Management Accounting and Control

Diunggah oleh

Tauseef AhmadDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Management Accounting and Control

Diunggah oleh

Tauseef AhmadHak Cipta:

Format Tersedia

MANAGEMENT ACCOUNTING AND CONTROL Costing: Costing is he technique and process of ascertaining costs.

According to wheldon, Costing is the classifying, recording and appropriate allocation of expenditure for the determination of the cost of product or services, the relation of these costs to sales value and the ascertainment or profitability. Cost accounting is such a specific branch of general accounting in which a/c of various expenses made over a product or service are prepared in such a way as to obtain information and data for the guidance of management and to work out the total and per unit cost. Cost accountancy: It is the application of costing and cost accounting principles, methods and techniques to the science, art and practice of control. It includes the presentation of information derived there form for the purpose of managerial decision making. Objectives !"nctions o# cost $cco"nting: . Cost determination: !he main ob"ective of cost accounting is to know the total and per unit cost of products, services, contracts or processes. #. Cost control: $y control on maximum and better production on mini cost may be possible. %. Cost reduction: Cost accounting system controls the expenditure with the ob"ective of cost reduction. &. 'uidance to management: !he information provided by the cost accounts guide the management in policy decisions. (. )etermination of selling price: It helps in fixing the reasonable sale price so that the competition may be faced and profit may be earned. *. Compliance to statutory requirements: u/s #+,- .-d. of the company act, ,(*, the central govt has made it compulsory for &/ industries to maintain cost accounts. Methods o# cost $cco"nting: . 0nit costing methods: !his method is employed in those industries where continuous production is carried out and all the manufactured units are identical. 1uch as brick making, flour mills, cloth mills, paper mills, cement, sugar mils etc. #. 2ob/contract costing: !his method is adopted by printers, manufacturers of machinery parts etc. 3hen the form of business is large and it continues for a longer period, contract costing method is adopted. 4or each contract a separate /c is maintained. %. 5rocess costing: !his method is adopted in paints, foods, medicine and soap making industries where there is a continuous production and the product of each process becomes the raw material for the next process, the product of each process becomes the raw material for the next process. !hus it is necessary to ascertain the total cost and cost per unit at the end of each process. &. $atch costing: 3here for the sake of convenience, the production work is completed in different batches and it is necessary to know the separate cost of each batch, this method is employed. 1uch as bakeries, pharmaceuticals. (. 6perating costing: In industries where commodities are not manufactured but the services are provided such as bus transport services, railways, hospitals, hotels. In this methods cost per unit of services is ascertained. *. 7ultiple costing: !his method is employed in industries where in the first instance different types of small parts are manufactured and later on by their assembly, final product comes out like !8, sewing machines, cars etc as various part differ from each other, a separate method of costing in respect of each component is used.

/. )epartmental costing: In organi9ation where productive work is divided into different departments, separate cost of each department is ascertained by using this method. :. Cost plus method: ;n agreed sum or percentage to cover overhead and profit is added in actual cost. ,. !arget costing: In this method, before starting manufacturing work, probable cost is estimated with the help of experienced persons. T%&es o# costing techni'"es: . <istorical costing: If the cost is ascertained with the help of actual expenses incurred, it is termed as historical costing. #. 1tandard costing: In this method, the standard expenses on some scientific basis are pre= determined and on the basis of standard expenses, standard cost is ascertained. %. 7arginal costing: In this method, the total cost is classified into fixed and variable expenses. !o ascertain the cost, only the variable expenses are considered.!his methods helps in calculating the effect on profits of changes in the quantity of sale and production of a product. &. )irect costing: ;ll direct costs are charged to operations, processes or products and indirect costs are carried to profit and loss a/c. (. ;bsorption costing: It is also termed as total costing. 0nder this all costs such as fixed and variable, direct and indirect are charged to operations, processes or product. *. 0niform costing: !his method of costing facilitates inter firm comparisons, if all the units of an industry adopt one and the same method of costing. M$n$ge(ent $cco"nting: 7; is concerned with all such accounting information that is useful to management. It is applied to the provision of accounting information for management activities such as planning, controlling and decision making etc. Unit)* Me$ning o# b"dget: It is predetermined statement of management policy during a given period which provides a standard for comparison with the results actually achieved. ;ccording to CI7; >a plan quantified in monetary terms prepared and approved prior to a defined period of time, usually showing planned income to be generated and expenditure to be incurred during the period and the capital to be employed to attain a given ob"ective? ; budget is primarily a planning and control device. ; budget is prepared in monetary terms/ quantitative terms ; budget is prepared for a definite future period. It shows planned income and expenditure and also the capital to be employed. 5urpose of a budget is to implement the policies formulated by the management for attaining the given ob"ectives. +"dgeting: !he act of preparing budget is called budgeting. ;ccording to batty, the entire process of preparing the budgets is known as budgeting. +"dget$r% control: It is a system of controlling costs through preparation of budgets. $udgeting is thus only a part of the budgetary control. ;ccording to CI7;, >$udgetary control is the establishment of budgets relating to the responsibilities of executives of a policy and the continuous comparison of the actual with the budgeted results, either to secure by individual action the ob"ective of the policy or to provide a basis for its revision? @stablishment of budgets for function/dept of the organi9ation. Comparison of actual performance with the budget on a continuous basis.

