Week 1 Update Foundations of Monetary Economics

Diunggah oleh

Izzuddin YussofHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Week 1 Update Foundations of Monetary Economics

Diunggah oleh

Izzuddin YussofHak Cipta:

Format Tersedia

EPPE 6124 Monetary Economics

- Foundations of Monetary Economics -

Main References:

Handa (chapt 1), Walsh (chapt 1), Mishkin (chapt 1)

Norlin Khalid

School of Economics, Faculty of Economics and Management,

Universiti Kebangsaan Malaysia

February 20, 2014

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Why Study Monetary Economics?

Empirical evidence suggest that money plays an important role in

generating business cycles Recessions (unemployment) and

expansions - to study the relationship between money and

business cycle, money and output as well as money and ination.

monetary policy acts as a stabilization policy and not a growth

policy.

study the conduct of an optimal monetary policy

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Money Growth (M2 annual rate) & Business Cycle in

U.S (1950-2011)

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Aggregate Price Level & Money Supply in U.S

(1950-2011)

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Average Ination Rate Vs. Average Rate of Money

Growth for Selected Countries (2000-2010)

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Stylized Facts - Long Run Correlations

The correlation between long run infation and money

growth is almost one across countries

McCandles & Weber (1995) - data 30-year from 110 countries

using several denitions of money - coe of corr varies between

0.92 and 0.96

A change in the growth rate of money induces an equal change in

the rate of price ination

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Stylized Facts - Long Run Correlations

There is no clear long run correlation between ination

and the growth of real output or between money growth

and the growth of real output.

Some nd positive correlations between money growth and

output, ex: McCandless & Weber (1995) for OECD

Some nd no LR correlation between money growth and output

growth, ex: Geweke (1986)

Some nd negative correlation between ination and output, ex:

Barro (1995, 1996)

Results hinge on which countries are used and therefore, long run

eects on output are less robust

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Stylized Facts - Long Run Correlations

The relationship between interest rates, ination and money.

Ination and nominal interest rates in the long run?

Fisher equation: i

t

= r

t

+E

t

t+1

In steady-state, i

ss

= r

ss

+

ss

If real returns are independent of ination, then higher long-run

ination should raise long-run interest rates (roughly conrmed by

empirical analyses, see Mishkin (1992), Moneet & Weber (2001))

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

Why do we Study Monetary Economics

Stylized Facts: Money and Economic Aggregates

Monetary Economics?

Anything that central bankers should be interested in - studies

the formulation of monetary policy, usually by the central bank

or the monetary authority, supply of money and interest rates -

what is actually done and what would be optimal.

It investigates the relationship between real economic variables at

the aggregate level and nominal variables - has considerable

overlap with macroeconomics.

It focuses on the monetary and other nancial markets, the

determination of the interest rate, the extent to which these

inuence the behavior of the economic units and the implications

of that inuence in the macroeconomic context.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

The concept of Money

Denition of money is a bit tricky - Money is anything that

generally accepted...although with no intrinsic value.

In economics money is dened as an asset (a store of value) which

functions as a generally accepted medium of exchange, i.e., it can

in principle be used directly to buy any good.

Generally accepted mediums of exchange are also called means of

payment. So money is characterized by being a fully liquid asset -

Thus, an assets liquidity is the ease with which the asset can be

converted into money or be used directly for making payments.

M1 -dened as currency in circulation + demand deposits held by

the non-bank public in commercial banks. Thus M1 embraces all

in practice fully liquid assets in the hands of the non-bank public.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

Historical Remark

1

Commodity Money

such as seashells, rice, cocoa and metals are used as money

comodities that were easily divisible, handy to carry, immutable

and involved low costs of storage and transportation

2

Paper Money

has became a more ecient way to trade - coins and notes in

circulation with little or no intrinsic value

regulation by a central authority

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

Functions of Money

Money is dened in terms of the functions that it performs.

The traditional specication of these functions is:

1

Medium of exchange/payments.

