Provident Savings Bank V Pinnacle Mortgage Corp

Diunggah oleh

johngaultJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Provident Savings Bank V Pinnacle Mortgage Corp

Diunggah oleh

johngaultHak Cipta:

Format Tersedia

LoislawFederalDistrictCourtOpinions

INREPINNACLEMORTGAGEINVESTMENTCORPORATION,(D.N.J.1998) INREPINNACLEMORTGAGEINVESTMENTCORPORATION,Debtor PROVIDENTSAVINGSBANK,aNewJerseyBankingCorporation, Plaintiff/Appellant,v.PINNACLEMORTGAGEINVESTMENTCORPORATION,a PennsylvaniaCorporation,etal.,Defendants,SETTLERSABSTRACTCO.,L.P., LAWYERSTITLEINSURANCECORP.,LANDTRANSFERCO,INC.,FIDELITYNATIONAL TITLEINSURANCECO.OFPENNSYLVANIA,GINOL.ANDREUZZI,PIONEERAGENCYII CORP.t/aPIONEERAGENCY,MUSSER&MUSSER,WILLIAME.WARD,QUAKERABSTRACT CO.,andSEARCHTECABSTRACT,INC.,Appellees. CIVILNO.980489(JBS),[BankruptcyCaseNo.9510608(JHW)],[Adv. Proc.No.951091] UnitedStatesDistrictCourt,D.NewJersey. Filed:December9,1998

WalterE.Thomas,Jr.,Esq.,TimothyJ.Matteson,Esq.,MarkA.Trudeau, Esq.,Stern,Lavinthal,Norgaard&Kapnick,Esqs.,Englewood,NewJersey, AttorneysforAppellant. EdwardJ.Hayes,Esq.,AndreaDobin,Esq.,Fox,Rothschild,O'Brien& Frankel,PrincetonPikeCorporateCenter,Lawrenceville,NewJersey, AttorneysforAppellees,SettlersAbstractCo.,L.P.,LandTransferCo, Inc.,FidelityNationalTitleInsuranceCo.ofPennsylvania,GinoL. Andreuzzi,PioneerAgencyIICorp.t/aPioneerAgency,Musser&Musser, QuakerAbstractCo,andSearchtecAbstract,Inc. OPINION SIMANDLE,DistrictJudge. I.INTRODUCTION ProvidentSavingsBankappealsfromaJudgmententeredonDecember17, 1997,pursuanttoawrittenopinionissuedonNovember19,1997,bythe HonorableJudithH.Wizmur,UnitedStatesBankruptcyJudge,aftertrial inanadversaryproceeding.ThatOpinionruledinfavorofthe Appellees,SettlersAbstractCo.,L.P.,LandTransferCo,Inc.,Fidelity NationalTitleInsuranceCo.ofPennsylvania,GinoL.Andreuzzi,Pioneer AgencyIICorp.t/aPioneerAgency,Musser&Musser,QuakerAbstractCo, andSearchtecAbstract,Inc.("titleagents").Reviewingalongstanding complexlendingrelationshipbetweenProvidentandthedebtor,Pinnacle MortgageCorporation,ofwhichthetenrealestatemortgageloansat issuehereinwereapart,theBankruptcyCourtheldthatappelleetitle agents(whohadadvancedtheirownfundstocoverdisbursementswhen ProvidentdishonoredPinnacle'schecks)hadamorevalidorhigher prioritysecurityinterestinthepromissorynotesandmortgagesexecuted aspartoftenseparateresidentialrealestateclosingthandid appellant.ProvidentSavingsBankappealsthisrulingandseeksthis Court'sdeterminationthatitwastheholderinduecourseofthose documents. TheprincipalissuetobedecidediswhethertheBankruptcyCourt correctlydeterminedundertheUniformCommercialCodethatProvidentwas notaholderinduecourseofthepromissorynotesarisingfromthese loans,whereitfoundthatProvidentsocloselyparticipatedinthe fundingandapprovalofthePinnaclebrokeredloansthatthetransaction didnotendattheclosingwiththetitleagents,suchthatProvidentdid notattainholderinduecoursestatusbecauseitdidnotfitthe requisiteroleofa"goodfaithpurchaserforvalue."Forthereasons

documents. TheprincipalissuetobedecidediswhethertheBankruptcyCourt correctlydeterminedundertheUniformCommercialCodethatProvidentwas notaholderinduecourseofthepromissorynotesarisingfromthese loans,whereitfoundthatProvidentsocloselyparticipatedinthe fundingandapprovalofthePinnaclebrokeredloansthatthetransaction didnotendattheclosingwiththetitleagents,suchthatProvidentdid notattainholderinduecoursestatusbecauseitdidnotfitthe requisiteroleofa"goodfaithpurchaserforvalue."Forthereasons thatwillbestatedherein,thejudgmentwillbeaffirmedbecausethe BankruptcyCourt'sfindingthatProvidentneverattainedHDCstatuswas neitherclearlyerroneousnorcontrarytolaw. II.BACKGROUND A.ProceduralHistory Thiscasearisesfromadisputeoverthevarioussecurityinterestsin mortgagedocumentsfromtenseparaterealestatetransactionsinlate October,1994,conductedbythedebtor,PinnacleMortgageInvestment Corporation(whobrokeredthetransactions),theappellant(whofinanced thetransactions),andtheappellees(whoweretitleclosingagentsin thetransactions).OnFebruary2,1995,appellantProvidentSavingsBank ("Provident")andothercreditorsfiledaninvoluntarypetitionunder Chapter7ofTitle11oftheBankruptcyCodeagainstPinnacleMortgage InvestmentCorporation("Pinnacle").AnorderforreliefunderChapter7 wasenteredbytheBankruptcyCourtonMarch6,1995. OnMarch24,1995,Providentcommencedthisadversaryproceedingby filingathreecountcomplainttodeterminetheextent,validity,and priorityofthevarioussecurityinterestsassertedbyPinnacle,Meridian Bank,LawyersTitleInsuranceCorporation,theappellees,andWilliamE. Wardwithregardtothepromissorynotesandmortgagesfromtenreal estatetransactions.[fn1]Appelleesrespondedtothecomplaintbyfiling ananswer,counterclaims,andcrossclaims,seekingmoneyjudgmentsin theamountofthecontestednotesandmortgages,interest,costofsuit, andattorneysfeesimpositionofaconstructivetrustintheirfavor withregardtothenotes,mortgages,andproceedsthereofandtohave thesubjectnotesandmortgagesavoidedandstrickeninfavorof subsequentlyexecutedmortgagesbetweentheappelleesandthe mortgagors.Providenttwiceamendeditscomplaint,finallyseekinga declaratoryjudgmentthatitistheholderinduecourseofthesubject notesandmortgagesundertheUniformCommercialCodeavoidanceofthe preferentialtransferbyappelleeAndreuzzipursuantto11U.S.C.547 and550avoidanceofthefraudulenttransferbyappelleeAndreuzzi pursuantto548and550andavoidanceofthepreferentialand fraudulenttransfersbyappelleespursuantto11U.S.C.547,548, and550. TrialinthismatterwasheldonJuly16,17,and18,1996,andOctober 1,3,and4,1996.AtthecloseofProvident'scaseinchief,uponmotion bytheappellees,allofthoseportionsoftheSecondAmendedComplaint whichdidnotpertaintoProvident'sstatusasaholderinduecourse ("HDC")weredismissed. B.TheFactualHistory InitsNovember19,1997opinion,theBankruptcyCourtdeterminedthat thefactsofthecaseareasfollows.DebtorPinnacleMortgageInvestment Corporation("Pinnacle"or"debtor")wasamortgagebankerwhich primarilydealtinresidentialmortgagelendingandrefinance.InDecember of1992,PinnacleandProvidentSavingsBank("Provident"or"appellant") enteredintoaMortgageWarehouseLoanandSecurityAgreement ("Agreement"),wherebyProvidentwouldfundPinnacle,whointurnfunded retailcustomerswhosoughttopurchaseorrefinanceresidentialreal estate.TheborrowerineachtransactionwouldgivePinnacleanoteand mortgage,bothofwhichactedascollateraltoprotectProvidentuntil Pinnaclesoldthemortgagetoathirdpartyinvestor,suchastheFederal HomeLoanMortgageCorporation("FreddieMac"),whosatisfiedPinnacle's debttoProvident.WarehouseAgreement3.4. 1.TheWarehouseAgreement Underthesetypesofagreements,therewouldusuallynotbeanycontact betweenthewarehouselenderandtheultimatemortgagor.Typically, PinnaclewouldarrangewithaprospectiveborrowerforPinnacleto advancefundsfortheborrowertopurchaseorrefinanceahomeandfor theborrowertoassignanoteandmortgagetoPinnacleascollateral.The mortgagewouldbeendorsedinblankinordertoaccommodatethefinal

