FIN500 Excel Assignment 1

Diunggah oleh

Magdalena SimicJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FIN500 Excel Assignment 1

Diunggah oleh

Magdalena SimicHak Cipta:

Format Tersedia

You want to buy a $300,000 house.

You plan to make a down payment of 20% of the purchase price and finance the rest wit loan. The loan is fully amortizing, and requires monthly payments at the end of each month. The nominal loan rate is 5%, co much of the purchase price will you finance with the mortgage loan? 2) What is your anticipated monthly mortgage paymen Answer 1) Loan amount 2) Monthly payment Answer N I PV PMT FV 360 0.004166667 $240,000.00 ($1,288.37) Use the appropriate formulas and Excel function to solve the problem (typed-in solutions receive 0 credit) $240,000

rice and finance the rest with a 30-year fixed rate mortgage e nominal loan rate is 5%, compounded monthly. 1) How monthly mortgage payment?

Suppose that you deposit $200 at the end of each month into an account paying an expected annual rate of return of 3%, compounded monthly. How much money will you have in the account in 10 years? Answer N I PV PMT FV 120 0.0025 ($200.00) $27,948.28 Use the appropriate formulas and Excel 10 function to solve the problem (typed-in 0.03 solutions receive 0 credit) ($200.00) $27,948.28 This side is done with adjustments in the FV equation for monthly compounding

ed annual rate of return of 3%,

hly compounding

Today is Dec. 31, 2012. You have been saving money each month over the past year, and have just made your last deposit in of 0.2% per year, compounded monthly. You did not have a set amount that you saved each month, instead, you saved any e month. Your savings history is given below in chronological order. Assume that you started the year with $0 in savings, and d each month into a checking account beginning on Jan. 31, 2012. 1) What is the value of your total savings today? 2) What is you have earned over the year? (Hint: today is time 0) Use the appropriate formulas and Excel function to solve the problem (typed-in solutions receive 0 credit) Savings Period Cash Flow FV 21.32 0 0.00 0.00 116.13 1 (21.32) 21.71 3.48 2 (116.13) 118.08 463.15 3 (3.48) 3.53 51.06 4 (463.15) 469.36 129.09 5 (51.06) 51.66 388.07 6 (129.09) 130.39 340.14 7 (388.07) 391.31 404.74 8 (340.14) 342.42 362.44 9 (404.74) 406.77 43.44 10 (362.44) 363.65 67.00 11 (43.44) 43.51 (67.00) 67.00 12 Total 2,390.06 2,409.39

Year 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012

Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

t year, and have just made your last deposit into a bank account that pays interest ou saved each month, instead, you saved any extra income that you had for the t you started the year with $0 in savings, and deposited your savings at the end of e value of your total savings today? 2) What is the dollar amount of interest that

1) Total account value 2) Total dollar amount of interest earned

Answer $2,409.39 $19.33

An investment offers to pay you $300 per quarter for 10 years. If the annual rate is 11% with quarterly compounding, then what is the present value of these cash flows? Answer N I PV PMT FV 40 0.0275 ($7,223.43) $300.00 Use the appropriate formulas and Excel function to solve the problem (typed-in solutions receive 0 credit)

quarterly

You currently have $4,000 in a bank account that pays a nominal rate of 1%, compounded monthly. You plan to make additional monthly deposits of $200, starting at the end of this month. How many payments will you have made when your account balance reaches $50,000? Answer 207.34 0.00083333 -$4,000.00 ($200.00) $50,000.00

N I PV PMT FV

208.00 Use the appropriate formulas and Excel function to solve the problem (typed-in solutions receive 0 credit).

nthly. You plan to ments will you have

A basketball player is offered the following contract today, Jan. 1, 2012: $2 million immediately, $2.40 million in 2012, $2.90 2014, and $3.80 million in 2015. Assume all payments other than the first $2 million are paid at the end of the year. If the app percent per year, what is the present value of the deal? Discount Rate 10% Period 0 1 2 3 4 Present Value of year end cash flows Present Value of everything (including initial) Cash Flow (millions) $2.00 $2.40 $2.90 $3.60 $3.80 $9.88 $11.88

