Law Circulatory Letter No.: 53

Diunggah oleh

sunil0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan2 halamanDRT-II, Chandigarh has forwarded to us certain observations w.r.t. The procedure followed by the Banks for effecting recovery in cases where Recovery Certificate has been issued by DRTs. If the property is not demarcated, the demarcation should be got done till the service of notices on the CDs. In cases where a new Recovery Certificate is issued, it is incumbent upon the Bank to get valuation report relating to the property mortgaged with the Bank.

Deskripsi Asli:

Judul Asli

LNRCirl53_13

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniDRT-II, Chandigarh has forwarded to us certain observations w.r.t. The procedure followed by the Banks for effecting recovery in cases where Recovery Certificate has been issued by DRTs. If the property is not demarcated, the demarcation should be got done till the service of notices on the CDs. In cases where a new Recovery Certificate is issued, it is incumbent upon the Bank to get valuation report relating to the property mortgaged with the Bank.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan2 halamanLaw Circulatory Letter No.: 53

Diunggah oleh

sunilDRT-II, Chandigarh has forwarded to us certain observations w.r.t. The procedure followed by the Banks for effecting recovery in cases where Recovery Certificate has been issued by DRTs. If the property is not demarcated, the demarcation should be got done till the service of notices on the CDs. In cases where a new Recovery Certificate is issued, it is incumbent upon the Bank to get valuation report relating to the property mortgaged with the Bank.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

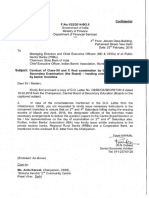

PUNJAB & SIND BANK

H.O.LAW & RECOVERY DEPTT.

4

TH

Floor, BANK HOUSE

21, RAJENDRA PLACE

NEW DELHI

-------------------------------------------------------------------------------------------------------------------------------

LAW CIRCULATORY LETTER NO. : 53 Dated: February 20, 2013

CODE No. of the Department: H-9010

Number of pages of Circulatory letter: 2

Running Circulatory letter No. of the Bank:

-------------------------------------------------------------------------------------------------------------------------------

ALL BRANCHES/CONTROLLING OFFICES

Reg: Steps for expediting the recovery cases pending at DRTs.

With the enactment of Debt Recovery Tribunal Act in 1993, the objective was to

have speedy recovery. A maximum time frame of 6 months was visualized for

settling the recovery cases by the Banks. However, in reality, we find many cases

are dragging for years together.

We have been informed by DRTs that the Banks are not taking suitable steps to

expedite the recovery proceedings even in cases where Recovery Certificates have

been issued by Honble Presiding Officer of respective DRTs. It has come to their

notice that quite often there are deficiencies in procedure followed by the Secured

Creditors (Banks) for putting the property to auction, which can be easily avoided.

In their endeavour to reduce the time taken in disposing of cases and to speed up

Bank recoveries, DRT-II, Chandigarh has forwarded to us certain observations

w.r.t. the procedure followed by the Banks for effecting recovery in cases where

Recovery Certificate has been issued by DRTs.

As soon as a new Recovery Certificate is issued, it is incumbent upon the Bank to

get valuation report relating to the property mortgaged with the Bank. In case the

property is not demarcated, the demarcation should be got done till the service of

notices is completed on the CDs.

With a view to expedite the recovery proceedings, notices under Rule 2 of Schedule

II of Income Tax Act, 1961, are being issued by DRT upon the defaulter to pay the

amount specified in the Certificate within fifteen days from the date of service of

the notice. These notices are being issued by DRT so that the time taken by the

Banks for service of notices is minimized.

However, DRT has observed the following deficiencies in the procedure being

followed by the Banks in such cases: -

(2)

Reg: Steps for expediting the recovery cases pending at DRTs.

1. That first the Banks wait for issue of notices under Rule 2. Then the Banks wait

for service of notices on the CDs by way of substituted services i.e. publication

of notices. Then the Bank takes its own time for filing valuation report and in

this process several months are being wasted which can be easily avoided if the

officers are aware about the importance of recovery of loan.