2

Store of value.

3

Standard of deferred payments.

4

Unit of account.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

Money Supply

The money supply is the total amount of money available in an

economy at a particular point in time (a stock).

Monetary aggregates:

1

M

0

i.e, monetary base -sometimes called high powered money.

2

M

1

i.e, dened as currency in circulation plus demand deposits

held by the non-bank public in commercial banks.

3

M

2

= M

1

plus savings deposits with unrestricted access and small-

denomination time deposits. These claims may not be instantly

liquid.

4

M

3

= M

2

plus large-denomination time-deposits

Notice that, denition of money have not become standardized,

so that their denitions remain country specic.

As we move down the list, the liquidity of the added assets

decrease, while their interest yield increases.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

Money Demand

In macroeconomics the demand for money is considered as part

of a portfolio allocation problem about how economic agents

allocate their nancial wealth among the dierent existing assets,

including money.

The portfolio decision involves a balance of considerations of

expected rate of return after tax, risk, and liquidity.

The incorporation of a micro-founded money demand in

macromodels is often based on one or another kind of short-cut:

1

The cash-in-advance constraint

2

The shopping-costs approach

3

The money-in-the-utility function approach.

4

The money-in-the-production-function approach.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Monetary Economics

The Concept of Money

What is money and what does it do?

Money Market

Money Market

Money market is meant an abstract market place (not a

physical location) where at any particular moment the aggregate

demand for money meets the aggregate supply of money.

Aggregate demand for real money balances can be approximated

by the function L(Y, i ), where L

Y

> 0 and L

i

< 0

Let the monetary aggregate in focus be M1 and let P be the

general price level in the economy (say the GDP deator)

Then money market equilibrium is:

M = PL(Y, i )

that is, the available amount of money equals nominal money

demand.

Norlin Khalid EPPE 6124 Monetary Economics - Foundations of Monetary Economics -

Anda mungkin juga menyukai

- Production Sharing AgreementsDokumen106 halamanProduction Sharing AgreementsAl Hafiz Ibn HamzahBelum ada peringkat

- The Supply of MoneyDokumen6 halamanThe Supply of MoneyRobertKimtaiBelum ada peringkat

- Money and BankingDokumen53 halamanMoney and BankingSamruddhi PatilBelum ada peringkat

- ECON 203 Midterm 2012W AncaAlecsandru SolutionDokumen8 halamanECON 203 Midterm 2012W AncaAlecsandru SolutionexamkillerBelum ada peringkat

- Keynes Demand For MoneyDokumen9 halamanKeynes Demand For MoneyAppan Kandala Vasudevachary100% (1)

- The Role of Banks, Non-Banks and The Central Bank in The Money Creation ProcessDokumen21 halamanThe Role of Banks, Non-Banks and The Central Bank in The Money Creation Processwm100% (1)

- Money Demand and SupplyDokumen22 halamanMoney Demand and SupplyHarsh Shah100% (1)

- Principle of Economics Consolidated Assignements-2 - 10th February 22Dokumen27 halamanPrinciple of Economics Consolidated Assignements-2 - 10th February 22Mani Bhushan SinghBelum ada peringkat

- Al-Halal Wal Haram Fil IslamDokumen380 halamanAl-Halal Wal Haram Fil IslamIzzuddin Yussof0% (1)

- Money Theories, Money and Monetary PolicyDokumen33 halamanMoney Theories, Money and Monetary PolicyFhremond ApoleBelum ada peringkat

- Money and Banking 2009 SpringDokumen117 halamanMoney and Banking 2009 SpringborchaliBelum ada peringkat

- Monetary EconomicsDokumen71 halamanMonetary Economicssweet haniaBelum ada peringkat

- Lecture One - IntroductionDokumen11 halamanLecture One - IntroductionKelvin OrongeBelum ada peringkat