debttoProvident.WarehouseAgreement3.4. 1.TheWarehouseAgreement Underthesetypesofagreements,therewouldusuallynotbeanycontact betweenthewarehouselenderandtheultimatemortgagor.Typically, PinnaclewouldarrangewithaprospectiveborrowerforPinnacleto advancefundsfortheborrowertopurchaseorrefinanceahomeandfor theborrowertoassignanoteandmortgagetoPinnacleascollateral.The mortgagewouldbeendorsedinblankinordertoaccommodatethefinal thirdpartyinvestor(suchasFreddieMac),withwhomPinnaclewould arrangetopurchasethemortgage,usuallyasapartofapoolof mortgagesthiswasknownasa"takeout"agreement.Allofthis completed,Pinnaclewouldsubmita"package"toProvidentseekingfunding fortheparticulartransactionunderits$10millionlineofcredit.[fn2] Thispackageincludedadescriptionoftheborrowerandthefunding,an assignmentofthemortgageendorsedinblank,atakeoutcommitment,and anagencyagreementthatindicatedtheborrower'sattorney'sagreement "toactastheagentoftheBank"todisbursetheAdvanceandtoobtain dueexecutionanddeliverytothebankoftheoriginalnotethat evidencesthedebtunderlyingtheMortgageLoan."WarehouseAgreement 5.3(A)(iii).TheAgreementrequiredallofthistobesubmitted alongwiththeinitialfundingrequest.Asamatterofcourse,however, theagencyagreementwasusuallyexecutedbythetitleagenthandlingthe closinginsteadofbytheborrower'sattorney,andProvidentcustomarily acceptedthemortgageassignmentandagencyagreementaftertheactual closing. AfterProvidentreceivedthepackageandcheckedtoseethatPinnacle's creditlimithadnotbeenexceeded(although,asstatedabove,often priortoreceiptofthemortgageassignmentandagencyagreement), ProvidentcreditedPinnacle'scheckingaccountwith98%oftherequested funds.WarehouseAgreement1.1,2.1.Pinnaclewouldwritea regular,uncertifiedchecktotheclosingagent,whowouldclosetheloan directlywiththeborroweronPinnacle'sbehalf.Pinnaclewassupposedto usespecificfundscreditedtotheiraccounttofundspecificclosings, butnocontrolswereinplacetomakesurethatPinnacleactuallydid so. WithPinnacle'scheckinhand,theclosingagentwouldusemoneyfrom itsownbankaccounttodisbursefundstothemortgagor,later replenishingitsbankaccountbydepositingPinnacle'scheck.Next,the closingagentwouldroutinelysendtheoriginalnote,acertifiedcopyof therecordedmortgage,andtheotherclosingdocumentstoPinnacle,who wouldsendthemontoProvident,whowouldreceivethisoriginalnote approximatelythreetofivedaysafterclosing.Providentandthe borrowershadnocontactindeed,Providentandtheclosingagentshadno contact,savetheextremelylimitedcontactbytheclosingagentswhodid returntheagencyagreementincludedintheborrowingpackage.Notall closingagentsdidreturntheagreementsignedmostofthosewhodid senteverythingthroughPinnacletogotoProvident,inaccordancewith Pinnacle'swritteninstructions,ratherthanremittingthenoteandother papersdirectlytoProvident,asstatedintheagencyagreement. Ultimately,Providentwouldsendthenoteandaccompanyingdocumentsto thethirdpartyinvestor,whowouldpayProvidentthefundswhich ProvidenthadoriginallyplacedinPinnacle'scheckingaccountbywiring moniestoProvidentinPinnacle'sname.Becausethethirdpartyinvestor wouldsendmultiplepaymentsineachwiretransfer,Pinnaclewouldtell Providenttowhichloanstoapplyeachofthefunds. 2.Pinnacle'sDecliningFinancialState AmongthetwentyorsowarehousecustomersthatProvidenthadduring 19931994,PinnaclewasthemostprofitableforProvident,providing hundredsofmillionsofdollarsinloantransactions.However,whenthe mortgagebankingindustrysufferedadeclineinbusiness,Pinnaclebegan toexperiencefinancialdifficultiesaswell. TheWarehouseAgreement,6.11,requiredPinnacletosubmit unauditedbalancesheetsandstatementsofincometoProvidentona quarterlybasis,thoughPinnaclecustomarilyprovidedmonthly statements.ThestatementsfiledforJune,July,andAugustof1993 reflectedanaccruedpretaxincomeforthefirstthreemonthsofthe fiscalyearof$281,351.StatementsforSeptember,October,andNovember of1993reflectedpretaxincomeof$923,923forthefirstsixmonthsof thefiscalyear.However,aftertheNovember30report,Pinnaclebeganto senditsreportsquarterly,whichwasinaccordancewiththeWarehouse AgreementbutwhichwasnonethelessunusualduetoPinnacle'scustomof submittingreportsmonthly.Thenextreport,coveringtheninemonth periodendingFebruary28,1994,wasdueonApril15butnotreceived

quarterlybasis,thoughPinnaclecustomarilyprovidedmonthly statements.ThestatementsfiledforJune,July,andAugustof1993 reflectedanaccruedpretaxincomeforthefirstthreemonthsofthe fiscalyearof$281,351.StatementsforSeptember,October,andNovember of1993reflectedpretaxincomeof$923,923forthefirstsixmonthsof thefiscalyear.However,aftertheNovember30report,Pinnaclebeganto senditsreportsquarterly,whichwasinaccordancewiththeWarehouse AgreementbutwhichwasnonethelessunusualduetoPinnacle'scustomof submittingreportsmonthly.Thenextreport,coveringtheninemonth periodendingFebruary28,1994,wasdueonApril15butnotreceived untilsometimeinMay.Itshowedpretaxincomeof$136,000forthe firstninemonths,oran$800,000lossinthepreviousthreemonths.The accompanyingunauditedbalancesheetsshowedareductionofassetsfrom $40millionto$28millioninthosethreemonths.Thefinalfinancial statementwasdueonAugust31,1994,butProvidentneverreceivedit. AtaholidaypartyinMay1994,EdmundR.Folsom,headofProvident's CommercialLendingDepartment,hadlearnedthatPinnaclehadsustained lossesinthewintermonths.OnAugust19,1994,SharonKinkead,of Provident'sWarehouseLendingDepartment,calledPinnacle'sheadquarters andlearnedfromPinnacle'sCFO,JosephMader,thattherewouldbea delayinthesubmissionoftheauditedfinancialstatementsforthe fiscalyearendingMay31,1994becauseofachangeofcomptroller,but thatthereportwouldbeprovidedbySeptember15,1994.Thatreport neverarrived,andnootherfinancialstatementswerereceivedupuntil Provident'sterminationofitsrelationshipwithPinnacleinearly November1994. 3.Provident'sRelationshipwithPinnacle ThroughoutitsrelationshipwithPinnacle,Providentroutinelyhonored overdraftsonbehalfofPinnacleabouttwentytimesin1993and fifteentimesin1994.Theseoverdraftsrangedfrom$7,240.87to $5,255,812. WhenacheckwaspresentedtothebankonPinnacle'saccountforwhich Pinnaclehadinsufficientfunds,SharonKinkeadwouldcontactPinnacleto askwhetherPinnaclewouldhonorthatoverdraft.Havingbeentoldthat thecheckwouldbecovered(usuallyfromananticipatedwiretransfer), Kinkeadandhersupervisor,Mr.Folsom,wouldhonoritandallowthe overdraft.UntilNovember1994,ProvidenthonoredallofPinnacle's overdrafts,withoutreviewingPinnacle'sbooksandrecordsormonitoring itscheckingaccount. Asmentionedearlier,Pinnacle'sCFO,JosephMader,hadinformed Providentthatitsfinalfiscalyearreportwouldbeforthcomingon September15,1994.WhenProvidentdidnotreceivetheauditedreportsby thatdate,Mr.FolsomspokewithMr.Mader,whoreportedthatthough Pinnaclehadsustainedlosses,itwasexpectingasubstantialinfusionof capital.Pinnaclewantedtoholdoffpublishingthereportsothatit couldaddafootnoteexplainingthattherewouldbeacapitalinfusion. Basedonthis,FolsomdecidedtoextendPinnacle'screditlinethrough theendofNovember. FolsomcalledMadersometimeinOctobertocheckonthestatusofthe report.WhenMaderreturnedthecallonNovember1,heinformedFolsom thatthecapitalinfusionhadfailed.Folsomdemandedameetingwith Pinnacle'sofficers. OnNovember2,FolsomandKinkeadmetwithMaderandAlMiller, PresidentofPinnacle.MaderandMillerpresentedinternallygenerated financialstatementsindicatingapretaxlossofsixmilliondollarsfor thepreviousfiscalyear,aswellasapretaxlossofalmostonemillion dollarsforthefirstquarterofthecurrentfiscalyear.Millerand Maderadmittedthattheyhadmisusedtheirwarehousecreditlinewith G.E.CapitalMortgageServices,Inc.,towhomtheywereindebtedfor aboutsixmilliondollars.They"admittedfraud"astoG.E.,but indicatedthattheyhadnotmisappropriatedtheProvidentfundsandasked foranextensionoffundingoftheirloanswhiletheyfinancially reorganized.Providentdeclinedtodoso. Atthattime,ProvidentfinallyreviewedPinnacle'sbooksand discoveredthatPinnaclehadbeendivertingsubstantialsumsofmoney fromPinnacle'sProvidentaccounttoitsoperatingaccountatMeridian Bank.KinkeadandFolsomalsolearnedthatPinnaclehadbeenrequesting advancesonloansearlierthanwasroutinelyrequested,possiblyusing themoneythatwassupposedtobeforspecificloansforotherpurposes instead.Indeed,Pinnaclewasengagingina"kiting"scheme, misappropriatingmoniesfromthirdpartyinvestorsthatshouldhavebeen appliedtopreviouslyfundedloans.APinnacleemployeetoldKinkeadthat

