Finance Lesson 3

Diunggah oleh

mhussainHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Finance Lesson 3

Diunggah oleh

mhussainHak Cipta:

Format Tersedia

Finance Self Study Guide for Staff of Micro Finance Institutions

LESSON 3

BREAK-EVEN ANALYSIS

Objectives: This session will provide the tools necessary to determine the break-even point for a borrower activity, for an income generating project, or for a micro-finance organization branch. Profitability can be forecast and managed when one knows: i) at what level of production a business will be able to cover all of its expenses; ii) what minimum product price is needed for the product to be viable at different levels of production; and iii) what happens if the financial estimate of costs and prices are changed. You will learn how to calculate a break-even point for an income generating activity and for a branch. Topics covered include:

Fixed costs Variable costs Contribution margin Required break-even volume/revenue Break-even portfolio size

Fixed Costs

The break-even point of a service or product is reached when total revenue equals total costs. Break-Even Analysis is the process of determining the rates at which resources generate revenue and expenses. It is important to calculate the breakeven point to determine if the resources of an organization provide sufficient revenue to meet expenses. The goal is to exceed the break-even point so that additional income (or profit) results. Consider the difference between fixed and variable costs. Fixed costs are those incurred on an ongoing basis and are not dependent on the level of production. [Note: fixed costs may increase with a significant increase in the level of production.] Fixed costs are costs which remain the same regardless of whether the operation makes one product or several hundred. They represent the minimum cost of operations. For example, to rear day-old chicks, an incubator is required. An incubator is a fixed asset and is a cost regardless of the volume of day-old chicks reared. Until a certain volume of production is reached, another incubator is not required. Fixed costs can be capital costs such as the costs to purchase a fixed asset, or operating costs such as rent or utilities. Think of some examples of fixed costs of businesses to which micro-finance organizations might lend. Examples are: rent, depreciation, maintenance and repair, salaries, insurance, utilities, fees, etc. Consider the differences between various businesses and the fixed costs associated with them.

Calmeadow

Finance Study Guide

Lesson 3

Step Costs: Other fixed costs are those that are considered "step" costs or those that increase once specific volume levels are reached. An example would be the purchase of another incubator once a certain number of chicks were produced. Other businesses incur step costs when a new employee is hired as the business grows. In the long-run, all fixed costs are step costs.

Variable Costs

Variable costs are those that are directly related to production and vary depending on the volume produced. For example, to rear more chicks, more day-old chicks are required. The purchase of day-old chicks is a variable cost for the business, that is, it increases with the volume of activity. What are some examples of variable costs of income generating activities? Examples are: raw materials, direct labour, commissions, etc. Place the sheet next to the fixed costs written out earlier. Consider the differences between various businesses and the variable costs associated with them. Variable costs per unit are constant while fixed costs per unit change with the volume of production. For example, if the variable costs (such as fuel, labour, etc.) of irrigating one acre of land are P70, then P700 is required to irrigate ten acres. If the number of acres increases, the variable costs will also increase. However, the variable cost per acre of land remains the same (P70). In contrast, fixed costs per acre of land decrease if the volume of land is increased. If one well supplies water to ten acres of land and the cost of the well is P100,000, then the fixed cost per acre is P10,000. If the volume of land to which the well supplies water is increased to 20 acres from 10, then the fixed cost per acre decreases to P5,000. Fixed costs do not decrease in total but decrease as a per acre cost as the volume of irrigated land increases.

Contribution Margin

To be profitable, all fixed and variable costs must be covered by revenue earned. To determine how much revenue is required per item (price to be charged) to cover all costs, the contribution margin is calculated. The contribution margin is defined as revenue less variable costs per item. Refer to the example on the next page, Break-Even Analysis I and go through each of the fixed and variable costs. Continue with the example and calculate the contribution margin. This is the amount per chair that contributes to covering the fixed costs of the carpentry workshop.

Required Break-Even Volume/Revenue

Continuing with the example, calculate the required break-even volume. The resulting number of chairs is the minimum that must be produced in the time period which the fixed costs are budgeted for to break even. If fixed costs increase due to increased prices or if the cost structure changes then the break even volume will also change.

