CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013

Diunggah oleh

Manish SahuHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013

Diunggah oleh

Manish SahuHak Cipta:

Format Tersedia

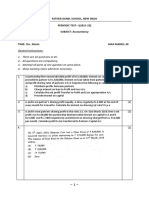

MOCK TEST PAPER-2

CBSE-XII

ACCOUNTANCY

Max. Marks : 80 Time Allowed : 3 hrs.

General Instruction: As per Model Test Paper-I.

PartA

(Accounting for Not-for-Profit Organisations, Partnership Firm and Companies)

1. What do you mean by a not for Profit Organisation ? (1)

2. How will you calculate interest on the drawings of equal amounts on the last day of

every month of the calendar year ? (1)

3. What is meant by Partnership ? (1)

4. A, B, C were partners in a firm in the ratio of 5 : 4 : 3. They admit D with 1/4 share. What

will be the sacrifice made by each partner ? (1)

5. State any two purpose for which the balance in share premium account can be utilised. (1)

6. Find the amount of 'Subscription Received' during 2001 : (3)

Subscriptions Income for 2001 (Creadited to Income and Expenditure A/c) Rs. 95,000

Subscriptions Receivable on : 31.12.2000 Rs. 20,000

31.12.2001 Rs. 15,000

7. A building has been purchased for Rs. 1,10,000 from X. X has been issued 12% debentures

of Rs. 100 each in purchase consideration at a premium of 10% Journalise. (3)

8. Alok forfeited 300 shares of Rs. 10 each, fully called up help by Ram for non-payment of

allotment money Rs. 3 per share and Final Call money of Rs. 4 per share. Out of these

shares 250 were reissued to Shyam for a total payment of 2,000. Give journal entries for

forfeiture and reissue. (3)

9. P, Q, R were partners in firm in the ratio of 1 : 2 : 2. After division of profits for the year

31.3.2001 their capitals were PRs. 1,50,000; QRs. 1,80,000; RRs. 2,10,000. During

the year they withdraw Rs. 20,000 each. The profit of the year was Rs. 60,000. The

partnership deed provided that interest on capital @ 10% p.a. While preparing the Final

accounts. Interest on Capital was not allowed.

Calculate the capital of P, Q, R as 1.4.2000 and pass the required entry for interest on

capital.

10. A, B, C were partners in a firm in the ratio of 4 : 3 : 3. Their capitals were Rs. 1,00,000;

Rs. 2,00,000 and Rs. 3,00,000. For the year 2006, interest on capital was credited to

them @ 10% instead of 9% p.a. Pass the necessary adjusting entry : (4)

11. Give four points of distinction between a share and a debenture. (4)

12. X Ltd. issued 6,000, 12% Deb. of Rs. 100 each at a discount of 6% on 1.1.2001. The

debenture were payable in instalments of Rs. 2,00,000 starting from 31.12.2003.

Show the discount on issue of debentures for the year 2001 to 2003. Calculate debenture

discount to we written off. (6)

13. From the following prepare an Income Expenditure Account and Balance Sheet for the

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

w

w

w

.

s

t

u

d

i

e

s

t

o

d

a

y

.

c

o

m

2 | CBSE-XII Accountancy

year ending 31.12.2001 :

Receipts and Payments Account

Particulars Particulars Amounts

Amount (Rs.) (Rs.)

(Rs.)

To Cash in Hand 7,130 By Machines 30,590

To Subscriptions 47,996 By Doctor's Honorarium 900

To Donations 14,500 By Salaries 27,500

To Interest on Investment @ 12% 12,000 By Petty Expenses 461

To Proceeds from Show 10,450 By Equipment 15,000

By Exp. on Charity Show 750

By Cash in Hand 8,775

92,076 92,076

1.1. 2001 (Rs.) 31.12.2001 (Rs.)

Susbscription Outstanding 240 280

Prereceived Susbscriptions 64 100

Stock of Medicine 8,810 9,740

Equipments 21,200 31,600

Buildings (cost less dep.) 40,000 38,000

Creditors for medicines 10,000 8,000

14. Akhil, Nikhil and Sunil were partners sharing profits and losses equally. Following was

their Balance Sheet as on 31st Dec.2002.

BALANCE SHEET

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Creditors 4,000 Buildings 20,000

General Reserve 4,500 Plant and Machinery 8,000

Capitals : Akhil 19,500 Stock 3,500

Nikhil 12,000 Debtors 8,000

Sunil 8,000 Cash at Bank 8,500

39,500

48,000 48,000

Sunil died on 1st May. 2003, the executor of the deceased partners was entitled to :

(i) Balance of partner's capital account and his share of reserves.