- Unit5 MoneyDokumen34 halamanUnit5 Moneytempacc9322Belum ada peringkat

- 5.2 Macroeconomics - Unit V - Lecture 2Dokumen2 halaman5.2 Macroeconomics - Unit V - Lecture 2Dyuti SinhaBelum ada peringkat

- Demand of Money: A Presentation by Sahil MirDokumen14 halamanDemand of Money: A Presentation by Sahil MirSahil MirBelum ada peringkat

- Micro Economics Final PresentationDokumen36 halamanMicro Economics Final PresentationFrank Joe MojicaBelum ada peringkat

- Supply and Demand For Money 1Dokumen25 halamanSupply and Demand For Money 1Diana AcostaBelum ada peringkat

- Money and Banking Class 12 NotesDokumen19 halamanMoney and Banking Class 12 Notesananthanmb11Belum ada peringkat

- What Is Money Supply Process?Dokumen4 halamanWhat Is Money Supply Process?imehmood88Belum ada peringkat

- Money Lecture 1 2020Dokumen40 halamanMoney Lecture 1 2020vusal.abdullaev17Belum ada peringkat

- Ecn 102 by WestminsterDokumen7 halamanEcn 102 by WestminsterTriggersingerBelum ada peringkat

- Group 3 Money Banking and Monetary PolicyDokumen46 halamanGroup 3 Money Banking and Monetary PolicyjustinedeguzmanBelum ada peringkat

- Money Growth and Inflation LessonDokumen27 halamanMoney Growth and Inflation Lessonlarasetiari123Belum ada peringkat

- Lecture 4Dokumen48 halamanLecture 4skye080Belum ada peringkat

- Term Paper ON Analysis of Monetary Policy and Commercial Banks of IndiaDokumen19 halamanTerm Paper ON Analysis of Monetary Policy and Commercial Banks of IndiaHemlatas RangoliBelum ada peringkat

- Exercise 10: Monetary Policy: M1 Vs M2Dokumen3 halamanExercise 10: Monetary Policy: M1 Vs M2Kenon Joseph HinanayBelum ada peringkat

- Money and Credit 4 PDFDokumen44 halamanMoney and Credit 4 PDFDan CeresauBelum ada peringkat

- ECO 299: Money and Financial Institutions: Topic: Supply of MoneyDokumen13 halamanECO 299: Money and Financial Institutions: Topic: Supply of MoneyEmmanuel IbiwoyeBelum ada peringkat

- Measuring The Quality of MoneyDokumen37 halamanMeasuring The Quality of MoneyAndré M. TrottaBelum ada peringkat

- RESUMENES Keynes y La Creación Del DineroDokumen14 halamanRESUMENES Keynes y La Creación Del DineroJavi TolentinoBelum ada peringkat

- Money and Monetary Policy: Md. Shawkat Ali Professor Department of EconomicsDokumen23 halamanMoney and Monetary Policy: Md. Shawkat Ali Professor Department of EconomicsEverything What U WantBelum ada peringkat

- MIT14 02F09 Lec10Dokumen27 halamanMIT14 02F09 Lec10mkmusaBelum ada peringkat

- Financial Markets: ECON 2123: MacroeconomicsDokumen40 halamanFinancial Markets: ECON 2123: MacroeconomicskatecwsBelum ada peringkat

- Monetary System: DR Sowmya SDokumen61 halamanMonetary System: DR Sowmya Svasu pradeepBelum ada peringkat

- 4 Week GEHon Economics IInd Semeter Introductory MacroeconomicsDokumen14 halaman4 Week GEHon Economics IInd Semeter Introductory Macroeconomicskasturisahoo20Belum ada peringkat

- Group 6 Money Growth & InflationDokumen27 halamanGroup 6 Money Growth & Inflationlarasetiari123Belum ada peringkat

- Module On Monetary EconomicsDokumen210 halamanModule On Monetary EconomicsBidemi Adekunle OkunadeBelum ada peringkat

- International MacroeconomicDokumen63 halamanInternational MacroeconomicShu YuBelum ada peringkat