;nalysis of variations of actual performance from that of the budgeted performance to know the reasons thereof. !aking suitable remedial action, where necessary. Aevision of budgets in view of changes in conditions.

Objectives o# +"dget$r% control: 5lanning: $y planning many problems are anticipated long before they arise and solutions can be sought through careful study, thus most emergencies can be avoided by planning. Co=ordination: $udgeting aids managers in coordinating their efforts so that ob"ectives of the organi9ation as a whole harmonise with the ob"ectives of its divisions @ffective planning and organi9ation contributes a lot in achieving coordination. !here should be coordination in the budgets of various dept. Communication: ; budget is communication device. !he approved budget copies are distributed to all management personnel who provide not only adequate understanding and knowledge of the programmes and police to be followed but also given knowledge about the restrictions to be adhered to. 7otivation: ; budget is a useful device for motivating managers to perform in line with the company ob"ectives. If individuals have actively participated in the preparation of budgets, it acts as a strong motivating force to achieve the targets. Control: ;s applied to budgeting, is a systemati9ed effort to keep the management informed of whether planned performance is being achieved or not. 4or this purpose, a comparison is made b/w plans and actual performance. !he difference b/w the two is reported to the management for taking corrective action. 5erformance evaluation: ; budget provides a useful means of informing managers how well they are performing in meeting targets. In many companies there is a practice of rewarding employees on the basis of their achieving the budget targets or promotion of a manager may be linked to his budget achievement record. Adv$nt$ges o# +"dget$r% control: $udgeting compels managers to think ahead i.e, to anticipate and prepare for changing conditions. It coordinates the activities of various departments and functions of the business. It increases production efficiency, eliminates waste and controls the costs. $udgetary control aims at maximi9ation of profits through careful planning and control. It provides a yardstick against which actual results can be compared. It shows management where action is needed to remedy a situation. ; budget motivates executives to attain the given goals. ; budgetary control system assists in delegation of authority and assignment of responsibility. It creates necessary conditions for the introduction of the standard costing technique. Li(it$tions o# +"dget$r% control: $udgets are based on forecasts and forecasting cannot be an exact science. !he strength or weakness of the budgetary control system depends to a large extent, on the accuracy with which estimates are made. $udgets will lose much of their usefulness if they acquire rigidity and are not revised with the changing circumstances. $udgeting cannot take the place of management but is only a tool of management.

!he installation and operation of a budgetary control system is a costly affair as it it requires the employment of speciali9ed staff and involves other expenditure which small concerns may find difficult to incur. T%&es o# b"dget: C$sh b"dget: It is a detailed estimate of cash receipts from all sources and cash payments for all purposes and resultant cash balances during the budget period. It makes certain that the business has sufficient cash available to meet its needs as and when these arise. It is a device coordinating and controlling the financial side of the business to ensure solvency and provide a basis for planning and financing required to cover up any deficiency in cash. 5urpose: It ensures that sufficient cash is available when required. It indicates cash excesses and shortages so that action may be taken in time to invest any excess cash or to borrow funds to meet any shortages. It establishes a sound basis for credit. It shows whether capital expenditure may be financed internally. It establishes a sound basis for control of cash position. 7ethods: Aeceipts and payments method ;d"usted profit and loss method $alance sheet method !le,ible b"dget: 4$ is one which is designed to change in relation to the level of activity attained. It has been developed with the ob"ective of changing the budget figures to correspond with the actual output achieved. !hus a budget might be prepared for various levels of activity, say *+B, /+B, ++B. -$les b"dget: 1ales budget is an estimated sale during a budget period. It lays down a comprehensive plan and program for sales department. 1ales manager is responsible for preparing sales budget. It expresses the figure in qty, in value according to area/territory. !he degree of accuracy with which sales are estimated determines the success of budgeting exercises. 4actors to be considered in forecasting sale: . 5ast sales #. Aeports by salesmen %. Company condition/business condition &. 7arket analysis (. 1easonal fluctuations/competition .roble(: ; company has four sales territories ,#,% and & each salesman is expected to sell the following number of units during the first quarter. ;ssume the average selling price to be As %+. !erritory # % & 2an ,+++ ,(++ #,(++ %,(++ 4eb #,+++ ,:++ #,:++ &,+++ 7arch #,(++ #,+++ %,+++ &,(++ 5repare the sales budget for the first quarter of the year. 1ales budget -first quarter. !erritory 2an 4eb 7arch !otal 0nit 8alue 0nit 8alue 0nit 8alue 0nit 8alue

