AlphaGrowth Annual Report 2013

Diunggah oleh

Fariz FdzHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AlphaGrowth Annual Report 2013

Diunggah oleh

Fariz FdzHak Cipta:

Format Tersedia

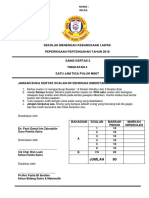

PUBLIC ISLAMIC

ALPHA-40 GROWTH

FUND

ANNUAL REPORT 2013

for the financial year ended 30 November 2013

Public Islamic Alpha-40 Growth Fund 1

Contents

Fund Information 2

Fund Performance 3

Managers Report 6

Trustees Report 14

Shariah Advisers Report 15

Statement By Manager 16

Independent Auditors Report 17

Statement Of Assets And Liabilities 19

Statement Of Income And Expenditure 20

Statement Of Changes In Net Asset Value 21

Statement Of Cash Flows 22

Notes To The Financial Statements 23

Corporate Information 40

Directors And Senior Management 42

Network Of Public Mutual Branch Ofces 47

Network Of Public Mutual Agency Ofces 49

2 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 3

Fund Information Fund Performance

For the Financial Year Ended 30 November 2013

( )

Fund Name

Public Islamic Alpha-40 Growth Fund (PIA40GF)

Fund Type

Capital Growth

Fund Category

Equity Fund (Shariah-compliant)

Fund Investment Objective

To achieve capital growth by investing in stocks which comply with Shariah

requirements.

Fund Performance Benchmark

The benchmarks of the Fund and their respective percentages are 75% FTSE

Bursa Malaysia EMAS Shariah Index (FBMS), 15% customised index by S&P

Opco, LLC based on Top 100 constituents by market capitalisation of the

S&P Shariah BMI Asia Ex-Japan Index and 10% 3-Month Islamic Interbank

Money Market (IIMM) rate.

FTSE, FT-SE and Footsie are trade marks of London Stock Exchange Group companies

and are used by FTSE International Limited (FTSE) under licence. BURSA MALAYSIA is a

trade mark of Bursa Malaysia Berhad (BURSA MALAYSIA).

The FTSE BURSA MALAYSIA EMAS SHARIAH INDEX is calculated by FTSE. All intellectual

property rights in the index values and constituent vests in FTSE and BURSA MALAYSIA. Neither

FTSE nor BURSA MALAYSIA sponsor, endorse or promote this product and are not in any way

connected to it and do not accept any liability. Public Mutual Berhad has obtained full licence from

FTSE to use such intellectual property rights in the creation of this product.

The S&P Shariah BMI Asia Ex-Japan Index (the Index) is the exclusive property of S&P Opco,

LLC, a subsidiary of S&P Dow Jones Indices LLC (S&P Dow Jones Indices) and/or its afliates.

Public Mutual has contracted with S&P Dow Jones Indices to calculate and maintain the Index.

Neither S&P Dow Jones Indices nor any of its afliates shall be liable for any errors or omissions

in calculating the Index.

Fund Distribution Policy

Incidental

Breakdown of Unitholdings of PIA40GF as at 30 November 2013

Size of holdings No. of % of No. of units

unitholders unitholders held (million)

5,000 and below 1,084 15.53 4

5,001 to 10,000 1,082 15.50 8

10,001 to 50,000 3,694 52.91 93

50,001 to 500,000 1,099 15.74 130

500,001 and above 22 0.32 36

Total 6,981 100.00 271

Note: Excluding Managers Stock.

Average Total Return for the Following Year Ended

30 November 2013

Average Total

Return of PIA40GF (%)

1 Year 14.12

Annual Total Return for the Financial Years Ended 30 November

Year 2013 2012 2011

PIA40GF (%) 14.12 13.65 0.36*

* The gure shown is for period since Fund commencement (6 December 2010).

The calculation of the above returns is based on computation methods of

Lipper.

Notes:

1. Total return of the Fund is derived by this formulae:

End of Period FYCurrent Year NAV per unit

- 1

End of Period FYPrevious Year NAV per unit

(Adjusted for unit split and distribution paid out for the period)

The above total return of the Fund was sourced from Lipper.

2. Average total return is derived by this formulae:

Total Return

Number of Years Under Review

Other Performance Data for the Past Three Financial Years

Ended 30 November

2013 2012 2011

Unit Prices (MYR)*

Highest NAV per unit for the year 0.3000 0.2861 0.2701

Lowest NAV per unit for the year 0.2600 0.2455 0.2266

Net Asset Value (NAV) and Units in

Circulation (UIC) as at the End of

the Year

Total NAV (MYR000) 77,748 83,781 105,466

UIC (in 000) 271,237 320,121 433,264

NAV per unit (MYR) 0.2866 0.2617 0.2434

Total Return for the Year (%) 14.12 13.65 0.36

Capital growth (%) 12.82 12.45 -0.80

Income (%) 1.15 1.07 1.17

Management Expense Ratio (MER) (%) 1.65 1.61 1.64

Portfolio Turnover Ratio (time) 0.42 0.42 1.28

* All prices quoted are ex-distribution.

Notes: MER is calculated by taking the total management expenses expressed as an annual

percentage of the Funds average net asset value.

Portfolio Turnover Ratio is calculated by taking the average of the total acquisitions and

disposals of the investments in the Fund for the year over the average net asset value of

the Fund calculated on a daily basis.

4 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 5

Distribution and Unit Split

Financial year 2013 2012 2011

Date of distribution 29.11.13 30.11.12 30.11.11

Distribution per unit

Gross (sen) 1.25 1.50 0.75

Net (sen) 1.20 1.50 0.75

Unit split - - -

Impact on NAV Arising from Distribution (Final) for the

Financial Years

2013 2012 2011

Sen Sen Sen

per unit per unit per unit

Net asset value before distribution 29.86 27.67 25.09

Less: Net distribution per unit (1.20) (1.50) (0.75)

Net asset value after distribution 28.66 26.17 24.34

Past performance is not necessarily indicative of future performance and unit

prices and investment returns may go down, as well as up.

Asset Allocation for the Past Three Financial Years

As at 30 November

(Per Cent of Net Asset Value)

2013 2012 2011

% % %

EQUITY SECURITIES

Quoted

Malaysia

Basic Materials 4.0 4.4 2.4

Communications 20.6 27.1 22.6

Consumer, Cyclical 2.1 - -

Consumer, Non-cyclical 14.5 6.0 6.0

Diversied 7.6 10.1 8.8

Energy 10.5 16.5 13.6

Financial 3.1 3.3 2.7

Industrial 7.6 5.7 7.7

Technology - 2.1 1.9

Utilities 11.0 10.8 9.9

81.0 86.0 75.6

Outside Malaysia

Hong Kong

Communications - - 3.9

Energy 1.2 0.6 2.4

1.2 0.6 6.3

Indonesia

Industrial - - 2.1

Asset Allocation for the Past Three Financial Years (contd)

As at 30 November

(Per Cent of Net Asset Value)

2013 2012 2011

% % %

Korea

Basic Materials - 1.8 1.5

Communications - 1.7 1.9

Consumer, Cyclical 1.2 2.1 2.9

Industrial - - 1.7

Technology 1.3 2.3 -

2.5 7.9 8.0

Singapore

Communications 1.4 - -

Diversied - - 0.5

Industrial 1.3 - -

2.7 - 0.5

Taiwan

Technology 1.6 1.3 1.0

Thailand

Communications 0.6 - -

TOTAL QUOTED EQUITY

SECURITIES 89.6 95.8 93.5

COLLECTIVE INVESTMENT

FUNDS

Quoted

Outside Malaysia

Hong Kong

Financial 0.4 - -

TOTAL QUOTED COLLECTIVE

INVESTMENT FUNDS 0.4 - -

MUDHARABAH DEPOSITS WITH

A FINANCIAL INSTITUTION 9.1 4.1 6.1

OTHER ASSETS & LIABILITIES 0.9 0.1 0.4

Fund Performance Fund Performance

For the Financial Year Ended 30 November 2013 For the Financial Year Ended 30 November 2013

6 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 7

Managers Report Managers Report

Overview

This Annual Report covers the nancial year from 1 December 2012 to

30 November 2013.

Public Islamic Alpha-40 Growth Fund (PIA40GF or the Fund) seeks to achieve

capital growth by investing in stocks which comply with Shariah requirements.

For the nancial year under review, the Fund registered a return of +14.12%

as compared to its Benchmarks return of +14.25%. The Funds Shariah-

compliant equity portfolio registered a return of +17.06% while its Islamic

money market portfolio registered a return of +2.94% during the nancial

year under review. A detailed performance attribution analysis is provided

in the sections below.