2. That after issue of notices under Rule 2, substituted service by way of

publication should be done by the Bank without seeking any adjournment so

that no time is wasted in effecting service upon the CDs. But the Banks are

seeking adjournments for the same again and again.

To mitigate this problem, DRT has desired that in case the Banks do not get the

notices published on the very first occasion, notices should be got published by

DRT for which the concerned Branch/ Office of the Bank will be liable to pay bill

for publication directly to the publication agency.

3. That the Nodal Officers should have a proper liaison with their Advocates which,

at present, is lacking. Complete list of pending cases has already been provided

to the Nodal Officers. The Nodal Officers should also come fully prepared so

that the respective Tribunals may be able to take some concrete steps for

recovery of dues.

It is matter of record that as per the initiative of Ministry of Finance, Nodal

Officers were appointed for each DRT who were supposed to regularly visit

DRTs, monitor all cases pending therein and meet POs and ROs regularly to see

that the cases are pursued vigorously in the Courts. The roles and

responsibilities of such Nodal Officers have been sparsely specified in Law

Circular No.210 dated 17.11.2011. We hope that these Nodal Officers must be

performing functions as advised in the said Circular so as to serve the purpose

for which they have been nominated.

Please take note of the points emerging out of the above mentioned deficiencies

found by DRTs and also discuss these issued with concerned Advocates, so that the

said anomalies, if any, w.r.t. procedure of the Bank be carefully taken care off so

that the time taken in disposing of cases before DRTs is reduced.

(H.S.GUJRAL)

Asstt.General Manager (L& R)

Anda mungkin juga menyukai

- Introduction to Negotiable Instruments: As per Indian LawsDari EverandIntroduction to Negotiable Instruments: As per Indian LawsPenilaian: 5 dari 5 bintang5/5 (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaDari EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaBelum ada peringkat

- JAIIB Principles and Practices of Banking Q & ADokumen13 halamanJAIIB Principles and Practices of Banking Q & ARahul FouzdarBelum ada peringkat

- Establishing Domestic Banks in the PhilippinesDokumen5 halamanEstablishing Domestic Banks in the PhilippinesKarl LabagalaBelum ada peringkat

- NBFC Guidelines Table of ContentsDokumen115 halamanNBFC Guidelines Table of ContentssrirammaliBelum ada peringkat

- Appendix 33 PDFDokumen7 halamanAppendix 33 PDFVenesse Sto. TomasBelum ada peringkat

- Banking Workshop Term 3Dokumen55 halamanBanking Workshop Term 3Arthur AmolaBelum ada peringkat

- DBF 3rd Exam Materials UpdatedDokumen17 halamanDBF 3rd Exam Materials UpdatedSreedev SureshbabuBelum ada peringkat

- Guidelines for settling bank dues through Lok AdalatsDokumen3 halamanGuidelines for settling bank dues through Lok AdalatsMahesh Prasad PandeyBelum ada peringkat

- JAIIB - Principles and Practices of Banking: CreditDokumen15 halamanJAIIB - Principles and Practices of Banking: CreditBiswajit DasBelum ada peringkat

- In Re Petition For Assistance V BIR DigestDokumen2 halamanIn Re Petition For Assistance V BIR DigestLiana AcubaBelum ada peringkat

- RA 1405 Section 3 Additional MaterialsDokumen5 halamanRA 1405 Section 3 Additional MaterialsSamuel BaulaBelum ada peringkat

- Recovery FinalDokumen22 halamanRecovery FinalHamza AhmedBelum ada peringkat

- Judge Dadole v. COADokumen2 halamanJudge Dadole v. COAYvonne MallariBelum ada peringkat

- Villafuerte v. RobredoDokumen3 halamanVillafuerte v. RobredoClarisseBelum ada peringkat