Calmeadow

Finance Study Guide

Lesson 3

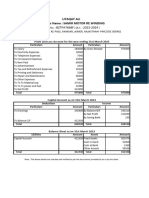

Break Even Analysis I SAMPLE CARPENTRY BUSINESS

Fixed Costs (Monthly) Depreciation of tools (Rd 15,000/year) Rent Utilities Assistants Salary TOTAL Variable Costs per Chair Wood Paint and others TOTAL Revenue per chair (market price) Contribution Margin (Revenue Variable Cost) Contribution Margin per Chair Required Break Even Volume Break Even Point = = Number of chairs required to break even = Required Break Even Revenue Break Even Point Revenue required to break even Total Fixed Costs Contribution Margin 2,170 100 Rd 1,250 500 220 200 2,170 Rd 150 50 200 300 300 200 = 100

22 chairs per month = = = (22 chairs x 200) + fixed costs 4,400 + 2,170 6,570 per month

Many businesses produce more than one item. Break Even Analysis II builds on the same information for fixed costs as Break Even Analysis I except there are now chairs, tables and cabinets being produced which provide different contribution margins. The break-even volume can be calculated on each item produced only if the fixed costs can be split among items. For example, if an equal number of chairs, tables and cabinets are made and they take an equal amount of time to make, then the contribution margins can simply be added together and divided by three. If there are more chairs than tables and cabinets produced, then the number of chairs, tables and cabinets produced must be multiplied by the contribution margin for each. Work through each of the contribution margins on the next page and then calculate the weighted contribution margin and required break-even volume as in the example.

Calmeadow

Finance Study Guide

Lesson 3

Break Even Analysis II SAMPLE CARPENTRY BUSINESS

Variable Costs per Chair (Monthly) Wood Paint and others TOTAL Revenue per chair Contribution Margin (Revenue Variable Cost) Contribution Margin per Chair Variable Costs per Table Wood Paint and others TOTAL Revenue per table Contribution Margin (Revenue Variable Cost) Contribution Margin per Table Variable Costs per Cabinet Wood Paint and others TOTAL Revenue per Cabinet Contribution Margin (Revenue Variable Cost) Contribution Margin per Cabinet Rd 150 50 200 300 300 200 = 100 Rd 250 65 315 450 450 315 = 135 Rd 450 125 575 700 700 575 = 125

Contribution margin of each product:

chairs tables cabinets

100 135 125

Example weighted contribution: If the percentage of total products produced were as follows: chairs 40% tables 30% cabinets 30% 100% and the Contribution Margins for each product were the same as listed above, then: (i) Weighted Contribution Margin = = (ii) Required Break-Even Volume = = (40% x 100) + (30% x 135) + (30% x 125) Rd 118 per item per month Total Fixed Costs Weighted Contribution Margin

2,170 118 = 19 items per month produced in the same proportion as above

Calmeadow

Finance Study Guide

Lesson 3

Break-Even Portfolio Size

Just as it is possible to determine the break-even point for a borrowers business, we can calculate the size of portfolio required for a branch or a micro-finance organization as a whole using break-even analysis. First it is necessary to calculate the Variable Cost Rate: Variable Cost Rate = Total Costs Fixed Costs Average Portfolio Outstanding

Using the effective cost calculation we covered in the last session, an estimation of the yield to the branch or organization can be calculated. This is referred to as the Portfolio Yield Rate and combines all interest and fees charged on the loan. Then we calculate the Contribution Margin (or Overhead Contribution Rate): Contribution Margin = Portfolio Yield Rate Variable Cost Rate As in the previous examples, the Break-Even rate is simply Fixed Costs divided by the Contribution Margin. Go through the following example: Break Even Analysis III BRANCH

Fixed Costs (Annual) Salaries and benefits Rent Utilities Administration costs Other costs TOTAL Variable Costs per Rd 1,000 Outstanding Financial Cost (%) Transportation (%) Loan loss provision (%) TOTAL (%) Revenue (yield) per Rd 1,000 outstanding (%) Rd 16,080 8,400 1,440 3,600 2,400 31,200 6.0 5.4 3.0 14.4 36.0

Contribution Margin (Yield Variable Cost Rate) = 21.6 Contribution = Contribution Margin x Portfolio Outstanding = 21.6% x Rd 1,000 = 216 Required Break Even Volume Break Even Point = = = Total Fixed Costs Contribution 31,200 216 144

Volume of Rd 1,000 outstanding required to break even = 144 x Rd 1,000 outstanding = Rd 144,000 outstanding/year

Calmeadow

Finance Study Guide

Lesson 3

Complete the following Break-even Exercises.

