FINS1613 Lecture Notes

Diunggah oleh

0b1ivionHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FINS1613 Lecture Notes

Diunggah oleh

0b1ivionHak Cipta:

Format Tersedia

Lecture Notes Week 1 FINS1613

Introduction

3/16/2014 10:37:00 PM

Fundamental questions What projects should a firm purchase? How should a firm raise money for and distribute profits from projects? o How do they raise capital? o How do they raise profits? A business plan Evaluating the opportunity Projects Key Characteristics o Profits and costs cash flows determined by (i) expected amount and (ii) expected timing o Uncertainty risk described by possible outcomes from

the project Types of Firms Terminology o Ownership The right to share in a firms profits o Control The right to directly manage or elect management of a firm o Personal Liability The responsibility to pay a firms financial obligations using personal assets when the firm cannot o Limited liability A limit that the owner can only lose the value of their investment when the firm cannot pay its financial obligations Sole Trader o Business owned and controlled by a single person o Personally liable for firms debts o Business ceases existence with death or withdrawal of the sole trader o Profits taxed at personal level o Also known as sole proprietorships o If the business fails, the bank can force the business (and owner) to sell assets to repay the loan General Partnership o Equal partnership between all parties o Equal liabilities

o If the business fails, the bank can lay claim against the assets of all the General Partners Limited Partnership o At least one limited partner; has ownership, but no control o If the business fails, the bank can lay claim against the assets of all the General Partners, only. Partnerships o Business owned by several partners General partners Ownership, control, and personal liability Limited partners Ownership, no control and limited liability o Profits taxed at personal level o Business ceases to exist with death or withdrawal of a single general partner unless other provisions are made Corporation o Includes shareholders o Board of Directors Each director is elected by the firms owners Hired the CEO o CEO Monitors firm and sets high level strategy Objective is to maximize firm value Everyday manager of the firm Implements rules and policies set by the board of directors Advised by high level executives Objective is to maximise firm value

o Chief Financial Officer (CFO) Evaluates investment decisions for the fimr Evaluates financing decisions for the firm Objective is to maximise firm value Key features of a corporation It is its own legal entity, distinct from the owners There is a separation of powers o Advantages over partnerships and sole traders Limited liability for the owners

Business continues operation when ownership

changes o Disadvantages Agency costs We assume that employees have their own objectives These personal objectives may not always agree with the value of maximizing objective of the firms owners An agency cost arises when an employee takes an action that serves their own interests instead of maximizing firm value Taxation o If the business fails, the bank can lay claim only against the assets of the company The Financial Manager Two primary responsibilities o Investment decisions Which projects should the firm pursue? o Financial decisions How should the firm raise capital to finance these projects? How should the firm distribute profits to investors? Section 1: Financial Mathematics Time Value of Money The difference in value between money today and money in the future. Or, the observation that two cash flows at two different points in time have different values (A dollar today is worth more than a dollar tomorrow) In order to compare or combine cash flows it is necessary to

convert all values to the same units by moving them to a common point in time Compounding Interest = Principle x (Interest Rate/100) Compounding Assumption We will always assume that interest is kept in the account. Therefore, the ending value in one period becomes the starting principle used to compute the interest payment in the subsequent period

Compounding Interest = Principle x (1+Interest Rate

Decimal)^n Discounting To calculate the equivalent present value of a cash flow in the future, multiply the future cash flow by a discount factor, or equivalently, divide by the appropriate interest rate factor. Discounting = P x (1/(1+r)n)

Lecture Notes Week 2 FINS1613

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Dividend FundamentalsDokumen2 halamanDividend Fundamentalsmousy_028Belum ada peringkat

- Production Management 15 Solved MCQS Part 1 PDFDokumen3 halamanProduction Management 15 Solved MCQS Part 1 PDFJasonSpring46% (13)

- Chapter 9 - Responsibility AccountingDokumen44 halamanChapter 9 - Responsibility Accountingsathishiim1985Belum ada peringkat

- International Marketing Handout 2022 P67Dokumen57 halamanInternational Marketing Handout 2022 P67Vu LyeBelum ada peringkat

- Global Media Culture: A World of IdeasDokumen4 halamanGlobal Media Culture: A World of IdeasSherelyn RoblesBelum ada peringkat

- Five-Forces Analysis For CSD Cola Wars CDokumen2 halamanFive-Forces Analysis For CSD Cola Wars CasheBelum ada peringkat

- Answers To FAR 2 Final ExaminationDokumen13 halamanAnswers To FAR 2 Final ExaminationSarah Quijan Boneo100% (1)

- A Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreDokumen74 halamanA Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreThasleem Athar95% (40)

- GST Calu-Aug-19 PDFDokumen1 halamanGST Calu-Aug-19 PDFLokambal RBelum ada peringkat

- ACCOUNTANCYDokumen292 halamanACCOUNTANCYSomen SahaBelum ada peringkat

- SM ch04Dokumen54 halamanSM ch04Rendy Kurniawan100% (1)

- Social Science Class 10 QuestionDokumen20 halamanSocial Science Class 10 Questionradhe thakurBelum ada peringkat

- Management PrerogativesDokumen13 halamanManagement PrerogativesJoseph CabreraBelum ada peringkat

- Loan Appraisal FrameworkDokumen29 halamanLoan Appraisal FrameworkNguyenCanh DuongBelum ada peringkat

- Offer Letter For Marketing ExecutivesDokumen2 halamanOffer Letter For Marketing ExecutivesRahul SinghBelum ada peringkat

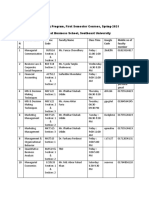

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberDokumen2 halamanSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকBelum ada peringkat

- The Bretton Woods Institutions and Their RoleDokumen12 halamanThe Bretton Woods Institutions and Their RoleUwayo NoelBelum ada peringkat

- Bonus StatementDokumen1 halamanBonus StatementSonu Sharma Club fanBelum ada peringkat

- Document1nsd A JnbasdhbkjhdhbkgehkgfDokumen4 halamanDocument1nsd A JnbasdhbkjhdhbkgehkgfAhmed NoorBelum ada peringkat

- International Labour OrganizationDokumen14 halamanInternational Labour OrganizationTroeeta BhuniyaBelum ada peringkat

- Microeconomics Assignment 2Dokumen4 halamanMicroeconomics Assignment 2Stremio HubBelum ada peringkat

- CA Refresher For LIC AAODokumen70 halamanCA Refresher For LIC AAOBibhuti bhusan maharanaBelum ada peringkat

- Assignment-Managerial Economics AssignmentDokumen17 halamanAssignment-Managerial Economics Assignmentnatashashaikh93Belum ada peringkat

- LankaBangla Annual Integrated Report 2019Dokumen392 halamanLankaBangla Annual Integrated Report 2019Afia Nazmul 1813081630Belum ada peringkat

- Chapter 1. The Role of Business in Social and Economic DevelopmentDokumen4 halamanChapter 1. The Role of Business in Social and Economic DevelopmentArk KnightBelum ada peringkat

- Wheat Follow Up Sept 23Dokumen9 halamanWheat Follow Up Sept 23Leonardo IntriagoBelum ada peringkat

- Auditing Problem Assignment Lyeca JoieDokumen12 halamanAuditing Problem Assignment Lyeca JoieEsse ValdezBelum ada peringkat

- StrategicDokumen41 halamanStrategicLogeswaran RajanBelum ada peringkat

- Anas WCMDokumen5 halamanAnas WCMAnas FareedBelum ada peringkat