Negotiable Instruments Law Essentials

Diunggah oleh

wuanabananaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Negotiable Instruments Law Essentials

Diunggah oleh

wuanabananaHak Cipta:

Format Tersedia

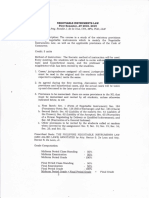

NEGOTIABLE INSTRUMENTS LAW By Atty. Mary Ann L.

Reyes

COURSE OUTLINE

I.

INTRODUCTION 1) History, Governing Laws (Act 2031, Code of Commerce, New Civil Code) 2) Applicability of the Negotiable Instruments Law Read: Kauffman vs. PNB, 42 Phil 182, Sept. 29 1921 GSIS vs. CA, 170 SCRA 533, February 23, 1989 3) Concept of Negotiable Instruments a) Negotiable Instruments Defined b) Functions of Negotiable Instruments c) What is Legal Tender [Sec. 52, 60, New Central Bank Act; BSP Circular no. 537, (2006)] Read: Tibajia vs. CA, 223 SCRA 163 PAL vs. CA, GR 49188, Jan. 30, 1990 4) Characteristics of Negotiable Instruments 5) Incidents in the Life of Negotiable Instruments 6) Kinds of Negotiable Instruments a) Negotiable Promissory Notes (Sec. 184, NIL) i. parties to a negotiable promissory note ii. kinds of negotiable promissory note b) Bills of Exchange (Sec. 126, 185, NIL) i. parties to a bill of exchange ii. kinds of bills of exchange 7) When Bill Treated as Notes (Sec. 17e, 130, NIL) 8) Bills and Notes Distinguished

9) Negotiable Instruments Compared with other Papers Read: Sesbreno vs. CA, GR 89252, May 24, 1993

10) Some Non-Negotiable Instruments a) b) c) d) Documents of Title Letters of Credit Certificates of Stock Postal Money Order

Read: Philippine Education Co. vs. Soriano, GR L-22405, June 30, 1971 e) Treasury Warrants

II.

FORM AND INTERPRETATION OF NEGOTIABLE INSTRUMENTS 1) How Negotiability is Determined Read: Caltex (Philippines) vs. CA, 212 SCRA 448, Aug. 10, 1992 2) Effect of Estoppel Read: Banco de Oro vs. Equitable Banking Corp., 157 SCRA 188 (1988) Phil. Bank of Commerce vs. Aruego, 102 SCRA 530, Jan. 31, 1981 3) Requisites of Negotiability (Sec. 1, NIL) a) must be in writing and signed by the maker or drawer (Sec. 191, NIL) b) must contain an unconditional promise or order to pay a sum certain in money i. ii. Promise or Order to Pay (Sec. 10, NIL) Promise or Order Must Be Unconditional

1) resolutory and suspensive condition (Art. 1173, 1181, NCC) 2) period 3) when is promise unconditional (Sec. 3, 39, NIL) 4) sum certain in money (Sec. 2, 5d, 6e, NIL; CB Circular 799, July 1, 2013; Art. 2209, Civil Code; acceleration, insecurity, extension clauses) Read: Metropolitan Bank vs. CA, 194 SCRA 169, Feb. 18, 1991 c) must be payable on demand or at a fixed or determinable future time Read: Pay vs. Palanca, 57 SCRA 618 d) must be payable to order or bearer (Sec. 8, 9, 184, NIL) Read: Ang Tek Lian vs. CA, 87 Phil 383, Sept. 25, 1950) e) drawee must be named or indicated with reasonable certainty (Sec. 1e, 130, NIL) 4) Omissions and Provisions That Do Not Affect Negotiability 5) Interpretation of Instruments

III.

FORM AND INTERPRETATION OF NEGOTIABLE INSTRUMENTS 1) Issuance/Delivery of Negotiable Instruments (Sec. 15, 16, 191, NIL) Read: Dela Victoria vs. Burgos, 245 SCRA 374, June 27, 1995 2) Negotiation Defined (Sec. 30, NIL) 3) Assignment and Negotiation Distinguished; Liability of Assignor (Art. 348, Code of Commerce) Read: Casabuena vs. CA, 286 SCRA 594 4) How are Negotiable Instruments and Non-Negotiable Instruments Transferred

