Ringo Rag Company

Diunggah oleh

AyuRahayuHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ringo Rag Company

Diunggah oleh

AyuRahayuHak Cipta:

Format Tersedia

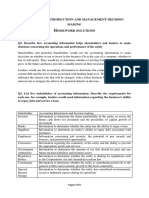

A.

Soal Kasus.

Ringo Rag Company

The setting for this case is Columbus, Ohio in the early 1950s. The numbers in the case have not been updated because there is no way to do so without changing one or more of the interrelationships which make the case so useful from a pedagogical standpoint. In tackling the case, keep in mind that when it was Current an hourly wage of $1.10 was reasonable and a new Cadillac sold for $4.000. In terms of the managerial issues involved, it is still an excellent case for 2000s. The Ringo Rag Company purchases scrap cotton fabric which is then converted into handy cleaning rags in usable size, after it is cleaned and graded. Main customers for these rags are garages, service stations, factories, and machine shops. The company buys its rags from three sources: textile converters, commercial laundries, and junk dealers. The production process for the company is not complicated. First, rags purchased from junk dealers are washed and dried in special heavy duty machines. The cleaned rags and those purchased from laundries, which are already washed, move next to the grading department. Here, each rag is inspected and graded according to its absorption ability as either A, B, or C quality, with A as the best grade. Textile converters sell their spoils (rags) clean and already grade. Next, the rags are cut into squares of about 1 to 1,5 feet. A the same time, any attached item such as buttons, metal ornaments, or snaps are removed. Rags purchased from textile converters do not have anything attached to them. Prices of material which are too small for futher cutting or contain holes or are not usable for any either reason are burned. The cut rags are then packaged in 5, 10, 20, and 50 pound cartons. Selling prices are as follows (quoted FOB warehouse): Quality A B C Carton Size 10 lb 20 lb $1.70 $3.20 $1.40 $2.60 $1.30 $2.40

5 lb $.90 $.75 $.70

50 lb $7.00 $5.50 $5.00

Raw material costs vary by source. Textile converters charge $6.00, $5.00, and $4,00 per cwt (hundred weight) for grade A, B, and C, respectively. Twenty percent of the weight purchased is lost as waste during the cutting process. This is referred to as loss factor. Last month, the following quantities were purchased from textile converters: Grade A Grade B Grade C 43,750 lb 25,000 lb 6,250 lb

Although each purchase was a little different, the company usually had to agree to take some quantity of C grade fabric when it bought A grade fabric. Laundries charge $3.00 per cwt. Past experience indicates a 33.33% loss factor. The yield ratio of material from the laundries is typically about grade A, grade B, and grade C. Last month, Ringo purchased 60,000 pounds of material from laundries. The highest loss factor is incurred from material purchased from junk dealers, where it amounts to 50%. The junk dealers price for material is $1.00 per cwt. Last month, the company purchased 50,000 pounds from this source. This ungraded material usually yield about 1/5 grade A, 2/5 grade B, and 2/5 grade C rags, about half of the overall loss occurs in grading and about half in cutting. The company employs twenty-five women in 3 departments. Each of these women is paid $1.10 perhours. Last months time cards indicate that their time was spent as follows: Grading Cutting Packing Total 1,000 hrs. 3,000 hrs. 600 hrs. 4,600 hrs.

Last months production and sales (cleaned, cut, and boxed) in pounds, was: Grade Grade A Grade B Grade C Total Produced 50,000 50,000 25,000 125,000 Sold Pounds $ 50,000 $7,750 50,000 $6,500 25,000 $3,125 125,000 $17,375

All sales are local, and orders are received by phone or mail. Last months production activities, sources of materials, prices, costs, and yields are representative of normal operations. Sales usually follow production very closely, with very little seasonal fluctuation. Two foremen are employed by the company, each paid $7,500 per year. Both are nephews of Mr. Ringo. One-fourth of their time is spent loading and unloading the washers and dryers. Another quarter of their time is spent supervising and checking the women. The two washer and dryer set owned by the company are depreciated over 5 years on a straight-line basis. Each set has a capacity of 100 pounds per load and can cycle about 16 loads during a working day. Expenses other than raw material and labor for a typical year are as follows:

Depreciation Natural Gas Electricity Rent Detergent (for the washers) Bookkeeper, Secretary Gasoline and oil (for cars) Travel (Lodging and meals) Packing cartons

$3,060 $600 $480 $3,200 $1,000 $4,100 $400 $6,000 $7,200

$760 washer and dryer; $300 cutting machines and tables; $2,000 for two cars. (a). Used for dryers is attributable to the washers and dryers, to cutting. Leased building (b).