Break-Even Analysis EXERCISES 1. What are fixed costs?

2.

What are variable costs?

3.

What is the break-even point?

4.

Define the contribution margin.

5.

Write down the formula for the break-even point.

Calmeadow

Finance Study Guide

Lesson 3

6.

Define the term step cost.

7.

Selina runs a weaving business. She makes and sells hand woven cloth by the metre. She produces 12 metres of cloth per month which she sells at a stand in the market each Sunday. She borrowed Q2,500 @ 15% annual flat rate from the Finance Fund of Guatemala for 6 months with monthly payments. Other information on her business includes: i) She purchased a hand loom for Q2,000, which she is depreciating over 2 years at Q83 per month ii) The cost of coloured threads is Q250 per metre iii) Transportation costs are Q100 per month iv) Stall rental is Q60 per month v) Selling price of the cloth is Q350 per metre Calculate the break-even point in metres and sales revenue per month.

8.

The ABC Credit company incurs the following monthly expenses: Salaries and benefits Administration expenses Rent and utilities Other fixed expenses Interest on debt @ 12% annual rate per 1,000 Interest paid on deposits @ 6% annual rate per 1,000 Travel and transportation per 1,000 loans outstanding 3,400 1,620 1,440 800 10 5 4.5

The ABC Credit company earns a 20% yield on their loans. Calculate the portfolio size required to break even in a month.

Calmeadow

Anda mungkin juga menyukai

- 3.facilities LayoutDokumen60 halaman3.facilities Layoutsrishti bhatejaBelum ada peringkat

- 18e Key Question Answers CH 7Dokumen2 halaman18e Key Question Answers CH 7AbdullahMughalBelum ada peringkat

- Practice Set Transportation ModelsDokumen15 halamanPractice Set Transportation ModelsSarah DeviBelum ada peringkat

- CostingDokumen3 halamanCostingAarti JBelum ada peringkat

- WG 1 Sep7 Problem SetDokumen2 halamanWG 1 Sep7 Problem SetJotham HensenBelum ada peringkat

- MS WS 1 (Breakeven)Dokumen2 halamanMS WS 1 (Breakeven)Omkar Reddy Punuru100% (1)

- Chapter 4 - Limitations of FunctionalDokumen1 halamanChapter 4 - Limitations of FunctionalHafizah MardiahBelum ada peringkat

- Worksheet 17 CBDokumen8 halamanWorksheet 17 CBTrianbh SharmaBelum ada peringkat

- Module 5 Production System - Capacity PlanningDokumen11 halamanModule 5 Production System - Capacity PlanningTrisha Sargento EncinaresBelum ada peringkat

- 11 Solutions PDFDokumen9 halaman11 Solutions PDFKenneth KibataBelum ada peringkat

- COSTACCTGDokumen112 halamanCOSTACCTGMaria Emarla Grace CanozaBelum ada peringkat

- Service and Production Department Cost AllocationDokumen58 halamanService and Production Department Cost AllocationLorena TudorascuBelum ada peringkat

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDokumen3 halamanADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishBelum ada peringkat

- AC17-602P-REGUNAYAN-End of Chapter 2 ExercisesDokumen12 halamanAC17-602P-REGUNAYAN-End of Chapter 2 ExercisesMarco RegunayanBelum ada peringkat

- Location StrategyDokumen15 halamanLocation Strategyhesham hassanBelum ada peringkat

- Incremental Analysis E7-11Dokumen2 halamanIncremental Analysis E7-11Rehairah Munirah100% (1)

- Assignment 1Dokumen2 halamanAssignment 1Betheemae R. MatarloBelum ada peringkat

- Volunteer Exercise Chapter 12 Harry's Car WashDokumen1 halamanVolunteer Exercise Chapter 12 Harry's Car Washish juneBelum ada peringkat

- The Correct Answer Is: $39,600 DecreaseDokumen11 halamanThe Correct Answer Is: $39,600 DecreaseMir Salman AjabBelum ada peringkat

- Nuview Case: I. Begin The Swot AnalysisDokumen5 halamanNuview Case: I. Begin The Swot AnalysisZhairen Chelseah RinBelum ada peringkat

- Short Term Decision Making 2Dokumen8 halamanShort Term Decision Making 2Pui YanBelum ada peringkat

- Or Ch5 Queing ZaferDokumen12 halamanOr Ch5 Queing ZaferMackeeBelum ada peringkat

