CPM Construction Company Accounting

Diunggah oleh

Prita HerdiantiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CPM Construction Company Accounting

Diunggah oleh

Prita HerdiantiHak Cipta:

Format Tersedia

CPM Construction Company Accounting

Diajukan sebagai salah satu tugas Rekayasa Biaya (SI-5252)

Dosen : Ir. Biemo W. Soemardi, MSE,Ph.D.

Disusun oleh :

Prita Herdianti

25013049

Program Studi Pascasarjana Manajemen Rekayasa Konstruksi

Fakultas Teknik Sipil dan Lingkungan

Institut Teknologi Bandung

2014

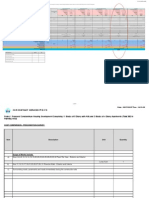

Tugas Rekayasa Biaya, CPM Construction Company Accounting

a. CPM Construction Company Journal

Transaction

on Number

Date

1/2/X3

2/4/X3

3/4/X3

3/8/X3

4/7/X3

5/8/X3

6/7/X3

7/3/X3

8/16/X3

10

9/16/X2

11

10/1/X3

12

10/20/X3

13

11/15/X3

14

12/15/X3

15

12/25/X3

16

12/25/X3

17

12/30/X3

18

12/30/X3

19

12/31/X3

Transaction

Debit

Bought construction equipment

Equipment (Asset)

$ 230.000,00

Cash (Asset)

Account payable-Trade (Liability)

Billed by Smith Material Supplier for cost of material

Material (Expenses)

$

80.000,00

Account payable-Trade (Liability)

Paid cost of material to Smith Material Supplier

Account payable-Trade (Liability)

$

80.000,00

Cash (Expenses)

Billed client (bill #1 on Job 101)

Account receivable-Trade (Asset)

$ 290.000,00

Account receivable-Retention (Asset)

$

30.000,00

Revenue (Revenue)

Billed by National Rental Co. for renting construction equipment

Renting construction equipment (Expenses)

$

60.000,00

Account payable-Trade (Liability)

Received from client for bill #1 on Job 101

Cash (Asset)

$ 290.000,00

Account receivable-Trade (Asset)

Paid to the National Rental Co. for the bill received on 4/7/X2

Account payable-Trade (Liability)

$

60.000,00

Cash (Asset)

Paid for cost of labor

Labor (Expenses)

$ 130.000,00

Cash (Asset)

Billed by subcontractor

Subcontractor (Expenses)

$

85.000,00

Account payable-Trade (Liability)

Paid to the subcontractor for the bill receiver on 8/16/X2

Account payable-Trade (Liability)

$

75.000,00

Cash (Asset)

Billed client (bill #2 on Job 101)

Account receivable-Trade (Asset)

$ 265.000,00

Account receivable-Retention (Asset)

$

15.000,00

Revenue (Revenue)

Account receivable are collected

Cash (Asset)

$

20.000,00

Account receivable-Trade (Asset)

Received from client for bill #2 on Job 101

Cash (Asset)

$ 365.000,00

Account receivable-Trade (Asset)

Account payable are paid

Account payable-Trade (Liability)

$

85.000,00

Cash (Asset)

Paid payroll expense

Payroll (Expenses)

$ 145.000,00

Cash (Asset)

Dividends paid to stockholders

Dividends (Equity)

$

60.000,00

Cash (Asset)

Building depreciation

Depreciation (Expenses)

$

30.000,00

Depreciation (Asset)

Construction equipment depreciation

Depreciation (Expenses)

$

75.000,00

Depreciation (Asset)

Billings in excess of cost are calculated

Total bid price = $ 1,250,000

Completion project = 55%

Revenue = 55% x $ 1,250,000 = $ 687,500

Total billed client = $ 600,000 (bill #4 and #11)

Cost in excess of billing (Asset)

$

87.500,00

Cost in excess of billing (Revenue)

Total Transaction

$ 2.557.500,00

Credit

$

$

75.000,00

155.000,00

80.000,00

80.000,00

320.000,00

60.000,00

290.000,00

60.000,00

130.000,00

85.000,00

75.000,00

280.000,00

20.000,00

365.000,00

85.000,00

145.000,00

60.000,00

30.000,00

75.000,00

$

87.500,00

$ 2.557.500,00

PRITA HERDIANTI | 25013049

Tugas Rekayasa Biaya, CPM Construction Company Accounting

b. Account of Transaction

ASSETS

No.