- Warangal All Round Mentoring Sept 2021 (1) 20211015220020Dokumen30 halamanWarangal All Round Mentoring Sept 2021 (1) 20211015220020Uday GopalBelum ada peringkat

- Unit - II Banking Law & Practices FullDokumen39 halamanUnit - II Banking Law & Practices FulllittlemagicpkBelum ada peringkat

- NPA MGMTDokumen60 halamanNPA MGMTRajib Ranjan SamalBelum ada peringkat

- Operation MuskaanDokumen8 halamanOperation Muskaanaltaibkhan318Belum ada peringkat

- Ramo 1-2000Dokumen526 halamanRamo 1-2000Mary graceBelum ada peringkat

- LBP v. Monet's Export and ManufacturingDokumen3 halamanLBP v. Monet's Export and ManufacturingGain DeeBelum ada peringkat

- Circular For Interest PaymentDokumen3 halamanCircular For Interest PaymentVibhu SinghBelum ada peringkat

- Advanced NEGOTIABLE INSTRUMENTS ACT ManikDokumen10 halamanAdvanced NEGOTIABLE INSTRUMENTS ACT ManikSahil GargBelum ada peringkat

- Concurrent Audit References 28-12-2012Dokumen12 halamanConcurrent Audit References 28-12-2012Sj RaoBelum ada peringkat

- BASIC Bank document withDokumen119 halamanBASIC Bank document withtanviriubdBelum ada peringkat

- Advanced NEGOTIABLE INSTRUMENTS ACT PriyaDokumen8 halamanAdvanced NEGOTIABLE INSTRUMENTS ACT PriyaSahil GargBelum ada peringkat

- Winding Up Banking Company ProcedureDokumen13 halamanWinding Up Banking Company ProcedureVinay KumarBelum ada peringkat

- Fund Front Office: Definition: Cash Reserve Ratio (CRR) in Terms of Section 42 (1) of The Reserve Bank of India ActDokumen17 halamanFund Front Office: Definition: Cash Reserve Ratio (CRR) in Terms of Section 42 (1) of The Reserve Bank of India ActSouravMalikBelum ada peringkat

- Winding Up of Banking CompanyDokumen13 halamanWinding Up of Banking CompanySaurabh ModBelum ada peringkat

- Annex Ure 2Dokumen68 halamanAnnex Ure 2madhu_bm31598Belum ada peringkat

- MORB 03 of 16Dokumen71 halamanMORB 03 of 16Dennis BacayBelum ada peringkat

- Annexure To KycDokumen5 halamanAnnexure To KycJitendra VirahyasBelum ada peringkat

- Finance Current Affairs January Week IiDokumen24 halamanFinance Current Affairs January Week IiBhav MathurBelum ada peringkat

- Chapter16 - Basic Savings Bank Deposit AccountDokumen3 halamanChapter16 - Basic Savings Bank Deposit Accountshubhram2014Belum ada peringkat

- 1710-Dda 31.05.17Dokumen53 halaman1710-Dda 31.05.17sunilBelum ada peringkat

- Directorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Dokumen76 halamanDirectorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Pankaj kumarBelum ada peringkat

- Collection of Direct Taxes - OLTASDokumen36 halamanCollection of Direct Taxes - OLTASnalluriimpBelum ada peringkat

- With Best Compliments From Staff Training Centre, AurangabadDokumen41 halamanWith Best Compliments From Staff Training Centre, AurangabadDeepchand BhartiBelum ada peringkat

- Suggested AnswerDokumen7 halamanSuggested Answerhoward almunidBelum ada peringkat

- Bank Reconciliation Statement PreparationDokumen10 halamanBank Reconciliation Statement PreparationAngela PaduaBelum ada peringkat

- Definition of Central BankDokumen10 halamanDefinition of Central BankShuhan ChowdhuryBelum ada peringkat

