Accounting Assignment1

Diunggah oleh

Runaway ShujiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Assignment1

Diunggah oleh

Runaway ShujiHak Cipta:

Format Tersedia

WORD COUNT

Number of Pages:

Number of Words: 3000

Word count is exclusive of the followings:

Cover Page

Content Page

Citation and Referencing

Conclusion

Gantt Chant

Tables

Grahs

Titles!"eadings

Confidential Page #

TABLE OF CONTENTS

#$0: %NTR&'(CT%&N $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$3

) %*PR&+,*,NT T& R,'(C, C&-T-. ,NC"/NC, +/0(, /N' 1(/0%T2$$$$$$3

#$#: '%33,R,NT T2P,- &3 C&-T %NC(RR,' %N T", C&*P/N2$$$$$$$$$$$$$$$$$$$$$$$$$$4

#$5: T", N,,' &3 /N' &P,R/T%&N C&-T%NG *,'T"&'- (-,'$$$$$$$$$$$$$$$$$$$$$$$6

#$3: C/C(0/T, C&-T- (-%NG /PPR&PR%/T, T,C"N%1(,-:$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#5

#$4: /N/02-, /N' PR,-,NT '/T/ 7/-,' &N T", %N3&R*/T%&N G%+,N$$#4

5$# +/NG C&*P/N2 W,,802 R,P&RT:$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#9

5$5: P,R3&R*/NC, %N'%C/T&R %N',NT%32 P&T,NT%/0 %*PR&+,*,NT-:$ #:

5$3: %*PR&+,*,NT T& R,'(C, C&-T-. ,NC"/NC, +/0(, /N' 1(/0%T2:

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$5;

3$0: C&NC0(-%&N$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$59

4$0: R,3,R,NC,-$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$56

List of Figures & Tables

3ig#: 3ixed Costs <+anderbilt 500#=$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$>

3ig5: +ariable Costs <+anderbilt 500#=$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$9

3ig3: -emi?+ariable Costs$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$6

3ig4: %nterdeendence of +ang Coman@ deartments <Case stud@ 50#4=$$$$$$$$$$$$$$$$$$$$$$#5

3ig>: +ang Coman@ Condensed %ncome -tatement <500>?5006=$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#4

Confidential Page 5

3ig9: +ang Coman@ Condensed %ncome rate -tatement <500>?5006=$$$$$$$$$$$$$$$$$$$$$$$$$$$$#;

3ig6: -ales vs$ Total Costs 500>?5006$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#;

3ig:: -ales vs$ Gross Profit$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#>

3ig#0: -ales vs$ /dministrative and -elling ,xenses$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#9

3ig##: -ales vs$ Net income$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#9

3ig#5: WeeAl@ Cost Reort$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#6

3ig#3 +ariable cost in 500>$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$#6

3ig#4: NiAe Global Contract 3actor@ WorAers 7@ Region <NiAe.%NC 50#5=$$$$$$$$$$$$$$$$$$$5#

3ig#;: +ang Coman@ %nvestment Center$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$54

1.0: INTRODUCTION

This report will show how Vang Company will calculate their financial, controlling the

cost and develop the business. It will be discussed and explained about:

) '%33,R,NT T2P,- &3 C&-T %NC(RR,' %N T", C&*P/N2

) T", N,,' &3 /N' &P,R/T%&N C&-T%NG *,'T"&'- (-,'

)C/C(0/T, C&-T- (-%NG /PPR&PR%/T, T,C"N%1(,-

) /N/02-, /N' PR,-,NT '/T/ 7/-,' &N T", %N3&R*/T%&N G%+,N

) +/NG C&*P/N2 W,,802 R,P&RT

) P,R3&R*/NC, %N'%C/T&R %N',NT%32 P&T,NT%/0 %*PR&+,*,NT-

) %*PR&+,*,NT T& R,'(C, C&-T-. ,NC"/NC, +/0(, /N' 1(/0%T2

Confidential Page 3

1.1: DIFFERENT TYPES OF COST INCURRED IN THE COMPANY

Each company want to start their business or have highest benefit they must clearly

now about their financial and accounting to have right investment, run and develop the

business. !ccounting is also definite the cost and benefit and help the directors or

managers balance it to achieve the goals and earn more money. "nowing about costs

incurred or revenues earned enables management to estimate the profitability of a

product with the cost to run the business in organisation such as departments, services,

and manufacturer. !ccounting also helps the managers run the business in right way,

set the selling price and balance the costs of sale to have highest benefits. #urthermore,

It puts a value to stocs of goods, control $uantities of product for preparing a balance

sheet of the company%s assets and liabilities &'earning (edia )*+*,

Cost accounting is a management information system, which analyses past, present and

future data to provide the basis for managerial action. It provides the information about

elements of cost including: (aterial, labour, expenses- overheads in direct and indirect

cost. It is also divided in #ixed Cost, Variable Cost and .emi/variable Cost these will be

provided in next paragraphs.

1.1.1Cost Classification:

!re the cost incurred in purchase the raw material, labour and e$uipment that

relate to producing finished products or the cost of administration, mareting and selling

product within a company. In other way, It is a cost that manager or director pay to run

their business and it is classified as direct cost and indirect cost.

1.1.1a Direct Cost:

!re the cost that relate directly with the production of goods and services in a

company. These are the basis cost that the manager can measure to pay before they

decide to run a process. It includes direct materials costs0 direct labour costs and direct

expenses.

1irect (aterials Costs:

!ny manufacture company want to produce product they also need to have the

raw materials, the direct materials costs include the direct payment of manufacture to

have the first basis to produce their product

Confidential Page 4

#or example, with Vang Company the direct materials costs are sil, buttonhole or clothe

dyes. These things are lined and influenced directly with the finished goods of Vang

Company0 which manager should buy to mae T/shirts.

1irect 'abour Costs:

!re included the cost that the manufacture must pay to their employee, manager

and the person or relation elements influence directly during producing the goods. The

direct labour costs in Vang Company are employee and manager 2 fixed salaries, $uality

checing fee and so on.

3ther 1irect expenses Costs:

It involves directly in producing product such as electronic fee to run and produce

a good or the payment of mareting lie advertisements, selling and retail store to sell

their product.

1.1.1b Indirect Costs:

4eside the direct costs, indirect costs or overheads are the cost, which will be

incurred in the course of maing a product, or providing service &'earning (edia )*+*,

that director or the manufacture cannot measure before producing the final product.

These costs also include (aterials, 'abour and 3ther Expenses costs.

