Alabama Appeals Court Reverses Decision On Chain of TitleCase

Diunggah oleh

dbush2778Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Alabama Appeals Court Reverses Decision On Chain of TitleCase

Diunggah oleh

dbush2778Hak Cipta:

Format Tersedia

Alabama Appeals Court Reverses Decision on Chain of TitleCase, Ruling Hinges on Question of Bogus Allonges 2012

In a unanimous decision, the Alabama Court of Civil Appeals reversed a lower court decision on a foreclosure case, U.S. Bank v. Congress and remanded the case to trial court. We d flagged this case as important because to our knowledge, it was the first to argue what we call the !ew "ork trust theor#, namel#, that the election to use !ew "ork law in the overwhelming ma$orit# of mortgage securiti%ations meant that the parties to the securiti%ation could operate onl# as stipulated in the pooling and servicing agreement that created that particular deal. &ver '(( #ears of precedents in !ew "ork have produced well settled case law that deems actions outside what the trustee is specificall# authori%ed to do as )void acts* having no legal force. +he rigidit# of !ew "ork trust has serious implications for mortgage securiti%ations. +he ,SAs re-uired that the notes .the borrower I&Us/ be transferred to the trust in a ver# specific fashion .endorsed with wet ink signatures through a particular set of parties/ before a cut0off date, which t#picall# was no later than 1( da#s after the trust closing. +he problem is, as we ve described in numerous posts, that there appears to have been massive disregard in the securiti%ation for compl#ing with the contractual re-uirements that the# established and appear to have complied with, at least in the earl# #ears of the securiti%ation industr#. It s difficult to know when the breakdown occurred, but it appears that well before 2((302((4, man# subprime originators -uit bothering with the nerd# task of endorsing notes and completing assignments as the ,SAs re-uired5 the# seemed to take the position the# could do that right before foreclosure. Indeed, that s kosher if the note has not been securiti%ed, but as indicated above, it is a no0go with a !ew "ork trust. +here is no legal wa# to remed# the problem after the fact. +he solution in the Congress case appears to have been a practice that has since become troublingl# become common6 a fabricated allonge. An allonge is an attachment to a note that is so firml# affi7ed that it can t travel separatel#. +he fact that a note was submitted to the court in the Congress case and an allonge that fi7ed all the problems appeared magicall#, on the eve of trial, looked highl# sus. +he allonge also contained signatures that looked less than legitimate6 the# were digiti%ed .remember, signatures as supposed to be wet ink/ and some were shrunk to fit signature lines. +hese issues were raised at trial b# Congress s attorne#s, but the fact that the magic allonge appeared the +hursda# evening before 8emorial 9a# weekend 2('' when the trial was set for +uesda# morning meant, among other things, that defense counsel was put on the back foot .for instance, how do #ou find and engage a signature e7pert on such short notice: Answer, #ou can t/. +he case was ruled in favor of the US Bank, in a narrow and strained opinion .which was touted as significantb# reliable securiti%ation industr# booster ,aul ;ackson/. It argued that the case was an e$ectment action .the final step to get the borrower out after the foreclosure was final/ so that, per securiti%ation e7pert, <eorgetown law professor Adam =evitin, ..the -uestion of ownership of the note was not an issue of standing, but an affirmative defense for which the homeowner had the burden of proof>Cra%# or not, however, this meant that the homeowner wasn t actuall# challenging the trust s standing. ?rom there it was a small step for the court to sa# that the homeowner couldn t invoke the terms of the ,SA because she wasn t a part# to it>.. +he case has been remanded back to trial court, and the $udges put the issue of the allonge front and center. ?iled under6 foreclosure +agged6 @ Adam =evitin, Alabama, allonge, BUA9B! &? ,A&&?, credit bid, e7 parte communication, fabricated allonge, fabricated documents, $udges, !aked Capitalism, !ew "ork trust, ,aul ;ackson, ,ooling and Servicing Agreement, ,SA, AB8IC, U.S. Bank, U.S. Bank v. Congress, #ves Smith

Anda mungkin juga menyukai

- Powell v. PalasadesdocDokumen1 halamanPowell v. Palasadesdocdbush2778Belum ada peringkat

- Collins v. Experian 1-5-15Dokumen13 halamanCollins v. Experian 1-5-15dbush2778Belum ada peringkat

- Loss-Share Questions and AnswersDokumen3 halamanLoss-Share Questions and Answersdbush2778Belum ada peringkat

- Consumer Protection Analysis State SummariesDokumen175 halamanConsumer Protection Analysis State Summariesdbush2778100% (1)

- Bennett-V-dbntc (FL 4th Appellate 2013) .PDF 8-7-14Dokumen3 halamanBennett-V-dbntc (FL 4th Appellate 2013) .PDF 8-7-14dbush2778Belum ada peringkat

- Affirmative Defenses - Striking Per Twombly StandardDokumen39 halamanAffirmative Defenses - Striking Per Twombly Standarddbush2778Belum ada peringkat

- No Contract No CaseDokumen6 halamanNo Contract No CasejpesBelum ada peringkat

- Sample Civil Form 26. Motion To DismissDokumen1 halamanSample Civil Form 26. Motion To Dismissdbush2778100% (1)

- AZ Steinberger V IndyMac+Judge McVey Garfield MemoDokumen13 halamanAZ Steinberger V IndyMac+Judge McVey Garfield MemovegasdudeBelum ada peringkat

- The Danger of Self Authenticating DocumentsDokumen2 halamanThe Danger of Self Authenticating Documentsdbush2778Belum ada peringkat