From its commencement on 6 December 2010 (being the last day of the

initial offer period) to 30 November 2013, the Fund registered a return of

+30.16% and outperformed its Benchmarks return of +24.90% over the

same period. Consequently, it is the opinion of the Manager that the Fund

has met its objective to achieve capital growth by investing in stocks which

comply with Shariah requirements.

Effect of Distribution Reinvestment on Portfolio Exposures

30-Nov-13

Before Distribution After Distribution

Reinvestment* Reinvestment*

Shariah-compliant Equities &

Islamic Derivatives 90.0% 86.4%

Islamic Money Market 10.0% 13.6%

* Assumes full reinvestment.

Change in Portfolio Exposures from 30-Nov-12 to 30-Nov-13

Average

30-Nov-12 30-Nov-13 Change Exposure

Shariah-compliant Equities &

Islamic Derivatives 90.6% 86.4% -4.2% 92.96%

Islamic Money Market 9.4% 13.6% +4.2% 7.04%

Returns Breakdown by Asset Class

Market /

Returns On Benchmark Benchmark Average Attributed

Investments Returns Index Used Exposure Returns

Shariah-

compliant

Equities &

Islamic Equity

Derivatives 17.06% 15.50% Benchmark 92.96% 15.86%

Islamic Money

Market 2.94% 3.09% 1M-IIMMR 7.04% 0.21%

less:

Expenses -1.95%

Total Net

Return for

the Year 14.12%

1M-IIMMR = 1-Month Islamic Interbank Money Market Rate

Shariah-compliant Equity Portfolio Review

For the nancial year under review, the Funds Shariah-compliant equity

portfolio registered a return of +17.06% and outperformed its equity

Benchmarks return of +15.50%. The Funds Shariah-compliant equity

portfolio outperformed the equity Benchmark as it was overweighted in stocks

within the Energy and Utilities sectors which performed strongly during the

nancial year under review.

The Benchmark of the Fund is a composite index of 75% FTSE Bursa

Malaysia EMAS Shariah Index (FBMS), 15% customised index based on Top

100 constituents by market capitalisation of the S&P Shariah BMI Asia Ex-

Japan Index and 10% 3-Month Islamic Interbank Money Market (IIMM) rate.

Income Distribution and Impact on NAV Arising from

Distribution

The gross distribution of 1.25 sen per unit (net distribution of 1.20 sen per unit)

for the nancial year ended 30 November 2013 had the effect of reducing the

Net Asset Value (NAV) of the Fund after distribution. As a result, the NAV per

unit of the Fund was reduced to RM0.2866 from RM0.2986 after distribution.

PIA40GF BENCHMARK

R

e

t

u

r

n

s

f

r

o

m

S

t

a

r

t

o

f

P

e

r

i

o

d

-20%

-10%

0%

10%

20%

30%

40%

Dec-10 Sep-11 May-12 Feb-13 Nov-13

Performance of PIA40GF from 6 December 2010

(Commencement Date) to 30 November 2013

8 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 9

The Fund commenced the nancial year under review with a Shariah-

compliant equity exposure of 90.6% and subsequently increased its

Shariah-compliant equity exposure to above 95% by May 2013. The Fund

maintained a relatively high Shariah-compliant equity exposure throughout

the nancial year to capitalise on Shariah-compliant investment opportunities

in the domestic and regional markets. At the end of the nancial year under

review, the Funds Shariah-compliant equity exposure was reduced to 86.4%

as the Fund locked in prots. Based on an average Shariah-compliant equity

exposure of 92.96%, the Shariah-compliant equity portfolio is deemed to

have registered a return of +15.86% to the Fund as a whole for the nancial

year under review. A full review of the performance of the equity markets is

tabled in the following sections.

Sector Allocations

In terms of sector allocation within the Shariah-compliant equity portfolio, the

top 5 sectors account for 64.2% of the Net Asset Value (NAV) of the Fund and

71.3% of the Funds Shariah-compliant equity portfolio. The weightings of the

top 5 sectors in Malaysia (unless otherwise indicated) are in the following

order: Communications (20.6%), Consumer, Non-cyclical (14.5%), Utilities

(11.0%), Energy (10.5%) and Industrial (7.6%).

Islamic Money Market Portfolio Review

During the nancial year under review, the Funds Islamic money market

portfolio, which was invested primarily in Shariah-based deposits, yielded

a return of +2.94%. In comparison, the 1-Month Islamic Interbank Money

Market Rate (1M-IIMMR) registered a return of +3.09% over the same period.

During the nancial year under review, the Funds exposure to the Islamic

money market investments increased from 9.4% to 13.6% following the

disposal of selected Shariah-compliant equity investments. Based on an

average exposure of 7.04%, the Islamic money market portfolio is estimated

to have contributed +0.21% to the Funds overall returns for the nancial

year under review.

Stock Market Review

Commencing the nancial year under review at 10,957.26 points, the FTSE

Bursa Malaysia EMAS Shariah (FBMS) Index rose towards the end of 2012

amid positive sentiment in regional markets and further strengthened to a

high of 11,590.89 points in early January 2013 before prot-taking caused the

market to ease to the years low of 10,935.32 points in early February 2013.

The FBMS Index subsequently rebounded beginning from mid-March 2013

on selected buying and broke above the 12,500-point level in mid-May 2013.

Cautious offshore sentiment and Fitch Ratings downgrade of Malaysias

sovereign outlook caused the market to fall below 12,500 points in late July

2013. A sell-down in emerging markets over their weakening current account

balances caused the FBMS Index to ease to a 3-month low of 11,722.02

points in late August 2013 before subsequently rebounding in tandem with

global equity markets on the back of the U.S. Federal Reserves decision

to delay tapering its monetary stimulus program in mid-September 2013.

Global equity markets pulled back in early October 2013 amidst the partial

shutdown of the U.S. governments operations and the debt ceiling deadline

before rallying in mid-October 2013 on the resolution of the U.S. budget.

Expectations that Malaysias 2014 Budget would address concerns about

Malaysias scal sustainability helped the local market to register a new all-

time high of 12,785.27 points in late October 2013. Malaysias better-than-

expected 3Q 2013 GDP growth helped the local market to remain rm in

November 2013 and the FBMS Index closed at 12,734.18 points to register

a gain of 16.22% for the nancial year under review.

Managers Report Managers Report

Starting the nancial year under review at 81.07 points, regional equity

markets as proxied by the S&P Shariah BMI Asia Ex-Japan (S&P SAEJ)

Index rose in December 2012 on improving outlook for Chinas economy and

commenced 2013 on a positive note in tandem with gains in global equity

markets. Renewed economic uncertainty in the Eurozone and concerns over

the impending automatic government spending cuts in the U.S. caused the

index to remain in a trading range in 1Q 2013 and early 2Q 2013.

Subsequently, the S&P SAEJ Index rose to a high of 85.80 points in mid-May

2013 before retracing in June 2013 after the Federal Reserve stated that the

quantitative easing program may be scaled down. The Index rebounded to

around the 80-point level in July 2013 before retreating in late August 2013

amidst a sell-down in emerging markets over their weakening current account

balances. The Index subsequently rebounded in tandem with global equity

markets on the back of the U.S. Federal Reserves decision to delay tapering

its monetary stimulus program in mid-September 2013.

Regional equity markets pulled back in early October 2013 amidst the partial

shutdown of the U.S. governments operations and debt ceiling deadline

before rallying to a new 2-year high of 87.13 points in late October 2013.

Optimism from the sweeping economic reforms outlined by China and positive

U.S. economic data helped the Index to remain rm in November 2013 and

the S&P SAEJ Index closed at 86.22 points to register a gain of 6.35%

(+12.77% in Ringgit terms) for the nancial year under review.

Regional markets, namely the South Korea, Taiwan, Singapore, Thailand

and Hong Kong markets registered returns of +15.47%, +14.43%, +7.74%,

+3.90% and +1.31% (in Ringgit terms) respectively for the nancial year

under review.

I

n

d

e

x

10,500

11,000

11,500

12,000

12,500

13,000

Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13

FTSE Bursa Malaysia EMAS Shariah Index

(30 November 2012 - 30 November 2013)

10 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 11

Money Market Review

Short-term interest rates remained generally stable as Bank Negara Malaysia

kept the Overnight Policy Rate (OPR) at 3.00%, unchanged since May 2011.

