Project Cash Flow: ARE 413 Construction Management

Diunggah oleh

naeem_shamsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Project Cash Flow: ARE 413 Construction Management

Diunggah oleh

naeem_shamsHak Cipta:

Format Tersedia

ARE 413

CONSTRUCTION MANAGEMENT

By

MOHAMMED JALALUDDIN

LECTURER

CONSTRUCTION ENGINEERING & MANAGEMENT DEPT

Handout # 11

Presentation Outline

Cash Flow

|Cash Flow Projection / What is Cash Flow Projection

Example Cash Flow of Simple Project

S-Curve

Cash Flow to Contractor

Progress Payment

Contractors Expenses and Income Profile

Contractors Financing

Overdraft

Mobilization Advance Payment

Objectives of Class :

To introduce cash flow concept during the life of a project

and example of cash flow projection of simple project

To draw the Contractors Expenses and Income Profile

To know the Contractors sources of Financing

Projection of Income

and expenses during

the life of the project

Several time scheduling

aids used by contractor

Project S-Curve

Owner requires

contractor to provide an

S curve of estimated

progress and costs

Cumulative costs across

the duration of the

project

A graphical portrayal of

the outflow of monies

(both direct & indirect)

Duration

S

R

Source: Dr. L. K. Gaafar

Activity Days Cost ($) Cost/day

A 2 200 100

B 5 500 100

C 2 200 100

D 7 500 71.4

E 1 100 100

F 2 100 50

Cash Flow

Source: Dr. L. K. Gaafar

Cash Flow

Daily Expenses

0

20

40

60

80

100

120

140

160

180

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Day

C

o

s

t

(

$

)

Cumulative Expenses

0

200

400

600

800

1000

1200

1400

1600

1800

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Day

C

o

s

t

(

$

)

Activity Days Cost ($) Cost/day

A 2 200 100

B 5 500 100

C 2 200 100

D 7 500 71.4

E 1 100 100

F 2 100 50

Day Activity Cost of day Total cost

1 A 100 100

2 A 100 200

3 B 100 300

4 B 100 400

5 B 100 500

6 B 100 600

7 B 100 700

8 C,D 171.4 871

9 C,D 171.4 1043

10 D,E 171.4 1214

11 D 71.4 1286

12 D 71.4 1357

13 D 71.4 1428

14 D 71.4 1500

15 F 50 1550

16 F 50 1600

Cash Flow to the Contractor

Progress Payments - Flow of money from owner to the

contractor

Estimates of work completed by the contractor periodically

and (usually monthly) and verified by owners reps

Evaluation based on type of contract

Lump Sum: Percentage of total contract completion

Unit Price: Actual field measurements of work

completed

Progress Payments

Contractor prepares a monthly progress claim (bill)

usually at the end of each month

The Owner evaluates the bill and pay contractor

within the time period stipulated in the contract

(usually within 30 days)

Owner keeps a retainage of 10% from each payment

(usually until cumulative progress bills reach 50% of

the total contract sum)

Contractors Income Profile

Stair-step

appearance since

the progress

payments are paid

in discrete

amounts

$

Duration

Contractors Expenses and Income

Profile

Clear indication of

expenses and income

The difference

between Expenses and

revenue makes it

necessary for the

contractor to obtain

temporary financing

$

Duration

Expenses and Income Profiles

Expenses and Income Profiles

Contractors Financing

Usually a bank extends a line of credit against

which the contractor can buy materials, make

payments and pay other expenses while waiting for

reimbursement from owner.

Bank charges interest on the outstanding balance

(overdraft)

Good policy to to try to minimize overdraft

Overdraft depends ON

Amount of markup (or profit) applied to

contractors bid

Amount of Retainage withheld by the owner

Delay between billing and payment by the owner

Banks evaluation of

construction contractors

High risky borrowers

If the contractor defaults, the loan is

secured only by some materials inventories

and partially completed construction

Charges very high interest rates on

borrowings

Mobilization Advance Payment

Some contractors offset the overdraft borrowing

requirement by requesting mobilization, money

from owner

Influence of mobilization on payment and income

profiles

Expenses and Income

Profiles (with mobilization

advance)

Mobilization Advance Payment

Some owners issue 20% of the advance payment at the

inception against a bank guarantee submitted by the

contractor

The advance payment recovered in each progress payment

at a rate of 20%.

