Group2 Synopsis Emerging Market Risk

Diunggah oleh

Amit Kumar JainHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Group2 Synopsis Emerging Market Risk

Diunggah oleh

Amit Kumar JainHak Cipta:

Format Tersedia

Group 2 Details

1. 2. 3. 4. Prashil Amit Purva Ranjit

Accounting for Sovereign Risk when Investing in Emerging Market

Synopsis The article of Sovereign risk in Emerging market illustrates about the contrast in the traditional and textbook approach in evaluating the investments net present value and how to structure the project investment so as to minimise the risk of expropriation i.e. the political risk. While investing in emerging markets, companies have ever faced the risk of expropriation by the host government in terms of taking over the company or forcibly accepting contracts or by high taxation etc. Hence it becomes important for the companies to consider the risk weighing to the effects of the government. The textbook approach explains that the investment projects are valued by first calculating the expected cash flows that includes all possible risk (including political risk) and then discounting the cash flows at systematic risk rate where as in practice the investment projects are evaluated by estimating the cash flows ignoring the political risk. To account the political risk, the rate used to discount the future cash flows includes both the systematic risk and the risk of expropriation. By traditional approach the cash flows estimated are higher than the true expected cash flows and hence the companies tends to use the higher future cash flows estimations as it sets a better performance benchmark than the forecast which inappropriately sets lower benchmark. Textbook Valuation Approach Adjusting cash flows The textbook DCF approach calculates the value of an investment project by discounting the projects expected future cash flows using a risk-adjusted rate of return that reflects only the systematic or general market, risk of the investment. To estimate the expected cash flow from an investment in another country, we must take into account the risk of expropriation. For example, for an investment to provide a cash flow equal to C at time t, the company must survive until time t. If the probability of expropriation by the government during the period t-1 to t is equal to p(t), then the probability of the firm surviving until time t equals [1-p(t)]^t where we refer to p(t) as the marginal probability of default at time t. In that case, the probability of surviving until year t can be expressed as [1-p(t)]^t and the

expected cash flow at time t, assuming that 100% of the project cash flows are expropriated in the event of default, is equal to C [1-p(t)]^t. The present value (PV) of expected cash flow at time t can be expressed as Assuming p(t)=p is a constant, the probability is (1-p)^t. PV= C(1-p)^t/(1+r)^t Industry approach Adjusting discount rate Industry participants typically adjust the discount rate rather than the cash flows to account for expropriation risk. Present values are then calculated by discounting what we will refer to as the projects promised project cash flows (C) at a discount rate k that reflects both the systematic risk of the project plus a risk adjustment for the risk of expropriation. Using this approach the PV is calculated as PV = C/(1+k)^t Equivalence between textbook and Industry practice From above, the traditional textbook DCF approach and the industry DCF approach generate the same PV if the sovereign default-adjusted return (k) is chosen appropriately. To find this rate, we set both the equations equal to one another and solve for the discount rate as follows k= [(1+r)/(1-p)]-1 Now using an example to find the sovereign default premium through the above equations, it is found out that When we discount cash flows in continuous time, the sovereign risk premium is almost equal to the probability of default p(t) The cumulative probability of expropriation grows dramatically in the early years of a projects life even when the annual probability of expropriation in any given year is very low.

Term Structure of Expropriation of Risk Premium Term Structure suggests that the appropriate discount rate for investments cash flow will be corresponded to the risk of expropriation for each year of the investment life. Front loading Project Cash Flows Using BOT Agreements

Build-operate-transfer (BOT) and build-own-operate transfer (BOOT) agreements are contract designs that can accomplish front-loading of project cash flows to the project sponsor while reducing the risk of expropriation. Also by building the eventual transfer of ownership of the assets into the agreement, the foreign investor can incorporate the economic consequences of the transfer into its analysis of investment cash flows.

Project Financing In Project financing the foreign investment is isolated from the other assets of the investing firm so that any losses due to expropriation are limited to the assets of the project. In order to secure project financing the investor generally requires the support of powerful financial institutions, which might include the major money centre banks and quasi-government agencies

Anda mungkin juga menyukai

- The Promise and Peril of Real OptionsDokumen17 halamanThe Promise and Peril of Real OptionsAmit Kumar JainBelum ada peringkat

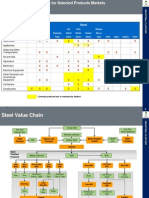

- 2011 07 27 SteelAlminium Value Chain MC FBDokumen8 halaman2011 07 27 SteelAlminium Value Chain MC FBAmit Kumar JainBelum ada peringkat

- Bellary Mining ScamDokumen3 halamanBellary Mining ScamAbheet SethiBelum ada peringkat

- Group2 Synopsis Emerging Market RiskDokumen3 halamanGroup2 Synopsis Emerging Market RiskAmit Kumar JainBelum ada peringkat

- LCG Group Project Draft TLDokumen9 halamanLCG Group Project Draft TLAmit Kumar JainBelum ada peringkat

- Cola Wars Continue: Case AnalysisDokumen10 halamanCola Wars Continue: Case Analysisshreyans_setBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)