PIS COFINS Entrega Futura

Diunggah oleh

dri05100 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

229 tayangan7 halamanThis document provides a simple guide on how to customize your system to allow posting of PIS and COFINS for a future delivery scenario. Author: Eduardo Rubia Company: SAP Brasil Created on: 26 August 2008 Author Bio 25 year old SAP Support consultant (soon moving on to RCA team) Currently located in Sao Paulo, Brazil.

Deskripsi Asli:

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document provides a simple guide on how to customize your system to allow posting of PIS and COFINS for a future delivery scenario. Author: Eduardo Rubia Company: SAP Brasil Created on: 26 August 2008 Author Bio 25 year old SAP Support consultant (soon moving on to RCA team) Currently located in Sao Paulo, Brazil.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

229 tayangan7 halamanPIS COFINS Entrega Futura

Diunggah oleh

dri0510This document provides a simple guide on how to customize your system to allow posting of PIS and COFINS for a future delivery scenario. Author: Eduardo Rubia Company: SAP Brasil Created on: 26 August 2008 Author Bio 25 year old SAP Support consultant (soon moving on to RCA team) Currently located in Sao Paulo, Brazil.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 7

Enabl i ng Post i ng of PI S/COFI NS f or

a Fut ur e Del i ver y Sc enar i o

Applies to:

SAP ERP (All releases). For more information, visit the Enterprise Resource Planning homepage.

Summary

This document provides a simple guide on how to customize your system to allow posting of PIS and COFINS for a

future delivery scenario.

Author: Eduardo Rubia

Company: SAP Brasil

Created on: 26 August 2008

Author Bio

25 year old SAP Support consultant (soon moving on to RCA team). Expertise: XX-CSC-BR*.

Currently located in So Paulo, Brazil.

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 1

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

Table of Contents

Introduction.........................................................................................................................................................3

Scope..................................................................................................................................................................3

Prerequisites.......................................................................................................................................................3

Customizing Sets................................................................................................................................................4

Common Sets .................................................................................................................................................4

Set up..............................................................................................................................................................4

Tax Codes....................................................................................................................................................................4

Tax Posting Strings......................................................................................................................................................5

Results ............................................................................................................................................................6

Invoice posting.............................................................................................................................................................6

Goods Receipt posting.................................................................................................................................................6

Copyright.............................................................................................................................................................7

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 2

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

Introduction

Until the availability of the current MP135 solution (SAP Note 747607), PIS and COFINS handling for future

delivery purchases could be done by the means of SAP Note 576192 guideline. With the current solution, this

is no longer possible, and no current SAP documentation explains how to handle this. This quick guide seeks

to handle this scenario through customizing only.

The following alternative has been designed to handle PIS/COFINS postings in Future Delivery processes in

this document:

PIS/COFINS with credit taken in the Goods Receipt

Scope

Only valid for industrialization purchases scenario.

Consumption, asset or resale are not treated here.

Legal Books were not tested.

Solution designed only for TAXBRA. Not tested in TAXBRJ .

Net Price must already include PIS/COFINS.

Prerequisites

Solution from SAP Note 852302 must be available

Customizing for CBT from SAP Note 747607 must be completed

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 3

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

Customizing Sets

Common Sets

Table/view J _1BKON1V must be filled up with the basic price conditions used in the Purchase document.

The standard schema is RM0000, and the basic price conditions are PRXX and PR00. For that schema, the

following entries should exist in J _1BKON1V:

PBXX COFI Cofins

PBXX PIS Pis

PB00 COFI Cofins

PB00 PIS Pis

If you use a different schema or if the schema contains more than one basic price conditions (e.g. WOTB),

then J _1BKON1V must contain *all* the basic price conditions used in the Purchase document.

Set up

Tax Codes

a. Make sure that tax code K3 is set as below:

IP1C IPI clearing

IC1C ICMS Clearing

b. Create new Tax Code KK naming it as Future delivery purchasing G/R with PIS/COF. Choose

Usage =1 and activate the following lines:

IPI1 IPI Deductible

ICM1 ICMS Deductible

IP1O IPI Offset

IC1O ICMS Offset

ICOF COFINS Deductible

IPIS PIS Deductible

ICOV COFINS Offset ICOS/ICOU

ICOS COFINS Normal PO/GR

ICOU COFINS Normal IV NVV

ICOA COFINS Normal PO/GR

IPSV PIS Offset IPSS / IPSU

IPSS PIS Normal PO/GR

IPSU PIS Normal IV NVV

IPSA PIS Normal PO/GR

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 4

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

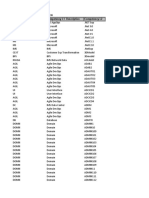

Tax Posting Strings

Through transaction SM30, create the following entries in table J _1BIM01V:

Usage A

Application TX

Procedure TAXBRA

Value string WE01 WE01 WE01 WE01

Condition type ICOS ICOV IPSS IPSV

Field with val. TINP6 TINP3 TINP7 TINP2

Field with +/- SHTINP6 SHTINP3 SHTINP7 SHTINP2

Auto. created X X X X

Line item ID M Material T Tax - general M Material T Tax - general

Quantity update X X

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 5

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

Results

Invoice posting

In the invoice, tax code K3 should be used. The invoice posting will be as below:

Account Tx Amount

Vendor K3 12.500,00-

GR/IR K3 10.000,00

ICMS K3 1.136,36

IPI K3 1.363,64

Goods Receipt posting

In the GR, use tax code KK. The postings will be as follows:

Account Tax Amount

Material KK 8.948,86

GR/IR 10.000,00-

IPI KK 1.136,36

ICMS KK 1.363,64

IPI clearing KK 1.136,36-

ICMS clearing KK 1.363,64-

COFINS deductible KK 863,64

PIS Deductible KK 187,50

As noticed, the material is valuated with 8.948,86, which is $10.000,00 minus the PIS/COFINS offset from

condition types IPSS and ICOS. No PRDIF postings are needed.

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 6

Enabling Posting of PIS/COFINS for a Future Delivery Scenario

SAP DEVELOPER NETWORK | sdn.sap.com BUSINESS PROCESS EXPERT COMMUNITY | bpx.sap.com

2008 SAP AG 7

Copyright

2008 SAP AG. All rights reserved.

No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of SAP AG.

The information contained herein may be changed without prior notice.

Some software products marketed by SAP AG and its distributors contain proprietary software components of other software vendors.

Microsoft, Windows, Outlook, and PowerPoint are registered trademarks of Microsoft Corporation.

IBM, DB2, DB2 Universal Database, OS/2, Parallel Sysplex, MVS/ESA, AIX, S/390, AS/400, OS/390, OS/400, iSeries, pSeries, xSeries,

zSeries, System i, System i5, System p, System p5, System x, System z, System z9, z/OS, AFP, Intelligent Miner, WebSphere,

Netfinity, Tivoli, Informix, i5/OS, POWER, POWER5, POWER5+, OpenPower and PowerPC are trademarks or registered trademarks of

IBM Corporation.

Adobe, the Adobe logo, Acrobat, PostScript, and Reader are either trademarks or registered trademarks of Adobe Systems

Incorporated in the United States and/or other countries.

Oracle is a registered trademark of Oracle Corporation.

UNIX, X/Open, OSF/1, and Motif are registered trademarks of the Open Group.

Citrix, ICA, Program Neighborhood, MetaFrame, WinFrame, VideoFrame, and MultiWin are trademarks or registered trademarks of

Citrix Systems, Inc.

HTML, XML, XHTML and W3C are trademarks or registered trademarks of W3C, World Wide Web Consortium, Massachusetts

Institute of Technology.

J ava is a registered trademark of Sun Microsystems, Inc.

J avaScript is a registered trademark of Sun Microsystems, Inc., used under license for technology invented and implemented by

Netscape.

MaxDB is a trademark of MySQL AB, Sweden.

SAP, R/3, mySAP, mySAP.com, xApps, xApp, SAP NetWeaver, and other SAP products and services mentioned herein as well as their

respective logos are trademarks or registered trademarks of SAP AG in Germany and in several other countries all over the world. All

other product and service names mentioned are the trademarks of their respective companies. Data contained in this document serves

informational purposes only. National product specifications may vary.

These materials are subject to change without notice. These materials are provided by SAP AG and its affiliated companies ("SAP

Group") for informational purposes only, without representation or warranty of any kind, and SAP Group shall not be liable for errors or

omissions with respect to the materials. The only warranties for SAP Group products and services are those that are set forth in the

express warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an

additional warranty.

These materials are provided as is without a warranty of any kind, either express or implied, including but not limited to, the implied

warranties of merchantability, fitness for a particular purpose, or non-infringement.

SAP shall not be liable for damages of any kind including without limitation direct, special, indirect, or consequential damages that may

result from the use of these materials.

SAP does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these

materials. SAP has no control over the information that you may access through the use of hot links contained in these materials and

does not endorse your use of third party web pages nor provide any warranty whatsoever relating to third party web pages.

Any software coding and/or code lines/strings (Code) included in this documentation are only examples and are not intended to be

used in a productive system environment. The Code is only intended better explain and visualize the syntax and phrasing rules of

certain coding. SAP does not warrant the correctness and completeness of the Code given herein, and SAP shall not be liable for errors

or damages caused by the usage of the Code, except if such damages were caused by SAP intentionally or grossly negligent.

Anda mungkin juga menyukai

- Best Practice: Data Volume Management For RetailDokumen67 halamanBest Practice: Data Volume Management For Retaildri0510Belum ada peringkat

- Best Practice: Data Volume Management For RetailDokumen67 halamanBest Practice: Data Volume Management For Retaildri0510Belum ada peringkat

- STO Full or Partial Return Transit Stock ProcessDokumen9 halamanSTO Full or Partial Return Transit Stock Processdri0510100% (1)

- SAP R3 Guide To EDI IDocs and InterfacesDokumen177 halamanSAP R3 Guide To EDI IDocs and Interfacesvickygupta123100% (26)

- Customizing WHT Accumulation For CBT Ref. Nota 916003Dokumen18 halamanCustomizing WHT Accumulation For CBT Ref. Nota 916003evandroscBelum ada peringkat

