Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook Stable

Diunggah oleh

api-231665846Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption of Euro Outlook Stable

Diunggah oleh

api-231665846Hak Cipta:

Format Tersedia

Research Update:

Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

Primary Credit Analyst: Maxim Rybnikov, London (+44) 207 176 7125; maxim.rybnikov@standardandpoors.com Secondary Contact: Frank Gill, London (44) 20-7176-7129; frank.gill@standardandpoors.com

Table Of Contents

Overview Rating Action Rationale Outlook Key Statistics Related Criteria And Research Ratings List

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 1

1294561 | 300051529

Research Update:

Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

Overview

Lithuania's external and fiscal performances have exceeded our 2013 expectations, and we forecast continued strong and sustainable economic growth averaging 4% over 2014-2017. We estimate that Lithuania now meets all quantitative euro accession criteria, and we believe it will be invited to join the eurozone in 2015. We are therefore raising our long-term sovereign ratings on Lithuania to 'A-' from 'BBB'. We are also revising the transfer and convertibility assessment upward to 'AA-' from 'A'. The stable outlook reflects our expectation that Lithuania's growth will remain sustainable, with the government committed to fiscal discipline.

Rating Action

On April 11, 2014, Standard & Poor's Ratings Services raised to 'A-' from 'BBB' its long-term foreign and local currency sovereign credit ratings on the Republic of Lithuania. At the same time, we affirmed the 'A-2' short-term ratings on Lithuania. The outlook is stable.

Rationale

The upgrade partly reflects our expectation that Lithuania's economic growth will remain robust and sustainable. The upgrade also reflects the sovereign's stronger-than-expected external and fiscal performances. In addition, we believe that Lithuania fulfils all quantitative euro accession criteria and will be invited to join the eurozone (European Economic and Monetary Union) in 2015. The Lithuanian economy expanded by 3.3% in real terms in 2013--the third-fastest growth in the EU, after Latvia and Romania--and we project growth to average close to 4% over 2014-2017. GDP per capita was $15,500 last year, and is set to increase further as the economy expands. Unlike in the period preceding the 2008 financial crisis, growth in Lithuania should remain sustainable and broad-based, in our view. It will be increasingly fueled by domestic demand, including investments, with net exports making a negative contribution. The economy is now operating at close to full capacity and unit labor costs have fallen by close to 12% in real terms since 2009, setting favorable conditions for increased investments in the short term. Lithuania's economy has become progressively open in recent years. We estimate

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 2

1294561 | 300051529

Research Update: Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

that exports will increase to 89% in 2014, from 54% of GDP in 2007. This poses some risks to our growth forecasts, however, especially if growth falters in the EU, where most of Lithuania's trading partners are. There are also risks from the weak performance of Russia's economy, although headline export figures may overstate this vulnerability because a sizable proportion of Lithuania's trade with Russia is in the form of re-exports. We also see some longer-term challenges, stemming largely from a population decline due to high emigration rates. Euro adoption tops the current government's agenda. According to our estimates, Lithuania meets all Maastricht criteria for euro adoption and will likely join the eurozone in January 2015. We believe that accession will eliminate any residual exchange rate risks in the heavily euroized economy (about two-thirds of all loans are euro-denominated). It will also facilitate Lithuania's access to a deep international capital market and grant domestic banks direct access to the European Central Bank's liquidity facilities. We also believe that joining the eurozone will improve the country's monetary flexibility. Under the current currency board arrangement, Lietuvos Bankas (the central bank) has no meaningful flexibility to steer monetary conditions to offset financial and economic stresses--as the 2009 recession demonstrated. Overall, institutional and governance effectiveness remains a credit strength. In the past, the authorities have quickly implemented measures to strengthen public finances. They also acted in a timely and efficient manner in handling the bankruptcy of two domestic banks--Snoras Bankas in 2011 and Ukio Bankas in 2013--limiting any spillover effects on the economy and public finances. Lithuania's presidential elections are scheduled for May, with the incumbent president--former finance minister and EU budget commissioner Dalia Grybauskaite--the favorite for reelection. Whatever the outcome, we do not expect the government's policy agenda to change materially. We anticipate a continued focus on sustainable budgetary policies, energy independence, and closer integration with EU institutions. Lithuania's 2013 external performance exceeded our expectations, with the current account balance turning to a surplus of 1.5% of GDP from a slight deficit in 2012. This was partly owing to increased current transfers, which could prove transitory, but also an increased surplus in the services account, bolstered by Lithuania's competitiveness. Business services, tourism, and transportation performed strongly last year. The competitiveness of Lithuania's economy is likely to get a further boost on completion of the liquified natural gas terminal at the end of 2014. We expect the price of natural gas to decrease for Lithuania as supply gets more diversified, given that Lithuania currently imports all its gas from Russia. Lower gas prices could be positive for Lithuania's export-oriented chemical industry, which accounts for over 40% of all domestic gas consumption.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 3