- Agan Interior Design - ExerciseDokumen2 halamanAgan Interior Design - ExerciseLouieBelum ada peringkat

- ExercisesDokumen19 halamanExercisesbajujuBelum ada peringkat

- Custom VansDokumen3 halamanCustom VansirishjadeBelum ada peringkat

- Quiz II SCM AnsDokumen3 halamanQuiz II SCM AnsCostina Luc0% (1)

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDokumen14 halamanAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniBelum ada peringkat

- 01 Workload Balancing (LP)Dokumen2 halaman01 Workload Balancing (LP)Holly Alexander100% (1)

- Chapter 12Dokumen1 halamanChapter 12Janice BalabatBelum ada peringkat

- Wall Street Efficiency MeasureDokumen7 halamanWall Street Efficiency MeasureMuhammad HaikalBelum ada peringkat

- Or Asgmt 236Dokumen6 halamanOr Asgmt 236Puja SharmaBelum ada peringkat

- Cost AacctDokumen19 halamanCost AacctKiraYamatoBelum ada peringkat

- Assignment Week 1Dokumen6 halamanAssignment Week 1Naveen TahilaniBelum ada peringkat

- CMA-Unit 3-Costing of Materials 18-19Dokumen48 halamanCMA-Unit 3-Costing of Materials 18-19RahulBelum ada peringkat

- Mid Term Exam - Cost Accounting With AnswerDokumen5 halamanMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDOBelum ada peringkat

- SEATWORKDokumen4 halamanSEATWORKMarc MagbalonBelum ada peringkat

- Baldwin Bicycle CompanyDokumen19 halamanBaldwin Bicycle CompanyMannu83Belum ada peringkat

- Huc Acc201-Revision Questions May Intake, 2022Dokumen29 halamanHuc Acc201-Revision Questions May Intake, 2022Sritel Boutique HotelBelum ada peringkat

- Eoq PDFDokumen23 halamanEoq PDFMica Ella Gutierrez0% (1)

- Ch04 Answer - Chapter 4 Activity-Based Costing Solutions To Questions 4-1 The Most Common Methods of - StuDocuDokumen1 halamanCh04 Answer - Chapter 4 Activity-Based Costing Solutions To Questions 4-1 The Most Common Methods of - StuDocuTadesse MolaBelum ada peringkat

- JobDokumen4 halamanJobNeha SmritiBelum ada peringkat

- MA Tutorial 2Dokumen6 halamanMA Tutorial 2Jia WenBelum ada peringkat

- Practice Problems: Decision MakingDokumen3 halamanPractice Problems: Decision MakingSamar Abdel Rahman100% (1)

- Chapter 12 SolutionsDokumen29 halamanChapter 12 SolutionsAnik Kumar MallickBelum ada peringkat

- MacDokumen4 halamanMacalwar_shi262068100% (1)

- Input Output: Flight Promos Flight Tend MonitoringDokumen2 halamanInput Output: Flight Promos Flight Tend MonitoringDayanara CuevasBelum ada peringkat

- Problems and Exercises in Introduction in Acctg and CVPDokumen4 halamanProblems and Exercises in Introduction in Acctg and CVPJanelleBelum ada peringkat

- Linear ProgrammingDokumen27 halamanLinear ProgrammingBerkshire Hathway cold100% (1)

- Management Accounting Sample QuestionsDokumen14 halamanManagement Accounting Sample QuestionsMarjun Segismundo Tugano IIIBelum ada peringkat

- Module 2. Pascal-Bunagan - Problem Solving ExerciseDokumen5 halamanModule 2. Pascal-Bunagan - Problem Solving ExerciseDiana BunaganBelum ada peringkat

- Capacity Planning: Mcgraw-Hill/IrwinDokumen15 halamanCapacity Planning: Mcgraw-Hill/IrwinKader KARAAĞAÇBelum ada peringkat

- Project Feasibility Studies ch8Dokumen5 halamanProject Feasibility Studies ch8Pradeep KrishnanBelum ada peringkat

- Abhishek 2 - Asset Id 1945007Dokumen3 halamanAbhishek 2 - Asset Id 1945007Abhishek SinghBelum ada peringkat

- Balakrishnan MGRL Solutions Ch14Dokumen36 halamanBalakrishnan MGRL Solutions Ch14Aditya Krishna100% (1)

