Mar 040314 06040314

Diunggah oleh

Raya DuraiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Mar 040314 06040314

Diunggah oleh

Raya DuraiHak Cipta:

Format Tersedia

4

th

March 2014

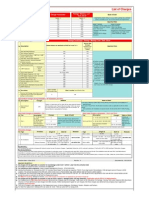

INDEX PREV. CLOSING % CHANGE DAILY TREND

NIFTY 6221.45 -0.88% SIDEWAYS

NIFTY FUT.

6239.45 -0.79%

SGX CNX NIFTY INDEX FUT. (8:15.am.)

6240.00 +0.22%

OUTLOOK FOR THE DAY

The market is likely to open flat taking cues from global markets. Asian stocks swung between gains and losses, after

the regional index yesterday capped its first back-to-back declines in a month, as investors weighed the crisis in

Crimea and ahead of the National Peoples Congress annual meeting in China starting tomorrow. The U.S. stock

market fell sharply Monday as political tensions between Ukraine and Russia over the Crimean peninsula pushed

investors to move into safe havens. As per provisional figures, foreign institutional investors (FIIs) bought shares

worth a net Rs 198.53 crore on 3

rd

March 2014. Domestic institutional investors bought shares worth Rs 1566.31 crore

on that day.

INTERNATIONAL MARKET

INDEX

CLOSING

(SPOT)

CHANGE

(%)

US MARKETS

NASDAQ COMPOSITE 4277.30 -0.72%

DOW JONES 16168.03 -0.94%

US MARKETS (FUTURE)

NASDAQ 100 3675.25 +0.18%

DOW JONES 16172.00 0.15%

ASIAN MARKETS

HANG SENG INDEX 22602.67 +0.45%

NIKKEI 225 14702.60 +0.34%

SHANGHAI COMP. INDEX 2069.04 -0.30%

SECTOR TO WATCH TODAY

Sectors to Outperform

Capital Goods & Consumer Durables

Sectors to Underperform

FMCG & Healthcare

MACRO NEWS

US construction spending edged up 0.1 percent to a seasonally adjusted annual rate of $943.1 billion in January from

the revised December estimate of $941.9 billion. The modest increase came as a surprise to economists, who had

been expecting construction spending to drop by about 0.5 percent.

INTRADAY TECHNICAL PICKS

Stock Name Buy/Sell Range Pr. Close Target 1 Target 2 SL

ADANIENT BUY 261-262 263.90 270 274 258

SIEMENS BUY 618-619 620.70 638 645 610

HINDUNILVR SELL 545-546 542.50 530 525 552

NIFTY SNAPSHOT

CURRENT PREVIOUS

Nifty Spot 6221.45 6276.95

Nifty Mar 6239.45 6289.25

Nifty Apr 6274.45 6325.65

Chg. OI (Mar) (%) -1.84 0.72

Chg. OI (Apr) (%) 5.43 16.12

Implied Volatility (%) 13.79 12.17

Nifty Support 6180 6180

Nifty Resistance 6350 6350

50 Day EMA 6185 6184

100 Day EMA 6173 6170

200 Day EMA 5988 5987

Put-Call Ratio 1.14 1.10

Historical Volatility (%) 14.54 14.50

Volatility Index 15.28 14.18

NIFTY STRATEGY

NIFTY-TECHNICAL OUTLOOK

Today the Markets are likely open on flat note. All emerging Markets

are trading mixed.

The coming session is likely to witness a range of 6180 on declines

and 6350 on advances.

WORLD APRKET COMMENTARY

In last session all leading American indices like Dow Jones Industrial

Average, NASDAQ index and the S&P 500 (SPX) ended in red. Dow

was down by 0.94% and closed at 16168; S&P 500 was shed by

0.74% at 1846. European indices ended in red. FTSE was down by

1.49%, DAX shed by 3.44% & CAC 40 was down by 2.66%.

Today major stock markets in Asia are trading mixed. Shanghai

Composite is down by 0.53% at 2064 and Hang Seng is up by 0.22%

at 22550. Japans Nikkei is up by 0.32% at 14699 and Singapores

Straits Times up by 0.29% at 3096.