Since the owners are less risky than the contractors, they

can borrow short-term money at a lower interest rates

Transfer the interim financing requirement from

contractor to the owner

Overall cost savings to owner and the contractor

Overdraft Requirement

The contractor needs to know what is the

maximum overdraft during the construction

project

Uses Income and expenses profiles to asses the

overdraft

Tabulate the expenses and revenues and find

the maximum overdraft

Plot of maximum

overdraft

Composite Overhead Profiles

Comparison of Payment

Schemes

Rate-of-return (ROR) analysis is helpful in

comparing the economic value to a contractor of

varying payment schemes

Examining the economic impact of;

varying retainage policies

delay in payment strategies

payment of mobilization

Evaluate the net present value between Revenue

and Expenses

Summary

Projection of Income and expenses during the life of the

project

The difference between Expenses and revenue makes it

necessary for the contractor to obtain temporary

financing

Usually a bank extends a line of credit against which the

contractor can buy materials, make payments and pay

other expenses while waiting for reimbursement from

owner

References: Janaka Y. Ruwanpura

Anda mungkin juga menyukai

- Project Cash Flow AnalysisDokumen25 halamanProject Cash Flow Analysisgopinathan_karuthedaBelum ada peringkat

- Lecture 3Dokumen85 halamanLecture 3Tadesse MegersaBelum ada peringkat

- Eup 222 Engineer in Society Project FinanceDokumen23 halamanEup 222 Engineer in Society Project FinanceJackie HwangBelum ada peringkat

- 2.8 SKILL Financial AnalysisDokumen63 halaman2.8 SKILL Financial AnalysisYared AssefaBelum ada peringkat

- FMID Group 2 - Financial Modelling and Project EvalutaionDokumen17 halamanFMID Group 2 - Financial Modelling and Project EvalutaionAkash MittalBelum ada peringkat

- Ge 4020Dokumen33 halamanGe 4020Yazeed AlotaibiBelum ada peringkat

- CEE+3348+7+-+Lesson+Seven+-+Project+Cost+Management+ Cash+Flow + +LAB+ 4-1Dokumen54 halamanCEE+3348+7+-+Lesson+Seven+-+Project+Cost+Management+ Cash+Flow + +LAB+ 4-1Chachi CBelum ada peringkat

- Cash Flow Forecasting in Construction ProjectsDokumen26 halamanCash Flow Forecasting in Construction ProjectsPallav Paban BaruahBelum ada peringkat

- Engineering EconomyDokumen87 halamanEngineering EconomyAbhishek KumarBelum ada peringkat

- Capital Budgeting - December 2015Dokumen19 halamanCapital Budgeting - December 2015apoorv jindalBelum ada peringkat

- Calculate Payback Period and Accounting Rate of ReturnDokumen19 halamanCalculate Payback Period and Accounting Rate of ReturnAkim DomoBelum ada peringkat

- Construction Cost Engineering 2Dokumen16 halamanConstruction Cost Engineering 2Ayyang, Frodece Crissarille W.Belum ada peringkat

- Lesson 21 Payment Claims 1 KMDokumen7 halamanLesson 21 Payment Claims 1 KMrajatBelum ada peringkat

- 6 1Dokumen16 halaman6 1Bangalore BharathBelum ada peringkat

- CES271 Chapter 5Dokumen34 halamanCES271 Chapter 5Aya mohamedBelum ada peringkat

- Eup 222 Engineer in Society Project FinanceDokumen44 halamanEup 222 Engineer in Society Project FinanceJackie HwangBelum ada peringkat

- PROJECT FINANCIAL CONTROL AND MANAGEMENTDokumen23 halamanPROJECT FINANCIAL CONTROL AND MANAGEMENTobengloloision2022Belum ada peringkat

- Capital Budgeting DecisionsDokumen28 halamanCapital Budgeting DecisionsMoshmi MazumdarBelum ada peringkat

- The Basics of Capital BudgetingDokumen56 halamanThe Basics of Capital BudgetingRanin, Manilac Melissa SBelum ada peringkat

- Guide to Capital Budgeting Decisions and Investment Project EvaluationDokumen38 halamanGuide to Capital Budgeting Decisions and Investment Project EvaluationHimanshu JainBelum ada peringkat

- Energy Investment AnalysisDokumen40 halamanEnergy Investment AnalysisJoeb DsouzaBelum ada peringkat

- FALLSEM2019-20 BAG2010 ETH VL2019201003985 Reference Material I 23-Jul-2019 Credit AnalysisDokumen36 halamanFALLSEM2019-20 BAG2010 ETH VL2019201003985 Reference Material I 23-Jul-2019 Credit AnalysisvimalBelum ada peringkat