Atthattime,ProvidentfinallyreviewedPinnacle'sbooksand discoveredthatPinnaclehadbeendivertingsubstantialsumsofmoney fromPinnacle'sProvidentaccounttoitsoperatingaccountatMeridian Bank.KinkeadandFolsomalsolearnedthatPinnaclehadbeenrequesting advancesonloansearlierthanwasroutinelyrequested,possiblyusing themoneythatwassupposedtobeforspecificloansforotherpurposes instead.Indeed,Pinnaclewasengagingina"kiting"scheme, misappropriatingmoniesfromthirdpartyinvestorsthatshouldhavebeen appliedtopreviouslyfundedloans.APinnacleemployeetoldKinkeadthat theProvidentlinewasnot"whole,"thatasmuchas$500,000mayhave beentakenfromit,thoughnofraudulentloanshadbeenmade. AsofNovember2,1994,allcheckspresentedtoProvidentonPinnacle's accounthadbeenprocessed,andthecustomerbalancesummaryshowedan overdraftof$206,653.67.OnNovember3,$830,127.48wasdepositedin Pinnacle'saccount.Sixteencheckstotaling$1,584,041.63werepresented toProvidentagainstPinnacle'saccountonNovember3.Therewere insufficientfundstocoverallsixteen,soFolsomsentaletterto Miller,Pinnacle'spresident,toaskwhichchecksshouldbepaid.Atthe time,Providentknewthatallsixteenofthosechecksrepresentedmonies thatPinnaclehaddeliveredtoborrowersandclosingagentsfor particularloans,aswellasthateachtransactionwasaccompaniedbya takeoutcommitmentbyathirdpartyinvestor,whowouldhavepaidfor theloan. Millerindicatedthatsixofthecheckscouldbepaid.Provident debited$863,821topayoffeightloansonNovember4,andotherchecks werepaidatMader'sinstruction.Therewasanoverdraftonthatdateof $178,303.73,andProvidenthonorednomorechecks.Theremainingtenof thesixteencheckspresentedonNovember3weredishonored,andthoseare thesubjectoftheinstantlitigation. 4.TheTenTransactions Priortotheclosingsineachofthetentransactionsinquestion, PinnaclehadrequestedfromProvidentandreceivedmonies tofundthetransactions.Asusual,Pinnaclepresentedtheclosingagent withanuncertifiedcheckdrawnonitsaccountatProvidentrepresenting paymentforthenoteandmortgagetobeexecutedbytheborrower, purchaser,orrefinanceroftheproperty.WithPinnacle'scheckinhand, theclosingagentsclosedeachtransaction,issuingchecksfromtheirown accountstothepartiesentitledtoreceivefunds.Theclosingagents thendepositedPinnacle'schecksintheirownaccounts,andtheirbanks presentedthosecheckstoProvidentforpayment.Ineachcase,Provident dishonoredthechecksduetoinsufficientfunds.Aftereachclosing,but beforethediscoveryofanyproblem,eachclosingagentreturnedthe originalnotetoPinnacle.Severalclosingagentsrecordedthemortgage andsentPinnaclecertifiedcopies.DespitethefactthatPinnacle's checkswerenothonored,eachclosingagenthonoredtheirowncheckswhen theywerepresented. Atthetime,uncertifiedfundswereroutinelyacceptedfrommortgage bankers,withafewexceptionsforoutofstatelenders,ignoringthe Pennsylvaniastatutewhichrequiredmortgagebankersandbrokersto certifyfunds.MostmortgagelenderssuchasPinnacleinsistedon acceptanceofregularcheckstitleinsurerscouldnotstayinbusiness iftheydidnotfollowthestandardintheindustry. Aswasusualforthesetransactions,Providenthadnocontactwithany oftheclosingagentspriortosettlement.Agencyagreementswere includedinmost,butnotall,oftheinstructionpackagessentby Pinnacletotherespectiveclosingagents.Theagreementprovidedthat Providenthadasecurityinterestinthenoteandmortgagemoreover,it providedthattheclosingagentwouldactasProvident'sagentin connectionwiththeloantransaction,agreeingtorecordthemortgageand thentosendboththeoriginalnoteandtheoriginalrecordedmortgageto Providentuponclosing.Thetextoftheagreementconflictedwiththe closinginstructionsthatPinnaclegavetotheclosingagents,which requiredthenotetobereturnedtoPinnacle.Insixoftheten transactions,theagreementwasexecuted,butitsprovisionswere basicallyignored,astheclosingdocumentswerereturneddirectlyto Pinnacle. Theclosingagentslearnedofthedishonorfromtheirownbanks. ProvidentdidnotattempttocontacttheclosingagentsuntilNovember 10,1994,whentheysentaletterwithinstructionstodeliverto Providentallnotes,mortgages,loanfiles,andothercollateral,andany moniesreceivedinconnectionwitheachmortgageloan.

transactions,theagreementwasexecuted,butitsprovisionswere basicallyignored,astheclosingdocumentswerereturneddirectlyto Pinnacle. Theclosingagentslearnedofthedishonorfromtheirownbanks. ProvidentdidnotattempttocontacttheclosingagentsuntilNovember 10,1994,whentheysentaletterwithinstructionstodeliverto Providentallnotes,mortgages,loanfiles,andothercollateral,andany moniesreceivedinconnectionwitheachmortgageloan. Severaloftheagentssoughtjudicialrelief.Twooftheclosingagents whoareappelleesinthismatter,GinoL.AndreuzziandthePioneer AgencyL.P.,holdstatecourtjudgmentsintheirfavor,foratotalof threejudgmentsagainstPinnacle,strikingthemortgagesandnotes executedbytheirrespectivebuyersinfavorofPinnacle.Andreuzzi,the closingagentintheHopecksettlement,filedsuitagainstPinnaclein theCourtofCommonPleasofLuzerneCounty,Pennsylvania,seekingaTRO tokeepPinnaclefromselling,transferring,orassigningthenoteand mortgageinquestion.ProvidentwasnotjoinedinAndreuzzi'scase,but itdidhavenoticeofthelitigation.Andreuzzifiledalispendenswith theProthonotaryonNovember14,1994.Aboutthreehoursafterthelis pendenswasfiled,ProvidentrecordedtheassignmentfromtheHopeck note.Ultimately,adefaultjudgmentwasenteredagainstPinnacle. PioneeralsofiledsuitsinconnectionwiththeWeaverandFisher transactions.Inbothcases,PioneersuedPinnacleandProvidentinthe CourtofCommonPleasofBerksCounty,Pennsylvania,onNovember14, 1994.ApreliminaryinjunctionwasenteredonNovember22,andadefault judgmentwasenteredagainstbothdefendantsonDecember21,1994.Two dayslater,Pinnaclemovedtoopenthedefaultjudgment.Itwasstill pendingonFebruary1,1995whenaninvoluntarypetitionwasfiledagainst Pinnacle.ProvidentremovedtheactiontotheBankruptcyCourtonMay8, 1995. Otherclosingagentsenteredintoagreementswiththeborrowersto executenewnotesandmortgages.Bythetimethiscamebeforethe BankruptcyCourt,themortgageshadeitherbeensatisfiedinfull,with proceedsheldinescrow,orpaymentsonthenewmortgagesandnoteswere beingmadebytheborrowerstotheclosingagentsinescrowpendingthe resolutionofthismatter. C.TheBankruptcyCourt'sFindingsandJudgment OnNovember19,1997,theBankruptcyCourtissueditsOpinioninfavor oftheappellees,rulingthat: (1)theappellantdidnotachievethestatusofanHDC withregardtothenotesandmortgagesinissue (2)theappelleeswouldbeentitledtoindemnification evenifanagencyrelationshipexistedbetweenthe appellantandappellees (3)theUniformFiduciariesLawisinapplicableto validatetheappellant'spositionwithregardtothe subjectnotesandmortgagesand (4)theappellantisprecludedfromrelitigatingthe transactionswithappelleesPioneerAgencyIICorp t/aPioneerAgencyandAndreuzzi. JudgmentagainstProvidentwasenteredonDecember17,1997.OnDecember 22,1997,appellantfiledanoticeofappealfromtheJudgment.On February13,1998,therecordonappealwastransmittedtothisCourt.As "nothingremainsforthe[lower]courttodo,"UniversalMinerals,Inc. v.C.A.Hughes&Co.,669F.2d98,101(3dCir.1981),theBankruptcy Court'srulingisfinal,andthusthisCourtproperlyhasappellate jurisdictionovertheDecember17,1997Orderpursuantto 28U.S.C.158(a). III.ISSUESPRESENTED Onappeal,Providentmakessixarguments.First,Providentarguesthat itistheholderinduecourse("HDC")ofthetenmortgagenotes. Second,ProvidentarguesthattheBankruptcyCourt'srulingthatthe appelleeswereentitledtoindemnificationiftheywereProvident'sagents isclearlyerroneous.Third,appellantcontendsthatthebankruptcycourt erredinrulingthatProvidentwasnotprotectedbytheUniform FiduciariesAct("UFA"),adoptedbybothNewJerseyandPennsylvaniaat N.J.S.A.3B:1454and7Pa.Cons.Stat.Ann.6361,respectively.

