Porter SM Ch. 11 - 3pp

Diunggah oleh

mfawzi010Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Porter SM Ch. 11 - 3pp

Diunggah oleh

mfawzi010Hak Cipta:

Format Tersedia

CHAPTER 11 Stockholders Equity

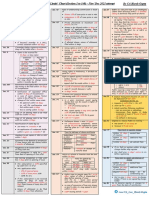

OVERVIEW OF EXERCISES PRO!"E#S A$% CASES

"e'r(i() Outco&es E*ercises Esti&'ted Ti&e i( #i(utes "e+el

1, Identify the components of the Stockholders Equity category of the balance sheet and the accounts found in each component. -, Sho that you understand the characteristics of common and preferred stock and the differences bet een the classes of stock. ., !etermine the financial statement impact hen stock is issued for cash or other consideration. /, !escribe the financial statement impact of stock treated as treasury stock. 0, &ompute the amount of cash di'idends hen a firm has issued both preferred and common stock. 1, Sho that you understand the difference bet een cash and stock di'idends and the effect of stock di'idends. 2, !etermine the difference bet een stock di'idends and stock splits. 3, Sho that you understand the statement of stockholders equity and comprehensi'e income. 4, +nderstand ho in'estors use ratios to e'aluate stockholders equity. 15, E,plain the effects that transactions in'ol'ing stockholders equity ha'e on the statement of cash flo s.

1 2

10 10

Easy Mod

" # $ % ( ) * 10 11 12 1" 1# 1$ 1% 1( 1) 1* 20

10 20 1$ 1$ 10 1$ 1$ 1$ 1$ 10 1$ $ $ $ $ $ 1$ 10

Mod Mod Mod Mod Mod Mod Mod !iff !iff Easy !iff Mod Mod Mod Mod Easy Mod Mod

11, !escribe the important differences bet een the sole proprietorship and partnership forms of organi-ation 'ersus the corporate form ./ppendi,0. 1E,ercise2 problem2 or case co'ers t o or more learning outcomes 3e'el 4 !ifficulty le'els5 Easy6 Moderate .Mod06 !ifficult .!iff0

1161

116-

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

"e'r(i() Outco&es

Pro7le&s '(d Alter('tes

Esti&'ted Ti&e i( #i(utes

"e+el

1, Identify the components of the Stockholders Equity category of the balance sheet and the accounts found in each component. -, Sho that you understand the characteristics of common and preferred stock and the differences bet een the classes of stock. ., !etermine the financial statement impact hen stock is issued for cash or other consideration. /, !escribe the financial statement impact of stock treated as treasury stock. 0, &ompute the amount of cash di'idends hen a firm has issued both preferred and common stock. 1, Sho that you understand the difference bet een cash and stock di'idends and the effect of stock di'idends. 2, !etermine the difference bet een stock di'idends and stock splits. 3, Sho that you understand the statement of stockholders equity and comprehensi'e income. 4, +nderstand ho in'estors use ratios to e'aluate stockholders equity. 15, E,plain the effects that transactions in'ol'ing stockholders equity ha'e on the statement of cash flo s. 11, !escribe the important differences bet een the sole proprietorship and partnership forms of organi-ation 'ersus the corporate form ./ppendi,0. 1E,ercise2 problem2 or case co'ers t o or more learning outcomes 3e'el 4 !ifficulty le'els5 Easy6 Moderate .Mod06 !ifficult .!iff0

1 121 1#1 2

20 1$ 1$ 1$

Mod Mod !iff Mod

1"1 121 1"1 1#1 " # $ 1"1 % (

20 1$ 20 1$ 20 1$ 20 20 20 10

Mod Mod Mod Mod Mod !iff Mod Mod Mod Mod

) * 10 11

1$ 1$ 20 10

!iff Mod Mod Mod

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116.

"e'r(i() Outco&es

C'ses

Esti&'ted Ti&e i( #i(utes

"e+el

1, Identify the components of the Stockholders Equity category of the balance sheet and the accounts found in each component. -, Sho that you understand the characteristics of common and preferred stock and the differences bet een the classes of stock. ., !etermine the financial statement impact hen stock is issued for cash or other consideration. /, !escribe the financial statement impact of stock treated as treasury stock. 0, &ompute the amount of cash di'idends hen a firm has issued both preferred and common stock. 1, Sho that you understand the difference bet een cash and stock di'idends and the effect of stock di'idends. 2, !etermine the difference bet een stock di'idends and stock splits. 3, Sho that you understand the statement of stockholders equity and comprehensi'e income. 4, +nderstand ho in'estors use ratios to e'aluate stockholders equity. 15, E,plain the effects that transactions in'ol'ing stockholders equity ha'e on the statement of cash flo s. 11, !escribe the important differences bet een the sole proprietorship and partnership forms of organi-ation 'ersus the corporate form ./ppendi,0. 1E,ercise2 problem2 or case co'ers t o or more learning outcomes 3e'el 4 !ifficulty le'els5 Easy6 Moderate .Mod06 !ifficult .!iff0

11 "1 "1 #

1$ 10 10 10

Mod Mod Mod Mod

1$

Mod

11 $ 2

1$ 1$ 1$

Mod Mod Mod

116/

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

89ESTIO$S 1, :he t o maCor components of stockholders equity are contributed capital and retained earnings. /ccounts in contributed capital include the &ommon Stock and =referred Stock accounts and the /dditional =aidDin &apital accounts. :he primary account in the retained earnings component is the >etained Earnings account. -, :he number of shares authori-ed is the total number that the corporation can issue2 as indicated in the corporate charter. Shares issued are shares that ha'e been distributed to stockholders. Shares outstanding is the number of shares in the stockholders hands as of the balance sheet date. :he difference bet een shares issued and shares outstanding is normally the result of treasury stock. ., 7irms designate the par 'alue of the stock for legal reasons. =ar 'alue is not an indication of the selling price or market 'alue of the stock. /, :he balance of the >etained Earnings account is not equal to the firms net income. :he account indicates the amount of income for all pre'ious years that has been earned but has not been paid out as di'idends to the stockholders. 0, =referred stock normally must be paid a di'idend before a di'idend may be paid to common stock. <o e'er2 e'en if the preferred stock is cumulati'e2 preferred stockholders do not ha'e a right to di'idends in arrears until the time the di'idend is declared. 1, =referred stock is generally a lo er risk stock that pro'ides a stable return but does not pro'ide for the potentially high return of a common stock. :he ad'antages of preferred stock are the safety and stability it pro'ides. 2, &ommon shareholders are considered residual shareholders because the amount of book 'alue of preferred shareholders is subtracted from total stockholders equity before the common book 'alue is determined. &ommon shareholders also ha'e a right to the earnings after preferred di'idends are distributed. 3, :he asset should be recorded at the fair market 'alue of the consideration gi'en .the stock0 or the fair market 'alue of the consideration recei'ed .the asset02 hiche'er is more readily determinable. 7air market 'alue may be determined by reference to sales of the stock on the stock e,change or2 in some cases2 by an appraisal of the asset. 4, :reasury stock is stock that has been issued and then repurchased by a corporation. :here are a 'ariety of uses of treasury stock2 including use in employee benefit plans2 pre'ention of an un anted takeo'er2 and reduction in the number of shares of stock to impro'e financial ratios. :reasury Stock is a contra equity account and is sho n as a reduction of stockholders equity.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

1160

15, ;ains or losses on treasury stock are not recorded on the income statement. >ather2 the amounts are sho n as additions or deductions of stockholders equity. /dditions appear in the =aidDin &apitalE:reasury Stock account. !eductions reduce that account or the >etained Earnings account if the =aidDin &apital account is not present. 8o income statement amounts are recorded to pre'ent manipulation of income by firms ho ould buy and sell their o n stock in order to sho a Fprofit.G 11, 7irms do not pay out all of their income as di'idends because there are other alternati'e uses of the income. Managements obCecti'e should be to ma,imi-e the ealth of the stockholders. Sometimes that can be achie'ed by paying di'idends6 other times it can be achie'ed by retaining the income and rein'esting it in alternati'es that ill produce a satisfactory return. 1-, / stock di'idend occurs hen a company issues shares of stock to its e,isting stockholders instead of paying cash as a di'idend. Stock di'idends should be recorded as a reduction of >etained Earnings and an increase in Stock !i'idend !istributable. :herefore2 stock di'idends do not affect total stockholders equity. 8ormally2 retained earnings is reduced by the market 'alue of the stock distributed. 1., It is better to recei'e a stock di'idend hen the company is using earnings to e,pand and rein'est in the business. / cash di'idend is preferred by in'estors ho need the cash to meet current needs2 like senior citi-ens. 1/, Stock di'idends do not reduce the par 'alue per share of the stock. Stock splits do reduce the par 'alue per share. Splits do not require any Cournal entry but should be noted in the notes that accompany the balance sheet. 10, Hook 'alue per share is calculated as the total net assets of the corporation di'ided by the number of shares of common stock. It is a measure of the rights of the common stockholders to the assets of the firm in the e'ent of liquidation. It does not mean that the common stockholders ill recei'e a di'idend equal to the book 'alue per share. 11, :he market 'alue per share of the stock is related to the income of the corporation2 but many other factors also influence the market 'alue. ;eneral economic factors such as inflation2 factors related to the particular industry2 ta, consequences2 and the mood of current and potential in'estors all ha'e an impact on the market 'alue of the stock. 12, :he statement of stockholders equity e,plains all reasons for the difference bet een the beginning and ending balances of each of the accounts in the stockholders equity category. :he retained earnings statement details the changes in only one component of stockholders equityEretained earnings. 13, :he ad'antages of organi-ing as a corporation include limited liability and the increased ability to raise funds from a ider group of unrelated in'estors. &ompanies choose not to incorporate because it costs to file papers ith the state and to issue stock2 and corporations must file annual reports2 open to public inspection.

1161

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

14, =artners could share income equally2 as a percentage of in'estment .capital balance02 or as a proportion based on the amount of hours each partner orks. :he partners can share income based on any method that is reasonable2 pro'ided that the method has been agreed upon2 in riting2 by the partners.