About $.01 per mile Half for purchasing, half for selling 5 and 10 lb. Boxes at $.07 each, and 20 and 50 lb. Boxes at $.01 each.

Miscellaneous Expenses $1,200 Notes: (a) One car is used in selling, the other in purchasing. (b) The building is used as follows: for storing unprocessed rags (average about 1 months purchased), for storing boxed rags (about one months sales), for cutting, and 1/8 each for grading and cleaning. One room used as an office is not counted in the building usage.

The company is organized as a partnership between Mr. James Ringo, who acts as purchasing agent and president, and Mr. John Wall who handles all sales. Before forming their partnership 6 years ago, Mr. Ringo was purchasing manager for a paper mill which produced fine rag-content papers. Mr. Wall had been responsible for waste products sales for a large clothing manufacturer. This case was written as part of a student project to provide cost analysis and business advice for the company. Mr. Ringo said he agreed to the project because he had no formal cost accounting records at all. He said he and Mr. Wall ran the business pretty much on their intuition and they often wondered whether there might be more profitable ways to do things. For example, Mr. Wall had asked him once why he bothered to sort the junk rags at all since almost half of them are C grade anyway. He didnt really have a good answer, and the question had led him to wonder whether he shouldnt perhaps drop the junk altogether when the washer/dryers wore out in a few years. He liked the idea of having several sources for raw material so he could shop around to keep his purchase prices low, but he couldnt prove to himself whether he was buying the right mix. He and Mr. Wall built up a good set of steady customers over the years with good service and good quality at competitive prices. But they had no idea which products were most profitable. QUESTIONS: You first task is to calculate contribution margin and full cost profit for each of the 5 different purchasing sources (Junk, Laundry, Tex A, Tex B, and Tex C). We suggest you start as follows: 1. Calculate average revenue per pound, by grade. 2. Calculate weighted average revenue per pound for each of the five purchasing sources.

3. Calculate raw material cost per pound sold, for each source. 4. Calculate direct labor cost per pound sold for: a. Grading. b. Cutting. (consider yields carefully). 5. Calculate packing cost (labor and material) per pound sold. 6. Calculate variable overhead per pound sold for the junk source. 7. Items 1 to 6 represent profit contribution by purchasing source. 8. Assign fixed overhead costs to each of the five purchasing sources: 9. Item 7 less item 8 represents full cost profit by source. Now, what does this have to do with the management issues? Specifically: 1. How close is the company to an optimal sourcing mix? 2. Can you calculate profitability by grade? Is this information useful? 3. What is your recommendation regarding selling all cleaned, cut and packaged junk rags as C grade, without sorting? 4. What other recommendations do you have for Mr. Ringo? 5. As an overall assessment, is this business in serious need of your help, or not? [Hint: can you estimate ROA (Return on Assets) for the business?]. B. Profil Perusahaan. 1. 2. 3. 4. Nama Perusahaan Tempat dan Waktu Jenis Perusahaan Aktivitas Perusahaan : : : : Ringo Rag Company Columbus , Ohio pada awal 1950-an Manufactured Perusahaan membeli scrap (sisa) kain katun yang kemudian diubah menjadi kain pembersih berguna dalam ukuran yang dapat digunakan Garasi, stasiun layanan, pabrik, dan toko-toko mesin Konverter tekstil, binatu komersial, dan dealer sampah Mr. James Ringo Pengalaman Kerja: manajer pembelian untuk pabrik kertas yang diproduksi baik kertas kain konten. Mr. John Wall Pengalaman Kerja: pernah bertanggung jawab atas produk-produk limbah penjualan untuk produsen pakaian besar.

5. 6. 7.

Customers Suppliers

: :

Mgr. Pembelian dan : Presiden Perusahaan

8.

Mgr. Penjualan

C.

Proses Produksi.

