Ratio Analysis

Diunggah oleh

ikjot5430Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ratio Analysis

Diunggah oleh

ikjot5430Hak Cipta:

Format Tersedia

CONTENTS

ACKNOWLEDGEMENT

PREFACE

METHODLOGY OF THE STUDY

OBJECTIVES OF THE STUDY

INTRODUCTION OF INDIAN SUGAR INDUSTRY

HISTORY OF THE NAWANSHAHR CO-OPERATIVE

SUGAR MILLS LTD.

GROWTH AND FUTURE PROSPECTS

ORGANISATIONAL STRUCTURE OF THE

NAWANSHAHR CO-OPERATIVE SUGAR MILLS LTD.

MAIN ACHIVEMENTS OF THIS SUGAR MILL

OBJECTIVES OF THE SUGAR MILL

SUGAR INDUSTRY & GOVERNMENT POLICY

FINANCIAL STATEMENT ANALYSIS

PRODECURE OF FINANCIAL STATEMENT ANALYSIS

METHODS OR DEVICES OF FINANCIAL ANALYSIS

RATIO ANALYSIS

NATURE OF THE RATIO ANALYSIS

GUIDELINES AND PRECAUTIONS USE IN RATIO

USE & SIGNIFICANCE OF RATIO ANALYSIS

SHORT TERM FINANCIAL POSITION

ACTIVITY RATIO

GENERAL PROFITABILITY RATIO

LONG TERM FINANCIAL POSITION

DEBT-EQUITY RATIO

SOLVENCY RATIO

FIXED ASSETS RATIO

EQUITY RATIO

RATIO OF CURRENT ASSETS TO PROPRIETORS

FUNDS

LIMITATIONS OF THE RATIO ANALYSIS

LIMITATIONS OF THE STUDY

CAUTIONS IN USING RATIO ANALYSIS

FINDIGS & SUGGESTIONS

BIBLIOGRAPHY

PREFACE

Theory & practice are the two aspects of the management. In order to produce dynamic

and promising executives, the two have been blended together. Practical training exposes

the potential manager to the actual work environment and provides them rich insight into

what actually goes on in the industrial climate of India. Infact this implementation of the

theory in practice is the life force of management.

As a part of my course reuirement for the degree of

!."#$.%I&Professional' underwent industrial training in T()

*A+A*,(A(- "#%#P)-ATI.) ,/0A- $I11, 1T2. for

period of six weeks.

I have tried to understand this industrial monster by

observing the financial set of complex. I have drawn my

conclusion s as my regarding the industry from my observation. I

was given training related to only a part of the function duties

performed. I too have learned from this experience and so I am

writing about the company and finance department, as I have

understood it.

The study has been written in very simple language. )very

effort was made to avoid any type of misunderstanding while

writing a report.

METHODOLOGY OF THE STUDY

2uring my training, I visited all the departments3 vi4. Production,

Accounts, "ommercial, marketing, and factory department and

collect information relating to my topic, whatever I could have

from them. 5or collecting information, I used following

techniues6

2iscussion with senior officers and other employees of the

mills.

Personal observations

,tudy of documents, files and annual reports.

It was difficult to all the activities of mill in a short period of six

weeks. 7et these methods of getting information ensure more

reliability and accuracy. +hatever I learnt about the mill, I tried to

present it in the report.

OBJECTIVES OF THE STUDY:-

The main ob8ectives of the study are as under6%

To get financial review of The *.".,.$. ltd. i.e. liuidity,

soundness and profitability.

To get idea of financial analysis.

To find out and study the change in the current period

figures.

To ascertain reasons for these changes and to take corrective

measures in future.

To study the overall financial position of the mill.

To get the practical knowledge of our sub8ect.

To know how the actual work is being done in the industry.

INTRODUCTION OF INDIAN SUGAR

INDUSTRY

,ugar industry is the second largest agro%industry of Industry

of India. India occupies the first position among the countries

producing sugarcane in the world. Industry gives employment to

three lakhs fifty thousand labourers. !eside this industry

provides indirect employments to two%lakhs fifty thousand

farmers to produce sugarcane currently. There are about 9:;

,ugar mills out of which <=> in co%operative sectors, ?:9 in

private sectors and @A in public sector.

In past, India has been producing gur and khandsari

since long time. !ut the modern sugar industry came into being

in ?:;= when the first sugar factory was installed in !ihar. The

second sugar factory was set up in ?:;9 in /.P. Initially the

progress of this industry was very slow and till ?:?9, there were

only six sugar factories in the country.

!y ?:=? to ?:=< the number of factories rose to =?. In

?:=<, the industry was given protection. !y ?:=>, the number of

sugar mills rose to ?=<. !y ?:@?, the number of sugar mills was

?=: and the production of sugar were ??.= lakhs tones. !y ?::?

to ?::< the number of sugar mills was 99B and industry

produced == lakhs tones of sugar. *ow there are more then @;;

sugar mills and industry produces more than ??; lakhs tones

sugar annually.

HISTORY OF THE NAWANSHAHR CO-

OPERATIVE SUGAR MILLS LTD.

The *awanshahr "o%operative ,ugar $ills has its @? years

glorious history. In the Pun8ab, there are ?9 "o%operative ,ugar

$ills and The *awanshahr "o%operative ,ugar $ills 1td. is the

A

th

mill of the state and 9

th

in co%operative sector and the only

mill of ,.!.,.*A0A-&*awanshahr' district. It is the most

successful mill in the district.with slow and steady speed, the

mill took ?= years from ?:@@%@A to ?:AB%A: to become

functional. It was registered under Pun8ab "o%operative

societies Act ?:@A with @= members. Its first crushing year

started in 2ecember ?:AB.