1294561 | 300051529

Research Update: Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

We anticipate that Lithuania's faster-than-trading-partners growth will nevertheless widen its current account deficit. That said, the deficit will remain contained, averaging just 1.7% of GDP over 2014-2017--significantly lower than the 10% average in 2003-2008, which proved unsustainable. We expect these deficits to be financed largely by foreign direct investment and EU funds, and we therefore forecast Lithuania's external debt net of liquid external assets to fall below 25% of current account receipts (CARs) in 2017, less than half pre-crisis levels. We estimate gross external financing needs will remain sizable at close to 120% of CARs plus usable reserves through 2017, also down from pre-crisis levels, which were above 150% (our calculation excludes the portion of reserves backing the monetary base, a deduction we make for all currency board arrangements). In line with our growth forecasts, we expect the general government deficit to narrow further over the forecast horizon, with an average change in general government debt of just 0.9% of GDP over 2014-2017, compared with 7.3% in 2009-2012. We estimate that the 2013 fiscal performance exceeded our previous expectations, with the general government budget deficit at 2.7% of GDP, lower than the maximum allowed under euro adoption criteria. In our view, the budgetary outlook has further improved following the Constitutional Court verdict on compensation for cuts to public sector wages and pensions, following an earlier ruling that declared some of the previous reductions unconstitutional. The recent verdict essentially allows wages and pensions to be restored and compensation to proceed gradually without straining the budget significantly in a particular year. Despite a threefold increase as a share of the economy since 2008, net general government debt remains low--especially compared to other European sovereigns--at 36% of GDP in 2013. Debt servicing accounts for a moderate 5.4% of general government revenues. Close to 80% of government debt is denominated in foreign currency and about 70% of it is held by nonresidents. We view as limited contingent liabilities for the Lithuanian government from the financial sector and public enterprises. Lithuania operates a currency board arrangement, which limits the country's options for conducting independent monetary policy. With about 120% reserve coverage of the monetary base, we do not see short-term risks for the litas' peg to the euro. Following a modest expansion in 2012, domestic credit contracted again in 2013, although this partly reflected the exit of a foreign bank from the Lithuanian market to concentrate its regional operations in Latvia. At 46% of GDP (as of 2013), bank credit to the resident private sector is lower than in any EMU member. We project a gradual pickup in domestic credit growth over the three-year forecast horizon, as companies will likely largely rely on cash reserves, rather than new borrowing, for financing investments. We also expect that subsidiaries of large Scandinavian financial institutions--which currently dominate Lithuania's banking system--will continue to support their Lithuanian subsidiaries.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 4

1294561 | 300051529

Research Update: Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

Outlook

The stable outlook reflects our expectation that Lithuania's economic growth will remain sustainable, with the government committed to fiscal discipline. It also reflects our expectation that Lithuania will join the eurozone in 2015. The outlook also balances the potential for better-than-expected fiscal and external performance against some longer-term challenges, such as the high emigration rates. If Lithuania's fiscal performance exceeds our expectations, we could raise the ratings. We could lower the ratings if the government relaxes its fiscal stance or if external performance deteriorates markedly, leading to the return of the high current account deficits that preceded the domestic economic crisis in 2009. The ratings could also come under pressure if, contrary to our expectations, Lithuania's eurozone accession is materially delayed.

