General Knowledge Today - 88

Diunggah oleh

niranjan_meharDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

General Knowledge Today - 88

Diunggah oleh

niranjan_meharHak Cipta:

Format Tersedia

Articles from General Knowledge Today

How RBI regulates Commercial Banks

2011-04-28 09:04:06 GKToday

To do a business of commercial banking in India, whether it is India or Foreign, a license from RBI is required. Opening of Branches is handled by the Branch Authorization Policy. This policy was made easier in recent times and an important provision is that : Indian banks no longer require a license from the Reserve Bank for opening a branch at a place with population of below 50,000. Corporate Governance: RBI policy ensures high quality corporate governance in banks. CRR and SLR: These are called Statutory Pre-emptions. Commercial banks are required to maintain a certain portion of their Net Demand and Time Liabilities (NDTL) in the form of cash with the Reserve Bank, called Cash Reserve Ratio (CRR) and in the form of investment in unencumbered approved securities, called Statutory Liquidity Ratio (SLR). Interest Rates: The interest rates on most of the categories of deposits and lending transactions have been deregulated and are largely determined by banks. Reserve Bank regulates the interest rates on savings bank accounts and deposits of non-resident Indians (NRI), small loans up to rupees two lakh, export credits and a few other categories of advances. Prudential Norms: Prudential Norms refers to ideal / responsible norms maintained by the banks. RBI issues "Prudential Norms" to be followed by the commercial banks to strengthen the balance sheets of banks. Some of them are related to income recognition, asset classification and provisioning, capital adequacy, investments portfolio and capital market exposures. RBI has issued its guidelines under the Basel II for risk management. Apart from that, RBI issues the public disclosure norms to enforce the market disciplines. Now all banks are required to disclose in their annual reports about capital adequacy, asset quality, liquidity, earnings aspects and penalties, if any, imposed on them. Similarly, the KYC norms (Know Your

Customer) Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) guidelines are some of the major issues on which RBI keeps issuing its norms and guidelines. Annual Onsite Inspection: RBI undertakes annual on-site inspection of banks to assess their financial health and to evaluate their performance in terms of quality of management, capital adequacy, asset quality, earnings, liquidity position as well as internal control systems. Based on the findings of the inspection, banks are assigned supervisory ratings based on the CAMELS rating. OSMOS: OSMOS refers to Off Site Surveillance and Monitoring System. The RBI requires banks to submit detailed and structured information periodically under OSMOS. On the basis of OSMOS, RBI analyzes the health of the banks.

Anda mungkin juga menyukai

- Further To The Above Developments, in July 2008, RBI Took Strict Measures To The Unsolicited Cards IssueDokumen21 halamanFurther To The Above Developments, in July 2008, RBI Took Strict Measures To The Unsolicited Cards IssueGourav Kumar SwainBelum ada peringkat

- Banking and Insurance - Assignment: TopicDokumen16 halamanBanking and Insurance - Assignment: TopicVinay SharmaBelum ada peringkat

- Module 4 Eco Sem 3Dokumen18 halamanModule 4 Eco Sem 3sruthikadug22Belum ada peringkat

- Principles and Practices of Banking: RBI - Functions and PoliciesDokumen7 halamanPrinciples and Practices of Banking: RBI - Functions and Policiespassion481Belum ada peringkat

- Rbi and Sebi Role in Financial System of IndiaDokumen4 halamanRbi and Sebi Role in Financial System of IndiaLokesh YadavBelum ada peringkat

- L-3 Regulatory Framework For Banks - RBIDokumen46 halamanL-3 Regulatory Framework For Banks - RBIVinay SudaniBelum ada peringkat

- Session. 2. Functions of RBIDokumen11 halamanSession. 2. Functions of RBIArbazuddin shaikBelum ada peringkat

- RRB Po GK Power CapsuleDokumen59 halamanRRB Po GK Power CapsuleDetective ArunBelum ada peringkat