Read: Sesbreno vs. CA, 222 SCRA 466, May 24, 1993 Consolidated Plywood vs IFC Leasing, 149 SCRA 448, April 30, 1987 Traders Royal Bank vs CA, 269 SCRA 16, March 3, 1997 5) How Negotiation Takes Place (Sec. 16, 30, 40, NIL) Read: Manuel Lim vs CA, 251 SCRA 409, Dec. 19, 1995 Dela Victoria vs Burgos, 245 SCRA 374, June 27, 1995 Development Bank of Rizal vs Sima Wei, 217 SCRA 743, March 9, 1993 6) Incomplete Negotiation of Order Instrument (Sec. 49, NIL) 7) Where Indorsement Should be Placed (Sec. 31, NIL) 8) When Person Deemed Indorser (Sec. 63, NIL) 9) Other Rules on Indorsement (Sec. 31, 32, 40-48, 49, NIL) Read: Enrique Montinola vs PNB, 68 Phil 178, Feb. 26, 1951 Ang Tek Lian vs CA, GR L-2516, Sept. 25, 1950 10) Kinds of Indorsement (Sec. 33, NIL) a) Blank and Special Indorsements (Sec. 34, 35, NIL) i. conversion of blank to special indorsement (Sec. 35, NIL)

b) Qualified and General Indorsement (Sec. 38, 65, NIL) Read: Metropol (Bacolod) Financing vs. Sambok Motors, 120 SCRA 864, Feb. 28, 1983 c) Conditional Indorsement (Sec. 39, NIL) d) Restrictive Indorsement (Sec. 36, 37, 47, NIL) Read: Gempesaw vs. CA, 218 SCRA 628, Feb. 9, 1993 e) Absolute Indorsement

f) Joint Indorsement (Sec. 41, NIL) g) Irregular Indorsement (Sec. 64, NIL) 11) When Indorsement Necessary (Sec. 30, 184, NIL) 12) Indorsement of Entire Instrument (Sec. 32, NIL) 13) Indorsement of Bearer Instrument (Sec. 40, NIL) 14) Indorsement When Payable to Two or More Persons (Sec. 41, NIL) 15) Indorsement in Representative Capacity (Sec. 44, NIL) 16) Presumption on Time, Place of Indorsement (Sec. 45, 46, NIL) 17) Continuation of Negotiable Character (Sec. 47, NIL) 18) Negotiation by Prior Party (Sec. 50, NIL) 19) Striking Out of Indorsement (Sec. 48, NIL) 20) Effect of Transfer Without Indorsement (Sec. 49, NIL) 21) Consideration for Issuance and Subsequent Transfer (Sec. 24, NIL) 22) What Constitutes Value (Sec. 25, NIL) Read: Bibiano Banas vs. CA, 325 SCRA 259, Feb. 10, 2000 23) Effect if Value Previously Given (Sec. 26, NIL) 24) Holder for Value (Sec. 26, 27, NIL) 25) Effect of Want of Consideration (Sec. 28, NIL) IV. HOLDERS 1) What is a holder (Sec. 191, NIL) a) Classes of Holder (Sec. 26, 27, 52, NIL)

b) Rights of Holders (Sec. 51, 88, 119, NIL) Read: Chan Wan vs Tan Kim, 109 Phil 706, Sept. 30, 1960 Atrium Management vs CA, 144 SCAD 390, Feb. 28, 2001 Marcelo Mesina vs CA, 145 SCRA 497, Nov. 13, 1986 2) Holders in Due Course (Sec. 52, 53, 54, 55, 56, 88, NIL) a) instrument complete and regular b) taken before overdue (Sec. 4, 7, 53, 83, 85, NIL) c) previously dishonored (Sec. 83, 149, NIL) d) notice of infirmity or defect (Sec. 54, 55, 56, NIL) e) good faith Read: De Ocampo vs Gatchalian, 3 SCRA 596, Nov. 30, 1961 Yang vs CA, No. 138074, Aug. 15, 2003 Bataan Cigar vs CA, 230 SCRA 643 (1994) Stelco Marketing vs CA, 210 SCRA 51, June 17, 1992 f) holder for value (Sec. 24-27, NIL) 3) Presumption of Due Course Holding (Sec. 59, NIL) 4) Rights of Holders in Due Course (Sec. 14, 16, 57, NIL); When Subject to Original Defenses (Sec. 58, NIL) Read: Salas vs CA, 181 SCRA 296 State Investment House vs CA, 175 SCRA 311, July 13, 1989 Prudencio vs CA, 143 SCRA 7, July 14, 1986 Stelco Marketing vs CA, GR No. 96160, June 17, 1992 5) Rights of Holders Not in Due Course (Sec. 14, 16, 51, 53, NIL) 6) Accomodation Parties (Sec. 29, NIL) 7) Shelter Rule (Sec. 58, NIL) Read: Charles Fossum vs Fernandez Hermanos, 44 Phil 713

V.