Singapore Nifty future is currently up by 14 point at 6240.

SECURITY IN BAN PERIOD

No security is in ban period for trade date Mar 04, 2014 F&O

segment.

We recommend the following trading strategy:

Buy 1 Lot Mar Month Nifty 6200 PE around 74.

Sell 1 Lot Mar Month Nifty 6100 PE around 44.

Strategy Stop Loss: 15 (6200 PE + 6100 PE).

Lot size: 50

Max Profit: 3500 (70*50)

Max Loss: 1500 (30*50)

FIIS ACTIVITY IN F&O IN LAST TEN SESSIONS

(DERIVATIVE SEGMENT)

BASIS GAP IN NIFTY

NIFTY CHANGE IN OPEN INTREST

FIIS ACTIVITY IN F&O IN LAST SESSION

(DERIVATIVE SEGMENT)

NIFTY TOTAL OPEN INTEREST

239.42

1247.23

467.50

-653.52

407.75

882.48

1890.77

1914.37

970.86

395.31

-1000.00

-500.00

0.00

500.00

1000.00

1500.00

2000.00

2500.00

1

7

-

F

e

b

1

8

-

F

e

b

1

9

-

F

e

b

2

0

-

F

e

b

2

1

-

F

e

b

2

4

-

F

e

b

2

5

-

F

e

b

2

6

-

F

e

b

2

8

-

F

e

b

0

3

-

M

a

r

17.9

11.7

6.3

16.5

8.5

7.1

9.0

33.95

12.3

18

0

5

10

15

20

25

30

35

40

1

7

-

F

e

b

1

8

-

F

e

b

1

9

-

F

e

b

2

0

-

F

e

b

2

1

-

F

e

b

2

4

-

F

e

b

2

5

-

F

e

b

2

6

-

F

e

b

2

8

-

F

e

b

0

3

-

M

a

r

-200000

0

200000

400000

600000

800000

1000000

1200000

5

7

0

0

5

8

0

0

5

9

0

0

6

0

0

0

6

0

5

0

6

1

0

0

6

2

0

0

6

3

0

0

6

4

0

0

6

5

0

0

Call Put

Buy

50.78%

Sell

49.22%

0

1000000

2000000

3000000

4000000

5000000

6000000

5

6

0

0

5

7

0

0

5

8

0

0

5

9

0

0

6

0

0

0

6

1

0

0

6

2

0

0

6

3

0

0

6

4

0

0

6

5

0

0

6

6

0

0

Call Put

FIIs are net buyer in (F&O segment) last

session by INR 395.31 crores.

Nifty Mar futures closed at a premium of

18.00 points.

Maximum Call for Mar month stands at the

levels of 6300.

Maximum Put for Mar month stands at the

levels of 6200.

Nifty is down by 0.88% and open interest

shed by 1.84%.

REC0MMENDATIONS:

ITC View: Bullish CMP: 330.30

On the daily chart, stock closes on upside range.

Momentum oscillators are neutral to positive.

We recommend to:

Buy Mar 340 Call at 3.60-3.80

Target: 8.00

Stop Loss: 2.20

Lot size: 1000

JINDALSTEL View: Bullish CMP: 244.05

On the daily chart, stock closes above 20 days moving

average. Momentum oscillators are neutral to positive.

We recommend to:

Buy Mar 250 Call At 7.00-7.20

Target: 14.00

Stop Loss: 5.60

Lot size: 1000

SBIN View: Bearish CMP: 1509.40

On the daily chart, stock makes upside shadow in

last session. Momentum oscillators are neutral to

negative.

