ExxonMobil Paper

Diunggah oleh

saba_zafarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ExxonMobil Paper

Diunggah oleh

saba_zafarHak Cipta:

Format Tersedia

MGMT 619: Capstone

Spring 2011

Prof. Darrel Mank

Prepared by:

Kannan Ananthanarayanan

Pranav Bhajiwala

Foram Gandhi

Kristine Garner

Rajesh Goudar

Venkat Iyer

i

1. WALLSTREETJOURNALARTICLEANDTHEEXECUTIVESUMMARY............................................................................ 1

WALLSTREETJOURNALARTICLE......................................................................................................................................................1

EXECUTIVESUMMARY ...................................................................................................................................................................2

MajorIssues ........................................................................................................................................................................2

KeyAnalysis.........................................................................................................................................................................3

FinalRecommendation .......................................................................................................................................................4

2. EXTERNALANALYSIS................................................................................................................................................ 5

INDUSTRYDEFINITION...................................................................................................................................................................5

SIXFORCESANALYSIS....................................................................................................................................................................5

Level3IndustryAttractiveness ...........................................................................................................................................5

Level2Analysis ...................................................................................................................................................................6

Upstream ........................................................................................................................................................................................... 6

DownstreamOil ................................................................................................................................................................................. 8

Chemical............................................................................................................................................................................................. 9

Level1Analysis .................................................................................................................................................................10

MACROENVIRONMENTALFORCESANALYSIS,ECONOMICTRENDSANDETHICALCONCERNS .....................................................................10

UpstreamandDownstreamOilandNaturalGas ............................................................................................................................. 10

PetrochemicalIndustry .................................................................................................................................................................... 14

COMPETITORANALYSIS ...............................................................................................................................................................15

FirmsCompetitors.............................................................................................................................................................15

OilIndustry....................................................................................................................................................................................... 15

NaturalGasIndustry ........................................................................................................................................................................ 16

ChemicalIndustry............................................................................................................................................................................. 16

PrimaryCompetitors .........................................................................................................................................................16

Oil ..................................................................................................................................................................................................... 16

NaturalGas....................................................................................................................................................................................... 17

Chemicals ......................................................................................................................................................................................... 17

PrimaryCompetitorsBusinessLevelandCorporateLevelStrategy.................................................................................17

HowCompetitorsAchieveTheirStrategicPosition...........................................................................................................18

ValueCostProfile ...........................................................................................................................................................19

INTRAINDUSTRYANALYSIS...........................................................................................................................................................19

StrategicGroupOverview.................................................................................................................................................20

StrategicGroupAnalysis ...................................................................................................................................................20

Technology&Innovation ................................................................................................................................................................. 21

IndustryKeySuccessFactors(KSFs) ..................................................................................................................................22

SWOTAnalysis...................................................................................................................................................................24

ii

OilIndustry....................................................................................................................................................................................... 24

NaturalGasIndustry ........................................................................................................................................................................ 25

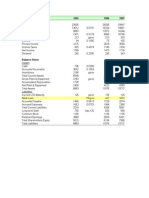

COMPARATIVEFINANCIALANALYSIS...............................................................................................................................................26

SUMMARYOFEXTERNALANALYSIS ................................................................................................................................................29

3. INTERNALANALYSIS .............................................................................................................................................. 30

BUSINESSDEFINITION/MISSION....................................................................................................................................................30

ORGANIZATIONSTRUCTURE,CONTROLANDVALUES .........................................................................................................................31

OrganizationStructure......................................................................................................................................................31

Controls .............................................................................................................................................................................31

Values................................................................................................................................................................................31

EthicalStandardsandpractices ........................................................................................................................................32

STRATEGICPOSITIONDEFINITION ..................................................................................................................................................33

BusinessPortfolio..............................................................................................................................................................33

CorporateStrategy............................................................................................................................................................33

BusinessPortfolioPerformance ........................................................................................................................................33

Acquisitions .......................................................................................................................................................................34

Divestiture.........................................................................................................................................................................35

JointVentureandAlliances...............................................................................................................................................35

BCGMatrix........................................................................................................................................................................36

BusinessStrategyMix .......................................................................................................................................................36

BUSINESSLEVELSTRATEGY...........................................................................................................................................................37

GrowthStrategy................................................................................................................................................................37

ImplicationsofStrategicmoveonBusinessandGrowthStrategy....................................................................................37

ImplicationsofStrategicmoveonBusinessInvestment ...................................................................................................38

RESOURCEANDCAPABILITIES ........................................................................................................................................................38

VRIOAnalysis: ...................................................................................................................................................................39

ValueDrivers: ....................................................................................................................................................................39

CostDrivers .......................................................................................................................................................................40

ImplicationsofStrategicmoveonValueCostProfile .......................................................................................................41

ValueChainSynergies .......................................................................................................................................................41

Customerretention ...........................................................................................................................................................42

Segmentation,TargetingandPositioning.........................................................................................................................42

ValuetoCustomers ...........................................................................................................................................................42

MarketingMix...................................................................................................................................................................42

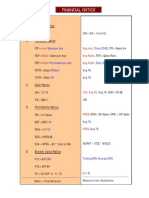

FINANCIALANALYSIS ...................................................................................................................................................................43

ValuationofExxonMobil ...................................................................................................................................................44

iii

ForecastingModelforScenarioAnalysis ..........................................................................................................................45

ScenarioAnalysis...............................................................................................................................................................46

ScenarioAnalysisDetails...................................................................................................................................................46

SensitivityAnalysis ............................................................................................................................................................47

4. ANALYSISOFTHEEFFECTIVENESSOFSTRATEGY .................................................................................................... 48

GOODNESSOFFITTEST ...............................................................................................................................................................48

COMPETITIVEADVANTAGETEST....................................................................................................................................................48

PERFORMANCETEST ...................................................................................................................................................................48

5. RECOMMENDATIONS ............................................................................................................................................ 49

SHORTTERMRECOMMENDATION..................................................................................................................................................49

LONGTERMRECOMMENDATIONS..................................................................................................................................................52

6. CONCLUSION......................................................................................................................................................... 54

COMPANYPROSPECTS.................................................................................................................................................................54

INVESTMENTADVICE...................................................................................................................................................................54

7. MAINAPPENDIX.................................................................................................................................................... 55

8. FINANCIALBACKGROUNDAPPENDIX..................................................................................................................... 83

9. GLOSSARYOFTERMS........................................................................................................................................... 108

10. ENDNOTES...................................................................................................................................................... 110

1

1. WallStreetJournalArticleandtheExecutiveSummary

WallStreetJournalArticle

The strategy analysis of ExxonMobil is based on two Wall Street J ournal articles: Exxon

Sees Burgeoning Demand for Natural Gas, dated 27 J anuary 2011, and Exxon Tilts Again

Toward Oil Production, dated 10 March 2011.

