Title On Real Property Owners and Their NeighborsDokumen85 halamanMERS, The Unreported Effects of Lost Chain of Title On Real Property Owners and Their NeighborsForeclosure Fraud100% (1)

- Message From Liz : What's InsideDokumen9 halamanMessage From Liz : What's InsideState Senator Liz KruegerBelum ada peringkat

- Federal Procurement Ethics: The Complete Legal GuideDari EverandFederal Procurement Ethics: The Complete Legal GuideBelum ada peringkat

- The Action in The Same Manner As The Original Instrument Was Required To Be Filed, Registered or RecordedDokumen4 halamanThe Action in The Same Manner As The Original Instrument Was Required To Be Filed, Registered or RecordedDinSFLABelum ada peringkat

- William McQueen v. Bertram Druker, 438 F.2d 781, 1st Cir. (1971)Dokumen7 halamanWilliam McQueen v. Bertram Druker, 438 F.2d 781, 1st Cir. (1971)Scribd Government DocsBelum ada peringkat

- 2017-07 Local Government Regulation Tramples Property Rights 1-PagerDokumen1 halaman2017-07 Local Government Regulation Tramples Property Rights 1-PagerTPPFBelum ada peringkat

- Landlord Tenant Guide PDFDokumen18 halamanLandlord Tenant Guide PDFAndrew NeuberBelum ada peringkat

- How Banks and Servicers Play Hide The BallDokumen10 halamanHow Banks and Servicers Play Hide The BallJim LeighBelum ada peringkat

- Document111 EditedDokumen3 halamanDocument111 EditedLA Roxa LucioBelum ada peringkat

- Illinois Supreme Court Rules 99.1 & Rule 113Dokumen4 halamanIllinois Supreme Court Rules 99.1 & Rule 113studiedoneBelum ada peringkat

- PHP E227 HTDokumen8 halamanPHP E227 HTNATSOIncBelum ada peringkat

- Burnet v. AT Jergins Trust, 288 U.S. 508 (1933)Dokumen4 halamanBurnet v. AT Jergins Trust, 288 U.S. 508 (1933)Scribd Government DocsBelum ada peringkat

- Introduction To Mechanics LiensDokumen11 halamanIntroduction To Mechanics LiensPDHLibrary100% (1)

- Misbehavior and Mistake in Bankruptcy Mortgage ClaimsDokumen64 halamanMisbehavior and Mistake in Bankruptcy Mortgage ClaimsPaul KrauseBelum ada peringkat

- Notice To Neighborhood On STR OrdinanceDokumen1 halamanNotice To Neighborhood On STR Ordinanceapi-662036605Belum ada peringkat

- Site-Built Affordable Housing - A PrimerDokumen66 halamanSite-Built Affordable Housing - A PrimerBradford HatcherBelum ada peringkat

- Site-Built Affordable Housing - A PrimerDokumen66 halamanSite-Built Affordable Housing - A PrimerBradford HatcherBelum ada peringkat

- Week 4 Short EssayDokumen3 halamanWeek 4 Short EssayRaeesa Potnis0% (1)

- This To Say About Late-Rent Fees Beware of These Lease Clauses Landlords Are Wise To Suspect Any Tenant Who Questions The PolicyDokumen3 halamanThis To Say About Late-Rent Fees Beware of These Lease Clauses Landlords Are Wise To Suspect Any Tenant Who Questions The PolicydebprendBelum ada peringkat

- The Lien WaiverDokumen5 halamanThe Lien WaiverMike KarlinsBelum ada peringkat

- Phillips Co. v. Dumas School Dist., 361 U.S. 376 (1960)Dokumen9 halamanPhillips Co. v. Dumas School Dist., 361 U.S. 376 (1960)Scribd Government DocsBelum ada peringkat

- Significance of Land Title RegistrationDokumen9 halamanSignificance of Land Title RegistrationmgbalbanoBelum ada peringkat

- The Case For Maryland's Property Assessment and Tax ReformDokumen45 halamanThe Case For Maryland's Property Assessment and Tax ReformdaggerpressBelum ada peringkat

- Report To New Yorkers On Housing From State Senator Liz KruegerDokumen4 halamanReport To New Yorkers On Housing From State Senator Liz KruegerState Senator Liz KruegerBelum ada peringkat