40 million in 2012, $2.90 million in 2013, $3.60 million in end of the year. If the appropriate discount rate is 10

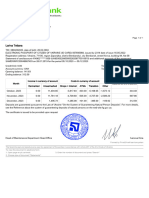

Suppose you plan to save $1,000 at the end of each year for a total of 10 years. You are considering four different mutual fun an average annual return of 2%, Fund 2 has an average annual return of 5%, Fund 3 has an annual average return of 10%, and average annual return of 15%. Assume annual compounding. For each year, calculate your total account value. Graph your r sure that your graph includes a legend, axis titles, and a chart title. (Hint: Year 10 FVs in the Answer area should match the on problem.) Fund N I/YR PV PMT FV 1 2 10 10 0.02 0.05 0 0 -1000 -1000 $10,950 $12,578 3 10 0.1 0 -1000 $15,937 4 10 0.15 0 -1000 $20,304

Your graph should look like this examp

$25,000

Year 0 1 2 3 4 5 6 7 8 9 10

1 2% $0 $1,000 $2,020 $3,060 $4,122 $5,204 $6,308 $7,434 $8,583 $9,755 $10,950

Answer 2 3 5% 10% $0 $0 $1,000 $1,000 $2,050 $2,100 $3,153 $3,310 $4,310 $4,641 $5,526 $6,105 $6,802 $7,716 $8,142 $9,487 $9,549 $11,436 $11,027 $13,579 $12,578 $15,937

4 15% $0 $1,000 $2,150 $3,473 $4,993 $6,742 $8,754 $11,067 $13,727 $16,786 $20,304

$20,000

Savings Values

$15,000

$10,000

$5,000

$0 0

ng four different mutual funds: Fund 1 has average return of 10%, and Fund 4 has an account value. Graph your results. Make r area should match the ones given in the

Use the appropriate formulas and Excel function to solve the problem (typed-in solutions receive 0 credit)

should look like this example. Move this example to another location in the worksheet and create your own graph.

Savings Values at Different Rates of Return

2% 5% 10% 15%

6 Years

10

12

2% 5% 10% 15%

Anda mungkin juga menyukai

- TODAY at BULLET Chapter 2 TVM ContinuedDokumen8 halamanTODAY at BULLET Chapter 2 TVM ContinuedSiêng Năng NèBelum ada peringkat

- TODAY at BULLET Chapter 2 TVM ContinuedDokumen8 halamanTODAY at BULLET Chapter 2 TVM ContinuedThùy LêBelum ada peringkat

- Exercises - Lecture 7 (A)Dokumen7 halamanExercises - Lecture 7 (A)Samuel ChunBelum ada peringkat

- Present value calculations for problems involving multiple cash flows and interest ratesDokumen42 halamanPresent value calculations for problems involving multiple cash flows and interest ratesAaron NatarajaBelum ada peringkat

- 2019 Exam - Moed A - Computer Science - (Solution)Dokumen11 halaman2019 Exam - Moed A - Computer Science - (Solution)adoBelum ada peringkat

- Time Value of Money: Lecture No.2 BES 2: Engineering Economy 1 Semester SY 2018 - 2019Dokumen35 halamanTime Value of Money: Lecture No.2 BES 2: Engineering Economy 1 Semester SY 2018 - 2019Jane Erestain BuenaobraBelum ada peringkat

- Maths201unit 1Dokumen80 halamanMaths201unit 1Siukeung PatrickBelum ada peringkat

- CH 04 EOC Solutions 4e StudentDokumen15 halamanCH 04 EOC Solutions 4e StudentMary Shannon DeeringBelum ada peringkat

- Module 2 - Time Value of MoneyDokumen61 halamanModule 2 - Time Value of MoneyNarayanan Subramanian100% (1)

- Amortization Methods and Schedules ExplainedDokumen46 halamanAmortization Methods and Schedules ExplaineddutersBelum ada peringkat

- Calculating Present and Future Values of Cash FlowsDokumen8 halamanCalculating Present and Future Values of Cash FlowsSashawn Douglas100% (1)

- ADM 3351-Final With SolutionsDokumen14 halamanADM 3351-Final With SolutionsGraeme RalphBelum ada peringkat