1

Current Assets

Cash

Date

1/2/X3

3/4/X3

5/8/X3

6/7/X3

7/3/X3

9/16/X2

10/20/X3

11/15/X3

12/15/X3

12/25/X3

12/25/X3

Total Cash

2

Account receivable-Trade

3/8/X3

5/8/X3

10/1/X3

10/20/X3

11/15/X3

Total Account receivable-Trade

3

Account receivable-Retention

3/8/X3

10/1/X3

Total Account receivable-Retention

4

Costs in Excess of Billings

12/31/X3

Total Costs in Excess of Billings

No.

1

Fixed Assets

Construction Equipment

1/2/X3

Depreciation-Building

$

$

Credit

Depreciation-Construction Equipment

Total Depreciation-Construction Equipment

TOTAL ASSETS

75.000

80.000

$

$

$

60.000

130.000

75.000

$

$

$

$

85.000

145.000

60.000

710.000

(35.000)

290.000

20.000

365.000

675.000

(120.000)

20.000

365.000

$

$

675.000

290.000

$

$

290.000

265.000

$

$

555.000

$

$

$

$

$

$

$

30.000

15.000

45.000

45.000

$

$

$

87.500

87.500

87.500

Debit

$

$

$

Credit

230.000

230.000

12/30/X3

$

$

Total Depreciation-Building

3

Date

Total Construction Equipment

2

Debit

230.000

$

$

30.000

30.000

(30.000)

$

$

75.000

75.000

(75.000)

12/30/X3

$

$

$ 102.500

PRITA HERDIANTI | 25013049

Tugas Rekayasa Biaya, CPM Construction Company Accounting

LIABILITY + OWNER'S EQUITY

No.

1

Account

Account payable-Trade

Date

1/2/X3

2/4/X3

3/4/X3

4/7/X3

6/7/X3

8/16/X3

9/16/X2

12/15/X3

Total Account payable-Trade

2

Material expenses

2/4/X3

Total Material expenses

3

Renting construction equipment

4/7/X3

Total Renting construction equipment

4

Labor expenses

7/3/X3

Total Labor expenses

5

Subcontractor expenses

8/16/X3

Total Subcontractor expenses

6

Payroll expenses

12/25/X3

Total Payroll expenses

7

Dividens equity

12/25/X3

Total Dividends equity

8

Depreciation-Building expenses

12/30/X3

Total Depreciation-Building expenses

9

Depreciation-Construction Equipment

expenses

12/30/X3

Total Depreciation-Construction Equipment expenses

10

Revenues

Debit

Credit

80.000

60.000

TOTAL LIABILITY + OWNER'S EQUITY

155.000

80.000

60.000

85.000

$

$

$

$

75.000

85.000

300.000

380.000

(80.000)

$

$

$

80.000

80.000

80.000

$

$

$

60.000

60.000

60.000

$

$

$

130.000

130.000

130.000

$

$

$

85.000

85.000

85.000

$

$

$

145.000

145.000

145.000

$

$

$

60.000

60.000

60.000

$

$

$

30.000

30.000

30.000

75.000

$

$

75.000

75.000

$

$

$

$

320.000

280.000

87.500

687.500

(687.500)

3/8/X3

10/1/X3

12/31/X3

Total Revenues

$

$

$ (102.500)

PRITA HERDIANTI | 25013049

Tugas Rekayasa Biaya, CPM Construction Company Accounting

C. Close Account and Income Statement for 20X3

CPM CONSTRUCTION COMPANY

INCOME STATEMENT

(for the year ended 20X3)

Sales (Revenues)

687.500

Construction (Operating Cost)

1. Material

2. Labors

3. Subcontracts

4. Payroll

Total Construction Cost

$

$

$

$

$

80.000

130.000

85.000

145.000

440.000

Equipment Cost

1. Rent payment

2. Equipment & Building Depreciation

Total Equipment Cost

$

$

$

60.000

105.000

165.000

Total Expenses

605.000

Income

Taxes 50%

$

$

82.500

41.250

Net Income

41.250

Dividend

60.000

Retained Earnings

(18.750)

Expenses:

