Chaptr 2

Diunggah oleh

Ankita TolasariaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chaptr 2

Diunggah oleh

Ankita TolasariaHak Cipta:

Format Tersedia

Financial statements are the end products of financial accounting.

They are the summarised statements and reports prepared by business concerns to disclose their accounting information and communicate them to the interested parties. Financial statements include mainly two statements which the accountant prepares at the end of a given period. These are Income Statement (Profit and Loss Account) and Position Statement (Balance Sheet). These statements are supplemented by Cash Flow Statement, Fund Flow Statement, Statement of Retained Earnings, Schedules etc. Income Statement: It is prepared to determine the operational position of the concern. It is a statement of revenues earned and the expenses incurred for earning that revenue. The difference is either profit or loss. The income statement is prepared for a particular period. Position Statement: It is one of the important financial statements depicting the financial strength of the concern. It shows on the one hand the properties that it utilises and on the other hand the sources of these properties. The balance sheet shows all the assets owned by the concern and the liabilities and claims it owes to owners and outsiders. It is prepared as on a particular date. Cash Flow Statement: It summarises the causes of changes in cash position of a business enterprise between two Balance Sheet dates. It focuses attention on cash changes only. It describes the sources of cash and its uses. Fund Flow Statement: It is designed to analyse the changes in the financial condition of a enterprise between two periods. This statement will

show the sources from which the funds are received and the uses to which these have been put. Statement of Retained Earnings: Also known as Profit and Loss Appropriation Account. It shows the appropriation of earnings like dividend paid, transfer to reserve, etc. The balance in this account will show the amount of profits retained and carried forward. Schedules: A number of schedules are prepared to supplement the information supplied in the Balance Sheet. The schedules of investments, fixed assets, debtors, etc. are prepared to give details about these transactions. All these schedules are used as part of financial statements.

ANALYSIS

AND

INTERPRETATION

OF

FINANCIAL

STATEMENTS

The financial statements become meaningless unless they are analysed and interpreted. On proper analysis and interpretation of the results, they become of valuable and useful. Managerial decisions often depend on the results of financial statements and their interpretations. Analysis of financial statement is the process of determining the significant operating and financial characteristics of a firm from the accounting data. It is the treatment of the information contained in the financial statements to afford a full diagnosis of the profitability and financial position of the firm. It helps the executives to evaluate past performance, present financial position, liquidating situation, profitability of the firm, and to make forecast for the future earnings.

Interpretation of financial statement refers to drawing inferences or conclusions on the basis of analysis conducted on the financial statements. Proper interpretation leads to proper conclusion and judgement and taking effective measures for improvements.

Objectives of Financial Analysis

Efficiency of operation: The earning capacity of a firm varies between periods due to different factors such as pricing, competition, etc. The analysis of financial statements helps to estimate the effieciency of operations of the firm. The ratios such gross profit ratio, net profit ratio, etc. are calculated and interpreted for the purpose of measuring the efficiency of operations of the business. Measure the financial position and financial performance of the firm: The analysis of financial statement help to gauge the financial position as on any particular date and the financial performance of the firm within the period under review. Long term liquidity of funds: Analysis of financial statements help to determine the long term liquidity of funds. It helps to make arrangement for funds for the future when required. Solvency of the firm: Analysis of Balance Sheet figures helps to measure the solvency of the firm. The solvencies measures by studying the value of assets over liabilities. It shows the debt paying capacity of the firm. Future prospects of the firm: The future prospects of the firm can be ascertained by studying the trend of activities for the last few years and the

expected changes that may take place in the near future. Trend ratios help to measure the future prospects of the business. Progress of the firm: By comparing the profit and loss account and balance sheet figures of the current year with those of the previous year or of the previous years helps to measure the progress of the firm. Comparative statements are prepared for the purpose of measuring the progress of the firm.

Features of Financial Analysis

To present a complex data contained in the financial statement in simple and understandable form. To classify the items contained in the financial statement in convenient and rational groups. To make comparison between various groups to draw various conclusions. Goals Financial analysts often assess the firms: Profitability - The firms ability to earn income and sustain growth in both short-term and long-term. A companys degree of profitability is usually based on the income statement, which reports on the companys results of operations. Solvency - The firms ability to pay its obligation to creditors and other third parties in the long-term. Liquidity - The firms ability to maintain positive cash flow, while satisfying immediate obligations.