The 1-Month Islamic Interbank Money Market Rate inched up from 3.07%

to 3.11% during the nancial year under review.

Economic Review

Malaysias GDP growth rose to 5.6% in 2012 from 5.1% in 2011 on account

of resilient private consumption and investment growth. Subsequently, the

economy slowed to 4.5% in the rst three quarters of 2013 amidst lower

growth in the services and manufacturing sectors. The construction sectors

growth eased to 11.3% from 18.1% over the same period.

Managers Report Managers Report

Source: Bank Negara Malaysia

On the regional front, Singapores GDP growth rebounded to 3.5% for the

rst three quarters of 2013 from 1.3% in 2012 due to stronger services sector

activities. Following a growth of 6.5% in 2012, Thailands GDP growth eased

to 3.6% over the rst three quarters of 2013 as consumption and investment

growth decelerated.

Chinas GDP growth was sustained at 7.7% for the rst three quarters of 2013

which was the same rate of growth in 2012 amid resilient domestic activities.

Hong Kongs GDP growth accelerated to 3.0% over the same period from

1.5% in 2012 as consumer spending growth recovered. Led by a recovery

in investment spending, Koreas GDP growth gained pace to 2.4% for the

rst three quarters of 2013 from 2.0% in 2012. For Taiwan, GDP growth

rebounded to 1.9% in the rst three quarters of 2013 from 1.3% in 2012 due

to stronger manufacturing and construction activities.

On the international front, growth of the U.S. economy moderated to 1.5% for

the rst three quarters of 2013 from 2.8% in 2012 on the back of a slowdown in

investment spending and a decline in government spending. The Eurozones

GDP contracted by 0.7% for the rst three quarters of 2013 which was the

same rate of decline in 2012 amidst sluggish investment spending.

Outlook and Investment Strategy

After remaining generally resilient in 1Q 2013, regional equity markets

generally eased in early 2Q 2013 as demand for emerging market stocks

was dampened by the Federal Reserves intention to scale back its monetary

stimulus program in the later part of 2013. However, following the U.S.

Federal Reserves decision to maintain its Quantitative Easing program,

regional markets rebounded in September. Looking ahead, the direction

of global and regional markets will depend on the pace of global economic

growth in the year ahead.

Depending on the impact of higher interest rates on consumer and investment

spending, the U.S. economy is expected to grow at 2.6% in 2014 compared to

1.7% estimated for 2013 on the back of the ongoing recovery in the housing

and job markets in the year ahead.

Source: Bank Negara Malaysia/Ministry of Finance

Led by lower exports of electrical and electronics goods and weak commodity

prices, Malaysias exports contracted by 0.2% for the rst nine months of

2013 versus a growth of 0.7% in 2012. Import growth was sustained at 5.5%

for the rst nine months of 2013 versus 5.8% in 2012. As imports outpaced

exports, Malaysias cumulative trade surplus for the rst nine months of

2013 narrowed by 37.4% to RM43.2 billion compared to RM69.0 billion in

the same period last year. Due to the positive trade surplus and fund inows,

Malaysias foreign reserves increased to RM446.2 billion as at end of October

2013 from RM427.2 billion at the end of 2012.

Malaysias ination rate inched up to 1.9% in the rst ten months of 2013

compared to 1.7% in 2012 on account of higher prices for food, tobacco

and transportation. However, the core ination rate was sustained at 1.2%

over the same period.

-3.0

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

9.0

8.0

2008 2009 2010 2011 2012 2013F 2014F

%

4.8

-1.5

7.4

5.1

5.6

4.7

5.0 - 5.5

Malaysias Annual GDP Growth

R

M

b

i

l

l

i

o

n

250

300

350

400

450

2008 2009 2010 2011 2012 2013 YTD

Malaysias International Reserves

12 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 13

The Eurozones economy is envisaged to register a modest recovery of 1.0%

in 2014 after a contraction of 0.3% estimated for 2013 as investment and

exports strengthen. The Eurozones real consumer spending has beneted

from the recent easing of inationary pressures while exports have also

stabilised.

On the regional front, Chinas GDP is projected to grow at a slower pace of

7.4% in 2014 compared to 7.8% estimated for 2013 as manufacturing and

construction activities continue to moderate. In the event of a steeper-than-

expected slowdown in external demand, the Chinese government has the

exibility to apply moderate scal stimulus to support domestic economic

growth. Over in Hong Kong, GDP growth is projected to gain pace to 3.5%

in 2014 from 3.0% in 2013 on expectations that the economy will benet

from the recovery in regional trade.

Meanwhile, an improvement in global demand for electronics exports is

expected to help South Korea and Taiwan register stronger GDP growth of

3.5% and 3.6% respectively in 2014 compared to 2.7% and 2.5% respectively

in 2013.

For Singapore, GDP is projected to gain pace to 3.7% in 2014 from 2.6%

estimated for 2013 as consumer spending and export demand recover in the

year ahead. Thailands GDP growth is projected at 4.5% in 2014 compared

to 3.3% estimated for 2013 on higher private consumer spending. The

anticipated recovery in regional trade coupled with the competitive Thai baht

is envisaged to help lift Thailands exports in the year ahead.

On the domestic front, Malaysias 2014 GDP growth is anticipated to rm

moderately to 5.0% from 4.7% estimated for 2013 amid an improvement in

exports. Private consumption is envisaged to be supported by an environment

of accommodative interest rates and stable job market conditions.

Meanwhile, the Ministry of Finance projected the 2014 Federal Government

budget decit to improve to -3.5% of GDP from -4.0% estimated for 2013.

With effect from 1 April 2015, the government will replace the current

Sales & Services Tax with a 6% Goods & Services Tax (GST). The Federal

Governments revenue is projected to grow by 1.7% in 2014 while total

expenditure is envisaged to be slightly higher by 0.3%. The Federal

Governments debt is estimated to increase by 7.9% to RM541.3 billion

which is equivalent to 54.8% of GDP as at end-2013 compared to 53.3%

of GDP as at end-2012.

At the end of November 2013, the local stock market is trading at a

prospective P/E of 17.2x, which is above its 10-year average P/E ratio of

16.5x. The markets dividend yield of 3.41% is higher than the 12-month

xed deposit rate of 3.15%.

Regional markets are generally trading at a discount to their historical average

following their respective performances over the nancial year under review.

Given the above factors, the Fund will continue to rebalance its investment

portfolio accordingly with the objective of achieving capital growth by investing

in stocks which comply with Shariah requirements.

Note: Q = Quarter

Managers Report Managers Report

Policy on Soft Commissions

The management company may receive goods or services which include

research materials, data and quotation services and investment related

publications by way of soft commissions provided they are of demonstrable

benet to the Fund and unitholders.

During the nancial year under review, PIA40GF has received data and

quotation services by way of soft commissions. These services were used

to provide nancial data on securities and price quotation information to the

Fund Manager during the nancial year under review.

14 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 15

Shariah Advisers Report

To the Unitholders of

PUBLIC ISLAMIC ALPHA-40 GROWTH FUND

We have acted as the Shariah Adviser of PUBLIC ISLAMIC ALPHA-40

GROWTH FUND. Our responsibility is to ensure that the procedures and

processes employed by PUBLIC MUTUAL BERHAD and that the provisions

of the Master Deed dated 28 January 1999 and subsequent Supplemental

Master Deeds (collectively referred to as Deeds) are in accordance with

Shariah principles.

In our opinion, PUBLIC MUTUAL BERHAD has managed and administered

PUBLIC ISLAMIC ALPHA-40 GROWTH FUND in accordance with Shariah

principles and complied with the applicable guidelines, rulings and decisions

issued by the Securities Commission of Malaysia pertaining to Shariah

matters for the nancial year ended 30 November 2013.

In addition, we also conrm that the investment portfolio of PUBLIC ISLAMIC

ALPHA-40 GROWTH FUND comprises securities which have been classied

as Shariah-compliant by the Shariah Advisory Council of the Securities

Commission of Malaysia and/or the Shariah Supervisory Board of Standard

& Poors Shariah Indexes. As for the securities which are not certied by

the Shariah Advisory Council of the Securities Commission of Malaysia and/

or the Shariah Supervisory Board of Standard & Poors Shariah Indexes,

we have reviewed the said securities and conrm that these securities are

Shariah-compliant.

