What Is Power Electronics?

Diunggah oleh

Ionuţ FloreaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

What Is Power Electronics?

Diunggah oleh

Ionuţ FloreaHak Cipta:

Format Tersedia

1

Power Electronics

What does it do?

Bill Drury

E3 Academy Summer School

12 July 2011 Bristol

What is Power Electronics?

Power Electronics is the application of solid-state electronics

for the efficient control and conversion of electrical power

Whereas more familiar electronics and microelectronics is used

to carry communications or data, with Power Electronics its

power thats handled and controlled

It is used from the very low milliwatt levels needed to operate a

mobile phone through to multi-gigawatt powers for high-voltage

energy transmission lines between countries

Wherever there is a need to modify a form of electrical energy

i.e. change its voltage, current or frequency then Power

Electronics comes into play

2

Is Power Electronics Important?

Though rarely seen as an end product by the general public, Power

Electronics plays a critical role in almost all aspects of our daily lives:

Renewable energy & the low-carbon economy are critically

dependent on PE

PE drives reliability and stability of the power-supply

infrastructure, and critical to the Smart Grid

Transportation is ever more heavily dependent on Power

Electronics, in railways, ships and increasingly cars and

aeroplanes

Industrial processes rely upon the control and energy efficiency

facilitated by Power Electronics

The environment, access and transportation within our buildings

are controlled and managed using Power Electronics

And our homes are proliferated with Power Electronics - in TVs,

washing machines, fridges, freezers, cookers, vacuum cleaners,

computer, mobile phones and even energy-efficient lighting

Power Electronics is a critical enabling technology for a large

proportion of (UK) industry

Often defines performance and/or competitive advantage of a product

or system

Wide Scope of Power Electronics Use

1 cm

1 W

200 m

2 GW

P

o

w

e

r

e

l

e

c

t

r

o

n

i

c

s

i

n

s

i

d

e

3

The Global Power Electronics Market

chart source: electronics enabling efficient energy usage, e4u, 2009

Automotive

13%

Industry &

Energy

26%

Consumer

Electronics

18%

Computer &

Office

26%

Commun-

ications

17%

A 70bn direct global market, growing at a rate

of 11% per annum.

The Global Power Electronics Market

70 billion direct market growing at 11% pa

The market is Global and Competitive

Multi-national companies operating with Global design

and manufacturing locations compete for high volume /

value business

Bespoke/ batch nature of business means that smaller

companies can compete nationally and internationally

Today the UK is competitive in key Global markets

including in the systems area alone:

Aerospace

Industrial Drives / Marine Drives / Renewable Energy Converters

Automotive

HVDC

The UK has established and good routes to market

4

The UK has a Rich History in

Power Electronics

World class companies across a number of market sectors

Internationally recognised universities educating the next

generations of power electronic engineers and expanding the

knowledge base through research

Also Critical to the supply chain are innovative SMEs

delivering new approaches and technologies to the market

The UK Power Electronics Market

UK Electronics Industry contributes > 50bn to UK GDP and

provides 500,000 jobs in 25,000 companies

UK Power Electronics Manufacturing accounts for about

6.5% (5 bn) of the Global Power Electronics product (as

opposed to component) manufacturing (based on

semiconductor device sales), with a very high percentage of

that production being exported. (Power Electronic equipment

manufacturing cost is relatively low)

The influence of the UK Power Electronics industry on the

global market is much more significant as UK-based design

groups contribute strongly to equipment that is

manufactured in part or in whole overseas

UK has a strong international reputation for design

UK remains a significant manufacturing base for not only

local but also many global companies

UK also has a strong SME base

The UK has established and good routes to market

5

Power Electronics Supports / Benefits

from a Large Supply and IP Chain

Basic /

Materials

Technology

University Advanced

Components Research

University Advanced

Systems Research

mW

GW

University

Basic

Research

Components

Power

Electronic

Systems

The UK Power Electronics Opportunity

The scope of Power Electronics is vast

Some high volume markets such as industrial drives are driven by

large multi-nationals (6 / top 10 with UK Design and/or manufacturing),

with a global presence in established and developing markets

Consider four areas - each being: embryonic, rapidly developing or

dramatically changing due to disruptive technology:

Automotive &

Transport

Aerospace

Electricity

Generation,

Transmission &

Distribution

Consumer

The UK is in a strong position to compete in these areas

Risk and opportunity are both likely to be high

Each area presents technically demanding challenges that will

certainly be relevant and supportive to the entire PE community

The UK is internationally competitive in Power Electronics

6

Aerospace

Future Power Electronic hardware for airliners

will be progressively more power dense than

current technology.

