Demonstration Lecture 5: Suggested Solutions

Diunggah oleh

phuthuymiDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Demonstration Lecture 5: Suggested Solutions

Diunggah oleh

phuthuymiHak Cipta:

Format Tersedia

Demonstration Lecture 5: Suggested Solutions 1. True.

The analysis underpinning the economy-wide short run aggregate supply curve is based on the derivation of the relevant supply curve for an individual firm. The first point to note is that an individual firm will produce up to the point where price of the product or service equals its relevant marginal cost. This is the firms profit-maximising condition. It also follows that in a perfectly competitive market that price will equal marginal revenue. aving established those criteria! the next step is to consider the individual firms production function in the short-run. "ssuming that the production function comprises a variable labour input! a fixed capital stock input! and a fixed level of technology! the marginal physical product of labour is the extra output that a firm can produce by adding an extra unit of labour input. The latter is presumed to show diminishing returns! or have a diminishing marginal physical product of labour for a given factor price #or money wage rate say per hour of labour$. %tudents should refer to pages 1&-1'! (hapter )! in the *rooks manuscript to see the relevant diagrams illustrating these relationships. The law of diminishing returns implies that the individual firms marginal cost #of production$ curve will be upwards sloping. In effect the latter curve is the individual firms supply curve! and so upwards sloping indicating that higher prices will induce higher levels of output in the short-run. +. True. The answer to this question builds on the previous answer. The key point to note is that one can establish a relationship between the marginal physical product of labour #,--.$! the individual firms marginal cost of production #,($! and the money wage rate #/$. "ssuming a constant or fixed money wage rate in the first instance! ,( 0 /1 ,--.. 2ext ! note that the profit-maximising criterion for an individual firm is to produce up to that level of production where ,( 0 -rice. Therefore - #or price$ 0 ,( 0 /1 ,--.. If - 0 /1 ,--.! it follows that by re-arranging the equation that ,--. 0 /1-. .ogically one can say that the ,--. is equivalent to a firms demand for labour schedule. 3urthermore a firm will be more likely to hire more labour when /1- #or the real wage$ is lower rather than higher. The demand for labour curve is therefore downwards sloping! as shown in the first of three diagrams on page 14 of (hapter ) of the *rooks manuscript. *y determining varying levels of labour demand at different levels of real wages #/1-$! it then possible to see what levels of output! 5! are achievable given the specification of the original production function.! as shown in the second diagram on page 14. 3inally by plotting the various price levels from the labour demand curve against the output levels from the production function! the third and final %6"% curve is obtained. 2ote that the latter is constructed for a given money wage7 a given level of capital stock7 and a given technology level. These are all shift parameters of the %6"%. &. True. In a competitive world the "8 and %6"% curves intersect so as to determine the price level. In turn the money wage rate! /! responds to that price level to determine a market-clearing real wage rate! /1-. "s flexible wages and prices! in time! provide a full-employment outcome! then it follows that the price outcome determined in the product market must be consistent with "8 and the %6"% being equal at the full-employment level. (ompetition should lead to simultaneous balance in both the labour and product markets. In turn this implies the existence of a vertical .6"% at the full-employment level of output. 3or a useful illustration of this relationship students should examine the + diagrams in %ection ).+.& of the *rooks manuscript. ). True. The .6"% is vertical at the full-employment level of output. %tudents should refer to the pair of diagrams located in %ection ).+.) of the *rooks manuscript! page +1. (ommencing at the short-run equilibrium point " #with an equilibrium real wage of /o1-o$! a fiscal expansion will lead to a rightward shift of the "8 curve from "89 to "81. Therefore the price level increases form -o to -1! and so movement to point ( results. The higher price level of -1 will lead to disequilibrium in the labour market! as it now produces a real wage result of /o1-1! which is the same as a reduction in the real wage rate. The latter produces a situation whereby demand for labour will exceed the supply of labour at that specific real wage rate. :ventually money wage rates will have to increase! and so /1 results. This however will move the %6"% from its original position to %6"%#/1$! and so a reduced level of 5 results! together with a higher price level. "gain labour market disequilibrium will result! and eventually a higher money wage rate will be needed to clear the labour market. This process will continue until point ; is reached and that is consistent with a price level of -x and the full-employment level of 5o. %imultaneous labour and product market equilibrium are achieved. <nce again it demonstrates that the .6"% is vertical at the full-employment level of output.