- Future Value of 1 Sample Problem: SolutionDokumen9 halamanFuture Value of 1 Sample Problem: Solutioncris_magno08Belum ada peringkat

- College of Business and Economics: B) Pmt-IpmtDokumen2 halamanCollege of Business and Economics: B) Pmt-Ipmtgatete samBelum ada peringkat

- Reading 1 The Time Value of MoneyDokumen46 halamanReading 1 The Time Value of MoneyNeerajBelum ada peringkat

- Session 8: Practice Problems: 30017 Corporate Finance Lecture SlidesDokumen18 halamanSession 8: Practice Problems: 30017 Corporate Finance Lecture SlidesGiuseppeBelum ada peringkat

- F3ReadingToLearn - Percentages 2Dokumen4 halamanF3ReadingToLearn - Percentages 2gordonkhlawBelum ada peringkat

- Using Solver For Financial PlanningDokumen4 halamanUsing Solver For Financial PlanningAmna JupićBelum ada peringkat

- MBA Mid-Term Exam SolutionsDokumen16 halamanMBA Mid-Term Exam SolutionsSomera Abdul QadirBelum ada peringkat

- Accounting Chapter 10Dokumen11 halamanAccounting Chapter 10Andrew ChouBelum ada peringkat

- TTM 10 Time Value of Money - LanjutanDokumen58 halamanTTM 10 Time Value of Money - LanjutanDede KurniatiBelum ada peringkat

- Time Value of Money: A Self-Test: Personal Finance: Another PerspectiveDokumen24 halamanTime Value of Money: A Self-Test: Personal Finance: Another PerspectiveFei Genuino Cruz100% (1)

- hw1 SolutionsDokumen3 halamanhw1 SolutionsJohn SmithBelum ada peringkat

- FMDokumen10 halamanFMKei YeeBelum ada peringkat

- 5 3 NotesDokumen7 halaman5 3 Notesapi-301176378Belum ada peringkat

- A Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesDokumen28 halamanA Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesMSA-ACCA100% (2)

- FI 580 Final Exam XCLDokumen28 halamanFI 580 Final Exam XCLjoannapsmith33Belum ada peringkat

- Calculating An Annuity: Total Principal × (1 + Rate)Dokumen23 halamanCalculating An Annuity: Total Principal × (1 + Rate)Prince AdyBelum ada peringkat

- Lecture 2- Basic of ExcelDokumen50 halamanLecture 2- Basic of Excelअभिजीत आखाडेBelum ada peringkat

- Fin440 Chapter 6 v.2Dokumen51 halamanFin440 Chapter 6 v.2Lutfun Nesa AyshaBelum ada peringkat

- The Time Value of Money - The BasicsDokumen64 halamanThe Time Value of Money - The BasicsTaqiya NadiyaBelum ada peringkat

- Optional Maths Revision Tutorial Questions: X X X A A A A A ADokumen44 halamanOptional Maths Revision Tutorial Questions: X X X A A A A A ASaizchiBelum ada peringkat

- Tutorial1 SolutionsDokumen5 halamanTutorial1 Solutionsfgdfdfgd3Belum ada peringkat

- Connect Quiz #2 SolutionsDokumen8 halamanConnect Quiz #2 SolutionsSunny VenkateshBelum ada peringkat

- Case Study 3 Wake Up and Smell The CoffeeDokumen25 halamanCase Study 3 Wake Up and Smell The CoffeeCheveem Grace Emnace100% (1)

- Tugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Dokumen5 halamanTugas Manajemen Keuangan (Maulana Ikhsan Tarigan) 197007091Maulana IkhsanBelum ada peringkat

- FIN300 Homework 1Dokumen7 halamanFIN300 Homework 1JohnBelum ada peringkat

- FI 3300 Corporation Finance Final ExamDokumen9 halamanFI 3300 Corporation Finance Final ExamJohn Brian D. SorianoBelum ada peringkat

- FINA 2330 Assignment 5Dokumen4 halamanFINA 2330 Assignment 5rebaBelum ada peringkat

- Exercises Fixed Income WT 2013Dokumen2 halamanExercises Fixed Income WT 2013xs_of_hateBelum ada peringkat