Power electronics . . . . . are on a steep curve of

performance and cost improvement.

The power electronics of just 10 years ago were

too large and heavy.

Quotation from Senior Boeing Technical Executive

(Reference Aviation Week & Space Technology 28 March 05)

Power Electronics in Aerospace

7

Conventional Aircraft Technologies

ENVIRONMENTAL

CONTROL SYSTEM

PRIMARY

ELECTRICAL

DISTRIBUTION

AVIONICS

ENGINE START

WING ICING

PROTECTION

APU

HYDRAULIC MAINS &

UNDERCARRIAGE

FLIGHT CONTROL &

ACTUATION

HYDRAULIC

BLEED AIR

ELECTRICAL

Total Electrical

Rating ~175kVA

Boeing 787 Widebody Airliner

More Electric Aircraft Concept

Each Generator

Rated at ~225kVA

Total Electrical

Rating ~1.4MVA

ENVIRONMENTAL

CONTROL SYSTEM

PRIMARY

ELECTRICAL

DISTRIBUTION

AVIONICS

ENGINE START

WING ICING

PROTECTION

APU

UNDERCARRIAGE

FLIGHT CONTROL

& ACTUATION

UNDERCARRIAGE

8

Opportunities & Market Size

As new designs of civil airliner are launched into fleet service between 2015 and

2025, the annual global market for the power electronic content of each shipset

will be between around 1225M at todays values.

Assuming a successful UK National Strategy is effective in supporting the UK share

of the global market at 15% to 20%.

Typical annual turnover per employee on OE (Original Equipment) in UK Aerospace

is ~213k.

Core Jobs in high added value manufacturing created/retained will be around

1000.

3100 other jobs will be indirectly supported elsewhere in UK manufacturing.

Significant degree of Vertical Integration of Technical Specialist & Sub-Contractors

in the UK based Supply Chain could considerably increase this total.

UK Strengths & Capabilities

UK can do all of the new technology (excepting civil aircraft APUs)

at systems level.

Equipment in biz jets, regionals, helicopters as well as airliners.

For flight critical technical equipment (other than cockpit avionics

and software based products) the UK probably has the same

footprint as France & Germany combined.

More than half of the global industrial base is in USA.

UK industrial leaders for each major equipment also has a UK

based competitor to their global corporate owner.

Global corporate owners spread over USA, UK, France.

9

UK Position

UK is presently No 2 in the global market for aviation (15% - 20%)

Behind USA (~60% or more)

Ahead of France, Germany (~10% each)

Analysts study on extent of low cost country investment

programmes in aeronautics. Power electronic related systems are

critical components like Engines compared with Structures

Bought in.

