Managing Emerging Market Risk

Diunggah oleh

valeHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Managing Emerging Market Risk

Diunggah oleh

valeHak Cipta:

Format Tersedia

GLOBAL LOGISTICS

h4-4 1 i ! I / f M

~f / I 1 f 1 1 / t-Ji

- -

tm

It

BY JOYCE KLINE, ACCENTURE

Supply chain risk has become

more problematic th a n ever be-

fo r e a n d th e increasing need to

penetr ate emerging markets is

only making th e probiem more

a c u te . Here are five br oad-r each-

ing steps shippers can tai<e to

establish a safety n e t.

market risk

M

ature home markets. M ore

and more widespread com-

petition. Downward pressure

on margins. Small wonder that com-

panies everywhere are thinkingand

actingmore globally. Pure and sim-

ple, global business is becoming every

company's reality.

Thousands of pitfalls line the path

to high performance in global opera-

tions. But among the most treacherous

is the need to understand and manage

risk. Then again, business is all about

risk. But with tbe advent of global

operationsand companies' growing

interest in emerging marketsrisk has

assumed a whole new dimension.

For example, risk is exacerbated by

limitations in physical infrastructure

(roads, ports, facilities, etc), which

are usually less developed in emerging

markets. Take India (one of the four

BRIC countries, along with Brazil,

Russia, and China), wbere transport

delays and inadequate cold storage

cause nearly balf of all domestically

May2007| WWW.LOGISTICSMGMT.COM

LOGISTICS MANAGEMENT 41

Emerging markets, continued

Increased inventories

and safety stock

Forward buying/hedging

strategies

Developing

I

Sourcingof contingent

suppi iers and/or i ogis-

tics providers

Forrmi r isl( tnuiagertEnt

program

EstabI ishing an inten-

tionaily geographical ly

distr ibuted supply base

Mature

Figure 1 : A continuum of suppiy chain

risk-mitigation approaches.

grown fruits and vegetables to rot before

delivery.

Political structures and policies

also enhance risk, since they're nearly

always more restrictive in emerging

markets. Even in the European Union

(EU) supply chain risk is elevated

because cabotage (intranational trans-

port) is zealously controlled. Haulers

based in one EU country usually are

not allowed to travel between points

within another EU country.

Or take China, which periodically

imposes licensing, health, technical,

and packaging restrictions that put

foreign companies at a disadvantage.

China recently released a draft regula-

tion requiring "one dealer license, one

product" in the auto sector, effectively

preventing newcomers from using

existing distribution channels and

giving domestic manufacturers more

time to prepare for direct competition.

Figuring out how to surmount these

risks is core to the challenge of global

operations.

But risk has another, even more dire,

component: anticipating and respond-

ing to unanticipated calamities. In a

recent column in Logistics Management

(www.logisticsmgmt.com), we profiled

a 2006 Accenture study on risk man-

agement and mitigation. The results

were sobering: Seventy-three percent

of companies have experienced supply

chain disruptions in the past five years.

Of those, executives at nearly 32 per-

cent said it took more than 'one month

to recover and 36 percent said it took

between one week and one month to

recover.

The vast majority (94 percent) said

the disruption affected profitability and

their companys ability to meet cus-

tomer expectations. Fifty-six percent

said the impact on customer expec-

tations was moderate or significant.

The report also identified the source of

most upheavals and the frequency with

which they were cited by respondents:

Poor performance of supply chain

partners (38 percent).

Volatility of fuel prices (37 percent).

Natural disasters (35 percent).

Inability to deal with logistics

capacity or complexity issues (33

percent).

Inaccurate plans and forecasts (30

percent).

The bottom line is twofold: Supply

chain risk has become more ubiqui-

tous and problematic than ever before,

and companies' increasing need to

penetrate emerging markets will only

make the problem more acute.

REFINING THE STRATEGY

A company's first-tier response to

global risk should be obvious: develop

and refine a global operating strategy.