EXERCISES 39 1

EXERCISE 1161 STOC:HO"%ERS E89IT; ACCO9$TS

1, Bes2 =referred Stock2 Increase -, Bes2 /dditional =aidDin &apital2 Increase ., 8ot recorded until declared /, &ash !i'idends =ayable is recorded as a liability2 !ecrease >etained Earnings 0, Bes2 Stock !i'idend !istributable2 8o change in total stockholders equity 1, Bes2 :reasury Stock2 !ecrease 2, Bes2 /dditional =aidDin &apitalE:reasury Stock2 Increase 3, Bes2 >etained Earnings2 Increase 39 1

EXERCISE 116- SO"VE FOR 9$:$OW$S

1, :otal par 'alue 4 I10 J 102000 4 I1002000 /dditional =aidDin &apital 4 I"$02000 K I1002000 4 I2$02000 :otal Stockholders Equity 4 I"$02000 L I1002000 .>etained Earnings0 K I102000 .:reasury Stock0 4 I##02000 -, 8umber of shares of :reasury Stock 4 number of shares issued K number outstanding 4 102000 K *2200 4 )00 shares &ost per share 4 I102000M)00 shares 4 I12.$0

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

1162

39 "

EXERCISE 116. STOC: ISS9A$CE

1, ', :he effect on the accounting equation of the issuance of common stock for cash is as follo s5

!A"A$CE SHEET

Assets &ash < ($20001 "i'7ilities = &ommon Stock /dditional =aidDin &apital

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses 2$200011 $02000111

1 I1$ $2000 4 I($2000 11 I$ $2000 4 I2$2000 111 I10 $2000 4 I$02000 7, :he effect on the accounting equation of issuing common stock for a building is as follo s5

!A"A$CE SHEET

Assets Huilding 1($2000 < "i'7ilities = &ommon Stock /dditional =aidDin &apital

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses "$20001 1#02000

1I$ (2000 4 I"$2000 c, :he effect on the accounting equation of issuing common stock to acquire a patent is as follo s5

!A"A$CE SHEET

Assets =atent < $020001 "i'7ilities = &ommon Stock /dditional =aidDin &apital

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses 10200011 #02000

1I2$ 22000 4 I$02000

1163

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

11 I$ 22000 4 I102000

EXERCISE 116. @Co(cludedA

-, &ommon Stock2 I$ par 'alue5 1#2000 shares issued and outstanding /dditional =aidDin &apital .I$02000 L I1#02000 L I#020000 :otal &ontributed &apital

I (02000 2"02000 I"002000

39 "

EXERCISE 116/ STOC: ISS9A$CES

1, ', :here is no effect on the accounting equation. 7, :he effect on the accounting equation of the issuance of common stock on March 102 200(2 is as follo s5

!A"A$CE SHEET

Assets &ash < 1($20001 "i'7ilities = &ommon Stock $0200011 /dditional =aidDin &apitalE &ommon 12$2000

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

1I"$ $2000 4 I1($2000 11I10 $2000 4 I$02000 c, :he effect on the accounting equation of the March 1)2 200(2 issuance of preferred stock is as follo s5

!A"A$CE SHEET

Assets &ash < 1220001 "i'7ilities = =referred Stock /dditional =aidDin &apitalE =referred

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses 10200011

22000

1I120 100 4 I122000 11I100 100 4 I102000

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

1164

EXERCISE 116/ @Co(cludedA

d, :he effect on the accounting equation of the /pril 122 200(2 issuance of common stock is as follo s5

!A"A$CE SHEET

Assets &ash < #$020001 "i'7ilities = &ommon Stock 100200011 /dditional =aidDin &apitalE &ommon "$02000

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

1I#$ 102000 4 I#$02000 11I10 102000 4 I1002000 -, )N =referred stock2 I100 par 'alue2 $2000 shares authori-ed2 100 shares issued and outstanding &ommon stock2 I10 par 'alue2 220002000 shares authori-ed2 1$2000 shares issued and outstanding /dditional paidDin capitalEpreferred stock /dditional paidDin capitalEcommon stock :otal contributed capital

I 102000 1$02000 22000 #($2000 I%"(2000

., :he balance sheet does not indicate the market 'alue of the stock. Market 'alue is a function of the demand for the stock at 'arious economic indicators such as interest rates and inflation.

11615

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 # 1,

EXERCISE 1160 TREAS9R; STOC:

', :he effect on the accounting equation of the purchase of treasury stock on Ouly 1 is as follo s5

!A"A$CE SHEET

Assets < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses :reasury Stock .#0200001

&ash

.#020000

1I20 22000 4 I#02000 7, :he effect on the accounting equation of the purchase of treasury stock on /ugust 1 is as follo s5

!A"A$CE SHEET

Assets &ash .(22000 < "i'7ilities = :reasury Stock

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses .(220001

1I1) #00 4 I(2200 -, >esale price of treasury stock .22#00 J I2)0 3ess5 &ost of treasury stock .I#02000 L I(22000 E,cess of selling price o'er cost I%(2200 #(2200 I202000

:his Fe,cess2G or Fgain2G is sho n on the balance sheet as an increase in the /dditional =aidDin &apitalE:reasury Stock account.

39 # 1,

EXERCISE 1161 TREAS9R; STOC: TRA$SACTIO$S

', :he effect on the accounting equation of the 7ebruary 1 purchase of treasury stock is as follo s5

!A"A$CE SHEET

Assets < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses :reasury Stock .100200001

&ash

.10020000

1I20 $2000 4 I1002000

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

11611

EXERCISE 1161 @Co(cludedA

7, :he effect on the accounting equation of the March 1 purchase of treasury stock is as follo s5

!A"A$CE SHEET

Assets &ash .1$2%000 < "i'7ilities = :reasury Stock

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses .1$2%0001

1I1" 12200 4 I1$2%00 -, :he company sold treasury stock at amounts less than those it had paid to reacquire the stock. In a sense2 the company had a loss of I) per share on the stock purchased 7ebruary 1 and I1 per share on the stock purchased March 12 but the FlossG is not sho n on the income statement. Instead2 the FlossG reduces stockholders equity. ., Heginning balance >eacquisition of treasury stockE7eb. 1 >eacquisition of treasury stockEMarch 1 >eissue of all treasury stock Ending balance 19'erall2 the total stockholders equity decreased by I#122005 I).$20000 L I1.122000 4 I#12200. 39 $

EXERCISE 1162 CASH %IVI%E$%S

I "*02000 .10020000 I 2*02000 .1$2%000 I 2(#2#00 11$2%00 .#1220001 I "#)2)00

1, =referred di'idends per year 4 12000 J I100 J *N 4 I*2000 ;e'r 200# 200$ 200% 200( PreBerred %i+ide(ds I 0 1020001 1(200011 *2000 Co&&o( %i+ide(ds I 0 0 "2000 1%2000

1I*2000 .from 200#0 L I12000 .for 200$0 4 I102000. 11I)2000 .from 200$0 L I*2000 .for 200%0 4 I1(2000. -, ;e'r 200# 200$ 200% 200( PreBerred %i+ide(ds I 0 *2000 *2000 *2000 Co&&o( %i+ide(ds I 0 12000 112000 1%2000

1161-

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 $ 1,

EXERCISE 1163 CASH %IVI%E$%S

=referred5 I2002000 J )N 4 I1%2000 &ommon5 I1002000 K I1%2000 4 I)#2000 :he effect on the accounting equation of the Ouly 1 declaration of a di'idend is as follo s5

!A"A$CE SHEET

Assets < "i'7ilities !i'idends =ayable = >etained Earnings

I$CO#E

-,

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses .10020000

1002000

:he effect on the accounting equation of the /ugust 1 payment of a di'idend is as follo s5

!A"A$CE SHEET

Assets &ash .10020000 < "i'7ilities = !i'idends =ayable

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

.10020000

.,

=referred5 I1%2000 J " years 4 I#)2000 &ommon5 I1002000 K I#)2000 4 I$22000

39 % 1,

EXERCISE 1164 STOC: %IVI%E$%S

', :he effect on the accounting equation of the Oanuary 1$ declaration of a 10N stock di'idend is as follo s5

!A"A$CE SHEET

Assets < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses Stock !i'idend !istributD able #020001 /dditional =aidDin &apitalE &ommon Stock )02000 >etained Earnings .1202000011

1#02000 10N I10 4 I#02000 11#02000 10N I"0 4 I1202000

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

1161.

EXERCISE 1164 @Co(cludedA

7, :he effect on the accounting equation of the Oanuary "0 issuance of the stock di'idend is as follo s5

!A"A$CE SHEET

Assets < "i'7ilities = &ommon Stock Stock !i'iD dend !isD tributable

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses #02000 .#020000

-,

WORTH; CO#PA$; PARTIA" !A"A$CE SHEET CA$9AR; .1 -552 Stockholders Equity &ommon Stock2 I10 par2 ##2000 shares issued and outstanding /dditional paidDin capitalEcommon stock >etained earnings :otal stockholders equity 1#02000 shares J 110N J I10 par 4 I##02000. 11I1002000 L I)02000 4 I1)02000. 111I#002000 K I1202000 4 I2)02000. 9'erall2 these transactions did not change total stockholders equity. :hey reclassified some equity from the retained earnings category to contributed capital. I##020001 1)0200011 2)02000111 I*002000

39 (

EXERCISE 11615 STOC: %IVI%E$%S VERS9S STOC: SP"ITS

1, Assets Stock !i'idend5

<

"i'7ilities

Stockholders Equity .>etained Earnings0 K$002000 .&ommon Stock !i'idend !istributable0 .$02000 J 100N J I100 L$002000

Stock Split5 8o Entry

1161/

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

EXERCISE 11615 @Co(cludedA

-, Stockholders Equity &ategory5 ', Stock %i+ide(d &ommon stock2 I10 par2 1002000 shares issued and outstanding /dditional paidDin capitalEcommon stock >etained earnings :otal stockholders equity 1$02000 shares J 200N J I10 4 I120002000 11I))02000 K I$002000 4 I")02000 7, Stock S?lit &ommon stock2 I$ par2 1002000 shares issued and outstanding /dditional paidDin capitalEcommon stock >etained earnings :otal stockholders equity 1=ar 4 I10M2 4 I$6 shares 4 $02000 J 2 4 1002000 39 ( 1, Oan. 1 May 1