- RRB Po Clerk Capsule 2015Dokumen59 halamanRRB Po Clerk Capsule 2015Abhishek GeraBelum ada peringkat

- IIBF Monthly Newsletter Highlights Banking Industry ChangesDokumen8 halamanIIBF Monthly Newsletter Highlights Banking Industry Changesluvnuts4u luvnutsBelum ada peringkat

- Supervisory FunctionsDokumen2 halamanSupervisory FunctionsSAVITHRI100% (3)

- IIBF Monthly Newsletter Highlights RBI Monetary Policy ChangesDokumen8 halamanIIBF Monthly Newsletter Highlights RBI Monetary Policy ChangesSushant MusaleBelum ada peringkat

- PreambleDokumen7 halamanPreambleSudhir Kumar SinghBelum ada peringkat

- Kyc and AmlDokumen6 halamanKyc and AmlPriyanka DhingraBelum ada peringkat

- LAB - Study Note - 3Dokumen19 halamanLAB - Study Note - 3ANANDMAYEE TRIPATHY PGP 2021-23 Batch100% (1)

- Reseacrch Paper PojectDokumen2 halamanReseacrch Paper PojectPradnya ShejwalBelum ada peringkat

- Main Functions Financial SupervisionDokumen9 halamanMain Functions Financial SupervisionAjay MykalBelum ada peringkat

- Quantitative and Qualitative Measures of Credit Control ComparedDokumen1 halamanQuantitative and Qualitative Measures of Credit Control Comparedniranjan_meharBelum ada peringkat

- Merchant Banking AND Non Banking Finance Company: Akash Gupta UBS, PURCDokumen32 halamanMerchant Banking AND Non Banking Finance Company: Akash Gupta UBS, PURCyashasviBelum ada peringkat

- Role of CRR and SLRDokumen9 halamanRole of CRR and SLRVineeta Malan50% (2)

- Banking Theory Law and PracticeDokumen17 halamanBanking Theory Law and PracticeDr.Satish RadhakrishnanBelum ada peringkat

- Document TTDokumen3 halamanDocument TTKhushi ChadhaBelum ada peringkat

- Indian Banking System and ConceptsDokumen42 halamanIndian Banking System and ConceptsKaran AroraBelum ada peringkat

- Bank of IndiaDokumen15 halamanBank of Indiashreyaasharmaa100% (1)

- Reserve Bank of IndiaDokumen28 halamanReserve Bank of Indiazara_naveed92Belum ada peringkat

- PPT of Role of Rbi Policies Functions and ProhibitoryDokumen17 halamanPPT of Role of Rbi Policies Functions and Prohibitoryr.vani75% (4)

- Licensing New Banks: Stringent RBI GuidelinesDokumen5 halamanLicensing New Banks: Stringent RBI GuidelinesCraig WilliamsBelum ada peringkat

- PDF For Banking Material-02Dokumen9 halamanPDF For Banking Material-02mairaj zafarBelum ada peringkat

- Difference Between Bank Rate and Repo Rate: What Is A CRR Rate?Dokumen9 halamanDifference Between Bank Rate and Repo Rate: What Is A CRR Rate?anjanashBelum ada peringkat

- Non Performing NpaDokumen21 halamanNon Performing NpaPriya Rakeshkumar MistryBelum ada peringkat

- 1939IIBF Vision April 2012Dokumen8 halaman1939IIBF Vision April 2012Shambhu KumarBelum ada peringkat

- 2.FIM-Module II-Banking InstitutionsDokumen11 halaman2.FIM-Module II-Banking InstitutionsAmarendra PattnaikBelum ada peringkat

- IIBF Vision February 2015Dokumen8 halamanIIBF Vision February 2015NitinKumarBelum ada peringkat

- FIM-Module II-Banking InstitutionsDokumen11 halamanFIM-Module II-Banking InstitutionsAmarendra PattnaikBelum ada peringkat