III.ISSUESPRESENTED Onappeal,Providentmakessixarguments.First,Providentarguesthat itistheholderinduecourse("HDC")ofthetenmortgagenotes. Second,ProvidentarguesthattheBankruptcyCourt'srulingthatthe appelleeswereentitledtoindemnificationiftheywereProvident'sagents isclearlyerroneous.Third,appellantcontendsthatthebankruptcycourt erredinrulingthatProvidentwasnotprotectedbytheUniform FiduciariesAct("UFA"),adoptedbybothNewJerseyandPennsylvaniaat N.J.S.A.3B:1454and7Pa.Cons.Stat.Ann.6361,respectively. Fourth,Providentargues,forthefirsttimeuponappeal,thatthe doctrineofavoidableconsequencesbarsappelleesfromrecoveringany damagesfromProvident.Fifth,Providentmaintainsthatthedoctrinesof lispendens,resjudicata,andcollateralestoppeldonotbar relitigationoftheseissuesastotheAndreuzzitransaction.Finally, ProvidentarguesthattheBankruptcyCourterredbygivingpreclusionary effecttothePioneeractiondefaultjudgments. ThisOpinionwillnotaddressProvident's"avoidableconsequences" argument,asitwasraised,forthefirsttime,uponappeal.[fn3] Moreover,thedoctrineofresjudicataprecludesreviewofthetwo transactionsforwhichPioneerwastheclosingagent,andIthusaffirm theBankruptcyCourt'sjudgmentastoPioneeronthatground.[fn4]Iwill affirmtheBankruptcyCourt'sholdingthatProvidentisnotentitledto theprotectionsoftheUniformFiduciariesAct,especiallyinlightof thefactthatProvidenthaswithdrawnitsargumentthatPinnaclewasits agent.[fn5]Forreasonsstatedherein,IwillaffirmtheBankruptcy Court'sholdingthatProvidentisnottheholderinduecourseofthe eight[fn6]transactionsstillinquestion.Accordingly,thereisnoneed forthisCourttoaddresstheBankruptcyCourt'salternatefindingthat theclosingagentswouldbeentitledtoindemnification.[fn7] IV.STANDARDOFREVIEW Onappeal,theweightaccordedtothefindingsoffactbyabankruptcy courtaregovernedbyFed.R.Bank.P.8013,whichprovidesasfollows: Onappealthedistrictcourtorbankruptcyappellate panelmayaffirm,modify,orreverseabankruptcy judge'sjudgment,order,ordecreeorremandwith instructionsforfurtherproceedings.Findingsof fact,whetherbasedonoralordocumentaryevidence, shallnotbesetasideunlessclearlyerroneous,and dueregardshallbegiventotheopportunityofthe bankruptcycourttojudgethecredibilityof witnesses. Fed.R.Bank.P.8013.UnderthisRule,abankruptcycourt'sfactual findingsmaybedisturbedonlyifclearlyerroneous.SeeFGHRealty Creditv.NewarkAirport/HotelLtd.,155B.R.93(D.N.J.1993).Wherea mixedquestionoflawandfactispresented,theappropriatestandard mustbeappliedtoeachcomponent.InreSharonSteelCorp.,871F.2d1217, 1222(3dCir.1989).Thus,areviewingcourt"mustacceptthe[lower] court'sfindingsofhistoricalornarrativefactsunlesstheyareclearly erroneous,but...mustexerciseaplenaryreviewanditsapplication ofthosepreceptstothehistoricalfacts."UniversalMinerals,Inc.v. C.A.Hughes&Co.,669F.2dat103. Whilestandardsforestablishingthatapartyisaholderinduecourse arewellsettledlaw,see,e.g.,Triffinv.Dillabough,448Pa.Super.72, 87,670A.2d684,691(1996),theCourt'sapplicationofthesestandards tothefactsdoesresultinamixedfindingoffactandlawthatis subjecttoamixedstandardofreview.MellonBank,N.A.v.Metro Communications,Inc.,945F.2d635,64142(3dCir.1991),cert.denied, 503U.S.937(1992).Thefactualfindingscanonlybereversedforclear error,InreGraves,33F.3d242,251(3dCir.1994),evenifthe reviewingcourtwouldhavedecidedthematterdifferently.Inre PrincetonNewYorkInvestors,Inc.,1998WL111674(D.N.J.1998).This Court,thus,maynotoverturnabankruptcyjudge'sfactualfindingsif thefactualdeterminationsbearany"rationalrelationshiptothe supportingevidentiarydata...."Fellheimer,Eichen&Braverman,P.C. v.CharterTechnologies,Inc.,57F.3d1215,1223(3dCir.1995)(citing Hootsv.Comm.ofPa.,703F.2d722,725(3dCir.1983).However,this Courtreviewsanylegalconclusionsdenovo. V.DISCUSSION AppellantarguesthattheBankruptcyCourt'sfindingthatappellantis notanHDCofthepromissorynotesandmortgagesfromtheeightremaining realestatetransactionsclosedbyappelleesisclearlyerroneous.The