ExxonMobilSeesBurgeoningDemandforNaturalGas

ExxonMobil raised market expectations for its revenue growth when it stated that the

demand for natural gas in heating homes and businesses and for generating electricity will grow

by two percent annually between now and the year 2030. This statement, along with the

companys recent acquisition of XTO Energy for $25 billion, shows the companys belief in and

commitment to its energy outlook.

ExxonMobilTiltstoOilAgain

The political turmoil in the Middle East, particularly in Libya, has limited the current supply

of oil, resulting in oil prices topping $100 per barrel, whereas the price for natural gas has

slumped, due to an abundance of new reserves. An article from March 2011 relays

ExxonMobils decision to reverse course from its J anuary position, and throw more weight

towards oil production, stating that the majority of the companys production over the next five

years will be heavily oil. This position is seemingly in contradiction to the article mentioned

previously, dated 27 J anuary 2011, in which ExxonMobil announced its increased focus on

natural gas. More specifically, ExxonMobil plans to boost its capital spending in 2011 by six

percent, of which eighty percent of the new production will come from crude oil, bucking the

recent industry trend of increasing production in natural gas.

1

The strategic move outlined in both the articles warrants an analysis on ExxonMobils short-

term and long-term strategy, and associated competitive, operational and financial implications.

2

ExecutiveSummary

Energy is the most fundamental resource that fuels the entire globe. The Energy sector is of

international importance and is widely followed by many national and international

organizations. ExxonMobil, the worlds largest public company in market capitalization, is the

benchmark for companies operating in the Oil & Gas Industry. The actions of industry leaders

like ExxonMobil are closely watched by the entire global Oil & Gas Industry ecosystem.

ExxonMobil recently announced that, the vast majority of its new production over the next

five years will be oil, and that it will increase capital spending on finding and refining energy

to $34 billion this year.

2

This announcement came within months after spending $25 billion in

acquiring XTO, a leading natural gas player.

Given the companys recent energy outlook report predicting natural gas to be the number

two global energy source by 2030

16

and its recent acquisition of XTO, ExxonMobils tilt towards

oil appears to be a significant strategic move.

MajorIssues

ExxonMobils strategic move raises a set of critical questions, including the obvious ones:

Are the recent moves of betting big on natural gas and immediately committing to pour a vast

amount of resources to produce oil in the next five years strategically consistent?; Should

ExxonMobil increase its investment in oil, or should it step up its commitment to natural gas

more than ever?; Is ExxonMobils action going to help it maintain its leadership, or will this

move give its competitors an opportunity to overthrow ExxonMobils dominance?

With rising oil prices and an oversupplied natural gas market, current economics clearly

favors oil production over natural gas production. However, conventional oil reserves are

dwindling, with companies struggling to find new oil; this is recently illustrated by the

unfavorable spotlight that was thrown on ExxonMobil regarding its dubious reserve replacement

ratio. This raises more questions needing to be address: How will ExxonMobil be able to

successfully execute on its mission to produce more oil?; What type of new technological

innovations and infrastructure and process improvements are required to succeed?; What

geopolitical, regulatory and environmental challenges must ExxonMobil overcome to profitably

execute its commitment?

KeyAnalysis

Global energy demand is expected to increase 35 percent by 2030.

16

The demands for

transportation, residential and commercial use are all expected to rise in the next two decades;

however, the growth rate of the current energy supply is not expected to keep pace with

increasing demand, calling for investment in the discovery and production of energy from all

types of sources.

The natural gas market is currently oversupplied, keeping the price of natural gas low,

resulting in a lower level of sustained profitability. Additionally, the adoption of natural gas

across the globe is part of a very long-term strategy. As the adoption of natural gas increases, it

should drive the prices for natural gas up, making the investment more financially attractive in

the long run.

The energy industry is a mature industry with conventional, fossil-fuel-based energy sources,

such as oil and coal, dwindling slowly. While the supply of conventional light crude oil is

declining, there is still an estimated three trillion barrels of heavy crude oil in the world, equaling

approximately 100 years of global consumption at current levels

3

. Current technology allows

only a fraction of heavy crude oil (400 billion barrels) to be recovered cost effectively

3

.

Therefore, boosting investment in unconventional oil exploration and processing technology is

important to building a sustainable competitive advantage. The total cycle for producing oil is

between two and five years for already developed fields, and seven to twelve years in unproven

fields

4

, so investments in technology need to be far in advance. Currently, the technologies to

extract oil from unconventional sources are not yet fully developed.

Though the goals of supermajor oil companies are essentially the same, there is a sharp

contrast in strategy. ExxonMobil made less investment to grow organically and has relied on its

XTO acquisition to boost its reserves; whereas Chevron has spent a significant amount in capital

projects with unwavering commitments to oil. ConocoPhillips, on the other hand, is divesting its

non-core assets to build necessary capital to invest in liquids. Competitors are stepping up their

oil investments, and ExxonMobil should not see itself at a competitive advantage by not acting

swiftly.

ExxonMobil is a long-term oriented company, and as such, it is not unusual for ExxonMobil

to invest in a long-term prospect like XTO, where it can acquire growth cost effectively,

especially in light of the companys strategic intent to be the leading supplier of global energy.

4

Our analysis suggests that the recent move of focusing on oil for next five years is well aligned

with ExxonMobils energy outlook and investments in natural gas. They both are part of a well-

balanced strategy that caters to short-term as well as long-term strategic needs.

FinalRecommendation

We recommend the following short-term actions:

1. Increase investments in oil exploration, production and refining

2. Expand chemical operations, especially in emerging markets

3. Focus on increasing commercial sales and retrenching retail sales

We also recommend the following long-term actions:

A. Increase investments in natural gas exploration and production

B. Invest in technology that would enable the company to explore, produce and refine heavy

crude efficiently

C. Invest in renewable energy sources to assert its corporate and social responsibility

D. Continue to improve ethical operating standards to be the recognized leader in the industry

5

2. ExternalAnalysis

IndustryDefinition

ExxonMobil (XOM) is a major integrated Oil & Gas (O&G) company with operations in oil

and gas exploration & production, refining, and marketing oil and chemicals.

The Oil & Gas industry value chain

5

is as follows:

The entire Industry value chain is broken into three main sections: Upstream, Mid-stream and

Downstream.

Upstream: This part of the value chain is also called Exploration & Production (E&P). The

global E&P market is focused on searching and exploration of oil and gas reserves around the

planet.

Mid-Stream: Oil and gas produced from E&P operations is collected and delivered to a

processing plant, where it is further refined and processed. The midstream industry stores and

transports the finished products to the Downstream industry.

Downstream: The Downstream oil sector industry refines the crude and distributes and sells the

end products in the market.

SixForcesAnalysis

Level3IndustryAttractiveness

Upstream is a moderate to highly attractive industry with a low threat of substitutes, low

threat of new entrants, and moderate supplier and buyer powers. Competition in this industry is

high.