Indirect (aterials Costs:

These cost is not relate directly with the producing goods process but it can be

said that is necessary e$uipment to have finished products in Vang Company lie

machines, the safety e$uipment for their employee, the light and so on.

Indirect 'abour Costs:

!re the costs will be appeared during the time employee producing a product or

the cost of administration such as producing a T/shirt, Vang Company must pay the cost

for wrong doing a T/shirt, the wages of inspector, the watch men and so on.

3ther Indirect Expenses Costs:

!re the expenses are not directly lined with the production of a good. These costs are

charged to the final product &5 Essays )*+6,. In other way, these are the cost of rent a

department, the insurance of a factory or the cost for doing extra a product such as fuel

power, electronic or telephone expenses in Vang Company.

Confidential Page ;

1.1.2Type Of Cost:

The cost is payment of organi7ation to run their processes, it fluent on the number of

finished product. The manager or director will relate to these costs to tae a decision/

maing. The cost can also be classified on how fre$uent they react to production

&5"essay )*+6,

1.1.2a Fixed Cost:

#ixed cost is identified as the unaffected cost during producing product in the

period of time. The payment is calculated by multiple the $uantities of product and the

cost per unit. ! line in the graph below shows the fixed cost in a company:

Fig1: Fixed Costs !"#de$%i&t '((1)

In Vang Company, fixed costs are included rent cost or wages of permanent

worers, these will be not changed in during producing time. These costs will be

identified to manage and control the payment within the company to eep the business

running as well0 if not they can easily mae their business run down and cannot pay the

cost for producing goods.

1.1.2b Variable Cost:

Compare with #ixed Cost, Variable Cost are the changing cost maybe occurred during

producing product in the short run0 which varies with the level of activity.

Confidential Page >

Fig': !"$i"%&e Costs !"#de$%i&t '((1)

In manufacturing industry lie T/shirt, Vang Company also cannot involve the Variable

Costs, these costs will occur during producing any T/shirt that the managers or directors

could not see it before. .ometimes they are costs plus for employee to produce a mount

of extra T/shirt, the labour costs or raw materials. Vang Company must count or

calculate these costs to prepare or mae right decisions to develop their business.

1.1.2c Semi Variable Cost:

.emi Variable Cost is composed of a mixture of fixed and variable elements.

These costs will be affected by changes in the level of activity. #or example, the fixed

cost will increase when Vang Company want to produce more 8* T/shirt per employee

they must pay more money on rent cost, electricity cost and so on &'earning (edia

)*+*,

Confidential Page 9

Fig*: Se+i,!"$i"%&e Costs

!s the manager can see in the graph, it shows about the semi/variable cost in business.

!ctually, Vang Company is a manufacture and they will increase or develop their

business and they also need to produce more T/shirt to supply the customers.

5nderstanding these costs, the manager can balance the price of good and the cost to

produce them then mae Vang Company will also have the best benefits. It is the main

purpose why Vang Company should do calculate these costs.

1.2: THE NEED OF ND O!ERTION CO"TIN# $EDTHOD" U"ED

Through the classification and types of cost the company will use the costing methods

for pricing or stoc valuation. #urthermore, controlling the business is very also important

in any company. Costing methods will provide to managers or directors a full view about

the financial then they can tae or mae the right decision for success of the

organi7ation. If the company taes wrong costing methods, actually it can mae the

business decline so they must improve their business or drawbac the organi7ation.

(oreover, it taes the company more times to adapt and re/develop their company

again. It is the main reasons why Vang Company must choose and use right costing

methods0 which will be discussed in next paragraphs.

1.2.1Job Costin

This method is applied to calculate the cost of orders or re$uests of customers or

partners of the company which are carried out separately for each product. (oreover,

these costs are based on the specific technical characteristics of the customer or the

Confidential Page 6

goods made separately in a short time. 9ob Costing is commonly used in the

construction and manufacturing industry, because it is based on orders, customers:

re$uirements to fulfill the needs of each individual and group. #or ;ine Company, 9ob

costings include cost of T/shirt order, shirt printing costs for security companies and

bans.

1.2.2 !at" Costin

4ath Costing includes all the fixed cost and variable cost that may arise in the production

of goods. The price of a product is calculated by dividing the total cost per unit. Costing

4ath in ;ine Company is understood as the cost of production of a certain amount of

good in a months or a year. #or example, each month ;ine Company produces +**,***

T/shirt to offer and sell at supermarets, department stores or customers and this cost is

calculated for the entire shipments divided by the number of T/shirts. 4y doing so,

managers can balance the cost to achieve the greatest profits.

1.2.# Contract Costin

Contract Costing and 9ob Costing are similar but the difference is Contract Costing is

long/term costs of orders or re$uirements of customers, the manufacturers and

customers are together bounded by the terms of the contract to meet the needs of two

parties. ;ine Company can apply this method to calculate the cost and different terms of

contract to extend the contracts with stores, supermarets and shopping centers for

many years.

1.2.$ Operation Costin

3peration Costing is also similar to <rocess Costing, in this method, price of products

and costs will be calculated based on the need to implement processes to produce one

finished product. ;ine Company uses this calculation method in weaving clothes, dying

or machinery stage.

1.2.% Ser&ice Costin:

This method is used to calculate the rates and costs of mining company focused and

service providers to meet the needs of our customers as cafeteria ;ine Company,

where worers, employees still use to buy water and food to meet their operational

needs.

Confidential Page :

In addition, to the price of the delivered goods, we can also apply the following methods:

Stoc' Val(ation:

!ccording to this method, the actual value of the goods, materials, manufactured

products of any shipment will be based on the number of units of inventory and actual

import prices of goods or materials. This method is applied to the materials and goods

with high value, few species, good management and protection conditions, identified

stable.

!dvantage: identify the value of goods, materials and export products $uicly.

1isadvantage: businesses have to trac and closely manage each export

shipment. This method is not suitable for the companies using a variety of materials,

products and goods because it would be difficult to count and manage.

FIFO )First In First O(t*:

This method assumes that the amount of material, goods, imported products, which are

first imported, will be before the storing products. In other words, according to this

method, the unit price of the first shipment is exported before the next entries until the

$uantity is sufficient.

!dvantage: 1etermine the value of materials and goods $uicly. (oreover, this

method can help the manager balance and ad=ust the price of each product and material

at the present time.

1isadvantage: the manager has to monitor and closely manage the cost of each

shipment, it is not suitable for the enterprises using a variety of materials, products,

goods and many times of import because it will cause difficulties in monitoring, and

managing the cost of each shipment.