supportingevidentiarydata...."Fellheimer,Eichen&Braverman,P.C. v.CharterTechnologies,Inc.,57F.3d1215,1223(3dCir.1995)(citing Hootsv.Comm.ofPa.,703F.2d722,725(3dCir.1983).However,this Courtreviewsanylegalconclusionsdenovo. V.DISCUSSION AppellantarguesthattheBankruptcyCourt'sfindingthatappellantis notanHDCofthepromissorynotesandmortgagesfromtheeightremaining realestatetransactionsclosedbyappelleesisclearlyerroneous.The disputehereisnotadisputeoflaw,asthepartiesagreeonwhatthe lawconcerningHDCsis.AstheBankruptcyCourtcorrectlyfound,[fn8] everyholderofanegotiableinstrumentispresumedtobeanHDC,Morgan GuarantyTrustCompanyofNewYorkv.Staats,631A.2d631,636 (Pa.Super.Ct.1993),butwhenadefenseoffraudismeritoriousastothe payee,theholderhastheburdenofshowingthatitisanHDCinorderto beimmunefromthatdefense.Normanv.WorldWideDistributors,Inc., 195A.2d115,117(Pa.Super.Ct.1963).Aholderofanegotiable instrument(suchasthepromissorynotesinthiscase)iseitherthe personwithpossessionofbearerpaperorthepersonidentifiedonthe instrumentifthatpersonisinpossession.13Pa.Cons.Stat.Ann. 1201N.J.S.A.12A:3201(WestSupp.1998).Theholderofa documentoftitle(suchasthemortgagesinthiscase)isthepersonin possessionifthedocumentismadeouttobearerortotheorderofthe personinpossession.Id.TheholderbecomesanHDCif: (1)theinstrumentwhenissuedornegotiatedtothe holderdoesnotbearsuchapparentevidenceofforgery oralterationorisnototherwisesoirregularor incompleteastocallintoquestionitsauthenticity and (2)theholdertooktheinstrument: (i)forvalue (ii)ingoodfaith (iii)withoutnoticethattheinstrumentis overdueorhasbeendishonoredorthatthereisan uncureddefaultwithrespecttopaymentofanother instrumentissuedaspartofthesameseries (iv)withoutnoticethattheinstrumentcontains anunauthorizedsignatureorhasbeenaltered (v)withoutnoticeofanyclaimtotheinstrument describedinsection3306(relatingtoclaimstoan instrument)and (vi)withoutnoticethatanypartyhasadefense orclaiminrecoupmentdescribedinsection3305(a) (relatingtodefensesandclaimsinrecoupment). 13Pa.Cons.Stat.Ann.3302.SeealsoN.J.S.A.12A:3302.In short,anHDCistheholderoftheinstrumentordocumentwhotookfor valueandingoodfaithwithoutnoticeofanyclaimsordefectsonthe instrumentordocument.IfclassifiedasanHDC,theholderholdswithout regardtodefenses,withcertainstatutoryexemptionswhichdonotapply here.13Pa.Cons.Stat.Ann.3305N.J.S.A.12A:3305. ItwascleartothepartiesandtotheBankruptcyCourtbelowthat Providentdidnothaveactualpossessionofthenotesandmortgages beforeNovember2,1998,whenitlearnedthattherewereinsufficient fundsinPinnacle'saccountatProvidenttocoverPinnacle'schecksto theclosingagentshere.Providentnonethelessarguedthatitwasthe holderofthenotesandmortgagesbecause,beforegainingactual knowledgeofPinnacle'sfraud,Provident"constructivelypossessed"the notesandmortgagesfromthemomentthattheclosingagents,whowere allegedlyProvident'sagents,tookpossessionofthenotesatthe closingsbeforeNovember2. TheBankruptcyCourtrejectedProvident'sargument,findingthatnone oftheappelleesactedasProvident'sagents,andthusProvidentnever constructivelyoractuallypossessedthenotesandmortgages.Thus,the BankruptcyCourtfoundthatProvidentneverbecametheholderofthese notesandmortgagesinthefirstplace.(Opinionat53.)Alternatively, theBankruptcyCourtfoundthatwhileProvidentdidgivevalueforthe notesandmortgages(Opinionat54),itdidnottakethosenotesand mortgagesingoodfaithandwithoutknowledgeofdefenses,andthus

closingsbeforeNovember2. TheBankruptcyCourtrejectedProvident'sargument,findingthatnone oftheappelleesactedasProvident'sagents,andthusProvidentnever constructivelyoractuallypossessedthenotesandmortgages.Thus,the BankruptcyCourtfoundthatProvidentneverbecametheholderofthese notesandmortgagesinthefirstplace.(Opinionat53.)Alternatively, theBankruptcyCourtfoundthatwhileProvidentdidgivevalueforthe notesandmortgages(Opinionat54),itdidnottakethosenotesand mortgagesingoodfaithandwithoutknowledgeofdefenses,andthus ProvidentisnotanHDC.(Opinionat63.)ThequestionbeforethisCourt iswhethertheBankruptcyCourt'srulingsinthisregardwereclearly erroneous.Iholdthatitwasneitherclearlyerroneousnorcontraryto establishedlawfortheBankruptcyCourttofindthatProvidentdidnot fittheroleof"goodfaithpurchaserforvalue"necessarytoclaimHDC statuseventhoughProvident'slackofgoodfaitharoseafterthetitle agentsclosedtherealestatetransactions.Asthefollowingdiscussion willexplain,inthecontextofacourseofdealingbetweenProvidentand Pinnacleextendingoverthousandsofsuchtransactions,Providentwas essentiallyapartytothemortgagelendingtransactionsandthus,by definition,cannotclaimHDCstatusinthenegotiablepaperswhich resultedfromthosetransactions,especiallybecauseProvidentgained knowledgeofdefensesbeforeitsownroleintheoriginalmortgage lendingtransactionwascomplete. IaffirmtheBankruptcyCourt'srulingthatProvidentisnottheHDCof thesenotesandmortgages.Insoholding,Ineednot,andthusdonot, reachtheissueofwhetherProvidentconstructivelypossessedthenotes andmortgages,[fn9]forholderstatusisirrelevantifProvidentdidnot takeingoodfaithandwithoutknowledgeofdefenses.BecauseIfindthat theBankruptcyCourt'srulingthatProvidentdidnottakeingoodfaith wasnotclearlyerroneous,IaffirmtherulingthatProvidentisnot entitledtotheprotectionsaffordedtoaholderinduecourse. TheBankruptcyCourtcorrectlystatedthelawongoodfaithinthis context:thetestforgoodfaithis"notoneofnegligenceofdutyto inquire,butratheritisoneofwillfuldishonestyoractualknowledge." ValleyBank&TrustCo.v.AmericanUtilities,Inc.,415F.Supp.298, 301(E.D.Pa.1976).SeealsoMellonBankv.PasqualisPoliti, 800F.Supp.1297,1302(W.D.Pa.1992),aff'd,990F.2d780(3dCir. 1993)CarnegieBankv.Shalleck,606A.2d389,394(N.J.Super.Ct. A.D.1992)GeneralInv.Corp.v.Angelini,278A.2d193(N.J.1971). Goodfaithmaybedefeatedonlybyactualknowledgeoradeliberate attempttoevadeknowledge.Ricev.Barrington,70A.169,170(N.J.E.& A1908)."Thereisnoaffirmativedutyofinquiryonthepartofone takinganegotiableinstrument,andthereisnoconstructivenoticefrom thecircumstancesofthetransaction,unlessthecircumstancesareso strongthatifignoredtheywillbedeemedtoestablishbadfaithonthe partofthetransferee."BankersTrustCo.v.Crawford,781F.2d39,45 (3dCir.1986).Moreover,anHDCmusttakenotonlyingoodfaith,but alsowithoutnoticeofdefensestotheinstrumentordocument.Onehas "notice"when (1)hehasactualknowledgeofit (2)hehasreceivedanoticeornotificationofitor (3)fromallthefactsandcircumstancesknowntohim atthetimeinquestionhehasreasontoknowthatit exists. Pa.Cons.Stat.Ann.1201. TheBankruptcyCourtherefoundthatProvidentdidnotinfacthave actualknowledgeofthefraudorpotentialdefenseoffailureof considerationatthetimeofeachseparateclosing.(Opinionat58.)The BankruptcyCourtalsofoundthatdespitethefactthatProvidentfailed toreviewPinnacle'sbooks,records,andcheckingaccountledger,failed tonoticetheoverdraftproblem,failedtoproperlymonitorwithdrawals, andfailedtoactafterknowledgeoffinancialdeteriorationindefault inprovidingtimelyauditedfinancialstatements,theappelleeshadnot provedthatProvidentactedwithwillfuldishonesty(id.)Providentdid actwithnegligenceorgrossnegligence,butgrossnegligencealoneis notenoughtodefeatanHDC'stitle.SeeWashington&CanonsburgRy.Co. v.Murray,211F.440,445(3dCir.1914)GeneralInv.Corp., 278A.2d193.Moreover,theBankruptcyCourtcorrectlynotedthatholder induecoursestatusisgenerallycreatedatthetimethattheclaimant becomesaholdermeaningatthetimeofnegotiation.N.J.S.A. 12A:3302Sisemorev.KierlowCo.,Inc.v.Nicholas,27A.2d473,478 (Pa.Super.Ct.1942).Intransactionssuchastheonesatissueherewhich