Proses produksi bagi perusahaan tidak rumit. Pertama, kain yang dibeli dari dealer sampah dicuci dan dikeringkan dalam mesin cuci heavy duty (tugas khusus yang berat). Kain bersih yang dibeli dari binatu, sudah dicuci , masuk ke departemen grading. Di sini , masing-masing kain diperiksa dan dinilai sesuai dengan kemampuan penyerapan baik sebagai kualitas A , B , atau C, dengan kualitas A sebagai kelas terbaik . Konverter Tekstil menjual kain mereka yang sudah bersih dan sudah dinilai kelasnya. Selanjutnya, kain dipotong menjadi kotak dari sekitar 1 sampai 1,5 meter. Pada saat yang sama , setiap item yang melekat seperti tombol , ornamen logam , atau terkunci dihapus . Kain yang dibeli dari konverter tekstil tidak punya apa-apa yang menyertainya.

D.

Harga Jual. Setelah kain dipotong-potong menjadi ukuran kotak sekitar 1 sampai 1,5 meter, kemudian dikemas dalam 5, 10, 20, dan 50 karton pound. Adapun Harga jual adalah sebagai berikut (dikutip FOB gudang ) : Quality A B C Carton Size 10 lb 20 lb $1.70 $3.20 $1.40 $2.60 $1.30 $2.40

5 lb $.90 $.75 $.70

50 lb $7.00 $5.50 $5.00

E.

Biaya Bahan Baku. Biaya bahan baku bervariasi menurut sumbernya, yaitu sebagai berikut: 1. Konverter Tekstil membebankan biaya $6,00, $5,00, dan $4,00 per CWT (hundredweight atau sama dengan 100 kilogram) untuk kelas A , B , dan C. 2. Binatu membebankan biaya $3.00 per CWT. 3. Dealer Sampah membebankan biaya untuk bahan adalah $ 1,00 per CWT

F.

Faktor Kehilangan (Loss Factor). Dua puluh persen (20%) dari berat yang dibeli hilang sebagai limbah selama proses pemotongan . Hal ini disebut sebagai "faktor kehilangan (Loss factor)". Bulan lalu, jumlah yang dibeli dari konverter tekstil adalah sebagai berikut: Grade A Grade B Grade C 43,750 lb 25,000 lb 6,250 lb

Meskipun setiap pembelian sedikit berbeda, perusahaan biasanya harus setuju untuk mengambil beberapa kuantitas kain kelas C ketika membeli Sebuah kain kelas A.. Pengalaman masa lalu menunjukkan faktor loss 33,33%. Rasio hasil bahan dari binatu biasanya sekitar kelas A , kelas B , dan kelas C. Bulan lalu, Ringo dibeli 60.000 bahan dari binatu. Faktor kerugian tertinggi terjadi dari bahan yang dibeli dari dealer sampah , di mana sebesar 50% . Sampah dealer harga untuk bahan adalah $ 1,00 per CWT . Bulan lalu , perusahaan membeli 50.000 dari sumber ini . Bahan ini biasanya tidak ditingkatkan mutunya menghasilkan sekitar 1/5 grade A , 2/5 kelas B , dan 2/5 kain kelas C , sekitar setengah dari kerugian secara keseluruhan terjadi pada grading dan sekitar setengah dalam pemotongan . G. Biaya Tenaga Kerja. Perusahaan ini mempekerjakan dua puluh lima perempuan di 3 departemen . Masing-masing wanita dibayar $ 1,10 per hours . Kartu waktu bulan lalu menunjukkan bahwa waktu mereka dihabiskan sebagai berikut :

Grading Cutting Packing Total

1,000 hrs. 3,000 hrs. 600 hrs. 4,600 hrs.

Dua mandor dipekerjakan oleh perusahaan , masing-masing dibayar $ 7.500 per tahun . Keduanya adalah keponakan dari Bapak Ringo . Seperempat dari waktu mereka dihabiskan bongkar muat mesin cuci dan pengering . Seperempat dari waktu mereka dihabiskan mengawasi dan memeriksa para wanita . H. Produksi dan Penjualan. Produksi bulan lalu dan penjualan ( dibersihkan , dipotong , dan kotak ) dalam pound , adalah : Grade Grade A Grade B Grade C Total Produced 50,000 50,000 25,000 125,000 Sold Pounds $ 50,000 $7,750 50,000 $6,500 25,000 $3,125 125,000 $17,375

