Jeevan Ananya

Diunggah oleh

Soumyajit RoyHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Jeevan Ananya

Diunggah oleh

Soumyajit RoyHak Cipta:

Format Tersedia

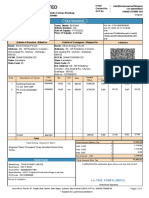

2045

2046

Kalol

2047

500000

1000000

6250

148250

58

500000

Mukherjee

57

1000000

6500

154750

59

500000

1000000

6750

161500

60

500000

1000000

6500

168000

2049

61FLAT, KALKAJI

500000

C - 142, DDA

2050

NEW DELHI62

- 110019 500000

1000000

7000

175000

1000000

6750

181750

2051

63

500000

1000000

MOB :- 9953108123,

9899115602

2052

64

500000

1000000

E-MAIL :- kmkmukherjee@gmail.com

7000

188750

7000

195750

2053

65

500000

1000000

7000

202750

2054

66

500000

1000000

7000

209750

2055

67

500000

1000000

7000

216750

2056

68

500000

1000000

7000

223750

2057

69

500000

1000000

:

0 18 Years 0

7000

: Yearly237750

Premium0Payable7000

230750

0: Rs.0

0

500000

500000

0

Rider Premiums

500000

0

0

Total Premium

INSURANCE ADVISOR

2048

Sum

Proposed

2058

70

: Rs.500000

500000

2059Premium

71

Basic

500000

: Rs.29999

A Proposal Jeevan Anand for you

0

Jeevan Anand

Premium Payable

For

500000

0

2060

72

2061

73

500000

500000

2062

74

500000

500000

Sec.80

Inv. Limit

: Rs.100000

2063 CCE 75

500000

500000

7000

244750

: Rs. 29999

7000

251750

6750

. . . . a0 life free0 of worries

258500

6750

265250

Sec.80

CCE Tax

: 30.90%

0

0 Rebate6500

271750

2064

76

500000

500000

6500

278250

2065

77

500000

500000

6250

284500

2066

78

500000

500000

6250

290750

2067

79

500000

500000

6250

297000

2068

80

500000

500000

5750

302750

2069

81

500000

500000

24/12/2011

5750

308500

2070

82

Year

Age

Risk Cover

500000

500000

Insurance

Facts

0

0

0

Annual

0

Premium

Tax

0

Saved

Nett

0

Premium

Returns

0

From L.I.C.

New Loan

Loan

5750 Total

314250

Available Available

Normal

Accident

Illustration

customized

for Mr. Ananya

Aged 23

2071

83 specially

500000

500000

0

0 Years. 0

0

5500

319750

2011

23

520500

1020500

29999

9270

20729

0

0

0

2072

84

500000

500000

0

0

0

0

5250

Jeevan Anand is an innovative insurance product from Life Insurance Corporation of India, which 325000

2012

24

543000

1043000

29999

9270

20729

0

0

0

2073

85

500000

500000

0

0

0

0

5000

330000

combines the benefits of an Endowment Policy and a Whole Life Policy.

2013

25

597500

1097500

29999

9270

20729

0

25500

25500

2074

86

500000

500000

0

0

0

0

5000

335000

2014

2075

2015

2076

2016

2077

2017

2078

2018

2079

2019

2080

2020

2081

2021

2082

2022

2083

2023

2084

2024

2085

2025

2086

2026

2087

2027

2088

26

633000

1133000

9270

20729

0

30500

56000

87

500000

0

0 premium paying

0

4750you are

339750

Under this500000

plan you pay

premiums 29999

for a0limited period.

During

the

period

27

669500

29999

9270

20729

0

25000

81000

88

500000

0 and the

0

0

4500

344250

covered to500000

the extent1169500

of the sum assured

bonuses

that 0vest on this policy.

After

the

28

707000

1207000

29999

20729

0 final additional

28750

109750

premium 500000

term is over

the sum assured

together9270

with

89

500000

0

0 accumulated

0 bonuses and

0

4750

349000

bonus (if any)

become

payable to you

free

income

tax.

29

745500

1245500

29999

9270

20729

0

33250

90

500000

500000

0 of any

0

0

0

4250

30

785000

1285000

29999

9270

20729

0

38250

91

500000

500000

0

0

0

0

4500

The highlight

of this plan

is that even

after

the maturity

of 20729

the policy

the coverage

on43750

your

31

825500

1325500

29999

9270

0

92

500000

500000

0

0

0

0

4500 life

continues500000

for your lifetime

to the extent

of the sum

assured20729

without

the payment

of any

further

32

867000

1367000

29999

9270

0

46000

93

500000

0

0

0

0

4750

143000

353250

181250

357750

33

94

34

95

500000

953000

500000

1409500

500000

1453000

500000

29999

0

29999

0

9270

0

9270

0

20729

0

20729

0

0

0

0

0

52000

5750

59750

5000

323000

372750

382750

377750

35

96

36

97

997500

500000

1043000

500000

1099500

500000

1497500

500000

1543000

500000

29999

0

29999

0

9270

0

9270

0

20729

0

20729

0

0

0

0

0

68500

9750

78750

9500

451250

387500

530000

397000

1599500

500000

1649500

500000

29999

0

29999

0

9270

0

9270

0

20729

0

20729

0

0

0

0

0

625500

419000

734500

434500

29999

0

9270

0

20729

0

20729

373122

0

0

0

0

1254500

1254500

95500

22000

109000

15500

124500

0

premiums.