6

Downstream is moderately attractive with a low threat of substitutes, low threat of new

entrants, moderate buyer power, and high competition. Vertical integration (i.e. backward

integration) can enable Downstream manufacturers to have a constant supply of crude oil. The

industry attractiveness is higher for integrated oil and gas manufacturers compared to non-

integrated companies due to the role of complements.

Chemical is moderately attractive with a low threat of new entrants, moderate buyer power,

and moderate competition. As stated previously, vertical integration (backward integration) can

enable Downstream manufacturers to have a constant supply of crude oil, and the industry

attractiveness is higher for integrated oil and gas manufacturers compared to non-integrated due

to the role of complements. Exhibit 1 summarizes the industry attractiveness for all business

segments.

Level2Analysis

Upstream

Firms in this industry operate and develop oil and gas fields. Activities include: the

exploration and production of crude petroleum; the mining and extraction of oil from oil shale

and oil sands; the exploration and production of natural gas; sulfur recovery from natural gas;

and recovery of hydrocarbon liquids. Firms may operate oil and gas wells on their own account

or for others on a contract or fee basis.

6

Supplier Power:

Suppliers are mining and drilling equipment manufacturers. They provide support services

on a fee or contract basis. The demand for oil drilling rises as the price of crude oil rises. As the

demand rises, suppliers can charge a higher price per hour; hence, supplier power is cyclical. In

an up cycle, the suppliers have power; in a down cycle, suppliers see their power lesson.

7

Pipe and tube supplier for oil and gas transportation: New oil and gas drilling requires new

pipelines for transporting oil and gas.

7

However, since domestic and international competition is

high and the industry is heavily regulated, pipe manufacturers do not exert any pricing pressure

on the oil and gas drilling companies

7

.

Pumping equipment: Pumping equipment is used to extract oil from the ground.

8

Compressors are used to prepare gas for storage and transportation

8

. These manufacturers do not

exert pricing power on the drilling companies due to high competition and fluctuating demand.

7

Buyer Power:

About 65 percent of output goes to refiners and 14 percent goes to the natural gas distribution

industry, making refiners the key buyers of crude oil.

6

Oil Refiners: Since crude oil is a globally traded commodity, buyers favor the provider which

is closest since they have to bear the shipping costs.

6

The buyer cannot force the Upstream

supplier of crude oil to reduce the price unless the global demand for oil and gas goes down.

However, the price also depends on the grade of oil (heavy versus light) and impurities

(governed by the amount of sulfur in oil). A lower level of impurities translates into the lower

operating costs for petroleum refiners and also makes complying with environmental regulations

easier. Light crude is easier to refine into gasoline and can be used to make a greater variety of

products; therefore, light crude is naturally more expensive than heavy crude. Refiners have

fixed capacity and are cost-wise better off running their plants at fixed capacity than by keeping

the plant idle and not buying crude in a high business cycle;

6

as such, refiners cannot put too

much pressure on drilling companies.

Cyclical demand: If the price is high to the extent that demand goes down, then price goes

down. During a down cycle, the buyer has power and vice versa.

Natural Gas Distributors: The firms in the Natural Gas Distribution industry provide

transport (via pipelines)

6

. They have to buy gas from the drilling companies at the market price.

Competition in the industry is moderate and does not give these distributors any bargaining

power.

Cyclical demand: If the price is high to the extent that demand goes down, then price goes

down. During a down cycle, the buyer has power; during an up cycle, the buyer experiences less

power. Currently, supply is up, bringing prices down.

Threat of New Entrants:

Risks involved in oil and gas exploration: Out of all the oil fields an oil company researches,

only 10 percent go into production

9

.

Capital required to bring fields into production: This depends on the price of an oil rig

rental (per day basis). Deep-water drilling rates are around $420,000 a day; for 100 days, the

cost can be around $420 million

10

.

Regulation: Environmental regulations force companies to reduce emissions, which can be

very expensive. The oil spill in the Gulf of Mexico resulted in the U.S. Government issuing an

order to stop any kind of oil drilling in the area. A new entrant should be able to absorb this

sudden stoppage in drilling activity, and would need to look for newer avenues for exploring.

8

Undertake sensitive negotiations with governments: Major oil and gas companies have

operations globally, and need to be in constant negotiations with the governments of those

countries in which they operate in order to continue doing business in those regions

6

.

Threat of Substitutes:

In 2009, nuclear energy accounted for about 9 percent of energy supply and renewable

energies accounted for 8 percent of the supply.

11

In 2035, the nuclear energy use is expected to

go down to 8 percent, and renewable energies are expected to provide 10 percent of the total

energy consumption.

11

As fossil fuels still make up the vast majority of energy supply, the threat

of substitutes to fossil fuels is low.

Competition:

The industry has a high level of competitive rivalry. Based on the commodity nature of oil

and gas, there is little product differentiation that can be achieved. Customers generally prefer

purchasing oil from the oil company which is geographically closest to them since shipping costs

are paid by the customers

6

. There are five major players in oil (ExxonMobil, British Petroleum,

Shell, ConocoPhillips, and Chevron) and share nearly equal market share (2.7 percent for

ExxonMobil and 10.3 percent for Chevron)

6

. The major players in natural gas are Chesapeake

Energy, Anadarko, Devon, BP, EnCana, ConocoPhillips, Chevron and Shell.

Complements:

Any integration that Upstream can achieve in its value chain is a good complement in terms

of having a market ready to process the supplies when oil prices are high.

12

DownstreamOil

Petroleum refiners manufacture a number of products from crude oil, the two most important

of which are gasoline and diesel.

6

Supplier Power:

The suppliers in Downstream are the Oil and Gas drilling companies, who explore and

produce crude oil. Their biggest cost is the cost of obtaining crude oil, and they tend to keep their

production at the same level to utilize maximum capacity. Suppliers have high-moderate power

since they can control their production to some extent.

6

Cyclical supplier power: If the price is high to the extent that demand goes down, then price

goes down. The suppliers power moves with demand and price, increasing as demand and price

go up.

9

Buyer Power:

Key buying industries are households, commercial transportation, international and domestic

airlines in the U.S., and Marine.

6

Cyclical Demand: Buyers have no bargaining power in an up cycle and will have to pay the

price that refiners demand. In a down cycle, buyers have power and can bargain on price since

demand is low; refiners have to reduce output which will make inefficient use of their plants,

causing losses.

Threat of New Entrant:

The refining industry is capital intensive due to the costs to meet environmental regulations

and to construct and maintain refineries. The low returns and government regulation act as

deterrents to new entrants.

6

Threat of Substitutes:

There really is no substitute for refineries. Although large refiners have operations overseas,

domestic production is processed in local refineries.