+IFO )+ast In First O(t*:

This method assumes the amount of materials, goods and products which are last

imported will be used before the storing products. In other words, according to this

method, the unit price of the last shipment is exported before the first entries until the

$uantity is sufficient. !ccordingly, the actual value of inventory is determined by the

amount of inventory and the unit price of the new entries at time of manufacture.

Confidential Page #0

!dvantage: 1etermine the price of goods and products in the maret at present.

(anager can continue to calculate the current price and mae the right decision

because input prices of the products will be included in the price of the current time.

1isadvantage: This method can interfere with the operation because the orders

are sometimes too many and the products are not enough to meet the needs of

consumers. 4usiness may have trouble in setting prices for existing products to balance

the price and sales. (oreover, maing changes and decisions will be more difficult

because of price fluctuations can affect the products.

C(m(lati&e ,ei"ted -&erae .ricin:

5nder this method, the actual cost of each type of material, goods, products is based on

the average price of each type of material, product inventory at the beginning and the

value of each type during the period. In other words, the actual cost of materials, goods,

products is based on the amount of inventory in the period and the average actual unit

price.

!dvantage: (anagers can calculate based on the average calculation methods

and data to mae decisions easily and balance the price of the product. This method is

more efficient than #I#3 and 'I#3 because there is no need to calculate costs of each

period and shipments.

1isadvantage: <rices of products are sometimes not consistent with consuming

demand and easy to be affected by inflation.

Confidential Page ##

1.*: CACULATE COSTS USIN- APPROPRIATE TECHNI.UES:

-ervice rovided

'eartments B 2 C

Producing ? - ? 30D 40D

Producing E P ;0D 40D 30D

-ervice E B ? 50D ?

-ervice E 2 50D ? ?

-ervice E C 30D #0D ?

*arAeting ? ? 50D

General &ffice ? ? #0D

#00D #00D #00D

Fig/: I#te$de0e#de#1e o2 !"#g Co+0"#3 de0"$t+e#ts C"se st4d3 '(1/)

!pply the case study, it can be easily said that the service of department > has )*

percent of the department ? so the cost of department allocation of > @ )*A? B )*.***.

;e can also calculate ? and C by ? @ )*A> B )*.*** and C @ D*A> B +*A? B +*.***.

Calculating:

> @ )*A? B )*.*** &+,

? @ )*A> B )*.*** &),

C @ D*A> B +*A? B +*.*** &D,

#rom &+, and &), we replace fomula &), into &+, we can have result of > is:

> @ )*.*** B )*A&)*.*** B )*A>,

> @ )*.*** B 6.*** B *.*6>

> E *.*6> @ )*.*** B 6.***

)6.*** @ *.FG>

> @ )6.*** - *.FG @ )8.***

Heplacing > @ )8.*** into ? we will have the result ? @ )*.*** B )*AI)8.*** @ )8.***

Heplacing > and ? into &D, we have C @ +*.*** B D*AI)8.*** B +*AI)8.*** @ )*.***

.o the cost of > @ )8.***, ? @ )8.*** and C @ )*.***

The figure will be shown in next table.

Confidential Page #5

#ig8: service department cost allocations &Case .tuty )*+6,

Tas ):

Direct Materials 120.000

Direct Wages 100.000

Factory Overhead 60.000

Administrative Overhead 56.000

Selling and Distribtion

Overhead !2.000

The #actory 3verhead rate @ #actory overhead - direct wages @ G*.*** - +**.*** @ G*A

!dministrative, selling and distribution overhead is calculated

@ &!dministrative overhead B selling and distribution overhead, - &direct materials B direct

wages B factory overhead,

@J @ &8G.*** B 6).***, - &+)*.*** B +**.*** B G*.***, @ FK.*** - )K*.*** @ D8A

Calculate selling price in )*+*:

#atory overhead @ factory overheads rate I direct labour @ G*AI6*.*** @ )6.***

Total #actory cost @ G*.*** B 6*.*** B )6.*** @ +)6.***

!dministration, selling and distribution overhead @ D8A of total factory cost

@ D8AI+)6.*** @ 6D.6**

Total Cost @ 6D.6** B +)6.*** @ +GL.6**

<rofit cost is )*A total factory cost and )*A total cost

Confidential Page #3

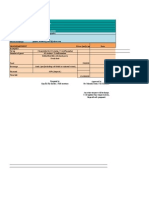

De"artment

s

# $ % Overhead be&ore

allocation

'otal

(ost

)rodcing *

S * +0, -..500 !0, -/.000 -60.000 -.5.000

)rodcing *

) 50,

-12.50

0 !0,

-10.00

0 +0, -6.000 -00.000

-11/.50

0

Service * # * 20, -5.000 * -5.000

Service * $ 20, -5.000 * * -5.000

Service * % +0, -..500 10, -2.500 * -10.000

Mar1eting * * 20, -!.000 -!.000

2eneral

O&&ice * * 10, -2.000 -2.000

100

,

-25.00

0

100

, 25.000 100,

-20.00

0 -150.000

-220.00

0

<rofit )*A total factory @ )*AI+)6.*** @ )6.***

Total Cost @ )6.K** B +GL.6** @ +F).)**

<rofit from )*A total cost @ )*AI+GL.6** @ DD.6K*

Total Cost @ DD.6K* B +GL.6** @ )**.KK*

!fter the calculating we can see that the total cost including expected profit is

M+F).)** and M)**.KK*

1.%: NL&"E ND !RE"ENT DT '"ED ON THE INFOR$TION #I(EN

!ccounting relates to the development of a company, if the manager or directors

do not have right calculation it can influence in the benefit, maing the decisions and

lose the business.