Transport

10

Applications

Automotive

Power Steering

Traction Inverters

Air conditioning

Pumps

Suspension

Charging

DC-DC Conversion

Rail

Traction Inverters

Marine

Propulsion System

Opportunities & Market Size

Automotive Example

UK 1.7m vehicles/year, at 75kW per vehicle

Potential of 127.5GWof installed PE/year

Worldwide 70m vehicles/year

Potential of 5000GWof installed PE/year

Charging infrastructure massive impact on grid

Supply chain for EVs not only Alstom Grid

Rail Example

Chinese market alone 7,200 vehicles at 3MW per

vehicle

Potential of 22GW of installed PE/year

11

UK Strengths & Capabilities

History over 100 years manufacturing experience for large

engineering projects

Converteam, Alstom Grid, Emerson, Bombardier

Universities

Nottingham Power Electronics, Packaging

Warwick, Cambridge Power Semiconductors

Manchester, Newcastle, Bristol, Strathclyde Machines and Drives

Edinburgh - Renewables

Imperial HVDC

Major World Players across supply chain components to

systems

UK is great at systems integration

UK automotive heritage - Zytek, Prodrive and Ricardo, JLR, TATA -

384,000 Jobs

Dynex, Westcode, Semelab, NXP, IR, National

Electricity Generation,

Transmission and Distribution

12

Technologies

Large industry

Energy storage

PV

Embedded

domestic

generation

Smart

meters

EVs

HVDC grid

Waste

CHP

CHP SMEs

Commercial

buildings

Industry

National/International Regional

Offshore

wind

Conventional

generation

Power quality

device

AC grid

Biofuels

Energy

storage

Community

H

2

Storage

Heat

Rail

Power Electronic Control Communicating device

Market Size & Opportunities

Wind Converters

36 GW Market in 2010

Source: GWEC Global Wind Report 2010

PV Converters

15 GW Market in 2010

Source: EPIA Solar Generation 6 Report 2011

HVDC Systems

24 GW Market in 2010

Source: Alstom Grid Estimate

Supply Chain

High value components

Big opportunities for 2

nd

and 3

rd

tier suppliers

Converter Value Analysis

13

HVDC Transmission

Alstom Grid - Stafford

Ningdong-Shandong project - the first

660kV HVDC transmission project

in the world.

4,000MW over a distance of 1,300km

Each of the two converter stations

contains two 2,000MW HVDC

converters, each in turn comprising

six suspended double-valve

structures

7.2kV electrically-triggered thyristors.

The rated power of 2,000MW per

converter is the highest of any HVDC

scheme in the world and, indeed, the

highest of any single power

electronic converter for any type of

application.

Tidal Power

Tidal Generation Ltd (Rolls-Royce)

500kW tidal power generation system in Orkney.

1MW system in planning - 10MW array planned within 5

years

Power Electronics is a key enabling technology for

realising a viable product.

14

UK Strengths & Capabilities

Systems integration has

always been a UK strength

Major Players

Converteam UK

Control Techniques

Alstom Grid UK

Established Supply Chain

Dynex

Westcode

Intl. Transformers (IST)

Norfolk Capacitors

World Class Universities

Innovative Start-ups

Lighting & Consumer

Electronics

15

Consumer, Office and Lighting

Key Differentiators

Industry-leading analog

HVICs, MOSFETs and

IGBT platforms

Industry-leading energy

saving design expertise

Silicon packaging

technology delivering

superior system

performance

Key Products

Digital Control ICs

High-Voltage Ics

Si MOSFETs

IGBTs

Integrated Power

Modules

29

Lighting Lighting

Computer

and Office

Equipment

Computer

and Office

Equipment

Appliances Appliances Consumer Consumer

Opportunities & Market Size

The global power discrete semiconductor and module

market is around $13.5bn with CAGR of 11.4%

Consumer and Computing markets are dependant on both

discrete semiconductor devices and modules

Market size for Consumer products in 2011 is expected to

be in excess of $2.6bn for discrete power semiconductors

and $225 million for power modules. CAGR is in line with the

overall market at 11%.

Lighting relies on discrete semiconductors and not modules

and has a market size of $594 million with CAGR of 8.1%

Computer and Office Equipment power management market

size is $3.5bn with CAGR 0f 14.5%

Source - IMS Research - The World Market for Semiconductor Discretes & Modules

2010 Edition

30

16

UK Strength & Capabilities

The UK has a number of top twenty global manufacturers

of power discretes and modules, namely International

Rectifier, NXP, DIODES (Zetex)

UK based design groups of power semiconductor

companies also figure in the global top twenty, ie

Infineon, STMicroelectronics

31

Industrial Drives

17

Industrial Drives

The market

The world market for industrial drives is over 8.5 billion

(excluding motors and systems integration), with growth

significantly ahead of the industrial norm. Its growth is

driven by two primary sources:

The growth of industrial automation, itself driven by the demands

for quality, productivity and interestingly - factory management

information from the production line

Energy saving driven mostly by cost-reduction opportunities

and increasingly supported by regulations such as the climate

change levy.