PARTIES WHO ARE LIABLE 1) Primary and Secondary Liability Distinguished (Sec. 61, 66, 192, NIL) 2) Payment By Party Secondarily Liable (Sec. 68, 70, 84, 89, 118, 120, 151, 184, NIL) 3) Liability vs. Warranties 4) Liability and/or Warranties of Parties a) Maker (Sec. 60, NIL) b) Drawer (Sec. 61, NIL) i. ii. Relationship with Drawee Relationship with Collecting Bank

Read: Jai-Alai vs BPI, 66 SCRA 29, Aug. 6, 1975 c) Acceptor (Sec. 62, 127, 139-141, 143, 165, 189, NIL) Read: PNB vs. Picornell, 46 Phil 716, Sept. 26, 1922 PNB vs CA, 25 SCRA 693, Oct. 29, 1968 d) Indorsers (Sec. 63, 68, NIL) i. General Indorser (Sec. 66, NIL)

Read: Ang Tiong vs Ting, 22 SCRA 713, Feb. 22, 1968 People vs Maniego, 148 SCRA 30, Feb. 27, 1987 (a) conditions precedent to make unqualified indorser liable ii. Qualified Indorser (Sec. 65, NIL)

iii.

Indorsers of Bearer Instruments (Sec. 40, 65, 67, NIL) Irregular Indorser (Sec. 64, NIL) Liability of Accommodation Party (Sec. 29, 52, NIL)

iv. v.

Read: Clark vs Sellner, GR 16477, Nov. 22, 1921 Crisologo vs CA, 177 SCRA 594, Sept. 15, 1989 PNB vs Maza, GR 24224, Nov. 3, 1925 Maulini vs Serrano, 28 Phil 640, Dec. 16, 1914 vi. Order of Liability (Sec. 68, NIL)

Read: People vs Maniego e) Persons Negotiating By Delivery (Sec. 65, NIL) f) Liability of Agent or Broker (Sec. 19-21, 69, NIL) Read: Philippine Bank of Commerce vs Aruego g) Person Who Should Sign (Sec. 18, NIL) i. Exceptions: Those who do not sign in their own names or whose signatures do not appear in instrument itself but are still liable (a) trade or assumed name (Sec. 18, NIL) (b) agent/authorized representative (Sec. 19, NIL) (c) incapacitated persons signing through legal guardians (d) forgers of signatures (Sec. 23, NIL) (e) those precluded from setting up defense of forgery (Sec. 23, NIL) (f) constructive acceptance (Sec. 137, NIL) (g) allonge (h) negotiating by mere delivery (Sec. 65, NIL)

VI.

DEFENSES 1) Real and Personal Defenses Distinguished 2) Real Defenses a) Minority and Ultra Vires Acts (Sec. 22, NIL) i. Defense of Minority not Total (See Art. 1341, New Civil Code Read: Atrium Management Corp. vs CA, GR 109491, Feb. 28, 2001 Crisologo-Jose vs CA, GR 80599, Sept. 15, 1989 b) Non-Delivery of an Incomplete Instrument (Sec. 15, 16, NIL) c) Fraud in Factum (vs Fraud in Inducement) Read: Salas vs CA, GR 76788, January 22, 1990 Prudencio vs CA, 143 SCRA 7, July 14, 1986 d) Forgery and Want of Authority (Sec. 23, NIL); Cut-off Rule i. ii. iii. iv. Forgery of Makers Signature Of Indorsers Signature Of Drawers Signature Forgery of Bearer Instrument

Read: Associated Bank vs. CA, GR 107382, Jan. 31, 1996 (doctrine of comparative negligence) Gempesaw vs. CA, 218 SCRA 682, Feb. 9, 1993 Republic vs. Estrada, GR L-40769, July 31, 1975 MWSS vs CA v. Persons Precluded from Setting Up Forgery

Read: MWSS vs CA, GR L-62943, July 14, 1986 Metropolitan Bank vs CA, 194 SCRA 169 (1991)

Samsung Construction vs Far East Bank, GR 129015, Aug. 15, 2003 PNB vs Quimpo, 158 SCRA 582, March 14, 1988 Banco de Oro vs Equitable Banking, GR 74917, Jan. 20, 1988 Westmont Bank vs Eugene Ong, GR 132250, Jan. 30, 2002 Ilusorio vs CA, GR 139130, Nov. 27, 2002 Traders Royal Bank vs RPN, GR 138510, Oct. 10, 2002 BPI vs CA e) Material Alteration [partial defense] (Sec. 124, 125, NIL) Read: PNB vs. CA, 256 SCRA 491, April 25, 1996 Montinola vs. PNB, 88 Phil 178, Feb. 26, 1951 i. Alteration of negotiable instrument a crime (Art. 172, Revised Penal Code) Alteration of Amount in NI Immaterial Alterations

ii. iii. f) Extinctive Prescription

Read: PCIB vs CA, 350 SCRA 446 Papa vs AU Valencia, 284 SCRA 643, Jan. 23, 1998 g) Illegality