6

Competition:

There is intense competition in the refining industry. The Nelson Complexity Iindex, a

broad-based tool to measure the value-added nature of a refinery, assigns higher values to

refineries that can process undesirable fuels into high-quality end products. There are five major

competitors (Chevron, Marathon Oil, Valero, ExxonMobil and ConocoPhillips). They have

nearly equal market share and dominate the industry.

6

Complements:

For Integrated Oil companies, vertical integration lets them sell their Upstream product

directly Downstream without involving distributors. This reduces cost and increases profit

margin. Thus, having a vertically integrated Downstream sub-segment ensures a steady supply of

oil.

Chemical

Supplier Power:

Petrochemical manufacturers use crude oil, refined oil and natural gas to produce

petrochemicals, and are affected by high prices in general.

Cyclical: Petrochemical manufacturers form a very small percentage of the output of the

refiners, crude oil producers and natural gas producers. However, when the business cycle is

high, the supplier has power and when the cycle is low, the supplier does not have power in

controlling price.

10

Buyer Power:

Buyers of petrochemicals are plastic, rubber, and resin manufacturers, as well as other

petrochemical manufacturers who use the intermediate products. Petrochemical manufacturers

pass on their oil costs to buyers. Since demand goes down considerably during a downturn,

Petrochemical manufacturers suffer with excess capacity.

13

Cyclical: During an up cycle, plastic and rubber manufacturers cannot bargain for price since

demand is high. However, during a down cycle, buyers get bargaining power.

Threat of New Entrants:

The chemical business is capital intensive. For example, a world-class ethylene plant can cost

more than $1 billion to construct.

13

The thin profits margins discourage new entrants. However,

internationally, China, Korea and Saudi Arabia are trying to enter the market

13

since they can

have higher margins due to lower labor costs.

Threat of Substitutes:

Environmental awareness amongst consumers to use environmentally friendly products

instead of plastic may also influence the level of demand.

13

Competition:

There are two major U.S. chemical manufacturers: Dow Chemicals and ExxonMobil. The

highest threat is the movement of production facilities overseas out of the U.S.

13

Dow Chemicals

has 2.7 percent market share and ExxonMobil has 3.2 percent market share; BASF, DuPont, and

SBAIC are other chemical players in the international arena.

13

Complements:

Many of the established players are part of integrated oil companies operating in integrated

oil refining and petrochemical complexes, a position that gives them a significant competitive

edge over potential stand-alone newcomers.

13

Level1Analysis

A detailed Level 1 analysis can be found in Exhibit 2.

MacroEnvironmentalForcesAnalysis,EconomicTrendsandEthicalConcerns

UpstreamandDownstreamOilandNaturalGas

Economic:

Historically the profitability of the oil and gas companies is tied to the strength of the

economy. The demand for petroleum products (and, by extension, for crude oil) is linked to the

11

overall level of activity in the economy. A regression analysis spanning the past twenty years

indicates that the level of real gross domestic product (GDP) can explain about 95 percent of the

demand for crude oil in the United States

6

.

The natural gas price has historically moved very little. From 1984 to 2010, the price of

natural gas has gone from $3.95 to $6.16.

14

Global:

Oil can be analyzed in terms of demand, supply and geopolitical factors. Oil is an

internationally traded commodity. Historically, OECD countries drive the demand for oil. North

America has historically had the largest demand for oil; in 2010 North America consumed 23.9

million barrel of oil per day. The second largest consumer is Europe with 14.4 million barrels

per day, and China and other Asian countries accounted for 9.4 and 10.4 million barrels per day,

respectively.

15

On the supply side, OPEC is the highest supplier of crude oil with 40 percent of the worlds

daily supply coming from OPEC countries. Although the demand for oil is expected to increase,

the supply from non-OPEC countries is expected to remain constant

16

.

In 2005, domestic conventional supplies of natural gas made up for 80 percent of demand. It

is expected to change to 30 percent in 2030. In the future, unconventional gas extraction is

expected to grow to meet the growing demand in gas for electricity generation across the globe

and in North America and China

16

.

As the U.S. has been the major consumer of energy, a downturn in the U.S. economy sould

result in an oil price decrease. However, in future, non-OECD countries are going to drive the

demand for energy.

11

By 2030, energy demand in non-OECD countries will be about 75 percent

higher than OECD demand. This will result in the U.S. no longer being able to put downward

pressure on oil in case they have an economic meltdown like the one in 2008. Therefore, the

drivers of oil price are going to change in the future.

Social/ Environmental:

Due to diminishing U.S. domestic supplies, oil companies resorted to deep water drilling.

Following the B.P. oil spill in the Gulf of Mexico, the U.S. Government put a ban on deep sea

drilling in the Gulf of Mexico.

16

Since local oil companies rely heavily on local oil production,

this affects their ability to produce oil. Industry participants are subject to extensive federal, state

and local regulations and environmental laws that govern discharge of materials into the

environment including the emission of air pollutants and the discharge of water pollutants.

12

Industry participants are also subject to regulations governing the manufacture, storage, handling

and disposal of hazardous substances and waste and other toxic materials.

6

Regulation in Oil and Gas Drilling: The Oil Drilling and Gas Extraction Industry is highly

regulated, with the federal and state governments being involved in all stages of production.

State governments determine which areas are open to oil exploration and extraction, issue

exploration and production leases, and enforce environmental legislation. The federal

government also maintains the Strategic Petroleum Reserve (SPR). This was established in 1977

in response to upheaval in the Middle East. The purpose of the reserve is to provide a stock of oil

that can be drawn down in the event of a major upheaval in the market.

In 2007, Congress passed the Energy Independence and Security Act, which contains

standards relating to producing a certain amount of renewable fuel (the renewable fuel standard

or RFS) and automotive standards to increase fleet gas mileage to 35 mpg by the year 2020.

6

Political:

The geopolitical turmoil around the world affects the U.S. because although the U.S. is the

third largest crude oil producer, about half of the petroleum the U.S. uses is imported.

11

(Canada

23.3 percent, Venezuela 10.7 percent, Saudi Arabia 10.4 percent, Mexico 9.2 percent, Nigeria

8.3 percent)

6

. Tensions sparked by perceived successful government transitions in Tunisia and

Egypt have caused a ripple effect throughout the Middle East. Oil prices rose substantially as

these tensions spread to other countries including Libya, Bahrain and Yemen. Speculation has

largely been behind the sharp crude oil price increase as traders believe that unrest in countries

near major oil producers may lead to actual supply disruptions. For instance, if Saudi Arabia

experiences significant unrest and its oil supply is threatened, prices may rise quickly as the

country is a major producer and exporter of crude oil.

6

In the U.S. the major oil companies are vertically integrated and they control the oil prices.

The high profits are due to the mergers in the oil industry, which also has reduced competition

17

.