- Nashville pm02Dokumen5 halamanNashville pm02priyantharatBelum ada peringkat

- Credit Appraisal @ Allahabad BankDokumen42 halamanCredit Appraisal @ Allahabad BankParthapratim DebnathBelum ada peringkat

- CASH FLOW ESTIMATION Week 6Dokumen30 halamanCASH FLOW ESTIMATION Week 6adulmi325Belum ada peringkat

- 3 Process of Feasibility StudyDokumen23 halaman3 Process of Feasibility Studyyrrehs 00Belum ada peringkat

- Chapter FourDokumen31 halamanChapter Fourtamirat tadeseBelum ada peringkat

- 29th Aug 2023 Final Complex Investment DecisionsDokumen15 halaman29th Aug 2023 Final Complex Investment DecisionsKunal KadamBelum ada peringkat

- Cap BudgetDokumen74 halamanCap BudgetBhutada_Sumeet_8280Belum ada peringkat

- Principles of Capital InvestmentDokumen35 halamanPrinciples of Capital InvestmentAnam Jawaid100% (1)

- MAS 2 CAp BudgetingDokumen45 halamanMAS 2 CAp BudgetingMarian B TersonaBelum ada peringkat

- Chap 7 Financial PlanDokumen51 halamanChap 7 Financial PlanShiyamala SubramaniamBelum ada peringkat

- Statement of Cash FlowsDokumen11 halamanStatement of Cash FlowsBri CorpuzBelum ada peringkat

- Capital BudgetingDokumen33 halamanCapital BudgetingmoosanipppBelum ada peringkat

- A Case For Project Revenue Management: Peter Varani PMPDokumen40 halamanA Case For Project Revenue Management: Peter Varani PMPpremwin1Belum ada peringkat

- Project AppraisalDokumen38 halamanProject AppraisalÎßhû ẞhåñdèl100% (1)

- Project Appraisal - Capital Budgeting MethodsDokumen55 halamanProject Appraisal - Capital Budgeting Methodsmanju09535Belum ada peringkat

- Cash Flow EstimationDokumen35 halamanCash Flow EstimationAtheer Al-AnsariBelum ada peringkat

- Basic Economic Principles: Chethan S.GowdaDokumen30 halamanBasic Economic Principles: Chethan S.GowdaTodesa HinkosaBelum ada peringkat

- Cost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Dokumen27 halamanCost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Nirjon BhowmicBelum ada peringkat

- Project Appraisal Criteria Key Investment MetricsDokumen49 halamanProject Appraisal Criteria Key Investment MetricsArun S BharadwajBelum ada peringkat

- Capital BudgetingDokumen45 halamanCapital BudgetingdawncpainBelum ada peringkat

- Time Value of MoneyDokumen38 halamanTime Value of MoneyVasanth Kumar100% (1)

- DR 6 UryutfyutfutduDokumen13 halamanDR 6 UryutfyutfutduWisnu1201091Belum ada peringkat

- Capital Budgeting Decisions: DR R.S. Aurora, Faculty in FinanceDokumen31 halamanCapital Budgeting Decisions: DR R.S. Aurora, Faculty in FinanceAmit KumarBelum ada peringkat

- Financing of Renewable Energy ProjectsDokumen17 halamanFinancing of Renewable Energy Projectsjamalq123100% (1)

- Should We Pursue Building of This Plant?Dokumen24 halamanShould We Pursue Building of This Plant?Dikshit KothariBelum ada peringkat

- Financial Aspects of Project Analysis: ReferencesDokumen40 halamanFinancial Aspects of Project Analysis: ReferencesRusty PlacinoBelum ada peringkat

- Contractor (Private) Financing For Water and Wastewater Facilities: Key Issues and ObstaclesDokumen37 halamanContractor (Private) Financing For Water and Wastewater Facilities: Key Issues and Obstaclessales leotekBelum ada peringkat

- Understand key capital budgeting techniques and calculationsDokumen16 halamanUnderstand key capital budgeting techniques and calculationsManish ChaturvediBelum ada peringkat

- MBA Financial Management Core Course 2013-15Dokumen36 halamanMBA Financial Management Core Course 2013-15Devansh DoshiBelum ada peringkat

- Present ValueDokumen8 halamanPresent ValueFarrukhsgBelum ada peringkat

- Chapter 9 Project Cash FlowsDokumen28 halamanChapter 9 Project Cash FlowsGovinda AgrawalBelum ada peringkat