- What Is KYCDokumen3 halamanWhat Is KYCPrateek LoganiBelum ada peringkat

- Credit ControlDokumen19 halamanCredit ControlPramil AnandBelum ada peringkat

- Structure and Functions of Reserve Bank of IndiaDokumen35 halamanStructure and Functions of Reserve Bank of IndiashivaBelum ada peringkat

- Structure and Functions of Reserve Bank of IndiaDokumen24 halamanStructure and Functions of Reserve Bank of Indiasridevi gopalakrishnanBelum ada peringkat

- Indian financial reforms focused on banking sectorDokumen10 halamanIndian financial reforms focused on banking sectornagendra yanamalaBelum ada peringkat

- Non-Banking Finance Companies: Prof. Anil KalraDokumen13 halamanNon-Banking Finance Companies: Prof. Anil KalraSaurabh SinghBelum ada peringkat

- Credit Appraisal SystemDokumen54 halamanCredit Appraisal SystemÂShu KaLràBelum ada peringkat

- Credit Appraisal SystemDokumen58 halamanCredit Appraisal Systemsatapathy_smruti12100% (10)

- Rbi (Reserve Bank of India)Dokumen24 halamanRbi (Reserve Bank of India)Proton VPNBelum ada peringkat

- Finance CompendiumDokumen28 halamanFinance CompendiumNeelu AggrawalBelum ada peringkat

- Weekly Economic Round Up 38Dokumen15 halamanWeekly Economic Round Up 38Mana PlanetBelum ada peringkat

- Central Bank and Its FunctionsDokumen7 halamanCentral Bank and Its FunctionsSuresh BhandiBelum ada peringkat

- How CRR affects loan ratesDokumen21 halamanHow CRR affects loan ratesDevendra Singh JodhaBelum ada peringkat

- Should CRR Be AbolishedDokumen12 halamanShould CRR Be AbolishedNimisha JainBelum ada peringkat

- Banking and Insurance OverviewDokumen27 halamanBanking and Insurance OverviewRajeshwariBelum ada peringkat

- Legal Framework Banking IndiaDokumen7 halamanLegal Framework Banking IndiaRiya SharmaBelum ada peringkat

- Rbiitsmonetarypolicy 090917083338 Phpapp01Dokumen23 halamanRbiitsmonetarypolicy 090917083338 Phpapp01Choudhary Abdul HamidBelum ada peringkat

- Commercial Banking System and Role of RBI A ST WDLDXPDokumen9 halamanCommercial Banking System and Role of RBI A ST WDLDXPNageshwar SinghBelum ada peringkat

- Regulatory Role of RBI and Its Monitory PolicyDokumen19 halamanRegulatory Role of RBI and Its Monitory PolicyManish Bhoir100% (1)

- OnenessDokumen160 halamanOnenessbikram111209005Belum ada peringkat

- Regional Rural Banks of India: Evolution, Performance and ManagementDari EverandRegional Rural Banks of India: Evolution, Performance and ManagementBelum ada peringkat

- Islamic Banking And Finance for Beginners!Dari EverandIslamic Banking And Finance for Beginners!Penilaian: 2 dari 5 bintang2/5 (1)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Dari EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Belum ada peringkat

- RLS Algorithm Adaptive FilterDokumen15 halamanRLS Algorithm Adaptive Filterniranjan_meharBelum ada peringkat

- InitiateSingleEntryPaymentSummary17 06 2017 PDFDokumen1 halamanInitiateSingleEntryPaymentSummary17 06 2017 PDFniranjan_meharBelum ada peringkat

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDokumen4 halamanMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharBelum ada peringkat

- Wand Hare 2015Dokumen11 halamanWand Hare 2015niranjan_meharBelum ada peringkat

- Aes Encryption: Encrypti ONDokumen12 halamanAes Encryption: Encrypti ONniranjan_meharBelum ada peringkat