Of the total, 7 billion relates to low voltage (up to 690V

ac) supplies, and 1.5 billion on medium voltage (2 to

6.6.11kV) supplies.

Industrial Drives - Industries

Metals

Oil & Natural Gas

Pow er Generation

Marine

Other Industries

Mining

Water &

Wastew ater

Chemical

Cement

Pulp & Paper

18

Industrial Drives - Applications

Manufacturing

Automation

Elevators &

Cranes

Air Conditioning

& Ref rigeration

Process

Industry Control

Other

Industrial Drives

Six of the top ten global market leaders in the

industrial drives market have design and/or

manufacturing facilities in the UK (Emerson

Control Techniques, Converteam, Siemens,

Parker (SSD), ABB (Baldor) and Yaskawa).

Provides employment for over 10,000. Over

2,500 jobs are directly involved in industrial drive

design and manufacture in the UK, with a similar

number of other jobs involved in the supply

chain, and more than 5,000 involved in systems

integration of the industrial drive product.

The contribution to GDP is in excess of 750

million.

19

Power Electronics -

The Hidden Critical Link

Transport

Domestic & Consumer Industrial

Commercial Energy

Anda mungkin juga menyukai

- ECTE423 - 923 - Power System Analysis - Week1-Week6 - AA-2024Dokumen103 halamanECTE423 - 923 - Power System Analysis - Week1-Week6 - AA-2024Rakih SajidBelum ada peringkat

- ECPE-Position Paper Energy EfficiencyDokumen18 halamanECPE-Position Paper Energy EfficiencyMarcWorldBelum ada peringkat

- Electrical Energy Efficiency: Technologies and ApplicationsDari EverandElectrical Energy Efficiency: Technologies and ApplicationsBelum ada peringkat

- Future Development of The Electricity Systems With Distributed GenerationDokumen34 halamanFuture Development of The Electricity Systems With Distributed GenerationliferockxxxBelum ada peringkat

- Power Quality and EMC in Smart GridDokumen6 halamanPower Quality and EMC in Smart GridMohammed MansoorBelum ada peringkat

- Efficiency Trends in Electric Machines and DrivesDokumen6 halamanEfficiency Trends in Electric Machines and Drivessadeq03Belum ada peringkat

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesDari EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesBelum ada peringkat

- Infineon IGBT ModulesDokumen16 halamanInfineon IGBT Modulesqlx4Belum ada peringkat

- Primera Eaton MEM SwitchesDokumen164 halamanPrimera Eaton MEM SwitchesCacto ChainBelum ada peringkat

- Smart Grid12 09Dokumen11 halamanSmart Grid12 09Akshatha NaikBelum ada peringkat

- Axial Flux Permanent Magnet Generators For Pico-HydropowerDokumen8 halamanAxial Flux Permanent Magnet Generators For Pico-HydropowerEngineers Without Borders UKBelum ada peringkat

- Distributed Generation in Developing CountriesDokumen12 halamanDistributed Generation in Developing CountriesSaud PakpahanBelum ada peringkat

- AREVA Smart Grid Solution - V4Dokumen43 halamanAREVA Smart Grid Solution - V4Puthanveedu Rajan SantoshBelum ada peringkat

- Electric Aviation and A Sustainable FutureDokumen12 halamanElectric Aviation and A Sustainable FuturedabuserBelum ada peringkat

- Intelligent Load Management in The Long Term Energy PlanDokumen18 halamanIntelligent Load Management in The Long Term Energy PlanrodanenergyBelum ada peringkat

- Wind TurbineDokumen10 halamanWind TurbineAtharv ChitkalwarBelum ada peringkat

- Europe: Impact of Dispersed and Renewable Generation On Power System StructureDokumen38 halamanEurope: Impact of Dispersed and Renewable Generation On Power System StructuredanielraqueBelum ada peringkat

- MEPS For: Three Phase Electric MotorsDokumen2 halamanMEPS For: Three Phase Electric MotorsAnonymous DJrec2Belum ada peringkat

- Siemens Electrical Engineering SolutionsDokumen419 halamanSiemens Electrical Engineering Solutions1wocker1100% (1)