That strategy must begin by confirm-

ing the primary reason for addressing

an emerging market. Is it to find new

On both sides, selling and sourcing, the

key is aligning market-entry objectives

with the supply chain characteristics that

typify each country or region. What works

in Brazil may not work in China.

sources of supply? Increase revenues

by attracting new buyers? Introduce

new products or product lines?

If the objective is to increase rev-

enues by tapping hot new markets, it's

essential that the company understand

on a market-by-market basis the readi-

ness and appropriateness of its prod-

uct portfolio, logistics channels, make/

buy approaches, and sales/marketing

support functions. If the goal is new

sourcing opportunities, the make-or-

break factor could be the right sourc-

ing model: Work with trading agents?

Form local joint ventures or wholly

owned foreign enterprises? Build

international procurement offices? On

both sides (selling and sourcing), the

key is aligning market-entry objectives

with the supply chain characteristics

that typify each country or region.

What works in Brazil may not work in

China.

The above generalities may be use-

ful up to a point. But they don't speak

to the specific issue of risk. In its most

recent (2006) study of global opera-

tions, Accenture found that the global

operations strategies of most compa-

nies were not developed with specific

attention to managing supply chain

risk. Three-quarters of the survey's 300

respondents noted that their companies

have not fully integrated risk-mitigation

with their global operations strategy.

Ten percent have done nothing what-

soever. In addition, more than half of

the survey respondents stated that their

global operations strategies have actu-

ally increased supply chain risk. Only

13 percent said that risk dropped as a

result of implementing/upgrading their

global operations strategy.

So what are the right ways to mini-

mize the risks associated with emerg-

ing markets? And what is the right way

to make those approaches part of an

evolving, continuously improving global

42 LOGISTICS MANAGEMENT WWW.LOGISTICSMGMT.COM | May 2007

Emerging markets, continued

operations strategy? Natu-

rally, there are hundreds

of individual steps that can

be taken to reduce supply

chain risk.

However, research by

Accenture has identified

five of the most far-reach-

ing and significant. As

shown in Figure 1, each

resides on a continuum of

"supply chain maturity,"

1

Increasing inventories and safety

stocks is a viable and widely

practiced option. However,

it's also' a buffer strategy that's typi-

cally employed by companies seek-

ing a foothold in an emerging market.

And it can be costly, and therefore

less likely to align with the company's

broader inventory management objec-

tives or the wishes of its C-suite,

2

Forward buying/hedging strategies

also can mitigate risk by ensur-

ing the cost-effective acquisi-

tion of needed products and materiel

from emerging markets. However, a

forward buying and hedging strategy

must be evaluated in light of each spe-

cific purchase. Acquiring supply-con-

strained materials such as titanium

will likely be viewed as strategic. But

hedging on a more readily available

commodity would likely be an inap-

propriate risk-abatement solution,

3

Building contingency relation-

ships with additional suppliers or

logistics services providers is often

a good way to prepare for potential dis-

ruptions in supply, unless it somehow

detracts from companies' valued rela-

tionships with current supply chain part-

ners. However, this is not a simple short-

term initiative, nor is it easy to undo.

New relationships increase agility

and potentially reduce risk, but they

take time. The key is ensuring that pro-

spective partners are highly qualified,

and that their supply chain processes

are compatible with those in place

at the companies that engage them.

Take the case of a leading high-tech

company seeking to maintain opera-

tions in the wake of the Indonesian

tsunamis. Strong contingency relation-

ships enabled it to move supply and

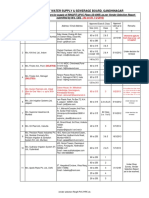

Risk-Mitigatioii Strategy Maturity | Strategy i Strategy DeeiiEd l Strategy Deeiipcl ' Effectiveness