3) Personal Defenses a) Ante-dating or post-dating (Sec. 12, NIL) b) Insertion of Wrong Date (Sec. 13, NIL) c) Filling up Blanks Beyond Authority (Sec. 14, NIL) d) Absence or Failure of Consideration (Sec. 28, NIL) Read: State Investment House vs CA

e) Simple Fraud, Duress, Intimidation, Force or Fear, Illegality of Consideration, Breach of Faith (Sec. 55, 56, 57, NIL) f) Want of Delivery of Complete Instrument (Sec. 16, NIL) g) Fraud in Inducement Read: Great Eastern Insurance vs. Hongkong and Shanghai Banking Corp., GR 18657, Aug. 23, 1922 Quirino Gonzalez Logging vs CA, GR 126568, April 20, 2003

VII.

ENFORCEMENT OF LIABILITY a) Parties Primarily and Secondarily Liable i. how to enforce primary liability (Sec. 60, 62, NIL)

b) General Steps in Enforcing Secondary Liability i. Promissory Notes (a) Presentment for Payment (Sec. 70, NIL) (b) Notice of Dishonor (Sec. 89, NIL) ii. Bills of Exchange (a) presentment for acceptance, when mandatory (Sec. 143, NIL) (b) if dishonored by non-acceptance 1. notice of dishonor (Sec. 89, 115, 116, NIL) 2. protest (Sec. 159, NIL) (c) if accepted 1. presentment for payment, unless excused/not required

(d) if dishonored upon presentment for payment 1. notice of dishonor 2. protest (e) for acceptor for honor, referee in case of need 1. protest for non-payment (Sec. 165, NIL) c) Presentment for Payment i. ii. iii. iv. Concept (Sec. 70, NIL) Requisites for Sufficiency of Payment (Sec. 72, NIL) Date of Presentment (Sec. 71, NIL) Rule in Determining Maturity Date (Sec. 85, NIL) a. fixed date b. payable on demand c. payable at a bank (Sec. 75, NIL) Rule in Computing Time (Sec. 86, NIL) Rule if Payable at a Bank (Sec. 75, 87, 127, 187, NIL) Place of Presentment (Sec. 70, 73, NIL) Presentment to Party Primarily Liable (Sec, 60, 62, 74, 76, 77, 78, NIL)

v. vi. vii. viii.

d) When Presentment Excused, Not Required (Sec. 79-82, NIL) e) Dishonor by Non-Payment (Sec. 83, NIL) f) Liability of Person Secondarily Liable When Instrument Dishonored (Sec. 84, NIL) Read: Crisologo-Jose vs. CA, Sept. 15, 1989 Salas vs CA, Jan. 22, 1990 PNB vs CA, 256 SCRA 491 Associated Bank vs CA, Jan. 31, 1996 Great Eastern vs Hongkong Shanghai Bank, Aug. 23, 1922

Republic vs Ebrada, July 31, 1975 PNB vs Quimpo, March 14, 1988 Gempesaw vs CA, Feb. 9, 1993 PCIBank vs CA, 350 SCRA 446 Papa vs AU Valencia, 284 SCRA 643 Far East Realty vs Cam, 166 SCRA 256 (1988) McGuire vs Province of Samar, GR L-8155, Oct. 23, 1956 Asia Banking vs Javier, GR 19051, April 1923 Gullas vs PNB, GR 43191, Nov. 13, 1935 Nyco Sales vs BA Finance, 200 SCRA 637, 1991 Great Asian Sales vs CA. GR 105774, April 25, 2002 Luis Wong vs CA, GR 117857, Feb. 2. 2001 g) Presentment for acceptance i. ii. iii. How made (Sec. 145, NIL) When made (Sec. 143, 144, NIL) Acceptance; requisites (Sec. 132, NIL) (a) how made (Sec. 132, 133-135, 137, 145, 72, 75, NIL) iv. v. vi. vii. viii. When deemed accepted (Sec. 137, NIL) Future bills (Sec. 135, NIL) Time to accept (Sec. 136, 146-147, NIL) Rule when incomplete bill accepted (Sec. 138, NIL) Kinds of acceptance (Sec. 139-142, NIL(

h) When Presentment for Acceptance Excused (Sec. 148, NIL) i) Dishonor by Non-Acceptance (Sec. 149, 150, 151, NIL) j) Notice of Dishonor (Sec. 89, NIL) i. ii. iii. iv. v. vi. vii. when instrument considered dishonored (Sec. 149, NIL) by whom given (Sec. 90, NIL) notice by agent (Sec. 91, 92, 94, NIL) time to give notice (Sec. 102-107, NIL) form of notice (Sec. 95, 96, NIL) to whom notice given (Sec. 97-101, NIL) place of notice (Sec. 108, NIL)

viii. ix. x. k) Protest i. ii. iii. iv. v. vi. vii. viii. ix. x.