Key Statistics

Table 1

Republic of Lithuania -- Selected Indicators

2007 Nominal GDP (US$ bil) GDP per capita (US$) Real GDP growth (%) Real GDP per capita growth (%) Change in general government debt/GDP (%) General government balance/GDP (%) General government debt/GDP (%) Net general government debt/GDP (%) General government interest expenditure/revenues (%) Oth dc claims on resident non-govt. sector/GDP (%) CPI growth (%) Gross external financing needs/CARs +use. res (%) Current account balance/GDP (%) Current account balance/CARs (%) 39 12,098 9.8 11.1 1.8 (1.0) 16.8 13.1 2.0 59.6 5.8 151.7 (14.5) (23.7) 2008 47 14,780 2.9 4.1 0.6 (3.3) 15.5 13.5 2.0 62.5 11.1 151.8 (13.3) (19.8) 2009 37 11,637 (14.8) (14.1) 10.4 (9.4) 29.3 24.1 3.6 69.7 4.2 156.3 3.9 6.2 2010 37 11,683 1.6 3.0 9.6 (7.2) 37.8 31.4 5.2 63.2 1.2 140.5 0.0 0.1 2011 43 14,114 6.0 9.2 4.5 (5.5) 38.3 35.8 5.4 53.2 4.1 131.8 (3.7) (4.3) 2012 42 14,096 3.7 5.3 4.5 (3.3) 40.5 35.1 5.9 51.0 3.2 127.3 (0.2) (0.3) 2013e 46 15,455 3.3 4.4 0.8 (2.7) 39.4 35.9 5.4 46.3 1.2 121.8 1.5 1.5 2014f 50 16,894 3.5 4.0 4.1 (2.1) 41.6 35.8 6.3 45.1 1.3 121.3 (0.6) (0.6) 2015f 53 18,012 3.8 4.3 1.1 (1.5) 40.4 35.0 6.5 44.0 2.0 120.0 (2.0) (2.0) 2016f 57 19,316 4.0 4.5 (1.8) (0.5) 36.0 33.0 6.3 42.9 2.3 119.8 (2.0) (1.9) 2017f 60 20,721 4.0 4.5 0.1 (0.5) 33.9 31.0 5.6 41.8 2.5 120.3 (2.1) (2.1)

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 5

1294561 | 300051529

Research Update: Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

Table 1

Republic of Lithuania -- Selected Indicators (cont.)

Narrow net external debt/CARs (%) Net external liabilities/CARs (%) 58.2 97.7 54.9 73.9 67.3 93.6 51.0 71.3 38.2 56.2 39.8 59.1 32.2 49.8 29.5 43.5 27.7 40.2 25.8 37.0 23.9 34.1

Other depository corporations (dc) are financial corporations (other than the central bank) whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private- sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. CARs--Current account receipts. e--Estimate. f--Forecast. The data and ratios above result from S&Ps own calculations, drawing on national as well as international sources, reflecting S&Ps independent view on the timeliness, coverage, accuracy, credibility, and usability of available information.

Related Criteria And Research

Related Criteria

Sovereign Government Rating Methodology And Assumptions, June 24, 2013 Methodology For Linking Short-Term And Long-Term Ratings For Corporate, Insurance, And Sovereign Issuers, May 7, 2013 Criteria For Determining Transfer And Convertibility Assessments, May 18, 2009

Related Research

Lithuania (Republic of), Nov. Lithuania Outlook To Positive Eurozone Accession; 'BBB/A-2' Sovereign Defaults And Rating 2013 22, 2013 On Strong Economic Growth And Likely Ratings Affirmed, Oct. 25, 2013 Transition Data, 2012 Update, March 29,

Ratings List

Upgraded; Outlook Action To Lithuania (Republic of) Long-Term Sovereign Credit Rating Senior Unsecured Transfer & Convertibility Assessment Ratings Affirmed Lithuania (Republic of) Short-Term Sovereign Credit Rating Short-Term Debt

Additional Contact: SovereignEurope; SovereignEurope@standardandpoors.com

From BBB/Positive BBB A

A-/Stable AAA-

A-2 A-2

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 6

1294561 | 300051529

Research Update: Lithuania Long-Term Rating Raised To 'A-' On Expected Adoption Of Euro; Outlook Stable

Complete ratings information is available to subscribers of RatingsDirect at www.globalcreditportal.com and at spcapitaliq.com. All ratings affected by this rating action can be found on Standard & Poor's public Web site at www.standardandpoors.com. Use the Ratings search box located in the left column. Alternatively, call one of the following Standard & Poor's numbers: Client Support Europe (44) 20-7176-7176; London Press Office (44) 20-7176-3605; Paris (33) 1-4420-6708; Frankfurt (49) 69-33-999-225; Stockholm (46) 8-440-5914; or Moscow 7 (495) 783-4009.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 7