Stability The firms ability to remain in business in the long run, without having to sustain significant losses in the conduct of its business. Assessing a companys stability requires the use of the income statement and the balance sheet, as well as other financial and non-financial indicators.

Purpose of Analysis of Financial Statements

To know the earning capacity or profitability. To know the solvency. To know the financial strengths. To know the capability of payment of interest and dividends. To make comparative study with other firms. To know the trend of business. To know the efficiency of management. To provide useful information to management.

Procedure of Financial Statement Analysis

The following procedure is adopted for the analysis and interpretation of financial statements: The analyst should acquaint himself with principles of accounting. He should know the plans and policies of the management so that he may be able to find out whether these plans are properly executed or not. The extent of analysis should be determined so that the sphere of work may be decided. If the aim is to find out the earning capacity of the enterprise, then, analysis of income statement will be undertaken. On the other hand, if financial position is to be studied, then, balance sheet will be necessary.

The financial data given in the statement should be recognized and rearranged. It involves grouping of similar data under same heads, breaking down of individual components of statement according to its nature and reducing the data to a standard form. A relationship is established among financial statements with the help of tools and techniques of financial analysis such as ratios, trends, common size statements, fund flow statements, etc. The information is interpreted in a simple and understandable way. The significance and utility of financial data is explained for help in decision making. The conclusions drawn from interpretation are presented to the management in the form of reports.

Functions of Finance Department

The functions of finance department include the following areas: Effective management of financial resources of the company. Coordinates & Monitors the functions of accounts activities in the units/marketing offers. Establish and maintain systems of financial control, internal check and render advice on financial & accounting matters including examination of feasibility report and detailed project reports. Establish and maintain proper system of budgetary control, cost control and management reporting. Maintain financial accounts and compile annual periodical accounts in accordance with the companies Act, 1956, ensuring the audit of accounts as per law/Govt. directions.

Looks after overall funds management and arranges funds required for the capital schemes and working capital form govt., banks and financial institutions etc. Timely payment of all taxes, levies & duties under the Law, Maintenance of records and filing returns statements connected with such taxes, levies and duties with the appropriate authorities, as per law. All the power involving financial implications are to be exercised in prior consultation with head of concerned finance department. In the event of any difference of opinion between the General Manger and the Head of Finance Dept., the matter shall be referred to Managing Director who after consulting Director (Finance) shall issue appropriate instruction after following the prescribed procedures.

Types of Financial Analysis

Distinction between the different types of financial analysis can be made either on the basis of material used for the same or according to the modus operandi of the analysis or the object of the analysis. The following chart will give a snap-shot view of it. External Analysis: It is made by those who do not have access to the deatailed accounting records of the company, i.e., banks, creditors and general public. These people depend almost entirely on published financial statements. The main objective of such analysis varies from party to party. Internal Analysis: Such analysis is made by the finance and accounting department to help the top management. These people have direct approach to the relevant financial records. So they can peep behind the two basic

financial statements and narrate the inside story. Such analysis emphasises on the performance appraisal and assessing the profitability of different activities. Horizontal Analysis: When the financial statements for a number of years are reviewed and analysed, the analysis is called horizontal analysis. The preparation of comparative statements is an example of horizontal analysis. As it is based on data from year to year, rather than on one date or period or time as a whole, this is also known as Dynamic Analysis. Vertical Analysis: It is also known as Static Analysis. When ratios are calculated from the Balance Sheet of one year, it is called vertical analysis. It is not very useful for long term planning as it does not include the trend study for future. Long term Analysis: In the long run, the company must earn a minimum amount sufficient to maintain a suitable rate of returm on the investment to provide for the necessary growth and development of the company and to meet the cost of capital. Thus, in the long run analysis the stress is on the stability and earning potentiality of the concern. In long term analysis, the fixed assets, long term debt structure and the ownership interst is analysed. Short term Analysis: It is mainly concerned with the working capital analysis. In the short run, a company must have ample funds readily available to meet its current needs and sufficient borrowing capacity to meet the contingencies. Hence, in short term analysis, the current assets and current liabilities are analysed and cash position of the concern is determined. For short term analysis the ratio analysis is very useful.

