Weaknesses of Stock Market of India

Diunggah oleh

chronicler92Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Weaknesses of Stock Market of India

Diunggah oleh

chronicler92Hak Cipta:

Format Tersedia

Principal weaknesses of stock market of India The stock market in India suffers from number of weaknesses.

The principal ones are mentioned below: Poor communication system -In my opinion, the communication system of the stock market in India is rather poor. Thisis clear from the fact that brokers often do not report their transact ions to the exchange authorities and clients do not know how much commission the brokers charge. Lack of professionalism -While there are brokers who are highly professional in their dealings, the majo rity of brokers seem to lack high professional standards. Many of them lack the professional expertise to guide and counsel their clients. Further, they resort to actions, which may hurt the interests of their clients. A senior member of t he governing board of the BSEobserved: The lack of professionalism is our sore po int and we do not have a proper mechanism to weed out the undesirables. Dominance of financial institutionsThe stock market in India is significantly influenced by the actions of financia l institutions. Even though the operations of these institutions are confined to a small group of shares, there impact is often quite pervasive. Under the influ ence of institutional buying, the market turns buoyant; contrariwise, under the pressure of institutional selling,the market becomes depressed. Poor liquidityThe Indian stock exchanges suffer from poor liquidity. Barring a small proportio n of scrips, which are actively traded and highly liquid, most are traded infreq uently and,hence, lack liquidity. Weak regulationEven though the Securities Contracts and Regulations Act vests the government w ith substantial powers, the regulation in practice tends to be somewhat ineffect ive. The stock exchange division of the Ministry of Finance, which is supposed t o supervise and control the stock exchanges, appears to be grossly understaffed and overburdened. There appearsto be a crying need to strengthen the regulatory machinery because of phenomenal growth in the volume of trading. Price distortionDue to speculative influences and other irrationalities and imperfections, stock pricestend to get distorted. The market seems to function largely on a hit or mi ss basis rather than on the basis of informed beliefs about the long-term prospec ts of individual enterprises. Kerb tradingTransaction between brokers who assemble outside the stock exchange after market hoursare referred to as kerb transactions . Though considered a punishable offence , kerbtrading flourishes and the issue whether it is legal or illegal is conside red irrelevant bymost brokers. In fact, brokers often report kerb transactions a long with transactions doneduring official business hours.

Some of the important defects or drawbacks of indian money market are :1. Absence of Integration : The Indian money market is broadly divided into the Organized and Unorganized Sectors. The former comprises the legal financial inst itutions backed by the RBI. The unorganized statement of it includes various ins titutions such as indigenous bankers, village money lenders, traders, etc. There is lack of proper integration between these two segments. 2. Multiple rate of interest : In the Indian money market, especially the banks, there exists too many rates of interests. These rates vary for lending, borrowi ng, government activities, etc. Many rates of interests create confusion among t he investors. 3. Insufficient Funds or Resources : The Indian economy with its seasonal struct ure faces frequent shortage of financial recourse. Lower income, lower savings, and lack of banking habits among people are some of the reasons for it. 4. Shortage of Investment Instruments : In the Indian money market, various inve stment instruments such as Treasury Bills, Commercial Bills, Certificate of Depo sits, Commercial Papers, etc. are used. But taking into account the size of the population and market these instruments are inadequate. 5. Shortage of Commercial Bill : In India, as many banks keep large funds for li quidity purpose, the use of the commercial bills is very limited. Similarly sinc e a large number of transactions are preferred in the cash form the scope for co mmercial bills are limited. 6. Lack of Organized Banking System : In India even through we have a big networ k of commercial banks, still the banking system suffers from major weaknesses su ch as the NPA, huge losses, poor efficiency. The absence of the organized bankin g system is major problem for Indian money market. 7. Less number of Dealers : There are poor number of dealers in the short-term a ssets who can act as mediators between the government and the banking system. Th e less number of dealers leads tc the slow contact between the end lender and en d borrowers. INACTIVE AND ERRATIC CAPITAL MARKET: The important function of any capital market is to promote economic development through mobilization of savings and their distribution to productive ventures. A s far as industrial finance in India is concerned,corporate customers are able t o raise their financial resources through development banks. So, they need not g o to the capital market. Moreover they don t resort to capital market since it is very erratic and inactive. Investors too prefer investments in physical financial assets. The weakness of t he capital market is a serious problem in assets to investments in our financial system.