- Impact of Macroeconomic Factors On Money SupplyDokumen30 halamanImpact of Macroeconomic Factors On Money Supplyshrekdj88% (8)

- Module Lesson 13Dokumen7 halamanModule Lesson 13Jonalyn BanaresBelum ada peringkat

- Financial MarketDokumen14 halamanFinancial MarketFel Salazar JapsBelum ada peringkat

- Money Demand (1) - 1Dokumen9 halamanMoney Demand (1) - 1kritikachhapoliaBelum ada peringkat

- ECB 301 Money, Banking and Finance Previous Year QuestionsDokumen44 halamanECB 301 Money, Banking and Finance Previous Year Questionshashtagsonam04Belum ada peringkat

- Demand and Supply of MoneyDokumen55 halamanDemand and Supply of MoneyMayurRawoolBelum ada peringkat

- FinanceDokumen9 halamanFinanceck124881Belum ada peringkat

- Demand and Supply of MoneyDokumen55 halamanDemand and Supply of MoneyKaran Desai100% (1)

- Research Paper On Theory of Money by Grilling DeveleporsDokumen14 halamanResearch Paper On Theory of Money by Grilling DeveleporsSIMRANJEET KAURBelum ada peringkat

- Rate of InterestpptDokumen14 halamanRate of InterestpptAppan Kandala VasudevacharyBelum ada peringkat

- Lecture (Monetary Theory & Policy)Dokumen12 halamanLecture (Monetary Theory & Policy)simraBelum ada peringkat

- Review of The Previous LectureDokumen17 halamanReview of The Previous LectureMuhammad Usman AshrafBelum ada peringkat

- Chapter 3 (Unit 1)Dokumen21 halamanChapter 3 (Unit 1)GiriBelum ada peringkat

- Economic Project On MoneyDokumen14 halamanEconomic Project On MoneyAshutosh RathiBelum ada peringkat

- Unit 2 - The Demand For MoneyDokumen31 halamanUnit 2 - The Demand For Moneyrichard kapimpaBelum ada peringkat

- Chapter 1: MoneyDokumen46 halamanChapter 1: MoneyFrozt ChrisBelum ada peringkat

- CH07 Money and Prices OnlineDokumen45 halamanCH07 Money and Prices OnlineNickBelum ada peringkat

- Reviewer in MonetaryDokumen3 halamanReviewer in MonetaryBaby Lyca ManaloBelum ada peringkat

- ANALYSIS of Monetary Policy & Commercial Banks of IndiaDokumen19 halamanANALYSIS of Monetary Policy & Commercial Banks of IndiasumancallsBelum ada peringkat

- Unit 4 MoneyDokumen39 halamanUnit 4 MoneyTARAL PATELBelum ada peringkat

- Money ManagementDokumen20 halamanMoney ManagementXen XeonBelum ada peringkat

- Pakis EcoDokumen17 halamanPakis EcoSuniel ChhetriBelum ada peringkat

- Dem LSCM Eco 2022 Session 16 & 17Dokumen79 halamanDem LSCM Eco 2022 Session 16 & 17Vanshaj SrivastavaBelum ada peringkat

- AEC 501 Question BankDokumen15 halamanAEC 501 Question BankAnanda PreethiBelum ada peringkat

- Demand For MoneyDokumen6 halamanDemand For MoneySarvesh KulkarniBelum ada peringkat

- The Monetary System: Analysis and New Approaches to RegulationDari EverandThe Monetary System: Analysis and New Approaches to RegulationBelum ada peringkat

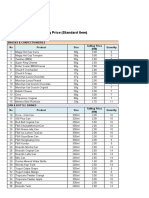

- Product Price List (Standard Item)Dokumen1 halamanProduct Price List (Standard Item)Izzuddin YussofBelum ada peringkat

- GST in MalaysiaDokumen15 halamanGST in MalaysiaIzzuddin YussofBelum ada peringkat