For ZICOlaw Shariah Advisory Services Sdn Bhd

(formerly known as ZI Shariah Advisory Services Sdn Bhd)

DR. AIDA OTHMAN DR. MOHAMAD AKRAM LALDIN

Director Designated Person Responsible

for Shariah Advisory

Kuala Lumpur, Malaysia

23 December 2013

To the Unitholders of

PUBLIC ISLAMIC ALPHA-40 GROWTH FUND

We, AMANAHRAYA TRUSTEES BERHAD, have acted as Trustee of

PUBLIC ISLAMIC ALPHA-40 GROWTH FUND for the nancial year ended

30 November 2013. In our opinion, PUBLIC MUTUAL BERHAD, the Manager,

has managed PUBLIC ISLAMIC ALPHA-40 GROWTH FUND in accordance

with the limitations imposed on the investment powers of the management

company and the Trustee under the Deed, other provisions of the Deed, the

applicable Guidelines on Unit Trust Funds, the Capital Markets and Services

Act 2007 and other applicable laws during the nancial year then ended.

We are of the opinion that:

(a) the procedures and processes employed by the Manager to value and/

or price the units of PUBLIC ISLAMIC ALPHA-40 GROWTH FUND are

adequate and that such valuation/pricing is carried out in accordance

with the Deed and other regulatory requirement;

(b) creation and cancellation of units are carried out in accordance with the

Deed and other regulatory requirement; and

(c) the distribution of returns made by PUBLIC ISLAMIC ALPHA-40

GROWTH FUND as declared by the Manager is in accordance with the

investment objective of PUBLIC ISLAMIC ALPHA-40 GROWTH FUND.

Yours faithfully

AMANAHRAYA TRUSTEES BERHAD

HABSAH BINTI BAKAR

Chief Executive Ofcer

Kuala Lumpur, Malaysia

24 December 2013

Trustees Report

For the Financial Year Ended 30 November 2013

16 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 17

Statement By Manager

We, TAN SRI DATUK SERI UTAMA THONG YAW HONG and TAN SRI DATO

SRI TAY AH LEK, being two of the directors of PUBLIC MUTUAL BERHAD, do

hereby state that in the opinion of the Manager, the accompanying statement

of assets and liabilities as at 30 November 2013 and the related statement

of income and expenditure, statement of changes in net asset value and

statement of cash ows for the nancial year ended on that date together

with the notes thereto, are drawn up in accordance with Malaysian Financial

Reporting Standards and International Financial Reporting Standards so

as to give a true and fair view of the nancial position of PUBLIC ISLAMIC

ALPHA-40 GROWTH FUND as at 30 November 2013 and of its nancial

performance, changes in net asset value and cash ows for the nancial year

then ended and comply with the requirements of the Deeds.

For and on behalf of the Manager

TAN SRI DATUK SERI UTAMA THONG YAW HONG

TAN SRI DATO SRI TAY AH LEK

Kuala Lumpur, Malaysia

23 December 2013

Independent Auditors Report

Independent auditors report to the Unitholders of

PUBLIC ISLAMIC ALPHA-40 GROWTH FUND

Report on the nancial statements

We have audited the nancial statements of PUBLIC ISLAMIC ALPHA-40

GROWTH FUND, which comprise the statement of assets and liabilities as

at 30 November 2013, and statement of income and expenditure, statement

of changes in net asset value and statement of cash ows for the nancial

year then ended, and a summary of signicant accounting policies and other

explanatory information, as set out on pages 19 to 39.

Managers and Trustees responsibility for the nancial statements

The Manager of the Fund is responsible for the preparation of nancial

statements so as to give a true and fair view in accordance with Malaysian

Financial Reporting Standards and International Financial Reporting

Standards. The Manager is also responsible for such internal control as

the Manager determines is necessary to enable the preparation of nancial

statements that are free from material misstatement, whether due to fraud

or error. The Trustee is responsible for ensuring that the Manager maintains

proper accounting and other records as are necessary to enable true and

fair presentation of these nancial statements.

Auditors responsibility

Our responsibility is to express an opinion on these nancial statements

based on our audit. We conducted our audit in accordance with approved

standards on auditing in Malaysia. Those standards require that we comply

with ethical requirements and plan and perform the audit to obtain reasonable

assurance about whether the nancial statements are free from material

misstatement.

An audit involves performing procedures to obtain audit evidence about

the amounts and disclosures in the nancial statements. The procedures

selected depend on our judgement, including the assessment of risks of

material misstatement of the nancial statements, whether due to fraud

or error. In making those risk assessments, we consider internal control

relevant to the Funds preparation of the nancial statements that give a

true and fair view in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion on the

effectiveness of the Funds internal control. An audit also includes evaluating

the appropriateness of the accounting policies used and the reasonableness

of accounting estimates made by the Manager, as well as evaluating the

overall presentation of the nancial statements.

We believe that the audit evidence we have obtained is sufcient and

appropriate to provide a basis for our audit opinion.

18 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 19

Independent Auditors Report (contd)

Opinion

In our opinion, the nancial statements give a true and fair view of the nancial

position of the Fund as at 30 November 2013 and of its nancial performance,

changes in net asset value and cash ows for the nancial year then ended in

accordance with Malaysian Financial Reporting Standards and International

Financial Reporting Standards.

Other matters

This report is made solely to the unitholders of the Fund, as a body, in

accordance with Securities Commissions Guidelines on Unit Trust Funds

in Malaysia and for no other purpose. We do not assume responsibility to

any other person for the content of this report.

Ernst & Young Yeo Beng Yean

AF: 0039 No. 3013/10/14 (J)

Chartered Accountants Chartered Accountant

Kuala Lumpur, Malaysia

23 December 2013

Statement Of Assets And Liabilities

As at 30 November 2013

Note 30.11.2013 30.11.2012 1.12.2011

MYR000 MYR000 MYR000

Assets

Investments 4 70,008 80,243 98,657

Tax recoverable 71 89 48

Other receivables 108 375 315

Cash and cash

equivalents 7 11,208 8,286 11,171

81,395 88,993 110,191

Liabilities

Due to brokers/nancial

institutions, net 8 321 - 1,097

Due to the Manager, net 9 13 352 306

Due to the Trustee 4 4 7

Other payables 69 55 66

Distribution payable 3,240 4,801 3,249

3,647 5,212 4,725

Total net assets 77,748 83,781 105,466

Net asset value (NAV)

attributable to

unitholders (Total equity) 10 77,748 83,781 105,466

Units in circulation

(in 000) 11 271,237 320,121 433,264

NAV per unit,

ex-distribution (in sen) 28.66 26.17 24.34

The accompanying notes are an integral part of this statement.

20 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 21

Statement Of Income And Expenditure

For the Financial Year Ended 30 November 2013

Note 2013 2012

MYR000 MYR000

Income

Prot from Mudharabah deposits 106 95

Dividend income 2,161 2,526

Net gain from investments 4 9,869 13,700

Net realised/unrealised foreign

exchange gain/(loss) 117 (164)

12,253 16,157

Less: Expenses

Trustees fee 13 49 72

Management fee 14 1,226 1,557

Audit fee 7 6

Tax agents fee 3 3

Brokerage fee 243 242

Administrative fees and expenses 64 47

1,592 1,927

Net income before taxation 10,661 14,230

Taxation 15 (23) (57)

Net income after taxation 10,638 14,173

Net income after taxation is made

up as follows:

Realised 2,116 6,382

Unrealised 8,522 7,791

10,638 14,173

Final distribution for the nancial year 16 3,240 4,801

The accompanying notes are an integral part of this statement.

For the Financial Year Ended 30 November 2013

Statement Of Changes In Net Asset Value

Unitholders Retained

Note capital earnings Total

MYR000 MYR000 MYR000

As at 1 December 2011 108,848 (3,382) 105,466

Creation of units 15,855 - 15,855

Cancellation of units (46,912) - (46,912)

Net income after taxation - 14,173 14,173

Distribution 16 - (4,801) (4,801)

As at 30 November 2012 77,791 5,990 83,781

As at 1 December 2012 77,791 5,990 83,781

Creation of units 10,582 - 10,582

Cancellation of units (24,013) - (24,013)

Net income after taxation - 10,638 10,638

Distribution 16 - (3,240) (3,240)

As at 30 November 2013 64,360 13,388 77,748

The accompanying notes are an integral part of this statement.