We recommend to:

Buy Mar 1450 Put At 22.00-22.50

Target: 55.00

Stop Loss: 12.00

Lot size: 125

STOCKS TREND ON DAILY CLOSING LEVELS FOR SHORT TERM

STOCKS

CLOSING

PRICE TREND

DATE TREND

CHANGED

RATE TREND

CHANGED

CLOSING

STOP LOSS

S&P Nifty 6221 UP 10.09.13 5897 5900

CNX IT Index 10209 Up 12.07.13 7249 9400

CNX Bank Index 10652 Down 29.01.14 10438 11000

A.C.C 1102 UP 28.02.14 1108 1040

AMBUJA CEMENT 167 Down 14.01.14 168 180

ASIANPAINT* 472 UP 20.09.13 491 455

AXIS BANK 1254 UP 02.12.13 1187 1060

BAJAJ AUTO 1919 Down 03.02.14 1829 1970

BANKBARODA 543 Down 30.01.14 532 620

BHARTI ARTL 286 Down 16.12.13 314 320

BHEL 163 UP 05.09.13 138 148

BPCL * 377 UP 30.10.13 362 320

CAIRN 328 Up 26.08.13 317 305

CIPLA 376 Down 13.02.14 381 400

COALINDIA 245 Down 17.01.14 272 280

DLF 139 Down 27.01.14 140 160

DRREDDY 2818 Up 17.07.12 1705 2400

GAIL 369 UP 20.09.13 342 320

GRASIM 2525 Down 03.02.14 2502 2700

HCL TECH 1504 Up 24.01.12 427 1200

H.D.F.C 816 Up 19.09.13 832 760

HDFC BANK 665 UP 11.10.13 660 600

HEROMOTOCO 1957 Up 26.07.13 1869 1850

HINDALCO 106 Down 04.02.14 102 108

HINDUNILVR 543 Down 16.08.13 599 610

ICICI BANK 1027 Down 30.01.14 981 1060

IDFC 95 Down 27.01.14 92 105

INDUSIND 391 Down 29.01.14 380 430

INFOSYS 3795 Up 12.07.13 2804 3500

ITC 329 DOWN 06.11.13 319 330

JIND STL & PWR 242 Down 13.02.14 234 260

JP ASSOCIATES 40 Down 27.01.14 40 50

KOTAK BANK 669 Down 27.01.14 656 730

LT 1098 UP 19.09.13 890 1020

LUPIN 980 UP 04.09.13 879 820

M&M 952 UP 29.10.13 901 830

MARUTI 1583 Down 28.01.14 1543 1700

NMDC 129 UP 26.09.13 127 125

NTPC 111 Down 03.01.14 132 135

ONGC 291 UP 31.10.13 293 268

PNB 539 UP 01.11.13 571 500

POWERGRID 95 Down 14.02.13 106 105

RANBAXY 360 UP 19.02.14 361 330

RELIANCE 804 Down 30.01.14 826 860

SBI 1516 Down 16.12.13 1730 1760

SESAGOA 174 Down 03.03.14 174 194

SUN PHARMA 625 UP 25.10.11 250 540

TATA MOTORS 409 UP 19.08.13 302 330

TATA POWER 78 Down 22.01.14 77 84

TATA STEEL 344 Down 28.02.14 344 380

TCS 2232 Up 15.01.13 1338 2040

ULTRACEMCO 1828 UP 25.02.14 1863 1750

WIPRO 585 UP 27.09.13 - 520

Note: These levels should not be confused with the weekly trendsheet which is sent in weekly magazine in the name of "Money Wise"

For Any Query or Suggestions email at

researchfeedback@smcindiaonline.com

Analyst

Dinesh Joshi dineshjoshi@smcindiaonline.com

Dhirender Singh Bisht dhirenderbisht@smcindiaonline.com

Disclaimer : This report is for the personal information of the authorized recipient and doesnt construe to be any investment, legal

or taxation advice to you. It is only for private circulation and use .The report is based upon information that we consider reliable,

but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis

of the contents of the report. The report should not be reproduced or redistributed to any other person(s)in any form without prior

written permission of the SMC. The contents of this material are general and are neither comprehensive nor inclusive. Neither SMC

nor any of its affiliates, associates, representatives, directors or employees shall be responsible for any loss or damage that may

arise to any person due to any action taken on the basis of this report. It does not constitute personal recommendations or take

into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any

entity/s. All investments involve risk and past performance doesnt guarantee future results. The value of, and income from