Anda mungkin juga menyukai

- Industrial Securities MarketDokumen16 halamanIndustrial Securities MarketNaga Mani Merugu100% (3)

- Tax PlanDokumen2 halamanTax PlanMrigendra MishraBelum ada peringkat

- Question Bank On Financial PlanningDokumen2 halamanQuestion Bank On Financial Planningfiiimpact50% (2)

- Vuoap01 0406 - Mba 201Dokumen17 halamanVuoap01 0406 - Mba 201prayas sarkarBelum ada peringkat

- Advance Payment of TaxDokumen35 halamanAdvance Payment of TaxTrapti Garg Goyal0% (1)

- Call Money MarketDokumen24 halamanCall Money MarketiyervsrBelum ada peringkat

- BCom 6th Sem - AuditingDokumen46 halamanBCom 6th Sem - AuditingJibin SamuelBelum ada peringkat

- Depository ServicesDokumen7 halamanDepository ServicesakhilBelum ada peringkat

- PDFDokumen4 halamanPDFvenkat naiduBelum ada peringkat

- Segmentation and Zone of ToleranceDokumen22 halamanSegmentation and Zone of Tolerancejdroxy4201108Belum ada peringkat

- Regulatory Framework For Banking in IndiaDokumen12 halamanRegulatory Framework For Banking in IndiaSidhant NaikBelum ada peringkat

- Regulations of Mutual FundDokumen11 halamanRegulations of Mutual FundKishan KavaiyaBelum ada peringkat

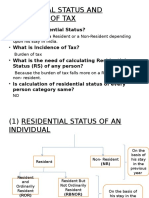

- Unit 2 Scope of Total Income and Residential StatusDokumen16 halamanUnit 2 Scope of Total Income and Residential StatusDeepeshBelum ada peringkat

- Channel DynamicsDokumen5 halamanChannel DynamicsGhani Thapa20% (5)

- OTCEI: Concept and Advantages - India - Financial ManagementDokumen9 halamanOTCEI: Concept and Advantages - India - Financial Managementjobin josephBelum ada peringkat

- Functions of A SalesmanDokumen2 halamanFunctions of A SalesmanpilotBelum ada peringkat

- Commercial Bill MarketDokumen25 halamanCommercial Bill Marketapeksha_606532056Belum ada peringkat

- Role of DFHI in Money MarketDokumen13 halamanRole of DFHI in Money Marketmanishg_17100% (1)

- Integrated & Non-Integrated System of AccountsDokumen20 halamanIntegrated & Non-Integrated System of Accountsrabi_kungle0% (2)

- AmalgamationDokumen14 halamanAmalgamationKrishnakant Mishra100% (1)

- Role of Advertising in Indian EconomyDokumen13 halamanRole of Advertising in Indian EconomyTashi GuptaBelum ada peringkat

- 48 Ty Chap3 MCQDokumen18 halaman48 Ty Chap3 MCQKadam Kartikesh67% (3)

- Legal Aspects of InsuranceDokumen16 halamanLegal Aspects of InsuranceJohn MichaelBelum ada peringkat

- Sharpe Index Model - Prof. S S PatilDokumen36 halamanSharpe Index Model - Prof. S S Patilraj rajyadav100% (1)

- Objective and Main Provision Of: Payment of Bonus ActDokumen10 halamanObjective and Main Provision Of: Payment of Bonus ActSanjay shuklaBelum ada peringkat

- 15MF02 Financial Derivatives Question BankDokumen12 halaman15MF02 Financial Derivatives Question BankDaksin PranauBelum ada peringkat

- Question Paper Review - Financial Services - Cpc6aDokumen7 halamanQuestion Paper Review - Financial Services - Cpc6ajeganrajrajBelum ada peringkat

- EPM-Performance Evaluation Parameters For E-CommerceDokumen42 halamanEPM-Performance Evaluation Parameters For E-CommerceKhushali OzaBelum ada peringkat

- Note On Public IssueDokumen9 halamanNote On Public IssueKrish KalraBelum ada peringkat

- HMT WATCHES CASE STUDY Analysis - Group 9Dokumen3 halamanHMT WATCHES CASE STUDY Analysis - Group 9aayushi bhandari100% (1)