- Example16 SIMULINK PDFDokumen11 halamanExample16 SIMULINK PDFgomgomBelum ada peringkat

- No ThanksDokumen5 halamanNo Thanksniranjan_meharBelum ada peringkat

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDokumen4 halamanMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharBelum ada peringkat

- 09 Chapter4Dokumen23 halaman09 Chapter4niranjan_meharBelum ada peringkat

- NSS 3-Reliable Low-Power Multiplier PDFDokumen10 halamanNSS 3-Reliable Low-Power Multiplier PDFThahsin ThahirBelum ada peringkat

- Without Applying Induction Motor Voltage SagDokumen4 halamanWithout Applying Induction Motor Voltage Sagniranjan_meharBelum ada peringkat

- Original Image To Be SelectedDokumen5 halamanOriginal Image To Be Selectedniranjan_meharBelum ada peringkat

- 05676476Dokumen8 halaman05676476niranjan_meharBelum ada peringkat

- Simulationlab EE0405 PDFDokumen78 halamanSimulationlab EE0405 PDFDhondiram KakreBelum ada peringkat

- Physical stock variances and expired goods issues noted in store auditDokumen4 halamanPhysical stock variances and expired goods issues noted in store auditniranjan_meharBelum ada peringkat

- Admission Schedule 201401132015Dokumen2 halamanAdmission Schedule 201401132015niranjan_meharBelum ada peringkat

- The Importance of Hard Work in SuccessDokumen1 halamanThe Importance of Hard Work in Successniranjan_meharBelum ada peringkat

- PTC Corporate Presentation-30!09!2012Dokumen25 halamanPTC Corporate Presentation-30!09!2012niranjan_meharBelum ada peringkat

- Research Activities Published Paper ICPS04Dokumen6 halamanResearch Activities Published Paper ICPS04Luiza DraghiciBelum ada peringkat

- Mysteries of The Sacred Universe - An OverviewDokumen11 halamanMysteries of The Sacred Universe - An Overviewniranjan_mehar100% (2)

- PTC's Sustainability Model Turns High Risk into Viable SolutionDokumen4 halamanPTC's Sustainability Model Turns High Risk into Viable SolutiongavinilaaBelum ada peringkat

- Brahma Kadi GinaDokumen4 halamanBrahma Kadi GinaAswith R ShenoyBelum ada peringkat

- RulesDokumen39 halamanRulesniranjan_meharBelum ada peringkat

- RasdfsDokumen39 halamanRasdfsKeyur GajjarBelum ada peringkat

- Detailed Project Report Solar PVDokumen19 halamanDetailed Project Report Solar PVbakoolk100% (3)

- 2013 2013 1 PB PDFDokumen28 halaman2013 2013 1 PB PDFImran ShahzadBelum ada peringkat

- Sri Yantra A DESTINEYDokumen14 halamanSri Yantra A DESTINEYsssmouBelum ada peringkat

- TeluguvDokumen1 halamanTeluguvniranjan_meharBelum ada peringkat

- Municipal Courts Building Redevelopment Plan, Downtown St. Louis, MO - 2012Dokumen17 halamanMunicipal Courts Building Redevelopment Plan, Downtown St. Louis, MO - 2012nextSTL.comBelum ada peringkat

- TNB Sustainability Report 2020Dokumen92 halamanTNB Sustainability Report 2020da_reaper_dasBelum ada peringkat

- Managerial Eco - AssugnmentDokumen14 halamanManagerial Eco - AssugnmentAbdullah NomanBelum ada peringkat

- BRC Global Standard For Packaging MaterialDokumen16 halamanBRC Global Standard For Packaging MaterialflathonBelum ada peringkat

- The Grameen Bank Model Corporate Success PDFDokumen11 halamanThe Grameen Bank Model Corporate Success PDFSamreet Singh100% (1)