when notice not required, excused, or dispensed with (Sec. 109-115, 118, NIL) other rules (Sec. 116, 117, NIL) delay in giving notice (Sec. 113, NIL)

by whom made (Sec. 154, NIL) when required (Sec. 152, 161, 167, 170, NIL) when protest need not be made (Sec. 118, NIL) protest for non-acceptance, non-payment (Sec. 157, NIL) how made (Sec. 153, NIL) when to be made (Sec. 155, NIL) protest for better security (Sec. 158, NIL) where made (Sec. 156, NIL) when protest dispensed with (Sec. 159, NIL) protest where bill lost (Sec. 160, NIL)

l) Notice of Dishonor vs. Protest m) Acceptance for Honor (Sec. 161-170, NIL) n) Acceptance for Honor vs Ordinary Acceptance o) Payment for Honor (Sec. 173-177, NIL) p) Acceptance for Honor vs Payment for Honor q) Payment by Person Primarily Liable vs Payment for Honor r) Bills in Sets (Sec. 178-183, NIL) VIII. DISCHARGE OF INSTRUMENTS a) Concept of Discharge b) How Instrument Discharged (Sec. 119, 120, NIL) i. payment in due course (Sec. 88, NIL) 1. by the principal debtor (Sec. 119a, NIL)

2. by the accommodated party (Sec. 119b, NIL) 3. payment by person secondarily liable (See Sec. 121, NIL); right of party who discharges instrument 4. to whom must payment be made ii. iii. renunciation by holder (Sec. 22, NIL) intentional cancellation 1. rule in case of unintentional cancellation (Sec. 123, NIL) iv. any act that discharges simple contracts (Art. 1231, Civil Code) principle debtor becomes holder

v.

c) Discharge of Persons Secondarily Liable (Sec. 120, NIL) d) Discharge of Prior Party e) Tender of Payment f) Release of Principal Debtor g) Extension of Term h) Payment for Honor (Sec. 171-177, NIL) i) Right of Party Who Discharges Instrument (Sec. 121, NIL) j) Surrender of Instrument upon Discharge Read: State Investment House vs CA, GR 101163, Jan. 11, 1993

IX.

CHECKS a) Checks defined (Sec. 185, 186, 189, NIL)

Read: Banco de Oro Savings vs Equitable Banking Corp., 157 SCRA 188 (1988) b) Distinguished from Drafts Read: RP vs Philippine National Bank, GR L-16106, Dec. 30, 1961 c) Relationship between Drawer, Drawee, and Payee d) Kinds of Checks i. cashiers check and managers check (See BSP Circular 259 series of 2000 and Circular 291, series of 2001) certified check (Sec. 187-189, NIL)

ii.

Read: New Pacific Timber vs Hon. Seneris, Dec. 19, 1980 PNB vs National City Bank of New York, 63 Phil 711 iii. crossed check (Art. 541, Code of Commerce) 1. kinds of crossed check 2. effects of crossing a check Read: Associated Bank vs CA, 208 SCRA 468 (1992) Bataan Cigar vs CA, 230 SCRA 648, March 3, 1994 Gempesaw vs CA, 218 SCRA 682, Feb 3, 1994 State Investment House vs IAC, 174 SCRA 310 iv. memorandum and travellers checks

Read: People vs Nitafan, GR No. 75954, Oct. 22, 1992

e) Checks and Bills of Exchange Distinguished f) Relationship between Payee, Drawer, Drawee Read: Spouses Moran vs CA, GR No. 105836, March 7, 1994 Gempesaw vs CA Hongkong and Shanghai Bank vs Catalan, Oct. 18, 2004 g) When Required to be Presented for Payment (Sec. 185, NIL) h) Effect of Death of Drawer i) Pertinent Philippine Clearing House Corp. rules; RA 7653, New Central Bank Act, Sec. 102 i. ii. iii. iv. relationship of parties warranties 24-hour rule iron clad rule for cashiers checks

Read: Mesina vs IAC j) Crimes Involving Checks i. ii. estafa [Revised Penal Code, Art. 315 (2d)] BP 22

Read: Domagsang vs CA, 347 SCRA 75 (2000) iii. Check Kiting [Art. 315 (1b), RPC)

Read: Ramos vs CA, 203 SCRA 657

Anda mungkin juga menyukai

- Negotiable Instruments Law GuideDokumen8 halamanNegotiable Instruments Law Guidempo_214Belum ada peringkat