22 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 23

For the Financial Year Ended 30 November 2013

Statement Of Cash Flows

Note 2013 2012

MYR000 MYR000

Cash ows from operating and

investing activities

Proceeds from sale of investments 43,927 59,112

Purchase of investments (23,739) (29,584)

Subscription of rights - (421)

Cash received from capital distribution - 1,631

Prot from Mudharabah deposits

received 105 96

Interest received from foreign currency

accounts 1 3

Net dividend income received 2,374 2,389

Trustees fee paid (49) (75)

Management fee paid (1,238) (1,580)

Audit fee paid (6) (6)

Tax agents fee paid - (3)

Taxation recovered 49 -

Payment of other fees and expenses (54) (58)

Payment to charitable bodies 6(b) (1) (3)

Net cash inow from operating and

investing activities 21,369 31,501

Cash ows from nancing activities

Cash proceeds from units created 10,492 15,911

Cash paid on units cancelled (24,250) (46,899)

Distribution paid (4,801) (3,249)

Net cash outow from nancing

activities (18,559) (34,237)

Net increase/(decrease) in cash and

cash equivalents 2,810 (2,736)

Effect of change in foreign exchange

rates 112 (149)

Cash and cash equivalents at the

beginning of the nancial year 8,286 11,171

Cash and cash equivalents at the end

of the nancial year 11,208 8,286

Cash and cash equivalents comprise:

Cash at banks 4,129 4,837

Mudharabah deposits with a nancial

institution 7,079 3,449

11,208 8,286

The accompanying notes are an integral part of this statement.

Notes To The Financial Statements

30 November 2013

1. The Fund, The Manager and Their Principal Activities

The Public Islamic Alpha-40 Growth Fund (hereinafter referred

to as the Fund) was set up pursuant to the execution of a

Supplemental Master Deed dated 12 November 2009 between the

Manager, Public Mutual Berhad, the Trustee, AmanahRaya Trustees

Berhad and the registered unitholders of the Fund. The Fund is

governed by a Master Deed dated 28 January 1999 and subsequent

Supplemental Master Deeds (collectively referred to as Deeds).

The Funds objective is to seek to achieve capital growth by investing in

up to a maximum of 40 stocks which comply with Shariah requirements.

The Fund invests in investments as dened in the Deeds. The Fund

was launched on 16 November 2010 and will continue its operations

until terminated by the Trustee as provided in the Master Deed.

The Manager of the Fund is Public Mutual Berhad, a company

incorporated in Malaysia. Its principal activities are the management of

unit trusts and the sale of trust units. Its ultimate holding company is Public

Bank Berhad, a licensed bank incorporated in Malaysia and listed on the

Main Market of Bursa Malaysia Securities Berhad (Bursa Malaysia).

2. Summary of Significant Accounting Policies

(a) Basis of Preparation

The nancial statements of the Fund have been prepared under

the historical cost convention, as modied by the revaluation of

nancial assets and nancial liabilities at fair value and comply

with Malaysian Financial Reporting Standards (MFRS) and

International Financial Reporting Standards (IFRS).

(b) First time Adoption of MFRS

For the periods up to and including the nancial year ended

30 November 2012, the Fund prepared its nancial statements

in accordance with Financial Reporting Standards in Malaysia

(FRS). These financial statements, for the financial year

ended 30 November 2013 are the Funds rst nancial statements

prepared in accordance with MFRS; and MFRS 1 - First Time

Adoption of Malaysian Financial Reporting Standards has been

applied. In preparing these nancial statements, the Funds

opening Statement of Assets and Liabilities was prepared as at

1 December 2011, the date of transition to MFRS.

The Fund has applied the exemption provided by MFRS 1 to

designate all its investments held at the date of transition at fair

value through prot or loss. An explanation of how the transition

from FRS to MFRS has affected the Funds Statement of Income

and Expenditure is set out below. The transition from FRS to

MFRS has no impact on the Statement of Assets and Liabilities

and Statement of Cash Flows.

24 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 25

2. Summary of Significant Accounting Policies (contd)

(b) First time Adoption of MFRS (contd)

Effect of

transition to

FRS MFRS MFRS

MYR000 MYR000 MYR000

Other investment income 2,621 - 2,621

Net gain from investments 9,347 4,353 13,700

Net realised/unrealised

foreign exchange loss (149) (15) (164)

11,819 4,338 16,157

Less: Expenses 1,927 - 1,927

Net income before taxation 9,892 4,338 14,230

Taxation (57) - (57)

Net income after taxation 9,835 4,338 14,173

Other comprehensive

income 4,338 (4,338) -

Total income 14,173 - 14,173

In addition, the Fund has early adopted MFRS 13 - Fair Value

Measurement. The adoption of MFRS 13 has no signicant impact

on the nancial statements of the Fund.

The Fund has not early adopted the following MFRS, Amendments

and IC Interpretations which have effective dates as follows:

Effective dates

for nancial periods

beginning on or after

MFRS 3 - Business Combination * 1 January 2013

MFRS 10 - Consolidated Financial 1 January 2013

Statements *

MFRS 11 - Joint Arrangement * 1 January 2013

MFRS 12 - Disclosure of Interests in Other 1 January 2013

Entities *

MFRS 119 - Employee Benets * 1 January 2013

MFRS 127 - Separate Financial Statements * 1 January 2013

MFRS 128 - Investments in Associates and 1 January 2013

Joint Ventures *

MFRS 9 - Financial Instruments 1 January 2015

Amendments to MFRS contained in the 1 January 2013

document entitled Annual Improvements

2009-2011 Cycle

Government Loans (Amendments to 1 January 2013

MFRS 1) *

Disclosures - Offsetting Financial Assets 1 January 2013

and Financial Liabilities (Amendments to

MFRS 7)

Offsetting Financial Assets and Financial 1 January 2014

Liabilities (Amendments to MFRS 132)

Notes To The Financial Statements

30 November 2013

2. Summary of Significant Accounting Policies (contd)

(b) First time Adoption of MFRS (contd)

Effective dates

for nancial periods

beginning on or after

Investment Entities (Amendments to 1 January 2014

MFRS 10, MFRS 12 and MFRS 127) *

Recoverable Amount Disclosures for 1 January 2014

Non-Financial Assets (Amendments to

MFRS 136) *

Novation of Derivatives and Continuation of 1 January 2014

Hedge Accounting (Amendments to

MFRS 139) *

IC Interpretation 20 - Stripping Costs in the 1 January 2013

Production Phase of a Surface Mine *

IC Interpretation 21 - Levies * 1 January 2014

* These MFRS, Amendments and IC Interpretations are not

relevant to the Fund.

(c) Accounting Estimates and Judgements

The preparation of the Funds nancial statements requires the

Manager to make judgements, estimates and assumptions that

affect the reported amounts of revenues, expenses, assets and

liabilities, and the disclosure of contingent liabilities at the reporting

date. However, uncertainty about these assumptions and estimates

could result in outcome that could require a material adjustment to

the carrying amount of an asset or a liability in the future.

There are no major judgements nor key assumptions concerning

the future and other key sources of estimation uncertainty at the

reporting date, that may cast signicant doubt upon the Funds

ability to continue as a going concern. Therefore, the nancial

statements continue to be prepared on the going concern basis.

(d) Financial Assets and Liabilities

Financial assets and nancial liabilities are recognised in the

Statement of Assets and Liabilities when, and only when, the Fund

becomes a party to the contractual provisions of the instrument.

i) Financial Assets

The Fund determines the classication of its nancial assets

at initial recognition, and the categories include nancial

assets at fair value through prot or loss (FVTPL) and loans

and receivables.

When nancial assets are recognised initially on trade date,

they are measured at fair value, plus, in the case of nancial

assets not at FVTPL, directly attributable transaction costs.

Financial assets are derecognised on trade date when the

rights to receive cash ows from the investments have expired

or the Fund has transferred substantially all risks and rewards

of ownership.

Notes To The Financial Statements

30 November 2013

26 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 27

2. Summary of Significant Accounting Policies (contd)

(d) Financial Assets and Liabilities (contd)

i) Financial Assets (contd)

Financial assets at FVTPL

Financial assets are classied as nancial assets at

FVTPL if they are held for trading or are designated as

such upon initial recognition. Financial assets held for

trading are those acquired principally for the purpose of

selling in the near term. Subsequent to initial recognition,

nancial assets at FVTPL are measured at fair value.

Changes in the fair value of those nancial instruments

are recorded in Net gain or loss on nancial assets

at FVTPL. Interest earned and dividend revenue

elements of such instruments are recorded separately

in Interest income and Dividend income respectively.

Exchange differences on nancial assets at FVTPL are

not recognised separately in prot or loss but are included

in net gain or net loss on changes in fair value of nancial

assets at FVTPL.

Loans and Receivables

The Fund does not have any loans throughout the

nancial year. Financial assets with xed or determinable

payments that are not quoted in an active market are

classied as receivables. Such receivables include

amount due from brokers/nancial institutions, amount

due from the Manager and other receivables. Subsequent

to initial recognition, these are measured at amortised

cost.