- BQDokumen2 halamanBQIzzuddin YussofBelum ada peringkat

- Joomla1.5 Installation Manual Version 0.5Dokumen52 halamanJoomla1.5 Installation Manual Version 0.5Ivan_Obillos_5435Belum ada peringkat

- Bbasyllabus 2015-16Dokumen55 halamanBbasyllabus 2015-16Shuvo HasanBelum ada peringkat

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesDokumen4 halamanWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Practicetest Macro17Dokumen5 halamanPracticetest Macro17Anonymous 7CxwuBUJz3Belum ada peringkat

- 1973 Oil CrisisDokumen2 halaman1973 Oil CrisisMinahill AkramBelum ada peringkat

- Macro Formula SheetDokumen3 halamanMacro Formula SheetWin NguyenBelum ada peringkat

- BCOMSCM Economics 1 PDFDokumen219 halamanBCOMSCM Economics 1 PDFShahista MahomedBelum ada peringkat

- Group 2 - Fiscal PolicyDokumen24 halamanGroup 2 - Fiscal PolicyJune MadriagaBelum ada peringkat

- FIN-444 Assignment-1: Submitted ToDokumen9 halamanFIN-444 Assignment-1: Submitted ToMehrab Jami Aumit 1812818630Belum ada peringkat

- IKEA Case Study 2Dokumen10 halamanIKEA Case Study 2sardar hussainBelum ada peringkat

- Say's Law: Modern InterpretationsDokumen8 halamanSay's Law: Modern InterpretationsVanya GuptaBelum ada peringkat

- UntitledDokumen196 halamanUntitledAbdilalaziz29 AhnadBelum ada peringkat

- ECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Dokumen56 halamanECON+2105+exam +3+study+guide Chapters+6-8 Exam+date+04152015Likhit NayakBelum ada peringkat

- Monetarism - WikipediaDokumen33 halamanMonetarism - WikipediaEdmund GrahlBelum ada peringkat

- Ekonomi Global: Willem A. Makaliwe (Lembaga Management FEBUI) 2021Dokumen14 halamanEkonomi Global: Willem A. Makaliwe (Lembaga Management FEBUI) 2021Irma SuryaniBelum ada peringkat

- Mock Test 19 Paper 1 - EngDokumen12 halamanMock Test 19 Paper 1 - Enghiu chingBelum ada peringkat

- Interest RatesDokumen48 halamanInterest RatesSakshi SharmaBelum ada peringkat

- 9 TH Eco Paper 2Dokumen4 halaman9 TH Eco Paper 2Zainab DurraniBelum ada peringkat

- Financial Structure of Nigerian EconomyDokumen27 halamanFinancial Structure of Nigerian EconomyDamilare O OlawaleBelum ada peringkat

- Pakistan - JPM ResearchDokumen11 halamanPakistan - JPM ResearchNadeem MalikBelum ada peringkat

- (New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFDokumen331 halaman(New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFioannaBelum ada peringkat

- Why Is Balance of Payment (BOP) Vital For A CountryDokumen2 halamanWhy Is Balance of Payment (BOP) Vital For A Countryshibashish PandaBelum ada peringkat

- 8 Key Factors That Affect Foreign Exchange RatesDokumen2 halaman8 Key Factors That Affect Foreign Exchange RatesdhitalkhushiBelum ada peringkat

- Productivity, Output, and EmploymentDokumen57 halamanProductivity, Output, and EmploymentMinerva EducationBelum ada peringkat

- BMAK Lectures III Part4Dokumen51 halamanBMAK Lectures III Part4theodoreBelum ada peringkat

- Guided Notes #2 Great DepressionDokumen1 halamanGuided Notes #2 Great DepressionGiovanni BurkeBelum ada peringkat

- Diskusi 6 Inggris NiagaDokumen2 halamanDiskusi 6 Inggris Niagakevin culesBelum ada peringkat

- International Monetary FundDokumen12 halamanInternational Monetary FundzakariaBelum ada peringkat