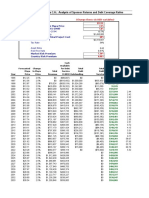

Revenue and expenses analysis of JetBlue Airways from 2002-2010

Diunggah oleh

prtkshnkrDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Revenue and expenses analysis of JetBlue Airways from 2002-2010

Diunggah oleh

prtkshnkrHak Cipta:

Format Tersedia

2002

2003

2004

2005

2006

Revenue

Expenes

Depreciation

Total

EBIT

TAX

NOPAT

Common Equity

Net WC

Change in Working Capital

Cash flow from Operation

600

502

18

520

80

27.2

52.8

290

63

29

-248.2

884

723

26

749

135

45.9

89.1

328

94

31

-243.9

1192

975

36

1011

181

61.54

119.46

345

126

32

-221.54

1485

1215

45

1260

225

76.5

148.5

310

157

31

-147.5

1802

1474

54

1528

274

93.16

180.84

326

191

34

-125.16

TV

Total

-248.2

-243.9

-221.54

-147.5

-125.16

NPV

No of Shares

Value

Terminal Growth Rate

Cost of Equity

Rf

Beta

RP

Tax Rate

Cost of Debt

STD

Long Term Current

Long Term Current

Total Debt

Equity

D/E

Cost of Per Share

Dividends

Pref Share

Kp

WACC

$1,340.43

40.58

$33.03

4% estimated

13.16%

5%

1.63

5%

34%

8.68% from south west

28781

54985

290665

374431

411462.6 this is estimated using debt equity ratio

0.91 avg of the industry as currently jet-blue has negative equity

16790

210441

7.98%

9.27%

2007

2008

2009

2010

2114

1753

65

1818

296

100.64

195.36

342

227

36

-117.64

2466

2016

75

2091

375

127.5

247.5

299

261

34

-10.5

2694

2202

83

2285

409

139.06

269.94

157

285

24

171.94

2912

2380

90

2470

442

150.28

291.72

132

308

23

226.72

-117.64

-10.5

171.94

Beta levered

Beta unlevered

Debt

Equity

1.1

1.02

1842

16,071.99

EPS

Price

0.42

20.69

P/E

49.3

No of share

Tax

et-blue has negative equity

776.8

31%

4,472.38

4,699.10

This is beta of assets

Assuming Market Value

Anda mungkin juga menyukai

- Sampa VideoDokumen24 halamanSampa VideodoiBelum ada peringkat

- Jetblue Airways Ipo ValuationDokumen6 halamanJetblue Airways Ipo ValuationXing Liang HuangBelum ada peringkat

- JetBlue Airways IPO ValuationDokumen15 halamanJetBlue Airways IPO ValuationThossapron Apinyapanja0% (2)

- Jet Blue IPO CaseDokumen4 halamanJet Blue IPO Casedivakar6250% (2)

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDokumen4 halamanDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaBelum ada peringkat

- Sampa Video Financials 2000-2006 Home Delivery ProjectionsDokumen1 halamanSampa Video Financials 2000-2006 Home Delivery ProjectionsOnal RautBelum ada peringkat

- Kohler Co. (A)Dokumen18 halamanKohler Co. (A)Juan Manuel GonzalezBelum ada peringkat

- JetBlue Airways IPO ValuationDokumen9 halamanJetBlue Airways IPO ValuationMuyeedulIslamBelum ada peringkat

- Case 45 Jetblue ValuationDokumen12 halamanCase 45 Jetblue Valuationshawnybiha100% (1)

- Rosario Acero S.A - LarryDokumen12 halamanRosario Acero S.A - LarryStevano Rafael RobothBelum ada peringkat

- Sampa Video: Project ValuationDokumen18 halamanSampa Video: Project Valuationkrissh_87Belum ada peringkat

- Pacific Grove Spice CompanyDokumen1 halamanPacific Grove Spice CompanyLauren KlaassenBelum ada peringkat

- 25th June - Sampa VideoDokumen6 halaman25th June - Sampa VideoAmol MahajanBelum ada peringkat

- Sampa VideoDokumen18 halamanSampa Videomilan979Belum ada peringkat

- AirThread Valuation MethodsDokumen21 halamanAirThread Valuation MethodsSon NguyenBelum ada peringkat