Semua penjualan bersifat lokal, dan pesanan yang diterima melalui telepon atau surat. Kegiatan produksi bulan lalu, sumber bahan, harga, biaya, dan hasil mewakili operasi normal. Penjualan biasanya mengikuti produksi yang sangat erat , dengan sangat sedikit fluktuasi musiman . I. Biaya Overhead Pabrik. Kedua mesin cuci dan pengering set yang dimiliki oleh perusahaan disusutkan selama 5 tahun secara garis lurus . Setiap set memiliki kapasitas 100 pound per beban dan dapat siklus sekitar 16 beban selama hari kerja . Beban lain selain bahan baku dan tenaga kerja untuk satu tahun khas adalah sebagai berikut :

Depreciation Natural Gas Electricity Rent Detergent (for the washers) Bookkeeper, Secretary Gasoline and oil (for cars) Travel (Lodging and meals) Packing cartons Miscellaneous Expenses

$3,060 $600 $480 $3,200 $1,000 $4,100 $400 $6,000 $7,200 $1,200

$760 washer and dryer; $300 cutting machines and tables; $2,000 for two cars. (a). Used for dryers is attributable to the washers and dryers, to cutting. Leased building (b).

About $.01 per mile Half for purchasing, half for selling 5 and 10 lb. Boxes at $.07 each, and 20 and 50 lb. Boxes at $.01 each.

Notes: (a) One car is used in selling, the other in purchasing. (b) The building is used as follows: for storing unprocessed rags (average about 1 months purchased), for storing boxed rags (about one months sales), for cutting, and 1/8 each for grading and cleaning. One room used as an office is not counted in the building usage. . J. Question 1. Hitung rata-rata pendapatan per pon , dengan kelas.

Diminta:

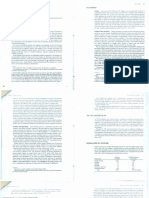

Jawab: Pon (bhs belanda) = Pound (Bhs Inggris); disingkat: lb, lbm) adalah satuan massa (Berat). Grade Grade A Grade B Grade C K. Question 2. Hitung pendapatan rata-rata tertimbang per pon untuk masing-masing lima sumber pembelian . Pembelian Kain Scrap (lb) (1) 43,750 60,000 50,000 Loss Factor (2) 1-20% 1/4*2/3 1/5*1/2 Unit tersedia Dijual (lb) (3=1*2) 35,000 10,000 5,000 50,000 Rata2 Pendapatan Tertimbang ($) (4) (5=4*5) 0.70 0.20 0.10 1.00 5,425 1,550 775 7,750 Revenue ($) (1) $7,750 $6,500 $3,125 Sold (lb) (2) 50,000 50,000 25,000 Rata2= $/lb (3=1/2) $.155/lb $.130/lb $.125/lb

Diminta: Jawab:

Grade Grade A Konverter Tekstil-Tex A Binatu Dealer Sampah

Grade B Konverter Tekstil-Tex B Binatu Dealer Sampah

25,000 60,000 50,000

1-20% 1/2*2/3 2/5*1/2

20,000 20,000 10,000 50,000

0.40 0.40 0.20 1.00

2,600 2,600 1,300 6,500

Grade C Konverter Tekstil-Tex C Binatu Dealer Sampah

6,250 60,000 50,000

1-20% 1/4*2/3 2/5*1/2

5,000 10,000 10,000 25,000

0.20 0.40 0.40 1.00

625 1,250 1,250 3,125

Grade A Grade B Grade C Total Revenue ($) Unit Sold (lb) Average Revenue per Pound ($/lb)

Dealer Sampah (Junk Dealer) $775 $1,300 $1,250 $3,325 50,000

Binatu (Laundries) $1,550 $2,600 $1,250 $5,400 60,000

Konverter Tekstil (Textile Converter) Tex A Tex B Tex C $5,425 $0 $0 $0 $2,600 $0 $0 $0 $625 $5,425 $2,600 $625 35,000 20,000 5,000

$0.067

$0.090

$0.155

$0.130

$0.125

L.

Question 3. Hitung biaya bahan baku per pon dijual , untuk setiap sumber .