1294561 | 300051529

Copyright 2014 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 11, 2014 8

1294561 | 300051529

Anda mungkin juga menyukai

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeDari EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeBelum ada peringkat

- Latvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook StableDokumen8 halamanLatvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook Stableapi-228714775Belum ada peringkat

- EIB Working Papers 2019/08 - Investment: What holds Romanian firms back?Dari EverandEIB Working Papers 2019/08 - Investment: What holds Romanian firms back?Belum ada peringkat

- Republic of Poland Ratings Affirmed Outlook Stable: Research UpdateDokumen8 halamanRepublic of Poland Ratings Affirmed Outlook Stable: Research Updateapi-228714775Belum ada peringkat

- Portugal 'BB/B' Ratings Affirmed Outlook Negative On Policy UncertaintyDokumen9 halamanPortugal 'BB/B' Ratings Affirmed Outlook Negative On Policy Uncertaintyapi-231665846Belum ada peringkat

- Outlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings AffirmedDokumen8 halamanOutlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings Affirmedapi-231665846Belum ada peringkat

- Polish Banking Sector Outlook 2014: Brighter Prospects Ahead As Economic and Operating Pressures RecedeDokumen16 halamanPolish Banking Sector Outlook 2014: Brighter Prospects Ahead As Economic and Operating Pressures Recedeapi-228714775Belum ada peringkat

- Greece Ratings Affirmed at 'B-/B' Outlook Stable: Research UpdateDokumen8 halamanGreece Ratings Affirmed at 'B-/B' Outlook Stable: Research Updateapi-228714775Belum ada peringkat

- Recovery For Central and Eastern European Banks Will Be Fragile in 2014Dokumen14 halamanRecovery For Central and Eastern European Banks Will Be Fragile in 2014api-228714775Belum ada peringkat

- Romania: Letter of Intent, Memorandum of Economic and FinancialDokumen36 halamanRomania: Letter of Intent, Memorandum of Economic and FinancialFlorin CituBelum ada peringkat

- Q&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?Dokumen11 halamanQ&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?api-228714775Belum ada peringkat

- Moodys Iceland July 2013 NewDokumen20 halamanMoodys Iceland July 2013 NewTeddy JainBelum ada peringkat

- Outlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings AffirmedDokumen9 halamanOutlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings Affirmedapi-228714775Belum ada peringkat

- Ratings On Spain Affirmed at 'BBB-/A-3' Outlook Negative: Research UpdateDokumen6 halamanRatings On Spain Affirmed at 'BBB-/A-3' Outlook Negative: Research Updateapi-227433089Belum ada peringkat

- Atvia Etter of NtentDokumen26 halamanAtvia Etter of NtentZerohedgeBelum ada peringkat

- STANDARD - PORTUGAL - 27april2010Dokumen5 halamanSTANDARD - PORTUGAL - 27april2010Maria Alvares RibeiroBelum ada peringkat

- Seb Merchant Banking - Country Risk Analysis 28 September 2016Dokumen6 halamanSeb Merchant Banking - Country Risk Analysis 28 September 2016Aylin PolatBelum ada peringkat

- Romania 'BBB - A-3' Ratings Affirmed - Outlook Stab - S&P Global Ratings - 12.04.2024Dokumen22 halamanRomania 'BBB - A-3' Ratings Affirmed - Outlook Stab - S&P Global Ratings - 12.04.2024Florin BudescuBelum ada peringkat

- Flash Comment: Latvia - February 11, 2013Dokumen1 halamanFlash Comment: Latvia - February 11, 2013Swedbank AB (publ)Belum ada peringkat

- Romania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook StableDokumen7 halamanRomania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook Stableapi-228714775Belum ada peringkat

- Policy Easing To Accelerate in H1: China Outlook 2012Dokumen21 halamanPolicy Easing To Accelerate in H1: China Outlook 2012valentinaivBelum ada peringkat

- Country Intelligence Report 2Dokumen34 halamanCountry Intelligence Report 2Li JieBelum ada peringkat

- Romania Long Term OutlookDokumen5 halamanRomania Long Term OutlooksmaneranBelum ada peringkat

- A I: M: L I: Ttachment Oldova Etter of NtentDokumen14 halamanA I: M: L I: Ttachment Oldova Etter of Ntentoctavs99Belum ada peringkat