The crushing capacity of the mill was expanded from

?<@; T"2 &Turnover "apacity 2ate', which became operational

on ?AC?;C?::;.

The mill is using double sulphitation plant of 8uice

clarification process.

The mill has established an alcohol plant at "handpur

-ukri on 0arshankar%*urpurbedi road about <@ km. from

*awanshahr. The plant started commercial production on

?@C?<C?::A.

The mill remains closed for six months during every

year and during season the mill runs for <9 hours a day.

GROWTH AND FUTURE PROSPECTS

The *awanshahr "o%operative ,ugar $ills 1td. +as registered

under Pun8ab "o%operative ,ocieties Act on <A%;9%?:@A with @=

members. The licensed capacity of 9;; T"2 &Turnover

"apacity 2ate' was considered low. It was increased to ?;;;

tones per day on *ovember ?:A= which was lowest as

compared to all other sugar mills in the state. The inauguration

ceremony was performed on <<

nd

*ovember ?:AB and actual

crushing was started on <?

st

2ecember ?:AB the present

membership of the mill stands at ?>B<; with a total share capital

of -s. :?>.A? lakh out of which individual members ?>=A>

with its @9=.A? lakh, "o%operative ,ocieties 9@< with share

capital amounting to -s. @.A: lakh and state government -s.

=AB.=; lakh. In addition to it, -s. @?<.99 lakh are lying in share

deduction money, which will ultimately be transferred to share

capital. #n B

th

Dune ?:B> the crushing capacity was further

increased from ?<@; tones to <@;; tones. 5urther expansion to

@;;; tones capacity is under consideration but initially it will be

for <@;; tones under moderni4ation scheme with power co%

generation.

+ith the installation of the mill, there had been all%

round development of the assigned rural area. About -s. =B crores

are being paid every year to the growers as cane price. There are

@A: villages in the assigned area and about <;,;;; acres are under

sugarcane cultivation. 2aily 9;; trolleys are being used for

supplying cane and 9;;%@;; labourers are engaged in sugarcane

harvesting and earn their livelihood. The sugarcane tops so

available are used as fodder for about ?@,;;; cattle and people

with low income can keep better milch cattle to say that main

revenue earning source of the state government is sugar industry

because the molasses made available by the sugar mill is used for

bottling and crores of rupees are earned as various taxes and duties.

ORGANISATIONAL STRUCTURE OF

THE NAWANSHAHR CO-OPERATIVE

SUGAR MILLS LTD

!#A-2 #5 2I-)"T#-,

"hairman & $2

"hief cane "hief )ngg. "hief Accounts !iologist "hief

2evp.#fficer #fficer "hemist

2y."hief 2y."hief 2y."hief Technicians 2y.

)ngg. Accountants "hemist

Add. "ane Assistant Assistant Agri. $anufacturing

2eptt.#fficer )ngg. Accounts "hemist "hemist

#fficer

Accountant 1ab Assistant 1ab

Incharge

"ane "ane Accountant

2evp. Accountant "lerk

Inspector

"ane ,upervisor "ane "lerk

"ane survey

MAIN ACHIEVEMENTS OF THE

NAWANSHAHR CO-OPERATIVE SUGAR

MILLS LTD .

The mill was able to get *ational awards in last A years, the details

of which are as under6%

?::=%:96% ?

st

position in technical efficiency and cane

development.

?::9%:@6% <

nd

position in both the above categories and around <

nd

best $ill.

?::@%:A6% "ommendation "ertificate in the cane development.

?::A%:>6% "ommendation "ertificate in the cane development.

?::>%:B6% <

nd

best mill in financial management.

?::B%::6% <

nd

pri4e in financial management

?:::%;;6% <

nd

pri4es in financial management.

<;;;%;?6% ?

st

pri4e in cane development.

?

st

pri4e in financial management.

?

st

pri4e in best co%operative sugar factory.

OBJECTIVES OF THE SUGAR MILL

The ob8ectives of the mill shall be to promote the economic interest of

the members and for this purpose, they have to carry on the

manufacture of ,ugar, ,ugar products and other ancillary products

and to make arrangement for their sales and also to take necessary

steps and measure for the development of sugarcane and sugar beet.

5or the purpose of attaining the aforesaid ob8ects, it shall be

competent for the mills.

To acuire, purchase or take on lease and erect or construct

on such land, building houses and sheds and others

constructions necessary and suitable for working of the mills

and its other ancillary activities and also to carry on other

socio%economics activities for the benefits of members and

others in its area.

To conduct business of mill in accordance with actCrules and

bye%laws and as per advice of $anaging 2irector, ,ugar fed

and directions issued by the registrar from time to time.

To acuire by purchase or otherwise plant and machinery and

euipment reuired for efficient working of the mills and its

other ancillary activities.

To construct residential uarters, hospital, schools, and

recreation centers, canteen etc., for the welfare of its

employees and their families so as to meet any statutory

reuirement.

To purchase ,ugar "aneC sugar beet from growers preferably

members. To purchase any other raw material on cash or

credit reuired by the mills or by its ancillary units.

To raise funds in such a manner as is prescribed in these bye%

laws.

To sell or to make arrangements for selling finished products

and other by products as manufactured by the mills and its

ancillary units under the advice of ,ugar fed.