2006 200. 200/

- - -

Sales 150.000 2/5.000 !00.000

3ariable &actory costs *.0.000 *05.000 *120.000

Fi4ed &actory costs *20.000 *25.000 *+0.000

2ross "ro&it 60.000 165.000 250.000

Administrative and selling e4"enses *25.000 *.0.000 *1+0.000

5et income +5.000 05.000 120.000

Fig5: !"#g Co+0"#3 Co#de#sed I#1o+e St"te+e#t '((5,'((6)

To anal@se and have right view to develo business in future. *r$"a 0ong will

Anow about these figures belowF which will be calculated and the cost ma@ include the

following:

The calculation in three @ears is the same$ *r$ "a 0ong can see the rates in 500> as an

examle$

The first calculation is the total cost

The total cost Gvariable factor@ costs H fixed factor@ costs G 90$000 H 50$000 G :0$000

Total cost rate G+ariable factor@ costs ! total salesG :0$000 ! #;0$000 G 0$> G >0D

Gross rofit rate G Gross rofit ! total sales G >0$000 ! #;0$000 G 0$4 G 40D

/dministrative and selling exenses rate G /dministrative and selling exenses !

total sales G 5;$000 ! #;0$000 G 0$#9 G #9D

Net rofit rate G net rofit ! total sales G 3;$000 ! #;0$000 G 0$53 G 53D

Confidential Page #4

/fter calculating the ercent or rate in each cost will be shown in the table below:

2006 200. 200/

- - -

Sales 150.000

100

% 2/5.000 100% !00.000 100%

3ariable &actory costs *.0.000 *05.000 *120.000

Fi4ed &actory costs *20.000 *25.000 *+0.000

'otal costs *00.000 60%

*

120.000 42% *150.000 38%

2ross "ro&it 60.000 40% 165.000 58% 250.000 63%

Administrative and selling

e4"enses *25.000 17% *.0.000 20% *1+0.000 33%

5et income +5.000 23% 05.000 33% 120.000 30%

Fig7: !"#g Co+0"#3 Co#de#sed I#1o+e $"te St"te+e#t '((5,'((6)

To analyse and control the data easier, manager can review in some graphs below to

mae the right decisions in future and see how the business was developed.

Fig6: S"&es 8s. Tot"& Costs '((5,'((6

Confidential Page #;

Fig9: S"&es 8s. -$oss P$o2it

.

Confidential Page #>

Fig1(: S"&es 8s. Ad+i#ist$"ti8e "#d Se&&i#g Ex0e#ses

Fig11: S"&es 8s. Net i#1o+e

These graphs show how Vang Company runs their business. (r. Na 'ong can easily

analyse that the business was developing and increasing the revenue through Oross

<rofit and Pet Income. #urthermore, as we can see in the total cost and .ales, the cost

reduced from G*A to DKA. It means Vang Company can save the cost but also develop

it to have more benefits for company.

'.1 !AN- COMPANY WEE:LY REPORT:

In this report, Vang Company can see the detail about the cost and their revenue then

control or manage the business to approach the goals in future and develop their

business also.

Confidential Page #9

Sl. 5o. )articlars 200/ 6-7 6,7 Wee1ly 84"enses

1 Sales 150000 100,

2 3ariable "rod cost *.0000

291 Material cost *+5000 *6.192+2/.6.

2.1.1 Direct material 6cloth7 *2!500 *!609/6+01+.

2.1.2 :ndirect material cost *10500 *2019+60/6+

292 ;abor cost *21000 *!029.+0.26

2.2.1 Direct labor cost *16/00 *+229101./0/

2.2.2 :ndirect labor cost 6S"ervisors7 *!200 */095!.0!521

29+ 'ele"hone charges *.000 *1+!92!65.5+

29! 8lectricity bill *.000 *1+!92!65.5+

+ Fi4ed "rod cost *+0000 *5.59+!2!65/

+91 <ental o& bisiness "remises 61000- "er S= &t7 0

+92 Maintenance cost o& tools9 >igs9 &i4tres 0

! 'otal (O2S *00000 60, *1.26902.+0.

5 2ross "ro&it 60000 115096/!0+2

6 Admin9 Selling ? Other 84"enses *25000 1., *!.09!5205!/

691 Sales commission *2500 *!.90!5205!/

. 5et "ro&it +5000 2+, 6.192+2/.6.

Fig1': Wee;&3 Cost Re0o$t

The cost will be shown in the grah below:

Fig1* !"$i"%&e 1ost i# '((5

3rom the grah. +ang Coman@ can anal@se and taAe the decision to minimiIe the costs

and maximiIe the rofit for their business$

Confidential Page #6

2.2: !ERFOR$NCE INDICTOR INDENTIF& !OTENTIL I$!RO(E$ENT":

/lthough the manager had a lan to do sometimes. in the real business the@ have

to be influenced b@ cost variances$ These are the costs that manager cannot saw and

guested before the lanning a rocess$ Without monitoring the use of resources or

controlling the coman@ to maAe decisions for the future. a business can be harmful and

eas@ to go down because the variances$ 7udget should be reared for each resonsibilit@

centre to Aee the business continuous$

Nowada@s. the cometition and economic are changing da@ b@ da@. if coman@ or

organisation want to survival and success the@ must secifies clearl@ about the

roductivit@. efficienc@ and the effectiveness$ This is the wa@ for an@ organisation and

+ang coman@ also if the@ want to develo the business$ 3irst. the@ must imrove their

roductivit@ from the sum of effectiveness and efficienc@ or b@ the wa@ of increasing the

effectiveness and efficienc@ roductivit@ also increase$

2.2.1 .erformance meas(re for t"e Cost centres:

The roductivit@ can be anal@sed b@ calculating the outut ! inut. the cost er

unit or the indices$ / successful rocess can be identified b@ the seed of how a roduct

will be roduced$ %f the outut increases. the roductivities will also increase$ 3or

examle. the labour roductivit@ in +ang Coman@ are the Juantities of roduct that an

emlo@ee or a store of +ang Coman@ will roduce and the outut or the income will be

more than amount of achieve goals$ /s we can see in the grahs before. *r$"a 0ong can

see easil@ that the rate of -ales vs$ Total Costs decreased$ %t means that the +ang

Coman@ saved the cost from 0$> K er unit to 0$36K er unit and the Juantities of unit

roduced also increased from #;0$000 to 400$000

/s we can see the indices also increased from 500>?5006. as Total Costs were

increase more than >9D b@ calculating <Total Costs in 500> ! Total Costs in 5006= x

#00D it means that the a@ment will also increase$ %n this case. the manager should

exand their business b@ roducing more units to get the benefits$ 7esides. the Jualit@.

resources or the comletion will affect the coman@$ %f the@ can imrove the Jualit@. save

costs. training emlo@ee and exand the business the@ will achieve easil@ the goals$

Confidential Page #:

3urthermore. it can be Anown as the effectiveness. if +ang Coman@ can maAe

and taAe the right decisions and do the thing in the right wa@ the@ can assess the

efficienc@$ Therefore effectiveness is the liabilit@ of the coman@ to achieve the set

targets and obLectives$ %f the outut in terms increase it means that the coman@ is getting

the efficienc@$

3or examle

2.2.2: .erformance meas(res for t"e re&en(e centers:

These 8P%s will show to manager how a business can sul@ or meet the

customer demand. not onl@ the Juantit@ but also the Jualit@ of roduct and how much the

revenue or benefit the@ will be received from that$ To anal@se and Anow more clearl@. the

manager will looA at and anal@se the data about customer reLects! returns. deliveries late.

