Adhar FBDT

Diunggah oleh

solo_gauravJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Adhar FBDT

Diunggah oleh

solo_gauravHak Cipta:

Format Tersedia

ALLAHABADBANK

DEVELOPMENT DEPARTMENT

AML & KYC CELL

HEAD OFFICE: 2, NETAJI SUBHAS ROAD, KOLKATA 700 001

Instruction Circular No. 12255/AML &KYC/2012-13/08 To: All Branches and Offices

Date : 08.01.2013

Acceptance of Aadhaar letter for KYC purposes -Campaign to link Aadhar number in existing accounts for implementation of Direct Benefit Transfer Initiative of Govt. Of India Attention is drawn to Appendix-III of the Instruction Circular No. 11954 /AML &KYC/2012-13/04 dated 29.06.2012 providing an indicative list of documents which may be obtained while opening of accounts. Unique Identification Authority of India (UIDAI) has advised Reserve Bank that banks are accepting Aadhaar letter issued by it as a proof of identity but not of address, for opening accounts. Accordingly, Reserve Bank of India vide a communication DBOD.AML.BC.No.65/14.01.001/2012-13 dated December 10, 2012 advised Banks that if the address provided by the account holder is the same as that on Aadhaar letter, it may be accepted as a proof of both identity and address. In view of the aforesaid RBI guidelines and recent Direct Benefit Transfer (DBT) initiative of the Government of India, all branches are advised to use Aadhar as a KYC document for opening of bank accounts to the extent possible to ensure that the bank account can be automatically linked to Aadhar. In this connection, a reference is made to HO Instruction Circular No. 12229/PSC/FI/2012-13/60 dated 26.12.2012 wherein under para 3 detailed guidelines are provided facilitating implementation of Direct Benefit Transfer initiative of Govt. of India. As large cash transfers are likely to take place through DBT, in order to get the benefit, it has now been decided to run a special campaign till 31.03.2013 to link Aadhar number to the existing bank accounts. Considering that the initiative is aimed at empowering the common man, all branches/offices should be proactive and ensure obtaining of Aadhar details while opening of accounts. The following action points should be considered for linking the Aadhar number in existing accounts during the campaign period: i) Adequate display should be made in a prominent place of the branch premises requesting customers to provide their Aadhar number in their existing Savings accounts to enable Aadhar linkage. ii) The front end officials should be sensitized to make customers aware of the advantages of Aadhar linkage.

Cont..(2).

.(2).

iii) In the exiting districts where Direct Benefit Transfer scheme is already in progress, the branch head should ensure opening of accounts of all the beneficiaries. Account opening campaigns may be conducted periodically at the identified wards/areas. iv) Proper liaison should be maintained with the dealing govt. officials to keep aware of the latest developments on Direct Benefit Transfer.

Aadhar linkage in the existing accounts as well as opening new accounts with Aadhar as KYC, provides an opportunity for the Bank to actively participate in the Cash Benefit Transfer Scheme as and when it is extended to other districts. In the 51 districts identified for first phase of implementation of Direct Bank Transfer, the concerned Zonal Offices should closely monitor the progress of the branches to ensure implementation of the scheme in letter and spirit. Branches/offices are advised to make a careful note of the aforesaid guidelines for meticulous compliance. (Ashok Chatterjee) General Manager (P&D)

Anda mungkin juga menyukai

- Read MeDokumen3 halamanRead Mesolo_gauravBelum ada peringkat

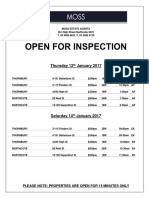

- Thursday 12 January 2017: Please Note: Properties Are Open For 15 Minutes OnlyDokumen1 halamanThursday 12 January 2017: Please Note: Properties Are Open For 15 Minutes Onlysolo_gauravBelum ada peringkat

- RporateDokumen7 halamanRporatesolo_gauravBelum ada peringkat

- Debug RFC AbapDokumen1 halamanDebug RFC Abapsolo_gauravBelum ada peringkat

- Example of Reflective Diary WritingDokumen3 halamanExample of Reflective Diary Writingsolo_gauravBelum ada peringkat