To conduct and take on rent godowns at the places of

manufacture as well as other places for storage of raw

materials and finished products.

To undertake research and other development activities for

the development of ,ugar "ane, ,ugar beet and ancillary

products of sugar including provisions of technical advice

regarding the improved cultivation practices on its own or in

collaboration with other co%operatives.

To sell or otherwise dispose off the whole or any part of its

assets, land, building, plant, machinery and stores as isC are

not reuired by the mill with the prior approval of registrar

on the recommendation of ,ugar fed.

To install plant and machinery for the utili4ation of ancillaryC

bye%products with approval of ,ugar fed.

To undertake supply of uality seeds, fertili4ers, insecticides,

pesticides implementsC euipments and other products

reuired as per acre development plan of the mills.

To undertake subsidiary and allied industries which are

conducive to the development and benefits to the mills and

for its members.

To seek affiliation with the Pun8ab ,tate "o%operative ,ugar

$ills 1td. To get professional know how and also to appoint

technical ad personnel on their advice.

To raise loans from the financial institutions from members

and others and to execute documents in favour of the state

government in respect of guarantees to be furnished to such

institutions on behalf of the mills.

To undertake surveys, research and evaluation studies on

,ugar "ane production on its own or through ,ugar fed.

To undertake advancement or loan to members, for ,ugar

"ane production and undertake recovery of these loan from

the members.

To array a serial spray on ,ugar "ane Cbeet crops in mills

area on payment basis.

To undertake propagation of ,ugar "ane by adoption of

approved packages and for better yield of ,ugar "ane Cbeet.

To acuire, purchase, take on lease or otherwise takeover

management, assets and liabilities of any ,ugar factory

including heir corporate, private or 8oint sectors as running

concern as approved by registrar.

To do such thing as are incidental or conductive to

the attainment of all or any of the above ob8ectives.

SUGAR INDUSTRY AND GOVERNMENT

POLICY

,ugar industry is a controlled industry of India. $ain

features of government policy regarding ,ugar industry are6%

2ual price policy has been adopted in respect of this industry

?@E of the total produce is taken away for the public distribution

system at controlled rate fixed from time to time which is not

linked with the actual cost of production. The remaining B@E is

left to the mill is called free sale at market rate.

In the setting up of a new unit "o%operative ,ugar $ill is given

preference.

,ugar producer should get a fair price of their produce. To that

end state government announces price of ,ugar "ane at the price

fixed by the government. *ew mill should have crushing capacity

of <@;; tones. Per day. #nly then government will issue license.

In order to develop ,ugar industry, funds are being mobili4ed by

imposing a levy under ,ugar "ane 1evy Act, ?:B<.

+ith a view to moderni4e ,ugar industry, development funds

have been established.

In ?::=, control on molasses was lifted.

FINANCIAL STATEMENT ANALYSIS

5inancial statement analysis is prepared primarily for decision%

making. They play a dominant role in setting the framework of

managerial decisions but the information provided in the

financial statement is no meaningful conclusions can be drawn

from these statements alone.

(owever the information provided in this

statement is of immense use in making through analysis and

interpretation of financial statements.

MEANING AND CONCEPT OF

FINANCIAL ANALYSIS:-

The term financial analysis, also known as analysis and

interpretation of financial statements refers to the process of

determining financial strength and weakness of the firm by

establishing strategic relationship between the items of the balance

sheet and profit & loss account and other operative data.

According to Metcalf & Titard , 5inancial statement analysis is a

process of evaluating the relationship between component parts of

financial statement to obtain better understanding of firmFs

position and performance.

The purpose of financial diagnosis of the information

contained in financial statement is to 8udge the profitability and

financial soundness of the firm. The analysis and financial

interpretation of the financial statement is essential to bring out

the mystery behind the figure in financial statement. 5inancial

statement is an attempt to determine the significance and the

meaning of the financial statement data so that forecast made of

the future earning, ability to pay interest and debt maturities and

probability of a sound dividend policy.

PROCEDURE OF FINANCIAL

STATEMENT ANALYSIS

Analyst should acuaint himself with the principles and

postulates of accounting. (e should know the plans and

policies of the management so that he may be able to find

out whether these plans are properly executed or not.

The extent of analysis should be determined so that the

sphere of work may be divided. If the aim is to find out the

earning capacity of enterprises then analysis of income

statement will be undertaken. #n the other hand, if financial

position is to be studied then the balance sheet analysis is

necessary.

The financial data given in the statements should be

recogni4ed and arranged. It will involve the grouping of

similar data under same heads, breaking down of individual

components of statements according to nature. The data

should be reduced to a statement form.

A relationship is established among financial statements

with the help of tools and techniues of analysis such as

ratios, trend, fund flow etc.

The information is interpreted in simple and understandable

way. The significance and utility of financial data is

explained for helping decision%making.

The conclusion drawn from interpretation is presented to

the management in the form of report.

METHODS OR DEVICES OF

FINANCIAL ANALYSIS

The following methods of analysis are generally used6%

"omparative Analysis

Trend Analysis

"ommon ,i4e ,tatement

5und 5low Analysis

"ash 5low Analysis

-atio Analysis

"ost%.olume%Profit Analysis

-ATI# A*A17,I, is discussed in the next pages.

INTRODUCTION:-

+e have already studied that

there are various methods or techniues used in analysis of

financial statements, such as comparative statement, trend analysis,

common si4e statements, and schedule of change in working

capital, fund flow and cash flow analysis, cost%volume%profit

analysis and ratio analysis.