- Bse, Nse, Ise, Otcei, NSDLDokumen17 halamanBse, Nse, Ise, Otcei, NSDLoureducation.in100% (4)

- Role of RbiDokumen4 halamanRole of Rbitejas1989Belum ada peringkat

- SebiDokumen13 halamanSebiNishat ShaikhBelum ada peringkat

- Product Mix StrategiesDokumen17 halamanProduct Mix StrategiesDr Rushen SinghBelum ada peringkat

- Mdu Question Paper Service MarketingDokumen2 halamanMdu Question Paper Service MarketingSongs Punjabi Share0% (1)

- Walter Model Equity ValuationDokumen13 halamanWalter Model Equity ValuationVaidyanathan RavichandranBelum ada peringkat

- Assessment of CompaniesDokumen5 halamanAssessment of Companiesmohanraokp22790% (1)

- PPT-6 Advertising BudgetDokumen10 halamanPPT-6 Advertising BudgetBoman TirBelum ada peringkat

- Code of Conduct For Brokers and Sub-BrokersDokumen25 halamanCode of Conduct For Brokers and Sub-BrokersSukirti ShikhaBelum ada peringkat

- Residential StatusDokumen15 halamanResidential StatusDeepak MinhasBelum ada peringkat

- Course Name: 2T7 - Cost AccountingDokumen56 halamanCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Indian Money MarketDokumen7 halamanIndian Money Market777priyankaBelum ada peringkat

- Post Issue ActivitiesDokumen3 halamanPost Issue ActivitiesmgajenBelum ada peringkat

- Problems On Lease and Hire PurchaseDokumen2 halamanProblems On Lease and Hire Purchase29_ramesh17050% (2)

- IRBIDokumen15 halamanIRBIVicky Hatwal100% (2)

- Fortune TellerDokumen3 halamanFortune TellerbharatBelum ada peringkat

- Performance Evaluation Parameters of Banks - NPA - FinalDokumen18 halamanPerformance Evaluation Parameters of Banks - NPA - FinalRam patharvat100% (3)

- Functions of SEBIDokumen6 halamanFunctions of SEBIKumar Raghav MauryaBelum ada peringkat

- Chapter - 2 Amalgamation of CompaniesDokumen10 halamanChapter - 2 Amalgamation of CompanieshanumanthaiahgowdaBelum ada peringkat

- Jagan Institute of Management Studies: Business-to-Business MarketingDokumen3 halamanJagan Institute of Management Studies: Business-to-Business MarketingVardhan SinghBelum ada peringkat

- MCQ's - NBFCDokumen2 halamanMCQ's - NBFCZara KhanBelum ada peringkat

- Financial Management in Psu'sDokumen14 halamanFinancial Management in Psu'sAkshaya Mali100% (1)

- Sales - GB02 - Functional Trainee JD - Bajaj Finance LTDDokumen1 halamanSales - GB02 - Functional Trainee JD - Bajaj Finance LTDRamm PrasaathBelum ada peringkat

- Regulatory Framework of Derivatives in IndiaDokumen2 halamanRegulatory Framework of Derivatives in Indiasvtasha0% (1)

- Responsibility CentresDokumen9 halamanResponsibility Centresparminder261090Belum ada peringkat

- Asset and LiabilityDokumen30 halamanAsset and LiabilitymailsubratapaulBelum ada peringkat

- Principal Weaknesses of Stock Market of India1Dokumen2 halamanPrincipal Weaknesses of Stock Market of India1Sameer KoolBelum ada peringkat

- Definitions of Money MarketDokumen7 halamanDefinitions of Money Marketsamaira7Belum ada peringkat

- Role of Money MarketsDokumen3 halamanRole of Money Marketssiddharthjain_90Belum ada peringkat

- Assignments - Fin Derivatives and InstrumentsDokumen19 halamanAssignments - Fin Derivatives and InstrumentsNaveed AnsariBelum ada peringkat

- Unit 1 - IFS - Question Bank - 20200717133730Dokumen3 halamanUnit 1 - IFS - Question Bank - 20200717133730Vignesh CBelum ada peringkat

- M6A Study Guide (V2.12)Dokumen352 halamanM6A Study Guide (V2.12)kenneth100% (1)

- Financial Services NotesDokumen16 halamanFinancial Services NotesNupur ChaturvediBelum ada peringkat