- Dokumen - Tips 128057344 Chapter 2Dokumen70 halamanDokumen - Tips 128057344 Chapter 2GianJoshuaDayritBelum ada peringkat

- Marginal Cost of ProductionDokumen9 halamanMarginal Cost of ProductionJunayed MostafaBelum ada peringkat

- Contribution Margin Definition - InvestopediaDokumen6 halamanContribution Margin Definition - InvestopediaBob KaneBelum ada peringkat

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDari EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantagePenilaian: 5 dari 5 bintang5/5 (1)

- How Do You Find The Optimal Output AlgebraicallyDokumen7 halamanHow Do You Find The Optimal Output AlgebraicallyasfawmBelum ada peringkat

- Concentration Can Overcome Bad HabitsDokumen4 halamanConcentration Can Overcome Bad HabitsmhussainBelum ada peringkat

- Jokes: - : Doctor Patient Doctor: PatientDokumen2 halamanJokes: - : Doctor Patient Doctor: PatientmhussainBelum ada peringkat

- Wonders of Nature Bird Series 2Dokumen3 halamanWonders of Nature Bird Series 2mhussainBelum ada peringkat

- Let's Resolve To Learn To Control Over AngerDokumen1 halamanLet's Resolve To Learn To Control Over AngermhussainBelum ada peringkat

- Wonders of Nature Bird Series 1Dokumen3 halamanWonders of Nature Bird Series 1mhussainBelum ada peringkat

- Heights of Part 1Dokumen2 halamanHeights of Part 1mhussainBelum ada peringkat

- Concentrate On WealthDokumen3 halamanConcentrate On WealthmhussainBelum ada peringkat

- Ideals Develop by ConcentrationDokumen2 halamanIdeals Develop by ConcentrationmhussainBelum ada peringkat

- Business Results Gained Through ConcentrationDokumen4 halamanBusiness Results Gained Through Concentrationmhussain100% (1)

- Concentrate So You Will Not ForgetDokumen2 halamanConcentrate So You Will Not ForgetmhussainBelum ada peringkat

- How Concentration Can Fulfill Your DesireDokumen3 halamanHow Concentration Can Fulfill Your DesiremhussainBelum ada peringkat

- 11-20 PagesDokumen10 halaman11-20 Pagesapi-19660532Belum ada peringkat

- Ideals Develop by ConcentrationDokumen2 halamanIdeals Develop by ConcentrationmhussainBelum ada peringkat

- Art of Concentrating With Practical ExerciseDokumen9 halamanArt of Concentrating With Practical ExercisemhussainBelum ada peringkat

- Derivative Market Dealers Module 81-90 PagesDokumen10 halamanDerivative Market Dealers Module 81-90 PagesmhussainBelum ada peringkat

- A Concentrated Will DevelopmentDokumen5 halamanA Concentrated Will DevelopmentmhussainBelum ada peringkat

- Art of Concentrating With Practical ExerciseDokumen9 halamanArt of Concentrating With Practical ExercisemhussainBelum ada peringkat

- Mental Control Through CreationDokumen3 halamanMental Control Through CreationmhussainBelum ada peringkat

- A Concentrated Will DevelopmentDokumen5 halamanA Concentrated Will DevelopmentmhussainBelum ada peringkat

- Concentrate On CourageDokumen3 halamanConcentrate On CouragemhussainBelum ada peringkat

- Derivative Market Dealers Module 71-80 PagesDokumen10 halamanDerivative Market Dealers Module 71-80 PagesmhussainBelum ada peringkat

- Capital MarketsDokumen41 halamanCapital Marketssrikwaits4u100% (5)

- 21-30 PagesDokumen10 halaman21-30 Pagesapi-3740451Belum ada peringkat

- Concentrate On WealthDokumen3 halamanConcentrate On WealthmhussainBelum ada peringkat

- Derivative Market Dealers Module 91-106 PagesDokumen16 halamanDerivative Market Dealers Module 91-106 PagesmhussainBelum ada peringkat

- Capital Market and NSDL Book 4Dokumen72 halamanCapital Market and NSDL Book 4mhussainBelum ada peringkat

- Study Material of Capital Markets...Dokumen221 halamanStudy Material of Capital Markets...srikwaits4u91% (22)

- Capital MarketsDokumen41 halamanCapital Marketssrikwaits4u100% (5)

- Capital Market and NSDL Book 3Dokumen103 halamanCapital Market and NSDL Book 3mhussainBelum ada peringkat