flexibilit@ measures. number of eole served and seed of service. customer satisfaction

Juestionnaire$

%n an@ business. customer is la@ing an imortant role in contributing the revenue

for the organisation or the coman@. if director or manager can meet their customerMs

demands and maAe them satisfies then the@ can earn the rofit more and easier$ /s *r$

"a 0ong can see that the Jualit@ or the total sales was increasing in three @ears from 500>

to 5006 <#;$000 E 400$000= it means that the business was exanded and growth and also

met the customer reJuirement$ 3urthermore. the more roduct the@ roduced. the more

roduct sul@ for their customer$ +ang Coman@ can ut their T?shirt in retails. stores

or suer marAets that the customer can bu@ easier or have relationshi with Transort

Coman@ to sul@ and delivers T?shirt JuicAl@$ %f the business is develoed. +ang

Coman@ can attract or influence customer using or launching their new roducts and

also comete with other cometitor$ The@ can receive the customer satisfaction

Juestionnaire b@ using surve@s. customer care deartment and customer meeting monthl@

or @earl@$

3or examle. in NiAe Cororation. the@ tried to aroach of NrisA mitigationO$

3urthermore. the@ also alied to use significant resources and focus on monitoring and

environment imrovement b@ creating new rograms <NiAeResonsibilit@ 50#5= through

these rograms not onl@ the emlo@ees can imrove their labour sAill and worA more

Confidential Page 50

effective but also the coman@ can save the cost for roducing and increase their roduct

Jualit@ such as in administration. worAing and deliver@$ *oreover. NiAe have man@ store

and have contracts with man@ sulier around the world. it hels them to exand the

business and sul@ roduct to customer in an@where$

Fig1/: Ni;e -&o%"& Co#t$"1t F"1to$3 Wo$;e$s B3 Regio# Ni;e<INC '(1')

3inall@. NiAe is a good sort brand and we can see in the figures that the@ have man@

factories and worAers that mean the roduct can be roduced and sul@ for customers

fast$ The more worAers the@ have. the more roducts will be roduced so it can be said

that NiAe roductivit@ is high$ NiAe also have web age. fan age. customer care and

man@ other deartment that the@ can receive and fix the customer satisfaction and

Juestionnaire$

2.2.# .erformance meas(re for profit center:

/s we can see in the table in Juestion 5$# *r$ "a 0ong can discuss and anal@se

easil@ about frofit center$

Confidential Page 5#

3ig: -ales vs$ Gross Profit

The development in Vang Company be continued discuss in the comparison

between .ales and Oross <rofit, the profit increase from 6*A to GDA and tae D-) the

Oross <rofit in )**G. 4esides, the number of .ales also increases in the several years

from +8*.*** to 6**.***. It shows that the $uantities of product were produced for

customers, suppliers of Vang Company increased. In economic, the more $uantities of

product you produce, the more benefit you will earn. It can be said that Vang Company

completed this target and balance the cost to have benefit for company.

Confidential Page 55

3ig: -ales vs$ /dministrative and -elling ,xenses

The .elling Expenses also increase because company must pay the cost for

their employee to sell the product or pay for the retail, store in supermaret and so on.

;hen the business has more benefit, the manager will expand it to other place. It is the

reason why the selling expenses increased0 but in general, these costs were not

significantly compare with gross profit or the net income0 which will be analysed in next

paragraph.

3ig: -ales vs$ Net income

Confidential Page 53

It can be seen clearly that the Pet income will be calculated by taing Oross

<rofit plus !dministrative and .elling Expenses. #or example, the Pet income in )**G is

calculated @ G*.*** B &/)8.***, @ D8.***. Then, the manager can see that in )**K, the

Pet income decreased because the costs in !dministrative and selling expenses

increased +* percent more than )**G to )**L &DA, so it effects on the net income. The

manager in Vang Company and (r. Na 'ong must control these costs and analyse to

mae the decisions in right moments and balance the payment and income to have

highest benefits, develop their company and also saving costs as much as possible. #or

example, reducing the wasting costs of electronic from machines, light or apply more

selling solutions to selling more effective.

).).6 <erformance measures for investment centres:

H3I is called as Heturn on Investment. These data can show how effective

investment that company invested and profit they receive. In other words, it is the rate

between profit - capital employed. Capital Employed @ Total assets E Current 'iabilities @

E$uity B Pon/current 'iabilities &Headyratios )*+6, through H3I can help (r. Na 'ong to

analyse the business and also release how much investment they can put to have a

most effective business and run as well. It relates to revenue and profit also if the

manager taes right decisions.

In Vang Company, (r. Na 'ong can reference this data in )**G and )**L as an

example:

)**G )**L

<rofit 8*.*** L8.***

.ales +8*.*** )K8.***

Capital Employed 8**.*** )8*.***

H3I +*A D*A

Fig1=: !"#g Co+0"#3 I#8est+e#t Ce#te$

!s we can see in the table that the invesment of Vang Company is effective and eep

the business grow because the rate of H3I is increased. In )**L the manager invested

)8*.*** M but they can have L8.*** M in profit the wor is more effective than )**G that

they put 8**.*** M in Capital Employed and got the <rofit 8*.*** M. Investment Centres

plays an important role in any organisation because if the manager do not now exactly

how they must to invest or cut down the money the business can be detroyed by wasting

money or lacing of money for producing in manufacture and so on.

Confidential Page 54

2.): I$!RO(E$ENT TO REDUCE CO"T"* ENCHNCE (LUE ND

+ULIT&:

In the recent years, the $uality of product was improved by many new

management techni$ues. It was contributing parts advanced for $uality management

activities such as system Qcorrect time for mediumR &9ust In Time,. It is the basis of Total

Suality (anagement.

TS(ETotal Suality (anagement is a management approach of an organisation,

$uality/oriented based on pro=ected participation of al members and bring about long/

term success through customer satisfaction and benefit of all members of the company

and society. The goal of TS( is to improve product $uality and customer satisfaction at

best allowed. The feature of TS( method compare with previous $uality management is

TS( provides a comprehensive system for the management and improvement of all

aspects related to $uality and mobili7e participation every department and every

individual to achieve $uality targets set. Vang Company can apply this system to

improve their product $uality and also enhance the value. !ctually, TS( is a mix of

Suality Control and <roductivity Control to approach goals is lead to have Q4est Suality

<roductR. Vang Company can also apply many management methods such as self/

control or management by fact. It is not only saving the costs for company but also they

will have a synchroisation in all departments. #or example, Vang Company will have

close relationship between manufactures and selling or administration department0

through TS( managers can control, follow the business trend and tae the decisions

easier and more effective.