- Sampa Video IncDokumen4 halamanSampa Video IncarnabpramanikBelum ada peringkat

- The value of an unlevered firmDokumen6 halamanThe value of an unlevered firmRahul SinhaBelum ada peringkat

- Sterling Student ManikDokumen23 halamanSterling Student ManikManik BajajBelum ada peringkat

- NPV Analysis of Sampa Video Online ExpansionDokumen13 halamanNPV Analysis of Sampa Video Online ExpansionAnirudh KowthaBelum ada peringkat

- Air Thread Case FinalDokumen49 halamanAir Thread Case FinalJonathan GranowitzBelum ada peringkat

- HP Case Competition PresentationDokumen17 halamanHP Case Competition PresentationNatalia HernandezBelum ada peringkat

- Analysis of Petrolera Zuata Petrozuata Debt CoverageDokumen2 halamanAnalysis of Petrolera Zuata Petrozuata Debt CoveragedewanibipinBelum ada peringkat

- ACC to Acquire AirThread for $7.5 BillionDokumen16 halamanACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- Ethodology AND Ssumptions: B B × D EDokumen7 halamanEthodology AND Ssumptions: B B × D ECami MorenoBelum ada peringkat

- Jetblue CaseDokumen5 halamanJetblue Caseangecorin_52730226275% (4)

- WrigleyDokumen28 halamanWrigleyKaran Rana100% (1)

- Group4 SectionA SampavideoDokumen5 halamanGroup4 SectionA Sampavideokarthikmaddula007_66Belum ada peringkat

- Caso TeuerDokumen46 halamanCaso Teuerjoaquin bullBelum ada peringkat

- Michael McClintock Case1Dokumen2 halamanMichael McClintock Case1Mike MCBelum ada peringkat

- Sun Microsystems Financials and ValuationDokumen6 halamanSun Microsystems Financials and ValuationJasdeep SinghBelum ada peringkat

- Case: Flash Memory, Inc. (4232)Dokumen1 halamanCase: Flash Memory, Inc. (4232)陳子奕Belum ada peringkat

- XLS EngDokumen26 halamanXLS EngcellgadizBelum ada peringkat

- Sampa Video Inc.: Thousand of Dollars Exhibit 4Dokumen2 halamanSampa Video Inc.: Thousand of Dollars Exhibit 4nimarBelum ada peringkat

- Fixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteDokumen1 halamanFixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteAbhishek Garg0% (2)

- Final AssignmentDokumen15 halamanFinal AssignmentUttam DwaBelum ada peringkat

- Excel Spreadsheet Sampa VideoDokumen5 halamanExcel Spreadsheet Sampa VideoFaith AllenBelum ada peringkat

- Debt Policy at Ust IncDokumen18 halamanDebt Policy at Ust InctutenkhamenBelum ada peringkat

- Valuation of Airthread Connections Questions TraductionDokumen2 halamanValuation of Airthread Connections Questions TraductionNatalia HernandezBelum ada peringkat

- Group 3-Case 1Dokumen3 halamanGroup 3-Case 1Yuki Chen100% (1)

- Midland Group 5Dokumen4 halamanMidland Group 5Pranav AggarwalBelum ada peringkat

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDokumen5 halamanIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenBelum ada peringkat

- Ameritrade Case Sheet Cost of EquityDokumen31 halamanAmeritrade Case Sheet Cost of Equitytripti maheshwariBelum ada peringkat

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Dokumen3 halamanSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajBelum ada peringkat

- Case 5 Midland Energy Case ProjectDokumen7 halamanCase 5 Midland Energy Case ProjectCourse HeroBelum ada peringkat

- Flash MemoryDokumen9 halamanFlash MemoryJeffery KaoBelum ada peringkat

- CASE Exhibits - HertzDokumen15 halamanCASE Exhibits - HertzSeemaBelum ada peringkat

- Finance Simulation - Capital BudgetingDokumen1 halamanFinance Simulation - Capital BudgetingKarthi KeyanBelum ada peringkat

- 1998 Smokeless Tobacco Brand Market SharesDokumen11 halaman1998 Smokeless Tobacco Brand Market SharesOmkar BibikarBelum ada peringkat

- Sneaker Excel Sheet For Risk AnalysisDokumen11 halamanSneaker Excel Sheet For Risk AnalysisSuperGuyBelum ada peringkat