For nancial assets carried at amortised cost, the Fund

assesses at each reporting date whether there is any

objective evidence that a nancial asset is impaired. If any

such evidence exists, the amount of impairment loss is

measured as the difference between the assets carrying

amount and the present value of estimated future cash

ows discounted at the nancial assets original effective

interest rate. The carrying amount of the nancial asset

is reduced and the amount of the loss is recognised in

prot or loss with the exception of receivables.

If in a subsequent period, the amount of the impairment

loss decreases and the decrease can be related

objectively to an event occurring after the impairment

was recognised, the previously recognised impairment

loss is reversed to the extent that the carrying amount

of the asset does not exceed its amortised cost at the

reversal date. The amount of reversal is recognised in

prot or loss.

Notes To The Financial Statements

30 November 2013

2. Summary of Significant Accounting Policies (contd)

(d) Financial Assets and Liabilities (contd)

ii) Financial Liabilities

Financial liabilities are classied according to the substance of

the contractual arrangements entered into and the denitions

of a nancial liability.

Financial liabilities are recognised initially at fair value and

subsequently stated at amortised cost. The Fund includes

in this category amount due to brokers/nancial institutions,

amounts due to the Manager and the Trustee, and other

payables. A nancial liability is derecognised when it is settled.

(e) Foreign Currency

i) Functional and presentation currency

The nancial statements of the Fund are measured using

the currency of the primary economic environment in which

the Fund operates (the functional currency). The nancial

statements are presented in Malaysian Ringgit (MYR), which

is also the Funds functional currency.

ii) Foreign currency transactions

Transactions in foreign currencies are measured and recorded

in the functional currency of the Fund on initial recognition at

exchange rates approximating those ruling at the transaction

dates. Monetary assets and liabilities denominated in foreign

currencies are translated at the rate of exchange ruling at

the reporting date. Non-monetary items denominated in

foreign currencies that are measured at historical cost are

translated using the exchange rates as at the dates of the

initial recognition.

Exchange differences arising from translation of monetary

items at the reporting date are recognised in prot or loss.

Exchange differences arising from the translation of non-

monetary nancial assets at FVTPL are included in prot

or loss.

(f) Unitholders Capital

The Unitholders contributions to the Fund meet the denition of

puttable instruments and are classied as equity instruments.

Distribution equalisation represents the average distributable

amount included in the creation and cancellation prices of units.

This amount is either refunded to Unitholders by way of distribution

and/or adjusted accordingly when units are cancelled.

(g) Cash and Cash Equivalents

Cash and cash equivalents comprise cash at banks and

Mudharabah deposits with nancial institutions which have an

insignicant risk of changes in value.

Notes To The Financial Statements

30 November 2013

28 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 29

2. Summary of Significant Accounting Policies (contd)

(h) Income

Income is recognised to the extent that it is probable that the

economic benefits will flow to the Fund and the income can

be reliably measured. Income is measured at the fair value of

consideration received or receivable.

Dividend income is recognised when the Funds right to receive

payment is established.

Prot from Mudharabah deposits, income from sukuk, accretion

of discount and amortisation of premium are recognised using the

effective interest method.

(i) Taxation

Current tax assets and liabilities are measured at the amount

expected to be recovered from or paid to the tax authorities. The

tax rate and tax laws used to compute the amount are those that

are enacted or substantively enacted by the reporting date. The

Fund also incurs foreign withholding taxes imposed by certain

countries on dividend and interest income derived from foreign

nancial instruments.

(j) Interest from Foreign Currency Accounts

A portion of the cash is maintained in foreign currency accounts

outside Malaysia to facilitate the settlement of purchase and selling

of foreign securities in a particular country. Interest earned, if any,

from these accounts is not recognised as income to the Fund. Such

interest will be channelled to charitable bodies as part of the Funds

cleansing process in line with the advice of the Shariah Adviser.

(k) Related Parties

Related parties refer to Public Bank Berhad and its subsidiaries.

3. Financial Risk and Capital Management Policies

The Fund is exposed to a variety of nancial risks, which include

market risk (such as price risk and currency risk), credit risk, single

issuer risk, liquidity risk and reclassication of Shariah status risk. The

overall nancial risk management objective of the Fund is to mitigate

capital loss.

Financial risk management is carried out through policy reviews,

internal control systems and adherence to the investment powers and

restrictions stipulated in the Securities Commissions Guidelines on Unit

Trust Funds in Malaysia.

(a) Market Risk

Market risk arises when the value of the securities uctuates in

response to the activities of individual companies, and general

market or economic environments. Market risk is managed

through portfolio diversication and changes in asset allocation.

It comprises the following risks:

Notes To The Financial Statements

30 November 2013

3. Financial Risk and Capital Management Policies (contd)

(a) Market Risk (contd)

i) Price Risk

Price risk is the risk that prices of equity securities and

collective investment funds rise or fall as a result of changes

in factors specic to a particular security or general market

conditions.

The increase/(decrease) in the NAV attributable to unitholders

as at reporting date, assuming equity and collective investment

funds prices change by +/(-) 5% with all other variables held

constant, is +/(-) MYR3,500,000 (2012: +/(-) MYR4,012,000).

This analysis is for illustration purpose only and not an

indication of future variances.

ii) Currency Risk

The Fund invests in nancial instruments denominated in

currencies other than its functional currency. Consequently,

the Fund is exposed to risks arising from changes in the

exchange rate of its functional currency relative to other

foreign currencies that might signicantly impact the value of

the Funds assets or liabilities denominated in currencies other

than Malaysian Ringgit.

The increase/(decrease) in the NAV attributable to unitholders

as at reporting date, assuming exchange rates of foreign

currencies uctuate by +/(-) 5% with all other variables held

constant, is +/(-) MYR554,000 (2012: +/(-) MYR650,000). This

analysis is for illustration purpose only and not an indication

of future variances.

(b) Credit Risk

Credit risk refers to the ability of an issuer or a counterparty to make

timely payments of prot, principals and proceeds from realisation of

investments. The Fund invests only in debt securities with at least

investment grade credit rating by the relevant credit rating agencies.

The Manager manages credit risk by setting counterparty limits and

undertaking credit evaluation to assess such risk.

(c) Single Issuer Risk

The Fund is restricted to invest in securities issued by any issuer

of not more than a certain percentage of its net asset value. Under

such restriction, the exposure risk to the securities of a single

issuer is minimised.

(d) Liquidity Risk

The Fund maintains a sufcient level of liquid assets to meet

anticipated payments and redemption by unitholders. Liquid

assets comprise cash, Mudharabah deposits with licensed nancial

institutions and other instruments, which can be converted into cash

within 7 days. The Funds policy is to maintain a prudent level of

liquid assets and monitoring of the daily creation and cancellation

of units so as to manage liquidity risk.

Notes To The Financial Statements

30 November 2013

30 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 31

3. Financial Risk and Capital Management Policies (contd)

(d) Liquidity Risk (contd)

The Funds nancial liabilities have contractual maturities of not

more than six (6) months.

(e) Reclassification of Shariah Status Risk

The currently held Shariah-compliant securities in the portfolio

of Shariah-based funds may be reclassied to be Shariah non-

compliant in the periodic review of the securities by the Shariah

Advisory Council of the Securities Commission (SACSC), the

Shariah Adviser or the Shariah Boards of the relevant Islamic

Indices. If this occurs, the value of the Fund may be adversely

affected where the Manager will take the necessary steps to dispose

of such securities in accordance with the advice from the SACSC

and/or the Shariah Adviser.

(f) Capital Management

The capital is represented by unitholders subscription to the Fund.

The amount of capital can change signicantly on a daily basis

as the Fund is subject to daily redemption and subscription at

the discretion of unitholders. The Manager manages the Funds

capital in accordance to its objective as stated in Note 1, while

maintaining sufcient liquidity to meet unitholders redemption as

explained in Note (d) above.

4. Investments

30.11.2013 30.11.2012 1.12.2011

MYR000 MYR000 MYR000

Financial assets at FVTPL

- Equity securities 69,676 80,243 98,657

- Collective investment funds 332 - -

70,008 80,243 98,657

The Funds investments are carried at fair value, which were determined

using prices in active markets for identical assets.

Quoted equity securities and collective investment funds

Fair value is determined directly by reference to the published market

price at the reporting date.

The market prices of the above quoted financial instruments are

determined by reference to information made publicly available by the

respective stock exchanges.