- Bank SecrecyDokumen4 halamanBank SecrecyDave A ValcarcelBelum ada peringkat

- Bank Reconciliation Statement (BRS) Questions PDFDokumen11 halamanBank Reconciliation Statement (BRS) Questions PDFAjitesh anandBelum ada peringkat

- BB 2013Dokumen25 halamanBB 2013Maisie Rose VilladolidBelum ada peringkat

- Final Arbitration ClaimDokumen14 halamanFinal Arbitration ClaimKhawar MahmoodBelum ada peringkat

- Important: The Depository Trust CompanyDokumen6 halamanImportant: The Depository Trust CompanyAutochthon GazetteBelum ada peringkat

- Decoding Section 138 N.I Act Using Legal SoftwaresDokumen13 halamanDecoding Section 138 N.I Act Using Legal SoftwaresashishpadhyBelum ada peringkat

- Unclaimed Balances and Dormant Account Directives 2021 - Final-1Dokumen13 halamanUnclaimed Balances and Dormant Account Directives 2021 - Final-1Fuaad DodooBelum ada peringkat

- Reserve Bank of IndiaDokumen32 halamanReserve Bank of IndiaAkash AgarwalBelum ada peringkat

- RBI Master Circular on KYC Guidelines and AML StandardsDokumen23 halamanRBI Master Circular on KYC Guidelines and AML StandardsSiva KumarBelum ada peringkat

- CASE ANALYSIS of Shankarlal Agarwalla V SBIDokumen7 halamanCASE ANALYSIS of Shankarlal Agarwalla V SBIMrunali RajBelum ada peringkat

- Management of Non-Performing Assets: K K Jindal Managing Director Global Management Services New DelhiDokumen34 halamanManagement of Non-Performing Assets: K K Jindal Managing Director Global Management Services New DelhiNoor Preet KaurBelum ada peringkat

- Idbi-B6-T2-Bl - VLC - Pmla and It Acts - Solutions - 24.4.2020Dokumen23 halamanIdbi-B6-T2-Bl - VLC - Pmla and It Acts - Solutions - 24.4.2020Rajamohan MuthusamyBelum ada peringkat

- Metropolitan Bankv. Rural Bank of GeronaDokumen7 halamanMetropolitan Bankv. Rural Bank of GeronaGedan TanBelum ada peringkat

- 2010fin MS263Dokumen5 halaman2010fin MS263nmsusarla999Belum ada peringkat

- In Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRDokumen3 halamanIn Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRnia coline mendozaBelum ada peringkat

- Implications of CDR Sanction TermsDokumen4 halamanImplications of CDR Sanction Termsrao_gmailBelum ada peringkat

- G.R. No. 158261 - in Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet) IncDokumen15 halamanG.R. No. 158261 - in Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet) IncLolersBelum ada peringkat

- Various Recovery Measures Adopted by Banks and Financial InstitutionsDokumen19 halamanVarious Recovery Measures Adopted by Banks and Financial InstitutionsjasmeetBelum ada peringkat

- Philippine Deposit Insurance Corporation vs. BirDokumen2 halamanPhilippine Deposit Insurance Corporation vs. BirBrian Jonathan ParaanBelum ada peringkat

- Tds Statement B. O. Arhat Bazar (d0397) - 1Dokumen2 halamanTds Statement B. O. Arhat Bazar (d0397) - 1sunilBelum ada peringkat

- TDS January 2019 PDFDokumen2 halamanTDS January 2019 PDFsunilBelum ada peringkat

- New Doc 2019-05-30 12.29.42Dokumen6 halamanNew Doc 2019-05-30 12.29.42sunilBelum ada peringkat

- Esps ApplicationDokumen2 halamanEsps ApplicationsunilBelum ada peringkat

- Bo RudrapryagDokumen4 halamanBo RudrapryagsunilBelum ada peringkat

- 43 Annexure Mortgage LoanDokumen1 halaman43 Annexure Mortgage LoansunilBelum ada peringkat