'. True. The key point to note in answering this question is to be able to understand the difference between the effect upon the %6"% of a change in the price level! and the effect upon the %6"% and the .6"% of a change in the overall supply of labour. The initial change in price! assuming a given money wage rate! will cause disequilibrium in the labour market! which will only be resolved by an eventual increase in the money wage rate. This will shift the %6"% back to the left. <n the other hand an increase in the supply of labour will move the labour supply curve to the right! within the labour market. This would in turn lead to a change in the money wage rate causing a shift of the %6"%. owever! because the total labour supply has changed! a new fullemployment level would result. .ogically this would lead to the .6"% shifting as well. 4. True. %tudents should refer to the appropriate definitions in =ordon! > th edition! page +19. #or if you are using the 4th edition! refer to page 14&$

Anda mungkin juga menyukai

- Energy Utility BillDokumen3 halamanEnergy Utility Billbob100% (1)

- Managerial Econ Cheat Sheet-1Dokumen3 halamanManagerial Econ Cheat Sheet-1Haris A33% (3)

- Xerox Case StudyDokumen19 halamanXerox Case StudyPrachi Jain100% (2)

- IT Business Plan Chapter SummaryDokumen35 halamanIT Business Plan Chapter SummaryKap DemonBelum ada peringkat

- International Economics 9th Edition Appleyard Solutions Manual DownloadDokumen13 halamanInternational Economics 9th Edition Appleyard Solutions Manual DownloadElna Todd100% (22)

- Reflective Essay - Pestle Mortar Clothing BusinessDokumen7 halamanReflective Essay - Pestle Mortar Clothing Businessapi-239739146Belum ada peringkat

- Conjoint AnalysisDokumen9 halamanConjoint AnalysisgunjeshthakurBelum ada peringkat

- Chapter 12Dokumen57 halamanChapter 12Crestu Jin0% (1)

- Bosch Quality CertificationDokumen7 halamanBosch Quality CertificationMoidu ThavottBelum ada peringkat

- Mining Operational ExcellenceDokumen12 halamanMining Operational ExcellencegarozoBelum ada peringkat

- Demand Management: Leading Global Excellence in Procurement and SupplyDokumen7 halamanDemand Management: Leading Global Excellence in Procurement and SupplyAsif Abdullah ChowdhuryBelum ada peringkat

- Financial Accounting 9th Edition Libby Solutions Manual 1Dokumen36 halamanFinancial Accounting 9th Edition Libby Solutions Manual 1jenniferallenoigcyajdtx100% (24)

- Product IdeationDokumen13 halamanProduct IdeationHenry Rock100% (1)

- RIMS School Magazine Project ManagementDokumen40 halamanRIMS School Magazine Project ManagementAditya Vora75% (12)

- Output-Inflation Tradeoffs Around The WorldDokumen5 halamanOutput-Inflation Tradeoffs Around The WorldVal Benedict MedinaBelum ada peringkat

- Macroeconomics 1 - Chapter FiveDokumen38 halamanMacroeconomics 1 - Chapter FiveBiruk YidnekachewBelum ada peringkat

- Top 4 Models of Aggregate Supply of WagesDokumen9 halamanTop 4 Models of Aggregate Supply of WagesSINTAYEHU MARYE TESHOMEBelum ada peringkat

- Organizer Rajendra Adhikari Presenter Anish OjhaDokumen13 halamanOrganizer Rajendra Adhikari Presenter Anish Ojhaanish ojhaBelum ada peringkat

- JEKKA LU 1 international tradeDokumen18 halamanJEKKA LU 1 international tradethobejanekellyBelum ada peringkat

- PDTN FXNDokumen9 halamanPDTN FXNrachmmmBelum ada peringkat

- PP SinhaDokumen13 halamanPP Sinhapepepepe86Belum ada peringkat

- ECONOMICS 2nd Sem Classical TheoryDokumen9 halamanECONOMICS 2nd Sem Classical TheoryVansh ChadhaBelum ada peringkat

- Introduction:-The National Income of A Country Is The Result of JointDokumen5 halamanIntroduction:-The National Income of A Country Is The Result of JointGaurav ChandrakantBelum ada peringkat