FINANCIAL INSTRUMENTS - 30 NOVEMBER 2013

The equity securities and collective investment funds held by the Fund

are categorised based on their principal business activities according

to the Bloomberg Sector Classication System as at the date of the

Statement of Assets and Liabilities.

Notes To The Financial Statements

30 November 2013

4. Investments (contd)

Per Cent

of Net

Fair Asset

Quantity Cost Value Value

(in 000) MYR000 MYR000 %

EQUITY SECURITIES

Malaysia

Basic Materials

Petronas Chemicals Group

Berhad 461 2,866 3,112 4.0

Communications

Axiata Group Berhad 934 4,759 6,276 8.1

DiGi.Com Berhad 649 1,839 3,161 4.1

Maxis Berhad 496 3,236 3,487 4.5

Media Chinese

International Limited 178 200 177 0.2

Star Publications

(Malaysia) Berhad 144 381 354 0.4

Telekom Malaysia Berhad 503 1,620 2,585 3.3

12,035 16,040 20.6

Consumer, Cyclical

UMW Holdings Berhad 133 1,771 1,655 2.1

Consumer, Non-cyclical

Felda Global Ventures

Holdings Berhad 400 2,105 1,784 2.3

IHH Healthcare Berhad 556 2,141 2,252 2.9

IOI Corporation Berhad 710 3,987 4,006 5.2

KPJ Healthcare Berhad 188 1,088 1,147 1.5

Kuala Lumpur Kepong

Berhad 83 1,808 2,041 2.6

11,129 11,230 14.5

Diversied

IJM Corporation Berhad 224 1,225 1,310 1.7

Sime Darby Berhad 473 4,318 4,565 5.9

5,543 5,875 7.6

Energy

Dialog Group Berhad 252 567 751 1.0

Perisai Petroleum Teknologi

Berhad 314 286 458 0.6

Petronas Dagangan Berhad 51 737 1,597 2.0

SapuraKencana Petroleum

Berhad 876 2,516 3,759 4.8

UMW Oil & Gas

Corporation Berhad 472 1,478 1,604 2.1

5,584 8,169 10.5

Notes To The Financial Statements

30 November 2013

32 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 33

4. Investments (contd)

Per Cent

of Net

Fair Asset

Quantity Cost Value Value

(in 000) MYR000 MYR000 %

EQUITY SECURITIES

(contd)

Malaysia (contd)

Financial

IJM Land Berhad 417 1,199 1,084 1.4

UEM Sunrise Berhad 578 1,569 1,330 1.7

2,768 2,414 3.1

Industrial

Gamuda Berhad 458 1,867 2,180 2.8

Hartalega Holdings Berhad 136 786 1,002 1.3

MISC Berhad 118 612 650 0.8

WCT Holdings Berhad 930 2,593 2,093 2.7

5,858 5,925 7.6

Utilities

Petronas Gas Berhad 140 1,884 3,340 4.3

Tenaga Nasional Berhad 526 3,477 5,185 6.7

5,361 8,525 11.0

Hong Kong

Energy

CNOOC Limited 74 484 489 0.6

PetroChina Company

Limited 126 581 480 0.6

1,065 969 1.2

Korea

Consumer, Cyclical

Hyundai Mobis 1 558 562 0.7

Kia Motors Corporation 2 361 419 0.5

919 981 1.2

Technology

Samsung Electronics

Company Limited * 581 982 1.3

Singapore

Communications

M1 Limited 42 293 354 0.4

Singapore

Telecommunications

Limited 39 339 372 0.5

StarHub Limited 33 330 360 0.5

962 1,086 1.4

* Denote less than 1,000 units of shares.

Notes To The Financial Statements

30 November 2013

4. Investments (contd)

Per Cent

of Net

Fair Asset

Quantity Cost Value Value

(in 000) MYR000 MYR000 %

EQUITY SECURITIES

(contd)

Singapore (contd)

Industrial

SembCorp Marine Limited 88 1,029 1,002 1.3

Taiwan

Technology

Taiwan Semiconductor

Manufacturing Company

Limited 109 876 1,247 1.6

Thailand

Communications

Advance Info Service

Public Company Limited

- Foreign 20 546 464 0.6

COLLECTIVE

INVESTMENT FUNDS

Hong Kong

Financial

The Link Real Estate

Investment Trust 21 351 332 0.4

TOTAL 59,244 70,008 90.0

The cost is translated to the Funds functional currency based on the

exchange rate at the date of the Statement of Assets and Liabilities.

2013 2012

MYR000 MYR000

Net gain from investments:

Financial assets at FVTPL

- realised gain on disposal 1,445 5,871

- unrealised gain on changes in fair value 8,424 7,829

9,869 13,700

Notes To The Financial Statements

30 November 2013

34 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 35

5. Fair Value of Financial Instruments

The Fund uses the following hierarchy for determining and disclosing

the fair value of nancial instruments by valuation technique:

Level 1: Quoted prices per respective stock markets for identical

assets or liabilities.

Level 2: Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (as

prices) or indirectly (derived from prices).

Level 3: Inputs for the asset or liability other than observable market

data.

As at 30 November 2013, the Fund held the following nancial instruments

carried at fair value on the Statement of Assets and Liabilities.

Level 1 Total

MYR000 MYR000

As at 30 November 2013

Financial assets at FVTPL

- Equity securities 69,676 69,676

- Collective investment funds 332 332

70,008 70,008

As at 30 November 2012

Financial assets at FVTPL

- Equity securities 80,243 80,243

6. Shariah Information of the Fund

(a) Reclassication of Shariah Status of Securities

Media Chinese International Limited was reclassied as Shariah

non-compliant on 29 November 2013 by the Shariah Advisory

Council of the Securities Commission of Malaysia. These securities

will be disposed of in accordance with the advice of the Shariah

Adviser.

(b) Payment to Charitable Bodies

Payment which must be made to charitable bodies comprised

the interest income of MYR358.38 derived from foreign currency

accounts. The Manager has channelled the total amount of

MYR358.38 to charitable bodies as part of the Funds cleansing

process.

In addition, the Shariah Adviser conrmed that the investment portfolio

of the Fund is Shariah-compliant, which comprises:

i) equity securities listed on Bursa Malaysia which have been

classied as Shariah-compliant by the Shariah Advisory Council

of the Securities Commission of Malaysia;

Notes To The Financial Statements

30 November 2013

6. Shariah Information of the Fund (contd)

ii) equity securities in foreign markets which have been classied

as Shariah-compliant either by the Shariah Supervisory Board of

Standard & Poors Shariah Indexes and duly veried by the Shariah

Adviser and/or those securities which have been reviewed and

classied as Shariah-compliant by the Shariah Adviser;

iii) investment in collective investment funds which was veried as

Shariah-compliant by the Shariah Adviser; and

iv) cash placements and liquid assets in local market, which are placed

in investments and/or instruments.

7. Cash and Cash Equivalents

2013 2012

MYR000 MYR000

Mudharabah deposits with a related

licensed Islamic bank 7,079 3,449

Cash at banks

- related parties 804 4,058

- others 3,325 779

4,129 4,837

11,208 8,286

Weighted average rates of return for the nancial year and the average

remaining maturities of Mudharabah deposits as of end of the nancial

year are as follows:

Weighted Average

Average Remaining

Rates of Return Maturities

2013 2012 2013 2012

% % Days Days

Mudharabah deposits,

less than 1 year 2.94 2.95 2 3

8. Due to Brokers/Financial Institutions, Net

2013 2012

MYR000 MYR000

Amount due to

- a related nancial institution 162 -

- other stockbroking companies 159 -

321 -

Notes To The Financial Statements

30 November 2013

36 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 37

Notes To The Financial Statements

30 November 2013

9. Due to the Manager, Net

The net amount due to the Manager represents amount payable for units

cancelled and/or amount payable for management fee, net of amount

receivable for the units created. Amounts for units created/cancelled are

receivable/payable within 10 days of creation/cancellation. Management

fee is payable on a monthly basis.