- Esps DetailsDokumen1 halamanEsps DetailssunilBelum ada peringkat

- Viewdocument PDFDokumen26 halamanViewdocument PDFsunilBelum ada peringkat

- Scan App CamScanner DocumentDokumen2 halamanScan App CamScanner DocumentsunilBelum ada peringkat

- Target of NULMDokumen5 halamanTarget of NULMsunilBelum ada peringkat

- Job Card EspsDokumen51 halamanJob Card EspssunilBelum ada peringkat

- New Doc 2019-05-30 15.14.48Dokumen5 halamanNew Doc 2019-05-30 15.14.48sunilBelum ada peringkat

- 398 Small DairyDokumen5 halaman398 Small DairysunilBelum ada peringkat

- Indian markets fall on profit booking amid global cues as PM meets Jaitley after he opts out of cabinetDokumen11 halamanIndian markets fall on profit booking amid global cues as PM meets Jaitley after he opts out of cabinetsunilBelum ada peringkat

- LC 255Dokumen1 halamanLC 255sunilBelum ada peringkat

- LNR Cir08 - 26.08.13Dokumen20 halamanLNR Cir08 - 26.08.13sunilBelum ada peringkat

- 398 Small DairyDokumen4 halaman398 Small DairysunilBelum ada peringkat

- 398 Small DairyDokumen4 halaman398 Small DairysunilBelum ada peringkat

- About MA Yojana GujaratiDokumen9 halamanAbout MA Yojana GujaratiKaran RajveerBelum ada peringkat

- CBSE - ExamDokumen3 halamanCBSE - ExamsunilBelum ada peringkat

- Gurshvinder SinghDokumen2 halamanGurshvinder SinghsunilBelum ada peringkat

- Loanee Farmer Time Period Clerarification LetterDokumen2 halamanLoanee Farmer Time Period Clerarification LettersunilBelum ada peringkat

- Gurdev Singh So Mal SinghDokumen3 halamanGurdev Singh So Mal SinghsunilBelum ada peringkat

- Hotel Booking Ref-2204817349747-1Dokumen3 halamanHotel Booking Ref-2204817349747-1sunilBelum ada peringkat

- Gursewak Singh So Mohinder SinghDokumen4 halamanGursewak Singh So Mohinder SinghsunilBelum ada peringkat

- Basant Singh So Bhagat SinghDokumen3 halamanBasant Singh So Bhagat SinghsunilBelum ada peringkat

- Gurwinder Singh So Dan SinghDokumen3 halamanGurwinder Singh So Dan SinghsunilBelum ada peringkat

- Gurjant SinghDokumen3 halamanGurjant SinghsunilBelum ada peringkat

- Gurbaz SinghDokumen3 halamanGurbaz SinghsunilBelum ada peringkat

- Chamkaur Singh So Ajaib SinghDokumen3 halamanChamkaur Singh So Ajaib SinghsunilBelum ada peringkat

- Motion To Fix BailDokumen3 halamanMotion To Fix BailJaps Alegre50% (4)

- Cwopa The Pennsylvania Manual Vol118 2007Dokumen1.042 halamanCwopa The Pennsylvania Manual Vol118 2007EH100% (1)

- CCBPI Vs MenezDokumen2 halamanCCBPI Vs MenezfaithBelum ada peringkat

- Lagatic Vs NLRCDokumen2 halamanLagatic Vs NLRCkwok_kc100% (2)

- Gerardo Rivera V EspirituDokumen3 halamanGerardo Rivera V EspirituAnonymous hS0s2moBelum ada peringkat

- CRW2601 Study Unit 6 Unlawfulness IIDokumen6 halamanCRW2601 Study Unit 6 Unlawfulness IIMmabutsi MathabatheBelum ada peringkat

- Dungeon Contract For Mistress SatanellaDokumen6 halamanDungeon Contract For Mistress SatanellaLorena Wuornos100% (2)

