Chapter 10

Diunggah oleh

ravevivalDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 10

Diunggah oleh

ravevivalHak Cipta:

Format Tersedia

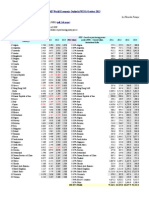

lntroduction to Bond Yields and

Prices 5Ot

(2t

Il It E I I

PV

of

(3y

949,243

0.04013 (4) Years 0.5 1.0

1.5

2.O

(1)

Cash Flows

Future Date

6 months

1 year 1.5 years 2 years

(x

10,000) 38.095 36.281

(3)

(4)

o.o2ao7

0,03822

0.03640 0.03467 0.03302 0.03145

o.03822

0.05460 0.06934 0.08255 0.09435 2.35863

: t

I

34.554

32.908 31.341 29.849

2.5 years

3 years

2.5 3.0 3.0 Duration

3 years

746.215 949.246

o.78612

1.00210

&builL

tffi!

Sum

2.71749

2.72yeats

h.d{f rfrrehrd

H*d

17-1

Using the information in demonstration Problem 17-1, if the coupon rate for the bond is

10 percent and the discount rate is 8 percent, with the same three years to maturity, show that the price of the bond is Rp10,515,400 with annual discounting and Rp10,522,400 with semiannual discounting. Use a calculator to determine the discount factors.

What would be the price of this bond if both the coupon rate and the discount rate were

10 percent?

17

-2

Using the information in Demonstt'ation Problem

these problems.

17

-2, solve for the price of the bond in

Problem 17-1 using both annual and semiannual discounting. Use a calculator to solve

7-3

With reference to Problem

paid quarterly?

17

-2, what would be the price of the bond if the coupon were

17-4 17-5

Calculate the price of a 10 percent coupon bond with eight years to maturity, given an

appropriate discount rate of 12 percent, using both annual and semiannual discounting.

Calculate the price of the bond in Problem

17

-4 if the maturity is 20 years rather than

8 years. Use semiannual discounting and the tables

in the appendix. Which of Malkiel's

principles are illustrated when comparing the price of this bond to the price determined

in Problem 17-l?

1

7-6

The YTM on a l0 percent, 1S-year bond is 12 percent. Calculate the price ofthe bond. Calculate the YTM for a l0-year zero-coupon bond sold at Rp4 million. Recalculate the

17-7

YTM if the bond had been priced at Rp3 million.

ntuh

17-8 17-g

Calculate the realized compound yield for a 10 percent bond with 20 years to maturity and an expected reinvestment rate of8 percent.

Consider a 12 percent l0-year bond purchased at face value. Based on Table

assuming a reinvestment rate of l0 percent, calculate:

l7-l

and

a. b. c.

theinterest-on-interest

the total return the realized return

a

17-10 Consider

junk bond with a

12 percent coupon and 20 years to maturity. The current

required rate of return for this bond is 15 percent. What is its price? What would be its price ifthe required yield rose to 17 percent? 20 percent?

Anda mungkin juga menyukai

- Repo and Reverse Repo RateDokumen8 halamanRepo and Reverse Repo RateJinujith MohanBelum ada peringkat

- CH2SOLUTIONS-AnswersProblemSetsDokumen4 halamanCH2SOLUTIONS-AnswersProblemSetsandreaskarayian8972100% (4)

- Ch05 Mini CaseDokumen8 halamanCh05 Mini CaseTia1977Belum ada peringkat

- International Relations: A Simple IntroductionDari EverandInternational Relations: A Simple IntroductionPenilaian: 5 dari 5 bintang5/5 (9)

- EngineeringeconomyanswerssssDokumen13 halamanEngineeringeconomyanswerssssMalik MalikBelum ada peringkat

- R35 The Term Structure and Interest Rate Dynamics Slides PDFDokumen53 halamanR35 The Term Structure and Interest Rate Dynamics Slides PDFPawan RathiBelum ada peringkat

- Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadDari EverandAdaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times - and BadPenilaian: 5 dari 5 bintang5/5 (2)