Level i in Place ' Effective i Ineffective : Gap

INCREASED INVENTORIES AND SAFETY STOCK

FORWARD BUYING/HEDGING

SOURCING CONTINGENT SUPPLIERS

FORMAL RISK MANAGEMENT PROGRAM

GEOGRAPHICALLY DISTRIBUTED SUPPLY BASE

1

2

3

4

5

43%

54%

42%

48%

40%

46%

57%

54%

52%

49%

39%

50%

27%

42%

27%

+7

+7

+27

+10

+22

Figure 2: Responses to a 2006 Accenture study on Supply Chain Risk Manage-

ment. Survey recipients were asked: "Which of the foliowing processes do you

have in piace to identify and mitigate suppiy chain risks, and how effective

have they been?"

production from its Asian operations

to alternate venues in North America

and Europe, At no time did this shift

impact the company's customers,

4

Further along the continuum is

the development of a formal risk

management program that clearly

defines and prescribes a company's

range of responses to a potential dis-

ruption. In simplest terms, this involves

the development of a structured, inte-

grated "resilience life cycle" across

which companies:

Identify and categorize risks,

Monitor threats,

Circulate information and alerts,

Develop mechanisms for mini-

mizing the effect of disruptions,

Prefabricate and enact potential

responses,

Develop mechanisms for recover-

ing in the most rapid and efficient way

Measure performance and develop-

metrics for continuous improvement,

5

The most "mature" example of

supply chain risk mitigation is an

intentionally geographically dis-

tributed supply basethe operative

word here is intentionally. Many com-

panies seek to develop an extended

supply chain in order to reduce cost and

maintain competitiveness. As a result,

suppliers in emerging markets are often

targeted. However, the qualification

process can be long, and ensuring cer-

tainty of supply is always challenging.

In the high-tech and aerospace

industries, for example, supplier quali-

fication can take 12 months or more.

Another challenge associated with dis-

tributed supply bases is the more com-

plex (and potentially more expensive)

circulation of material for assembly

or point of use. Simply put, emerging

markets and intentionally distributed

supply bases are poster children for

the design of insightful, innovative

global operations strategies,

INTEGRATING MITIGATION

It is interesting to note that Accen-

ture-researched companies haven't nec-

essarily enacted the five practices in the

same sequence we have just described.

As shown in Figure 2, forward buying/

hedging is used more widely than the

"less mature" practice of increasing

inventories and safety stock.

Yet both have the narrowest

"effectiveness gap"the difference

between those companies deeming

the practice effective versus ineffec-

tive, Cenerally speaking, however,

the more mature practices have been

enacted by fewer companies and

have a significantly higher level of

perceived effectiveness.

In net, every emerging market and

every supply chain strategy has its own

cadre of risks. Though there are hun-

dreds of responses, most are mirrors or

subsets of the five strategies we've just

discussed. We should also highlight that

companies bent on high performance

develop their global operations strate-

gies knowing that built-in risk manage-

ment programs are critical. These com-

panies balance their emerging market

objectives against the related (and doc-

umented) risk. In fact, it's often high

expertise, high expectations and, most

of all, high levels of preparedness that

make them high performers.

Joyce Kline is a senior manager in the

Accenture Supply Chain Managem.ent

Strategy practice. Based in Boston,

she can he reached at joyce.s.kline

accenture.com.

44 LOGISTICS MANAGEIVIENT

WWW.LOGISTICSMGMTCOM | May 2007

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Exam Flashcards: by Jonathan DonadoDokumen520 halamanExam Flashcards: by Jonathan Donadosolarstuff100% (1)

- 21-3971-CLA - DisenŞo Preliminar Cimentacion - Normal SoilDokumen4 halaman21-3971-CLA - DisenŞo Preliminar Cimentacion - Normal SoilJose ManzanarezBelum ada peringkat

- ENOVIA V6 Product PortfolioDokumen32 halamanENOVIA V6 Product PortfolioARUN PATILBelum ada peringkat

- Zaroulas Mies Fullpaper 2020 05 21Dokumen9 halamanZaroulas Mies Fullpaper 2020 05 21sidgonzoBelum ada peringkat

- Unit-II Some PPT NetDokumen2 halamanUnit-II Some PPT NetbandisaidaiahBelum ada peringkat