Technological:

New shale gas extraction technology enables oil and gas drilling companies to get new

regions to extract gas from. This has resulted in a U.S. shale gas production increase 14-fold over

the last decade, with reserves tripling over the last few years. Thirty percent domestic gas

production growth has outpaced the sixteen percent consumption growth, leading to declining

imports and declining prices of natural gas in the short term. China has obtained a stake in

Chesapeake in Texas, U.S. in order to gain access to explore shale gas drilling technology.

18

Natural gas price projections are significantly lower than past years due to an expanded shale gas

13

resource base. Technology will continue to evolve and play a key role in increasing efficiency,

expanding supplies and mitigating emissions

16

Since oil from conventional sources is diminishing, oil companies need to look at

unconventional and hard-to-extract locations to get oil. This has triggered technology innovation

in the Arctic regions, as well as deep-water drilling technology. There has been progress in

safety measures taken as well to prevent oil spills and corresponding environmental damage.

16

Demographic:

The world population is growing and has grown from about 1 billion people in 1800 to

approximately 7 billion today. By 2030, world population is likely to grow to 8 billion. A

century ago, wood and coal were the most prominent sources of energy. Today, access to

modern technology contributes to growth in demand and supply of oil and natural gas. Another

factor that contributes to the growth in demand for energy is the standard of living of people

across the globe. As standard of living improves, the demand for energy per capita increases.

Since global population growth is greater in non-OECD countries, the growth in standard of

living is an important factor in determining the growth of demand for energy.

16

Ethical:

Various theories hold that burning fossil fuels like oil and gas have large environmental

impacts due to resulting emissions. Emissions from burning fossil fuel can also cause air

pollution, which may have harmful effects on peoples health through breathing impure air.

19

Although natural gas burns cleaner, the technology used to extract natural gas can cause more

greenhouse-gas emissions than the use of coal or oil.

20

Forecasted Oil demand:

The U.S. Energy Information Administration (EIA) projects that net imports of U.S. crude oil

and petroleum products will only slightly increase in 2035 in spite of the growth in demand.

U.S. petroleum import dependence falls from 51 percent in 2009 to 45 percent by 2035 in EIA's

reference case projection.

11

Non-OECD demand for oil is expected to raise above the OECD countries.

11

Total global energy use in 2010 has been 500 quadrillion BTUs with oil being the major source

of energy. Forecasted U.S. energy consumption in 2030 is 650 quadrillion BTUs, with oil still

dominating as a source of energy. Energy efficiency gains reduce consumption by 13 percent

from where it would otherwise be.

11

Please see Table 1 for a summary of the forecasts of energy

demand by energy source.

14

Table 1: Energy Demand in past and forecast

11

Source Percentage demand in 2010 Percentage demand in 2030

Petroleum 32% 30%

Natural gas 22% 25%

Coal 25% 22%

Nuclear 8% 10%

Hydro 2% 2%

Other Renewable 1% 2%

Biomass Waste 10% 9%

Forecasted Natural Gas Demand:

Natural gas consumption is driven by Industrial use (35 percent) and central electric power

(29 percent).

11

Hence, any increase in demand for electricity will result in increase in demand

for natural gas. Currently, coal dominates as the major supplier of electricity. By 2030, natural

gas is expected to outstrip the use of coal.

16

PetrochemicalIndustry

Petrochemicals play an important role in the U.S. economy since many of the goods

produced by petrochemical manufacturers are fundamental building blocks used in the

production of a variety of consumer and industrial products. Therefore, petrochemicals are

affected by their production volatility, as well as the prices of oil and gas, which are used as raw

materials to produce the intermediary.

13

Economic:

The same factors that affect oil and gas are those that affect petrochemical.

Global:

U.S. producers are being adversely affected by the development of large-scale, low-cost

export-oriented plants located in the Middle East; Saudi Arabias ethylene capacity alone more

than doubled between 1990 and 2001 to 5.4 million metric tons, and by 2005 had increased again

to reach 7.7 million metric tons. South Korea and China have also invested considerable

resources in growing their petrochemical industries to become significant petrochemical

exporters.

13

Social/Environmental:

The same factors that affect oil and gas are those that affect petrochemical.

Political/ Regulatory:

The same factors that affect oil and gas are those that affect petrochemical.

15

Technological:

The technology used in this industry has been fairly static over the past ten years. Most of the

technological development has been aimed towards increasing the efficiency of the production

process and the manufacturing assets of the participant.

13

Ethical:

The same factors that affect oil and gas are those that affect petrochemical.

Demographic:

The same factors that affect oil and gas are those that affect petrochemical.

Forecasted demand:

In the five years from 2011 to 2016, the Petrochemical Manufacturing industry demand is

expected to grow by an estimated 4 percent per year.

21

CompetitorAnalysis

ExxonMobil operates in three major industries: oil, natural gas, and chemicals. Since the

dynamics, opportunities, and challenges in each are very different, the competitors in each

industry are analyzed separately.

FirmsCompetitors

OilIndustry

The world oil market is dominated by government-controlled companies that actually control

the majority of both current production (more than 52 percent in 2007) and proven reserves (88

percent in 2007).

22

The companies operating in the world oil market can be broadly classified

into three categories:

National oil companies that function as corporate entities but have strategic and

operational autonomy and support of national governments. Examples are: Petrobras

(Brazil), Statoil (Norway), PetroChina (China), and ONGC (India).

National oil companies that operate as an extension of the government Saudi Aramco

(Saudi Arabia), Pemex (Mexico), and PDVSA (Venezuela). They support their respective

governments programs like subsidizing fuels to domestic consumers.

Investor-owned oil companies (ExxonMobil, Shell, and BP) form a relatively smaller

segment of the world oil market and sell their output in competitive markets.

ExxonMobil is the largest among the six big non-state owned, vertically integrated oil

companies, popularly known as Big Oil (or supermajors) companies; the others in this

16

category are Royal Dutch Shell, BP, ConocoPhillips, Chevron, and Total S.A. In addition, there

is increasing competition from national oil companies like Saudi Aramco, Gazprom and China

National Petroleum Corporation (CNPC). Though the big oil companies have the technological

know-how and large assets at their disposal, they are at a disadvantage when it comes to access

to oil reserves, as OPEC controls the majority. Access to high growth markets in non-OECD

countries is difficult as these markets are already served by incumbent, local, state-owned

companies like Petrobras in Brazil, Oil and Natural Gas Corporation (ONGC) in India, and

PetroChina in China.

NaturalGasIndustry

Though the oil business has been dominated by the Big Oil companies, the natural gas

business in the U.S. was, until recently, managed by small, independent, non-integrated

companies.

23

With replacement ratios for oil dropping and the oil-rich regions becoming more

politically unstable, Western oil companies are scrambling to find new ways to address growing

energy demand. Big Oil companies started foraying into natural gas, an adjacent market.