- EN EN: European CommissionDokumen24 halamanEN EN: European Commissionapi-58353949Belum ada peringkat

- UK Research: How Long Can The UK Maintain Its AAA Rating?Dokumen15 halamanUK Research: How Long Can The UK Maintain Its AAA Rating?Daniel Archer-CoxBelum ada peringkat

- Nordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Dokumen7 halamanNordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Glenn ViklundBelum ada peringkat

- Studii Economice - CofaceDokumen2 halamanStudii Economice - CofaceVelicanu Bekk ZsuzsaBelum ada peringkat

- CIS Sovereign Debt Report 2014: Borrowing To Decrease To $51 BillionDokumen9 halamanCIS Sovereign Debt Report 2014: Borrowing To Decrease To $51 Billionapi-228714775Belum ada peringkat

- Macro Update: Slowdown, But Continued Good Resilience in BalticsDokumen2 halamanMacro Update: Slowdown, But Continued Good Resilience in BalticsSEB GroupBelum ada peringkat

- Flash Comment: Latvia - December 7, 2012Dokumen1 halamanFlash Comment: Latvia - December 7, 2012Swedbank AB (publ)Belum ada peringkat

- Country Intelligence: Report: TurkeyDokumen27 halamanCountry Intelligence: Report: TurkeyFlorian SarkisBelum ada peringkat

- Baltic Sea Report 2015Dokumen31 halamanBaltic Sea Report 2015Swedbank AB (publ)Belum ada peringkat

- Public Sector Budgeting Short Essay QuestionDokumen7 halamanPublic Sector Budgeting Short Essay QuestionBrilliant MycriBelum ada peringkat

- Flash Comment: Latvia - November 8, 2012Dokumen1 halamanFlash Comment: Latvia - November 8, 2012Swedbank AB (publ)Belum ada peringkat

- Country Reports - UkraineDokumen44 halamanCountry Reports - UkraineMarcusShusterBelum ada peringkat

- June 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Dokumen70 halamanJune 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Ilya MozyrskiyBelum ada peringkat

- Mozambique Long-Term Rating Lowered To 'B' On High Debt Accumulation 'B' Short-Term Rating Affirmed Outlook StableDokumen7 halamanMozambique Long-Term Rating Lowered To 'B' On High Debt Accumulation 'B' Short-Term Rating Affirmed Outlook Stableapi-228714775Belum ada peringkat

- Colliers International (2014) Bucharest Market Research and Forcast ReportDokumen28 halamanColliers International (2014) Bucharest Market Research and Forcast ReportSimonaGradinaruBelum ada peringkat

- Long-Term Ratings On Italy Lowered To 'BBB' Outlook NegativeDokumen7 halamanLong-Term Ratings On Italy Lowered To 'BBB' Outlook Negativeapi-227433089Belum ada peringkat

- Eurozone: Outlook For Financial ServicesDokumen20 halamanEurozone: Outlook For Financial ServicesEuglena VerdeBelum ada peringkat

- Russia Foreign Currency Ratings Lowered To 'BBB-/A-3' On Risk of Marked Deterioration in External Financing Outlook NegDokumen9 halamanRussia Foreign Currency Ratings Lowered To 'BBB-/A-3' On Risk of Marked Deterioration in External Financing Outlook Negapi-228714775Belum ada peringkat

- 2013 March Ernst & Yang Report German EconomyDokumen8 halaman2013 March Ernst & Yang Report German Economygpanagi1Belum ada peringkat

- Autumn Statement 2013Dokumen123 halamanAutumn Statement 2013Michael HicksBelum ada peringkat

- Autumn Statement 2013Dokumen130 halamanAutumn Statement 2013LukeNicholls07Belum ada peringkat

- Ratings Articles en Us ArticleDokumen4 halamanRatings Articles en Us ArticlemarcelluxBelum ada peringkat

- EU Budget in My Country SlovakiaDokumen12 halamanEU Budget in My Country Slovakiatjnevado1Belum ada peringkat

- Ukraine Downgraded To 'B-' On Government's Lack of Strategy To Secure Foreign Currency Funding Outlook Remains NegativeDokumen7 halamanUkraine Downgraded To 'B-' On Government's Lack of Strategy To Secure Foreign Currency Funding Outlook Remains Negativeapi-228714775Belum ada peringkat