It can be also said that in Pie, they had applied the TS( in all their business,

they have more than F** contract factories, + milion worers and more than 8**.***

different products but their $uality of their product are also good because they shape

sustainability solutions. !nother reasons are the business will be influenced by outside

factors such as competitors, government and customer. They realise that if they produce

a best product for customer they can also compete with competitors and also attract

more customer and improve product $uality. TS( also focus on the enviromental in

manufacture to save and have healthy products &Pie,IPC )*+),. #rom that, Vang

Company can apply these methods for their business. They can improve their

administration, manufacture management and also improve the $uality of T/shirt by

improving their employee%s sills, tae decisions about location, suppliers, and

warehouses. ;hen the $uality is good, it means that the business will have more

Confidential Page 5;

customers and the revenue also. It is the reason why Vang Company should apply and

run TS( in their business.

Confidential Page 5>

).0: CONCLU"ION

!fter calculating and analysing we can be said that financial is very important for any

company0 which want to develop and minimi7e the cost. Through this, the manager can

also manage and control the business trend. Vang Company is an example0 which show

how to develop a business to compete with other competitors and attract more

customers.

Confidential Page 59

%.0: REFERENCE"

3wen Vanderbilt &)**+, Cost Volume <rofit !nalysis T3nlineU available from

V htt"@AABBB2.oBen.vanderbilt.edA2ermain.CoerAmgt!1+Acv"Acv".htmlJ T)8

(arch )*+6U

Pie Hesponsibility &)*+), (anufacturing T3nlineU available from

V http:--www.nieresponsibility.com-report-content-chapter-manufacturingJ T)K

(arch )*+6U

Iam sam hubpages &)*+6, (ethod of Costing and Types of Costing T3nlineU available

from

V http:--iamsam.hubpages.com-hub-(ethods/of/CostingJ T)K (arch )*+6U

5" Essays &)*+6, 1ifferent types of cost T3nlineU available from

V http:--www.uessays.com-essays-accounting-different/types/of/cost/that/

an/organi7ation/would/incur/accounting/essay.phpJ T)8 (arch )*+6U

;ord <ress &)**K, TS( definition T3nlineU available from

V http:--n$center.wordpress.com-)**K-*6-)*-$uan/ly/chat/luong/toan/dien/t$m/

la/gi-J T)L (arch )*+6U

Confidential Page 56

Anda mungkin juga menyukai

- Cost Sheet Analysis of Britannia BreadDokumen27 halamanCost Sheet Analysis of Britannia BreadSagar Yadav89% (9)

- Othm L7Dokumen50 halamanOthm L7Ishan IsmethBelum ada peringkat

- Custom T-shirt Printing Cost AnalysisDokumen8 halamanCustom T-shirt Printing Cost AnalysisCianne AlcantaraBelum ada peringkat

- Financial Analysis For Boa CoffeeDokumen2 halamanFinancial Analysis For Boa CoffeeRunaway ShujiBelum ada peringkat

- 9-204-066 Dividend Policy - 204702-XLS-ENGDokumen17 halaman9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteBelum ada peringkat

- BDAP2203Dokumen4 halamanBDAP2203Clarissa ChenBelum ada peringkat

- Ankita ProjectDokumen17 halamanAnkita ProjectRaman NehraBelum ada peringkat

- COST ACCOUNTING: TRACK AND ANALYZE BUSINESS COSTSDokumen39 halamanCOST ACCOUNTING: TRACK AND ANALYZE BUSINESS COSTSraman sharma100% (1)

- Overhead Cost and Labour CostDokumen8 halamanOverhead Cost and Labour CostMAAN SINGHANIABelum ada peringkat

- cost-sheet-analysisDokumen37 halamancost-sheet-analysismanjeetkumar93544Belum ada peringkat

- Summary Notes 2-Cost ClassificationDokumen10 halamanSummary Notes 2-Cost ClassificationDKzBelum ada peringkat

- Ekotek Chapter 10Dokumen9 halamanEkotek Chapter 10muhammad cayoBelum ada peringkat

- Prime Cost, Conversion Cost and Carrying CostDokumen4 halamanPrime Cost, Conversion Cost and Carrying CostIris YangBelum ada peringkat

- Java NotesDokumen15 halamanJava NotesIqbal HawreBelum ada peringkat

- Cost Sheet NewDokumen25 halamanCost Sheet Newnagesh dashBelum ada peringkat

- Capture 4Dokumen6 halamanCapture 4sagung anindyaBelum ada peringkat

- Definition of 'Selling, General & Administrative Expense - SG&A'Dokumen6 halamanDefinition of 'Selling, General & Administrative Expense - SG&A'Akeel ChoudharyBelum ada peringkat

- Cost Sheet Project - Hindustan Petroleum Corporation LTDDokumen20 halamanCost Sheet Project - Hindustan Petroleum Corporation LTDkuldeep100% (1)

- Managerial Economics NotesDokumen17 halamanManagerial Economics NotesBell BottleBelum ada peringkat

- Elements of Cost in Overheads and Labor Rates and Their SignificanceDokumen15 halamanElements of Cost in Overheads and Labor Rates and Their SignificanceBrandy SangurahBelum ada peringkat

- Nature and Purpose of Cost AccountingDokumen10 halamanNature and Purpose of Cost AccountingJustus100% (1)

- Week 2 Day 1 and 2Dokumen29 halamanWeek 2 Day 1 and 2tantangernaldo73Belum ada peringkat

- Job Order vs Process Costing: Understanding the Key DifferencesDokumen3 halamanJob Order vs Process Costing: Understanding the Key DifferencesUmair Siyab100% (1)

- Product CostDokumen2 halamanProduct Costmba departmentBelum ada peringkat

- Accountancy SectionDokumen124 halamanAccountancy Sections7k1994Belum ada peringkat

- Direct and Indirect Cost Classification GuideDokumen10 halamanDirect and Indirect Cost Classification GuideNeelBelum ada peringkat

- Introduction To CostsDokumen7 halamanIntroduction To CostsLisaBelum ada peringkat

- Chap 002Dokumen75 halamanChap 002dbjnBelum ada peringkat

- Factory Overhead - RFDDokumen32 halamanFactory Overhead - RFDSamantha DionisioBelum ada peringkat