(ii) Share of goodwill calculated on the basis of three times the average profits of the last

4 years. Goodwill is not to be raised in the books.

(iii) Share of profit from the closure of the last accounting year till the date of death on

the basis of the profit of the preceding completed year before death.

(iv) Interest on deceased's capital @ 6% p.a. Rs.5,000 would be paid to deceased's executor

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

w

w

w

.

s

t

u

d

i

e

s

t

o

d

a

y

.

c

o

m

Mock Test Paper-2 | 3

immediately and the balance was to be kept in his loan account.

Profit and Losses of the preceding years :

1999Rs. 8,000 profit 2,000Rs. 10,000 loss

2001Rs. 12,000 profit 2002Rs. 18,000 profit

Pass journal entries and prepare Sunila Account and Sunils Executor's Account.

15. A, B, Ltd. Invited applications for 1,00,000 equity shares of Rs. 10 each payable as Rs. 2

on application, Rs. 3on allotment and the balance on first and final call. Applications

were received for 3,00,000 shares and they were allotted on pro-rata basis. The excess

application money was to be adjoined against allotment. M who had applied 3,000 shares

failed to pay the call money and his shares were forfeited and received at Rs. 8 per share

fully paid up. Pass the journal entries. (8)

Or

Z Ltd. invited applications for insuring 40,000 eq. shares of Rs. 10 each at premium of

Rs. 2 per share the amount was payable on application = Rs. 6 (including premium) and

the balance on allotment.

Applications for 50,000 shares were received. Pro-rata was made on all applications. A

share holders to whom 8,000 shares were allotted failed to pay allotment money. So, his

shares were forfeited. Later on those shares were re-issued for Rs. 70,000 as fully paid

up. Pass journal entries.

16. M and K were partners in a firm. Their Balance Sheet as on 31.12.2002 was as follows :

(8)

BALANCE SHEET

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Outstanding Expenses 10,000 Cash in Hand 4,000

Creditors 30,000 Cash at Bank 56,000

Banks Overdraft 20,000 Debtors 30,000

Bills Payable 30,000 Furniture 12,000

Reserve 18,000 Machinery 24,000

Capitals : M 45,000 Buildings 57,000

K 30,000

1,83,000 1,83,000

They decided to admit Ram on following terms :

(i) Machinery, Buildings, Furniture be depreciated by 5%.

(ii) A provision of 5% be created for doubtful debts.

(iii) Goodwill to be valued at Rs.1,20,000.

(iv) Ram brings Rs. 75,000 as capital and he will receive1/4 share in future profits.

Prepare Revaluation Account, Capital Accounts and Balance Sheet of new firm.

Or

A, B, C were partners in the ratio 3 : 2 : 1. Their Balance Sheet as on 31.3.04 as under :

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

w

w

w

.

s

t

u

d

i

e

s

t

o

d

a

y

.

c

o

m

4 | CBSE-XII Accountancy

BALANCE SHEET

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Capitals : 30,000 Cash-in-Hand 28,000

Bills Payable 16,000 Debtors 25,000

Reserve 12,000 Provision 3,000

Capitals : 22,000

A 40,000 Stock 18,000

B 40,000 Furniture 30,000

C 30,000 Machinery 70,000

1,68,000 1,68,000

B retires on 1.4.2004 on the following terms :

(i) Provision for doubtful debts will be raised by Rs. 1,000.

(ii) Stock will be depreciated by 10% and furniture by 5%.

(iii) There is an outstanding claim for damages of Rs. 1,100 and it is to be provided for.

(iv) Creditors will be written back by Rs. 6,000.

(v) Goodwil of the firm is valued at Rs. 24,000. Goodwill is not to be shown in the books.

(vi) B is paid in full with the cash brought in by A and C in such a manner that their

capitals are in proportion to their ratio 3 : 2 and cash in hand remains at Rs. 10,000.

Prepare the relevant accounts in the books of the firm.

