Thesis

Diunggah oleh

givens201Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Thesis

Diunggah oleh

givens201Hak Cipta:

Format Tersedia

Literary Review: Article Summaries 1. Adaval, R., & Wyer, R. S. (2011).

Conscious and nonconscious comparisons with price anchors: Effects on willingness to pay for related and unrelated products. Consumers use price anchors to create relative price points at which they feel comfortable making a purchase with the least cognitive dissonance. This article demonstrates the relationship between related and unrelated products and how consumers associate causes attached to a purchase. 2. Cai, G., Chao, X., & Li, J. (2009). Optimal reserve prices in name-your-own-price auctions with bidding and channel options. Study analyzes the niche market of NYOP marketing schemes, specifically the structure of Priceline.com. People that use NYOP websites like Priceline.com are motivated to do so by price and psychological sensitive benefits. The author also postulated that select your own price may be better than NYOP because it requires less cognitive effort. 3. Fay, S. (2009). Competitive reasons for the name-your-own-price channel. Article explains how NYOP can help soften competition. When implementing NYOP, consumers differ in their frictional costs and can differentiate retailers from posted price rivals. 4. Hinz, O., Hann, I., & Spann, M. (2011). Price discrimination in E-commerce? an examination of dynamic pricing in name-your-own price markets. Compares fixed threshold price setting with adaptive threshold price setting. Weighing in on consumer cognition and the unfairness factor of adaptive pricing, the article shows that adaptive price setting is more profitable for companies. 5. Karahan, N. G., & Abbas, A. E. (2012). Measuring consumer impatience and the effects of timing in name-your-own-price channels. Analyzes optimal bidding scheme for NYOP. The paper analyzes the companys profit with changes in threshold price, the number of repeat bids, and the bidder charateristics. 6. Koschate-Fischer, N., Stefan, I. V., & Hoyer, W. D. (2012). Willingness to pay for cause-related marketing: The impact of donation amount and moderating effects. 7. O'Loughlin, H. (2010, Thursday, September 2, 2010). 3 tips for naming your own price: Learn from panera bread and radiohead. 8. Robinson, S. R., Irmak, C., & Jayachandran, S. (2012). Choice of cause in cause-related marketing. Study analyzes cause-related marketing and allowing consumers to choose the cause, rather than the company predetermining the cause. The study also shows this only works when the choice gives consumers a perception of a greater personal role of the cause. Choice may also have a negative role in some conditions. 9. Shapiro, D. (2011). Profitability of the name-your-own-price channel in the case of risk-averse buyers.

Shapiro shows the profitability of NYOP and how it can attract more consumers relatively to posted price products. NYOP with alternative pricing captures consumers that would have otherwise been excluded from participating due to demand constraints. 10. Spann, M., Skiera, B., & Schfers, B. (2004). Measuring individual frictional costs and willlngness-to-pay via name- your-own-price mechanisms. This article examines the frictional costs involved in NYOP and the implications they have in a buyers decision making process. They develop a pricing scheme that estimates a consumers willingness-to-pay along with the limitations they impose. 11. Wilson, J. G., & Zhang, G. (2008). Optimal design of a name-your-own price channel. This article examines the conflict of producer/consumer need to maximize profit the and the conflict that ensues. The article entails an explicit solution to the problem, allowing NYOP to be a win-win solution for both buyer and seller.

References Adaval, R., & Wyer, R. S. (2011). Conscious and nonconscious comparisons with price anchors: Effects on willingness to pay for related and unrelated products. Journal of Marketing Research (JMR), 48(2), 355-365. doi:10.1509/jmkr.48.2.355

Cai, G., Chao, X., & Li, J. (2009). Optimal reserve prices in name-your-own-price auctions with bidding and channel options. Production & Operations Management, 18(6), 653-671. doi:10.1111/j.1937-5956.2009.01045.x

Fay, S. (2009). Competitive reasons for the name-your-own-price channel. Marketing Letters, 20(3), 277-293. doi:10.1007/s11002-009-9070-9

Hinz, O., Hann, I., & Spann, M. (2011). Price discrimination in E-commerce? an examination of dynamic pricing in name-your-own price markets. MIS Quarterly, 35(1), 81-A10.