- Burundi: Second Review Under The Extended Credit Facility-Debt Sustainability AnalysisDokumen16 halamanBurundi: Second Review Under The Extended Credit Facility-Debt Sustainability AnalysisBharat SethBelum ada peringkat

- Vanuatu Article IV Consultation 2013Dokumen52 halamanVanuatu Article IV Consultation 2013Kyren GreiggBelum ada peringkat

- Autumn Statement 2012Dokumen4 halamanAutumn Statement 2012Martin ForsytheBelum ada peringkat

- EC Greece Forecast Autumn 13 PDFDokumen2 halamanEC Greece Forecast Autumn 13 PDFThePressProjectIntlBelum ada peringkat

- Romania'S Challenges For Joining The Eu: A Dream Too Far Away?Dokumen4 halamanRomania'S Challenges For Joining The Eu: A Dream Too Far Away?Larisa PîrvuBelum ada peringkat

- CW The Year Ahead 2015-2016Dokumen32 halamanCW The Year Ahead 2015-2016vdmaraBelum ada peringkat

- Govt Debt and DeficitDokumen4 halamanGovt Debt and DeficitSiddharth TiwariBelum ada peringkat

- Poland On Its Way To GreeceDokumen7 halamanPoland On Its Way To GreeceH5F CommunicationsBelum ada peringkat

- Economic Report 2007Dokumen55 halamanEconomic Report 2007Alexandra-Maria VargaBelum ada peringkat

- Alternative Lending Market Report 2016Dokumen18 halamanAlternative Lending Market Report 2016CrowdfundInsider100% (2)

- Nigeria Ratings Affirmed Outlook Negative On Increasing Political, Institutional, and Fiscal RisksDokumen8 halamanNigeria Ratings Affirmed Outlook Negative On Increasing Political, Institutional, and Fiscal Risksapi-228714775Belum ada peringkat

- Portugal: Letter of Intent, Memorandum of Economic and Financial Policies, and Technical Memorandum of UnderstandingDokumen25 halamanPortugal: Letter of Intent, Memorandum of Economic and Financial Policies, and Technical Memorandum of UnderstandingDuarte levyBelum ada peringkat

- UntitledDokumen19 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen3 halamanUntitledapi-231665846Belum ada peringkat

- Ratings On Senegal Affirmed at 'B+/B' Outlook Stable: Research UpdateDokumen7 halamanRatings On Senegal Affirmed at 'B+/B' Outlook Stable: Research Updateapi-231665846Belum ada peringkat

- Euro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit RateDokumen7 halamanEuro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit Rateapi-231665846Belum ada peringkat

- UntitledDokumen14 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen22 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen9 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen7 halamanUntitledapi-231665846Belum ada peringkat

- Kingdom of Bahrain Ratings Affirmed at 'BBB/A-2' On Stable Growth Prospects Outlook StableDokumen7 halamanKingdom of Bahrain Ratings Affirmed at 'BBB/A-2' On Stable Growth Prospects Outlook Stableapi-231665846Belum ada peringkat

- Ratings On Spain Raised To 'BBB/A-2' On Improved Economic Prospects Outlook StableDokumen8 halamanRatings On Spain Raised To 'BBB/A-2' On Improved Economic Prospects Outlook Stableapi-231665846Belum ada peringkat

- Outlook On The United Kingdom Revised To Stable On Broadening Economic Recovery Ratings Affirmed at 'AAA/A-1+'Dokumen9 halamanOutlook On The United Kingdom Revised To Stable On Broadening Economic Recovery Ratings Affirmed at 'AAA/A-1+'api-231665846Belum ada peringkat

- UntitledDokumen8 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen7 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen11 halamanUntitledapi-231665846Belum ada peringkat

- Which Emerging Market Banking Systems Could Suffer Most From Fed Tapering?Dokumen15 halamanWhich Emerging Market Banking Systems Could Suffer Most From Fed Tapering?api-231665846Belum ada peringkat

- Europe's Housing Market Recovery Is Not Yet On Solid Ground: Economic ResearchDokumen30 halamanEurope's Housing Market Recovery Is Not Yet On Solid Ground: Economic Researchapi-231665846Belum ada peringkat

- UntitledDokumen17 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen17 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen15 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen8 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen11 halamanUntitledapi-231665846Belum ada peringkat