PartB

(Analysis of Financial Statements)

17. Give any four objectives of analysis of financial statements ? (1)

18. State any five items which are shown under the heading Reserves and Surplus in the

Balance Sheet of a company as per Schedule-VI, Part-I of Company's Act 1956. (1)

19. How are the various activities classified according to AS-3 (Revised) while preparing

cash flow statement. (1)

20. Inventory Turnover Ratio is three times. Sales are Rs. 1,80,000, Op. Stock is Rs. 2,000

more than Closing Stock. Calculate the Opening and Closing Stock when goods are sold

at 20% profit on cost. (4)

21. Following are the summarised Balance Sheet of PP Ltd. Prepare comparative Balance

Sheet : (4)

Balance Sheet

Liabilities 2003 2004 Assets 2003 2004

(Rs.) (Rs.) (Rs.) (Rs.)

Share Capital 7,50,000 9,00,000 Fixed Assets 12,45,000 11,55,000

Reserve 1,50,000 2,25,000 Current Assets 6,60,000 8,25,000

Loans 4,20,000 3,00,000

Current Liabilities 5,85,000 5,55,000

19,05,000 19,80,000 19,05,000 19,80,000

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

w

w

w

.

s

t

u

d

i

e

s

t

o

d

a

y

.

c

o

m

Mock Test Paper-2 | 5

22. The following information is given about a Company : (4)

Rs.

Sales 1,50,000

G.P. 30,000

Cost of Goods sold 1,20,000

Opening Stock 29,000

Closing 29,000

Debtors 16,000

Net Profit 14,000

Net Fixed Assets 1,10,000

Calculate :

(i) Gross Profit Ratio : (ii) Net Profit Ratio;

(iii) Fixed Assets Turnover Ratio

23. From the following prepare a Cash Flow Statement : (6)

(Rs.)

Op. Cash Balance 10,000

Cl. Cash Balance 12,000

Decrease in Debtors 5,000

Increase in Creditors 7,000

Sale of Fixed Assets 20,000

Redemption of Debentures 50,000

Net Profit for the year 20,000

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

Downloaded from WWW.STUDIESTODAY.COM Downloaded from WWW.STUDIESTODAY.COM

w

w

w

.

s

t

u

d

i

e

s

t

o

d

a

y

.

c

o

m

Anda mungkin juga menyukai

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsDari EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- APICS CSCP 2020 Module 1 Section BDokumen427 halamanAPICS CSCP 2020 Module 1 Section Bmd shadman akif67% (3)

- Sales Letter Agora FinancialDokumen10 halamanSales Letter Agora FinancialJapa Tamashiro JrBelum ada peringkat

- Opre 3310 Final Exam Study Guide 2020Dokumen2 halamanOpre 3310 Final Exam Study Guide 2020An KouBelum ada peringkat

- Statement of Cash Flows: Preparation, Presentation, and UseDari EverandStatement of Cash Flows: Preparation, Presentation, and UseBelum ada peringkat

- Pilar EEMDokumen17 halamanPilar EEMjesusmemBelum ada peringkat

- New Employee Onboarding Process in An OrganizationDokumen3 halamanNew Employee Onboarding Process in An OrganizationNishan ShettyBelum ada peringkat

- XII AccountancyDokumen4 halamanXII AccountancyAahna AcharyaBelum ada peringkat

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokumen20 halamanClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatBelum ada peringkat

- XII - Accy. QP - Revision-15.2.14Dokumen6 halamanXII - Accy. QP - Revision-15.2.14devipreethiBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Dokumen17 halamanCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokumen7 halamanCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsBelum ada peringkat

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokumen20 halamanCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperBelum ada peringkat

- Accountancy Model QuestionsDokumen19 halamanAccountancy Model QuestionsSunil Kumar AgarwalaBelum ada peringkat

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDokumen5 halamanSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeBelum ada peringkat

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Dokumen5 halamanSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaBelum ada peringkat

- Accountancy EngDokumen8 halamanAccountancy EngBettappa Patil100% (1)

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokumen34 halamanClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsBelum ada peringkat

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokumen58 halamanAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Belum ada peringkat

- AccountancyDokumen0 halamanAccountancyJaimangal RajaBelum ada peringkat

- Accountancy Sample Question PaperDokumen20 halamanAccountancy Sample Question PaperrahulBelum ada peringkat

- 29Dokumen3 halaman29sharathk916Belum ada peringkat

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Dokumen8 halamanCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Accountancy Previous QuestionsDokumen4 halamanAccountancy Previous QuestionsmurthyBelum ada peringkat

- 12 Acc 1 ModelDokumen11 halaman12 Acc 1 ModeljessBelum ada peringkat

- Class XII Accountancy Paper For Half Yearly PDFDokumen13 halamanClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpBelum ada peringkat