Karahan, N. G., & Abbas, A. E. (2012). Measuring consumer impatience and the effects of timing in name-your-own-price channels. IEEE Transactions on Engineering Management, 59(2), 226-239. doi:10.1109/TEM.2011.2122336

Koschate-Fischer, N., Stefan, I. V., & Hoyer, W. D. (2012). Willingness to pay for cause-related marketing: The impact of donation amount and moderating effects. Journal of Marketing Research (JMR), 49(6), 910-927. doi:10.1509/jmr.10.0511

O'Loughlin, H. (2010, Thursday, September 2, 2010). 3 tips for naming your own price: Learn from panera bread and radiohead. Message posted to http://blog.roominatemarketing.com/2010/09/3-tips-for-naming-your-own-price-learn.html

Robinson, S. R., Irmak, C., & Jayachandran, S. (2012). Choice of cause in cause-related marketing. Journal of Marketing, 76(4), 126-139. doi:10.1509/jm.09.0589

Shapiro, D. (2011). Profitability of the name-your-own-price channel in the case of risk-averse buyers. Marketing Science, 30(2), 290-304. doi:http://mktsci.journal.informs.org/archive/

Spann, M., Skiera, B., & Schfers, B. (2004). Measuring individual frictional costs and willlngness-to-pay via name- your-own-price mechanisms. Journal of Interactive Marketing (John Wiley & Sons), 18(4), 22-36. doi:10.1002/dir20022

Wilson, J. G., & Zhang, G. (2008). Optimal design of a name-your-own price channel. Journal of Revenue & Pricing Management, 7(3), 281-290. doi:10.1057/rpm.2008.13

Anda mungkin juga menyukai

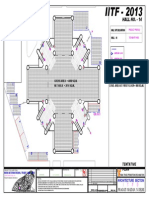

- Hall 12-12ADokumen1 halamanHall 12-12Agivens201Belum ada peringkat

- Hall 14Dokumen1 halamanHall 14givens201Belum ada peringkat

- IITF - 2013: Hall 11 Hall 10 Hall 9 Hall 8Dokumen1 halamanIITF - 2013: Hall 11 Hall 10 Hall 9 Hall 8givens201Belum ada peringkat

- Exhibitor ListDokumen3 halamanExhibitor Listgivens201Belum ada peringkat

- 1-The Ashesi-Swarthmore Summer CourseDokumen9 halaman1-The Ashesi-Swarthmore Summer Coursegivens201Belum ada peringkat

- List of Foreign Participants: Sr. No. Publisher's NameDokumen1 halamanList of Foreign Participants: Sr. No. Publisher's Namegivens201Belum ada peringkat

- A Dmit Ca RD For W Ritten Tests: Dear C AndidateDokumen1 halamanA Dmit Ca RD For W Ritten Tests: Dear C Andidategivens201Belum ada peringkat

- Back To The RevolutionDokumen17 halamanBack To The Revolutiongivens201Belum ada peringkat

- 3rdyear Assesment Notice 2011 12Dokumen1 halaman3rdyear Assesment Notice 2011 12givens201Belum ada peringkat

- Obtained Dept List TribalDokumen1 halamanObtained Dept List Tribalgivens201Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Ticket: Fare DetailDokumen1 halamanTicket: Fare DetailSajal NahaBelum ada peringkat

- P01 - PT in Building & Its AdvantagesDokumen11 halamanP01 - PT in Building & Its AdvantagesPartha Pratim RoyBelum ada peringkat

- Densha: Memories of A Train Ride Through Kyushu: By: Scott NesbittDokumen7 halamanDensha: Memories of A Train Ride Through Kyushu: By: Scott Nesbittapi-16144421Belum ada peringkat

- Properties of WaterDokumen23 halamanProperties of WaterNiken Rumani100% (1)

- Vendor Registration FormDokumen4 halamanVendor Registration FormhiringBelum ada peringkat

- Intro To MavenDokumen18 halamanIntro To MavenDaniel ReckerthBelum ada peringkat