- Capital Budgeting - Discounted and Undiscounted MethodDokumen47 halamanCapital Budgeting - Discounted and Undiscounted MethodTacitus KilgoreBelum ada peringkat

- International Capilat BudgetingDokumen43 halamanInternational Capilat BudgetingHimanshu GuptaBelum ada peringkat

- Capital Financing and AllocationDokumen41 halamanCapital Financing and AllocationRhizhail MortallaBelum ada peringkat

- Eco Lec5 Present WorthDokumen48 halamanEco Lec5 Present WorthHiro Hashimoto100% (1)

- Field Guide for Construction Management: Management by Walking AroundDari EverandField Guide for Construction Management: Management by Walking AroundPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityDari EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityPenilaian: 4 dari 5 bintang4/5 (2)

- Applied Corporate Finance. What is a Company worth?Dari EverandApplied Corporate Finance. What is a Company worth?Penilaian: 3 dari 5 bintang3/5 (2)

- Secretarial Practices OutlineDokumen5 halamanSecretarial Practices Outlinenaeem_shamsBelum ada peringkat

- TRF-77 Green Electric LTDDokumen34 halamanTRF-77 Green Electric LTDnaeem_shamsBelum ada peringkat

- LC GuideDokumen35 halamanLC Guidenaeem_shamsBelum ada peringkat

- Compendium of Withholding Tax PDFDokumen44 halamanCompendium of Withholding Tax PDFnaeem_shamsBelum ada peringkat

- Dos and Donts of ConcreteDokumen28 halamanDos and Donts of ConcreteThanh Khiet UngBelum ada peringkat

- PWC Finance 2013Dokumen237 halamanPWC Finance 2013abcabc2012100% (1)

- Project Cash Flow: ARE 413 Construction ManagementDokumen25 halamanProject Cash Flow: ARE 413 Construction Managementnaeem_shamsBelum ada peringkat

- BudgetDokumen69 halamanBudgetnaeem_shamsBelum ada peringkat

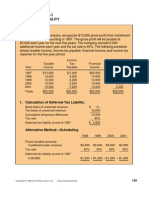

- Deferred Tax IllustrationDokumen8 halamanDeferred Tax IllustrationFaseeh IqbalBelum ada peringkat

- Consolidated Financial Statements 2013 (En)Dokumen27 halamanConsolidated Financial Statements 2013 (En)naeem_shamsBelum ada peringkat

- ItaxDokumen3 halamanItaxnaeem_shamsBelum ada peringkat

- Consult - New-Registration - Form (For Local)Dokumen16 halamanConsult - New-Registration - Form (For Local)naeem_shamsBelum ada peringkat

- Article Excel If Statements Look UpsDokumen8 halamanArticle Excel If Statements Look UpsMuneeb MansoorBelum ada peringkat

- Comp Exam15 QP 05032k11Dokumen2 halamanComp Exam15 QP 05032k11naeem_shamsBelum ada peringkat

- Income TaxDokumen10 halamanIncome Taxnaeem_shamsBelum ada peringkat

- SEZDokumen26 halamanSEZnaeem_shamsBelum ada peringkat

- Economics MCQsDokumen168 halamanEconomics MCQsSanjeev Subedi83% (23)

- 1 Piping CostingDokumen33 halaman1 Piping Costingamoldhole97% (34)

- Special Economic Zones - An Overview PDFDokumen7 halamanSpecial Economic Zones - An Overview PDFnaeem_shamsBelum ada peringkat

- WHT on Goods and Services 2013Dokumen13 halamanWHT on Goods and Services 2013touseefahmadBelum ada peringkat

- Comp Exam15 QP 05032k11Dokumen2 halamanComp Exam15 QP 05032k11naeem_shamsBelum ada peringkat

- Construction ContractsDokumen10 halamanConstruction Contractsnaeem_shamsBelum ada peringkat

- BFD Revision Kit (Question Bank With Solutions - Topicwise)Dokumen106 halamanBFD Revision Kit (Question Bank With Solutions - Topicwise)naeem_shamsBelum ada peringkat

- Withholding Tax U/S 153Dokumen10 halamanWithholding Tax U/S 153kschishtiBelum ada peringkat

- InTech-Power Quality and Electrical Arc Furnaces PDFDokumen25 halamanInTech-Power Quality and Electrical Arc Furnaces PDFnaeem_shamsBelum ada peringkat

- Purchase Agreement ChinaDokumen2 halamanPurchase Agreement Chinanaeem_shamsBelum ada peringkat