- Paper 1: AccountingDokumen30 halamanPaper 1: Accountingsuperdole83Belum ada peringkat

- Accountancy For Class XII Full Question PaperDokumen35 halamanAccountancy For Class XII Full Question PaperSubhasis Kumar DasBelum ada peringkat

- 3hr Paper 4feb 2010Dokumen3 halaman3hr Paper 4feb 2010Bhawna BhardwajBelum ada peringkat

- Paper 1: AccountingDokumen30 halamanPaper 1: AccountingSatyajit PandaBelum ada peringkat

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Dokumen7 halamanAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghBelum ada peringkat

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokumen37 halamanClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsBelum ada peringkat

- Corporate Accounting QUESTIONSDokumen4 halamanCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Module-2 Sample Question PaperDokumen18 halamanModule-2 Sample Question PaperRay Ch100% (1)

- Cbse-Class 12 Sample PaperDokumen24 halamanCbse-Class 12 Sample PapervenumadhavBelum ada peringkat

- Accounts First Term Grade 12Dokumen5 halamanAccounts First Term Grade 12NivpreeBelum ada peringkat

- Monthly Test - Acc. Aug 2020Dokumen5 halamanMonthly Test - Acc. Aug 2020akash debbarmaBelum ada peringkat

- Sample Paper Class XII Subject-Accountancy Part ADokumen5 halamanSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarBelum ada peringkat

- Accountancy - Paper-I - 2012Dokumen3 halamanAccountancy - Paper-I - 2012MaryamQaaziBelum ada peringkat

- 11 CaipccaccountsDokumen19 halaman11 Caipccaccountsapi-206947225Belum ada peringkat

- Accounts XiiDokumen12 halamanAccounts XiiTanya JainBelum ada peringkat

- CBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Dokumen13 halamanCBSE Gulf Board Class 12 ACCOUNTANCY Exam Sample Question Paper 2020Kunal KapoorBelum ada peringkat

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Dokumen4 halamanFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffBelum ada peringkat

- List of Quesion PapersDokumen14 halamanList of Quesion PapersLofidBelum ada peringkat

- Accountancy March 2008 EngDokumen8 halamanAccountancy March 2008 EngPrasad C M100% (2)

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokumen5 halamanSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoBelum ada peringkat

- Accountancy 12th Class PaperDokumen5 halamanAccountancy 12th Class PaperSanjana SinghBelum ada peringkat

- Advanced Corporate AccountingDokumen6 halamanAdvanced Corporate Accountingamensinkai3133Belum ada peringkat

- 12 Accountancy Sample Paper 2014Dokumen26 halaman12 Accountancy Sample Paper 2014Rachit JainBelum ada peringkat

- AccountsDokumen12 halamanAccountsGautam KhanwaniBelum ada peringkat

- Financial Accounting IIDokumen3 halamanFinancial Accounting IIKushalBelum ada peringkat

- 12 Accounts 2020 21 Practice Paper 3Dokumen9 halaman12 Accounts 2020 21 Practice Paper 3Vijey RamalingamBelum ada peringkat

- Class XII Commerce (1) GGBDokumen10 halamanClass XII Commerce (1) GGBAditya KocharBelum ada peringkat

- Intermediate Group I Test PapersDokumen57 halamanIntermediate Group I Test Paperssantbaksmishra1261Belum ada peringkat

- Accounting For Partnership Firms: Short Answer Type QuestionsDokumen8 halamanAccounting For Partnership Firms: Short Answer Type QuestionssalumBelum ada peringkat

- Sample Paper 4Dokumen6 halamanSample Paper 4Ashish BatraBelum ada peringkat

- Worksheet Accounts Ut 1 RefrenceDokumen10 halamanWorksheet Accounts Ut 1 Refrencemayankkochar216Belum ada peringkat

- Sy Bcom Oct2011Dokumen83 halamanSy Bcom Oct2011Anonymous l0j1IwcPDBelum ada peringkat

- Introduction To Partnership AccountsDokumen20 halamanIntroduction To Partnership Accountsanon_672065362100% (1)

- Mock Paper-4 (With Answer)Dokumen18 halamanMock Paper-4 (With Answer)RBelum ada peringkat

- Part - A Partnership, Share Capital and Debentures: General InstructionsDokumen7 halamanPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalBelum ada peringkat

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsDari EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionBelum ada peringkat