inprovidingtimelyauditedfinancialstatements,theappelleeshadnot provedthatProvidentactedwithwillfuldishonesty(id.)Providentdid actwithnegligenceorgrossnegligence,butgrossnegligencealoneis notenoughtodefeatanHDC'stitle.SeeWashington&CanonsburgRy.Co. v.Murray,211F.440,445(3dCir.1914)GeneralInv.Corp., 278A.2d193.Moreover,theBankruptcyCourtcorrectlynotedthatholder induecoursestatusisgenerallycreatedatthetimethattheclaimant becomesaholdermeaningatthetimeofnegotiation.N.J.S.A. 12A:3302Sisemorev.KierlowCo.,Inc.v.Nicholas,27A.2d473,478 (Pa.Super.Ct.1942).Intransactionssuchastheonesatissueherewhich involveblankendorsements,theinstrumentsanddocumentsarebearer paperandarethusnegotiatedupondeliveryalone.13Pa.Cons.Stat. Ann.3201N.J.S.A.12A:3201. Nonetheless,theBankruptcyCourtfoundthatProvidentfailedtoattain thestatusofaholderinduecourse.Itacknowledgedthatonceaparty establishesitspositionasaholderinduecourse,nofutureactioncan underminethatstatussointheusualtransactionwithnegotiablebearer paper,actualknowledgeofdefensesgainedafterpossessiondonotdefeat HDCstatus.(Opinionat63.)SeeBricksUnlimited,Inc.v.Agee, 672F.2d1255,1259(5thCir.1982)ParkGasolineCo.v.Crusius, 158A.334(N.J.1932).However,theBankruptcyCourtsaid,itwasnot findinglackofgoodfaithaftergainingHDCstatus,butratherthat ProvidentdidnotgainHDCstatusinthefirstplace,forthesewerenot the"usual"transactions.Takenina"globalsense,"theBankruptcyCourt said,thesetransactionsdidnotenduntilafterthesettlements. (Opinionat58.) Usually,onewhotakesanegotiableinstrumentforvaluehasonlythe underlyingcircumstancesofthattransactionbywhichtodetermineif thereisreasontogivepauseastotheveracityofthatinstrument.A lenderprovidesfundstoaborrowerwhoexecutesapromissorynote.Once thattransactioniscomplete,thelendertransfersthenotetoasecond lenderinexchangeforwhichthefirstlenderreceivesfundsreplenishing hisaccountandenablinghimtolendthesamefundstoanotherborrower. HDCstatusisgiventothatsecondlenderifitactsingoodfaithand withoutknowledgeofdefenses,andthereisnogeneraldutyforthat secondlendertoinquireunlessthecircumstancesaresosuspiciousthat theycannotbeignored.See,e.g.Triffin,670A.2dat692.Intheusual HDCtransaction,therearetwodiscernibletransactions,twoexchangesof fundsandnotes.AstheBankruptcyCourtpointedout,thepurposeof givingthatsecondlenderHDCstatusis"tomeetthecontemporaryneeds offastmovingcommercialsociety...(citationomitted)andtoenhance themarketabilityofnegotiableinstruments[allowing]bankers,brokers andthegeneralpublictotradeinconfidence."Triffin, 670A.2dat693.However,"themoretheholderknowsabouttheunderlying transaction,andparticularlythemorehecontrolsorparticipatesor becomesinvolvedinit,thelesshefitstheroleofagoodfaith purchaserforvaluethecloserhisrelationshiptotheunderlying agreementwhichisthesourceofthenote,thelessneedthereisfor givinghimthetensionfreerightsnecessaryinafastmoving, creditextendingcommercialworld."Unicov.Owen,50N.J.101,109110 (1967).SeealsoJonesv.ApprovedBancreditCorp.,256A.2d739,742 (Del.1969)(insuchasituation,"[thefinancer]shouldnotbeableto hidebehind`thefictionalfence'ofthe...UCCandtherebyachievean unfairadvantageoverthepurchaser."). Here,therewerenottwoseparate,discernibletransactions. Provident'sfundingofPinnaclewhofundedtheborrowerswasonecomplex transaction.Theactsofathirdpartyinvestorwhowouldbuythenotes andmortgagesfromProvidentwouldhavebeenthesecondseparate, discernibletransactionhere.ProvidentdidnotreplenishPinnacle's accountinexchangeforreceivingthenotesandmortgages,suchthat Pinnaclewouldhavemoremoneytomakemoreloans,asinthe"usual" transaction.Rather,inacomplexandlongstandingschemeencompassing thousandsoftransactionsoverseveralyears,ProvidentgavePinnaclea lineofcredit,andthen,afterPinnaclegaveProvidentinformationabout individualproposedloanstoborrowers,Providenttransferredmoneyto Pinnacle'saccount,inordertolaterreceivethenoteandmortgagefrom eachtransactionandpassthemontoathirdpartyinvestor.The BankruptcyCourt,asafactualmatter,foundthatunderthiscomplex scheme,notransactionsbetweenanyofthepartieswerecompleteuntil bothofthetransactionswereconcluded,particularlybecausethe"second lender"(Provident)hadtheultimatecontroloverthefirsttransaction (byorderingthedishonorofPinnacle'schecks).[fn10] IcannotsaythattheBankruptcyCourt'sfactualfindingwasclearly erroneous.TheBankruptcyCourt'srulingaccordswiththeevidenceas wellaswiththepolicyunderlyingtheholderinduecoursedoctrine.I holdthatwhereawarehouselendersocloselyparticipatesinthefunding

scheme,notransactionsbetweenanyofthepartieswerecompleteuntil bothofthetransactionswereconcluded,particularlybecausethe"second lender"(Provident)hadtheultimatecontroloverthefirsttransaction (byorderingthedishonorofPinnacle'schecks).[fn10] IcannotsaythattheBankruptcyCourt'sfactualfindingwasclearly erroneous.TheBankruptcyCourt'srulingaccordswiththeevidenceas wellaswiththepolicyunderlyingtheholderinduecoursedoctrine.I holdthatwhereawarehouselendersocloselyparticipatesinthefunding andapprovalofmortgageswhichwillultimatelyleadtothewarehouse lender'srightsinmortgagesandpromissorynotesthatthetransactions betweenmortgagebankerandmortgagorandbetweenwarehouselenderand mortgagebankerareinfactonecontinuoustransaction,ratherthantwo discernibletransactions,ashowingofthewarehouselender'slackof goodfaithaftertheclosingbetweentitleagentandmortgagorbutbefore themortgagebanker'scheckispresentedtothewarehouselendermay destroyHDCstatus.Indeed,wherethepartywhoclaimsHDCstatuswasin essenceapartytotheoriginaltransaction,itcannot,bydefinition,be aholderinduecourse. Providenthadagreatdealofinvolvementintheongoingseriesof transactionsandampleknowledgeofPinnacle'soverallfinancial wellbeing,developedthroughyearsoffundingPinnacle'screditlinefor thousandsofsuchtransactionsandreceiptofPinnacle'speriodic financialreports.Ithadparticularinformationabouttheborrowers beforeitfundedtheseloans.Itwas,infact,partoftheloan transactions,andnotaseparatepartywhobecameanHDCthroughthe givingofvalueatasecondseparate,discernibletransaction.Provident hadtoomuchcontrolof,participationin,andknowledgeofthe underlyingtransactiontoclaimthatitwasagoodfaithpurchaserfor value.See,e.g.,FidelityBankNat'lAssoc.,740F.Supp.at239. Because,underthiscomplextransactionalscheme,Providentfunctioned essentiallyasapartywhichapprovedandfundedtheloansandgained actualknowledgeofadefensetothenotesandmortgages(lackof consideration)beforethetransactionswerecomplete,itwasnotclearly erroneousfortheBankruptcyCourttofindthatProvidentlackedthegood faithnecessarytoclaimHDCstatus.Accordingly,theBankruptcyCourt's rulingisaffirmed. VI.CONCLUSION Fortheforegoingreasons,IwillaffirmtheBankruptcyCourt'sruling thatappellantProvidentSavingsBankwasnottheholderinduecourseof thenotesandmortgagesfromthetentransactionsclosedbyappellees. Thedefenseoffailureofconsiderationthusisavailableagainst Provident.IthereforeaffirmtheBankruptcyCourt'sjudgmentthat appellees,andnotappellant,areentitledtothenotesandmortgages.The accompanyingOrderisentered. ORDER Thismatterhavingcomeuponthecourtupontheappealofappellant, ProvidentSavingsBank,fromaJudgmententeredonDecember17,1997,by theHonorableJudithH.Wizmur,UnitedStatesBankruptcyJudgeforthe DistrictofNewJersey,andtheCourthavingconsideredtheparties' submissionsandforthereasonssetforthintheOpinionoftoday's date ITISthisdayofDecember,1998,hereby ORDEREDthattheJudgmententeredbytheHonorableJudithH.Wizmur, UnitedStatesBankruptcyJudgefortheDistrictofNewJersey,on December17,1997,whichgrantedthenotesandmortgagesfrom transactionsclosedbytheappelleesinthismattertotheappellees, be,andherebyis,AFFIRMED. [fn1]Theappellant'scauseofactionagainstdefendantWilliamE.Ward wasremovedtostatecourtinDelawareuponmotiononthebasisof abstentionpursuantto28U.S.C.1334(c)whereitisnowpending. Theappellant'scauseofactionagainstMeridianBankwasresolvedprior totrialpursuanttotheStipulationofSettlementwithrespecttoCount IIoftheComplaint,filedonJuly16,1996.Allclaimsbetweenthe appellantandLawyersTitleInsuranceCorporationweremutuallydismissed attrial.

[fn2]TheAgreementsaid$10million,butattimesupto$12.5million wasadvanced.