- Q1,2,3Dokumen6 halamanQ1,2,3Bhavika JoshiBelum ada peringkat

- Asg Acc CompletedDokumen4 halamanAsg Acc CompletedSyaidatina AishahBelum ada peringkat

- Managerial Accounting and Cost Concepts This Chapter Explains That in Managerial Accounting The Term Cost Is Used in Many Different Ways. TheDokumen36 halamanManagerial Accounting and Cost Concepts This Chapter Explains That in Managerial Accounting The Term Cost Is Used in Many Different Ways. TheSohaib ArifBelum ada peringkat

- A. Detailed Organizational Structure of Finance DepartmentDokumen22 halamanA. Detailed Organizational Structure of Finance Departmentk_harlalkaBelum ada peringkat

- CostDokumen33 halamanCostversmajardoBelum ada peringkat

- Ethan Menezes Fybcom B 088 Topic: Cost Analysis Busniess Economics 8928885792Dokumen20 halamanEthan Menezes Fybcom B 088 Topic: Cost Analysis Busniess Economics 8928885792The CarnageBelum ada peringkat

- Understanding Direct, Indirect, Fixed and Variable CostsDokumen5 halamanUnderstanding Direct, Indirect, Fixed and Variable CostsJoe DomarsBelum ada peringkat

- Cost Accounting Practices in The Service IndustryDokumen4 halamanCost Accounting Practices in The Service Industryasma zainBelum ada peringkat

- Management Accounting: Basic of CoastingDokumen8 halamanManagement Accounting: Basic of CoastingJagruti100Belum ada peringkat

- UNIT 3 Micro EconomicsDokumen21 halamanUNIT 3 Micro EconomicsFakeBelum ada peringkat

- Cost SheetDokumen18 halamanCost SheetSrinivas DevarakondaBelum ada peringkat

- Cost Accounting and Control: Cagayan State UniversityDokumen74 halamanCost Accounting and Control: Cagayan State UniversityAntonBelum ada peringkat

- Manufacturing OverheadDokumen5 halamanManufacturing OverheadSheila Mae AramanBelum ada peringkat

- Unit 1 Introduction To Cost AccountingDokumen4 halamanUnit 1 Introduction To Cost AccountingReema DsouzaBelum ada peringkat

- Introduction To Cost Accounting Final With PDFDokumen19 halamanIntroduction To Cost Accounting Final With PDFLemon EnvoyBelum ada peringkat

- Job Costing Process CostingDokumen25 halamanJob Costing Process CostingAnkul Baria100% (6)

- Table of Contents and Cost Classification GuideDokumen25 halamanTable of Contents and Cost Classification GuideAmarshanaBelum ada peringkat

- Cost Accounting FundamentalsDokumen6 halamanCost Accounting FundamentalsLovenia MagpatocBelum ada peringkat

- Costing ProjectDokumen36 halamanCosting ProjectNishaTambeBelum ada peringkat

- Managerial Accounting - Chapter3Dokumen27 halamanManagerial Accounting - Chapter3Nazia AdeelBelum ada peringkat

- Chapter 1: Cost Sheet (Unit Costing)Dokumen102 halamanChapter 1: Cost Sheet (Unit Costing)Rimsha HanifBelum ada peringkat

- Coursematerial mmzg511 MOML15Dokumen6 halamanCoursematerial mmzg511 MOML15srikanth_bhairiBelum ada peringkat

- Steps in Job CostingDokumen8 halamanSteps in Job CostingBhagaban DasBelum ada peringkat

- Factory OverheadsDokumen22 halamanFactory OverheadskromatographicBelum ada peringkat

- Actual Costing SystemDokumen19 halamanActual Costing SystemFarid MahdaviBelum ada peringkat

- Discussion 3 FinanceDokumen7 halamanDiscussion 3 Financepeter njovuBelum ada peringkat

- Cost and Cost ClassificationDokumen10 halamanCost and Cost ClassificationAmod YadavBelum ada peringkat

- Cost AccountingDokumen36 halamanCost AccountingNikhil PatelBelum ada peringkat

- Cost Accounting and Control 1Dokumen205 halamanCost Accounting and Control 1celynah.rheudeBelum ada peringkat

- Lecture #3 Managerial AccountingDokumen5 halamanLecture #3 Managerial AccountingBushra HaroonBelum ada peringkat

- Marginal Cost of ProductionDokumen9 halamanMarginal Cost of ProductionJunayed MostafaBelum ada peringkat

- AccountingDokumen14 halamanAccountingMayurdhvajsinh JadejaBelum ada peringkat

- Remodelers' Cost of Doing Business Study, 2020 EditionDari EverandRemodelers' Cost of Doing Business Study, 2020 EditionBelum ada peringkat

- Developing Global Management Competencies IDokumen5 halamanDeveloping Global Management Competencies IRunaway ShujiBelum ada peringkat

- Business Game ScheduleDokumen2 halamanBusiness Game ScheduleRunaway ShujiBelum ada peringkat

- PUMA Company Profile - Sports Brand HistoryDokumen1 halamanPUMA Company Profile - Sports Brand HistoryRunaway ShujiBelum ada peringkat

- Assignment MAAR 2Dokumen47 halamanAssignment MAAR 2Runaway ShujiBelum ada peringkat

- ACNB 2 of 2 2015 AugustDokumen7 halamanACNB 2 of 2 2015 AugustRunaway ShujiBelum ada peringkat

- Assignment MAAR 1Dokumen28 halamanAssignment MAAR 1Runaway ShujiBelum ada peringkat

- HR Assignment - Ha ThanhDokumen19 halamanHR Assignment - Ha ThanhRunaway ShujiBelum ada peringkat

- Personal and Professional Development PlanDokumen33 halamanPersonal and Professional Development PlanRunaway Shuji33% (3)

- APC 309 ABC Mock Exam Solution A and BDokumen3 halamanAPC 309 ABC Mock Exam Solution A and BRunaway ShujiBelum ada peringkat

- The Work Breakdown Structure TemplateDokumen1 halamanThe Work Breakdown Structure TemplateRunaway ShujiBelum ada peringkat

- Personal and Professional Development PlanDokumen33 halamanPersonal and Professional Development PlanRunaway Shuji33% (3)

- Sbe A2 Sud12Dokumen8 halamanSbe A2 Sud12Runaway ShujiBelum ada peringkat

- Assignment Guiide OBDokumen5 halamanAssignment Guiide OBRunaway ShujiBelum ada peringkat

- The Main Barrier of Marketing Plan For Cie: Name: Tran Anh Dung (Jay) Lecturer: Mr. Frederick IgnacioDokumen23 halamanThe Main Barrier of Marketing Plan For Cie: Name: Tran Anh Dung (Jay) Lecturer: Mr. Frederick IgnacioRunaway ShujiBelum ada peringkat