- Lecture-No2 Time Value of MoneyDokumen33 halamanLecture-No2 Time Value of MoneyElias GonzalesBelum ada peringkat

- Principles of Finance Work BookDokumen53 halamanPrinciples of Finance Work BookNicole MartinezBelum ada peringkat

- Midterm 09 SolutionsDokumen10 halamanMidterm 09 SolutionsNivetha ManiBelum ada peringkat

- 1030proj1-Buying A HouseDokumen5 halaman1030proj1-Buying A Houseapi-325431488Belum ada peringkat

- Kieso 6Dokumen54 halamanKieso 6noortiaBelum ada peringkat

- UC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasDokumen3 halamanUC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasMaria Elena SalgadoBelum ada peringkat

- Week 6Dokumen7 halamanWeek 6Phil OdendronBelum ada peringkat

- ACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemDokumen5 halamanACF 103 - Fundamentals of Finance Tutorial 2-3 - Solutions: Homework ProblemRiri FahraniBelum ada peringkat

- Financial Functions in Excel: by Varma PradeepDokumen38 halamanFinancial Functions in Excel: by Varma PradeepZEEL SATVARABelum ada peringkat

- Strategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Dokumen6 halamanStrategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Zahid UsmanBelum ada peringkat

- BU283 FINAL - All Homework SolutionsDokumen239 halamanBU283 FINAL - All Homework Solutionsm soo0% (2)

- Easy Problem Chapter 5Dokumen5 halamanEasy Problem Chapter 5Natally LangfeldtBelum ada peringkat

- ACC 421 Week+5+Team+AssignmentsDokumen19 halamanACC 421 Week+5+Team+AssignmentsBabay Taz0% (2)

- HW1-time Value of Money SOLUÇÃODokumen6 halamanHW1-time Value of Money SOLUÇÃOSahid Xerfan NetoBelum ada peringkat

- Ch16 Tool KitDokumen18 halamanCh16 Tool Kitjst4funBelum ada peringkat

- Finance for Non-Financiers 1: Basic FinancesDari EverandFinance for Non-Financiers 1: Basic FinancesBelum ada peringkat

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDari EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetBelum ada peringkat

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyDari EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyBelum ada peringkat

- Linear Regression ModelsDokumen3 halamanLinear Regression ModelsMagdalena SimicBelum ada peringkat

- Lab 43Dokumen10 halamanLab 43Magdalena SimicBelum ada peringkat

- Lab 8Dokumen10 halamanLab 8Magdalena SimicBelum ada peringkat

- Resistor Value Comparison and Linear Regression AnalysisDokumen2 halamanResistor Value Comparison and Linear Regression AnalysisMagdalena SimicBelum ada peringkat

- Lab 10Dokumen7 halamanLab 10Magdalena SimicBelum ada peringkat

- Lab 4Dokumen6 halamanLab 4Magdalena Simic100% (1)

- Lab 9Dokumen16 halamanLab 9Magdalena SimicBelum ada peringkat

- RC and RL Circuit AnalysisDokumen8 halamanRC and RL Circuit AnalysisMagdalena SimicBelum ada peringkat

- Lab 6Dokumen6 halamanLab 6Magdalena SimicBelum ada peringkat

- Lab 3Dokumen3 halamanLab 3Magdalena SimicBelum ada peringkat

- I-V Characteristics of Devices and CircuitsDokumen15 halamanI-V Characteristics of Devices and CircuitsMagdalena SimicBelum ada peringkat

- Lab 43Dokumen10 halamanLab 43Magdalena SimicBelum ada peringkat

- Lab 2Dokumen13 halamanLab 2Magdalena SimicBelum ada peringkat

- Lab 1Dokumen9 halamanLab 1Magdalena SimicBelum ada peringkat

- EE Lab Analyzes Linear and Non-Linear ComponentsDokumen15 halamanEE Lab Analyzes Linear and Non-Linear ComponentsMagdalena SimicBelum ada peringkat

- Resistor: Theoretical ( ) Measured ( ) Percent Error (%)Dokumen1 halamanResistor: Theoretical ( ) Measured ( ) Percent Error (%)Magdalena SimicBelum ada peringkat

- Statements PDFDokumen4 halamanStatements PDFSami Ullah Khan Larhi78% (9)