Globally, there are big state-owned companies. Gazprom, of Russia, has 17 percent of the

worlds natural gas reserves.

24

ONGC is an Indian state-owned oil and gas company that

contributes 81 percent of India's natural gas production.

25

The Chinese market is dominated by

three local companies: China National Offshore Oil Corporation (CNOOC), CNPC (parent of

PetroChina), and China Petrochemical Corporation (parent of Sinopec). The natural gas market

is highly fragmented, with dominant players in each region and no single company having

control over multiple geographies.

ChemicalIndustry

ExxonMobil also manufactures and sells commodity petrochemicals and a wide variety of

specialty products. The competitors for ExxonMobil in this market are: BASF (Germany), Dow

Chemical, Ineos (UK), Saudi Basic Industries Corporation, DuPont and Chevron Phillips

Chemical Company LLC (CPChem).

26

PrimaryCompetitors

Oil

The primary competitors for ExxonMobil in the oil industry are the other Big Oil companies:

Shell, BP, ConocoPhillips, Chevron, and Total S.A. See Exhibit 3 for a detailed comparison of

competitors. The common trend across all competitors is the rise in production of natural gas.

17

This indicates that the Big Oil companies are now adjusting their energy portfolio to account for

the depleting oil reserves. ExxonMobils jump in production of natural gas in 2010 is attributed

to the acquisition of XTO. ConocoPhillips, in particular, is seeing its overall replacement ratios

falling and a drop is seen both in oil and natural gas.

NaturalGas

The primary competitors for ExxonMobil are Chesapeake Energy, Anadarko, Devon, BP,

EnCana, ConocoPhillips, Chevron and Shell (see Exhibit 4). Rapid consolidation in the natural

gas industry is occurring of late, with large oil companies snapping up companies or resources

from smaller and mid-sized companies. More details can be found in Exhibit 5.

Chemicals

BASF is the worlds largest chemical company. In addition to a wide variety of chemical

products, BASF also has interests in oil and gas through its subsidiary Wintershall AG and joint

ventures with Gazprom.

27

Dow Chemical is the second largest chemical company worldwide.

28

ExxonMobil Chemical ranks first or second in the production of many petrochemicals. It is

active in all aspects of hydrocarbon industry, has integrated plants with its refineries and has

high-level joint ventures making it highly competitive.

29

Ineos, the U.K.s largest chemicals

company, is formed from divested assets from BP, Dow Chemical, BASF, and Unilever.

Privately held, it is also known to have a lean management team.

30

Saudi Basic Industries

Corporation (SABIC) is owned 70 percent by the Saudi government and processes the huge

amount of Saudi Arabian oil byproducts into chemicals.

31

DuPont was one of the most

diversified chemicals company and is now slimming down to focus on biotech, safety and

protection products. Chevron Phillips Chemical Company LLC (CPChem) is owned 50/50 by

ConocoPhillips and Chevron and is one of the worlds top producers of specialty chemicals.

32

PrimaryCompetitorsBusinessLevelandCorporateLevelStrategy

Since oil and gas are commodities, companies have focused on an overall low-cost strategy

and are leveraging their size to achieve larger economies of scale. Here are more specific

strategies that are more likely to be seen applied across all companies:

Vertical integration from production to refining to distribution

Grow in size to accumulate huge assets, as the oil and gas business needs substantial

capital investment

Relationships with players in oil-rich regions (e.g., Saudi Arabia and Kuwait)

18

J oint ventures with other oil & gas companies like the joint oil exploration in Arctic

33

The business dynamics vary remarkably between oil and natural gas industries. Success in

the gas industry depends more on how quickly a company can seize an opportunity and buy into

a new concept or technology. Also, gas wells last for a much shorter period of time than oil

wells, forcing companies to keep chasing new reserves. This will require the companies to

optimally leverage their economies of scale for natural gas compared to oil.

34

Mid-sized

companies no longer see a high barrier to enter the gas market because of the abundance of

natural gas deposits.

HowCompetitorsAchieveTheirStrategicPosition

Since success in the oil and gas industry depends largely on access to reserves and the

technology to harness it, it is very important to have access to a huge capital base, to build strong

relationships with organizations and countries where the reserves are located, and to efficiently

transport crude fuel to refineries. For example, ExxonMobil has joined with Qatar Petroleum and

other partners to further develop the worlds largest non-associated natural gas field.

35

Chevron has landed a massive multi-billion dollar deal in the Wafra oil field of Saudi Arabia

where it is experimenting ways to extract heavy oil economically amidst challenges unique to the

Arabian desert.

36

This means competitors leverage their technical expertise, strong relationships

and huge capital investments to take big risks. In return, they reap huge rewards if things work

out.

Shell is the second largest oil and gas company and its strategy has been to enhance their

worldwide Upstream portfolio for profitable growth, through exploration and focused

acquisitions, and through divestment of non-core positions. Shell agreed to buy most of East

Resources for $4.7 billion to expand its holdings of the promising U.S. shale gas deposits. Shell

has also been following a joint acquisition strategy it jointly acquired Australias Arrow

Energy Ltd. for $3 billion along with PetroChina. Shell expects its share of natural gas to be

more than half of its total energy production in 2012.

37

BP is the third largest energy company in the world, having a very diverse portfolio including

oil, natural gas, wind, solar, and bio-fuels.

38

ConocoPhillips is the fourth largest oil and gas company, and the sixth-largest reserves

holder among non-state controlled companies. ConocoPhillips is known worldwide for its

technological expertise in reservoir management and exploration, 3-D Seismic technology, high-

grade petroleum coke upgrading and sulfur removal.

39

19

Total S.A. is the fifth largest and highly diversified energy company in the world. Total

engages in all aspects of the petroleum industry (Upstream and Downstream), petrochemicals,

coal mining, solar, biomass, and nuclear.

40

ValueCostProfile

While running its business, a firm invests capital (called cost drivers) and creates value for its

shareholders through value drivers. The common value drivers in the oil and gas industry are

proven reserves (oil and gas), production of oil and gas to meet the demand, financial health,

geographical diversification, diversification beyond oil and gas and its brand image. The cost

drivers are refinery utilization, marketing and distribution costs, operational excellence, safety,

and economies of scale. The value and cost drivers are weighted based on their relative

contribution towards a companys performance.

The Value Cost analysis was done for ExxonMobil and its competitors (See Exhibit

24A). The analysis shows that ExxonMobils value drivers are significant compared to its

competitors, while there is scope for improvement in the areas of refinery utilization and

marketing and distribution. It should be noted that our financial analysis shows that

ExxonMobils Downstream business has lower profit margin that its other two segments

(Upstream and Chemical). The effect of cost drivers is more than the value drivers in the case of

ConocoPhillips, making its Value Cost profile negative.

IntraIndustryAnalysis

The oil and gas industry is a mature and declining industry.