PRITA HERDIANTI | 25013049

Tugas Rekayasa Biaya, CPM Construction Company Accounting

d. Balance Sheet

CPM CONSTRUCTION COMPANY

BALANCE SHEET

Account

31 Desember 20X2

31 Desember 20X3

ASSETS

Cash

A/R-Trade

A/R-Retention

Buildings

Buildings Depreciation

Equipment

Equipment Depreciation

Costs in excess of billings

Other Assets

TOTAL ASSETS

LIABILITIES

Account Payable

Notes Payable

Long Term Loans

Deferred Taxes

TOTAL LIABILITIES

NET WORTH

Capital Stocks

Retained Earnings

TOTAL NET WORTH

TOTAL LIABILITIES & NET WORTH

175.000

110.000

$

$

$

$

300.000

(150.000)

240.000

(80.000)

$

$

140.000

35.000

20.000

$

$

$

$

$

$

150.000

(30.000)

160.000

(75.000)

537.500

20.000

615.000

937.500

$

$

$

85.000

50.000

100.000

165.000

50.000

100.000

315.000

235.000

$

$

$

$

$

$

$

$

290.000

90.000

380.000

$

$

$

380.000

206.250

586.250

615.000

901.250

PRITA HERDIANTI | 25013049

Anda mungkin juga menyukai

- Sample Cash Flow Construction ProjectsDokumen6 halamanSample Cash Flow Construction ProjectsRoshan de Silva89% (9)

- Managing Successful Projects with PRINCE2 2009 EditionDari EverandManaging Successful Projects with PRINCE2 2009 EditionPenilaian: 4 dari 5 bintang4/5 (3)

- F.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Dokumen12 halamanF.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Carlyn Joy Paculba67% (9)

- The NEC4 Engineering and Construction Contract: A CommentaryDari EverandThe NEC4 Engineering and Construction Contract: A CommentaryBelum ada peringkat

- The New 3D Layout for Oil & Gas Offshore Projects: How to ensure successDari EverandThe New 3D Layout for Oil & Gas Offshore Projects: How to ensure successPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- FAR100 FAR110-oct2007Dokumen9 halamanFAR100 FAR110-oct2007kaitokid77Belum ada peringkat

- Ice Cream Truck Project: Engineering Economy (IE255)Dokumen8 halamanIce Cream Truck Project: Engineering Economy (IE255)Mohammad KashifBelum ada peringkat

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Dokumen10 halamanMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikBelum ada peringkat

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionDari EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- BSBFIM601 Assessment TaskDokumen29 halamanBSBFIM601 Assessment Tasksingh singh50% (4)

- POA Exercise AnswersDokumen90 halamanPOA Exercise AnswersEmily Tan50% (2)

- Property, Plant and Equipment Problems 5-1 (Uy Company)Dokumen14 halamanProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Method of Costing (I)Dokumen8 halamanMethod of Costing (I)anon_672065362Belum ada peringkat

- Contarct CostingDokumen13 halamanContarct CostingBuddhadev NathBelum ada peringkat

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDokumen7 halaman2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- Assignment Problems-Wk 4-Adnan-N0033642335Dokumen8 halamanAssignment Problems-Wk 4-Adnan-N0033642335Mohammad AdnanBelum ada peringkat

- CH 10 Revision 1Dokumen4 halamanCH 10 Revision 1Deeb. DeebBelum ada peringkat

- P Project FinanceDokumen31 halamanP Project FinanceShady Ahmed MohammedBelum ada peringkat

- FII - Assignment 3 y 4Dokumen8 halamanFII - Assignment 3 y 4AdamBelum ada peringkat

- Ice Cream Churner: Released By: The Development Commissioner (SSI), Ministry of SSI, New DelhiDokumen9 halamanIce Cream Churner: Released By: The Development Commissioner (SSI), Ministry of SSI, New DelhiBunty RathoreBelum ada peringkat

- ch03 Part6Dokumen6 halamanch03 Part6Sergio HoffmanBelum ada peringkat

- LTCC AnswerDokumen4 halamanLTCC AnswerRhina MagnawaBelum ada peringkat

- Chapter 5Dokumen20 halamanChapter 5Clyette Anne Flores Borja100% (1)

- Asiagate PaymentsDokumen11 halamanAsiagate PaymentsHoven MacasinagBelum ada peringkat

- CES271 Chapter 5Dokumen34 halamanCES271 Chapter 5Aya mohamedBelum ada peringkat

- Terrace CostsDokumen2 halamanTerrace CostsMichelle PaninopoulosBelum ada peringkat