# % &

,+++ ,(++ #,(++ %,(++ :,(++

%+,+++ #,+++ &(,+++ ,:++ /(,+++ #,:++ ,+(,+++ &,+++ #,((,+++ +,*++

*+,+++ (&,+++ :&,+++ ,#+,+++ %, :+++

#,(++ #,+++ %,+++ &,(++ #,+++

/(,+++ *+,+++ ,+,+++ ,%(,+++ %,*+,+++

(,(++ (,%++ :,%++ #,+++ % , ++

,*(,+++ ,(,,+++ #,&,,+++ %,*+,+++ ,,%%,+++

.rod"ction b"dget: It is a forecast of a number of units to be produced during the budget period. It is prepared in relation to the sale budget. !he number of units to be produced is arrived after taking into account opening and closing stock. !his prepared by factory in charge or production manager. !he factors to be considered are: 1ales budget 5lant capacity Cag time 1tock Dty to be held ;vailability of key factor 5roduction planning

5roduction budget is prepared in two parts: . 5roduction volume budget #. Cost of production/ manufacturing cost budget-direct material, direct labour and overheads. 5roblem: !he following information has been made available from the records for last * month. . !he units to be sold in different months are: 2uly= ++ ;ug= ++ 1ep= /++ 6ct= ,++ Eov=#(++ )ec= #%++ 2an=#+++

#. !here will be no 3I5 at the end of any month. %. 4inished units equal to half of sales for the next month will be in stock at the end of every month. &. $udgeted production -units.=##,+++, direct materials per unit= +, direct wages per unit= &. 4actory overheads=::,+++ 5repare production budget and production cost budget.

1ol: .rod"ction b"dget #or / (onths 5articulars 2uly ;ug 1ep 6ct Eov )ec

1ales-in units. -F.C/1 G of sales for next month

++ ((+

++ :(+

/++ ,(+

,++ #(+

#(++ (+

#%++ +++

*(+ -=. 6/1 5roduction in units ((+ ++

,(+ ((+ &++

#*(+ :(+ :++

% (+ ,(+ ##++

%*(+ #(+ #&++

%%++ (+ # (+

.rod"ction cost b"dget for * months -2uly to )ec. ++F &++F :++F ##++F #&++F# (+.H +(+ units

)irect material + per unit )irect wages & per unit -

+(+x +.H

+(++

+(+x&.H&&#++

4actory overheads -::+++/#.H&&+++ !otal = ,:/++

5roblem: ; company manufactures product ; and $. during the year ending, it is expected to sell (+++ kg of product ; and /(+++ kg of product $ at %+ and * per kg respectively. !he direct material 5,D and A are mixed in the proportion of %:(:# in the manufacture of product ; and D A are mixed in the proportion of :# of manufacture $.

1ol: 5articulars 1ales F C/1 =6/1 5roduction

.rod"ction b"dget #or the %e$r ending 5roduct ; -kg. (+++ (++ *(++ %+++ %(++ 5roduct $ -kg. /(+++ &(++ /,(++ &+++ /((++

M$teri$l b"dget: !his budget shows the estimated Dty of all the raw materials and components needed for production demanded by production budget.

5articulars ;- %(++kg in %:(:#. $-/((++kg in :# DA.

5-Ig. &+(+ =

D-Ig. */(+ #( */

A-Ig. #/++ (+%%%

7aterial consumption -F.C/1 -=.6/1 7aterial purchase budget Cost per Ig @xpenditure on purchase

&+(+ %+++ &(++ #((+ # %+*++

% , / *+++ %+++ %&, / + %&, /+

(%+%% ,+++ %++++ %#+%% : #(*#*&

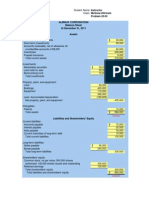

M$ster b"dget: 7aster budget is a consolidated summary of all the functional budgets. It has two parts -i. -ii. 6perating budget i.e., budgeted profit and loss a/c 4inancial budget i.e., budgeted balance sheet

!hus a pro"ected profit and loss a/c and a balance sheet together constitute a master budget. It is prepared by the budget director -budget officer. and is presented to the budget committee for approval. If approved, it is submitted to the board of director for final approval. !he board may make certain amendments/alternations before it is finally approved.