- Head v. New Mexico Bd. of Examiners in Optometry, 374 U.S. 424 (1963)Dokumen19 halamanHead v. New Mexico Bd. of Examiners in Optometry, 374 U.S. 424 (1963)Scribd Government DocsBelum ada peringkat

- Maria and Jose Perez v. Bac Home Loans Servicing LP, Rec On Trust, NaDokumen41 halamanMaria and Jose Perez v. Bac Home Loans Servicing LP, Rec On Trust, NaForeclosure Fraud100% (1)

- Article 38 Letter Pyle P8Dokumen3 halamanArticle 38 Letter Pyle P8Angga RyanBelum ada peringkat

- 2.7 Blind Advertising and Legal Advice: Not Designate Their License StatusDokumen36 halaman2.7 Blind Advertising and Legal Advice: Not Designate Their License StatusbadbybrellcBelum ada peringkat

- For Immediate Release Home Builders Oppose Mandate of Indoor Sprinklers in Draft Building CodeDokumen1 halamanFor Immediate Release Home Builders Oppose Mandate of Indoor Sprinklers in Draft Building Codeapi-239431845Belum ada peringkat

- P R T: O D T M: Hysical and Egulatory Akings NE Istinction OO ANYDokumen7 halamanP R T: O D T M: Hysical and Egulatory Akings NE Istinction OO ANYJulian PimientoBelum ada peringkat

- Research Paper Eminent DomainDokumen9 halamanResearch Paper Eminent Domainafmcvhffm100% (1)

- Tejas Motel, L.L.C. v. City of Mesquite, No. 22-10321 (5th Cir. Mar. 22, 2023)Dokumen18 halamanTejas Motel, L.L.C. v. City of Mesquite, No. 22-10321 (5th Cir. Mar. 22, 2023)RHTBelum ada peringkat

- PR MortgageFraudDokumen1 halamanPR MortgageFraudgreergirl2Belum ada peringkat

- Why Procedural Requirements Are Necessary To Prevent Further Loss To HomeownersDokumen34 halamanWhy Procedural Requirements Are Necessary To Prevent Further Loss To HomeownersForeclosure Fraud100% (3)

- The Complete Guide to Passing Your Real Estate Sales License Exam On the First AttemptDari EverandThe Complete Guide to Passing Your Real Estate Sales License Exam On the First AttemptPenilaian: 1.5 dari 5 bintang1.5/5 (3)

- The King Takes Your Castle: City Laws That Restrict Your Property RightsDari EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsBelum ada peringkat

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.Dari EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Belum ada peringkat

- Building Legacy Wealth: Top San Diego Apartment Broker shows how to build wealth through low-risk investment property and lead a life worth imitatingDari EverandBuilding Legacy Wealth: Top San Diego Apartment Broker shows how to build wealth through low-risk investment property and lead a life worth imitatingBelum ada peringkat

- BEYOND THE BRICK WALLS: A critical analysis of the South African Sectional Titles ActDari EverandBEYOND THE BRICK WALLS: A critical analysis of the South African Sectional Titles ActBelum ada peringkat

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemDari EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemBelum ada peringkat

- 09 Prop Flier WebDokumen1 halaman09 Prop Flier Web1ethelBelum ada peringkat

- Analyses 09Dokumen65 halamanAnalyses 091ethelBelum ada peringkat

- TX AmendmentsDokumen6 halamanTX Amendments1ethelBelum ada peringkat

- HRO Report AmendmentsDokumen28 halamanHRO Report Amendments1ethelBelum ada peringkat

- Local Investors Summit 2019 More 9895621248Dokumen52 halamanLocal Investors Summit 2019 More 9895621248Ambrose Mathew100% (1)

- 2020 - UMass Lowell - NCAA ReportDokumen79 halaman2020 - UMass Lowell - NCAA ReportMatt BrownBelum ada peringkat

- Bitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Dokumen3 halamanBitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Bibi JumpolBelum ada peringkat

- CES-107-J Assembly and Test 21000 SeriesDokumen13 halamanCES-107-J Assembly and Test 21000 SeriesJorge SanchezBelum ada peringkat

- Site MappingDokumen74 halamanSite MappingLina Michelle Matheson BrualBelum ada peringkat