Diminta: Jawab:

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Material Purchased (lb) (1) 60,000 50,000 43,750 25,000 6,250 Material Cost (per cwt) (1) $3 $1 $6 $5 $4

Loss Factor (2) 33.33% 50.00% 20.00% 20.00% 20.00% Conversion cwt to lb (dibagi 100) (2) 100 100 100 100 100

Unit Loss (lb) (3=1/2) 20,000 25,000 8,750 5,000 1,250 Material Cost (per lb) (3=1/2) $0.03 $0.01 $0.06 $0.05 $0.04

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Material Purchased (lb) (1) 60,000 50,000 43,750 25,000 6,250

Unit Loss (lb) (2) 20,000 25,000 8,750 5,000 1,250

Unit Sold (lb) (3=1+2) 40,000 25,000 35,000 20,000 5,000 125,000

Material Cost per lb (4) $0.03 $0.01 $0.06 $0.05 $0.04

Total Material Cost (5=1*4) $1,800 $500 $2,625 $1,250 $250 $6,425

Material cost per pound sold (6=5/3) $0.045 $0.020 $0.075 $0.063 $0.050

M. Question 4. Diminta: Menghitung biaya tenaga kerja langsung per pound dijual : a . Grading . b . Cutting . ( mempertimbangkan hasil hati-hati ) .

Jawab: Grading Sold (lb) (1) 40,000 25,000 65,000 Cutting Sold (lb) (1) 40,000 25,000 35,000 20,000 5,000 125,000 Direct Labour (jam) (3) 620 380 1000 Direct Labour (jam) (3) 960 600 840 480 120 3000 Cost per jam (4) 1.1 1.1

Binatu Dealer Sampah

Komposisi (2=1/2) 0.62 0.38 1.00

Total Cost (5=3*4) 682 418 1000

Cost per lb (6=5/1) 0.01705 0.01672

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Komposisi (2=1/2) 0.32 0.20 0.28 0.16 0.04 1.00

Cost per jam (4) 1.1 1.1 1.1 1.1 1.1

Total Cost (5=3*4) 1056 660 924 528 132 3300

Cost per lb (6=5/1) 0.0264 0.0264 0.0264 0.0264 0.0264

N.

Question 5. Hitung biaya pengepakan ( tenaga kerja dan bahan ) per pon dijual .

Diminta:

Jawab: Packing Cost Sold (lb) (1) 40,000 25,000 35,000 20,000 5,000 125,000

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Komposisi (2=1/2) 0.32 0.20 0.28 0.16 0.04 1.00

Direct Labour (jam) (3) 192 120 168 96 24 600

Cost per jam (4) 1.1 1.1 1.1 1.1 1.1

Total Cost (5=3*4) 211.2 132 184.8 105.6 26.4 660

Cost per lb (6=5/1) 0.00528 0.00528 0.00528 0.00528 0.00528

Binatu Dealer Sampah Konverter Tekstil-Tex A Konverter Tekstil-Tex B Konverter Tekstil-Tex C

Boxes Cost Box Sold yang (lb) dibutuhkan (1) (2) 40,000 800 25,000 500 35,000 700 20,000 400 5,000 100 125,000 2,500

Harga Box per unit (3) 0.1 0.1 0.1 0.1 0.1

Total Cost (4=2*3) 80 50 70 40 10 250

Cost per lb (5=4/1) 0.002 0.002 0.002 0.002 0.002

O. Question 6.

Diminta:

Hitung overhead variabel per pon dijual untuk sumber sampah .

Jawab:

P.

Question 7. Item 1 sampai 6 merupakan kontribusi laba dengan membeli sumber.

Diminta: Jawab:

Revenue Variable Cost: Raw Material Labour (Grading) Labour (Cutting) Labour (Packing) Labour (Boxes) Total Variable Cost Contribution Margin

Dealer Sampah (Junk Dealer) 0.07 0.02000 0.01672 0.02640 0.00528 0.00200 0.07040 (0.00040)

Binatu (Laundries) 0.09 0.04500 0.01705 0.02640 0.00528 0.00200 0.09573 (0.00573)

Konverter Tekstil (Textile Converter) Tex A 0.16 0.07500 0.00000 0.02640 0.00528 0.00200 0.10868 0.05132 Tex B 0.13 0.06300 0.00000 0.02640 0.00528 0.00200 0.09668 0.03332 Tex C 0.13 0.05000 0.00000 0.02640 0.00528 0.00200 0.08368 0.04632

Q. Question 8.

Diminta: Jawab: R.

Menetapkan biaya overhead tetap untuk masing-masing dari lima sumber pembelian.

Question 9. Butir 7 less item 8 merupakan laba biaya penuh oleh sumber.