- December 2010 TC6ADokumen7 halamanDecember 2010 TC6AAhmed Raza MirBelum ada peringkat

- Materi Kuliah Crash ProgramDokumen14 halamanMateri Kuliah Crash ProgramImam Syafi'iBelum ada peringkat

- 25-Wood and Steel AlmirahDokumen7 halaman25-Wood and Steel AlmirahGlobal Law FirmBelum ada peringkat

- ACC20020 Management - Accounting Exam - 16-17Dokumen12 halamanACC20020 Management - Accounting Exam - 16-17Anonymous qRU8qVBelum ada peringkat

- Tendering Assignment Qs 37Dokumen51 halamanTendering Assignment Qs 37Prasad RajapakshaBelum ada peringkat

- Activity Based Costing - SolutionDokumen19 halamanActivity Based Costing - Solutionsyedsajid1990Belum ada peringkat

- Construction IllustrationDokumen54 halamanConstruction IllustrationCatherine Joy Vasaya100% (3)

- Topic7A Capital Allowances Solutions 2021Dokumen8 halamanTopic7A Capital Allowances Solutions 2021HA Research ConsultancyBelum ada peringkat

- Page 1 Of5 University of Swaziland Department of Accounting Supplementary Exam Paper - Semester - IIDokumen5 halamanPage 1 Of5 University of Swaziland Department of Accounting Supplementary Exam Paper - Semester - IIThuli MagagulaBelum ada peringkat

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Dokumen18 halamanFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- Project CrashingDokumen20 halamanProject CrashingTatianna GroveBelum ada peringkat

- Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFDokumen6 halamanLecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFjasminetsoBelum ada peringkat

- CH 4.7-Project Financial Analysis - CH 5Dokumen41 halamanCH 4.7-Project Financial Analysis - CH 5yemsrachhailu8Belum ada peringkat

- Ekonomi Answer FinalDokumen18 halamanEkonomi Answer FinalChristine TeohBelum ada peringkat

- Chapter 5 Financial Study (Part1) : A. Major AssumptionsDokumen9 halamanChapter 5 Financial Study (Part1) : A. Major AssumptionsAnne XxBelum ada peringkat

- Lec - 4Dokumen48 halamanLec - 4Tamene TayeBelum ada peringkat

- Quantity Surveying Programme Universiti Teknologi Mara Perak Professional Practice Ii QSD389 Assignment 1Dokumen6 halamanQuantity Surveying Programme Universiti Teknologi Mara Perak Professional Practice Ii QSD389 Assignment 1Rahim GenesisBelum ada peringkat

- Skylight ComparisonDokumen362 halamanSkylight ComparisonmarklesterBelum ada peringkat

- Acctg For Special Transaction - 3rd Lesson PDFDokumen9 halamanAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaBelum ada peringkat

- Mini-Case 1 Ppe AnswerDokumen11 halamanMini-Case 1 Ppe Answeryu choong100% (2)

- Contract CostingDokumen4 halamanContract CostingAr Niloy100% (1)

- 5 LT CONSTRUCTION CONTRACT HandoutDokumen2 halaman5 LT CONSTRUCTION CONTRACT HandoutDJAN IHIAZEL DELA CUADRABelum ada peringkat

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDokumen139 halamanAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFbeenie manBelum ada peringkat

- Fee Proposal 02072018 r1Dokumen4 halamanFee Proposal 02072018 r1Sasiram RajasekaranBelum ada peringkat

- BDAW2103Dokumen13 halamanBDAW2103zenden92Belum ada peringkat

- Accounts Assignment 2Dokumen12 halamanAccounts Assignment 2shoaiba167% (3)

- Suggested Answers (Chapter 3)Dokumen8 halamanSuggested Answers (Chapter 3)kokomama231Belum ada peringkat

- Accounting For Non-Current AssetDokumen30 halamanAccounting For Non-Current AssetSeruan Kedamaian100% (1)

- Chapter 10Dokumen89 halamanChapter 10kazimkoroglu100% (1)

- Code of Practice for Project Management for Construction and DevelopmentDari EverandCode of Practice for Project Management for Construction and DevelopmentBelum ada peringkat

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryDari EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryBelum ada peringkat

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesDari EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionBelum ada peringkat

- Simple and Compound InterestDokumen26 halamanSimple and Compound InterestCarlos Cary Colon100% (7)