EXERCISE 11611 STOC: %IVI%E$%S A$% STOC: SP"ITS

I1200020001 ($02000 ")0200011 I221"02000

I $0020001 ($02000 ))02000 I221"02000

Halance %02000 J 1$N

8o'. 1 :otal shares outstanding -, I10M2 4 I$ per share ., Stockholders equity5 &ommon stock2 I$ par 'alue2 1")2000 shares issued and outstanding /dditional paidDin capital1 >etained earnings PI122#02000 K .*2000 J I200Q :otal stockholders equity 1*2000 shares J .I20 K I100 4 I*02000 from May 1. I*02000 L I#)02000 4 I$(02000

%02000 shares *2000 %*2000 J 2 1")2000 shares

%*02000 $(02000 120%02000 I22"202000

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

11610

39 )

EXERCISE 1161- REPORTI$D CHA$DES I$ STOC:HO"%ERS E89IT; ITE#S

R;%E I$C, STATE#E$T OF STOC:HO"%ERS E89IT; FOR THE ;EAR E$%E% APRI" .5 -552 Co&&o( Stock Halance2 May 12 200% 8et income !i'idends Halance2 /pril "02 200( I"#$2000 I"#$2000 Additio('l P'id6i( C'?it'l I122*)2000 I122*)2000 Ret'i(ed E'r(i()s I"201"2000 $$%2000 .()20000 I"2#*12000 Tot'l Stockholders Equity I#2%$%2000 $$%2000 .()20000 I$21"#2000

39 )

EXERCISE 1161. CO#PREHE$SIVE I$CO#E

:he +nreali-ed ;ainM3ossE/'ailableDforDSale Securities account occurred hen the company adCusted its in'estments for the changes in the market 'alue of the securities. Rhen a company buys stock in another company and the 'alue of the stock changes2 it is necessary to rite up or do n the stock. In the case of a'ailableDforDsale securities2 the adCustment is not considered a gain or loss on the income statement. Instead2 the adCustment is recorded directly to the stockholders equity category. :he account titled 7oreign &urrency :ranslation /dCustments occurred hen assets held in currencies other than +.S. dollars ere con'erted to dollars. !uring that con'ersion2 a gain or loss occurs. :his gain or loss is not the result of selling the assets and is often referred to as a FpaperG gain or loss. :here are arguments pro and con on the concept of comprehensi'e income. Some firms belie'e that some items should not be presented on the income statement because of their si-e or 'olatility. =resentation on the income statement may make it difficult for statement users to predict future income. 9ther firms belie'e that all income items should be reflected on the income statement. :hey belie'e that income is more useful if the statement user can 'ie the effects of all items.

11611 39 *

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

EXERCISE 1161/ PA;O9T RATIO A$% !OO: VA"9E PER SHARE

1, !i'idend =ayout >atio5 I#$2000MI)02000 4 $%.2$N $oteE :he solution assumes that the common stockholders ha'e a right to the total net income of I)02000. :he preferred stock is not cumulati'e2 and it does not indicate that a cash di'idend as declared to the preferred stockholders. 7urther2 it appears that the preferred stockholders recei'ed a stock di'idend during the year2 rather than a cash di'idend. :herefore2 the I#$2000 of income should be attributable to the common stockholders. -, Hook Salue per Share5 :otal stockholders equity 4 =referred stock =aidDin capitalEpreferred &ommon stock =aidDin capitalEcommon >etained earnings 3ess5 3iquidation 'alue of preferred stock .12100 shares J I1200 8et assets applicable to common stock 8umber of shares of common stock5 I$002000MI$ per share 4 1002000 shares Hook 'alue per share 4 I)0"2000M1002000 4 I).0" I1102000 $$2000 $002000 $02000 2202000 I*"$2000 1"22000 I)0"2000

39 10

EXERCISE 11610 I#PACT OF TRA$SACTIO$S I$VO"VI$D ISS9A$CE OF STOC: O$ STATE#E$T OF CASH F"OWS

7EIssuance of common stock for cash 7EIssuance of preferred stock for cash 8EIssuance of common stock for equipment 8EIssuance of preferred stock for land and building 8E&on'ersion of preferred stock into common stock $oteE E'en though they are financing transactions2 no cash changed hands in the transactions marked F8.G /s a result2 they ould not be listed under the financing category of the statement of cash flo s. <o e'er2 they ould be reported in a supplementary schedule relating to the statement of cash flo s.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

11612

39 10

EXERCISE 11611 I#PACT OF TRA$SACTIO$S I$VO"VI$D TREAS9R; STOC: O$ STATE#E$T OF CASH F"OWS

7E>epurchase of common stock as treasury stock 7E>eissuance of common stock .held as treasury stock0 8E>etirement of treasury stock $oteE E'en though it is a financing transaction2 no cash changed hands in the retirement of treasury stock transaction. /s a result2 it ould not be listed under the financing category of the statement of cash flo s. <o e'er2 this transaction ould be reported in a supplementary schedule relating to the statement of cash flo s.

39 10

EXERCISE 11612 I#PACT OF TRA$SACTIO$S I$VO"VI$D %IVI%E$%S O$ STATE#E$T OF CASH F"OWS

7E=ayment of cash di'idend on common stock 7E=ayment of cash di'idend on preferred stock 8E!istribution of stock di'idend 8E!eclaration of stock split $oteE E'en though they are financing transactions2 no cash changed hands in the transactions marked F8.G /s a result2 they ould not be listed under the financing category of the statement of cash flo s. <o e'er2 they ould be reported in a supplementary schedule relating to the statement of cash flo s. 39 10

EXERCISE 11613 %ETER#I$I$D %IVI%E$%S PAI% O$ STATE#E$T OF CASH F"OWS

1, !i'idends payable2 !ecember "12 200% =lus di'idends declared during 200( 3ess cash payments during 200( !i'idends payable2 !ecember "12 200( I)02000 L I#002000 K T 4 I1002000 T 4 I")02000

I )02000 #002000 .T0 I1002000

-, &lifford ould report the cash di'idend payments of I")02000 as a cash outflo the financing acti'ities category of its 200( statement of cash flo s.

in

11613 39 11

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

EXERCISE 11614 SO"E PROPRIETORSHIP @A??e(di* A

1, :he o ners equity section of =ar ;olfs balance sheet consists of the o ners capital account as follo s5 Roods2 &apital .I$02000 K I102000 K I2020000 I202000

39 11

EXERCISE 116-5 PART$ERSHIPS @A??e(di*A

Heginning balance /dd5 /llocation of net income 3ess5 Rithdra als Ending balance 1I$02000M" 4 I1%2%%( rounded.

"eFis I202000 1%2%%(1 I"%2%%( .$20000 I"12%%(

C'&'l I $02000 1%2%%( I %%2%%( .1220000 I $#2%%(

"'?i( I"02000 1%2%%% I#%2%%% .*20000 I"(2%%%

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

11614

PRO!"E#S 39 1

PRO!"E# 1161 STOC:HO"%ERS E89IT; CATEDOR;

PEE"ER CO#PA$; PARTIA" !A"A$CE SHEET %ECE#!ER .1 -552 Stockholders Equity =referred stock2 I100 par2 (N2 12000 shares authori-ed2 $00 shares issued and outstanding &ommon stock2 I$ par2 102000 shares authori-ed2 $2000 shares issued2 #2%00 shares outstanding /dditional paidDin capitalEpreferred stock /dditional paidDin capitalEcommon stock /dditional paidDin capitalEtreasury stock :otal contributed capital >etained earnings 3ess5 treasury stock2 #00 shares2 common :otal stockholders equity 1M10 1M10 1M20 =referred stock5 $00 J I100 par 4 I$02000 credit /dditional paidDin capital5 $00 J .I120 K I1000 4 I102000 credit &ommon stock5 #2000 J I$ par 4 I202000 credit /dditional paidDin capital5 #2000 J .I)0 K I$0 4 I"002000 credit &ommon stock5 12000 J I$ par 4 I$2000 credit /dditional paidDin capital5 12000 J .I(0 K I$0 4 I%$2000 credit I $02000 2$2000 102000 "%$2000 $00 I#$02$00 1"2$00 .2#20000 I##02000

/cquisition of treasury stock5 :reasury stock5 $00 J I%0 4 I"02000 debit >esale of treasury stock5 :reasury stock5 100 J I%0 4 I%2000 credit /dditional paidDin capital5 100 J .I%$ K I%00 4 I$00 credit 12M"1 8et income5 >etained earnings I#02000 credit 12M"1 =referred di'idend5 .$00 J I100 par J (N0 4 I"2$00 debit to retained earnings &ommon stock di'idend5 #2%00 outstanding J I$ per share 4 I2"2000 debit to retained earnings

116-5

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 2

PRO!"E# 116- EVA"9ATI$D A"TER$ATIVE I$VEST#E$TS

1, &ommon stock has o nership pri'ileges. :he residual of the company belongs to the common shareholders. =referred stock has preference o'er common stockholders in di'idend payouts. Honds earn interest that is a legal obligation of the company. -, :he return on the preferred stock depends upon its issue price. If it is assumed that the stock is issued at par 'alue2 the return is )N. Since all three instruments yield the same rate of return2 )N2 Ellen should choose to in'est in the bonds because they carry the lo est risk. /s risk increases2 the e,pected rate of return on an in'estment should increase.

39 $ 1,

PRO!"E# 116. %IVI%E$%S FOR PREFERRE% A$% CO##O$ STOC:

PreBerred Stock I1002000 J )N 4 I)2000 =er share5 I)2000M12000 4 I).00 PreBerred Stock I)2000 J " years 4 I2#2000 =er share5 I2#2000M12000 4 I2#.00

Co&&o( Stock I$*2000 K I)2000 4 I$12000 I$12000M202000 4 I2.$$ Co&&o( Stock I$*2000 K I2#2000 4 I"$2000 I"$2000M202000 4 I1.($

-,

39 %

PRO!"E# 116/ EFFECT OF STOC: %IVI%E$%

1, :he memo to the board of directors should include the follo ing points5 ', / stock di'idend does not change the total stockholders equity amount. 7, / stock di'idend does reduce the balance of >etained Earnings and transfers the amount of the stock di'idend to the contributed capital component of stockholders equity. c, / stock di'idend results in additional shares of stock outstanding. :herefore2 it affects the financial ratios of the firm. 7or e,ample2 book 'alue per share and earnings per share decline as a result of the stock di'idend.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116-1

PRO!"E# 116/ @Co(cludedA

-, :he statement to the stockholders should stress the follo ing points5 ', Each stockholder has the same proportionate o nership of the company after the di'idend as before the di'idend. 7, / stock di'idend is likely to cause the market price per share of the stock to decline. :he additional shares recei'ed by the stockholder should offset the decline in the per share price and lea'e the stockholder at least as ell off as before the di'idend. c, Rhat happens to the stock price after the stock di'idend is dependent on the companys profitability and a ide 'ariety of industry and economic factors.