- Theory of DistributionDokumen10 halamanTheory of DistributionprudenceBelum ada peringkat

- TaussigDokumen9 halamanTaussigAjeev kumarBelum ada peringkat

- Ayush Shakya - Ba LLB 2 Sem - Economics 20GSOL1020032 - SEC 2Dokumen2 halamanAyush Shakya - Ba LLB 2 Sem - Economics 20GSOL1020032 - SEC 2White WolfBelum ada peringkat

- Theory of Production and Cost Analysis: Unit - IiDokumen17 halamanTheory of Production and Cost Analysis: Unit - IisantoshvimsBelum ada peringkat

- Introduction of Classical and Keynesian Theory of IncomeDokumen12 halamanIntroduction of Classical and Keynesian Theory of IncomePriyamBelum ada peringkat

- Calvo - Staggered Prices in A Utility-Maximizing FrameworkDokumen16 halamanCalvo - Staggered Prices in A Utility-Maximizing Frameworkanon_78278064Belum ada peringkat

- Labour Demand and Wages ChangeDokumen9 halamanLabour Demand and Wages ChangeAhmed Edson MbukwaBelum ada peringkat

- Summary - Production Theory and Cost Theory and EstimationDokumen11 halamanSummary - Production Theory and Cost Theory and Estimationhimanshupadia1998Belum ada peringkat

- Learning Objective: Concept of Wages and Marginal Productivity Theory of LabourDokumen3 halamanLearning Objective: Concept of Wages and Marginal Productivity Theory of LabourRohitPatialBelum ada peringkat

- Economia Tema 5Dokumen8 halamanEconomia Tema 5Javier RubiolsBelum ada peringkat

- Assignment No. 2 Q.1 How Monopoly Demand Is Derived When Several Inputs Are Used in The Production Process?Dokumen10 halamanAssignment No. 2 Q.1 How Monopoly Demand Is Derived When Several Inputs Are Used in The Production Process?gulzar ahmadBelum ada peringkat

- Details of FActor of Production PDFDokumen12 halamanDetails of FActor of Production PDFnakilBelum ada peringkat

- Marginal Productivity Theory of Distribution: Definitions, Assumptions, Explanation!Dokumen9 halamanMarginal Productivity Theory of Distribution: Definitions, Assumptions, Explanation!khalidaBelum ada peringkat

- REVIEW QUESTIONS Classical Economics and DepressionDokumen5 halamanREVIEW QUESTIONS Classical Economics and Depressionkoorossadighi1Belum ada peringkat

- Homework 5Dokumen7 halamanHomework 5aventor aventorBelum ada peringkat

- DD and SS in Factor MktsDokumen69 halamanDD and SS in Factor Mktsapi-3857552Belum ada peringkat

- Frictions in The Labour MarketDokumen26 halamanFrictions in The Labour MarketNana Pauline MukwanguBelum ada peringkat

- Econ Notes 6Dokumen24 halamanEcon Notes 6Engineers UniqueBelum ada peringkat

- Economics 152 - Wage Theory and Policy Problem Set #3 - SolutionsDokumen7 halamanEconomics 152 - Wage Theory and Policy Problem Set #3 - SolutionsJason LohBelum ada peringkat

- Classical Theory of Income and EmploymentDokumen13 halamanClassical Theory of Income and EmploymentKritika MalikBelum ada peringkat

- Chap 5Dokumen20 halamanChap 5wasisiBelum ada peringkat

- Classical Approach of Macroeconomics: After Reading This Chapter, You Will Be Conversant WithDokumen14 halamanClassical Approach of Macroeconomics: After Reading This Chapter, You Will Be Conversant Withutreja12Belum ada peringkat

- Topic 3: Market EquilibriumDokumen6 halamanTopic 3: Market EquilibriumBi bomeBelum ada peringkat

- General Equilibrium and Economic EfficiencyDokumen23 halamanGeneral Equilibrium and Economic EfficiencyJennifer CarliseBelum ada peringkat

- Specific Factor Model ExplainedDokumen5 halamanSpecific Factor Model ExplainedBagus AndriantoBelum ada peringkat

- Market Equilibrium PriceDokumen15 halamanMarket Equilibrium Pricevinu50% (2)

- Theory of DistributionDokumen37 halamanTheory of DistributionGETinTOthE SySteMBelum ada peringkat