MEANING OF RATIO

-atio is the relationship between two variables written in terms of

fraction.

RATIO = NUMERATORDENOMINATOR

According to G)11 and !)25#-2, Ha ratio is an expression of

the uantitative relationship between two numbers.I

NATURE OF RATIO ANALYSIS

-atio analysis is a techniue of analysis and

interpretation of financial statements. It is the process of

establishing and interpreting various ratios for helping in certain

decisions. (owever ratio analysis is not an end in itself. It is only a

mean of better understanding of financial strengths and weaknesses

of a firm.

The ratio may be used as a symptom like blood pressure, the

pulse rate or the body temperature and their interpretation depends

upon the caliber and competence of the analyst. The following are

the four steps involved in the ratio analysis6

,election of relevant data from the financial statements depending

upon the ob8ective of the analysis.

"alculation of appropriation ratio from the above data.

"omparisons of the calculated ratios with the ratios of the same

firm in the past, or the present.

Interpretation of the ratios.

GUIDELINES AND PRECAUTIONS USE IN

RATIO

The calculations of ratios may not be a difficult task but their

usage is not easy. The information on which these are based, the

constraints of financial statements, ob8ectives for using them, the

caliber of the analyst etc. are important factors which may be kept

in mind while interpreting various ratios6%

Accuracy of financial statements: - !efore calculating ratios

one should see whether proper concepts and conventions have

been used for preparing financial statements or not. These

statements should also be properly audited by competent auditors.

The precautions will establish the reliability of data given in

financial statements.

Objectives or Purpose of Analysis:- The type of ratio to be

calculated will depend upon the purpose for which these are

reuired. If the purpose is to study current financial position then

ratios relating to current assets and current liabilities will be

studied. A creditor, a banker, a shareholder, all has different

ob8ects for studied ratios. The purpose or ob8ect for which has

ratios are reuired to be studied should always be kept in mind for

studying various ratios. 2ifferent ob8ects may reuire the study of

different ratios.

Selection of ratios:- Another precaution in the ratio analysis is

the proper selection of appropriate ratios. The ratios should match

the purpose for which these are reuired. "alculation of large

number of ratios without determining their need in the present

context may confuse the proper light on the matter to be discussed.

Use of standards:- The ratio gives an indication of financial

position only when discussed with the reference to certain

standards. /nless otherwise these ratios are compared with certain

standards, one will not be able be able to reach at conclusions.

These standards may be rule of thumb as in case of current ratios

&<6?' and acid%test ratio &?6?', may be industry standards, may be

budgeted or pro8ected ratios etc. The comparison of calculated

ratios with standards with the help of analyst in forming his

opinion about financial situation of the concern.

Caliber of the analyst!- The ratios are only the tools of analysis

and their interpretation will depend upon the caliber and

competence of analyst. (e should be familiar with various

financial statements and the significance of changes etc. A wrong

interpretation may create confusion for the concern since wrong

conclusion may lead to wrong decisions. The utility of ratios is

linked to the expertise to the analyst.

Ratios provide only a base:- The ratios are only guidelines for

the analyst. (e should study any other relevant information,

situation in the concern, general economic etc. before reaching

final conclusions.

USE AND SIGNIFICANCE OF RATIO ANALYSIS

The ratio analysis is one of the most powerful tools of the

financial analysis. It is used as a device to analysis and interprets

the financial health of enterprise. Dust like a doctor examines his

patient by recording his body temperature, blood pressure etc.

before making his conclusion regarding his illness and before

giving his treatment, a financial analyst analysis the financial

statements with various tools of analysis before commenting upon

the financial health or weakness of an enterprise.

MANAGERIAL USES OF RATIO ANALYSIS

Helpful in decision main!:- 5inancial statements are

prepared primarily for decision making. !ut the information

provided in financial statements is not end in itself and no

meaningful conclusion can be drawn from these statements alone.

-atio analysis helps in making decision from the information

provided in these financial statements.

Helps in financial forecastin! and plannin!:- -atio analysis

is of much help in financial forecasting and planning. Planning is

look ahead and the ratios calculated for a number of years works as

a guide for the future from these ratios. Thus, ratio analysis helps

in forecasting and planning.

Helps in co-ordination:- -atio even helps in co%ordination,

which is of utmost importance in effective business management.

!etter communication of efficiency and weakness of an enterprise

results in better co%ordination in the enterprise.

Helps in control:- -atio analysis even helps in making effective

control of the business. ,tandard ratio can be based upon Performa

financial statements and variances or deviations, if any, come to

the knowledge of the management which helps in effective control

of business.

Other uses:% There are so many uses of ratio analysis. It is the

essential part of the budgetary control and standard costing. -atios

are of utmost importance important in the analysis and

interpretation of financial statements as they bring out the strengths

or weaknesses of a firm.

UTILITY TO

SHAREHOLDERS/INVESTORS

As investor in the company will like to access the financial

position of the concern, where he is going to invest. (is first

interest will be the security of the investment and then a return in

the form of dividend or interest. 5or the first purpose he will try to

access the value of fixed assets and the loan rose against them. The

investor will feel satisfy only if the concern has sufficient amount

of assets.

1ong term solvency ratios will help him in assessing

financial position of the concern. Profitability ratios, on the other

hand, will be useful to the investors in making up his mind whether

present position of the concerns warrants further investments or

not.

UTILITY TO CREDITORS

The creditors or suppliers extend short term credit to

the concern. They are interested to know whether financial position

of the concerns warrants their payment at a specified time or not.