- Dependent ClauseDokumen28 halamanDependent ClauseAndi Febryan RamadhaniBelum ada peringkat

- MegaMacho Drums BT READ MEDokumen14 halamanMegaMacho Drums BT READ MEMirkoSashaGoggoBelum ada peringkat

- Unit 1 Bearer PlantsDokumen2 halamanUnit 1 Bearer PlantsEmzBelum ada peringkat

- New Presentation-Group AuditingDokumen23 halamanNew Presentation-Group Auditingrajes wariBelum ada peringkat

- Land CrabDokumen8 halamanLand CrabGisela Tuk'uchBelum ada peringkat

- VRARAIDokumen12 halamanVRARAIraquel mallannnaoBelum ada peringkat

- Study and Interpretation of The ScoreDokumen10 halamanStudy and Interpretation of The ScoreDwightPile-GrayBelum ada peringkat

- Final SEC Judgment As To Defendant Michael Brauser 3.6.20Dokumen14 halamanFinal SEC Judgment As To Defendant Michael Brauser 3.6.20Teri BuhlBelum ada peringkat

- E-CRM Analytics The Role of Data Integra PDFDokumen310 halamanE-CRM Analytics The Role of Data Integra PDFJohn JiménezBelum ada peringkat

- Oil List: Audi Front Axle DriveDokumen35 halamanOil List: Audi Front Axle DriveAska QianBelum ada peringkat

- EPMS System Guide For Subcontractor - V1 2Dokumen13 halamanEPMS System Guide For Subcontractor - V1 2AdouaneNassim100% (2)

- Advanced Herd Health Management, Sanitation and HygieneDokumen28 halamanAdvanced Herd Health Management, Sanitation and Hygienejane entunaBelum ada peringkat

- APJ Abdul Kalam Success StoryDokumen1 halamanAPJ Abdul Kalam Success StorySanjaiBelum ada peringkat

- Acute Suppurative Otitis MediaDokumen41 halamanAcute Suppurative Otitis Mediarani suwadjiBelum ada peringkat

- Music Production EngineeringDokumen1 halamanMusic Production EngineeringSteffano RebolledoBelum ada peringkat

- Initial Police Report: Calamba City Police Station Brgy Real, Calamba City, Laguna E-Mail: 545-1694/545-6789 Loc 8071Dokumen1 halamanInitial Police Report: Calamba City Police Station Brgy Real, Calamba City, Laguna E-Mail: 545-1694/545-6789 Loc 8071Jurish BunggoBelum ada peringkat

- PCM Cables: What Is PCM Cable? Why PCM Cables? Application?Dokumen14 halamanPCM Cables: What Is PCM Cable? Why PCM Cables? Application?sidd_mgrBelum ada peringkat

- The Original Lists of Persons of Quality Emigrants Religious Exiles Political Rebels Serving Men Sold For A Term of Years Apprentices Children Stolen Maidens Pressed and OthersDokumen609 halamanThe Original Lists of Persons of Quality Emigrants Religious Exiles Political Rebels Serving Men Sold For A Term of Years Apprentices Children Stolen Maidens Pressed and OthersShakir Daddy-Phatstacks Cannon100% (1)

- Actron Vismin ReportDokumen19 halamanActron Vismin ReportSirhc OyagBelum ada peringkat

- Power System Protection (Vol 3 - Application) PDFDokumen479 halamanPower System Protection (Vol 3 - Application) PDFAdetunji TaiwoBelum ada peringkat

- Corelink Mmu600ae TRM 101412 0100 00 enDokumen194 halamanCorelink Mmu600ae TRM 101412 0100 00 enLv DanielBelum ada peringkat

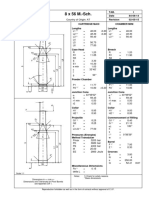

- 8 X 56 M.-SCH.: Country of Origin: ATDokumen1 halaman8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimBelum ada peringkat

- Sage TutorialDokumen115 halamanSage TutorialChhakuli GiriBelum ada peringkat

- Case ColorscopeDokumen7 halamanCase ColorscopeRatin MathurBelum ada peringkat