- Electrical Safety in Oil & Gas Industries: Challenges & Solutions For Industrializing CountriesDokumen31 halamanElectrical Safety in Oil & Gas Industries: Challenges & Solutions For Industrializing Countriessupper1980Belum ada peringkat

- ETUT1160 11wk SmartgridDokumen34 halamanETUT1160 11wk SmartgridkardraBelum ada peringkat

- Distributed Resource Electric Power Systems Offer Significant Advantages Over Central Station Generation and T&D Power SystemsDokumen8 halamanDistributed Resource Electric Power Systems Offer Significant Advantages Over Central Station Generation and T&D Power SystemsAbdulrahmanBelum ada peringkat

- 03 Paper 1010 CepoiDokumen6 halaman03 Paper 1010 Cepoiarnika33Belum ada peringkat

- 1.3.4. Energy StorgeDokumen3 halaman1.3.4. Energy StorgeDr. Narendra AgnihotriBelum ada peringkat

- 2009 NokiaSiemens Site StarDokumen21 halaman2009 NokiaSiemens Site StarGuido FreilingBelum ada peringkat

- Facts Volume 1Dokumen92 halamanFacts Volume 1Maniak Muligambia100% (1)

- 24keynote NI Energy Technology Summit: Le Sfide e Le Tendenze Nelle Smart GridDokumen27 halaman24keynote NI Energy Technology Summit: Le Sfide e Le Tendenze Nelle Smart GridNational Instruments ItalyBelum ada peringkat

- PEG Catalog Siemens PDFDokumen419 halamanPEG Catalog Siemens PDFrukmagoudBelum ada peringkat

- Siemens Power Engineering Guide 2008Dokumen419 halamanSiemens Power Engineering Guide 2008Roberto Fernandez50% (2)

- Energies: Challenges of The Optimization of A High-Speed Induction Machine For Naval ApplicationsDokumen20 halamanEnergies: Challenges of The Optimization of A High-Speed Induction Machine For Naval ApplicationsMostafa8425Belum ada peringkat

- GreenComm ICC09 Keynote1 ZuckermanDokumen36 halamanGreenComm ICC09 Keynote1 ZuckermanSeshanjali BurriBelum ada peringkat

- Distributed Generation in Developing CountriesDokumen12 halamanDistributed Generation in Developing CountriesZara.FBelum ada peringkat

- Fueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGEDari EverandFueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGEBelum ada peringkat

- Power Quality and EMC in Smart GridDokumen6 halamanPower Quality and EMC in Smart GridBernardMightBelum ada peringkat

- Report On Wind Power Potential in Crotia & PolandDokumen142 halamanReport On Wind Power Potential in Crotia & PolandAnkur BhatnagarBelum ada peringkat

- Efficiency Trends in Electric Machines and DrivesDokumen6 halamanEfficiency Trends in Electric Machines and Drivesvalentin mullerBelum ada peringkat

- The Hidden Cost of Poor Power Quality: October 31, 2003Dokumen7 halamanThe Hidden Cost of Poor Power Quality: October 31, 2003Juan CasasBelum ada peringkat

- (Type The Document Title) : Chapter No. Title Page No. 1Dokumen31 halaman(Type The Document Title) : Chapter No. Title Page No. 1Rajasekhar MosuruBelum ada peringkat

- Industrial Assignment 1. Application Power ElectronicsDokumen2 halamanIndustrial Assignment 1. Application Power ElectronicsLM BecinaBelum ada peringkat

- Electric AircraftDokumen26 halamanElectric AircraftPeter IjaramendiBelum ada peringkat

- Effect of Renewable Energy and Electric Vehicles On Smart GridDokumen11 halamanEffect of Renewable Energy and Electric Vehicles On Smart GridArmando MaloneBelum ada peringkat

- SGO Smart Grid IntroductionDokumen16 halamanSGO Smart Grid IntroductionRoger HicksBelum ada peringkat

- ETP Smartgrids Vision and Strategy Paper - enDokumen44 halamanETP Smartgrids Vision and Strategy Paper - enhapi_42Belum ada peringkat