- ISLAMIC MARRIAGE LAWDokumen10 halamanISLAMIC MARRIAGE LAWD.K MareeBelum ada peringkat

- SWOT Analysis of WalmartDokumen8 halamanSWOT Analysis of WalmartaliBelum ada peringkat

- Peer Influence Case Study ImplicationsDokumen4 halamanPeer Influence Case Study ImplicationsJazley ManiegoBelum ada peringkat

- Karunya University in Association With Zenken Corporation Offers Placement Opportunities in Japan (Responses)Dokumen57 halamanKarunya University in Association With Zenken Corporation Offers Placement Opportunities in Japan (Responses)ECE Prof. A.MohanBelum ada peringkat

- Uct ProspectusDokumen91 halamanUct ProspectusJohann WieseBelum ada peringkat

- Chapter 4Dokumen12 halamanChapter 4norleen.sarmiento100% (2)

- Overview of Counts Chino AnthraxDokumen3 halamanOverview of Counts Chino AnthraxChivis MartinezBelum ada peringkat

- TOS Quiz 4Dokumen6 halamanTOS Quiz 4maria ronoraBelum ada peringkat

- Serg's Products v. Pci Leasing-DigestDokumen2 halamanSerg's Products v. Pci Leasing-Digesthermana990100% (2)

- Masters of Social Psychology - Schellenberg, James A., 1932Dokumen162 halamanMasters of Social Psychology - Schellenberg, James A., 1932Pablo StuartBelum ada peringkat

- Cdi 1 Fundamentals of Criminal Investigation & Intelligence - PowerpointDokumen22 halamanCdi 1 Fundamentals of Criminal Investigation & Intelligence - PowerpointJoey Figueroa94% (17)

- UCSP Lesson 2 Handout On Culture and SocietyDokumen3 halamanUCSP Lesson 2 Handout On Culture and SocietyJoyce Orda100% (1)

- MT103 522286795pdfDokumen3 halamanMT103 522286795pdfMasoud Dastgerdi100% (4)

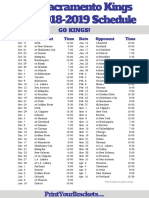

- Sacramento Kings 2018-19 Schedule GuideDokumen1 halamanSacramento Kings 2018-19 Schedule GuideMelchor BalolongBelum ada peringkat

- Historical Notes: Ncient Methods OF Preserving Copper Plate GrantsDokumen12 halamanHistorical Notes: Ncient Methods OF Preserving Copper Plate GrantsTG GamerBelum ada peringkat

- Resources and Capabilities - VRIO NotesDokumen5 halamanResources and Capabilities - VRIO NotesKshitij LalwaniBelum ada peringkat

- Jko2 NewDokumen34 halamanJko2 NewRitesh RanjanBelum ada peringkat

- Pega Client Lifecycle ManagementDokumen36 halamanPega Client Lifecycle ManagementVamsidhar Reddy DBelum ada peringkat

- Practical Guide SequelecDokumen24 halamanPractical Guide SequelecDevi PrasadBelum ada peringkat

- Marine and Coastal Claim Area - Wai 2768Dokumen30 halamanMarine and Coastal Claim Area - Wai 2768lellobotBelum ada peringkat

- Factors affecting demand of Cadbury products in IndiaDokumen7 halamanFactors affecting demand of Cadbury products in IndiaNajish FarhanBelum ada peringkat

- Cambridge Igcse Results Statistics June 2021Dokumen2 halamanCambridge Igcse Results Statistics June 2021SMBelum ada peringkat

- Business Law Chapter 5 - Cyber TortsDokumen57 halamanBusiness Law Chapter 5 - Cyber TortsBul LanBelum ada peringkat

- Presidential Powers ExplainedDokumen3 halamanPresidential Powers ExplainedDragoşCosminRăduţăBelum ada peringkat

- Tristar Case Sol.Dokumen4 halamanTristar Case Sol.Niketa JaiswalBelum ada peringkat