39 (

PRO!"E# 1160 %IVI%E$%S A$% STOC: SP"ITS

1, March 1 /pril 1 Oune 1

>etained Earnings and total stockholders equity decrease. :otal stockholders equity remains unchanged. &ommon Stock !istributable increases by I(2$00 .1$2000 J $N J I100. /dditional =aidDin &apitalE&ommon Stock increases by I%2000 .1$2000 J $N J I)0. >etained Earnings decrease by I1"2$00. :otal stockholders equity does not change. &ommon Stock !istributable decreases and common stock increases by I(2$00. >etained Earnings and total stockholders equity decrease by I(2)($ P.1$2000 L ($00 J I0.$0Q. :otal stockholders equity does not change. :he par 'alue of common stock changes from I10 to I$ as the number of shares issued and outstanding doubles from 1$2($0 to "12$002 but the total par 'alue does not change. :he total stockholders equity also does not change.

Ouly 1 Sept. 1 9ct. 1 !ec. 1

116--

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

PRO!"E# 1160 @Co(cludedA

-, :he stockholders equity category as of !ecember "12 200(2 follo s5 FRE%ERI:SE$S I$C, PARTIA" !A"A$CE SHEET %ECE#!ER .1 -552 Stockholders Equity =referred stock2 I)0 par2 (N2 "2000 shares issued and outstanding &ommon stock2 I$ par2 "12$00 shares1 issued and outstanding /dditional paidDin capitalEpreferred stock /dditional paidDin capitalEcommon stock :otal contributed capital >etained earnings :otal stockholders equity

ould appear as

I 2#02000 1$(2$00 %02000 2"1200011 I %))2$00 22(112)2$111 I"2#002"2$

1.1$2000 L ($0 stock di'idend0 J 2 .stock split0 4 "12$00 11I22$2000 L I%2000 stock di'idend 4 I2"12000 111I221002000 K I1%2)00 cash di'idend K I1"2$00 stock di'idend K I(2)($ cash di'idend L I%$02000 net income 4 I22(112)2$ ., / stock di'idend results in the capitali-ation of part of the >etained Earnings account. :he 'alue of the shares issued in the stock di'idend is deducted from the >etained Earnings account and added to the &apital Stock account .and the /dditional =aidDin &apital account for small stock di'idends0. :he number of outstanding shares is increased2 and the par 'alue of the shares is unchanged. In a stock split2 there is no change to any of the capital accounts. :here is an increase in the number of outstanding shares2 hich is offset by a corresponding decrease in the par 'alue of those shares.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116-.

39 )

PRO!"E# 1161 STATE#E$T OF STOC:HO"%ERS E89IT;

PreBerred Stock Halance2 Oanuary 1 I 0 Sale of preferred stock $02000 Sale of common stock Issuance of common stock for building site =urchase of treasury stock Sale of treasury stock 8et income &ash di'idendsE =referred &ash di'idendsE &ommon Halance2 !ecember "1 I$02000

Co&&o( Stock I 0 I

P'id6i( C'?it'l 0 102000 "002000 %$2000 $00

Tre'sury Stock I 0

Ret'i(ed E'r(i()s I 0

202000 $2000

."020000 %2000 #02000 ."2$000

I2$2000

I"($2$00

I.2#20000

.2"20000 I 1"2$00

E*?l'('tio(sE 1M10 =referred Stock5 $00 J I100 par 4 I$02000 increase /dditional =aidDin &apital5 $00 J .I120 K I1000 4 I102000 increase 1M10 1M20 &ommon Stock5 #2000 J I$ 4 I202000 increase /dditional =aidDin &apital5 #2000 J .I)0 K I$0 4 I"002000 increase &ommon Stock5 12000 J I$ par 4 I$2000 increase /dditional =aidDin &apital5 12000 J .I(0 K I$0 4 I%$2000 increase

/cquisition of treasury stock5 :reasury Stock5 $00 J I%0 4 I"02000 decrease >esale of treasury stock5 :reasury Stock5 100 J I%0 4 I%2000 increase /dditional =aidDin &apital5 100 J .I%$ K I%00 4 I$00 increase 12M"1 8et income5 >etained Earnings5 I#02000 increase 12M"1 &ash di'idends5 =referred Stock5 .$00 J I100 J (N0 4 I"2$00 decrease in >etained Earnings &ommon Stock5 #2%00 outstanding J I$ per share 4 I2"2000 decrease in >etained Earnings

116-/

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 )

PRO!"E# 1162 WA"6#ARTS CO#PREHE$SIVE I$CO#E

1, &omprehensi'e Income for the year ended Oanuary "12 200$ .in millions05 8et income 7oreign currency translation adCustment <edge accounting adCustment Minimum pension liability adCustment &omprehensi'e income I1022%( 221"0 .1*#0 .*"0 I122110

:he effect of including these items on the income statement ould ha'e been to increase net income. Rhile this ould sho all sources of income for the period2 these numbers could lead readers to belie'e this is an ordinary result of operations. -, Some items2 such as the market 'alue adCustments on in'estments and the foreign currency translation adCustment2 are considered to be F paperG gains or losses6 these adCustments are not presented on the income statement because they are also unreali-ed. :hese adCustments are often 'olatile and may be quite si-able. 7urther2 no cash inflo s or outflo s directly result from these adCustments. /ccordingly some of the stockholders of RalDMarts may prefer that these items be reported on the statement of stockholders equity. Including these items on the income statement might make it difficult for in'estors to predict future income. 9n the other hand2 because this information may be useful in e'aluating the effecti'eness of the companys management2 others might prefer to see these items reported on the income statement. 39 10

PRO!"E# 1163 EFFECTS OF STOC:HO"%ERS E89IT; TRA$SACTIO$S O$ STATE#E$T OF CASH F"OWS

&ash flo s from financing acti'ities5 Issuance of preferred stock .$00 J I1200 Issuance of common stock .#2000 J I)00 =urchase of treasury stock .$00 J I%00 >eissuance of treasury stock .100 J I%$0 8et cash flo from financing acti'ities :he follo ing transactions statement of cash flo s5

I %02000 "202000 ."020000 %2$00 I"$%2$00

ould not appear in the financing acti'ities section of the

=eeler obtained the building site by issuing 12000 shares of common stock6 no cash changed hands. /s a result2 this transaction ould be reported as a noncash in'esting and financing transaction on the statement of cash flo s. /ssuming that the indirect method is used2 the companys 200( net income ould appear as the first item under the cash flo s from operating acti'ities section of the statement of cash flo s.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116-0

PRO!"E# 1163 @Co(cludedA

:he di'idend declared on !ecember "12 200(2 ill not be paid until 200). /s a result2 the payment of this di'idend ill appear as a cash outflo in the financing section of the 200) statement of cash flo s.

39 11

PRO!"E# 1164 I$CO#E %ISTRI!9TIO$ OF A PART$ERSHIP @A??e(di*A

1. If income is I1$20002 it should be distributed as follo s5 Salary to /bbott Interest to &ostello5 10N J I"002000 >emainder in 251 ratio5 .I1$2000 K I$020000 J 2M" 4 .I1$2000 K I$020000 J 1M" 4 :otal distributed A77ott I 202000 .2"2"""0 I ."2"""0 .112%%(0 I 1)2""" Costello I "02000

$oteE ;enerally2 salary and interest are allocated first to the partners accounts and then2 if there is a deficit2 the deficit is allocated in the agreed ratio. In this case2 the result is a negati'e amount distributed to Ms. /bbott. -, If income is I$020002 it should be distributed as follo s5 Salary to /bbott Interest to &ostello5 10N J I"002000 :otal distributed ., If income is I)020002 it should be distributed as follo s5 Salary to /bbott Interest to &ostello5 10N J I"002000 >emainder on 251 ratio5 .I)02000 K I$020000 J 2M" .I)02000 K I$020000 J 1M" :otal !istributed A77ott I202000 202000 I#02000 102000 I#02000 Costello I"02000 A77ott I202000 I202000 Costello I"02000 I"02000

116-1

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 11 1,

PRO!"E# 11615 SO"E PROPRIETORSHIPS @A??e(di*A

!A"A$CE SHEET

Assets &ash 1202000 < "i'7ilities = OF(ers Equity &hong Bu2 &apital 1202000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o record in'estment by o ner.

!A"A$CE SHEET

Assets &ash 122000 < "i'7ilities = OF(ers Equity &hong Bu2 !ra ing .1220000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o record ithdra al by o ner.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses Sales .10)20000 E,penses )#2000 Income Summary 2#2000

:o close re'enues and e,penses.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity &hong Bu2 &apital 2#2000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses .2#20000

:o close income summary.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity &hong Bu2 &apital .1220000 &hong Bu2 !ra ing 122000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o close the dra ings account.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116-2

PRO!"E# 11615 @Co(cludedA

Heginning balance In'estment by o ner /dd5 8et income 3ess5 Rithdra als Ending balance

0 1202000 I1202000 2#2000 .1220000 I1"22000

-, :he capital account indicates the amount of the o ners in'estment that has not been ithdra n. It is based on accrual accounting and does not indicate the amount of cash in the business.