Tools and Techniques of Financial Analysis (Methods)

The analysis of financial statements consists of a study of relationships and trends to determine whether or not the financial position of the concern and its operating efficiency have been satisfactory. In the process of this analysis, various tools or methods are used by the financial analyst. The analytical tools generally available to an analyst for this purpose are as follows: Comparative financial and operating statements Common-size statements Trend ratios(trend percentages) Average analysis Statement of changes in working capital Funds flow and cash flow analysis Ratio analysis 1. Comparative financial and operating statements: The preparation of comparative financial and operating statements is an important device of horizontal financial analysis. Financial data becomes more meaningful when compared with similar data for a previous period or a number of prior periods. Statements prepared in a form that reflects financial data of two or more periods are known as comparative statements. Such statements are very helpful in measuring the effects of the conduct of a business during the period under consideration. Comparative satatement may show :

Anda mungkin juga menyukai

- New Final ProjDokumen71 halamanNew Final ProjAnkita TolasariaBelum ada peringkat

- Proje PROJctDokumen63 halamanProje PROJctAnkita TolasariaBelum ada peringkat

- IdeaDokumen1 halamanIdeaAnkita TolasariaBelum ada peringkat

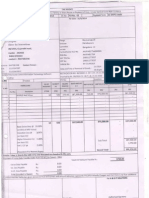

- Tax Invoice Software Excise Duty DetailsDokumen1 halamanTax Invoice Software Excise Duty DetailsAnkita TolasariaBelum ada peringkat

- Financial Statements Are The End Products of Financial AcountingDokumen20 halamanFinancial Statements Are The End Products of Financial AcountingAnkita Tolasaria100% (1)

- IV Semester Cbcss A'2014 - Revised T - T 2014Dokumen18 halamanIV Semester Cbcss A'2014 - Revised T - T 2014Ankita TolasariaBelum ada peringkat

- Apple ComputersDokumen1 halamanApple ComputersAnkita TolasariaBelum ada peringkat

- Final ProjDokumen76 halamanFinal ProjAnkita TolasariaBelum ada peringkat

- Final QuestinnaireeeeeDokumen5 halamanFinal QuestinnaireeeeeRenuTolasariaBelum ada peringkat

- Shree Sai Innovations: 8/1954, Gujarathi Road COCHIN - 682002 MOB:-9567054497Dokumen1 halamanShree Sai Innovations: 8/1954, Gujarathi Road COCHIN - 682002 MOB:-9567054497Ankita TolasariaBelum ada peringkat

- BILLING ADRESS - Sree Vinayaka SystemsDokumen1 halamanBILLING ADRESS - Sree Vinayaka SystemsAnkita TolasariaBelum ada peringkat

- Aditya Agarwal, BiodataDokumen1 halamanAditya Agarwal, BiodataAnkita TolasariaBelum ada peringkat

- Financial Statements Are The End Products of Financial AcountingDokumen20 halamanFinancial Statements Are The End Products of Financial AcountingAnkita Tolasaria100% (1)

- Taj Hotel ProjectDokumen51 halamanTaj Hotel ProjectGosai Jaydeep67% (3)

- Batch Number.......................... YM 09102XN Winning Number........................ TY7448500Dokumen2 halamanBatch Number.......................... YM 09102XN Winning Number........................ TY7448500Ankita TolasariaBelum ada peringkat

- Jas T 3921286742600Dokumen6 halamanJas T 3921286742600Ankita TolasariaBelum ada peringkat

- Delaware Delaware Delaware Delaware Delaware DelawareDokumen6 halamanDelaware Delaware Delaware Delaware Delaware DelawareAnkita TolasariaBelum ada peringkat

- Delaware Delaware Delaware Delaware Delaware DelawareDokumen6 halamanDelaware Delaware Delaware Delaware Delaware DelawareAnkita TolasariaBelum ada peringkat

- SynopsisDokumen2 halamanSynopsisAnkita TolasariaBelum ada peringkat

- Marketing ProjectDokumen83 halamanMarketing ProjectPayal SamsukhaBelum ada peringkat

- Dipti ProjDokumen43 halamanDipti ProjAnkita TolasariaBelum ada peringkat

- Roshny ProjectDokumen74 halamanRoshny Projectsunnycrave100% (1)

- Ratio AnalysisDokumen50 halamanRatio AnalysisAnkita TolasariaBelum ada peringkat

- Ratio AnalysisDokumen50 halamanRatio AnalysisAnkita TolasariaBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Accounts Receivable: QuizDokumen4 halamanAccounts Receivable: QuizRisa Castillo MiguelBelum ada peringkat