- Negotiable Instruments Course OutlineDokumen13 halamanNegotiable Instruments Course OutlinePJDBelum ada peringkat

- Negotiable Instruments Law SyllabusDokumen11 halamanNegotiable Instruments Law SyllabusRamos GabeBelum ada peringkat

- Course Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Dokumen12 halamanCourse Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Nica Cielo B. LibunaoBelum ada peringkat

- COURSE OUTLINE ON NEGOTIABLE INSTRUMENTSDokumen9 halamanCOURSE OUTLINE ON NEGOTIABLE INSTRUMENTSJericho Christian Fabian BautistaBelum ada peringkat

- NEGOSyllabusDokumen10 halamanNEGOSyllabusBianca Alana Hizon LimjucoBelum ada peringkat

- Nego Cases - Atty. Reyes (Ausl)Dokumen7 halamanNego Cases - Atty. Reyes (Ausl)Anonymous 3hf2TXf100% (1)

- SYLLABUS Negotiable Instruments LawDokumen5 halamanSYLLABUS Negotiable Instruments Lawkeithnavalta100% (1)

- Negotiable Instruments Law EssentialsDokumen3 halamanNegotiable Instruments Law EssentialsRay Joshua ValdezBelum ada peringkat

- Credtrans 23Dokumen6 halamanCredtrans 23Bayani KamporedondoBelum ada peringkat

- Negotiable Instruments Syllabus (2015)Dokumen7 halamanNegotiable Instruments Syllabus (2015)Netweight100% (1)

- Syllabus For Negotiable Instruments LawDokumen11 halamanSyllabus For Negotiable Instruments LawmickBelum ada peringkat

- Credit Transactions Syllabus PBCDokumen6 halamanCredit Transactions Syllabus PBCBayani Kamporedondo100% (1)

- Negotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRADokumen8 halamanNegotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRAdnel13Belum ada peringkat

- Syllabus - Negotiable InstrumentsDokumen8 halamanSyllabus - Negotiable InstrumentsRoy Angelo NepomucenoBelum ada peringkat

- Negotiable Instruments Law SyllabusDokumen13 halamanNegotiable Instruments Law Syllabusk santosBelum ada peringkat

- Negotiable Instruments Law Course OutlineDokumen9 halamanNegotiable Instruments Law Course OutlineChris Dianne Miniano SanchezBelum ada peringkat

- Introduction to Negotiable Instruments LawDokumen17 halamanIntroduction to Negotiable Instruments LawArvin AbyadangBelum ada peringkat

- Syllabus, Negotiable Instruments LawDokumen3 halamanSyllabus, Negotiable Instruments LawBong Bong SilupBelum ada peringkat

- Negotiable Instruments Law Course OutlineDokumen8 halamanNegotiable Instruments Law Course OutlineMarie Jade Ebol AranetaBelum ada peringkat

- Nego - Outline (2015)Dokumen7 halamanNego - Outline (2015)Mak FranciscoBelum ada peringkat

- Course Syllabus: Negotiable Instruments (Act 2031)Dokumen9 halamanCourse Syllabus: Negotiable Instruments (Act 2031)Jessamine OrioqueBelum ada peringkat

- Negotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 TibajiaDokumen8 halamanNegotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajiairishgrace1234Belum ada peringkat

- Negotiable Instruments Syllabus 1Dokumen6 halamanNegotiable Instruments Syllabus 1JirehPorciuncula100% (1)

- Nego OutlineDokumen7 halamanNego OutlineFncsixteen UstBelum ada peringkat

- NEGOTIABLE INSTRUMENTS LAW Course OutlineDokumen7 halamanNEGOTIABLE INSTRUMENTS LAW Course OutlineRee-Ann Escueta Bongato100% (4)

- Negotiable Instruments Outline GuideDokumen9 halamanNegotiable Instruments Outline GuideKrishielle AnneBelum ada peringkat

- Philippine Civil Law Concepts and ApplicationsDokumen3 halamanPhilippine Civil Law Concepts and ApplicationsJela SyBelum ada peringkat

- SYLLABUSDokumen7 halamanSYLLABUSDiane JulianBelum ada peringkat

- JMC College of LawDokumen12 halamanJMC College of LawJhay-r Bayotlang IIBelum ada peringkat

- Negotiable Instrument Law - Course Syllabus - USJR 2nd Sem 2020-2021Dokumen7 halamanNegotiable Instrument Law - Course Syllabus - USJR 2nd Sem 2020-2021Walpurgis NightBelum ada peringkat

- SG On The Special Commercial Laws 7-20-17Dokumen16 halamanSG On The Special Commercial Laws 7-20-17bernaBelum ada peringkat