- Trend LineDokumen6 halamanTrend Lineajtt38Belum ada peringkat

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDari EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsBelum ada peringkat

- CT1 Assignment Chapter 14Dokumen5 halamanCT1 Assignment Chapter 14Gaurav satraBelum ada peringkat

- Present Value Calculations for Retirement PlanningDokumen38 halamanPresent Value Calculations for Retirement Planningmarjannaseri77100% (1)

- Continental CarriersDokumen2 halamanContinental Carrierschch917100% (1)

- Original Design Scenario Cash Flow AnalysisDokumen6 halamanOriginal Design Scenario Cash Flow AnalysisNeha DeewanBelum ada peringkat

- Bond Portfolio Management 25728 Autumn 2012 Assignment 1Dokumen5 halamanBond Portfolio Management 25728 Autumn 2012 Assignment 1Dai DexterBelum ada peringkat

- Lecture 5 - TutorialDokumen2 halamanLecture 5 - TutorialCarmen Alexandra IamandiiBelum ada peringkat

- Chap 010Dokumen9 halamanChap 010siddharth.savlodhiaBelum ada peringkat

- Topic 3 ExamplesDokumen9 halamanTopic 3 ExamplesJessica MccormickBelum ada peringkat

- Compound Interest Formula and ApplicationsDokumen10 halamanCompound Interest Formula and ApplicationsYanie TahaBelum ada peringkat

- Question Bank 2 - SEP2019Dokumen6 halamanQuestion Bank 2 - SEP2019Nhlanhla ZuluBelum ada peringkat

- Set A FinalDokumen5 halamanSet A FinalHimanshu BohraBelum ada peringkat

- Economics (Shifted Series)Dokumen15 halamanEconomics (Shifted Series)api-26367767100% (2)

- Set B FinalDokumen5 halamanSet B FinalHimanshu BohraBelum ada peringkat

- PS5 IR Derivatives 3Dokumen2 halamanPS5 IR Derivatives 3Oscar LinBelum ada peringkat

- Set C FinalDokumen5 halamanSet C FinalHimanshu BohraBelum ada peringkat

- PT 8Dokumen6 halamanPT 8KidlatBelum ada peringkat

- Solve math and finance problems in 1 hour to prove your skillsDokumen23 halamanSolve math and finance problems in 1 hour to prove your skillsKatherine Kit LeeBelum ada peringkat

- Coupan Price CalculationDokumen7 halamanCoupan Price CalculationgopalushaBelum ada peringkat

- PS3SDFSDFDokumen3 halamanPS3SDFSDFsillBelum ada peringkat

- Mid05 1Dokumen4 halamanMid05 1hatemBelum ada peringkat

- Zero-Coupon Yield Curve ExerciseDokumen22 halamanZero-Coupon Yield Curve ExercisePham Minh DucBelum ada peringkat

- Term Structure of Interest RateDokumen2 halamanTerm Structure of Interest RateRehabUddinBelum ada peringkat

- Fin 4225 Quiz 2 (Answer Sheet) (Dokumen3 halamanFin 4225 Quiz 2 (Answer Sheet) (bexultan.batyrkhanovBelum ada peringkat

- Cal Tech Expert ProblemsDokumen40 halamanCal Tech Expert ProblemsNick GeneseBelum ada peringkat

- Assignment B: Made By:-Virender Singh SahuDokumen11 halamanAssignment B: Made By:-Virender Singh SahuVirender Singh SahuBelum ada peringkat

- Chapter 6 ZicaDokumen45 halamanChapter 6 ZicaVainess S Zulu100% (4)

- MCF22 Fic HW1Dokumen3 halamanMCF22 Fic HW1Vasilije NikacevicBelum ada peringkat

- Acs 304. Financial Mathematics IiDokumen5 halamanAcs 304. Financial Mathematics IiKimondo KingBelum ada peringkat

- Engineering Economics ProblemsDokumen9 halamanEngineering Economics Problemsjac bnvstaBelum ada peringkat