- Classical Labor MarketsDokumen9 halamanClassical Labor MarketsRajesh GargBelum ada peringkat

- TOPIC 3 Ecu 402Dokumen6 halamanTOPIC 3 Ecu 402Mksu GeniusBelum ada peringkat

- Understanding Aggregate Demand and SupplyDokumen11 halamanUnderstanding Aggregate Demand and SupplyAsad NaeemBelum ada peringkat

- Value of Marginal ProductDokumen5 halamanValue of Marginal ProductMohammad BathishBelum ada peringkat

- Lecture 6 - S21Dokumen7 halamanLecture 6 - S21AsadBelum ada peringkat

- Question BDokumen3 halamanQuestion BJe HoeBelum ada peringkat

- Chapter 9 - The Is-Lm/Ad-As ModelDokumen20 halamanChapter 9 - The Is-Lm/Ad-As Modelvivianguo23Belum ada peringkat

- Production FunctionDokumen17 halamanProduction FunctionharlloveBelum ada peringkat

- Bent Hansen's Dynamic Excess Demand Model of InflationDokumen13 halamanBent Hansen's Dynamic Excess Demand Model of InflationuzmaBelum ada peringkat

- Macroeconomic Principles ReviewDokumen51 halamanMacroeconomic Principles ReviewJonny Schuman100% (1)

- Production and cost optimization conceptsDokumen19 halamanProduction and cost optimization conceptsSri SruthiBelum ada peringkat

- Introductory Macroeconomics Semester 2, Economics (Hons.) CBCS Classical Model of Output and Employment Determination Prepared by Abanti GoswamiDokumen7 halamanIntroductory Macroeconomics Semester 2, Economics (Hons.) CBCS Classical Model of Output and Employment Determination Prepared by Abanti GoswamiArijit PaulBelum ada peringkat

- Market SupplyDokumen3 halamanMarket SupplyXia EnrileBelum ada peringkat

- International Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFDokumen34 halamanInternational Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFedward.archer149100% (12)

- Assignment TwoDokumen5 halamanAssignment TwoAmal RidèneBelum ada peringkat

- The Economic Crisis According to MarxDokumen7 halamanThe Economic Crisis According to MarxHazar YükselBelum ada peringkat

- QUIZ 3: Macro - Winter 2007Dokumen3 halamanQUIZ 3: Macro - Winter 2007Leslie LimBelum ada peringkat

- Market Equilibrium ExplainedDokumen10 halamanMarket Equilibrium ExplainedAbsolitudeHeartBelum ada peringkat

- Market Power Rules of ThumbDokumen7 halamanMarket Power Rules of ThumbDuarte RosaBelum ada peringkat

- Factors of Production Market AnalysisDokumen21 halamanFactors of Production Market Analysisfbbr geheBelum ada peringkat

- Employability Skills: Brush Up Your Business StudiesDari EverandEmployability Skills: Brush Up Your Business StudiesBelum ada peringkat

- Final Exam 2013cDokumen4 halamanFinal Exam 2013cphuthuymiBelum ada peringkat

- ECON1268 Final Exam S2 2011Dokumen7 halamanECON1268 Final Exam S2 2011phuthuymiBelum ada peringkat

- ECON1268 Final Exam S2 2011Dokumen7 halamanECON1268 Final Exam S2 2011phuthuymiBelum ada peringkat

- Econ-1042 Sample Mcqs110Dokumen3 halamanEcon-1042 Sample Mcqs110phuthuymiBelum ada peringkat

- Econ-1042 Sample Mcqs1120Dokumen3 halamanEcon-1042 Sample Mcqs1120phuthuymiBelum ada peringkat

- ECON1268 Final Exam S2 2011Dokumen7 halamanECON1268 Final Exam S2 2011phuthuymiBelum ada peringkat

- EF 210 Sample Multiple Choice Questions Semester 1 2008 AnswerDokumen1 halamanEF 210 Sample Multiple Choice Questions Semester 1 2008 AnswerphuthuymiBelum ada peringkat

- EF 210 Sample Multiple Choice Questions Semester 1 2008: Sheet1Dokumen1 halamanEF 210 Sample Multiple Choice Questions Semester 1 2008: Sheet1phuthuymiBelum ada peringkat