- Debug RFC AbapDokumen1 halamanDebug RFC Abapsolo_gauravBelum ada peringkat

- Had OopsDokumen3 halamanHad Oopssolo_gauravBelum ada peringkat

- White Paper Application Performance Management (APM)Dokumen26 halamanWhite Paper Application Performance Management (APM)solo_gauravBelum ada peringkat

- Comprehensive Analysis On The Indian Renewable Energy Sector."feb 3,2012)Dokumen3 halamanComprehensive Analysis On The Indian Renewable Energy Sector."feb 3,2012)solo_gauravBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 3125 Vitalogic 4000 PDFDokumen444 halaman3125 Vitalogic 4000 PDFvlaimirBelum ada peringkat

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDokumen27 halamanSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunBelum ada peringkat

- Draft Contract Agreement 08032018Dokumen6 halamanDraft Contract Agreement 08032018Xylo SolisBelum ada peringkat

- M2 Economic LandscapeDokumen18 halamanM2 Economic LandscapePrincess SilenceBelum ada peringkat

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDokumen2 halamanPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407Belum ada peringkat

- PC210 8M0Dokumen8 halamanPC210 8M0Vamshidhar Reddy KundurBelum ada peringkat

- Basic Vibration Analysis Training-1Dokumen193 halamanBasic Vibration Analysis Training-1Sanjeevi Kumar SpBelum ada peringkat

- TSR KuDokumen16 halamanTSR KuAngsaBelum ada peringkat

- TEVTA Fin Pay 1 107Dokumen3 halamanTEVTA Fin Pay 1 107Abdul BasitBelum ada peringkat

- Basics: Define The Task of Having Braking System in A VehicleDokumen27 halamanBasics: Define The Task of Having Braking System in A VehiclearupBelum ada peringkat

- 1400 Service Manual2Dokumen40 halaman1400 Service Manual2Gabriel Catanescu100% (1)

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Dokumen11 halamanIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaBelum ada peringkat

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDokumen2 halamanAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfBelum ada peringkat

- P394 WindActions PDFDokumen32 halamanP394 WindActions PDFzhiyiseowBelum ada peringkat

- 4 Bar LinkDokumen4 halaman4 Bar LinkConstance Lynn'da GBelum ada peringkat

- Perkins 20 Kva (404D-22G)Dokumen2 halamanPerkins 20 Kva (404D-22G)RavaelBelum ada peringkat

- PLT Lecture NotesDokumen5 halamanPLT Lecture NotesRamzi AbdochBelum ada peringkat

- Daraman vs. DENRDokumen2 halamanDaraman vs. DENRJeng GacalBelum ada peringkat

- Unit 1Dokumen3 halamanUnit 1beharenbBelum ada peringkat

- Government of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Dokumen2 halamanGovernment of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Satyaki Prasad MaitiBelum ada peringkat

- BSCSE at UIUDokumen110 halamanBSCSE at UIUshamir mahmudBelum ada peringkat

- Hexoskin - Information For Researchers - 01 February 2023Dokumen48 halamanHexoskin - Information For Researchers - 01 February 2023emrecan cincanBelum ada peringkat

- Address MappingDokumen26 halamanAddress MappingLokesh KumarBelum ada peringkat

- Maths PDFDokumen3 halamanMaths PDFChristina HemsworthBelum ada peringkat

- Shubham Tonk - ResumeDokumen2 halamanShubham Tonk - ResumerajivBelum ada peringkat

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDokumen28 halamanMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiBelum ada peringkat

- Guide For Overseas Applicants IRELAND PDFDokumen29 halamanGuide For Overseas Applicants IRELAND PDFJasonLeeBelum ada peringkat

- Portrait of An INTJDokumen2 halamanPortrait of An INTJDelia VlasceanuBelum ada peringkat

- Reverse Engineering in Rapid PrototypeDokumen15 halamanReverse Engineering in Rapid PrototypeChaubey Ajay67% (3)

- Ucm6510 Usermanual PDFDokumen393 halamanUcm6510 Usermanual PDFCristhian ArecoBelum ada peringkat