116-3 39 11

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

PRO!"E# 11611 PART$ERSHIPS @A??e(di*A

/llocation of net income5 8et income 3ess5 Salary 3ess5 Interest .I1002000 J %N0 >emainder to allocate Halance of equity

$erise I (2200

O!rie( I %2000

Tot'l I212200 1"2200 I )2000 )2000 I 0

#2000 I112200

#2000 I102000

1It is assumed that the net income amount is after the amount of salary to 8erise has been deducted2 so total net income ould ha'e been I212200. Heginning balance /dd5 In'estments /llocation of net income 3ess5 Rithdra als Ending balance $erise I 0 2$2000 112200 I"%2200 11"2200 I2"2000 O!rie( I 0 1002000 102000 I1102000 #2000 I10%2000

1Salary allocation of I%00 J 12 4 I(2200 L I%2000 ithdra als 4 I1"2200

#9"TI6CO$CEPT PRO!"E#S 39 12#

PRO!"E# 1161- A$A";SIS OF STOC:HO"%ERS E89IT;

1, =referred stock issued 4 I1202000MI"0 par 4 #2000 shares -, =referred stock outstanding 4 #2000 K 100 .:reasury Stock0 4 "2*00 shares ., .I1202000 L I%20000M#2000 4 I"1.$0 /, I(02000M(2000 4 I10 per share 0, .I(02000 L I$%020000M(2000 4 I*0 per share 1, I"2200M100 shares 4 I"2 per share 2, I($(2000 L I#02000 K I"2200 4 I(*"2)00 3, PI(*"2)00 K ."2*00 preferred shares J I"0 par0QM(2000 4 I*%.%*

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116-4

39 "2#2( 1,

PRO!"E# 1161. EFFECTS OF STOC:HO"%ERS E89IT; TRA$SACTIO$S O$ THE !A"A$CE SHEET

Assets ', =055 555 7, =-5 555 =35 555 c, >11 555 d,

<

"i'7ilities

= Stockholders Equity =155 555 =/55 555 =15 555 =45 555 >11 555

=15 455

>15 455G =135 555

e, 8o accounting entry B, =135 555 1.1002000 L 102000 K 120000.I0.100 $oteE :he net income in transaction B, results in an increase of I1)02000 in o ners equity. :he corresponding I1)02000 may ha'e been an increase in assets .as sho n02 a decrease in liabilities2 or some combination of the t o. -, HORTO$ I$C, PARTIA" !A"A$CE SHEET %ECE#!ER .1 -5XX Stockholders Equity &ommon stock2 220002000 authori-ed2 2202000 issued2 21)2000 outstanding2 I0.$0 par 'alue /dditional paidDin capital .I#002000 L I*020000 >etained earnings .KI102*00 L I1)020000 3ess5 :reasury stock :otal Stockholders Equity I1102000 #*02000 1%*2100 .1%20000 I($"2100

., $oteE :he &ompany is authori-ed to issue 220002000 shares of common stock2 I0.$0 par 'alue. /t the end of the year2 2202000 shares are issued6 ho e'er2 only 21)2000 are outstanding because the &ompany has purchased 22000 shares of common stock for further distribution. :he figures presented reflect the retroacti'e treatment of a 2DforD1 stock split during the year.

116.5

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 12# 1,

PRO!"E# 1161/ STOC:HO"%ERS E89IT; SECTIO$ OF THE !A"A$CE SHEET

IVES I$C, !A"A$CE SHEET AS OF XXX Assets &ash /ccount recei'able =lant2 property2 and equipment :otal assets "i'7ilities /ccounts payable !i'idends payable Stockholders Equity &ommon stock2 I1 par2 1002000 shares outstanding /dditional paidDin capital >etained earnings :reasury stock :otal liabilities and stockholders equity "2$00 $2000 10)2000 I11%2$00 I $2$00 12$00 I

1002000 112000 .120000 .$000 I11%2$00

:reasury stock is not an asset6 it is a contra o ners equity account. >etained earnings is not an asset6 it is the accumulated2 undistributed profit of the company. -, :he >etained Earnings account has a debit balance because the accumulated earnings of the company represent a net loss andMor di'idends paid out ha'e e,ceeded the cumulati'e earnings.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116.1

A" TE R $ AT E P R O! "E # S 39 1

PRO!"E# 1161A STOC:HO"%ERS E89IT; CATEDOR;

:E!"ER CO#PA$; PARTIA" !A"A$CE SHEET %ECE#!ER .1 -552 Stockholders Equity =referred stock2 I100 par2 (N2 22000 shares authori-ed2 12000 shares issued &ommon stock2 I$ par2 202000 shares authori-ed2 102000 shares issued2 *2100 shares outstanding /dditional paidDin capitalEpreferred stock /dditional paidDin capitalEcommon stock /dditional paidDin capitalEtreasury stock :otal contributed capital >etained earnings 3ess5 :reasury stock2 *00 shares2 common :otal stockholders equity 1M10 1M10 1M20 =referred Stock5 12000 J I100 par 4 I1002000 credit /dditional =aidDin &apital5 12000 J .I120 K I1000 4 I202000 credit &ommon Stock5 )2000 J I$ 4 I#02000 credit /dditional =aidDin &apital5 )2000 J .I)0 K I$0 4 I%002000 credit &ommon Stock5 22000 J I$ par 4 I102000 credit /dditional =aidDin &apital5 22000 J .I(0 K I$0 4 I1"02000 credit I1002000 $02000 202000 ("02000 $00 I*002$00 2(2$00 .$#20000 I)(#2000

:reasury stock acquired5 :reasury Stock5 12000 J I%0 4 I%02000 debit :reasury stock resold5 :reasury Stock5 100 J I%0 4 I%2000 credit /dditional =aidDin &apital5 100 J .I%$ K I%00 4 I$00 credit 12M"1 8et income5 >etained Earnings5 I)02000 credit 12M"1 !i'idend5 =referred5 12000 J I100 par J (N 4 I(2000 debit &ommon5 *2100 shares J I$ 4 I#$2$00 debit

116.-

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 2

PRO!"E# 116-A EVA"9ATI$D A"TER$ATIVE I$VEST#E$TS

1, Co&&o( stockEdi'idends become an obligation of the company after they are declared. =rior to the declaration2 the company is not obligated to pay di'idends to common shareholders. PreBerred stockEdi'idends become an obligation of the company after they are declared. =rior to the declaration2 the company is not obligated to pay di'idends. <o e'er2 preferred stockholders ha'e preference o'er common stockholders and ill recei'e di'idends before common stockholders. In addition2 the cumulati'e feature requires that all di'idends in arrears be paid to preferred stockholders before any di'idends are paid to common stockholders. !o(dsEthe interest and principal payments are a legal obligation of the company. -, >ob should in'est in the common stock because the return is greatest. >ob must be a are2 ho e'er2 that the risk is also the greatest. If the company fails to perform as it has in the past and is e,pected to perform in the future2 >ob not only ould lose di'idends but might lose the in'estment in stock.

39 $ 1,

PRO!"E# 116.A %IVI%E$%S FOR PREFERRE% A$% CO##O$ STOC:

PreBerred Stock I2002000 J )N 4 I1%2000 =er share5 I1%2000M22000 4 I).00 PreBerred Stock I1%2000 J " years 4 I#)2000 =er share5 I#)2000M22000 4 I2#.00

Co&&o( Stock I11)2000 K I1%2000 4 I1022000 I1022000M#02000 4 I2.$$ Co&&o( Stock I11)2000 K I#)2000 4 I(02000 I(02000M#02000 4 I1.($

-,

39 %

PRO!"E# 116/A EFFECT OF STOC: %IVI%E$%

1, :he statement should include the follo ing points5 ', / stock di'idend does not change the total stockholders equity amount. 7, / stock di'idend does reduce the balance of >etained Earnings and transfers the amount of the stock di'idend to the contributed capital component of stockholders equity. c, / stock di'idend results in additional shares of stock outstanding. :herefore2 it affects the financial ratios of the firm. 7or e,ample2 book 'alue per share and earnings per share decline as a result of the stock di'idend.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116..

PRO!"E# 116/A @Co(cludedA

-, :he statement to the stockholders should stress the follo ing points5 ', Each stockholder has the same proportionate o nership of the company after the di'idend as before the di'idend. 7, / stock di'idend is likely to cause the market price per share of the stock to decline. :he additional shares recei'ed by the stockholder should offset the decline in the per share price and lea'e the stockholder at least as ell off as before the di'idend. c, Rhat happens to the stock price after the stock di'idend is dependent on the companys profitability and a ide 'ariety of industry and economic factors.

39 (

PRO!"E# 1160A %IVI%E$%S A$% STOC: SP"ITS

1, March 1 /pril 1 Oune 1

&ash di'idends increase .or >etained Earnings decrease0 and total stockholders equity decreases. :otal stockholders equity remains unchanged. &ommon Stock !istributable increases by I)2000 .102000 J )N J I100. /dditional =aidDin &apitalE&ommon Stock increases by I122)00 .102000 J )N J I1%0. >etained Earnings decrease by I202)00. :otal stockholders equity does not change. &ommon Stock !istributable decreases and &ommon Stock increases by I)2000. >etained Earnings and total stockholders equity decrease by I(2$%0 P.102000 L )000 J I0.(0Q. :otal stockholders equity does not change. :he par 'alue of common stock changes from I10 to I"."" as the number of shares issued and outstanding triples from 102)00 to "22#002 but the total par 'alue does not change. :he total stockholders equity also does not change.