- Course Guide For Negotiable Instruments Law Ay 2020 21Dokumen21 halamanCourse Guide For Negotiable Instruments Law Ay 2020 21Jia BBelum ada peringkat

- Credit TransDokumen8 halamanCredit TransMa-an SorianoBelum ada peringkat

- CREDIT TRANSACTIONS OUTLINEDokumen8 halamanCREDIT TRANSACTIONS OUTLINEthornapple25Belum ada peringkat

- Caltex Phil. Inc. v. Court of Appeals, 212 SCRA 448 Development Bank of Rizal v. Sima Wei, 219 SCRA 736Dokumen8 halamanCaltex Phil. Inc. v. Court of Appeals, 212 SCRA 448 Development Bank of Rizal v. Sima Wei, 219 SCRA 736EJ T TaningcoBelum ada peringkat

- Law 412Dokumen14 halamanLaw 412Alyanna BarreBelum ada peringkat

- Syllabus on Philippine Constitutional LawDokumen10 halamanSyllabus on Philippine Constitutional LawnitzBelum ada peringkat

- Edited Dlsu College of Law Syllabus 2Dokumen13 halamanEdited Dlsu College of Law Syllabus 2khristel_calantoc_57Belum ada peringkat

- Torts and Damages Under Dean AlbanoDokumen1 halamanTorts and Damages Under Dean AlbanoEdione CueBelum ada peringkat

- Torts and Damages Under Dean AlbanoDokumen1 halamanTorts and Damages Under Dean AlbanoEdione Cue100% (1)

- Syllabus in Credit Transactions PDFDokumen4 halamanSyllabus in Credit Transactions PDFLouise Ysabel SacloloBelum ada peringkat

- Confilct of Laws SyllabusDokumen5 halamanConfilct of Laws SyllabusAbhor TyrannyBelum ada peringkat

- Col CasesDokumen10 halamanCol CasesMary GraceBelum ada peringkat

- Negotiable Instruments Law EssentialsDokumen7 halamanNegotiable Instruments Law EssentialsJoovs JoovhoBelum ada peringkat

- Credit Transactions 2019.0717Dokumen13 halamanCredit Transactions 2019.0717Paul S.D.Belum ada peringkat

- Corporation Law Outline 2020Dokumen12 halamanCorporation Law Outline 2020Jim ParedesBelum ada peringkat

- Supreme Court upholds land titles in Manotok caseDokumen6 halamanSupreme Court upholds land titles in Manotok caseSK Fairview Barangay BaguioBelum ada peringkat

- Course Outline in Obligation & Contracts (Prof. Elmer T. Rabuya)Dokumen2 halamanCourse Outline in Obligation & Contracts (Prof. Elmer T. Rabuya)Anonymous 10aeOc2Belum ada peringkat

- Legislative Powers and Constitutional ConstructionDokumen10 halamanLegislative Powers and Constitutional ConstructionJohn Dexter FuentesBelum ada peringkat

- Cases in Civil CodeDokumen4 halamanCases in Civil CodeAnne DerramasBelum ada peringkat

- Course Outline CLR1Dokumen34 halamanCourse Outline CLR1Pam NolascoBelum ada peringkat

- COMMERCIAL LAW REVIEW OutlineDokumen25 halamanCOMMERCIAL LAW REVIEW OutlinemifajBelum ada peringkat

- Commercial Law ReviewDokumen28 halamanCommercial Law ReviewmifajBelum ada peringkat

- Corporation Law Outline 2019136839796Dokumen12 halamanCorporation Law Outline 2019136839796Vincent Bernardo100% (1)

- LAW 517 – STATUTORY CONSTRUCTIONDokumen15 halamanLAW 517 – STATUTORY CONSTRUCTIONApple Grace GaydaBelum ada peringkat

- Iran-United States Claims Arbitration: Debates on Commercial and Public International LawDari EverandIran-United States Claims Arbitration: Debates on Commercial and Public International LawBelum ada peringkat

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1972.Dari EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1972.Belum ada peringkat

- How to Exercise Statutory Powers Properly: Cayman Islands Administrative LawDari EverandHow to Exercise Statutory Powers Properly: Cayman Islands Administrative LawBelum ada peringkat

- Panama v. France)Dokumen24 halamanPanama v. France)wuanabananaBelum ada peringkat

- Japan v. Russian FederationDokumen36 halamanJapan v. Russian FederationwuanabananaBelum ada peringkat

- Japan v. Russian FederationDokumen36 halamanJapan v. Russian FederationwuanabananaBelum ada peringkat