Diminta: Jawab: S.

Management Issues 1.

Diminta: Jawab: T. Management Issues 2.

Diminta: Jawab:

U.

Management Issues 3.

Diminta: Jawab:

V.

Management Issues 4.

Diminta: Jawab: W. Management Issues 5. Diminta: Jawab:

Anda mungkin juga menyukai

- Rel Costing RevDokumen5 halamanRel Costing RevJenicareen Eulalio67% (3)

- Acccob2-Chapter 7 Intangible Assets - Workbook Exercises - SolutionsDokumen5 halamanAcccob2-Chapter 7 Intangible Assets - Workbook Exercises - SolutionsMelyssa Dawn GullonBelum ada peringkat

- Craft Brewery Breakeven Analysis TemplateDokumen2 halamanCraft Brewery Breakeven Analysis TemplateDharmateja PalapartiBelum ada peringkat

- SOP ScrapDokumen4 halamanSOP ScrapZain Mohiuddin89% (9)

- Howework 1 FFMDokumen7 halamanHowework 1 FFMparikshat7Belum ada peringkat

- Effect of Elements On SteelDokumen18 halamanEffect of Elements On SteelMohamed Ahmed MaherBelum ada peringkat

- Chapter 1 Simple Linear RegressionDokumen62 halamanChapter 1 Simple Linear RegressionDe El Eurey ShineBelum ada peringkat

- Bubt STA231 Mid Term Question Summer 2021Dokumen2 halamanBubt STA231 Mid Term Question Summer 2021Mustafizur Rahman RafeeBelum ada peringkat

- This Study Resource Was: Problem 5Dokumen3 halamanThis Study Resource Was: Problem 5Hasan SikderBelum ada peringkat

- Comm 225: Pom, Winter 2012 - Review Questions,: Topic: Statistical Process ControlDokumen4 halamanComm 225: Pom, Winter 2012 - Review Questions,: Topic: Statistical Process ControlWayli90Belum ada peringkat

- AUD Southampton PLCDokumen3 halamanAUD Southampton PLCAivie Pangilinan0% (1)

- Chapter 06 - Behind The Supply CurveDokumen90 halamanChapter 06 - Behind The Supply CurveJuana Miguens RodriguezBelum ada peringkat

- ME-Tut 2Dokumen2 halamanME-Tut 2Shekhar SinghBelum ada peringkat

- Sample of Tsi ReportsDokumen31 halamanSample of Tsi ReportsMoez Moez100% (2)

- M&A Strategy - ArcelorMittalDokumen83 halamanM&A Strategy - ArcelorMittalСергей ЮшкинBelum ada peringkat

- PDF QT Practice SetDokumen13 halamanPDF QT Practice Setpankaj5470100% (1)

- Chapter 6 Financial Estimates and ProjectionsDokumen15 halamanChapter 6 Financial Estimates and ProjectionsKusum Bhandari33% (3)

- Marketiniac Finale Case PDFDokumen6 halamanMarketiniac Finale Case PDFTahiratul ElmaBelum ada peringkat

- Marketiniac Round-2 Case PDFDokumen6 halamanMarketiniac Round-2 Case PDFTahiratul ElmaBelum ada peringkat

- Lec 05 - Incremental AnalysisDokumen46 halamanLec 05 - Incremental AnalysisTanjil Hasan TajBelum ada peringkat

- A Capacity Planning Assignment 2016 Bassam Senior Modified SolutionDokumen10 halamanA Capacity Planning Assignment 2016 Bassam Senior Modified SolutionAhmad Ayman FaroukBelum ada peringkat

- Engineering Ethics Final Term Presentation RoughDokumen25 halamanEngineering Ethics Final Term Presentation Roughasif amirBelum ada peringkat

- Business Plan AbayDokumen21 halamanBusiness Plan AbayYohannes EndalewBelum ada peringkat

- Application of Service Costing in Hotel IndustryDokumen5 halamanApplication of Service Costing in Hotel Industrychirag shah100% (1)

- Individual Assignment 1 ACTDokumen4 halamanIndividual Assignment 1 ACTKalkidanBelum ada peringkat

- Aas 2Dokumen3 halamanAas 2Rishabh GuptaBelum ada peringkat

- Unbalanced Transportation ModelDokumen4 halamanUnbalanced Transportation ModelSunil Prasanna PatraBelum ada peringkat