5roblem: 7anufacturing co requires you to present the master budget for next year. 1ales J;= *+++++ $= #+++++ )irect material =*+B of sales )irect wages= #+ workersK (+ p.m Indirect labour=work manager=(++ p.m 4oreman=&++ p.m 1tores and spares= #.(B on sales )ep on machinery= #*++ Cight and power=%+++ Aepair= :+++ 6ther exp +B on direct wages ;dministration exp=%*+++ per year.

1ol:

M$ster b"dget 4or the year ending

1ales ; $ Tot$l s$les Cess: )irect material -*+B of :+++++. &:++++ %*+++

*+++++ #+++++ :+++++

)irect wages-#+x (+x #. .ri(e cost 4ixed factory overheads: 3orks manager salary-(++x #. 4oreman salary-&++x #. )epreciation Cight power 8ariable factory overheads: 1tores and spares Aepair 1undry.exp 0or1s cost Gross &ro#it Less: ;dmin ,selling and distribution exp Net &ro#it

( *+++ *+++ &:++ #*++ %+++ #++++ :+++ %*++

#*&++

% *++ (/&+++

##*+++ %*+++ ,++++

-t$nd$rd cost: 1tandard costs are predetermined costs or target costs that should be incurred under efficient operating conditions. ;ccording to CI7;, Condon, 1tandard cost is the predetermined cost based on technical estimates for materials, labour and overhead for a selected period of time for a prescribed set of working conditions. ;ccording to $rown and <oward, the standard cost is a predetermined cost which determines what each product or service should cost under a given circumstances. -t$nd$rd costing is a technique whereby standard costs are computed and subsequently compared with the actual costs to find out the differences between the two. !hese differences are then analy9ed to know the causes thereof so as to provide a basis of control. ;ccording to CI7;, Condon, the preparation of standard costs and applying them to measure the variations with a view to maintain maximum efficiency in production. !e$t"res: . 1tandard cost is a pre=determined cost #. 4ollowing processes are included in standard costing %. 1tandard costing technique is an effective technique of cost control. &. 5rime ob"ect is to guide and advise the management for maintaining maximum level of efficiency in production. (. It applied in such industry where a standard product is produced again and again such as engineering industry. -te&s: standard costing system involves the following steps . !he setting of standard costs for different elements of costs i,e material, labour and overheads. #. ;scertaining actual costs. %. Comparing standard with actual costs to determine the differences b/w the two, known as variances. &. ;naly9ing variance for ascertaining reasons thereof. (. Aeporting of these variances and analysis thereof to management for appropriate action, where necessary. Adv$nt$ges: 7easurement of efficiency of different operations of production is possible under system as standard costs are compared with actual costs.

Aeasons for variation in standard costs and actual costs can be ascertained by this technique. !his facilitates the management in removing in efficiency. 7anagement by exception is possible on those operations only where variances are greater. Aight and responsibilities of persons are properly and exactly fixed. !his system helps the management in decision making and in preparation of future plans. It helps in establishing an effective budgetary control. 1tandard provide incentives and motivation to work It is helpful in cost audit because if satisfactory reasons variations are disclosed. 1tudy of variance helps the management in reducing cost. Li(it$tions: !his system cannot be applied under instable market conditions and there is no control of fluctuations of prices. It cannot be applied without the application of budgetary control. It cannot be applied effectively in industries which produce non standardi9ed products. !his system is not suitable for small concerns. !his system cannot be applied industries where quality of materials changes frequently. Inaccurate and unreliable standards cause misleading results. ; business may not be able to keep standards up=to=date. -t$nd$rd costing v s b"dget$r% control: $asis 1tandard costing $udgetary control 1cope )eveloped mainly for the $udgets are complied for different manufacturing function and functions of business J sales , cash etc sometimes also for marketing and administration functions. Intensity Intensive in application as it calls for @xtensive in nature and intensity of detailed analysis of variances. analysis tends to be much less than in standard costing Aelation 8ariances are usually revealed Control is exercised by statistically putting to through accounts. budgets and actual side by side. accounts 0sefulness It represent realistic yardsticks and It represent an upper limit on spending more useful for controlling and without consider the effectiveness of exp reducing costs. in terms of output. $asis It established after considering $udget may be based on previous year production capacity, methods and costs without any attention being to other factors which require attention efficiency when determining an acceptable level of efficiency. 5ro"ection It is a pro"ection of cost accounts. It is a pro"ection of financial accounts. A&&lic$bilit% o# st$nd$rd costing: !he applicability of standard costing requires certain conditions to be fulfilled. ; sufficient volume of standard products or components should be produced. 7ethods, operations and processes should be capable of being standardi9ed. ; sufficient number of costs should be capable of being controlled.