- Assignment Class - Xi Subject - Mathematics Topic - Introduction of Three-Dimensional GeometryDokumen7 halamanAssignment Class - Xi Subject - Mathematics Topic - Introduction of Three-Dimensional GeometryManish SahuBelum ada peringkat

- Forumla of MathsDokumen3 halamanForumla of MathsManish SahuBelum ada peringkat

- Welcome To Bank of BarodaDokumen1 halamanWelcome To Bank of BarodaManish SahuBelum ada peringkat

- Umesh Kumar Sahu: (Vocal Artist)Dokumen2 halamanUmesh Kumar Sahu: (Vocal Artist)Manish SahuBelum ada peringkat

- Henri Fayol Sum UpDokumen2 halamanHenri Fayol Sum UpPrashantTannaBelum ada peringkat

- Cost To CostDokumen5 halamanCost To CostManish SahuBelum ada peringkat

- Royal British College, Inc.: Business FinanceDokumen4 halamanRoyal British College, Inc.: Business FinanceLester MojadoBelum ada peringkat

- Mutual Fund Galat Hai PDFDokumen23 halamanMutual Fund Galat Hai PDFNarendar KumarBelum ada peringkat

- Answer KeyDokumen4 halamanAnswer KeyDynBelum ada peringkat

- Unit I - Logistics ManagementDokumen12 halamanUnit I - Logistics ManagementDeepesh PathakBelum ada peringkat

- CFA Level 1 - V2 Exam 1 PMDokumen30 halamanCFA Level 1 - V2 Exam 1 PMHongMinhNguyenBelum ada peringkat

- Internship Report On: Weatherford International PakistanDokumen32 halamanInternship Report On: Weatherford International Pakistanayub shahBelum ada peringkat

- Output Vat Quiz - HernandezDokumen4 halamanOutput Vat Quiz - HernandezDigna HernandezBelum ada peringkat

- Business Process Management Journal: Article InformationDokumen24 halamanBusiness Process Management Journal: Article InformationAnys PiNkyBelum ada peringkat

- Philo Task 1Dokumen1 halamanPhilo Task 1BABYLYN ENDRINALBelum ada peringkat

- Static FilesDokumen27 halamanStatic FilesMariano CarranzaBelum ada peringkat

- Job Hunting Is Getting Worse by Alana SemuelsDokumen4 halamanJob Hunting Is Getting Worse by Alana SemuelsKal LamigoBelum ada peringkat

- Advocacy For The Modernization of The Jeepneys in The PhilippinesDokumen1 halamanAdvocacy For The Modernization of The Jeepneys in The PhilippinesblimcastroBelum ada peringkat

- BDO UITFs 2017 PDFDokumen4 halamanBDO UITFs 2017 PDFfheruBelum ada peringkat

- Suggested Solution Far 660 Final Exam JUNE 2016Dokumen8 halamanSuggested Solution Far 660 Final Exam JUNE 2016Nur ShahiraBelum ada peringkat

- NO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahDokumen1 halamanNO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahMuhammad ikmail KhusaimiBelum ada peringkat

- Cost AssignmentDokumen4 halamanCost AssignmentSYED MUHAMMAD MOOSA RAZABelum ada peringkat

- PRA Public-Private Partnership Guide: Alberto C. AgraDokumen34 halamanPRA Public-Private Partnership Guide: Alberto C. AgraAlexander PinedaBelum ada peringkat

- Theme 2 Technology and The Geo-Economy - FinalDokumen57 halamanTheme 2 Technology and The Geo-Economy - Finalreginaamondi133Belum ada peringkat

- Reflection Paper About Global MigrationDokumen5 halamanReflection Paper About Global MigrationRochelle Ann CunananBelum ada peringkat

- Regulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinerDokumen33 halamanRegulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinermarhelunBelum ada peringkat

- 01 TFS PresentationDokumen23 halaman01 TFS PresentationShardul ManjrekarBelum ada peringkat

- Consumer ChoiceDokumen45 halamanConsumer ChoiceFazlul Amin ShuvoBelum ada peringkat

- Assignment 2Dokumen2 halamanAssignment 2Rence MarcoBelum ada peringkat

- Value Based Management Research Article PDFDokumen15 halamanValue Based Management Research Article PDFDr. Purvi DerashriBelum ada peringkat

- EM (Study Notes) - Sir Mubashir WaseemDokumen15 halamanEM (Study Notes) - Sir Mubashir WaseemMudassirBelum ada peringkat