- Marco Rubio's Brother in Law IndictmentDokumen70 halamanMarco Rubio's Brother in Law IndictmentSyndicated NewsBelum ada peringkat

- Criminal Law II: Crimes Against Personal Liberty and SecurityDokumen50 halamanCriminal Law II: Crimes Against Personal Liberty and SecurityAngelo BasaBelum ada peringkat

- Article 1767Dokumen5 halamanArticle 1767Trisha Mae BahandeBelum ada peringkat

- Growth of Administrative Law in IndiaDokumen2 halamanGrowth of Administrative Law in IndiaAkhil SinghBelum ada peringkat

- Think & Learn Leave Policy SummaryDokumen10 halamanThink & Learn Leave Policy SummaryRakshitAnandBelum ada peringkat

- Sequatchie County Jail Media Report From 4-22-2013 To 4-28-2013Dokumen9 halamanSequatchie County Jail Media Report From 4-22-2013 To 4-28-2013NewsDunlapBelum ada peringkat

- Rules On Stat ConDokumen4 halamanRules On Stat ConMj GarciaBelum ada peringkat

- Example Policy and Procedure: Implementation of Advance Care Planning in Residential Aged Care FacilitiesDokumen23 halamanExample Policy and Procedure: Implementation of Advance Care Planning in Residential Aged Care FacilitiesMax RamirezBelum ada peringkat

- Almacen Vs BaltazarDokumen2 halamanAlmacen Vs BaltazarAl RxBelum ada peringkat

- Jurisdiction of The Insurance Commissioner RevisedDokumen10 halamanJurisdiction of The Insurance Commissioner RevisedVan John MagallanesBelum ada peringkat

- Quieting of Title - Ownership CasesDokumen664 halamanQuieting of Title - Ownership CasesKleyr De Casa Albete100% (3)

- Mitigating CircumstancesDokumen6 halamanMitigating CircumstancesjanickaBelum ada peringkat

- ART. 300 BMG Records Vs NLRCDokumen3 halamanART. 300 BMG Records Vs NLRCJuan DoeBelum ada peringkat

- 14 - Chapter 9 PDFDokumen59 halaman14 - Chapter 9 PDFKUNAL1221Belum ada peringkat

- Insurance CasesDokumen8 halamanInsurance Caseslucas100% (1)

- Seminar Report On: Rattan Professional Education College Sohana, Sas Nagar (Mohali)Dokumen48 halamanSeminar Report On: Rattan Professional Education College Sohana, Sas Nagar (Mohali)Bharat AhujaBelum ada peringkat

- LeRay Town Justice John Hallett Resigns After Being Charged With Making Homophobic Remarks and Gestures To An AttorneyDokumen4 halamanLeRay Town Justice John Hallett Resigns After Being Charged With Making Homophobic Remarks and Gestures To An AttorneyNewzjunkyBelum ada peringkat

- Laurel V MisaDokumen1 halamanLaurel V MisacrisBelum ada peringkat

- Book Review: Edition, Avtar Singh, Eastern Book Company, Lucknow, 2011. Pages 312. Price: Rs. 275Dokumen6 halamanBook Review: Edition, Avtar Singh, Eastern Book Company, Lucknow, 2011. Pages 312. Price: Rs. 275SimranBelum ada peringkat

- 3 - Mariano vs. Atty. LakiDokumen2 halaman3 - Mariano vs. Atty. LakiJOSHUA KENNETH LAZAROBelum ada peringkat

- New Vendor Application 11 2015Dokumen1 halamanNew Vendor Application 11 2015api-49541982350% (2)

- DBP vs. Court of Appeals and Lydia Cuba (38 charactersDokumen1 halamanDBP vs. Court of Appeals and Lydia Cuba (38 charactersJonnifer QuirosBelum ada peringkat

- CIR Vs Fitness by Design - Case DigestDokumen2 halamanCIR Vs Fitness by Design - Case DigestKaren Mae ServanBelum ada peringkat