- Exam281 20131Dokumen14 halamanExam281 20131AsiiSobhiBelum ada peringkat

- Management Science PDFDokumen9 halamanManagement Science PDFNahom Girma100% (1)

- 3 Soal AMB - Des2018Dokumen4 halaman3 Soal AMB - Des2018Try WijayantiBelum ada peringkat

- Assignment 04Dokumen8 halamanAssignment 04John MilanBelum ada peringkat

- Case StudyDokumen20 halamanCase Studywenkyganda100% (1)

- Soal-Soal Capital Budgeting # 1Dokumen2 halamanSoal-Soal Capital Budgeting # 1Danang0% (2)

- The Trial Balance and The Other Information For Consulting Engineers PDFDokumen2 halamanThe Trial Balance and The Other Information For Consulting Engineers PDFTaimur TechnologistBelum ada peringkat

- Or PracticeProblems 2015Dokumen24 halamanOr PracticeProblems 2015Hi HuBelum ada peringkat

- Econometric Modeling: Model Specification and Diagnostic TestingDokumen52 halamanEconometric Modeling: Model Specification and Diagnostic TestingYeasar Ahmed UshanBelum ada peringkat

- MB0026 Managerial Economics'AssignmentsDokumen13 halamanMB0026 Managerial Economics'Assignmentsvinc_palBelum ada peringkat

- Introduction To Management AccountingDokumen55 halamanIntroduction To Management AccountingUsama250100% (1)

- Standard Costing and Variance Analysis NotesDokumen8 halamanStandard Costing and Variance Analysis NotesPratyush Pratim SahariaBelum ada peringkat

- ACcDokumen1 halamanACcRaam Tha BossBelum ada peringkat

- Biomass StovesDokumen281 halamanBiomass StovesHartono Prayitno100% (1)

- Consumer Surplus Excel Template: Visit: EmailDokumen5 halamanConsumer Surplus Excel Template: Visit: EmailMustafa Ricky Pramana Se100% (1)

- Assignment - CMA - 604Dokumen4 halamanAssignment - CMA - 604Shifat sjtBelum ada peringkat

- Mock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Dokumen12 halamanMock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Zaira AneesBelum ada peringkat

- Summary BD Labour Law 2006Dokumen5 halamanSummary BD Labour Law 2006Naim H. Faisal100% (1)

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDokumen4 halamanModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelBelum ada peringkat

- WAQ Produces A Single Product XDokumen2 halamanWAQ Produces A Single Product Xmj192Belum ada peringkat

- Assignment of AccountingDokumen3 halamanAssignment of AccountingShanida AdzkiaBelum ada peringkat

- Managerial EcoDokumen2 halamanManagerial Ecoasad100% (1)

- Question Bank Paper: Cost Accounting McqsDokumen8 halamanQuestion Bank Paper: Cost Accounting McqsNikhilBelum ada peringkat

- Paper 8Dokumen63 halamanPaper 8Richa SinghBelum ada peringkat

- ch04 Managerial AccountingDokumen27 halamanch04 Managerial AccountingshaileshkumarguptaBelum ada peringkat

- Qchapter 4: Activity-Based CostingDokumen27 halamanQchapter 4: Activity-Based CostingPrecious Vercaza Del RosarioBelum ada peringkat

- Costing Prob FinalsDokumen52 halamanCosting Prob FinalsSiddhesh Khade100% (1)

- IPPTChap 001Dokumen44 halamanIPPTChap 001Ase MihardjaBelum ada peringkat

- Marketiniac - Round 1 - Case PDFDokumen6 halamanMarketiniac - Round 1 - Case PDFTahiratul ElmaBelum ada peringkat

- Cost of Capital PDFDokumen44 halamanCost of Capital PDFAditya ShresthaBelum ada peringkat

- 0fa74module 1bDokumen2 halaman0fa74module 1bDev Sharma100% (1)

- ACC 1102 Case StudyDokumen1 halamanACC 1102 Case StudyMohammad Mosharof HossainBelum ada peringkat

- Eba200 Midterm v2022Dokumen4 halamanEba200 Midterm v2022Jason Saberon Quiño100% (1)

- BEPP250 Final TestbankDokumen189 halamanBEPP250 Final TestbankMichael Wen100% (2)