Theappellant'scauseofactionagainstMeridianBankwasresolvedprior totrialpursuanttotheStipulationofSettlementwithrespecttoCount IIoftheComplaint,filedonJuly16,1996.Allclaimsbetweenthe appellantandLawyersTitleInsuranceCorporationweremutuallydismissed attrial.

[fn2]TheAgreementsaid$10million,butattimesupto$12.5million wasadvanced.

[fn3]Itisawellestablishedlawthatappellatecourtsmaynotpass uponanissuenotpresentedinalowercourt.Singletonv.Wulff, 428U.S.106,120(1976).ThesameholdstrueforaU.S.DistrictCourt sittinginitsappellatecapacityovermattersappealedfromthe bankruptcycourt.SeeBarrettv.CommonwealthFed.Sav.andLoanAss'n, 939F.2d20(3dCir.1991)InreMiddleAtlanticStudWeldingCo., 503F.2d1133,1134n.1(3dCir.1974).BecauseProvidentneverraised thisissuebeforetheBankruptcyCourt,Iwillnotconsideritnow.

[fn4]Theresjudicatadoctrinepreventsrelitigationofclaimsthatgrow outofatransactionoroccurrencefromwhichotherclaimshaveearlier beenraisedanddecidedvalidly,finally,andonthemerits.Federated DepartmentStoresv.Moitie,452U.S.394,298(1981).UnderPennsylvania law,defaultjudgments,absentfraud,areaffordedresjudicataeffect. InreGraves,156B.R.949,954(E.D.Pa.1993),aff'd,33F.3d242(3d Cir.1994).OnDecember21,1994,theCourtofCommonPleasofBerks County,Pennsylvania,entereddefaultjudgmentsagainstProvidentonboth theWeaverandFishertransactions,thosetransactionsforwhichPioneer wastheclosingagent.Duetothesedefaultjudgments,thedoctrineof resjudicatabarsrelitigationofthePioneercausesofaction.The BankruptcyCourtalsoheldthattheAndreuzzitransactionwasbarredby resjudicataorcollateralestoppelbecauseofthelispendens.That, however,isamoredifficultissueandonethatIneednotreachnow,as myaffirmanceoftheBankruptcyCourt'sjudgmentappliesequallytothe Andreuzzitransactiononthemerits.

[fn5]AttrialandinitsbriefstothisCourt,asanalternativetoits holderinduecourseargument,Providentarguedthatitwasprotectedby thePennsylvaniaUniformFiduciariesAct,7Pa.Cons.Stat.6361, andtheNewJerseyUniformFiduciariesLaw,N.J.S.A.3B:14 54,the provisionsofwhicharesubstantiallysimilar.Thetwolawsprotecta personwhotransfersmoneytoafiduciaryingoodfaith,bynotingthat "anyrightortitleacquiredfromthefiduciaryinconsiderationofsuch paymentortransferisnotinvalidinconsequencesofamisapplicationby thefiduciary."7Pa.Cons.Stat.6361N.J.S.A.3B:14 54.The BankruptcyCourtheldthatPinnaclewasnotProvident'sagentor fiduciary,andthustheUFAdidnotapply.(Opinionat66.)Inlightof thefactthatProvident'scounsel,atoralargumentbeforethisCourton November13,1998,themselvesarguedthatPinnaclewasnotProvident's fiduciary,IwillaffirmthisaspectoftheBankruptcyCourt'sruling withoutneedtoexaminethefactualbasesonwhichitrelied.

[fn6]TherestofthisOpinionislimitedtotheeighttransactionsnot handledbyPioneer,sinceonlythePioneertransactionsareboundbyres judicata.

[fn7]AsPartVofthisOpinionexplains,oneoftheseveralbasesfor theBankruptcyCourt'sdecisionthatProvidentisnottheHDCofthe mortgagesandnotesisthatthesettlementagentswerenotProvident's agents,andthusProvidentdidnotconstructivelypossessthemortgages andnotespriortogainingknowledgeofclaimsordefensesonthose notes.(Opinionat3453.)Inthealternative,incaseappellatecourts determinedthatProvidentwastheHDCofthosenotesbecauseanagency relationshipdidexist,theBankruptcyCourtheldthattheclosing agents,andnotProvident,wouldstillbetheonesentitledtothenotes andmortgages,fortheagentswouldhavehadarighttoindemnification fromProvident.(Id.at6364.)Though,asIexplaininPartV,Idonot reachtheagencyissue,IdoaffirmtheBankruptcyCourt'sHDCrulingon othergrounds.Indoingso,Iamaffirmingthedecisionthatthe appellees,andnotProvident,areentitledtothenotesandmortgages.The BankruptcyCourt'sindemnificationrulingisjustanalternativereason forfindingthattheappelleesareentitledtothenotesandmortgages. Havingalreadyagreedthattheclosingagentsaresoentitledbecause ProvidentisnotanHDC,thereisnoneedtoaddressthatalternative rulinguponappeal.

andmortgages,fortheagentswouldhavehadarighttoindemnification fromProvident.(Id.at6364.)Though,asIexplaininPartV,Idonot reachtheagencyissue,IdoaffirmtheBankruptcyCourt'sHDCrulingon othergrounds.Indoingso,Iamaffirmingthedecisionthatthe appellees,andnotProvident,areentitledtothenotesandmortgages.The BankruptcyCourt'sindemnificationrulingisjustanalternativereason forfindingthattheappelleesareentitledtothenotesandmortgages. Havingalreadyagreedthattheclosingagentsaresoentitledbecause ProvidentisnotanHDC,thereisnoneedtoaddressthatalternative rulinguponappeal.

[fn8]Sevenoftheeightremainingtransactionsherearegovernedby Pennsylvanialaw.TheeighthisunderNewJerseylaw,butthetwostates' lawsonHDCstatusarelargelyconsistentontheissuesraisedinthese proceedings.

[fn9]TheBankruptcyCourtagreedthatauthorityfromotherjurisdictions suggestthatapartymaybecomeaconstructiveholderwhenitsagent takespossessionofanegotiableinstrumentonitsbehalf.(Opinionat 3637.)However,theBankruptcyCourtmadethefactualfindingthat appelleeswerenotProvident'sagents.Itdeterminedthatthoughsixof thetentransactionsinvolvedwrittenagencyagreements,thoseagreements werenotcontrollinginlightofthecourseofdealingbetweenthe parties(Opinionat46),andthatProvidentdidnototherwisemeetits burdenofestablishingthatanagencyrelationshipexisted.BecauseI findthattheBankruptcyCourt'sdeterminationthatProvidentdidnotact ingoodfaithisnotclearlyerroneous,andbecausethelackofgood faithaloneisenoughofabasistosustainajudgmentthatProvidentis notanHDCoftheseeightnotesandmortgages,Ineednotaddresswhether theagencydeterminationwasclearlyerroneous.

[fn10]UndertheBankruptcyCourt'sfindingsoffact,Providentwas,in reality,apartytotheoriginaltransaction.Thesituationissomewhat analogoustoaconsumergoodsfinancerwhohasasubstantialvoiceinthe underlyingtransactionthatfinancerisnotentitledtoHDCstatus. WestfieldInvestmentCo.v.Fellers,181A.2d809(N.J.Super.Ct.Law Div.).Providenthadasubstantialvoiceinprovidingandcarryingout fundingoftheunderlyingborrowingtransactions,anditthuscannot claimthatitwasagoodfaithHDCwhenitlearnedofthedefenseof failureofconsiderationpriortodishonoringthePinnaclechecks.

Copyright2013CCHIncorporatedoritsaffiliates

Anda mungkin juga menyukai

- CA BK Mandatory Form MTN To Strip Junior Lien / Second Mortgage4003-2-4-Mtn To Avoid 2nd CH 13Dokumen3 halamanCA BK Mandatory Form MTN To Strip Junior Lien / Second Mortgage4003-2-4-Mtn To Avoid 2nd CH 13johngaultBelum ada peringkat

- Constructive Trust Created With Transfer Without ValueDokumen4 halamanConstructive Trust Created With Transfer Without ValuejohngaultBelum ada peringkat

- Mortgage Drafting and Restatement (3d) of Property 1998Dokumen41 halamanMortgage Drafting and Restatement (3d) of Property 1998johngaultBelum ada peringkat

- Beeson DKT 1-2 Docs From State CourtDokumen52 halamanBeeson DKT 1-2 Docs From State CourtjohngaultBelum ada peringkat

- Residential Funding Corporation Sold 476M in Loans To RAMPDokumen17 halamanResidential Funding Corporation Sold 476M in Loans To RAMPjohngaultBelum ada peringkat

- FNMA REMIC Master Trust Agreement - 080107Dokumen114 halamanFNMA REMIC Master Trust Agreement - 080107johngaultBelum ada peringkat