- Key Considerations For Rating Banks in An Independent ScotlandDokumen9 halamanKey Considerations For Rating Banks in An Independent Scotlandapi-231665846Belum ada peringkat

- UntitledDokumen15 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen5 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen16 halamanUntitledapi-231665846Belum ada peringkat

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveDokumen11 halamanInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-231665846Belum ada peringkat

- UntitledDokumen10 halamanUntitledapi-231665846Belum ada peringkat

- UntitledDokumen15 halamanUntitledapi-231665846Belum ada peringkat

- A KariozenDokumen4 halamanA Kariozenjoseyamil77Belum ada peringkat

- SAP InvoiceDokumen86 halamanSAP InvoicefatherBelum ada peringkat

- Menu EngineeringDokumen9 halamanMenu Engineeringfirstman31Belum ada peringkat

- NokiaDokumen88 halamanNokiaAkshay Gunecha50% (4)

- Aplicatie Practica Catapulta TUVDokumen26 halamanAplicatie Practica Catapulta TUVwalaBelum ada peringkat

- Companies in UAEDokumen1 halamanCompanies in UAEChelle Sujetado De Guzman50% (2)

- ACCT1501 MC Bank QuestionsDokumen33 halamanACCT1501 MC Bank QuestionsHad0% (2)

- Online Shopping PDFDokumen4 halamanOnline Shopping PDFkeerthanasubramaniBelum ada peringkat

- Project Analysis Report Optus StadiumDokumen14 halamanProject Analysis Report Optus StadiumRida ZainebBelum ada peringkat

- T&S Commercial Invoice Dlrvary Channal Packing ListDokumen3 halamanT&S Commercial Invoice Dlrvary Channal Packing ListkksgmailBelum ada peringkat

- Sample CH 01Dokumen29 halamanSample CH 01Ali Akbar0% (1)

- Ble Assignment 2019 21 BatchDokumen2 halamanBle Assignment 2019 21 BatchRidwan MohsinBelum ada peringkat

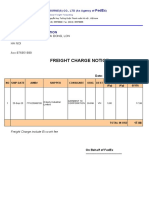

- Freight Charge Notice: To: Garment 10 CorporationDokumen4 halamanFreight Charge Notice: To: Garment 10 CorporationThuy HoangBelum ada peringkat

- Coca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFDokumen33 halamanCoca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFLouise AncianoBelum ada peringkat

- Cash ReceiptDokumen1 halamanCash ReceiptShellinaBelum ada peringkat

- One Point LessonsDokumen27 halamanOne Point LessonsgcldesignBelum ada peringkat

- Ecoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot CanadaDokumen4 halamanEcoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot Canadaming_zhu10Belum ada peringkat

- Obayomi & Sons Farms: Business PlanDokumen5 halamanObayomi & Sons Farms: Business PlankissiBelum ada peringkat

- The Implications of Globalisation For Consumer AttitudesDokumen2 halamanThe Implications of Globalisation For Consumer AttitudesIvan Luis100% (1)

- Leadership and Strategic Management - GonoDokumen47 halamanLeadership and Strategic Management - GonoDat Nguyen Huy100% (1)

- "Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click HereDokumen98 halaman"Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click Herevj_aeroBelum ada peringkat

- F23 - OEE DashboardDokumen10 halamanF23 - OEE DashboardAnand RBelum ada peringkat

- G12 ABM Marketing Lesson 1 (Part 1)Dokumen10 halamanG12 ABM Marketing Lesson 1 (Part 1)Leo SuingBelum ada peringkat

- Progress Test 4 KeyDokumen2 halamanProgress Test 4 Keyalesenan100% (1)

- Leadership & Innovation BrochureDokumen10 halamanLeadership & Innovation BrochureFiona LiemBelum ada peringkat

- Problems in Bureaucratic SupplyDokumen4 halamanProblems in Bureaucratic Supplyatt_doz86100% (1)

- Financial Accounting AssignmentDokumen11 halamanFinancial Accounting AssignmentMadhawa RanawakeBelum ada peringkat

- Coin Sort ReportDokumen40 halamanCoin Sort ReportvishnuBelum ada peringkat

- Revionics - White.paper. (Software As A Service A Retailers)Dokumen7 halamanRevionics - White.paper. (Software As A Service A Retailers)Souvik_DasBelum ada peringkat