- Calvo C. UCPB General InsuranceDokumen6 halamanCalvo C. UCPB General InsurancewuanabananaBelum ada peringkat

- Calimutan V PeopleDokumen17 halamanCalimutan V PeoplewuanabananaBelum ada peringkat

- Benedicto vs. IacDokumen3 halamanBenedicto vs. IacRishel TubogBelum ada peringkat

- Other Long Term InvestmentsDokumen1 halamanOther Long Term InvestmentsShaira MaguddayaoBelum ada peringkat

- International Financial Reporting StandaDokumen122 halamanInternational Financial Reporting StandaZain AliBelum ada peringkat

- Far110 Group Assignment 2Dokumen7 halamanFar110 Group Assignment 21ANurul AnisBelum ada peringkat

- Brand Portfolio at LOrealDokumen17 halamanBrand Portfolio at LOrealFaheemBelum ada peringkat

- Parcor Chapter 1Dokumen6 halamanParcor Chapter 1Taylor SwiftBelum ada peringkat

- Proposal Preparation of Manganese Ore and Copper OreDokumen17 halamanProposal Preparation of Manganese Ore and Copper OreleniucvasileBelum ada peringkat

- Greenfield Airport PolicyDokumen9 halamanGreenfield Airport Policyjim mehtaBelum ada peringkat

- Book of Hull - Week 1Dokumen6 halamanBook of Hull - Week 1zamunda0809Belum ada peringkat

- Chapter 11 - InnovationDokumen32 halamanChapter 11 - Innovationjdphan100% (1)

- Econ 202 Pre-Test 1 Chapters (4, 22-24)Dokumen8 halamanEcon 202 Pre-Test 1 Chapters (4, 22-24)Amogh SharmaBelum ada peringkat

- FTIL Annual Report 2009Dokumen180 halamanFTIL Annual Report 2009Alwyn FurtadoBelum ada peringkat

- Analysis of Financial StatementsDokumen48 halamanAnalysis of Financial StatementsNguyễn Thùy LinhBelum ada peringkat

- Manufacturing sector's Nifty weighting up in 2022Dokumen49 halamanManufacturing sector's Nifty weighting up in 2022lovishBelum ada peringkat

- Wells Fargo Scandal: Compiled and Presented By: M.Hashim, Muneeb Tariq, Hamza Arif and Sher KhanDokumen24 halamanWells Fargo Scandal: Compiled and Presented By: M.Hashim, Muneeb Tariq, Hamza Arif and Sher KhanHashim MalikBelum ada peringkat

- Stock Market IndexDokumen27 halamanStock Market Indexjubaida khanamBelum ada peringkat

- D Ifta Journal 00Dokumen48 halamanD Ifta Journal 00dan397100% (1)

- Financial Statements 2018 Adidas Ag eDokumen86 halamanFinancial Statements 2018 Adidas Ag ewaskithaBelum ada peringkat

- Deep Learning in Trading PDFDokumen10 halamanDeep Learning in Trading PDFRicardo Velasco GuachallaBelum ada peringkat

- A Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019Dokumen36 halamanA Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019ArunBelum ada peringkat

- Capital Structure Theories VivaDokumen43 halamanCapital Structure Theories VivaPuttu Guru PrasadBelum ada peringkat

- Lecture 2a - Construction EquipmentDokumen37 halamanLecture 2a - Construction EquipmentLouise Luy100% (1)

- ExxonMobil Analysis ReportDokumen18 halamanExxonMobil Analysis Reportaaldrak100% (2)

- Coca Cola Balance Sheet Analysis 2009-2005Dokumen2 halamanCoca Cola Balance Sheet Analysis 2009-2005Devender SinghBelum ada peringkat

- UK Railways Rolling Stock Procurement and LeasingDokumen20 halamanUK Railways Rolling Stock Procurement and Leasingsanto_tango100% (1)

- GBusiSBG11 PDFDokumen168 halamanGBusiSBG11 PDFkemime100% (2)

- Draft Resolution For Society-TrustDokumen2 halamanDraft Resolution For Society-Trustammaiappar0% (2)

- Economic Survey 2018-19: Key HighlightsDokumen468 halamanEconomic Survey 2018-19: Key HighlightsAmit JaiswalBelum ada peringkat

- Industry-Specific Interview Prep: Banks, Insurance, Real Estate & MoreDokumen3 halamanIndustry-Specific Interview Prep: Banks, Insurance, Real Estate & MoreCedric TiuBelum ada peringkat

- Financial Statements and Ratio Analysis: ChapterDokumen25 halamanFinancial Statements and Ratio Analysis: Chapterkarim67% (3)

- Trade War Between US and ChinaDokumen1 halamanTrade War Between US and ChinaRajarshi MaityBelum ada peringkat