- Tourgeman V Collins FDCPA 9th Circuit 6-25-14Dokumen31 halamanTourgeman V Collins FDCPA 9th Circuit 6-25-14dbush2778Belum ada peringkat

- Mot For Evidentiary HearingDokumen3 halamanMot For Evidentiary Hearingdbush2778Belum ada peringkat

- CFPB List Consumer-reporting-AgenciesDokumen17 halamanCFPB List Consumer-reporting-Agenciesdbush2778Belum ada peringkat

- Electronic Filing in FLDokumen2 halamanElectronic Filing in FLdbush2778Belum ada peringkat

- Brief in Support of Notice For Dismissal For Lack of JurisdictionDokumen27 halamanBrief in Support of Notice For Dismissal For Lack of Jurisdictiondbush2778Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Essay On CorruptionDokumen37 halamanEssay On Corruptionanon_177068038100% (3)

- Academic Calendar Winter VIT 2020-21Dokumen1 halamanAcademic Calendar Winter VIT 2020-21ShubhamBelum ada peringkat

- ME 457 Experimental Solid Mechanics (Lab) Torsion Test: Solid and Hollow ShaftsDokumen5 halamanME 457 Experimental Solid Mechanics (Lab) Torsion Test: Solid and Hollow Shaftsanon-735529100% (2)

- IDENTIFYING AND FORMING EQUIVALENT FRACTIONS 3RD CO Mrs BiscaydaDokumen68 halamanIDENTIFYING AND FORMING EQUIVALENT FRACTIONS 3RD CO Mrs BiscaydaLilibeth BiscaydaBelum ada peringkat

- ACS ChartDokumen1 halamanACS ChartJoey TingBelum ada peringkat

- Strategic Management Final Notes For ExamDokumen65 halamanStrategic Management Final Notes For ExamNilesh Mandlik50% (2)

- Oral-Communication WEEK 5Dokumen18 halamanOral-Communication WEEK 5Alkin RaymundoBelum ada peringkat

- NOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsDokumen3 halamanNOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsHussien NizaBelum ada peringkat

- BD20203 - Lecture Note Week 4 - Bank Negara MalaysiaDokumen40 halamanBD20203 - Lecture Note Week 4 - Bank Negara MalaysiaLim ShengBelum ada peringkat

- Review MT2Dokumen33 halamanReview MT2Vishwanath KrBelum ada peringkat

- Cruz Vs Catapang CaseDokumen2 halamanCruz Vs Catapang CaseBoni AcioBelum ada peringkat

- Stages of LaborDokumen3 halamanStages of Laborkatzuhmee leeBelum ada peringkat

- Left Brain Right Stuff Rosenzweig en 20830Dokumen5 halamanLeft Brain Right Stuff Rosenzweig en 20830albertBelum ada peringkat

- NCCS Statement On Homosexuality (Dec 2017)Dokumen1 halamanNCCS Statement On Homosexuality (Dec 2017)NCCS AdminBelum ada peringkat

- Harry Potter Past TenseDokumen1 halamanHarry Potter Past TenseAdonis1985Belum ada peringkat

- 3414Dokumen2 halaman3414ziabuttBelum ada peringkat

- Sisyphus - Journal of Education - Vol 5, Issue 1Dokumen121 halamanSisyphus - Journal of Education - Vol 5, Issue 1Instituto de Educação da Universidade de LisboaBelum ada peringkat

- Management QuestionsDokumen5 halamanManagement QuestionsAhmedAlhosaniBelum ada peringkat

- Electrical Electronic Devices ShabbatDokumen79 halamanElectrical Electronic Devices Shabbatמאירה הדרBelum ada peringkat

- 20 Century Filipino: Traditional ComposersDokumen13 halaman20 Century Filipino: Traditional ComposersMawi AguiluzBelum ada peringkat

- Applying The Rossiter-Percy Grid To Online Advertising Planning - The Role of Product - Brand Type in Previsit IntentionsDokumen9 halamanApplying The Rossiter-Percy Grid To Online Advertising Planning - The Role of Product - Brand Type in Previsit Intentionsa861108Belum ada peringkat

- Indian MuseumsDokumen32 halamanIndian MuseumsRavi ShankarBelum ada peringkat

- Zinc DustDokumen5 halamanZinc Dustvishal.nithamBelum ada peringkat

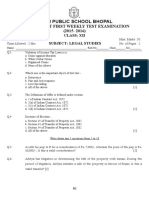

- Legal Studies XII - Improvement First Weekly Test - 2Dokumen3 halamanLegal Studies XII - Improvement First Weekly Test - 2Surbhit ShrivastavaBelum ada peringkat

- Conditional Sentences 01Dokumen2 halamanConditional Sentences 01Thân Ngọc ThủyBelum ada peringkat

- MSW Paper 2Dokumen34 halamanMSW Paper 2Yassar KhanBelum ada peringkat

- Bolos, JR Vs Comelec G.R. No. 184082Dokumen3 halamanBolos, JR Vs Comelec G.R. No. 184082MAry Jovan PanganBelum ada peringkat

- Ele Imhpssdp 1ST Term NotesDokumen7 halamanEle Imhpssdp 1ST Term NotesDANIELLE TORRANCE ESPIRITUBelum ada peringkat

- Unit 3 - 1 PDFDokumen3 halamanUnit 3 - 1 PDFyngrid czBelum ada peringkat

- Shiva Paradha Kshamapana StotramDokumen7 halamanShiva Paradha Kshamapana StotrambondmumbaiBelum ada peringkat