The concern pays short%term creditors out of its current assets. If

the current assets are uite sufficient to meet current liabilities,

then the creditors will hesitate in extending credit facilities.

"urrent and acid%test ratios will give an idea about the current

financial position of the concern.

UTILITY TO EMPLOYEES

The employees are also interested in the financial

position of the concern especially profitability. Their wages

increases and amount of fringe benefits are related to the volume

of profits earned by the concern. The employees make use of

information available in financial statements. .arious profitability

ratios relating to gross profit, operating profit, net profit etc. enable

employees to put forward their view point for the increase of

wages and other benefits.

UTILITY TO GOVERNMENT

0overnment is interested to know the overall strength

of the industry. .arious financial statements published by

industrial units are used to calculate ratio for determining short%

term, long%term and overall financial position of the concerns.

Profitability indexes can also be prepared with the help of ratios.

0overnment may also base its future policies on the basis of

industrial information available from various units. The ratios may

be used as indicators of overall financial strength of public as well

as private sectors. In the absence of reliable economic information,

government plans and policies may not prove successful.

SHORT TERM FINANCIAL POSITION

"#$U#%#&' RA&#OS:- 1iuidity ratios measure the ability

of the firm to meet its current liability or short%term obligations as

and when they become due. A firm must ensure that it does not

suffer from lack of liuidity. A very high degree of liuidity is also

bad as idle assets earn nothing. There should be proper balance

between high liuidity and lack of liuidity. In fact, analysis of

liuidity needs the preparation of cash budgets and cash and fund

flow statementJ but liuidity ratios, by establishing a relationship

between cash and other current assets to current obligations,

provide a uick measure of liuidity. A firm should ensure that it

does not suffer from lack of liuidity, and also that it does not have

excess liuidity. The most common ratios, which indicate the

extent of liuidity or lack it, are6 &i' "urrent ratio and &ii' Kuick

ratio. #ther ratios include cash ratio, interval measure and net

working capital ratio.

CURRENT RATIO :-

It measures the firmFs short term solvency.

"urrent -atio is the relationship between the current assets and

current liabilities. "urrent assets include cash and those assets that

can be converted into cash within a year, such as marketable

securities, debtors and inventories. Prepaid expenses are also

included in current assets as they represent the payments that will

not made by the firm in the future. All obligations or liabilities

maturing within the year are included in current liabilities. "urrent

liabilities include creditors, bills payable, accrued expenses, short%

term bank loan, income tax liability and long term debt maturing in

the current year. A ratio of greater than one means the firm has

more current assets than current liabilities. The current ratio is a

measure of the firmFs short term solvency. It indicates the

availability of current assets in rupees for every one rupee of

current liability. This ratio is also known as working capital ratio.

It can be calculated as6

L"#$"%"&'

R(&")

C$**+,&

R(&")

A-"%-T+.&

R(&")

A/.)0$&+ L"#$"%

R(&")

Current Ratio L Current Assets

Current "iabilities

A ratio of greater than one means that the firm has

more current assets than current claims against them.

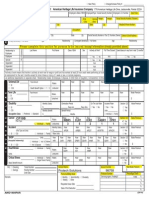

CURR()& RA&#O O* &H( )A+A)SHAHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

C$**+,& A..+&. 6A7 823915::: ;4:2:4358 :14<5<:31

C$**+,& L"(/"0"&"+. 6B7 8353224:8 <91;3;5:5 <853;4128

C$**+,& R(&") 6AB7 2.484&"=+. 2.3<;&"=+. 9.9&"=+.

INTERPRETATION

The rule of thumb of current ratio of current assets and current

liabilities is <6? i.e. current assets should be double than current

liabilities but here in case of sugar mill, the current ratio in <;;>

was ;.B96? and in <;;: it raised to ?6? which shows that the more

investment in fixed assets and its liuidity position in current assets

is not well.

LIMITATIONS OF CURRENT RATIO

"urrent ratio is a general and uick measure of liuidity of a

firm. It represents the margin of safety or cushion available to the

creditors and other current liabilities. It is most widely used for

making short term analysis of the financial position or short term

solvency of the firm. !ut one has to be careful while using current

ratio as a measure of liuidity, because it suffers from following

limitations6%

CRU%( : - It is crude ratio because it measures only the uantity

not the uality of current assets.

+#)%O+ %R(SS#)- : % .aluation of current assets and

window dressing is another problem of current ratio. "urrent assets

and current liabilities are manipulated in such a way that current

ratio losses its significance. It does not present the real financial

position of the concern. The inferences drawn from such a ratio

will be faulty and deceptive. +indow dressing may be indulged in

the following ways6%

o #vervaluation of closing stock

o #bsolete or worthless stocks are shown in the closing inventory at

their cost instead of writing them off.

o #mission of a liability for merchandise in inventory.

o Inadeuate provision for bad and doubtful debts.

QUICK OR LIQUID RATIO

Q$"-> R(&")? also called (-"%-&+.& *(&")? establishes

a relationship between uick, or liuid, assets and current

liabilities. This ratio established the relationship between liuid

assets and current liabilities. An asset is a liuid if it can be

converted into cash immediately without the loss of value. "ash is

the most liuid assets. #ther assets that are considered to be

relative liuid and included in uick assets are debtors and bills

receivables and marketable securities &temporary uoted

investments'. Inventories normally reuire some time for reali4ing

into cashJ their value also has a tendency to fluctuate. Kuick ratio

is the most severe test of short term solvency.