- Concall-Transcript-Q2FY22 EdelweissDokumen12 halamanConcall-Transcript-Q2FY22 EdelweissAmeya WartyBelum ada peringkat

- Epstein Exhibit 16Dokumen16 halamanEpstein Exhibit 16Hannah NightingaleBelum ada peringkat

- Oracle Receivables An OverviewDokumen69 halamanOracle Receivables An OverviewmanukleoBelum ada peringkat

- Cat Forklift v225b Spare Parts ManualDokumen23 halamanCat Forklift v225b Spare Parts Manualethanmann190786ikm100% (81)

- Supreme Court: Tañada, Sanchez, Tañada, Tañada For Petitioner. N.M. Lapuz For RespondentDokumen10 halamanSupreme Court: Tañada, Sanchez, Tañada, Tañada For Petitioner. N.M. Lapuz For RespondentDiannee RomanoBelum ada peringkat

- Serrano de Agbayani Vs PNB - DigestDokumen2 halamanSerrano de Agbayani Vs PNB - DigestG Ant Mgd100% (1)

- As 1788-2-1987 Abrasive Wheels Selection Care and UseDokumen6 halamanAs 1788-2-1987 Abrasive Wheels Selection Care and UseyowiskieBelum ada peringkat

- Chapter 3 BOND VALUATIONDokumen2 halamanChapter 3 BOND VALUATIONBrandon LumibaoBelum ada peringkat

- Mactan Cebu Air V Heirs of IjordanDokumen13 halamanMactan Cebu Air V Heirs of Ijordanmonkeypuzzle93Belum ada peringkat

- Depots:: Stagecoach (Midlands)Dokumen15 halamanDepots:: Stagecoach (Midlands)Nathan AmaizeBelum ada peringkat

- OSHA Orientation: Occupational Safety & Health Administration (OSHA)Dokumen31 halamanOSHA Orientation: Occupational Safety & Health Administration (OSHA)raj Kumar100% (1)

- Lupang Hinirang - WikipediaDokumen46 halamanLupang Hinirang - WikipediaYmeri ResonableBelum ada peringkat

- TCS 10 Year Financial Statement FinalDokumen14 halamanTCS 10 Year Financial Statement Finalgaurav sahuBelum ada peringkat

- 12 First Optima Realty Corp vs. SecuritronDokumen2 halaman12 First Optima Realty Corp vs. SecuritronFloyd Mago100% (1)

- Any Rise in Temperature: Isothermal CompressionDokumen6 halamanAny Rise in Temperature: Isothermal CompressionSANLU HTUTBelum ada peringkat

- G. R. No. 108998 Republic Vs Court of Appeals Mario Lapina and Flor de VegaDokumen5 halamanG. R. No. 108998 Republic Vs Court of Appeals Mario Lapina and Flor de VegaNikko Franchello SantosBelum ada peringkat

- UST GOLDEN NOTES 2011-InsuranceDokumen35 halamanUST GOLDEN NOTES 2011-InsuranceAnthonette MijaresBelum ada peringkat

- Echavez v. Dozen Construction PDFDokumen3 halamanEchavez v. Dozen Construction PDFCathy BelgiraBelum ada peringkat

- Rubia Fleet 300 PDFDokumen2 halamanRubia Fleet 300 PDFdnoaisaps100% (1)

- Race, Class, and Gender in The United States An Integrated Study 10th EditionDokumen684 halamanRace, Class, and Gender in The United States An Integrated Study 10th EditionChel100% (10)

- Kant 9 ThesisDokumen6 halamanKant 9 ThesisMary Montoya100% (1)

- 5 Challenges in SG's Social Compact (Tham YC and Goh YH)Dokumen5 halaman5 Challenges in SG's Social Compact (Tham YC and Goh YH)Ping LiBelum ada peringkat

- Finland Pestle AnalysisDokumen4 halamanFinland Pestle AnalysisKart HickBelum ada peringkat

- Appendix Master C1D VisaDokumen6 halamanAppendix Master C1D VisaJared YehezkielBelum ada peringkat

- Database Design Project: Oracle Baseball League Store DatabaseDokumen4 halamanDatabase Design Project: Oracle Baseball League Store Databasehalim perdanaBelum ada peringkat