10. Net Asset Value Attributable to Unitholders (Total Equity)

2013 2012

MYR000 MYR000

Unitholders capital 64,360 77,791

Retained earnings 13,388 5,990

77,748 83,781

Retained earnings

- realised reserves 2,266 3,390

- unrealised reserves 11,122 2,600

13,388 5,990

11. Units in Circulation

As of end of the nancial year, the total number of units in circulation

is as follows:

2013 2012

No. of units No. of units

(in 000) (in 000)

At beginning of the nancial year 320,121 433,264

Creation of units 38,326 59,810

Cancellation of units (87,210) (172,953)

At end of the nancial year 271,237 320,121

12. Holdings of Units by the Manager

As of end of the nancial year, the total number and value of units held

legally by the Manager are as follows:

2013 2012

No. of units No. of units

(in 000) MYR000 (in 000) MYR000

The Manager 224 64 152 40

13. Trustees Fee

The Trustees fee is computed daily based on 0.06% per annum of the

net asset value, subject to a minimum fee of MYR18,000 per annum

and a maximum fee of MYR600,000 per annum. Prior to 30 April 2012,

the Trustees fee was computed daily based on 0.08% per annum of the

net asset value, subject to a minimum fee of MYR18,000 per annum.

Notes To The Financial Statements

30 November 2013

14. Management Fee

The management fee is computed daily based on 1.50% per annum

of the net asset value.

15. Taxation

2013 2012

MYR000 MYR000

Malaysian tax - 14

Foreign withholding tax 23 43

23 57

Domestic income tax is calculated at the Malaysian statutory tax rate of

25% of the estimated assessable income for the nancial year.

The Malaysian taxation charge for the current nancial year is on taxable

dividend income after deducting tax allowable expenses.

A reconciliation of income tax expense applicable to net income before

taxation at the statutory income tax rate to income tax expense at the

effective income tax rate of the Fund is as follows:

2013 2012

MYR000 MYR000

Net income before taxation 10,661 14,230

Taxation at Malaysian statutory rate of 25% 2,665 3,558

Tax effects of:

- income not subject to tax, net (3,031) (3,985)

- expenses not deductible for tax purposes 79 81

- restriction on tax deductible expenses

for unit trust funds 287 360

- 14

Foreign withholding tax 23 43

Tax expense 23 57

16. Distribution

Final distribution declared on 29 November 2013 (2012: 30 November 2012)

to unitholders is derived from the following sources:

2013 2012

MYR000 MYR000

Prot from Mudharabah deposits 83 59

Dividend income 1,979 1,926

Net realised gain on sale of investments 1,379 3,872

Net realised gain/(loss) on foreign exchange 15 (111)

Previous nancial years net realised income 1,527 983

4,983 6,729

38 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 39

16. Distribution (contd)

2013 2012

MYR000 MYR000

Less:

Expenses (1,592) (1,927)

Attributable tax (unitholders) (151) (1)

(1,743) (1,928)

3,240 4,801

Gross distribution per unit (sen) 1.25 1.50

Net distribution per unit (sen) 1.20 1.50

Included in distribution for the financial year is an amount of

MYR1,527,000 (2012: MYR983,000) made from previous nancial

years net realised income.

17. Transactions with Related and Other Brokers/Financial

Institutions

Value of Per Cent Brokerage Per Cent

Trade of Total Fees and of Total

Trade Commissions Fees and

Name Commissions

MYR000 % MYR000 %

Public Investment

Bank Berhad

(related party) 29,725 44 68 43

Mercury Securities

Sdn Bhd 27,085 40 61 38

CLSA Securities

Korea Limited 2,969 4 9 6

Public Securities

Limited (related

party) 1,756 3 4 3

TA Securities

Holdings Berhad 1,185 2 3 2

Kenanga Investment

Bank Berhad 1,146 2 3 2

J.P. Morgan

Securities Limited 780 1 2 1

Deutsche Securities

Korea Co. (DSK) 648 1 2 1

UBS Securities Malaysia

Sdn Bhd 601 1 2 1

Public Bank (Hong

Kong) Limited

(related party) 397 - 1 -

Others 1,638 2 4 3

67,930 100 159 100

Notes To The Financial Statements

30 November 2013

Notes To The Financial Statements

30 November 2013

17. Transactions with Related and Other Brokers/Financial

Institutions (contd)

The directors of the Manager are of the opinion that transactions

with related parties have been entered into in the normal course of

business and have been established on terms and conditions that

are not materially different from that obtainable in transactions with

unrelated parties.

18. Management Expense and Portfolio Turnover Ratios

(a) Management Expense Ratio (MER)

The MER for the nancial year is 1.65% (2012: 1.61%). It is the

total management expenses expressed as an annual percentage

of the Funds average net asset value.

(b) Portfolio Turnover Ratio (PTR)

The PTR for the nancial year is 0.42 time (2012: 0.42 time). It

represents the average of the total acquisitions and disposals of

the investments in the Fund for the nancial year over the average

net asset value of the Fund calculated on a daily basis.

19. Segment Information

For management purposes, the Fund is organised into one main

operating segment, which invests in various nancial instruments and

the analysis of the Funds investment income by segments is as follows:

2013 2012

MYR000 MYR000

(a) Investment Type

Equity securities 12,088 15,957

Collective investment funds 12 -

Warrants 47 105

Mudharabah deposits 106 95

12,253 16,157

(b) Regional Location

Malaysia 11,492 15,938

Asia Pacic region 761 219

12,253 16,157

40 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 41

Corporate Information

Manager

Public Mutual Berhad (23419-A)

Registered Office

Block B, Sri Damansara Business Park

Persiaran Industri, Bandar Sri Damansara

52200 Kuala Lumpur

Tel: 603-62796800

Fax: 603-62779800

Secretaries

Ms. Tang Pueh Fong (MIA 8078)

Ms. Pang Siew Han (MIA 6968)

Banker

Public Bank Berhad

Trustee of the Fund

AmanahRaya Trustees Berhad

Tingkat 2, Wisma TAS

No. 21, Jalan Melaka

50100 Kuala Lumpur

Shariah Adviser

ZICOlaw Shariah Advisory Services Sdn Bhd

(formerly known as ZI Shariah Advisory Services Sdn Bhd)

Suite 2-4, Level 2

Tower Block, Menara Milenium

Jalan Damanlela

Pusat Bandar Damansara

50490 Kuala Lumpur

Auditor of the Manager and the Fund

Ernst & Young

Level 23A, Menara Milenium

Jalan Damanlela

Pusat Bandar Damansara

Damansara Heights

50490 Kuala Lumpur

Tax Adviser

KPMG Tax Services Sdn Bhd

Level 10, KPMG Tower

8, First Avenue

Bandar Utama

47800 Petaling Jaya

Selangor

Corporate Information

Management Staff

Yeoh Kim Hong

Chief Executive Ofcer / Executive Director

Lum Ming Jang

Senior General Manager - Investment

Richard Tan Koon Eam

General Manager - Information Technology

Lee Kean Gie

General Manager - Agency Operations

Alex Sito Kok Chau

General Manager - Marketing & Financial Planning

Hang Siew Eng

General Manager - Customer Administration & Service

Tang Pueh Fong

General Manager - Finance & Operations

Evelyn Chu Swee Yin

General Manager - Agency Development & Training

Senior Compliance Officer

Abdul Samad Bin Jaafar

Assistant General Manager - Compliance

42 Public Islamic Alpha-40 Growth Fund Public Islamic Alpha-40 Growth Fund 43

Directors And Senior Management

Tan Sri Dato Sri Dr. Teh Hong Piow

Non-independent Director / Chairman

Tan Sri Dato Sri Dr. Teh Hong Piow, is a Director of Public Mutual since

September 2006. He began his banking career in 1950 and has 63 years

experience in the banking and nance industry. He founded Public Bank Bhd.

in 1965 at the age of 35. He was appointed as a Director of Public Bank Bhd.

on 30 December 1965 and had been the Chief Executive Ofcer of Public

Bank Bhd. since its commencement of business operations in August 1966.

He was re-designated as Chairman of Public Bank Bhd. and Chairman of

Public Bank Group with effect from 1 July 2002.

Tan Sri Dato Sri Dr. Teh Hong Piow had won both domestic and international

acclaim for his outstanding achievements as a banker and the Chief Executive

Ofcer of a leading nancial services group. Awards and accolades that he

had received include:

Asias Commercial Banker of the Year 1991

The ASEAN Businessman of the Year 1994

Malaysias Business Achiever of the Year 1997

Malaysias CEO of the Year 1998

Best CEO in Malaysia 2004

The Most PR Savvy CEO 2004

The Asian Banker Leadership Achievement Award 2005 for Malaysia

Award for Outstanding Contribution to the Development of Financial

Services in Asia 2006

Lifetime Achievement Award 2006

Award for Lifetime Achievement in Corporate Excellence, Dedication

and Industry 2006

Asias Banker of High Distinction Award 2006

The BrandLaureate Brand Personality Award 2007

ASEAN Most Astute Banker Award 2007