$uic Ratio 0 $uic or "i1uid Assets

Current "iabilities

$uic or "i1uid Assets

0 Current Assets 2 Stoc 2 Prepaid (3penses

$U#C4 RA&#O O* &H( )A+A)SHAHR CO-OP(RA&#,(

SU-AR .#""S "&%.

P(*&"-$0(*. 1223 1224 1225

Q$"-> A..+&. 6A7 598:235 <495133 91;294;:3

C.L. 6B7 8353224:8 <91;3;5:5 <853;4128

Q$"-> R(&") 6AB7 2.295&"=+. 2.299&"=+. 2.11&"=+.

INTREPRETATION

/sually, a high acid test ratio is an indication that the firm is

liuid and has the ability to meet its current liabilities in time and

vice%versa. As a rule of thumb ?6? is considered satisfactory. There

is decrease in uick ratio from ;.;??6? in<;;B to ;.<<6? in <;;:.

Also according to the rule of thumb it represents very bad position

of the sugar mill.

ABSOLUTE LIQUID RATIO OR CASH

RATIO

,ince cash is the most liuid asset although receivable, debtors and

!C- are generally more liuid than inventories, yet there may be

doubts regarding their reali4ation into cash immediately or in time.

Trade investment or marketable securities are euivalent of cashJ

they may be included in the computation of cash ratio6

Cash Ratio 0 Absolute "i1uid Assets

Current "iabilities

A5SO"U&( RA&#O O* &H( )A+A)SHAHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

A.L. A..+&. 6A7 <15:<85 1<31583 89<442<

C$**+,& L"(/"0"&"+. 6B7 8353224:8 <91;3;5:5 <853;4128

A/.)0$&+ R(&") 6AB7 2.299&"=+. 2.22<&"=+. 2.11&"=+.

INTREPRETATION

The rule of thumb for absolute liuid ratio is ;.@6? i.e. assets

should be half than its current liabilities. (ere in sugar mill, the

ratio in <;;> was ;.;??6? increased to ;.;;@6? in <;;B. ,o it shows

good liuidity position of sugar mill in case of absolute liuid

ratio.

AC&#,#&' RA&#OS

The Activity -atios are also called the Turnover -atios or

performance -atios. 5unds of creditors and owners are invested in

various assets, the larger the amount of sales. A-&"@"&' R(&"). are

employed to evaluate the efficiency with which the firm manages

and utili4ed its assets. These ratios are also called T$*,)@+*

R(&"). because they indicate the speed with which the assets are

being converted or turned over into sales. Activity ratios, thus,

involves a relationship between sales and assets. ,everal activity

ratios can be calculated to 8udge the effectiveness of assets

effectiveness of assets utili4ation.

5unds are invested in various assets in a

business to make sales and earn profits. The efficiency with which

assets are managed directly affected the value of assets. The better

management of assets, the larger is the amount of sales and profits.

Activity ratios measures the efficiency of effectiveness with which

a firm manages the ratio at which the fund invested in inventories

are converted into sales. 2epending upon the purpose, a number of

turnover ratios are calculated.

TYPES OF ACTIVITY RATIO

#nventory Creditors %ebtors +orin!

&urnover &urnover &urnover Capital

Ratio Ratio Ratio &urnover

Ratio

INVENTORY TURNOVER RATIO

Inventory turnover ratio is also known as stock

velocity. It established the relationship between the cost of goods

sold during a given period and average amount of inventory carried

during that period. It would indicate whether inventory has been

efficiently used or not. The purpose is to see whether only the

reuired minimum funds have been locked up in inventory. )very

firm has to maintain certain level of stock of finished goods. !ut

the level of inventory should not be too high or too low. Inventory

Turnover indicates of the firm in producing and selling its product.

It can be calculated on next page6

#nventory &urnover Ratio

0 Cost of -oods Sold

Avera!e #nventory

Cost of -oods Sold 6CO-S7

0 Sales 2 -ross Profits

OR

Cost of -oods Sold 6CO-S7

0 Openin! stoc 8 Purchases 8 %irect

(3penses 2 Closin! Stoc

Avera!e #nventory

0 Openin! Stoc 8 Closin! Stoc

9

The average inventory is the average opening

and closing balance of inventory. In a manufacturing company

inventory of finished goods is used to calculate inventory

turnover.

#),()&OR' &UR)O,(R RA&#O O* &H(

)A+A)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

N+& S(0+. 6A7 <18941::; <2:<1295

1

15<;322::

A@+*(A+ I,@+,&)*'6B7 8925:232; ;4599:<<

1

8<45298<8

ITR6AB7 9.1&"=+. 9.;&"=+. 2.:8&"=+.

INTERPRETATION

Inventory Turnover -atio measures the

velocity of conversion of stock into sales. /sually, a high

Inventory Turnover C,tock velocity indicates efficient management

of inventory because more freuently the stock is soldJ the lesser

amount of money is reuired to finance the inventory. A low

inventory turnover ratio indicates an inefficient management of

inventory. (ere in sugar mill, the ratio in <;;> was ?.< increased

to ?.= in <;;B. ,o it shows good inventory position of the sugar

mill in case of Inventory Turnover -atio.

INVENTORY CONVERSION PERIOD

It may also be of interest to see average time taken for

clearing the stock. This can be possible by calculating inventory

conversion period.

This can be calculated by following formula6%

#nventory Conversion Period

0 )o/ of :orin! days in a year

#nventory &urnover Ratio

#),()&OR' CO),(RS#O) P(R#O% O* &H(

)A+A)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

D('. ", ( '+(*6A7 ;:< ;:< ;:<

ITR 6B7 9.1 9.; 2.:8

ICP6AB7 ;28%('. 142%('. 132%('.