Ouly 1 Sept. 1 9ct. 1 !ec. 1

116./

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

PRO!"E# 1160A @Co(cludedA

-,

SVE$!ERD I$C, PARTIA" !A"A$CE SHEET %ECE#!ER .1 -552 Stockholders Equity =referred stock2 I)0 par2 )N2 12000 shares issued and outstanding &ommon stock2 I"."" par2 "22#001 shares issued and outstanding /dditional paidDin capitalEpreferred /dditional paidDin capitalEcommon :otal contributed capital >etained earnings :otal stockholders equity I )02000

10)200011 %02000 2"(2)00111 I #)$2)00 22%%$22#01111 I"21$120#0

1.102000 L )00 stock di'idend0 J " .stock split0 4 "22#00 11!ifference due to rounding of par 'alue 111I22$2000 L I122)00 stock di'idend 4 I2"(2)00 1111I12*)02000 K I%2#00 cash di'idend K I202)00 stock di'idend K I(2$%0 cash di'idend L I(202000 net income 4 I22%%$22#0 ., / stock di'idend results in the capitali-ation of part of the >etained Earnings account. :he 'alue of the shares issued in the stock di'idend is deducted from the >etained Earnings account and added to the &apital Stock account .and the /dditional =aidDin &apital account for small stock di'idends0. :he number of outstanding shares is increased2 and the par 'alue of the shares is unchanged. In a stock split2 there is no change to any of the capital accounts. :here is an increase in the number of outstanding shares2 hich is offset by a corresponding decrease in the par 'alue of those shares.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116.0

39 )

PRO!"E# 1161A STATE#E$T OF STOC:HO"%ERS E89IT;

PreBerred Stock Halance2 Oanuary 1 I 0 Sale of preferred stock 1002000 Sale of common stock Issuance of common stock for building site =urchase of treasury stock Sale of treasury stock 8et income &ash di'idendsE =referred &ash di'idendsE &ommon Halance2 !ecember "1 I1002000

Co&&o( Stock I 0

P'id6i( C'?it'l I 0 202000 %002000 1"02000 $00

Tre'sury Stock I 0

Ret'i(ed E'r(i()s I 0

#02000 102000

.%020000 %2000 )02000 .(20000

I$02000

I($02$00

I.$#20000

.#$2$000 I 2(2$00

E*?l'('tio(sE 1M10 =referred Stock5 12000 J I100 par 4 I1002000 increase /dditional =aidDin &apital5 12000 J .I120 K I1000 4 I202000 increase 1M10 1M20 &ommon Stock5 )2000 J I$ 4 I#02000 increase /dditional =aidDin &apital5 )2000 J .I)0 K I$0 4 I%002000 increase &ommon Stock5 22000 J I$ par 4 I102000 increase /dditional =aidDin &apital5 22000 J .I(0 K I$0 4 I1"02000 increase

/cquisition of treasury stock5 :reasury Stock5 12000 J I%0 4 I%02000 decrease >esale of treasury stock5 :reasury Stock5 100 J I%0 4 I%2000 increase /dditional =aidDin &apital5 100 J .I%$ K I%00 4 I$00 increase 12M"1 8et income5 >etained Earnings5 I)02000 increase 12M"1 &ash di'idends5 =referred Stock5 .12000 J I100 J (N0 4 I(2000 decrease in >etained Earnings &ommon Stock5 *2100 outstanding J I$ per share 4 I#$2$00 decrease in >etained Earnings

116.1

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 )

PRO!"E# 1162A COSTCOS CO#PREHE$SIVE I$CO#E

1, 9ther comprehensi'e income includes items that are not in the traditional net income amount but are included in the broader measure of comprehensi'e income. :hese items include5 foreign currency translation adCustments2 adCustments in the market 'alues of certain in'estments2 and occasionally an adCustment for the minimum pension liability amount. -, 9ther transactions that affect stockholders equity include5 issuing stock or repurchasing stock as treasury stock2 cash di'idends2 and stock di'idends. ., &ash di'idends reduce stockholders equity. / stock di'idend changes the balance of accounts ithin the stockholders equity category2 but the total amount of stockholders equity is not affected. 39 10

PRO!"E# 1163A EFFECTS OF STOC:HO"%ERS E89IT; TRA$SACTIO$S O$ THE STATE#E$T OF CASH F"OWS

&ash flo s from financing acti'ities5 Issuance of preferred stock .12000 J I1200 Issuance of common stock .)2000 J I)00 =urchase of treasury stock .12000 J I%00 >eissuance of treasury stock .100 J I%$0 8et cash flo s from financing acti'ities :he follo ing transactions statement of cash flo s5

I1202000 %#02000 .%020000 %2$00 I(0%2$00

ould not appear in the financing acti'ities section of the

@ebler obtained the building site by issuing 22000 shares of common stock6 no cash changed hands. /s a result2 this transaction ould be reported as a noncash in'esting and financing transaction on the statement of cash flo s. /ssuming the indirect method is used2 the companys 200( net income ould appear as the first item under the cash flo s from operating acti'ities section of the statement of cash flo s. :he di'idend declared2 on !ecember "12 200(2 ill not be paid until 200). /s a result2 the payment of this di'idend ill appear as a cash outflo in the financing section of the 200) statement of cash flo s.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116.2

39 11 1,

PRO!"E# 1164A I$CO#E %ISTRI!9TIO$ OF A PART$ERSHIP @A??e(di*A

:'tH Salary to @atInterest to @an5 10N J I%002000 >emainder in 251 ratio5 .I"02000 K I10020000 J 2M" 4 .I"02000 K I10020000 J 1M" 4 :otal distributed I #02000

:'( I %02000

.#%2%%(0 I .%2%%(0 .2"2"""0 I "%2%%(

$oteE ;enerally2 salary and interest are allocated first to the partners accounts and then2 if there is a deficit2 the deficit is allocated in the agreed ratio. :he result2 in this case2 is a negati'e amount distributed to @at-. -, If income is I10020002 it should be distributed as follo s5 :'tH Salary to @atInterest to @an5 10N J I%002000 :otal distributed I#02000 I#02000 I%02000 I%02000 :'(

., If income is I1%020002 it should be distributed as follo s5 :'tH Salary to @atInterest to @an5 10N J I%002000 >emainder in 251 ratio5 .I1%02000 K I10020000 J 2M" .I1%02000 K I10020000 J 1M" :otal !istributed I#02000 I%02000 #02000 I)02000 202000 I)02000 :'(

116.3

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

39 11 1,

PRO!"E# 11615A SO"E PROPRIETORSHIPS @A??e(di*A

!A"A$CE SHEET

Assets &ash 1$02000 < "i'7ilities = OF(ers Equity &hen &hien 3ao2 &apital 1$02000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o record in'estment by o ner.

!A"A$CE SHEET

Assets &ash 1$2000 < "i'7ilities = OF(ers Equity &hen &hien 3ao2 !ra ing .1$20000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o record ithdra al by o ner.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses Sales .1"$20000 E,penses 10$2000 Income Summary "02000

:o close re'enues and e,penses.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity &hen &hien 3ao2 &apital "02000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses ."020000

:o close income summary.

!A"A$CE SHEET

Assets < "i'7ilities = OF(ers Equity &hen &hien 3ao2 &apital .1$20000 &hen &hien 3ao2 !ra ing 1$2000

I$CO#E

STATE#E$T

= Re+e(ues > E*?e(ses

:o close dra ings account.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116.4

PRO!"E# 11615A @Co(cludedA

Heginning balance In'estments by o ner /dd5 8et income 3ess5 Rithdra als Ending balance

I 0 1$02000 I1$02000 "02000 .1$20000 I1%$2000

-, :he capital account indicates the amount of the o ners income that has not been ithdra n. It is based on accrual accounting and does not indicate the amount of cash in the business.

116/5 39 11

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

PRO!"E# 11611A PART$ERSHIPS @A??e(di*A

/llocation of net income5 8et income 3ess5 Salary 3ess5 Interest .I1#02000 J %N0 >emainder to allocate 112200 Halance of equity

"ocke I102)00

:eyes I )2#00

Tot'l I"02#001 1*2200 I 112200 I 0

$2%00 I1%2#00

$2%00 I1#2000

1It is assumed that the net income amount is after the amount of salary to 3ocke has been deducted. Heginning balance /dd5 In'estments /llocation of net income 3ess5 Rithdra als Ending balance "ocke I 0 "$2000 112000 I#%2000 )2#00 I"(2%00 :eyes I 0 1#02000 )2%00 I1#)2%00 $2%00 I1#"2000

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116/1

A" TE R $ ATE # 9 "TI6 C O$ C E P T PR O! "E # S 39 12#

PRO!"E# 1161-A A$A";SIS OF STOC:HO"%ERS E89IT;

1, =referred stock issued 4 I#002000MI$0 par 4 )2000 shares -, =referred stock outstanding 4 )2000 K 200 .:reasury Stock0 4 (2)00 shares ., .I#002000 L I1220000M)2000 4 I$1.$0 /, I2)02000M1#2000 4 I20 0, .I2)02000 L I*)020000M1#2000 4 I*0 1, I122)00M200 4 I%# 2, I12%(#2000 L I)02000 K I122)00 4 I12(#12200 3, PI12(#12200 K .(2)00 J I$00QM1#2000 4 I*%.$1 39 "2#2( 1, ', 7, c, d, e, L"#02000 1.I102000 L I102000 K I120000.I0.$00 $oteE :he net income of transaction e. increases o ners equity by I"#02000 .as sho n0. :he corresponding amount may be an increase to assets2 a decrease in liabilities2 or some combination. -, &ontributed capital is the amount gi'en in e,change for assets. In the first transaction2 the company ga'e stock for cash2 an asset. In the second transaction2 the company ga'e stock for a patent2 also an asset. &ontributed capital may also be gi'en for payment of debt. >etained earnings is the second category of o ners equity and it represents the amount of undistributed2 accumulated earnings of the company. <iltons retained earnings balance is the income of I"#02000 less di'idends of I*2$00 4 I""02$00.

PRO!"E# 1161.A EFFECTS OF STOC:HO"%ERS E89IT; TRA$SACTIO$S O$ THE !A"A$CE SHEET

Assets L1002000 L1002000 K102000

<

"i'7ilities

Stockholders Equity L102000 L*02000 L102000 L*02000 K102000

L*2$00

K*2$001 L"#02000

116/-

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

PRO!"E# 1161.A @Co(cludedA

., :he book 'alue of the common stock at the end of the year is computed as follo s5 Stockholders EquityE &ommon stock /dditional paidDin capitalEcommon stock >etained earnings .I"#02000 K I*2$000 3ess5 :reasury stock :otal 8umber of shares of stock outstanding 4 102000 L 102000 K 12000 4 1*2000 Hook 'alue per share 4 I$202$00M1*2000 4 I2(."* I 202000 1)02000 ""02$00 .1020000 I$202$00

39 12# 1,

PRO!"E# 1161/A STOC:HO"%ERS E89IT; SECTIO$ OF THE !A"A$CE SHEET

DRAI$FIE"% I$C, PARTIA" !A"A$CE SHEET Stockholders Equity =referred stock2 102000 shares authori-ed2 $2000 shares issued and outstanding2 I10 par2 $N &ommon stock2 1200020000 shares authori-ed2 1002000 shares issued and *(2000 shares outstanding2 I1 par 'alue /dditional paidDin capital >etained earnings :reasury stock2 "2000 shares of common :otal Stockholders Equity I $02000 1002000 %)2#00 $#2*00 .1$20000 I2$)2"00

-, !i'idends =ayable is a liability.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116/.