Industries producing standardi9ed products which are repetitive in nature, i.e industries using process costing method, fulfil all above conditions and thus the system can be used to the best advantage in such industries eg fertili9ers, cement, steel, sugar etc. In "obbing industries, it is not worthwhile to develop and employ a full system of standard costing. !his is because in such industries each "ob undertaken may be different from another and setting standards for each "ob may prove difficult and expensive. In such industries, a partial system may be adopted in appropriate circumstances.

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Business Plan For Coffee ShopDokumen4 halamanBusiness Plan For Coffee ShopNaveen DavisBelum ada peringkat

- SAP IM Tutorial - SAP Investment Management Module Training TutorialsDokumen3 halamanSAP IM Tutorial - SAP Investment Management Module Training TutorialsAnil KumarBelum ada peringkat

- Ebook Bookkeeping Accounting Basics PDFDokumen30 halamanEbook Bookkeeping Accounting Basics PDFRohit Kumar MohantyBelum ada peringkat

- Problems For PracticeDokumen10 halamanProblems For PracticeYawar AliBelum ada peringkat

- Business Plan Hadush's GroupDokumen12 halamanBusiness Plan Hadush's Grouphadush gebreslassieBelum ada peringkat

- Poultry Farm Business PlanDokumen20 halamanPoultry Farm Business PlanGizachew NadewBelum ada peringkat

- Travel Agency Business PlanDokumen33 halamanTravel Agency Business PlanHimanshu Singh100% (8)

- Pivot The GreatDokumen16 halamanPivot The GreatAngeline AcebucheBelum ada peringkat

- AF1401 2020 Autumn Lecture 2Dokumen38 halamanAF1401 2020 Autumn Lecture 2Dhan AnugrahBelum ada peringkat

- House PropertyDokumen10 halamanHouse PropertyksisubalanBelum ada peringkat

- Wala LangDokumen8 halamanWala LangMax Dela TorreBelum ada peringkat

- Garden Yoga Centre Business PlanDokumen36 halamanGarden Yoga Centre Business Plandeepdeka123100% (1)

- PartnershipDokumen41 halamanPartnershipBinex67% (3)

- Software Certification CABADokumen63 halamanSoftware Certification CABAMbaStudent56Belum ada peringkat

- Tax Evasion PetitionDokumen6 halamanTax Evasion PetitionAshutosh ShuklaBelum ada peringkat

- LM1-BF-XII-1st SemesterDokumen4 halamanLM1-BF-XII-1st SemesterMark Gil GuillermoBelum ada peringkat

- Chap 003Dokumen8 halamanChap 003dbjn0% (1)

- 4.1 Questions On Income From SalaryDokumen4 halaman4.1 Questions On Income From SalaryAashi GuptaBelum ada peringkat

- Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDokumen214 halamanProfits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToPragasBelum ada peringkat

- Porter Chapter 7 SolnsDokumen42 halamanPorter Chapter 7 SolnsAbhishekThyagarajanBelum ada peringkat

- CPWA Code MCQDokumen43 halamanCPWA Code MCQSamrat Mukherjee100% (3)

- Notes For MGT101 Financial Accounting Full Notes PDFDokumen161 halamanNotes For MGT101 Financial Accounting Full Notes PDFUme SalmaBelum ada peringkat

- Indian Income Tax ReturnDokumen43 halamanIndian Income Tax ReturnAshish GorivaleBelum ada peringkat

- Test Bank ACC101ng NDokumen92 halamanTest Bank ACC101ng NTrọng MinhBelum ada peringkat

- Internship Report BD - SonDokumen61 halamanInternship Report BD - Sonthanh nguyenBelum ada peringkat

- Lotus Halal FIF - ProspectusDokumen55 halamanLotus Halal FIF - ProspectusGbolahan OjuolapeBelum ada peringkat

- Buku Besar Ud BuanaDokumen23 halamanBuku Besar Ud BuanaNabilla ParamitaBelum ada peringkat

- Mam Karina Template Periodic 1Dokumen21 halamanMam Karina Template Periodic 1Claudine bea NavarreteBelum ada peringkat

- Chapter 05Dokumen36 halamanChapter 05Sonny Jim100% (1)

- Unit I: Income From Profits and Gains of Business or Profession'Dokumen20 halamanUnit I: Income From Profits and Gains of Business or Profession'anuBelum ada peringkat