- Court Rules NO Evidence MERS May Assign NoteDokumen6 halamanCourt Rules NO Evidence MERS May Assign NotejohngaultBelum ada peringkat

- In RE SALAMON B A P 9th Cir Re Anti DeficiencyDokumen7 halamanIn RE SALAMON B A P 9th Cir Re Anti DeficiencyjohngaultBelum ada peringkat

- Statute of Limitations May Be Avoided in A Counter-ClaimDokumen7 halamanStatute of Limitations May Be Avoided in A Counter-ClaimjohngaultBelum ada peringkat

- Rescission Is Permissible in NV 6 Year SOLDokumen2 halamanRescission Is Permissible in NV 6 Year SOLjohngaultBelum ada peringkat

- Equitable Recoupment To Revive Time-Barred ClaimsDokumen3 halamanEquitable Recoupment To Revive Time-Barred ClaimsjohngaultBelum ada peringkat

- Third Party Beneficiary and Ius QuaesitumDokumen5 halamanThird Party Beneficiary and Ius QuaesitumjohngaultBelum ada peringkat

- Equitable Recoupment AnnotatedDokumen5 halamanEquitable Recoupment Annotatedjohngault100% (1)

- Merspolicy With Fannie MaeDokumen4 halamanMerspolicy With Fannie MaeGreg TyllBelum ada peringkat

- In RE SALAMON B A P 9th Cir Re Anti DeficiencyDokumen7 halamanIn RE SALAMON B A P 9th Cir Re Anti DeficiencyjohngaultBelum ada peringkat

- Nguyen V Chase Tila Claim and Other Quieted TitleTila ClaimDokumen86 halamanNguyen V Chase Tila Claim and Other Quieted TitleTila ClaimjohngaultBelum ada peringkat

- Nguyen Chase Motions Rule 60 (B) and 55 Re Default JudgmentDokumen57 halamanNguyen Chase Motions Rule 60 (B) and 55 Re Default JudgmentjohngaultBelum ada peringkat

- Jesinoski USSC Tila Rescission Case TranscriptDokumen63 halamanJesinoski USSC Tila Rescission Case TranscriptjohngaultBelum ada peringkat

- Tila Violations: Is Your Claimant An Assignee of The Creditor?Dokumen6 halamanTila Violations: Is Your Claimant An Assignee of The Creditor?johngaultBelum ada peringkat

- MERS Says Notes NOT Regulated by Article III of The UCC - Submits Case Law in Support.Dokumen20 halamanMERS Says Notes NOT Regulated by Article III of The UCC - Submits Case Law in Support.johngaultBelum ada peringkat

- Avoiding The Statue of Limitations by Counter-ClaimDokumen12 halamanAvoiding The Statue of Limitations by Counter-ClaimjohngaultBelum ada peringkat

- Deeds of Trust, State Law, and The ConstitutionDokumen2 halamanDeeds of Trust, State Law, and The ConstitutionjohngaultBelum ada peringkat

- 2006 PSA Trust Bear Stearns EMC La SalleDokumen796 halaman2006 PSA Trust Bear Stearns EMC La SallejohngaultBelum ada peringkat

- Request For Production of Note and Mortgage For Forensic Testing SupplementDokumen7 halamanRequest For Production of Note and Mortgage For Forensic Testing Supplementjohngault100% (2)

- Funky Endorsements and Allonge RFC Deutsche and ALSDokumen44 halamanFunky Endorsements and Allonge RFC Deutsche and ALSjohngault100% (1)

- FNMA MBS Prospectus Including GuaranteeDokumen76 halamanFNMA MBS Prospectus Including GuaranteejohngaultBelum ada peringkat

- Sample - Assignment - From - Mers To Non Member Investor or ServicerDokumen1 halamanSample - Assignment - From - Mers To Non Member Investor or ServicerjohngaultBelum ada peringkat

- Motion To Remand To State Court Re ForeclosureDokumen22 halamanMotion To Remand To State Court Re Foreclosurejohngault100% (2)

- Demand For Production For Inspection and Forensic TestingDokumen5 halamanDemand For Production For Inspection and Forensic TestingjohngaultBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- HSBCnet Payments User GuideDokumen120 halamanHSBCnet Payments User GuideelmenshawymarwaBelum ada peringkat

- Record Retention Guide in The UKDokumen5 halamanRecord Retention Guide in The UKArchive Management SystemsBelum ada peringkat

- India's Banking System:: Introduction To Indian Banking IndustryDokumen3 halamanIndia's Banking System:: Introduction To Indian Banking IndustrySathish KumarBelum ada peringkat

- Customer Satisfaction-ICICI BankDokumen98 halamanCustomer Satisfaction-ICICI BankSabinYadav88% (16)

- Def Motion in Opp To SJ - Premature..No Compliance With Discovery 6-40-11Dokumen6 halamanDef Motion in Opp To SJ - Premature..No Compliance With Discovery 6-40-11melzena11Belum ada peringkat

- Oxford - BoothDokumen20 halamanOxford - BoothRamBelum ada peringkat

- Note: A Minimum of 40 Lectures Is Mandatory For Each CourseDokumen2 halamanNote: A Minimum of 40 Lectures Is Mandatory For Each CourseCiaraAtreyaBelum ada peringkat

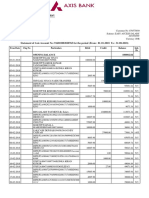

- Statement of Axis Account No:916010083028765 For The Period (From: 01-01-2018 To: 31-08-2018)Dokumen9 halamanStatement of Axis Account No:916010083028765 For The Period (From: 01-01-2018 To: 31-08-2018)Saran ManiBelum ada peringkat

- Bank Written-3rd Batch (Syllabus)Dokumen6 halamanBank Written-3rd Batch (Syllabus)Phantom 4xxBelum ada peringkat

- Financial ReadinessDokumen101 halamanFinancial ReadinessMatthew Conboy100% (1)

- Credit Skills For Bankers Certificate Sme IndiaDokumen4 halamanCredit Skills For Bankers Certificate Sme IndiaitsurarunBelum ada peringkat

- Module One Introduction To MicrofinanceDokumen5 halamanModule One Introduction To MicrofinanceMaimon AhmetBelum ada peringkat

- Disbursement Voucher Disbursement Voucher: Classificat Ion of Disbursement Classificat Ion of DisbursementDokumen8 halamanDisbursement Voucher Disbursement Voucher: Classificat Ion of Disbursement Classificat Ion of DisbursementErica Dizon100% (1)

- Research in Economics: Arkadiusz Siero NDokumen10 halamanResearch in Economics: Arkadiusz Siero NJózsef PataiBelum ada peringkat

- Relatório SAPLDokumen46 halamanRelatório SAPLMateus OliveiraBelum ada peringkat

- Compoun Interest LessonDokumen6 halamanCompoun Interest Lessonsonamaegarcia23Belum ada peringkat

- Assignment ON Merger of Centurian Bank of Punjab by HDFC BankDokumen10 halamanAssignment ON Merger of Centurian Bank of Punjab by HDFC BankAmardeep Singh SodhiBelum ada peringkat

- Wells Fargo Everyday CheckingDokumen3 halamanWells Fargo Everyday Checkingbaga ibakBelum ada peringkat

- Saunders Notes PDFDokumen162 halamanSaunders Notes PDFJana Kryzl DibdibBelum ada peringkat

- Builders Outlook 2016 Issue 12Dokumen16 halamanBuilders Outlook 2016 Issue 12TedEscobedoBelum ada peringkat

- 아너스기출 고2 천재이재영3과 - 답지Dokumen5 halaman아너스기출 고2 천재이재영3과 - 답지채린Belum ada peringkat

- Direct Deposit Enrollment Form: The Bancorp Bank 123Dokumen1 halamanDirect Deposit Enrollment Form: The Bancorp Bank 123rita ggggggBelum ada peringkat

- Info HelplineDokumen23 halamanInfo HelplineAMINBelum ada peringkat

- Robinsons Bank SpaDokumen1 halamanRobinsons Bank SpaMaricar Dasal BulandresBelum ada peringkat

- Tutorial 1Dokumen2 halamanTutorial 1musicslave96Belum ada peringkat

- DSE HistoryDokumen20 halamanDSE HistoryMd Sharif HossainBelum ada peringkat

- Bankers Trust Case Study - Finance TrainDokumen2 halamanBankers Trust Case Study - Finance TrainPeterGomesBelum ada peringkat

- HSBCDokumen21 halamanHSBCHarsha SanapBelum ada peringkat

- Response To Comments On Sh. Ashish Gupta MemorandumDokumen5 halamanResponse To Comments On Sh. Ashish Gupta MemorandumShaurya SinghBelum ada peringkat

- Transaction StatementDokumen10 halamanTransaction StatementChandan SripathiBelum ada peringkat