% E C IS IO$ C AS E S REA%I$D A$% I$TERPRETI$D FI$A$CIA" STATE#E$TS

39 12)

%ECISIO$ CASE 1161 CO#PARI$D TWO CO#PA$IES I$ THE SA#E I$%9STR;E FOOT "OC:ER A$% FI$ISH "I$E

1, 7oot 3ocker had the follo ing number of shares5 /uthori-ed5 $00 million Issued5 1$(22)02000 9utstanding5 1$$2$0#2000 7inish 3ine had the follo ing number of shares5 /uthori-ed5 &lass /2 100200020002 &lass H2 1020002000 Issued5 &lass /2 #(2%#*20002 &lass H2 $21#12000 9utstanding5 &lass /2 #"2$()20002 &lass H2 $21#12000 -, 7oot 3ockers >etained Earnings account increased during the period from I12")% million to I12%01 million. 7inish 3ines >etained Earnings account increased from I20% million to I2%" million. >etained earnings is increased by the net income for the period and reduced by di'idends that are declared to stockholders. ., 7oot 3ocker had a total stockholders equity of I2202( million I#2) million. hile 7inish 3ine had

:he dollar amount of stockholders equity2 by itself2 does not indicate the o'erall position of the company because the t o companies are not the same si-e. Hoth companies are solid companies and ha'e a large amount of 'alue to the stockholders as reflected by total stockholders equity.

39 10

%ECISIO$ CASE 116- REA%I$D FI$ISH "I$ES STATE#E$T OF CASH F"OWS

1, :he company had only one source of cash from financing acti'ities during the year5 issuance of common stock. -, !i'idends paid to stockholders as I#2)%#2000. ., Rhen treasury stock is purchased2 cash is reduced in the asset category and total stockholders equity is reduced by the same amount.

116//

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

#A:I$D FI$A$CIA" %ECISIO$S 39 122

%ECISIO$ CASE 116. %E!T VERS9S PREFERRE% STOC:

1, :he purpose of this problem is to allo students to see the similarities and differences bet een a liability and an equity. In the problem2 the loan of 7irst &ompany is 'ery similar to the preferred stock of Second &ompany. Hoth securities indicate annual payments of )N .interest or di'idend0. 7urther2 the stock carries a mandatory redemption feature that indicates it must be repaid or redeemed at the end of fi'e years. $oteE :here are specific 7/SH and SE& guidelines on the classification of preferred stock ith mandatory redemption features that you may ish to ask the students to reference. Especially note the 7/SH difficulties ith S7/S 1$0. :here may2 ho e'er2 be differences bet een the securities of 7irst and Second companies. 3egally2 the loan payable has a right to assets before stock. /lso2 the preferred stock di'idend is cumulati'e2 but that is not the same as interest on a loan. Stockholders do not ha'e the right to di'idends until they ha'e been declared2 e'en hen the stock is cumulati'e. -, Rhether the preferred stock should be considered a liability or an equity is a matter of Cudgment. :his is a good opportunity to stress form o'er substance. :he proper classification of the security should be based on the students belief about the substance of the transaction rather than on hether the company has chosen to call the security a loan or stock. 39 2

%ECISIO$ CASE 116/ PREFERRE% VERS9S CO##O$ STOC:

PreBerred StockE=referred stock has no 'oting rights. :he company is not obligated to pay di'idends until they are declared6 ho e'er2 the cumulati'e feature requires that the company pay preferred shareholders all di'idends in arrears before common shareholders recei'e a di'idend. If one person purchased all $02000 shares of common stock2 the ne in'estor ould o n 11N .$0M#$00 of the company. :he original o ners ould o n 1)N .)0M#$00 of the company. If one or t o of the original o ners purchased the stock2 the po er could shift to those shareholders. !i'idends are ne'er required on common stock. :hey become a legal obligation of the company only after they are declared. In order to de'elop a recommendation2 the issues concerned must be e'aluated more thoroughly. If the primary concern is the ability to monitor cash flo 2 then common stock is more attracti'e. <o e'er2 common stock is not attracti'e if the current o ners are concerned that additional shares of stock may result in loss of 'oting control of the company. 9ne solution may be to issue common stock that allo s the current stockholders the right to maintain their o nership percentage. /nother solution may be to issue a second class of common stock that does not ha'e equal 'oting rights.

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116/0

ETHICA" %ECISIO$ #A:I$D 39 *

%ECISIO$ CASE 1160 I$SI%E I$FOR#ATIO$

:he ethical issue in this case is hether or not Oim Hrock acted improperly hen he ad'ised his father to buy shares of <ubbard Inc. stock. Surprisingly2 in discussing this case ith students2 many students do not see that Hrock has a professional responsibility to his employer. 7urther2 most students are not a are of the term Finsider information.G Issues that should be discussed include the follo ing5 1, Ras anyone harmed by Hrocks actions2 e.g.2 the parties that sold the stock at a lo priceU -, !oes it matter if Hrock himself profited or if some other party purchased stock based on his kno ledgeU ., !o brokers and analysts recei'e information about the firm that is not a'ailable to the publicU !oesnt e'eryone engage in insider informationU /, If Hrock decides he did act unethically2 situationU hat action should he take to correct the

0, Rhat company policies or procedures could be adopted to ensure that similar situations do not arise in the futureU

39 $

%ECISIO$ CASE 1161 %IVI%E$% PO"IC;

>etained earnings represents accumulated2 undistributed earnings of the company2 but it is not an asset. :he earnings may be tied up in buildings and land used in production or e'en in current assets like in'entory and supplies. If the larger di'idend creates a orking capital problem2 it may Ceopardi-e the future of the company. It ould not be good to 'ote for a large di'idend if the company ill not ha'e enough cash to meet current obligations.

116/1

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

REA" WOR"% PRACTICE 11,1 /n accumulated deficit represents a debit balance in the >etained Earnings account. ;enerally2 this is the result of the company incurring losses in either the current period or in past periods. :he account increased .that is2 it became less negati'e0 in the current period.

REA" WOR"% PRACTICE 11,:he company had preferred stock authori-ed but none as issued during the year. :he company had t o classes of common stock5 &lass / common stock and &lass H common stock. .

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116/2

SO"9TIO$ TO I$TEDRATIVE PRO!"E#S P'rt .

1.

Assets Equipment )

!A"A$CE SHEET

< "i'7ilities 3ease 9bligation ) =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

!A"A$CE SHEET

Assets < "i'7ilities = /ccumulated !epreciationE Equipment .10

I$CO#E

STATE#E$T

!epreciation .10

Stockholders Equity = Re+e(ues > E*?e(ses

!A"A$CE SHEET

Assets &ash .1.$0 < "i'7ilities = 3ease 9bligation .1.00

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses Interest E,pense .0.$0

;riffins financial ratios under a capital lease are as follo s5 &urrent ratio5 I).0MI#.0 4 2 to l !ebtDtoDequity ratio5 I1%MI## 4 0."% 8et income 4 I10.# million E=S net income 4 .I10.# million K I0.1 million0M# 4 I2.$( million .rounded0. -, Alter('ti+e A, If the equipment had been acquired under an operating lease instead of a capital lease2 the transaction ould ha'e been as follo s5

!A"A$CE SHEET

Assets &ash .1.$0 < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses >ental E,pense .1.$0

116/3

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

I$TEDRATIVE PRO!"E# @Co(ti(uedA

;riffins balance sheet and income statement ould appear as follo s5 DRIFFI$ I$C, !A"A$CE SHEET %ECE#!ER .1 -552 @I$ #I""IO$SA Assets &ash 9ther current assets 9ther longDterm assets :otal assets "i'7ilities 9ther current liabilities 9ther longDterm liabilities :otal liabilities Stockholders Equity =referred stock /dditional paidDin capital on preferred stock &ommon stock /dditional paidDin capital on common stock >etained earnings :otal stockholders equity :otal liabilities and stockholders equity I ".0 %.0 I *.0 I 1.0 2.0 #.0 1%.0 21.0 ##.0 I$".0 I 1.% %.# #$.0 I$".0

DRIFFI$ I$C, I$CO#E STATE#E$T FOR THE ;EAR E$%E% %ECE#!ER .1 -552 @I$ #I""IO$SA >e'enues E,penses5 >ent on leased asset !epreciationEother assets 9ther e,penses Income ta, ."0N rate0 :otal e,penses Income before e,traordinary loss E,traordinary loss .net of I0.* ta,es0 8et income E=S before e,traordinary loss E=S e,traordinary loss E=SEnet income I $0.00 I 1.$0 ".20 2(.#0 $.#0 "(.$0 I 12.$0 .2.100 I 10.#0 I ".10 .0.$"0 I 2.$(

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

116/4

I$TEDRATIVE PRO!"E# @Co(ti(uedA

;riffins financial ratios under an operating lease ould be as follo s5 &urrent ratio5 I).0MI".0 4 2.%( to l !ebtDtoDequity ratio5 I*MI## 4 0.20 8et income 4 I10.# million E=S net income 4 I2.$( .rounded0. /n operating lease results in offDbalanceDsheet financing. :herefore2 the leased asset does not appear on the balance sheet as an asset and the obligation does not appear as a liability. :his causes a more fa'orable current ratio and debtDtoDequity ratio. 8et income and E=S are not affected because the amount of the lease payment is I1.$ million under either an operating or a capital lease. Alter('ti+e !, If ;riffin had issued bonds to purchase the asset2 the transactions ould ha'e been as follo s5

!A"A$CE SHEET

Assets &ash ) < "i'7ilities Honds =ayable ) =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

!A"A$CE SHEET

Assets Equipment ) &ash .)0 < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

!A"A$CE SHEET

Assets < "i'7ilities = /ccumulated !epreciationE Equipment .10

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses !epreciation E,pense .10