investments may vary because of the changes in the macro and micro factors given at a certain period of time. The person should

use his/her own judgment while taking investment decisions. Please note that we and our affiliates, officers, directors, and

employees, including persons involved in the preparation or issuance if this material;(a) from time to time, may have long or short

positions in, and buy or sell the securities thereof, of company (ies) mentioned here in or (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies) or act as

advisor or lender/borrower to such company(ies) or (c) may have any other potential conflict of interest with respect to any

recommendation and related information and opinions. All disputes shall be subject to the exclusive jurisdiction of Delhi High court.

Anda mungkin juga menyukai

- FnowebclnDokumen1 halamanFnowebclnRaya DuraiBelum ada peringkat

- Savings Account De-Linkage FormDokumen1 halamanSavings Account De-Linkage FormRaya DuraiBelum ada peringkat

- Revised List of Charges 4 Dec 12Dokumen1 halamanRevised List of Charges 4 Dec 12Raya DuraiBelum ada peringkat

- Airtel USSD CodeDokumen7 halamanAirtel USSD CodeRaya Durai100% (1)

- Demat Account De-Linkage FormDokumen1 halamanDemat Account De-Linkage FormRaya DuraiBelum ada peringkat

- Machinist 12812 7Dokumen5 halamanMachinist 12812 7Raya DuraiBelum ada peringkat

- StudyGuide MachinistDokumen30 halamanStudyGuide MachinistRaya Durai100% (1)

- Technidex: Stock Futures IndexDokumen3 halamanTechnidex: Stock Futures IndexRaya DuraiBelum ada peringkat

- Regd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1Dokumen1 halamanRegd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1Raya DuraiBelum ada peringkat

- Tata Steel: CMP: INR452 TP: INR496 BuyDokumen10 halamanTata Steel: CMP: INR452 TP: INR496 BuyRaya DuraiBelum ada peringkat

- Job Description CNC Machinist (Advanced) : Key Skills and CompetenciesDokumen2 halamanJob Description CNC Machinist (Advanced) : Key Skills and CompetenciesRaya DuraiBelum ada peringkat

- Beyond Greed and FearDokumen279 halamanBeyond Greed and Fearreviur100% (13)

- The Complete Guide To Day TradingDokumen295 halamanThe Complete Guide To Day Tradingholtla94% (72)

- Weekly View:: Nifty Likely To Trade in Range of 6600-6800Dokumen14 halamanWeekly View:: Nifty Likely To Trade in Range of 6600-6800Raya DuraiBelum ada peringkat

- Index Analysis: Technical Outlook - 3 March'14Dokumen3 halamanIndex Analysis: Technical Outlook - 3 March'14Raya DuraiBelum ada peringkat

- Daily Technical Report: Sensex (21120) / Nifty (6277)Dokumen4 halamanDaily Technical Report: Sensex (21120) / Nifty (6277)Raya Durai100% (1)

- Daily Activity Report - TejasreDokumen53 halamanDaily Activity Report - TejasreRaya DuraiBelum ada peringkat

- Tele Register July'13 AbinayaDokumen1 halamanTele Register July'13 AbinayaRaya DuraiBelum ada peringkat

- Abinaya DSMR - Report 2013Dokumen54 halamanAbinaya DSMR - Report 2013Raya DuraiBelum ada peringkat

- Oct Nov Dec Date Attendance Date Attendance Date AttendanceDokumen2 halamanOct Nov Dec Date Attendance Date Attendance Date AttendanceRaya DuraiBelum ada peringkat

- Enq Analysis of Sept 2013 - BiDokumen3 halamanEnq Analysis of Sept 2013 - BiRaya DuraiBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 2nd Quiz Key To CorrectionDokumen3 halaman2nd Quiz Key To CorrectionJohn Paul MagbitangBelum ada peringkat

- Corporate RestructuringDokumen40 halamanCorporate RestructuringSingh RahulBelum ada peringkat

- Introduction To SHE and Issuance of SharesDokumen1 halamanIntroduction To SHE and Issuance of Shareslei dcBelum ada peringkat