- DEMOLEC1Dokumen9 halamanDEMOLEC1phuthuymiBelum ada peringkat

- Demonstration Lecture 4: Suggested SolutionsDokumen2 halamanDemonstration Lecture 4: Suggested SolutionsphuthuymiBelum ada peringkat

- EF 210 Sample Multiple Choice Questions Semester 1 2008: Sheet1Dokumen1 halamanEF 210 Sample Multiple Choice Questions Semester 1 2008: Sheet1phuthuymiBelum ada peringkat

- Topic 4 Capital Budgeting Part 2Dokumen42 halamanTopic 4 Capital Budgeting Part 2phuthuymiBelum ada peringkat

- Demonstration Lecture 3: Suggested SolutionsDokumen2 halamanDemonstration Lecture 3: Suggested SolutionsphuthuymiBelum ada peringkat

- Topic 1 Introduction To Business FinanceDokumen28 halamanTopic 1 Introduction To Business FinancephuthuymiBelum ada peringkat

- Topic 4 Capital Budgeting Part 1Dokumen44 halamanTopic 4 Capital Budgeting Part 1phuthuymiBelum ada peringkat

- Mid-Term Exam Sem 3 2012Dokumen9 halamanMid-Term Exam Sem 3 2012phuthuymiBelum ada peringkat

- Economic Growth of Nepal and Its Neighbours PDFDokumen12 halamanEconomic Growth of Nepal and Its Neighbours PDFPrashant ShahBelum ada peringkat

- Midi Siness German Dictionary PDFDokumen341 halamanMidi Siness German Dictionary PDFSemir HandzicBelum ada peringkat

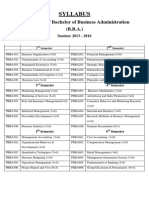

- BBA Syllabus 2013-2016Dokumen59 halamanBBA Syllabus 2013-2016GauravsBelum ada peringkat

- JAVA TcsDokumen8 halamanJAVA Tcs123rajdeepBelum ada peringkat

- What Is Microsoft Word Used For?Dokumen3 halamanWhat Is Microsoft Word Used For?Mahmood AliBelum ada peringkat

- Construction Management: ENCE4331: Cost and Price ExamplesDokumen7 halamanConstruction Management: ENCE4331: Cost and Price ExamplesTania MassadBelum ada peringkat

- Ax40 Enus BSC 01 Dynamics Ax Balanced Score CardDokumen12 halamanAx40 Enus BSC 01 Dynamics Ax Balanced Score CarddareosikoyaBelum ada peringkat

- Oracle Ebusiness Suite Maintenance Guide r122 PDFDokumen603 halamanOracle Ebusiness Suite Maintenance Guide r122 PDFnbharat9Belum ada peringkat

- Gas Portfolio and Transport OptimizationDokumen10 halamanGas Portfolio and Transport OptimizationDaplet ChrisBelum ada peringkat

- Chapter 1-7Dokumen54 halamanChapter 1-7Sheila Tugade Dela CruzBelum ada peringkat

- Gi FSWKG Iu 6 Er OhkDokumen3 halamanGi FSWKG Iu 6 Er OhkPrasanna Das RaviBelum ada peringkat

- Chapter 01Dokumen15 halamanChapter 01Alan Wong100% (1)

- Suvarna Paravanige - Sanction of Building Plan in a Sital AreaDokumen1 halamanSuvarna Paravanige - Sanction of Building Plan in a Sital AreaareddappaBelum ada peringkat

- Mountanium Perfumes Website LaunchDokumen39 halamanMountanium Perfumes Website LaunchHaritaa Varshini Balakumaran0% (1)

- Accounting An Introduction NZ 2nd Edition Atrill Test BankDokumen26 halamanAccounting An Introduction NZ 2nd Edition Atrill Test Banksophronianhat6dk2k100% (25)

- Hinduja Ventures Annual Report 2015Dokumen157 halamanHinduja Ventures Annual Report 2015ajey_p1270Belum ada peringkat

- Performing Effective MTBF Comparisons For Data Center InfrastructureDokumen16 halamanPerforming Effective MTBF Comparisons For Data Center Infrastructure(unknown)Belum ada peringkat

- 5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSDokumen92 halaman5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSKhozema GoodluckBelum ada peringkat