909500

37

98

38

99

1149500

500000

General Terms

39

1200500

100

500000

of this Plan

2029

1700500

500000

40Minimum

1252500

1752500

Age At Entry

41

500000

1000000

2030

42

2031

43Maximum

500000

1000000

Premium

2032

44Ceasing500000

Age

1000000

2033

45

1000000

2028

2034

2035

Maximum

Age At 1000000

Entry

500000

500000

Paying Term

46Premium

500000

1000000

2036

47Minimum

500000

1000000

Sum Assured

48

500000

1000000

2037

29999

9270

18

years completed

539982

0

166860

0

65 years

Birthday)

0 (Age Nearer

0

0

225000

362250

271000

367000

141750

859000

0

1000750

64250

64250

4000

68250

4250

72500

4250

76750

4500

81250

4750

86000

90750

75 years (Age Nearer Birthday)

5 years

0 to 57 years

0

0

Rs. 1,00,000

4750

5000

95750

Sum Assured

49Maximum

500000

1000000

No Limit

0

5250

101000

2038

50

500000

1000000

5500

106500

2039

51

500000

1000000

2040

52

500000

1000000

Exclusively available upto Rs.5,00,000 during the Premium

0

0 age 70. No0additional

5500

paying0 term and thereafter

upto

premium112000

0

0

0

0

5750

117750

is required to be paid

2041

53

500000

1000000

4750

122500

7000

129500

Double Accident Benefit

2042

54Loans 500000

2043

55

500000

1000000

6250

135750

2044

56

500000

1000000

6250

142000

1000000

Available

of 3 full

0 after payment

0

0 years premiums

0

Anda mungkin juga menyukai

- Wbjee 2009 Paper With SolutionsDokumen53 halamanWbjee 2009 Paper With SolutionsMichelle RobertsBelum ada peringkat

- Rel Debt 13Dokumen28 halamanRel Debt 13Soumyajit RoyBelum ada peringkat

- HDFC DebtDokumen82 halamanHDFC DebtSoumyajit RoyBelum ada peringkat

- 3 Series Product BrochureDokumen10 halaman3 Series Product BrochureSoumyajit RoyBelum ada peringkat

- Media CabinetDokumen1 halamanMedia CabinetSoumyajit RoyBelum ada peringkat

- Travel To LakshadweepDokumen6 halamanTravel To LakshadweepSoumyajit RoyBelum ada peringkat

- Modular KitchenDokumen1 halamanModular KitchenSoumyajit RoyBelum ada peringkat

- Rich Text Editor FileDokumen1 halamanRich Text Editor FileSoumyajit RoyBelum ada peringkat

- Atoms SemiconDokumen11 halamanAtoms SemiconSoumyajit RoyBelum ada peringkat

- TVunit HandmadeDokumen1 halamanTVunit HandmadeSoumyajit RoyBelum ada peringkat

- Permutation and Combinations ProblemsDokumen9 halamanPermutation and Combinations ProblemsSoumyajit RoyBelum ada peringkat

- Receipt of House RentDokumen1 halamanReceipt of House RentSoumyajit RoyBelum ada peringkat

- LSI India House Deposit ApplicationDokumen1 halamanLSI India House Deposit ApplicationSoumyajit RoyBelum ada peringkat

- Wedding ReceptionDokumen1 halamanWedding ReceptionSoumyajit RoyBelum ada peringkat

- Rich Text Editor FileDokumen1 halamanRich Text Editor FileSoumyajit RoyBelum ada peringkat

- Subhojit Banerjee Final CVDokumen6 halamanSubhojit Banerjee Final CVSoumyajit RoyBelum ada peringkat

- SumonDokumen2 halamanSumonSoumyajit RoyBelum ada peringkat

- Example 1Dokumen2 halamanExample 1Soumyajit RoyBelum ada peringkat

- Particle Dynamics-Quest AnswerDokumen1 halamanParticle Dynamics-Quest AnswerSoumyajit RoyBelum ada peringkat

- Atanu Haldar PrescriptionDokumen1 halamanAtanu Haldar PrescriptionSoumyajit RoyBelum ada peringkat