- NikeDokumen3 halamanNikeAdhiraj MukherjeeBelum ada peringkat

- Sangam and Excel Mini Case Solution TemplateDokumen3 halamanSangam and Excel Mini Case Solution TemplateSHUBHAM DIXITBelum ada peringkat

- Wipro 6.72% - 0.32% 55.20% 209.18% - 55.11% - 13.33% 42.78% 26.13% 24.12% 32.82% STD 0.73708 Pe TCSDokumen5 halamanWipro 6.72% - 0.32% 55.20% 209.18% - 55.11% - 13.33% 42.78% 26.13% 24.12% 32.82% STD 0.73708 Pe TCSAnkit_4668Belum ada peringkat

- Corporate Valuation Yeats and Tse CostingDokumen27 halamanCorporate Valuation Yeats and Tse CostingSagar IndranBelum ada peringkat

- Sales and Expenses 1994-2001Dokumen23 halamanSales and Expenses 1994-2001arnabpramanikBelum ada peringkat

- Valuation GroupNo.12Dokumen4 halamanValuation GroupNo.12John DummiBelum ada peringkat

- Income Statement Analysis and Projections 2005-2010Dokumen5 halamanIncome Statement Analysis and Projections 2005-2010Gullible KhanBelum ada peringkat

- Solution of Tata Motors Case StudyDokumen19 halamanSolution of Tata Motors Case StudyVishakha PawarBelum ada peringkat

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Dokumen17 halamanSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikBelum ada peringkat

- United Engineers - CIMBDokumen7 halamanUnited Engineers - CIMBTheng RogerBelum ada peringkat

- JSW SteelDokumen34 halamanJSW SteelShashank PatelBelum ada peringkat

- Jankalyan Raktapedhi, Pune: Outward No.: DateDokumen1 halamanJankalyan Raktapedhi, Pune: Outward No.: DateprtkshnkrBelum ada peringkat

- Days To GoDokumen1 halamanDays To GoprtkshnkrBelum ada peringkat

- Course OutlineDokumen6 halamanCourse OutlineprtkshnkrBelum ada peringkat

- AppoloDokumen21 halamanAppoloprtkshnkrBelum ada peringkat

- NothingDokumen7 halamanNothingprtkshnkrBelum ada peringkat

- Value: The Four Cornerstones of Corporate FinanceDari EverandValue: The Four Cornerstones of Corporate FinancePenilaian: 4.5 dari 5 bintang4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDari Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelBelum ada peringkat

- Joy of Agility: How to Solve Problems and Succeed SoonerDari EverandJoy of Agility: How to Solve Problems and Succeed SoonerPenilaian: 4 dari 5 bintang4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Dari EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Penilaian: 4.5 dari 5 bintang4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)Dari EverandFinance Basics (HBR 20-Minute Manager Series)Penilaian: 4.5 dari 5 bintang4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDari EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDari EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistPenilaian: 4.5 dari 5 bintang4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfDari EverandProduct-Led Growth: How to Build a Product That Sells ItselfPenilaian: 5 dari 5 bintang5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDari EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanPenilaian: 4.5 dari 5 bintang4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDari EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsBelum ada peringkat

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDari EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisPenilaian: 5 dari 5 bintang5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Dari EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Penilaian: 4.5 dari 5 bintang4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDari EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBelum ada peringkat

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDari EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualDari EverandNote Brokering for Profit: Your Complete Work At Home Success ManualBelum ada peringkat

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDari EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursPenilaian: 4.5 dari 5 bintang4.5/5 (34)

- Financial Risk Management: A Simple IntroductionDari EverandFinancial Risk Management: A Simple IntroductionPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDari Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDari EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaPenilaian: 3.5 dari 5 bintang3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDari EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthBelum ada peringkat

- Double Your Profits: In Six Months or LessDari EverandDouble Your Profits: In Six Months or LessPenilaian: 4.5 dari 5 bintang4.5/5 (6)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDari EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorBelum ada peringkat

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDari EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingPenilaian: 4.5 dari 5 bintang4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDari EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionPenilaian: 5 dari 5 bintang5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDari EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPenilaian: 4.5 dari 5 bintang4.5/5 (32)