- MoI Seeks To Grant Two New Units Pioneer Industry Status - Business Recorder PDFDokumen3 halamanMoI Seeks To Grant Two New Units Pioneer Industry Status - Business Recorder PDFnaeem_shamsBelum ada peringkat

- Epzaord PDFDokumen40 halamanEpzaord PDFnaeem_shamsBelum ada peringkat

- Sales Tax Act 1990 Updated Upto 2010Dokumen84 halamanSales Tax Act 1990 Updated Upto 2010Sohail AnjumBelum ada peringkat

- Trang Bidv TDokumen9 halamanTrang Bidv Tgam nguyenBelum ada peringkat

- Arpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionDokumen4 halamanArpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionLovely ArpiaBelum ada peringkat

- Bianchi Size Chart for Mountain BikesDokumen1 halamanBianchi Size Chart for Mountain BikesSyafiq IshakBelum ada peringkat

- Toshiba l645 l650 l655 Dabl6dmb8f0 OkDokumen43 halamanToshiba l645 l650 l655 Dabl6dmb8f0 OkJaspreet Singh0% (1)

- The Awesome Life Force 1984Dokumen8 halamanThe Awesome Life Force 1984Roman PetersonBelum ada peringkat

- 11th AccountancyDokumen13 halaman11th AccountancyNarendar KumarBelum ada peringkat

- Poetry Recitation Competition ReportDokumen7 halamanPoetry Recitation Competition ReportmohammadBelum ada peringkat

- Compro Russindo Group Tahun 2018 UpdateDokumen44 halamanCompro Russindo Group Tahun 2018 UpdateElyza Farah FadhillahBelum ada peringkat

- UG022510 International GCSE in Business Studies 4BS0 For WebDokumen57 halamanUG022510 International GCSE in Business Studies 4BS0 For WebAnonymous 8aj9gk7GCLBelum ada peringkat

- Supply Chain AssignmentDokumen29 halamanSupply Chain AssignmentHisham JackBelum ada peringkat

- 2 - How To Create Business ValueDokumen16 halaman2 - How To Create Business ValueSorin GabrielBelum ada peringkat

- Tanroads KilimanjaroDokumen10 halamanTanroads KilimanjaroElisha WankogereBelum ada peringkat

- Canine Guided Occlusion and Group FuntionDokumen1 halamanCanine Guided Occlusion and Group Funtionlittlestar35100% (3)

- KT 1 Ky Nang Tong Hop 2-ThươngDokumen4 halamanKT 1 Ky Nang Tong Hop 2-ThươngLệ ThứcBelum ada peringkat

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokumen1 halamanTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pravin AwalkondeBelum ada peringkat

- Toxicology: General Aspects, Types, Routes of Exposure & AnalysisDokumen76 halamanToxicology: General Aspects, Types, Routes of Exposure & AnalysisAsma SikanderBelum ada peringkat

- Bandwidth and File Size - Year 8Dokumen2 halamanBandwidth and File Size - Year 8Orlan LumanogBelum ada peringkat

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDokumen3 halamanNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomBelum ada peringkat

- Sangam ReportDokumen37 halamanSangam ReportSagar ShriBelum ada peringkat

- 2010 Economics Syllabus For SHSDokumen133 halaman2010 Economics Syllabus For SHSfrimpongbenardghBelum ada peringkat

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingDokumen2 halamanJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiBelum ada peringkat

- List of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity BanggoodDokumen6 halamanList of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity Banggoodyogesh parmarBelum ada peringkat

- GASB 34 Governmental Funds vs Government-Wide StatementsDokumen22 halamanGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Mastering ArpeggiosDokumen58 halamanMastering Arpeggiospeterd87Belum ada peringkat

- Strategies To Promote ConcordanceDokumen4 halamanStrategies To Promote ConcordanceDem BertoBelum ada peringkat

- RA 4196 University Charter of PLMDokumen4 halamanRA 4196 University Charter of PLMJoan PabloBelum ada peringkat

- Meta Trader 4Dokumen2 halamanMeta Trader 4Alexis Chinchay AtaoBelum ada peringkat

- Passive Voice Exercises EnglishDokumen1 halamanPassive Voice Exercises EnglishPaulo AbrantesBelum ada peringkat

- A Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan NajafiDokumen9 halamanA Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan Najafiinfo3814Belum ada peringkat

- Should Animals Be Banned From Circuses.Dokumen2 halamanShould Animals Be Banned From Circuses.Minh Nguyệt TrịnhBelum ada peringkat