41

Most of the major producing

conventional oil fields were discovered decades ago and are in decline

42

, the world conventional

oil reserves are depleting,

43

and the relative finding of newer fields and deposits is slow.

44

As a

result, the industry is consolidating, primarily through asset acquisition and through mergers. In

2010, there were 947 deals announced with the value of $270 billion, a 35 percent increase over

2009.

45

The mobility barriers to entry remain the same as identified previously. Although there

were few innovative technologies recently discovered or invented,

46

none of these were

significantly disruptive other than the fracking process and horizontal drilling that XTO

brought to ExxonMobil for increased production from shale rocks

47

.

20

StrategicGroupOverview

ExxonMobils peers for the strategic group analysis are Royal Dutch Shell (RDS), British

Petroleum (BP), Conoco Phillips (COP) and Chevron Corp (CVX). These five major integrated

O&G are public-owned companies. See Exhibit 31 for detailed strategic group maps.

StrategicGroupAnalysis

In this section, all the five companies are evaluated and their performance is identified. The

data used for analyzing the strategic group analysis is provided in Exhibit 30.

ExxonMobil (XOM): ExxonMobil is the leader in the strategic group. All of its core lines of

business are doing well. ExxonMobil is able to generate high revenue in both the product lines of

oil and gas. In Downstream, ExxonMobils refineries are performing well to their production

and capacity. ExxonMobils resources are well deployed.

The company has the largest natural gas reserves, but is second to BP for oil reserves. Due to

the nature and state of the industry, ExxonMobil has to consider ways to increase its oil reserves

in order to maintain its leadership position. In the Downstream, ExxonMobil is doing well with

its refining business. In Downstream marketing, ExxonMobil is transitioning out of the retail

network (i.e., dealer or company-operated) in the U.S. and moving to a branded distributor

model.

48

ExxonMobils accidents (seventy-five in 2011) are rated medium in the strategy group

compared to the companys production. These incidents can significantly impact business and

brand value. (For example, BP paid up to $10 billion for environmental damages

49

and fines,

excluding a loss of $101 billion in its market capitalization within the span of two weeks (See

Exhibit 29)). The companys days of inventory is medium compared to its peer group.

ExxonMobil is also financially stable with the second lowest total debt among the peer group.

Royal Dutch Shell (RDS): Royal Dutch Shell is one of the largest competitors in the

strategic group for natural gas reserves. However, it has low oil reserves compared to the group.

It is able to generate considerable amount of revenue. In Downstream activities, RDS has good

production capacity and refineries to handle the capacity, but refineries are under utilized for oil

production. RDS has more than 25,000 retail outlets worldwide and, like the rest of the peer

group, RDS is trying to exit direct retailing business to focus on profitable Upstream activities.

In operations, RDS has significant human capital and is aligned with strategic group leaders.

Although RDS does not have significant oil production in the strategic group, the number of

accidents is higher than its peers. RDS Days of Inventory is high compared to its peer group and

has the highest total debt.

21

British Petroleum (BP): BP is one of the largest competitors of ExxonMobil from the

strategic group, with high oil reserves. Despite high oil reserves, BP is unable to generate a

considerable amount of revenue. This is attributable to the major oil spill in April 2010 that was

caused at BPs oil well, one of the largest marine oil spills in the history of the petroleum

industry.

50

This event has significantly impacted BPs ability to generate revenue. In the

Downstream, BP is limited in its production due to its refining capacity constraints. In future,

BP will need a considerable amount of refining capacity to be able to handle the reserves. BP has

more than 22,400 retail outlets worldwide. In operations, BP has significant human capital but is

not performing as well compared to the strategic leaders XOM and RDS. BP, apart from its 2010

oil spill, has similar safety accident records compared to its peer group. The days of inventory for

BP is the highest among the peer group, and its total debt is the second highest in the peer group.

Chevron (CVX): Chevron, although low, has sizable oil reserves. Chevron is the oil

production leader in the strategic group. Its production is about 30 percent of the entire peer

group put together. In the Downstream, Chevron is low on capacity and refining capability. It

also has more than 20,000 retail outlets worldwide. From operations, Chevrons human capital

of 62,000 is not performing as well compared to XOM and RDS. Chevron is the worst performer

within the group based on safety accident records, with 129 accident or safety issues in 2011.

Chevrons large production output is well supported by its low days of inventory. Chevron also

has the lowest debt in the peer group.

ConocoPhillips (COP): COP is the laggard in the strategic group. It does not report its oil

and gas reserves. In order to perform the analysis, its reserves were computed using barrels-of-

oil-equivalent (BOE), an industry term to describe combined oil and gas reserves. It was in the

poorest quadrant for all the strategic map analysis, with the exception of lower debt and

accidents compared to the group. It has the smallest reserves to revenue. In Downstream, COP

has limited capacity and less refining power compared to the group leaders. In 2011, COP had

the lowest number of accidents compared to the group, which could be due to its low production

levels. It has higher total debt than XOM and CVX, and its low production is supported well

with its low days of inventory.

Technology&Innovation

In the oil and gas industry it takes about five to seven years to extract oil from a viable oil

well to get into the supply chain. (See Exhibit 13.) The technological innovations in the oil and

gas industry are primarily around discovering, exploring, refining, transportation and storing.

These new technological innovations expedite discovering oil and gas and exploring in very

22

difficult conditions, dramatically bringing down costs of production and bringing products to

markets quicker to meet the growing energy demand. A sample of recent technological

innovations include:

High-End Geological Exploration An application

51,52

that can explore large geologic

formations, identify blocks of rock 20 kilometers on a side, and then pan or zoom in to

see if it holds oil. The ability to explore on another corner of the world without leaving

the office and directly playing it on a large computer screen with an array of high-end

computers significantly reduces the costs of exploration. This technology has

dramatically reduced the exploration costs, while increasing the success rate of finding

new wells.

Horizontal Drilling

53

This innovation is typically used for natural gas exploration,

and is a method to drill thousands of feet vertically and then drill a thousand feet

horizontally along targeted reservoir, which allows well bore to contact a larger cross

section to increase productivity rates. ExxonMobil acquired XTO, which had a

significant expertise level with this complex technology needed. XTOs technology and

assets helped ExxonMobil drive a 24 percent increase gas output during first-quarter of

2011.

54

Deepwater Exploration Technology like deepwater spar

55

and Floating LNG

56

provide a stable floating platform to support drilling operations in deepwater oil and gas

fields. This helps the discovery and capture of oil and natural gas in high seas where

common on-shore infrastructure cannot be deployed.

Other notable innovations include: Hydro processing Catalysts,

57

a refining technology that

improves refinery operations; Cryogenic Liquid Energy Transfer, a technology

58

that can

transfer and off-load liquefied natural gas from tankers at an offshore terminal facility in isolated

coastlines with no natural harbors; and Gas Storage technology,

59

that helps store massive

amounts of gas by improving operating performance and reduced maintenance.