- Midterm Exam - Answer Key for Economics 135Dokumen2 halamanMidterm Exam - Answer Key for Economics 135kasimBelum ada peringkat

- Cash flow diagrams and interest factors for capital budgeting problemsDokumen8 halamanCash flow diagrams and interest factors for capital budgeting problemssaulpvBelum ada peringkat

- EC3314 Spring PSet 4 SolutionsDokumen6 halamanEC3314 Spring PSet 4 Solutionschristina0107Belum ada peringkat

- N The The Similar Com Per Stock The C H Afortheendofthelaste 2: Average The Book Value ofDokumen2 halamanN The The Similar Com Per Stock The C H Afortheendofthelaste 2: Average The Book Value ofrajashree mahapatraBelum ada peringkat

- Plugin Final HW4Dokumen5 halamanPlugin Final HW4Eyal Ben DovBelum ada peringkat

- Institute of Actuaries of India: ExaminationsDokumen6 halamanInstitute of Actuaries of India: ExaminationsRochak JainBelum ada peringkat

- Lesson notes on simple interest formulas and conceptsDokumen9 halamanLesson notes on simple interest formulas and conceptsLouie Jay Remojo KilatonBelum ada peringkat

- Beegum Hafna M Hafees Roll No 11Dokumen17 halamanBeegum Hafna M Hafees Roll No 11athiyadas65Belum ada peringkat

- ct12005 2012Dokumen282 halamanct12005 2012Patrick MugoBelum ada peringkat

- Engineering Econ and Financial ManagementDokumen10 halamanEngineering Econ and Financial ManagementLoala SMDBelum ada peringkat

- Practice Problems Eng EconomyDokumen4 halamanPractice Problems Eng Economymahmoud koriemBelum ada peringkat

- Chapter Three Compound Interest 2021Dokumen9 halamanChapter Three Compound Interest 2021Fongoh Bobga RemiBelum ada peringkat

- APS5Dokumen6 halamanAPS5jamesnwhiteside4883Belum ada peringkat

- Valuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers BelowDokumen7 halamanValuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers Belowevivanco1899Belum ada peringkat

- The Analysis and Valuation of Bonds: Answers To QuestionsDokumen4 halamanThe Analysis and Valuation of Bonds: Answers To QuestionsIsmat Jerin ChetonaBelum ada peringkat

- Subjectct12005 2009Dokumen176 halamanSubjectct12005 2009paul.tsho7504Belum ada peringkat

- Interest Rate DerivativesDokumen17 halamanInterest Rate Derivativescharles luisBelum ada peringkat

- Ie198 Eeco DrillsDokumen6 halamanIe198 Eeco DrillsTintin Tao-onBelum ada peringkat

- Class Examples - Introduction To ValuationDokumen14 halamanClass Examples - Introduction To ValuationmohammedBelum ada peringkat

- FandI Subj102 200009 Exampaper PDFDokumen4 halamanFandI Subj102 200009 Exampaper PDFClerry SamuelBelum ada peringkat

- Institute of Actuaries of India: ExaminationsDokumen5 halamanInstitute of Actuaries of India: ExaminationsHemanshu JainBelum ada peringkat

- Feedback On Class Test PerformanceDokumen3 halamanFeedback On Class Test PerformanceLau Pan WangBelum ada peringkat

- Mqp1 10mba Mbafm02 AmDokumen4 halamanMqp1 10mba Mbafm02 AmDipesh JainBelum ada peringkat

- FINANCIAL ECONOMICS EXAMDokumen6 halamanFINANCIAL ECONOMICS EXAM萧霄Belum ada peringkat

- Week 8: Finance: Investment Analysis and Portfolio ManagementDokumen2 halamanWeek 8: Finance: Investment Analysis and Portfolio ManagementHw SolutionBelum ada peringkat