- Capital Market and NSDL Book 2Dokumen55 halamanCapital Market and NSDL Book 2mhussainBelum ada peringkat

- Final Oracle Leasing Solution To IFRS16 ASC842Dokumen74 halamanFinal Oracle Leasing Solution To IFRS16 ASC842Rajendran SureshBelum ada peringkat

- Mas Problems 2018Dokumen30 halamanMas Problems 2018Christine Ballesteros Villamayor75% (4)

- Chap 006Dokumen24 halamanChap 006Xeniya Morozova Kurmayeva100% (12)

- Sheet 23 24Dokumen1 halamanSheet 23 24aliliyaqat648Belum ada peringkat

- Hightech Inc Was A Small Company Started by Four Entrepreneurs PDFDokumen1 halamanHightech Inc Was A Small Company Started by Four Entrepreneurs PDFhassan taimourBelum ada peringkat

- 6d25add230 7bab8cc98f PDFDokumen140 halaman6d25add230 7bab8cc98f PDFRiskaAprilliaBelum ada peringkat

- Smith Nephew Pharma Equity AnalysisDokumen60 halamanSmith Nephew Pharma Equity Analysissazk07Belum ada peringkat

- Simbol TradingDokumen25 halamanSimbol TradingEmman ElagoBelum ada peringkat

- Vs PublicDokumen4 halamanVs Publicspam adsBelum ada peringkat

- 5 Years Financial HighlightsDokumen3 halaman5 Years Financial HighlightsMd. Shaikat Alam Joy 1421759030Belum ada peringkat

- Economics For Today 5th Edition Layton Test BankDokumen33 halamanEconomics For Today 5th Edition Layton Test Bankcassandracruzpkteqnymcf100% (26)

- Introduction To AccountingDokumen3 halamanIntroduction To AccountingDamith Piumal Perera100% (1)

- In Year 1 Amc Will Earn 2000 Before Interest andDokumen1 halamanIn Year 1 Amc Will Earn 2000 Before Interest andAmit PandeyBelum ada peringkat

- Final Exam For PhotoDokumen16 halamanFinal Exam For PhotofaizaBelum ada peringkat

- Quiz Budgeting and Standard CostingDokumen2 halamanQuiz Budgeting and Standard CostingAli SwizzleBelum ada peringkat

- EXAMPLE 19.4 Economic Value AddedDokumen34 halamanEXAMPLE 19.4 Economic Value AddedRiniBelum ada peringkat

- ToA - Quizzer 9 Inty PPE & BiologicalDokumen15 halamanToA - Quizzer 9 Inty PPE & BiologicalRachel Leachon100% (1)

- SheDokumen2 halamanSheRhozeiah LeiahBelum ada peringkat

- S7 Capital Structure Online VersionDokumen34 halamanS7 Capital Structure Online Versionconstruction omanBelum ada peringkat

- Problem 3 Accounts ReceivableDokumen11 halamanProblem 3 Accounts ReceivableAngelie Bocala CatalanBelum ada peringkat

- Manarang Auto Repair Shop Journal by The Month of January 2019Dokumen9 halamanManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesBelum ada peringkat

- BTNC3 - Nhom 8Dokumen7 halamanBTNC3 - Nhom 8Lê LinhhBelum ada peringkat

- Abeba Full ResearchDokumen53 halamanAbeba Full Researchadisu desalegnBelum ada peringkat

- CVP Analysis QuizzerDokumen12 halamanCVP Analysis QuizzerBRYLL RODEL PONTINOBelum ada peringkat

- The Merits of An Asset-BasedDokumen4 halamanThe Merits of An Asset-Basedanna maeBelum ada peringkat

- Practice Set 1 ABC-3Dokumen3 halamanPractice Set 1 ABC-3reiBelum ada peringkat

- Profit and Loss Projection 1yr March 2018Dokumen1 halamanProfit and Loss Projection 1yr March 2018Aqsa SajjadBelum ada peringkat

- Strategic Business Reporting Class Notes: (International)Dokumen259 halamanStrategic Business Reporting Class Notes: (International)Ramen ACCA100% (1)

- Q44 46 SolutionDokumen7 halamanQ44 46 SolutiontaikhoanscribdBelum ada peringkat

- Basic AccountingDokumen84 halamanBasic AccountingMusthaqMohammedMadathilBelum ada peringkat