- New FileDokumen1 halamanNew FileSoumyajit RoyBelum ada peringkat

- AHB RCV TX OperationsDokumen2 halamanAHB RCV TX OperationsSoumyajit RoyBelum ada peringkat

- Template-Physics+Math Syllabi UploadedDokumen29 halamanTemplate-Physics+Math Syllabi UploadedSoumyajit RoyBelum ada peringkat

- Classroom Course For IIT-JEE-AIEEE 2014Dokumen2 halamanClassroom Course For IIT-JEE-AIEEE 2014Soumyajit RoyBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 1601 eDokumen3 halaman1601 eJulius Sangalang100% (1)

- Taxable Income and Tax DueDokumen13 halamanTaxable Income and Tax DueSheena Gane Esteves100% (1)

- Fixed Rental Agreement Extension Proposal FOR PRC - 16-FEB-2023Dokumen5 halamanFixed Rental Agreement Extension Proposal FOR PRC - 16-FEB-2023SooranBelum ada peringkat

- Rev SKBPP Forms1 3Dokumen3 halamanRev SKBPP Forms1 3Naka Ng TetengBelum ada peringkat

- 73 153 1 PBDokumen18 halaman73 153 1 PBTataBelum ada peringkat

- PUD Taxes White PaperDokumen9 halamanPUD Taxes White PaperemmettoconnellBelum ada peringkat

- E-Filing of Taxes - A Research PaperDokumen8 halamanE-Filing of Taxes - A Research PaperRieke Savitri Agustin0% (1)

- Application For Lottery Prize ClaimDokumen3 halamanApplication For Lottery Prize ClaimAMit PrasadBelum ada peringkat

- 879 Eltron Energy PVT LTDDokumen1 halaman879 Eltron Energy PVT LTDHaseeb TyzBelum ada peringkat

- Correction of ErrorDokumen1 halamanCorrection of ErrorElmer JuanBelum ada peringkat

- Blowbits Solutions LLP: Tax InvoiceDokumen1 halamanBlowbits Solutions LLP: Tax InvoiceCA Shrikant VaranasiBelum ada peringkat

- 2007 BIR-RR ContentsDokumen5 halaman2007 BIR-RR ContentsMary Grace Caguioa AgasBelum ada peringkat

- InvoicexyDokumen1 halamanInvoicexySiddharth PatelBelum ada peringkat

- Smart Privilege: Key HighlightsDokumen1 halamanSmart Privilege: Key HighlightsYogesh MeenaBelum ada peringkat

- Limitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Dokumen9 halamanLimitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Taxpert Professionals Private LimitedBelum ada peringkat

- Tax PPT - DeductionsDokumen20 halamanTax PPT - Deductionsjayparekh28Belum ada peringkat

- Retirement Notification FormDokumen2 halamanRetirement Notification FormAbongile PhinyanaBelum ada peringkat

- EGE08-21-22-099-NPCI Insulation WorksDokumen2 halamanEGE08-21-22-099-NPCI Insulation WorksSangu GopaBelum ada peringkat

- Income Tax Calculation MemoDokumen3 halamanIncome Tax Calculation Memoajeetpoly100% (3)

- Income and Business TaxationDokumen138 halamanIncome and Business Taxationjustine reine cornico100% (1)

- Commissioner of Internal Revenue v. Nanox Philippines, Inc., G.R. No. 230416, May 5, 2021Dokumen2 halamanCommissioner of Internal Revenue v. Nanox Philippines, Inc., G.R. No. 230416, May 5, 2021Meg PalerBelum ada peringkat

- Cir vs. Dash Engineering Philippines, IncDokumen2 halamanCir vs. Dash Engineering Philippines, InclexxBelum ada peringkat

- Tax Invoice: 1046.17 Total Invoice Amount RsDokumen2 halamanTax Invoice: 1046.17 Total Invoice Amount RsAayush AggarwalBelum ada peringkat

- Inctax 2Dokumen45 halamanInctax 2janeferrarin551Belum ada peringkat

- f1098t 2021Dokumen6 halamanf1098t 2021Batman Arkham Kinght™️Belum ada peringkat

- View CertificateDokumen1 halamanView CertificateGopal PenjarlaBelum ada peringkat

- Royster Company v. United States, 479 F.2d 387, 4th Cir. (1973)Dokumen7 halamanRoyster Company v. United States, 479 F.2d 387, 4th Cir. (1973)Scribd Government DocsBelum ada peringkat

- Tax Invoice: FromDokumen1 halamanTax Invoice: FromGravindra ReddyBelum ada peringkat

- Deposit Interest Certificate 40903908Dokumen2 halamanDeposit Interest Certificate 40903908adityaBelum ada peringkat

- Dec 2010Dokumen1 halamanDec 2010S Kalu SivalingamBelum ada peringkat