- International Financial Market Instruments: Presented ByDokumen45 halamanInternational Financial Market Instruments: Presented BygeetshijBelum ada peringkat

- Analysis of Investment Strategie1Dokumen51 halamanAnalysis of Investment Strategie1Kalinga MahalikBelum ada peringkat

- Analytics of Monetary (Policy in India Since IndependenceDokumen18 halamanAnalytics of Monetary (Policy in India Since IndependenceFarhaan GulBelum ada peringkat

- Q. Is There A Relationship Between Financial Institutions and Financial Markets?Dokumen3 halamanQ. Is There A Relationship Between Financial Institutions and Financial Markets?Zabir Tahzin HassanBelum ada peringkat

- Chapter 7 Importance of Money and Capital MarketsDokumen9 halamanChapter 7 Importance of Money and Capital MarketsSyrill CayetanoBelum ada peringkat

- BWM 4103 Islamic Treasury Management Quiz 2&quiz 3Dokumen5 halamanBWM 4103 Islamic Treasury Management Quiz 2&quiz 3Nabila SyahirahBelum ada peringkat

- Money Market Vs Capital MarketDokumen53 halamanMoney Market Vs Capital MarketrajBelum ada peringkat

- Assignment in Banking SystemDokumen4 halamanAssignment in Banking Systemfakrul0% (1)

- Chapter 2: Overview of The Financial SystemDokumen43 halamanChapter 2: Overview of The Financial Systememre kutayBelum ada peringkat

- Financial Markets: Departmental Notes Business Department 0752818204Dokumen12 halamanFinancial Markets: Departmental Notes Business Department 0752818204kimuli FreddieBelum ada peringkat

- Group 8 - Investment Management - 704aDokumen29 halamanGroup 8 - Investment Management - 704aJewelyn CioconBelum ada peringkat

- QUIZ FinanceDokumen39 halamanQUIZ FinanceAbhishek YadavBelum ada peringkat

- PWC Consolidation Equity Method Accounting Guide 2019Dokumen361 halamanPWC Consolidation Equity Method Accounting Guide 2019Gilberto Herrera100% (2)

- 5-8 Financial Markets McqsDokumen26 halaman5-8 Financial Markets McqsdmangiginBelum ada peringkat

- Assessment Task 1: Cash & Cash Equivalent Questions: Investment Rating Asset StocksDokumen20 halamanAssessment Task 1: Cash & Cash Equivalent Questions: Investment Rating Asset StocksDaisy Ann Cariaga SaccuanBelum ada peringkat

- Chapter 8 Student Textbook JJBDokumen24 halamanChapter 8 Student Textbook JJBapi-30995537633% (3)

- All Lets - Check - Ulo First SimDokumen8 halamanAll Lets - Check - Ulo First SimWennonah Vallerie LabeBelum ada peringkat

- Final Marchant BankingDokumen42 halamanFinal Marchant BankingSupriya PatekarBelum ada peringkat

- HS Finance Cluster Sample Exam 2018Dokumen35 halamanHS Finance Cluster Sample Exam 2018Omar Ahmed mohamudBelum ada peringkat

- Financial Market and InstituionsDokumen99 halamanFinancial Market and Instituionsዝምታ ተሻለBelum ada peringkat

- CH 7Dokumen67 halamanCH 7李ABelum ada peringkat

- Evaluation (10 Mins) Quiz: Part 1: True/FalseDokumen3 halamanEvaluation (10 Mins) Quiz: Part 1: True/Falseclaire juarez100% (1)

- Classification of Financial MarketDokumen4 halamanClassification of Financial MarketRituraj RanjanBelum ada peringkat

- Project Proposal: Pangiran Budi Service SDN BHD SC Pangiran Budi Service SRLDokumen32 halamanProject Proposal: Pangiran Budi Service SDN BHD SC Pangiran Budi Service SRLSamurawi HailemariamBelum ada peringkat

- Source of Fund (Bank's Liability)Dokumen6 halamanSource of Fund (Bank's Liability)sayed126Belum ada peringkat

- Quiz # 3Dokumen22 halamanQuiz # 3Kking ChungBelum ada peringkat

- Evaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementDokumen35 halamanEvaluation of Present Scenario and Estimation of Future Prospects of Portfolio ManagementMayura Telang100% (1)