- WING Investor Presentation IR Website 2018 WingstopDokumen37 halamanWING Investor Presentation IR Website 2018 WingstopAla BasterBelum ada peringkat

- Asset Disposal & Statement of Cash FlowsDokumen3 halamanAsset Disposal & Statement of Cash FlowsShoniqua JohnsonBelum ada peringkat

- Chap 001Dokumen19 halamanChap 001WilliamBelum ada peringkat

- DEBIT and CREDIT Accounting Part 6Dokumen4 halamanDEBIT and CREDIT Accounting Part 6Kim Yessamin MadarcosBelum ada peringkat

- Wells Technical InstituteDokumen24 halamanWells Technical Institutelaale dijaanBelum ada peringkat

- Cfas ReviewerDokumen10 halamanCfas ReviewerMarian grace DivinoBelum ada peringkat

- 08 Social Ncert History Ch03 Ruling The Countryside QuesDokumen4 halaman08 Social Ncert History Ch03 Ruling The Countryside QuesTTP GamerBelum ada peringkat

- Financial Statement of JS Bank: Submitted ToDokumen22 halamanFinancial Statement of JS Bank: Submitted ToAtia KhalidBelum ada peringkat

- AFM AssignmentDokumen3 halamanAFM AssignmentAin NsrBelum ada peringkat

- Workers' Welfare Fund Ordinance, 1971Dokumen13 halamanWorkers' Welfare Fund Ordinance, 1971ismailBelum ada peringkat

- Itad Bir Ruling No. 044-21Dokumen9 halamanItad Bir Ruling No. 044-21Crizedhen VardeleonBelum ada peringkat

- Supply Chain SegmentationDokumen12 halamanSupply Chain Segmentationchokx008100% (1)

- Business Registration and LicensingDokumen30 halamanBusiness Registration and LicensingRheneir MoraBelum ada peringkat

- Estate and Donor RulingsDokumen27 halamanEstate and Donor Rulingscmv mendozaBelum ada peringkat

- 11 16 18 10 06 705Dokumen2 halaman11 16 18 10 06 705Finance - SnackerStreetBelum ada peringkat

- Shell Pakistan Limited Financial Statements For The Year Ended December 31, 2010Dokumen60 halamanShell Pakistan Limited Financial Statements For The Year Ended December 31, 2010popatiaBelum ada peringkat

- Philippine National Bank vs. Court of Appeals G.R. No. 97995 - January 21, 1993 FactsDokumen5 halamanPhilippine National Bank vs. Court of Appeals G.R. No. 97995 - January 21, 1993 FactsPatricia SanchezBelum ada peringkat

- Techbid - Botteling Plant PLCDokumen385 halamanTechbid - Botteling Plant PLCAmitBelum ada peringkat

- 4.1 Debt and Equity FinancingDokumen13 halaman4.1 Debt and Equity FinancingAliza UrtalBelum ada peringkat

- Exam 1 F08 A430-530 With SolutionDokumen13 halamanExam 1 F08 A430-530 With Solutionkrstn_hghtwrBelum ada peringkat

- M07 Heiz5577 01 Se C07SDokumen12 halamanM07 Heiz5577 01 Se C07SsebastianBelum ada peringkat

- MGT3580: Global Enterprise Management (Simulation Questions)Dokumen3 halamanMGT3580: Global Enterprise Management (Simulation Questions)Chan JohnBelum ada peringkat

- Analysis of HCLDokumen34 halamanAnalysis of HCLRidhima KalraBelum ada peringkat

- Application For Property Tax Reduction For 2017: L L L L L LDokumen1 halamanApplication For Property Tax Reduction For 2017: L L L L L LO'Connor AssociateBelum ada peringkat

- CPAR Tax On Estates and Trusts (Batch 92) - HandoutDokumen10 halamanCPAR Tax On Estates and Trusts (Batch 92) - HandoutNikkoBelum ada peringkat

- FSA - Tutorial 6-Fall 2021Dokumen5 halamanFSA - Tutorial 6-Fall 2021Ging freexBelum ada peringkat

- Dumaguete Cathedral Credit Cooperative VDokumen7 halamanDumaguete Cathedral Credit Cooperative VJihan LlamesBelum ada peringkat

- Agriculture Economics NotesDokumen133 halamanAgriculture Economics NotesGary BhullarBelum ada peringkat