- Assets Liabilities Income ExpenditureDokumen16 halamanAssets Liabilities Income ExpenditurevidyaBelum ada peringkat

- Baiq Agita Karenina Pratiwi - A1c019036 - Akl Tugas-2Dokumen12 halamanBaiq Agita Karenina Pratiwi - A1c019036 - Akl Tugas-2Melati SepsaBelum ada peringkat

- WRD 26e - EX 12-24 Chapter 12Dokumen2 halamanWRD 26e - EX 12-24 Chapter 12Thắng KynBelum ada peringkat

- Exodus Company's Trial BalanceDokumen2 halamanExodus Company's Trial BalanceQueen ValleBelum ada peringkat

- Botswana Tax Lecture Slides, SydneyDokumen84 halamanBotswana Tax Lecture Slides, SydneysmedupeBelum ada peringkat

- RBI extends DCCO for stalled projects with new ownershipDokumen6 halamanRBI extends DCCO for stalled projects with new ownershipTinyZuneBelum ada peringkat

- Responsibility Accounting, Transfer Pricing and Balance ScorecardDokumen9 halamanResponsibility Accounting, Transfer Pricing and Balance ScorecardLobenia RenalynBelum ada peringkat

- Chapter 6 Financial AssetsDokumen6 halamanChapter 6 Financial AssetsJoyce Mae D. FloresBelum ada peringkat

- Finals - IADokumen6 halamanFinals - IAShariine BestreBelum ada peringkat

- Financial Statement Analysis GuideDokumen3 halamanFinancial Statement Analysis GuideAmit KumarBelum ada peringkat

- WTON - Annual Report - 2017 PDFDokumen742 halamanWTON - Annual Report - 2017 PDFbuwat donlotBelum ada peringkat

- FManAcc Learning Week 12 Seminar Questions 2020 - 2021Dokumen4 halamanFManAcc Learning Week 12 Seminar Questions 2020 - 2021A.M NationBelum ada peringkat

- Indian Financial SystemDokumen9 halamanIndian Financial SystemVyshnav esBelum ada peringkat

- Seylan Bank Annual Report 2016Dokumen302 halamanSeylan Bank Annual Report 2016yohanmataleBelum ada peringkat

- I/zlanila: Section As ofDokumen25 halamanI/zlanila: Section As ofGilbert AguillonBelum ada peringkat

- Chapter 10Dokumen50 halamanChapter 10duy blaBelum ada peringkat

- Financial Management - Exercise 2 (NPV & IRR)Dokumen7 halamanFinancial Management - Exercise 2 (NPV & IRR)Tanatip VijjupraphaBelum ada peringkat

- EARRINGS UNLIMITED BUDGETDokumen3 halamanEARRINGS UNLIMITED BUDGETsinbad9772% (18)

- Chapter 11 Financial Preparation For Entrepreneurial VenturesDokumen27 halamanChapter 11 Financial Preparation For Entrepreneurial VenturesBlue StoneBelum ada peringkat

- SagaxDokumen168 halamanSagaxJosepBelum ada peringkat

- SEC Opinion 12-06 - Treasury SharesDokumen3 halamanSEC Opinion 12-06 - Treasury SharesArvinBelum ada peringkat

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Dokumen4 halamanAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainBelum ada peringkat

- CARODokumen9 halamanCAROSai Lakshmi PBelum ada peringkat

- Investment advisor ethics questionsDokumen15 halamanInvestment advisor ethics questionsBảo TrâmBelum ada peringkat

- Valuation: Accounting For Risk and The Expected ReturnDokumen43 halamanValuation: Accounting For Risk and The Expected ReturnWoozy ZiBelum ada peringkat

- Checklist For Effective Due Diligence of Commercial LeasesDokumen8 halamanChecklist For Effective Due Diligence of Commercial LeasesKalyan DuttBelum ada peringkat

- Due Diligence Checklist Inhouse BSPDokumen3 halamanDue Diligence Checklist Inhouse BSPRajesh BogulBelum ada peringkat

- Difference Between Sole Proprietorship, Partnership & Joint Stock CompanyDokumen12 halamanDifference Between Sole Proprietorship, Partnership & Joint Stock CompanyPradip MehtaBelum ada peringkat

- Financial Accounting Problems and SolutionsDokumen10 halamanFinancial Accounting Problems and SolutionsThe ShiningBelum ada peringkat