- AFAR-04-Joint ArrangementsDokumen2 halamanAFAR-04-Joint ArrangementsChristianAquinoBelum ada peringkat

- Ebay 10k AnalysisDokumen7 halamanEbay 10k Analysisapi-506586804Belum ada peringkat

- Chapter 12Dokumen13 halamanChapter 12Abood Alissa100% (1)

- Topic 2 - Business CombinationsDokumen32 halamanTopic 2 - Business Combinationshayat_illusionBelum ada peringkat

- GAIM Bro Final1Dokumen8 halamanGAIM Bro Final1keymitBelum ada peringkat

- CV Derry 2022Dokumen1 halamanCV Derry 2022mks iainsagBelum ada peringkat

- Flipkart Mis B1Dokumen16 halamanFlipkart Mis B1Aanshi PriyaBelum ada peringkat

- Fabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Dokumen24 halamanFabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Maria Nikka GarciaBelum ada peringkat

- PRM Handbook Introduction and ContentsDokumen23 halamanPRM Handbook Introduction and ContentsMike Wong0% (1)

- Offering Memorandum: Sustainability Finance Real Economies SICAV-SIFDokumen72 halamanOffering Memorandum: Sustainability Finance Real Economies SICAV-SIFGeorgio RomaniBelum ada peringkat

- Solution of Amalgamation - Home AssignmentDokumen32 halamanSolution of Amalgamation - Home Assignmentlucky_mugal786Belum ada peringkat

- Practical Management Science 6th Edition Winston Solutions ManualDokumen11 halamanPractical Management Science 6th Edition Winston Solutions ManualMeganJohnsontqpmf89% (9)

- Corporate RestructuringDokumen490 halamanCorporate RestructuringMohammed Zubair BhatiBelum ada peringkat

- Topic 7 Job Costing Tutorial - QDokumen4 halamanTopic 7 Job Costing Tutorial - QNUR FARIZA MOHAMAD ABDUL LATIFBelum ada peringkat

- Order Flow Trading PDFDokumen14 halamanOrder Flow Trading PDFalexis walter100% (3)

- Financial Management For ArchitectsDokumen10 halamanFinancial Management For ArchitectsARD SevenBelum ada peringkat

- PR - ACEN Sub Issues USD400M in FFL Green Bonds Final VersionDokumen3 halamanPR - ACEN Sub Issues USD400M in FFL Green Bonds Final VersionPaulBelum ada peringkat

- Company Accounts Issue of Shares Par Premium DiscountDokumen20 halamanCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Banking and Marketing TermsDokumen17 halamanBanking and Marketing TermsVigya JindalBelum ada peringkat

- Pertemuan 2 - Hutang Jangka PanjangDokumen27 halamanPertemuan 2 - Hutang Jangka Panjangbernadetta paradintya utamiBelum ada peringkat

- Case Study: Economic Value AddedDokumen2 halamanCase Study: Economic Value AddedJulio Cajas VissoniBelum ada peringkat

- Financial Reporting Statements and AnalysisDokumen245 halamanFinancial Reporting Statements and AnalysisSandeep Singh100% (1)

- Test Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadDokumen56 halamanTest Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadTeresaMoorecsrby100% (40)

- 1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsDokumen22 halaman1996 - Dennis Et Al. - EVA For Banks - Value Creation, Risk Management and Profitability Measurment - 326 CitationsAbdulAzeemBelum ada peringkat

- Chap2 Case 1Dokumen1 halamanChap2 Case 1Xyza Faye RegaladoBelum ada peringkat

- Determining The Target Cash Balance: Appendix 27ADokumen8 halamanDetermining The Target Cash Balance: Appendix 27AEstefanīa Galarza100% (1)

- 3Q17 Net Income Down 39.2% Y/y, Outlook Remains Poor: Universal Robina CorporationDokumen8 halaman3Q17 Net Income Down 39.2% Y/y, Outlook Remains Poor: Universal Robina Corporationherrewt rewterwBelum ada peringkat