- 332 Mid 15Dokumen5 halaman332 Mid 15Nicholas PoulimenakosBelum ada peringkat

- Beta SahamDokumen6 halamanBeta SahamravevivalBelum ada peringkat

- Brave Heart TabsDokumen8 halamanBrave Heart TabsravevivalBelum ada peringkat

- Brave Heart TabsDokumen8 halamanBrave Heart TabsravevivalBelum ada peringkat

- Chapter 17Dokumen1 halamanChapter 17ravevivalBelum ada peringkat

- Brave Heart TabsDokumen8 halamanBrave Heart TabsravevivalBelum ada peringkat

- International Finance (405-B)Dokumen11 halamanInternational Finance (405-B)Lalit ShahBelum ada peringkat

- Voluntary and Involuntary UnemploymentDokumen2 halamanVoluntary and Involuntary UnemploymentAnonymous sn07CR3uLFBelum ada peringkat

- Macroeconomics Chapter 13 International Trade QuestionsDokumen25 halamanMacroeconomics Chapter 13 International Trade QuestionsYousef KhanBelum ada peringkat

- Investment Appraisal PDFDokumen3 halamanInvestment Appraisal PDFHazwan JamhuriBelum ada peringkat

- IMF World Economic Outlook (WEO) October 2013Dokumen1 halamanIMF World Economic Outlook (WEO) October 2013Eduardo PetazzeBelum ada peringkat

- Ec 392 PS 2Dokumen1 halamanEc 392 PS 2Pablo MercadoBelum ada peringkat

- UntitledDokumen2 halamanUntitledRedier RedBelum ada peringkat

- Amaia Payment SchemesDokumen6 halamanAmaia Payment SchemesMhack ColisBelum ada peringkat

- CFP Introduction To Financial Planning ModuleDokumen4 halamanCFP Introduction To Financial Planning ModulesnehalfpaBelum ada peringkat

- History of RTGS in India - How Real Time Gross Settlement WorksDokumen7 halamanHistory of RTGS in India - How Real Time Gross Settlement WorksDixita ParmarBelum ada peringkat

- Principles of MIcroeconomics - Notes - Markets/Supply/Demand - Part 2Dokumen4 halamanPrinciples of MIcroeconomics - Notes - Markets/Supply/Demand - Part 2Katherine SauerBelum ada peringkat

- Homework 12: Keynesian Models and Money DemandDokumen5 halamanHomework 12: Keynesian Models and Money DemandlolDevRBelum ada peringkat

- Should Company Lease or Buy Asset Based on IRRDokumen6 halamanShould Company Lease or Buy Asset Based on IRRMuntazir HussainBelum ada peringkat

- 5037asd8876 HKDADokumen4 halaman5037asd8876 HKDAdaedric13100% (1)

- Soneri Bank Limited Balance SheetDokumen3 halamanSoneri Bank Limited Balance SheetSaad Ur RehmanBelum ada peringkat

- Interest Rates and AmountsDokumen3 halamanInterest Rates and Amountsseemachauhan48Belum ada peringkat

- Css - Profit and Loss AccountDokumen7 halamanCss - Profit and Loss AccountramaanejaBelum ada peringkat

- International BusinessDokumen2 halamanInternational BusinessPrateek Sinha0% (2)

- Calculate Savings, Loans, Annuities and Present/Future ValuesDokumen1 halamanCalculate Savings, Loans, Annuities and Present/Future ValuesNaveed NawazBelum ada peringkat

- Indian Currency MarketDokumen15 halamanIndian Currency MarketSneha PatelBelum ada peringkat

- Customer Satisfaction Study Reliance Mutual FundsDokumen2 halamanCustomer Satisfaction Study Reliance Mutual FundsebabjiBelum ada peringkat

- Imprest Cash Account FormDokumen5 halamanImprest Cash Account FormrkthbdBelum ada peringkat

- Private Equity Study on India's Growing IndustryDokumen21 halamanPrivate Equity Study on India's Growing IndustryPrabakar NatrajBelum ada peringkat

- Uses of Index NumbersDokumen7 halamanUses of Index NumbersAjay KarthikBelum ada peringkat

- CO5117 TuteSols Topic08 2011Dokumen2 halamanCO5117 TuteSols Topic08 2011Shibin JayaprasadBelum ada peringkat