INTERPRETATION

Inventory turnover ratio measures the velocity of

conversion of stock into sales. /sually a high inventory turnover

ratio indicates efficient management of inventory because more

freuently the stocks are sold, the lesser amount of money is

reuired to finance the inventory and a low inventory turnover

ratio indicates an inefficient management of inventory. Thus, the

inventory turnover ratio of sugar mill is satisfactory in all the three

years.

CREDITORS TURNOVER RATIO

"reditors are naturally interested in finding out how

much time the firm is likely to take in paying its creditors. This

ratio indicates velocity with which the creditors are turned over

in relation to purchases. (igher the creditorFs turnover ratio the

more favorable it is6%

Creditors &urnover Ratio

0 &otal Credit purchases

Avera!e &rade Creditors

Avera!e &rade Creditors

0Openin! Creditors 8 Closin! Creditors

9

CR(%#&ORS &UR)O,(R RA&#O O* &H( )A+A)SHAHR

CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

N+& P$*-B(.+.6A7 ;;:518242 81;313589 88319:435

A@+*(A+ C*+%"&)*.6B7 11::823<; 11::823<; 1522<48;1

CTR6AB7 9.84&"=+. 9.325&"=+. 9.<81&"=+.

INTERPRETATION

The ratio indicates the velocity with which the

creditors are turned over in relation to purchases. 0enerally, higher

the creditorsF velocities better it is or otherwise lower the creditorsF

velocity, less favorable are the results. (ere in sugar mill, the ratio

in <;;> was ?.9B increased to ?.>;: in <;;B. ,o it shows good

A.)-A0) T-A2) "-)2IT#-, position of the sugar mill in

case of A.)-A0) T-A2) "-)2IT#-,.

- TB+ I,.&"&$&+ )C CB(*&+% A--)$,&(,& )C I,%"(

By:-Rajwinder

Kaur

BIBLIOGRAPHY

A--)$,& D+D(*&=+,&

P$*-B(.+ D+D(*&=+,&

S(0+. D+D(*&=+,&

C(,+ D+D(*&=+,&

B(0(,-+ SB++& 122:-23?1223-24?1224-25

A--)$,&. B))>.

L+%A+*.

F",(,-"(0 M(,(A+=+,&

-I.M. PANDEY

F",(,-"(0 M(,(A+=+,&

-R.P. RUSTAGI

F",(,-"(0 =(,(A+=+,&

LIMITATIONS OF THE RATIO ANALYSIS

The ratio analysis is one of the most powerful tools of analysis.

-atios are simple to calculate and easy to understand, but even

they suffer from some serious limitations.

"imited use of sin!le ratio: - A single ratio usually, does not

convey much of sense. To make a better interpretation, a number

of ratios have to be calculated which is likely to confuse the

analyst than help him in making any meaningful conclusions.

"ac of ade1uate ratio: - There are no well accepted standard

or rules of thumb for all ratios which can be accepted as norms. It

renders interpretation of the ratios difficult.

#nherent limitations of accountin!: - 1ike financial

statements, ratios are also suffers from the inherent weakness of

accounting records, such as their historical nature. -atios of the

past are not necessarily true indicators of the future.

Chan!e of accountin! procedure:- "hange in accounting

procedure by a firm often makes ratio analysis misleading example

a change in valuation methods of inventories from 5I5# to 1I5#

increase in the cost of sales and reduce considerably the value of

closing stock which makes stock turnover ratio to be lucrative

+indo: dressin!: - 5inancial statements can easily be window

dressed to present a better picture of its financial and profitability

position to outsiders. (ence one has to be very careful in making a

decision from ratios calculated from such financial statements.

Personal bias: - -atios are only means of financial analysis and

not end in itself. -atio has to be interpreted and different people

may interpret the same in different ways.

#ncomparable: - *ot only industries differ in their nature but

also the firms of the similar business widely differ in their si4e and

accounting procedure etc. It makes comparison of ratios difficult

and misleading. $oreover comparisons are made difficult due to

difference in definitions of various financial term used in the ratio

analysis.

About fi!ure distort: - -atios devoid of absolute figures may

prove distort as ratio analysis and not a ualitative analysis.

Price level chan!es: - +hile making ratio analysis,

consideration is made to the changes in price level and this make

interpretation of ratio invalid.

Ratio has no substitute: - -atio analysis is merely a tool of

financial statements analysis. (ence, become useless if separated

form the statements from which they are computed.

%iversified product lines: - $any businesses operate a large

numbers of divisions in uite different industries. In such cases

ratios are calculated on the basis of aggregated data cannot be used

for inter%firm comparisons.

*inancial data are badly distorted by inflation: - (istorical

cost values may be substantially different from true values. ,uch

distortions of financial data are carried in the financial ratios.

&o !ive a !ood shape to the popularly used financial

ratios6 % The business may make some year%ending ad8ustments.

,uch window dressing can changes the character of the financial

ratios which would be different had there been no such change.

CAUTIONS IN USING RATIO ANALYSIS

The ratio analysis is a widely used techniue to evaluate

the financial position and performance of a business. !ut there are

certain problems in using ratios. ,o the analyst should be cautions in

using -atio Analysis as it suffers from the following problems6%

It is difficult to decide on the proper basis of comparison.

The comparison is rendered difficult because of difference in

situations of two companies or of one company over years.