- 0000888805Dokumen6 halaman0000888805dri0510Belum ada peringkat

- Setup TaxbraDokumen18 halamanSetup Taxbradri0510Belum ada peringkat

- Brazil Localization ImpostosDokumen77 halamanBrazil Localization Impostosdri0510Belum ada peringkat

- Apoio ImpostosDokumen89 halamanApoio ImpostosthiagoleitteBelum ada peringkat

- NFE10 Master Guide en v13Dokumen26 halamanNFE10 Master Guide en v13dri0510Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 13 HCM eDokumen134 halaman13 HCM eravindravtBelum ada peringkat

- RR SkillSheetDokumen172 halamanRR SkillSheetSanjay KumarBelum ada peringkat

- Installation Guide - Ibm Websphere Application Server: Tivoli Asset Management For It Release 7.1Dokumen174 halamanInstallation Guide - Ibm Websphere Application Server: Tivoli Asset Management For It Release 7.1Anonymous kKiwxqhBelum ada peringkat

- 2.4 - Troubleshooting - LabDokumen8 halaman2.4 - Troubleshooting - Labraymart_omampoBelum ada peringkat

- IDUG 2013 Sheryl Larsen Tuning SQLDokumen112 halamanIDUG 2013 Sheryl Larsen Tuning SQLVibhaw Prakash RajanBelum ada peringkat

- DB2 UDB The Basics: Keith E. GardenhireDokumen67 halamanDB2 UDB The Basics: Keith E. GardenhireDharani Dinesh PathipatiBelum ada peringkat

- HitachiTuningManager TroubleshootingGuideDokumen550 halamanHitachiTuningManager TroubleshootingGuideWalterBelum ada peringkat

- MQ 9.0 Software CompatibilityDokumen94 halamanMQ 9.0 Software Compatibilitymur2zaBelum ada peringkat

- IBM Cloud and Smarter Infrastructure | Tivoli Storage Manager server database tipsDokumen59 halamanIBM Cloud and Smarter Infrastructure | Tivoli Storage Manager server database tipsRoman GarabadjiuBelum ada peringkat

- Ex 20Dokumen712 halamanEx 20push5Belum ada peringkat

- MDM Sizing GuideDokumen32 halamanMDM Sizing GuideGowri KaushikBelum ada peringkat

- Database MemoDokumen3 halamanDatabase MemoPritam RoyBelum ada peringkat

- Installation Guide SAP Sourcing 2007 PDFDokumen88 halamanInstallation Guide SAP Sourcing 2007 PDFDiogo FerreiraBelum ada peringkat

- Liferay DXP 7.4 Compatibility MatrixDokumen3 halamanLiferay DXP 7.4 Compatibility MatrixGnaniyar RasikowBelum ada peringkat

- Large Objects With DB2 zOS and OS390Dokumen192 halamanLarge Objects With DB2 zOS and OS390api-3731933Belum ada peringkat

- MIS Essentials 3rd Edition Kroenke Test Bank 1Dokumen24 halamanMIS Essentials 3rd Edition Kroenke Test Bank 1janet100% (50)

- SAP Solution Manager Service Level Reporting: Best Practice For E2E Solution OperationsDokumen18 halamanSAP Solution Manager Service Level Reporting: Best Practice For E2E Solution Operationsamakr2010Belum ada peringkat

- Mehul Technical Trainer ProfileDokumen4 halamanMehul Technical Trainer ProfilemehukrBelum ada peringkat

- ARSystem Ini TemplateDokumen16 halamanARSystem Ini Templateabc112233445500Belum ada peringkat

- ERwin GuideDokumen109 halamanERwin GuidedandamudishanthiBelum ada peringkat

- Non-Cumulatives - Stock HandlingDokumen97 halamanNon-Cumulatives - Stock HandlingTupa ShakrBelum ada peringkat

- Syed Sajid Wasim: Summary of Core CompetenciesDokumen8 halamanSyed Sajid Wasim: Summary of Core CompetenciesZahid HossainBelum ada peringkat

- SAP TM 8.1 Operation GuideDokumen48 halamanSAP TM 8.1 Operation GuidevlkrizBelum ada peringkat

- The DB2 Database Manager InstanceDokumen39 halamanThe DB2 Database Manager InstancesakinahBelum ada peringkat

- IDUG 2013 Sheryl Larsen Performance Tuning SQLDokumen112 halamanIDUG 2013 Sheryl Larsen Performance Tuning SQLkotmaniBelum ada peringkat

- CICS - Intro and Overview V4Dokumen39 halamanCICS - Intro and Overview V4Alejandro PonceBelum ada peringkat

- Ds Odbc Linux UnixDokumen20 halamanDs Odbc Linux UnixRishi PopatBelum ada peringkat

- Shawne Slaughter REsume New MastersDokumen3 halamanShawne Slaughter REsume New MastersfreweightBelum ada peringkat

- RESUME SUMMARYDokumen5 halamanRESUME SUMMARYlsm_28Belum ada peringkat

- Abap New DebuggerDokumen92 halamanAbap New DebuggeradavellysBelum ada peringkat