- DGA Ebook WebDokumen16 halamanDGA Ebook Webrvmolina100% (1)

- 15 06 05 Ministerial Statement Electricity PolicyDokumen41 halaman15 06 05 Ministerial Statement Electricity PolicyAnonymous UpWci5Belum ada peringkat

- Electrical Machines and Power-Electronic Systems For High-Power Wind Energy Generation ApplicationsDokumen27 halamanElectrical Machines and Power-Electronic Systems For High-Power Wind Energy Generation ApplicationsFatih BurakBelum ada peringkat

- PV Power Plants 2011Dokumen108 halamanPV Power Plants 2011Ssagar KadamBelum ada peringkat

- Module 2Dokumen89 halamanModule 2edoエドインBelum ada peringkat

- ADokumen72 halamanAMohit KothariBelum ada peringkat

- Complete 2008Dokumen417 halamanComplete 2008cchiletlBelum ada peringkat

- The U.S. High-Tech Industry AND Electricity DemandDokumen27 halamanThe U.S. High-Tech Industry AND Electricity DemandImèn ChoueichBelum ada peringkat

- Overcoming Barriers For The Scaling Up of EE Appliances in NigeriaDokumen63 halamanOvercoming Barriers For The Scaling Up of EE Appliances in NigeriaFunsho AloBelum ada peringkat

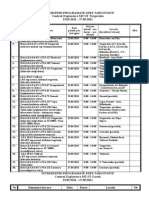

- ORAR Sem 2 - 2015-2016 EnergeticaDokumen70 halamanORAR Sem 2 - 2015-2016 EnergeticaEugen SimionBelum ada peringkat

- Three-Phase - Enclosure SF - Gas - Insulated Substations (Gis) 72.5 170kVDokumen8 halamanThree-Phase - Enclosure SF - Gas - Insulated Substations (Gis) 72.5 170kVIonuţ FloreaBelum ada peringkat

- Intrerup Er I Program at Et G 20150123Dokumen3 halamanIntrerup Er I Program at Et G 20150123Ionuţ FloreaBelum ada peringkat

- Intrerup Er I Program at Et G 20110518Dokumen2 halamanIntrerup Er I Program at Et G 20110518Ionuţ FloreaBelum ada peringkat

- Substation GroundingDokumen74 halamanSubstation GroundingBattinapati ShivaBelum ada peringkat

- IterationDokumen16 halamanIterationM Sohaib IrshadBelum ada peringkat

- Lucrarea 25 ImgDokumen31 halamanLucrarea 25 ImgrubenmarianBelum ada peringkat

- Lucrarea 25 ImgDokumen31 halamanLucrarea 25 ImgrubenmarianBelum ada peringkat

- Book of Abstract - DeMII 2017Dokumen186 halamanBook of Abstract - DeMII 2017GogyBelum ada peringkat

- AeroCraft-Systems GB PDFDokumen20 halamanAeroCraft-Systems GB PDFFerdiansyah Iqbal RafandiBelum ada peringkat

- Climate change: Solution: 1. ΔT = -0.310°C 2. ΔT = -0.479°C 3. ΔT = -0.576°CDokumen6 halamanClimate change: Solution: 1. ΔT = -0.310°C 2. ΔT = -0.479°C 3. ΔT = -0.576°CBastiaan Gelaude0% (1)

- Gec 004 Week 12 Instructional Module-1Dokumen5 halamanGec 004 Week 12 Instructional Module-1Nicole ValentinoBelum ada peringkat

- Csec Integrated Science Scheme of Work For CfssDokumen16 halamanCsec Integrated Science Scheme of Work For CfssOsmany MadrigalBelum ada peringkat

- How To Fuel The Future - B1 English Listening Test - Test-EnglishDokumen1 halamanHow To Fuel The Future - B1 English Listening Test - Test-Englishtamerlanataiisi99Belum ada peringkat

- Adequacy Evaluation of Wind Power Generation Systems: Guided By: TeamDokumen7 halamanAdequacy Evaluation of Wind Power Generation Systems: Guided By: TeamAshish AssisiBelum ada peringkat