- Accounts of Blind PersonsDokumen8 halamanAccounts of Blind PersonshvenkiBelum ada peringkat

- J&K BankDokumen7 halamanJ&K BankAzhar Shokin100% (1)

- SBI Scholar Loan SchemeDokumen2 halamanSBI Scholar Loan Schemekanv gulatiBelum ada peringkat

- General Mathematics - Simple and Compound InterestDokumen16 halamanGeneral Mathematics - Simple and Compound InterestPrince Joshua Sumagit100% (2)

- RTGS FormDokumen2 halamanRTGS FormravilotusBelum ada peringkat

- AccountStatement29-11-2022 To 29-11-2022Dokumen2 halamanAccountStatement29-11-2022 To 29-11-2022Amit KumarBelum ada peringkat

- Excel EstadisticaDokumen31 halamanExcel EstadisticaJesús David Moreno PalaciosBelum ada peringkat

- Working Capital Management at Indusind BankDokumen18 halamanWorking Capital Management at Indusind BankSanchit Mehrotra100% (2)

- John Linus D. Junio Q2 G-11 Piaget Gen Math Mod 3 AnnuityDokumen3 halamanJohn Linus D. Junio Q2 G-11 Piaget Gen Math Mod 3 AnnuityJohnLi JunioBelum ada peringkat

- Registration FormDokumen2 halamanRegistration Formapi-300796688Belum ada peringkat

- Capital Adequacy Framework for Indian BanksDokumen326 halamanCapital Adequacy Framework for Indian BanksucoBelum ada peringkat

- Formulario WolfsbergDokumen3 halamanFormulario WolfsbergAndrea VeitBelum ada peringkat

- Виписка з банкуDokumen1 halamanВиписка з банкуЛаріна ТетянаBelum ada peringkat

- Going To The BankDokumen6 halamanGoing To The BankFigen ErgürbüzBelum ada peringkat

- Credit ApprisalDokumen74 halamanCredit Apprisalpiupush100% (1)

- Evaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Dokumen32 halamanEvaluation of Customer Satisfaction On Personal Loan (HDFC& ICICI)Suresh Babu Reddy50% (2)

- Casino Opening and Closing Procedures 2017Dokumen4 halamanCasino Opening and Closing Procedures 2017Angela BrownBelum ada peringkat

- Blackstone's Purchase of Citigroup's Loan PortfolioDokumen3 halamanBlackstone's Purchase of Citigroup's Loan PortfolioRishav Agarwal50% (2)

- Aaconapps2 03RHDokumen12 halamanAaconapps2 03RHAngelica DizonBelum ada peringkat

- Share Market ScamDokumen14 halamanShare Market ScamPramod DasadeBelum ada peringkat

- Chapter 6 Practice Questions PDFDokumen7 halamanChapter 6 Practice Questions PDFleili fallahBelum ada peringkat

- Bantayan in ActionDokumen8 halamanBantayan in ActionSeph TorresBelum ada peringkat

- Account Activity Generated Through HBL MobileDokumen2 halamanAccount Activity Generated Through HBL MobileSaqib NawazBelum ada peringkat

- An Automated Teller Machine (ATM) Is A Computerized Telecommunications Device That EnablesDokumen2 halamanAn Automated Teller Machine (ATM) Is A Computerized Telecommunications Device That EnablesParvesh GeerishBelum ada peringkat

- Implementation of Islamic Banking in Pakistan By-M.hashaamDokumen27 halamanImplementation of Islamic Banking in Pakistan By-M.hashaamSyedMohammadHashaamPirzadaBelum ada peringkat

- SB - Kishore and Tarun PDFDokumen1 halamanSB - Kishore and Tarun PDFsheetalBelum ada peringkat

- Deposit Account AgreementDokumen23 halamanDeposit Account AgreementSucreBelum ada peringkat

- Simple Loan Calculator: Option A: Solve For The PAYMENTDokumen3 halamanSimple Loan Calculator: Option A: Solve For The PAYMENTnaresh100939Belum ada peringkat

- Micro Finance PPT FinalDokumen37 halamanMicro Finance PPT FinalVaibhav Alawa100% (2)