!A"A$CE SHEET

Assets &ash .1.$0 < "i'7ilities = Honds =ayable .1.00

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses Interest E,pense .0.$0

11605

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

I$TEDRATIVE PRO!"E# @Co(ti(uedA

;riffins balance sheet and income statement ould appear as follo s5 DRIFFI$ I$C, !A"A$CE SHEET %ECE#!ER .1 -552 @I$ #I""IO$SA Assets &ash 9ther current assets Equipment .net of accumulated depreciation0 9ther longDterm assets :otal assets "i'7ilities &urrent portion of bonds payable 9ther current liabilities Honds payableElong term 9ther longDterm liabilities :otal liabilities Stockholders Equity =referred stock /dditional paidDin capital on preferred stock &ommon stock /dditional paidDin capital on common stock >etained earnings :otal stockholders equity :otal liabilities and stockholders equity I 1.0 ".0 %.0 %.0 I1%.0 I 1.0 2.0 #.0 1%.0 21.0 ##.0 I%0.0 I 1.% %.# (.0 #$.0 I%0.0

DRIFFI$ I$C, I$CO#E STATE#E$T FOR THE ;EAR E$%E% %ECE#!ER .1 -552 @I$ #I""IO$SA >e'enues E,penses5 !epreciation of equipment !epreciation of other assets Interest on bonds payable 9ther e,penses Income ta, ."0N rate0 :otal e,penses Income before e,traordinary loss E,traordinary loss .net of I0.* ta,es0 8et income E=S before e,traordinary loss E=S e,traordinary loss E=SEnet income I $0.00 I 1.00 ".20 0.$0 2(.#0 $.#0 "(.$0 I 12.$0 .2.100 I 10.#0 I ".10 .0.$"0 I 2.$(

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

11601

I$TEDRATIVE PRO!"E# @Co(ti(uedA

;riffins financial ratios if the asset is purchased ith the proceeds from the issuance of bonds are as follo s5 &urrent ratio5 I).0MI#.0 4 2 to l !ebtDtoDequity ratio5 I1%MI## 4 0."% 8et income 4 I10.# million E=S net income 4 .I10.# million K I0.1 million0M# 4 I2.$( .rounded0. :he effect on the financial statements of purchasing an asset ith the bond proceeds is the same as if the asset ere acquired ith a capital lease .=art 1 of this problem0. :herefore2 the financial ratios are the same as in =art 1. Alter('ti+e C, If ;riffin issued preferred stock and purchased the asset2 the transactions ould be as follo s5

!A"A$CE SHEET

Assets &ash ) < "i'7ilities = =referred Stock 2 /dditional =aid in &apital =referred %

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

!A"A$CE SHEET

Assets "i'7ilities =Stockholders Equity Equipment ) &ash .)0 = Re+e(ues > E*?e(ses

I$CO#E

STATE#E$T

!A"A$CE SHEET

Assets < "i'7ilities = /ccumulated !epreciationD Equipment .10

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses !epreciation E,pense .10

!A"A$CE SHEET

Assets &ash .0.20 < "i'7ilities = >etained Earnings .0.20

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses

1:he abo'e entry records the di'idend on the additional 2002000 shares of stock issued. :he total number of shares outstanding is "002000.

1160-

7I8/8&I/3 /&&9+8:I8; S93+:I98S M/8+/3

I$TEDRATIVE PRO!"E# @Co(ti(uedA !A"A$CE SHEET

Assets &ash .0.10 < "i'7ilities =

I$CO#E

STATE#E$T

Stockholders Equity = Re+e(ues > E*?e(ses :a, E,pense .0.110

1Hecause the di'idend does not result in a ta, deduction2 the ta, e,pense for the year is increased. :his transaction records the additional ta,. If ;riffin issued stock to acquire the equipment2 the financial statements appear as follo s5 DRIFFI$ I$C, !A"A$CE SHEET %ECE#!ER .1 -552 @I$ #I""IO$SA Assets &ash 9ther current assets Equipment .net of accumulated depreciation0 9ther longDterm assets :otal assets "i'7ilities 9ther current liabilities 9ther longDterm liabilities :otal liabilities Stockholders Equity =referred stock /dditional paidDin capital on preferred stock &ommon stock /dditional paidDin capital on common stock >etained earnings :otal stockholders equity :otal liabilities and stockholders equity I ".0 %.0 I *.0 I ".0 ).0 #.0 1%.0 21.2 $2.2 I%1.2 I 2.) %.# (.0 #$.0 I%1.2 ould

&</=:E> 11 ? S:9&@<93!E>S EA+I:B

1160.

I$TEDRATIVE PRO!"E# @Co(cludedA

DRIFFI$ I$C, I$CO#E STATE#E$T FOR THE ;EAR E$%E% %ECE#!ER .1 -552 @I$ #I""IO$SA >e'enues E,penses5 !epreciation of equipment !epreciationEother assets 9ther e,penses Income ta, ."0N rate0 :otal e,penses Income before e,traordinary loss E,traordinary loss .net of I0.* ta,es0 8et income E=S before e,traordinary loss E=S e,traordinary loss E=SEnet income I$0.00 I 1.00 ".20 2(.#0 $.$0 "(.10 I12.*0 .2.100 I10.)0 I ".1$ .0.$"0 I 2.%2

;riffins financial ratios ould appear as follo s5 &urrent ratio5 .I2.) L I%.#0MI".0 4 ".0( to l !ebtDtoDequity ratio5 I*.0MI$2.2 4 0.1( 8et income 4 I10.) million E=S net income 4 .I10.) million K I0." million0M# 4 I2.%2 .rounded0. :he use of preferred stock to acquire the equipment causes a difference in the financial statements because the preferred stock is part of stockholders equity2 rather than liabilities. /lso2 the di'idend on preferred stock is not ta, deductible2 hereas lease payments or interest payments are ta, deductible. :he resulting impact is an increase in the current ratio2 net income2 and E=S but a decrease in the debtDtoDequity ratio.

Anda mungkin juga menyukai

- CH 4Dokumen12 halamanCH 4Miftahudin Miftahudin0% (1)

- List of PEZA-registered Warehousing and Logistics CompaniesDokumen219 halamanList of PEZA-registered Warehousing and Logistics CompaniesJeremy YapBelum ada peringkat

- Virtual PE & VC Conference Attendee List - 23-6-2020 PDFDokumen8 halamanVirtual PE & VC Conference Attendee List - 23-6-2020 PDFKadri UgandBelum ada peringkat

- Accounting For Retained EarningsDokumen11 halamanAccounting For Retained EarningsSarah Johnson100% (1)

- Famba 8e - SM - Mod 08 - 040920 1Dokumen41 halamanFamba 8e - SM - Mod 08 - 040920 1Shady Mohsen MikhealBelum ada peringkat

- Corporation Accounting - DividendsDokumen6 halamanCorporation Accounting - DividendsGuadaMichelleGripalBelum ada peringkat

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownDari EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownBelum ada peringkat

- Nipcib 000002Dokumen5.529 halamanNipcib 000002AlfoFS100% (3)

- Tugas Individu 2Dokumen3 halamanTugas Individu 2Araminta DewatiBelum ada peringkat

- Two Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?Dokumen8 halamanTwo Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?HARSHBHATTERBelum ada peringkat

- Stockholders' Equity: Overview of Exercises, Problems, and CasesDokumen50 halamanStockholders' Equity: Overview of Exercises, Problems, and Casesginish12Belum ada peringkat

- 8Dokumen25 halaman8JDBelum ada peringkat

- Module 8 - Shareholders' Equity, Retained Earnings, and DividendsDokumen10 halamanModule 8 - Shareholders' Equity, Retained Earnings, and DividendsLaurio, Genebabe TagubarasBelum ada peringkat

- SM Chapter 01Dokumen36 halamanSM Chapter 01mfawzi010Belum ada peringkat

- Viney7e SM Ch06Dokumen16 halamanViney7e SM Ch06eternitystarBelum ada peringkat

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDokumen12 halamanCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Belum ada peringkat

- Real AccountingDokumen22 halamanReal Accountingakbar2jBelum ada peringkat

- Lesson 6 - Statement of Financial Position (Part 2)Dokumen9 halamanLesson 6 - Statement of Financial Position (Part 2)yana jungBelum ada peringkat

- Mutual FundDokumen10 halamanMutual FundmadhuBelum ada peringkat

- Finacial StatementsDokumen3 halamanFinacial Statementsjung3232 -Belum ada peringkat

- Module 5 Part 4 The Corporation-Retained EarningsDokumen27 halamanModule 5 Part 4 The Corporation-Retained EarningsKRISTINA CASSANDRA CUEVASBelum ada peringkat

- Introduction To Corporate Finance: Chapter OrganizationDokumen10 halamanIntroduction To Corporate Finance: Chapter OrganizationTonyWalterBelum ada peringkat

- C 3 A F S: Hapter Nalysis of Inancial TatementsDokumen27 halamanC 3 A F S: Hapter Nalysis of Inancial TatementskheymiBelum ada peringkat

- Financial StatementsDokumen2 halamanFinancial StatementsMaricielo LopezBelum ada peringkat

- Accounting Module1Dokumen12 halamanAccounting Module1Gierome Ian BisanaBelum ada peringkat

- CH 15Dokumen36 halamanCH 15BryanaBelum ada peringkat

- Fin 3013 Chapter 4Dokumen46 halamanFin 3013 Chapter 4PookguyBelum ada peringkat

- How To Read Balance SheetDokumen28 halamanHow To Read Balance SheetAnupam JyotiBelum ada peringkat

- Fairfield Institute of Management and Technology: Financial Management (Sub Code:204)Dokumen10 halamanFairfield Institute of Management and Technology: Financial Management (Sub Code:204)chandniBelum ada peringkat

- ACCT1002 U7-20151028nprDokumen12 halamanACCT1002 U7-20151028nprSaintBelum ada peringkat

- Appropriated P & L DetailsDokumen10 halamanAppropriated P & L DetailsM Usman AslamBelum ada peringkat

- Equity Finance Lecture SlidesDokumen14 halamanEquity Finance Lecture Slidesdewanelma95Belum ada peringkat

- Solution Manual For Core Concepts of Accounting Raiborn 2nd EditionDokumen18 halamanSolution Manual For Core Concepts of Accounting Raiborn 2nd EditionJacquelineFrancisfpgs100% (36)