- Gomis-Bellmunt Et Al. - 2020 - Flexible Converters For Meshed HVDC Grids From Flexible AC Transmission Systems (FACTS) To Flexible DC Gr-AnnotatedDokumen14 halamanGomis-Bellmunt Et Al. - 2020 - Flexible Converters For Meshed HVDC Grids From Flexible AC Transmission Systems (FACTS) To Flexible DC Gr-AnnotatedSanzad LumenBelum ada peringkat

- VITA Publications - Revised 10.07Dokumen10 halamanVITA Publications - Revised 10.07aymmon8950Belum ada peringkat

- Design and Implementation of Intelligent Energy DistributionDokumen7 halamanDesign and Implementation of Intelligent Energy DistributionUday MujumdarBelum ada peringkat

- Offshore Wind Turbine Cost Structure Analysis: High Technology Letters October 2020Dokumen16 halamanOffshore Wind Turbine Cost Structure Analysis: High Technology Letters October 2020Mohammed AzarudeenBelum ada peringkat

- Levelized Cost of Energy Calculation - BV - ENDokumen16 halamanLevelized Cost of Energy Calculation - BV - ENpankajmayBelum ada peringkat

- Wwind MillDokumen35 halamanWwind MillRaja ManeBelum ada peringkat

- Wind Load Calculation, BNBC 2006: Height From GL (FT) Height From GL (M)Dokumen14 halamanWind Load Calculation, BNBC 2006: Height From GL (FT) Height From GL (M)sjrokz100% (1)

- Wind Solar Hybrid Indias Next Wave of Renewable Growth - October 2020Dokumen24 halamanWind Solar Hybrid Indias Next Wave of Renewable Growth - October 2020abhiBelum ada peringkat

- Mountaineer: There's No Denying The Sense of CellDokumen8 halamanMountaineer: There's No Denying The Sense of CellMountaineersBelum ada peringkat

- IELTS Reading Practice 1 (Academic) Time Allowed: 1 Hour Number of Questions: 40 Instructions All Answers Must Be Written On The Answer SheetDokumen92 halamanIELTS Reading Practice 1 (Academic) Time Allowed: 1 Hour Number of Questions: 40 Instructions All Answers Must Be Written On The Answer SheetCold Reaper GamingBelum ada peringkat

- DUKES 2014 PrintedDokumen274 halamanDUKES 2014 PrintedWhite angelBelum ada peringkat

- GEA34352 Aeros For Grid Firming Aug 2019Dokumen16 halamanGEA34352 Aeros For Grid Firming Aug 2019amir.kalantariBelum ada peringkat

- Accenture Five Reasons For The World To CareDokumen20 halamanAccenture Five Reasons For The World To CareGlobal Supply Chain CouncilBelum ada peringkat

- Factsheet Windmarkt DuitslandDokumen10 halamanFactsheet Windmarkt DuitslandEnergiemediaBelum ada peringkat

- America's Power LetterDokumen3 halamanAmerica's Power LetterjeffbradynprBelum ada peringkat

- December 19, 2013Dokumen10 halamanDecember 19, 2013The Delphos HeraldBelum ada peringkat

- Maximum Power Point Tracking and MPPT Efficiency For Wind and Solar Energy Conversion Standalone SystemDokumen6 halamanMaximum Power Point Tracking and MPPT Efficiency For Wind and Solar Energy Conversion Standalone SystemMuslim NuryogiBelum ada peringkat

- Enercon Technology Service EngDokumen32 halamanEnercon Technology Service EnggeguzeBelum ada peringkat

- Conservative Manifesto 2017Dokumen88 halamanConservative Manifesto 2017NedBelum ada peringkat

- Wind Turbine Wake in Atmospheric TurbulenceDokumen187 halamanWind Turbine Wake in Atmospheric TurbulenceCore CoreBelum ada peringkat

- PSAT Documentation 2011Dokumen484 halamanPSAT Documentation 2011MARpreparadoresBelum ada peringkat

- Uttarakhand MHPDokumen10 halamanUttarakhand MHPVineet SinghBelum ada peringkat