- PP 10Dokumen27 halamanPP 10Ahmed BdairBelum ada peringkat

- EthicsDokumen23 halamanEthicsRunaway ShujiBelum ada peringkat

- 1.1 Discuss Definitions of Quality in Terms of Business and Services ProvisionDokumen10 halaman1.1 Discuss Definitions of Quality in Terms of Business and Services ProvisionRunaway ShujiBelum ada peringkat

- CIE BudgetDokumen7 halamanCIE BudgetRunaway ShujiBelum ada peringkat

- A1 - BDM - NancyDokumen21 halamanA1 - BDM - NancyRunaway ShujiBelum ada peringkat

- SBE 1 SampleDokumen11 halamanSBE 1 SampleRunaway ShujiBelum ada peringkat

- The Relationship Between Educational Attainment and Professional Attainment in DanangDokumen3 halamanThe Relationship Between Educational Attainment and Professional Attainment in DanangRunaway ShujiBelum ada peringkat

- Redo WLP 1Dokumen8 halamanRedo WLP 1Runaway ShujiBelum ada peringkat

- Assignment 1 Sbe GuideDokumen1 halamanAssignment 1 Sbe GuideRunaway ShujiBelum ada peringkat

- Assignment TQM 1Dokumen13 halamanAssignment TQM 1Runaway ShujiBelum ada peringkat

- Assignment 1 Sbe GuideDokumen1 halamanAssignment 1 Sbe GuideRunaway ShujiBelum ada peringkat

- Event Date Lunch Set Menu 11 December 2014: Time Venue Number of Guest 10:00 Lemongrass Rest 43 Studen + 5 Staff MemberDokumen3 halamanEvent Date Lunch Set Menu 11 December 2014: Time Venue Number of Guest 10:00 Lemongrass Rest 43 Studen + 5 Staff MemberRunaway ShujiBelum ada peringkat

- Grade - Sem 1Dokumen4 halamanGrade - Sem 1Runaway ShujiBelum ada peringkat

- Ical-111 76 183 2 RVDokumen4 halamanIcal-111 76 183 2 RVhebishtBelum ada peringkat

- The Limitations of Mutual FundsDokumen1 halamanThe Limitations of Mutual FundsSaurabh BansalBelum ada peringkat

- Resume Amit KR Singh NewDokumen3 halamanResume Amit KR Singh NewCharlie GuptaBelum ada peringkat

- CFI 3 Statement Model CompleteDokumen9 halamanCFI 3 Statement Model CompleteshashankBelum ada peringkat

- TPM Event CalenderDokumen3 halamanTPM Event Calenderamarpal07Belum ada peringkat

- Traditional VS Modern MarketingDokumen17 halamanTraditional VS Modern Marketingneha palkarBelum ada peringkat

- Student Notice: Project ReportDokumen22 halamanStudent Notice: Project ReportneetuBelum ada peringkat

- Prelim Quiz 1 System IntegDokumen11 halamanPrelim Quiz 1 System IntegMark RosellBelum ada peringkat

- FABIZ I FA S2 Non Current Assets Part 4Dokumen18 halamanFABIZ I FA S2 Non Current Assets Part 4Andreea Cristina DiaconuBelum ada peringkat

- Skill Matrix AccountsDokumen2 halamanSkill Matrix AccountsAfsal CkBelum ada peringkat

- Adani's Holistic Approach for India's FutureDokumen26 halamanAdani's Holistic Approach for India's FutureRow Arya'nBelum ada peringkat

- Insurance Basics: Characteristics, Risks, and BenefitsDokumen10 halamanInsurance Basics: Characteristics, Risks, and Benefitsmark sanadBelum ada peringkat

- Food Safety Manager's ResumeDokumen5 halamanFood Safety Manager's ResumeMarsit Med AmineBelum ada peringkat

- Physical Evidence and Servicescape: EssaysDokumen7 halamanPhysical Evidence and Servicescape: EssaysCristinaBelum ada peringkat

- Indian FMCG Industry, September 2012Dokumen3 halamanIndian FMCG Industry, September 2012Vinoth PalaniappanBelum ada peringkat

- Promotion DecisionsDokumen21 halamanPromotion DecisionsLagishetty AbhiramBelum ada peringkat

- CRM Module 4Dokumen13 halamanCRM Module 4SOHOM GANGULYBelum ada peringkat

- Assign 2 Management AccountingDokumen10 halamanAssign 2 Management AccountingRamin Mostamer ZiaBelum ada peringkat

- Company Profile Law Firm Getri, Fatahul & Co. English VersionDokumen9 halamanCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDBelum ada peringkat

- Small Business Term Paper on Opportunities in BangladeshDokumen25 halamanSmall Business Term Paper on Opportunities in BangladeshMaisha MaliatBelum ada peringkat

- Sana HNMDokumen12 halamanSana HNMSana MirBelum ada peringkat

- NFT Data Startup Snickerdoodle Labs Raises $2.3M Seed Round From Kenetic, Blockchain Capital, Tribe Capital and FTX/Sam Bankman-FriedDokumen3 halamanNFT Data Startup Snickerdoodle Labs Raises $2.3M Seed Round From Kenetic, Blockchain Capital, Tribe Capital and FTX/Sam Bankman-FriedPR.comBelum ada peringkat

- Agency and Mortgage Lecture NotesDokumen13 halamanAgency and Mortgage Lecture NotesNA Nanorac JDBelum ada peringkat

- FILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.Dokumen2 halamanFILIPINAS COMPAÑIA DE SEGUROS vs. CHRISTERN, HUENEFELD and CO., INC.zacBelum ada peringkat

- Piyush Kumar Saini - AIDP - End TermDokumen5 halamanPiyush Kumar Saini - AIDP - End TermPiyush SainiBelum ada peringkat

- Chase Lesson 3 PDFDokumen4 halamanChase Lesson 3 PDFstraywolf0Belum ada peringkat

- Production Management Midterm ReviewDokumen21 halamanProduction Management Midterm Reviewielsiu21184Belum ada peringkat

- Chapter-16: Developing Pricing Strategies and ProgramsDokumen16 halamanChapter-16: Developing Pricing Strategies and ProgramsTaufiqul Hasan NihalBelum ada peringkat

- No. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountDokumen3 halamanNo. Requisition / Material Code / Description Quantity Unit Unit Price Disc % AmountMond NaBelum ada peringkat