The typical industry Research and Development spending on these types of innovations is $1

billion annually

60

.

IndustryKeySuccessFactors(KSFs)

For the oil and gas industry, the five main Key Success Factors (KSFs) are: Exploration and

Oil discovery, Manufacturing, Financial, Technology and Marketing & Distribution. See Exhibit

32 for additional details on key success factors.

23

Exploration & Oil discovery: This is a critical KSF for the oil and gas industry (30 percent).

The critical nature of oil and gas production companies should be able to continuously and

consistently discover and explore to increase its reserves. ExxonMobil has ample projects

planned in the short-term

61

to successfully execute this KSF. In the longer term, ExxonMobil

has to find ways to increase oil reserves.

Manufacturing & refining is an equally critical KSF for the oil and gas industry (30 percent).

The ability to get proven oil and gas resources into the supply chain for production and

manufacturing by refining and processing will enable the companies to monetize its reserves. If

the manufacturing is unable to create the required output, customers can easily switch to other

suppliers due to the commodity nature of the products. ExxonMobil with its refinery capacity

61

and production efficiency has the ability to successfully execute this KSF. However, the

company must also ensure the safety of its workers and its assets. This can otherwise lead to

significant legal and state fines as seen in connection to BPs 2010 oil spill in the Gulf of

Mexico.

Financial and Manufacturing are the next leading KSFs for the oil and gas industry, both with

a weight of 20 percent. The oil & gas industry is a very capital-intensive business. These fixed

assets, like refineries, are expected to scale to significant levels from one specific location. Apart

from these fixed assets, newer fields exploration and the ability to bring a well to production

take considerable amount of time, as stated previously. (See Exhibit 13.) This delay in the

ability to bring products to market, along with heavy capital expenditure, requires a significant

amount of financial backing. Apart from capital intensive manufacturing and assets, the

industrys accident prone nature requires companies to be prepared for the worst (BP was fined

$10B for the Gulf oil spill

62

). ExxonMobil has significant financial stability to execute this KSF

successfully.

Technology is the immediate second KSF for the industry (10 percent). As the oil and gas

wells deplete, the industry is increasingly trying to find new hydrocarbon sources in

unconventional areas like tar sands and deep water in a way that is safe and economically

profitable. Disruptive technological innovations and applications help companies gain advantage

in the industry. ExxonMobil with its current resources compared to industry and financial

backing should address this KSF.

Marketing & Distribution plays a critical role for oil & gas companies (10 percent). The

commodity products need to be brought to the right markets at the right prices, need to increase

customer loyalty and retention and finally need to increase brand awareness to attract new

24

customers. This critical KSF is a significant contributor to oil & gas companies. While

ExxonMobil is ahead of its competitors, this KSF should focus on more profitable segment

customers like states and commercial airlines.

The other KSFs that were considered and placed lower were Skills and Capability; although

critical since the oil and gas industry employs more than 50,000 employees and many more

contractors, this received a lower rating than the other KSFs. The supply chain KSF was rolled

into manufacturing and manufacturing operations, and inventory and storage was rolled into the

financial KSF.

SWOTAnalysis

OilIndustry

Strength: ExxonMobil is a well-established company and a market leader in the oil and gas

industry and it has been in existence for over a century. It has a strong brand name and industry

presence that gives its customers a sense of security. The company has diversified into many

different areas of the energy industry and is performing consistently in revenue generation.

ExxonMobil is vertically integrated and operationally very efficient, which is evident from its

industry leading profit margins. ExxonMobil has 40.6 million acreage combined in: North

America with ten year leases, in Africa with twenty-five to fifty year leases, and in Asia with

twenty to thirty year leases.

60

It has highest number of refineries compared to its peer group (See

Exhibit 30). Exxons 27 percent of production from North America is expected to grow to 35

percent in 2015, with contributions from both established operations and new projects.

60

It has

the largest natural gas reserves and the lowest debt in its strategic group (See Exhibit 31).

Weakness: The key weakness confronting ExxonMobil is the decline in its oil reserves and

its low replacement rate for oil reserves. In Downstream, ExxonMobil generates about 12

percent revenues (See Exhibit 5). This is partly due to its 26,000 retail outlets and declining

inflation-adjusted margins. This weakness might be mitigated by a branded distributor model.

60

ExxonMobil has not been able to handle environmental and social group issues effectively.

63

Threats: There are several threats to ExxonMobil in the oil industry. ExxonMobil, along with

other Western oil companies, are at the mercy of OPEC since OPEC controls most of the oil

reserves in the world. The reserves are concentrated in politically unstable regions making oil

business tricky and unpredictable. Most companies are seeing the replacement ratios declining

for oil. In contrast, large natural gas reserves are being discovered in easier to access regions like

the U.S. and newer technologies (like hydraulic fracturing) have made extracting natural gas

25

more feasible now. Substitute power from natural gas is getting stronger, which will increasingly

grab energy market share from oil. The oil industry, in general, will see more competition from

natural gas, as the barrier to enter the natural gas industry is much lower than that for the oil

industry. Incumbent large oil companies will see their dominant position threatened if they dont

diversify soon as natural gas will gain in prominence going forward.

Opportunities: The oil industry will continue to offer opportunities even in the long term. Oil

business is more profitable than natural gas due to the low price of natural gas. As per

ExxonMobils energy outlook, oil is projected to remain the number one source of energy

through 2030. Incumbent large companies are favored in the oil industry owing to inherent

advantages of economies of scale and access to huge capital. They can leverage their existing

contracts and relationships to block new entrants. The number of vehicles is projected to grow

(especially in non-OECD countries) and this is good news for the oil industry because oil-based

products will continue to be the primary fuel (gasoline & diesel).

See Exhibit 33 for additional details on the SWOT analysis for the oil business segment.

NaturalGasIndustry

Strength: The acquisition of XTO, the technology leader in efficient natural gas exploration,

has helped ExxonMobil fortify its position for natural gas exploration. As mentioned above,

ExxonMobil has strong financials, industry presence and brand name in the energy industry.

ExxonMobil has several large commercial contracts for both the short-term and the long-term

(20 years or above) for its natural gas supply.

64, 65

Weakness: In the natural gas industry, profit margin is very low compared to the oil industry.

The capital investment for natural gas is less than oil, and this leads to a large number of small

players in the natural gas industry, keeping the price of natural gas low. ExxonMobil cannot

leverage its oil infrastructure for gas exploration and refining. Also, as mentioned in the

competitive analysis, natural gas wells get depleted faster than oil wells. Therefore, ExxonMobil

needs to ensure that it finds the right amount of reserves for natural gas at a faster rate than oil.

Threats: A lower price (as compared to oil) makes natural gas businesses less profitable.

Hydraulic fracturing is a promising technique to extract vast deposits of shale gas in the U.S. but