- Practice Questions Cost BehaviourDokumen6 halamanPractice Questions Cost BehaviourCamila Miranda Kanda100% (1)

- Ringo Rag Company Ringo Rag Company: A. Soal KasusDokumen13 halamanRingo Rag Company Ringo Rag Company: A. Soal KasusIndriya ApulinaBelum ada peringkat

- Documents - Tips Ringo Rag CompanyDokumen15 halamanDocuments - Tips Ringo Rag Companyhanish_21100% (1)

- Applsci 13 02003 v4Dokumen22 halamanApplsci 13 02003 v4Mohammad SoltaniBelum ada peringkat

- Fnes 104-Food SystemDokumen2 halamanFnes 104-Food Systemapi-310111771Belum ada peringkat

- Ehs Templates SamplesDokumen22 halamanEhs Templates Samplesdhir.ankurBelum ada peringkat

- Steel Industry CaseDokumen23 halamanSteel Industry CaseNoemie FontaineBelum ada peringkat

- Ea Recycling Brochure 2016Dokumen24 halamanEa Recycling Brochure 2016audilioBelum ada peringkat

- 1a. Lion Titco Company ProfileDokumen12 halaman1a. Lion Titco Company ProfileIFTIKUETBelum ada peringkat

- Recycled Claim Standard: Implementation Manual 2.2Dokumen32 halamanRecycled Claim Standard: Implementation Manual 2.2Lamia ould amerBelum ada peringkat

- Scrap NFL PanipatDokumen9 halamanScrap NFL PanipatJitenderSinghBelum ada peringkat

- 65 PDFDokumen218 halaman65 PDFOumaima BdzBelum ada peringkat

- TMT BarsDokumen11 halamanTMT Barsgowtham svBelum ada peringkat

- Arcelor Mittal Annual-Report-Combined-2021Dokumen424 halamanArcelor Mittal Annual-Report-Combined-2021Headshot's GameBelum ada peringkat

- Rosario Acero S.A.1Dokumen9 halamanRosario Acero S.A.1Mrittika SahaBelum ada peringkat

- Table of Content: Name: Andrel Bailey Grade: 11r School: Clan Carthy High Centre NumberDokumen20 halamanTable of Content: Name: Andrel Bailey Grade: 11r School: Clan Carthy High Centre NumberYouth VybzBelum ada peringkat

- Accountancy Project: StorylineDokumen2 halamanAccountancy Project: StorylineYatish AgrawalBelum ada peringkat

- G-G Toys Case StudyDokumen5 halamanG-G Toys Case StudyBanana QBelum ada peringkat

- WCO - EFC White Paper2022 - Materials and CorrosionDokumen22 halamanWCO - EFC White Paper2022 - Materials and CorrosionBANNOUR OthmaneBelum ada peringkat

- National Power Corporation vs. Pinatubo Commercial: G.R. No. 176006 March 26, 2010Dokumen22 halamanNational Power Corporation vs. Pinatubo Commercial: G.R. No. 176006 March 26, 2010Stella BertilloBelum ada peringkat

- WTM Classified 180315Dokumen16 halamanWTM Classified 180315Digital MediaBelum ada peringkat

- TOO4TO Module 5 / Sustainable Resource Management: Part 2Dokumen39 halamanTOO4TO Module 5 / Sustainable Resource Management: Part 2TOO4TOBelum ada peringkat

- Attachment 0Dokumen32 halamanAttachment 0maría joséBelum ada peringkat

- Upcycling: 1. Complete The Crossword Below. AcrossDokumen3 halamanUpcycling: 1. Complete The Crossword Below. AcrossPorsha SevikulBelum ada peringkat

- 2010 Puzzle Cube ProjectDokumen6 halaman2010 Puzzle Cube Projectapi-106613477Belum ada peringkat

- SAP FICO Vs SAP S4 HANA FINANCEDokumen34 halamanSAP FICO Vs SAP S4 HANA FINANCEsmart srini100% (2)

- Production Planning and Control L - 1Dokumen37 halamanProduction Planning and Control L - 1Tamanna100% (2)

- PR - Disposal of Waste MaterialDokumen4 halamanPR - Disposal of Waste MaterialSlid ISOBelum ada peringkat

- Manual Paper Recycling Machine DesignDokumen6 halamanManual Paper Recycling Machine DesignLakshmanan Arunachalam100% (1)