- Experiment 5 DACDokumen3 halamanExperiment 5 DACABHISHEK SHARMABelum ada peringkat

- Sewer Connection Application Guidance PDFDokumen7 halamanSewer Connection Application Guidance PDFSamuel FuentesBelum ada peringkat

- Compact 40/25Dokumen58 halamanCompact 40/25znim04Belum ada peringkat

- NBN Co: Financial Management SolutionDokumen2 halamanNBN Co: Financial Management SolutionAccentureAustraliaBelum ada peringkat

- Chapter 2 - 2 Plane Curvilinear MotionDokumen37 halamanChapter 2 - 2 Plane Curvilinear MotionAlfredo Ruiz ValenciaBelum ada peringkat

- Internship Report May 2016Dokumen11 halamanInternship Report May 2016Rupini RagaviahBelum ada peringkat

- WT Lab ManualDokumen44 halamanWT Lab ManualVenkatanagasudheer Thummapudi100% (1)

- Sec VlanaclsDokumen10 halamanSec VlanaclsTry FajarmanBelum ada peringkat

- Published Document Guidance On The Use of BS EN 13108, Bituminous Mixtures - Material SpecificationsDokumen8 halamanPublished Document Guidance On The Use of BS EN 13108, Bituminous Mixtures - Material SpecificationsCristián JiménezBelum ada peringkat

- PORTFOLIO: OFFICE WORK (20/06/2022-20/12/2022) Harleen KlairDokumen34 halamanPORTFOLIO: OFFICE WORK (20/06/2022-20/12/2022) Harleen KlairHarleen KlairBelum ada peringkat

- Huawei: Quidway Full Series Ethernet Routing SwitchesDokumen90 halamanHuawei: Quidway Full Series Ethernet Routing SwitchesWalter Aguiar0% (1)

- VB Script ReferenceDokumen27 halamanVB Script ReferenceRajkumarBelum ada peringkat

- Waqas Riaz: Total Years of Experience: 2 Years ObjectiveDokumen2 halamanWaqas Riaz: Total Years of Experience: 2 Years ObjectiveIrfanBelum ada peringkat

- Receiving Material Procedure (Done) (Sudah Direvisi)Dokumen8 halamanReceiving Material Procedure (Done) (Sudah Direvisi)Hardika SambilangBelum ada peringkat

- Panel 01-Eldora-Grand-1500V-2021-R01 - G1Dokumen2 halamanPanel 01-Eldora-Grand-1500V-2021-R01 - G1DHAVAL SHAHBelum ada peringkat

- Tutorial - 05 - Excavation Settle 3DDokumen13 halamanTutorial - 05 - Excavation Settle 3DAlejandro Camargo SanabriaBelum ada peringkat

- C12200Dokumen3 halamanC12200xgiorg100% (1)

- Turbin 1Dokumen27 halamanTurbin 1Durjoy Chakraborty100% (1)

- Schematic Lenovo ThinkPad T410 NOZOMI-1Dokumen99 halamanSchematic Lenovo ThinkPad T410 NOZOMI-1borneocampBelum ada peringkat

- Introduction To Wireless Application Protocol (WAP) OGIDokumen12 halamanIntroduction To Wireless Application Protocol (WAP) OGIApram SinghBelum ada peringkat

- Braun KF40 - CDokumen17 halamanBraun KF40 - CAgung UtoyoBelum ada peringkat

- Service Manual: PhilipsDokumen39 halamanService Manual: PhilipsRogerio E. SantoBelum ada peringkat

- Preview ISO+749-1977 PDFDokumen3 halamanPreview ISO+749-1977 PDFLiana GaniBelum ada peringkat

- GWSSB Vendor List 19.11.2013Dokumen18 halamanGWSSB Vendor List 19.11.2013sivesh_rathiBelum ada peringkat

- D6489 PDFDokumen3 halamanD6489 PDFKalindaMadusankaDasanayakaBelum ada peringkat