The price level changes make the interpretations of ratios

invalid.

The differences in the definition if terms in the balance sheet

and the profit and loss statement make the interpretation of

ratio difficult.

The ratios calculated at a point of time are less informative

but more defective as they suffer from short%term changes.

The ratios are generally calculated from past financial

statements and, thus are no indicators of future.

LIMITATIONS OF THE STUDY

o I have prepared my report on the ratio analysis of T()

*A+A*,(A(- "#%#P)-ATI.) ,/0A- $I11,

1T2.,*A+A*,(A(-. I could study 8ust one topic in the limited

period of six weeks.

o !y selecting one topic I ignored all other important topics e.g.

5inancial ,tatement Analysis, Personnel $anagement, +orking

"apital Analysis etc.

o I got an opportunity to study the financial position of T()

*A+A*,(A(- "#%#P)-ATI.) ,/0A- $I11, 1T2.,

*A+A*,(A(- and I could not reach the other top most

companies situated at different places.

o The period of study was not enough to take all factors into

consideration of concerned company.

FINDINGS AND SUGGESTIONS

I am giving some suggestions after undergoing training for a

limited period of six weeks in the *A+A*,(A(- "#%

#P)-ATI.) ,/0A- $I11, 1T2., *A+A*,(A(-, yet I

have tried to from opinion about the whole unit. I have given these

suggestions with the help of my analysis at least to some extent to

improve working and financial performance of the mills.

The mill should avail the facility of cash discount on sales.

The mill make should make efforts to decrease its cost of

goods sold by effective use of resources like raw material,

labour forces etc.

The management should try to utili4e total installed capacity.

The mills should concentrate on the profitability as well as on

the customers and farmersF satisfactions.

The system of management in the stores is not satisfactory.

There should be some modern procedure for placing

inventory and the employees in the stores should have

adeuate knowledge about the store%keeping.

The mill should give stress on the uality of product

regularly.

The mills should be free to set their price policy

independently so that they can compete with private mills.

The mill should make effort to establish alcoholic plant. It

will increase the profitability of the mills.

AVERAGE PAYMENT PERIOD

The average payment period can be meaningfully evaluated by

comparing it with the credit period allowed by the suppliers. To the

extent possible, a firm should try to maintain the Average Payment

Period which is approximately eual to the credit term of the

supplier. This will help improving 0oodwill and credit worthiness

of the firm in the market. The average payment period ratio

represents the average numbers of days taken by the firm to pay its

creditors. 0enerally lower ratio represents the better liuidity

position and higher ratio represents poor liuidity position. !ut a

higher payment period also implies greater credit period en8oyed

by the firm and conseuently larger the benefit reaped from credit

suppliers. It can be calculated by the following formula6%

Avera!e Payment Period

0 )o/ of :orin! days in a year

Avera!e trade creditors

A,(RA-( PA'.()& P(R#O% O* &H( )A+A)SHAHR

CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(* 1223 1224 1225

N). )C E)*>",A %('. 6A7 ;:< ;:< ;:<

CTR 6B7 9.84 9.32 9.<8

APP 6AB7 183%('. 19<%('. 1;3%('.

INTERPRETATION

The average payment period presents the average number of

days taken by the firm to pay its creditors. 0enerally the lower

ratio, the better is the liuidity position of the firm and the higher

ratio indicates the vice%versa. ,o, the average payment period of

the sugar mill satisfactory which shows the better liuidity position

of sugar mill. (ere in sugar mill, the average payment period in

<;;> was <9> days decreased to <?@ days in <;;B. ,o it shows

good average payment period of the sugar mill.

WORKING CAPITAL TURNOVER

RATIO

The +orking "apital Turnover -atio studies the velocity or

utili4ation of the working capital of the firm during a year. The

working capital here refers to the net working capital which is

eual to the total current assets less total liabilities. +orking

capital of a concern is directly related to sales. The current assets

like debtors, !ills receivable, cash, stock etc. change with the

decrease or increase in sales. It can be calculated with the

following formula6%

+orin! Capital &urnover Ratio

0 Cost of Sales

Annual +orin! Capital

+orin! Capital

0 Current Assets - Current "iabilities

+OR4#)- CAP#&A" &UR)O,(R RA&#O &H(

)A+A)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(* 1223 1224 1225

N+& S(0+. 6A7 <18941::; <2:<12951 ;:99<::<5

A@+*(A+ W.C. 6B7 -31<39954 -91:;2<93< ;58143;8

W.C.T.R(&") 6AB7 -3.11 -8.29 3.55

INTERPRETATION

+orking "apital Turnover -atio indicates the velocity of the

utili4ation of net working capital. This ratio indicates the number

of times the working capital is turned over in the course of year.

This ratio measures the efficiency with which the working capital

is used by a firm. +orking capital turnover ratio of the sugar mill

is not satisfactory as it negative in <;;>, <;;B and <;;: which is

%>.<<6? in <;;>, %9.;?6? in <;;B, and >.::6? in <;;: as we can say

that more funds are invested in fixed assets of the sugar mill.

GENERALLY PROFITABILITY

RATIO

The following ratios are known as generally profitability ratios6%

-ross Profit Ratio

Operatin! Ratio

Operatin! profit ratio

(3penses Ratio

)et Profits Ratio

TB+ (/)@+ =+,&"),+% *(&"). (*+ %".-$..+% ), ,+F& D(A+.!-

GROSS PROFIT RATIO

0ross profit ratio measures the relationship of

gross profits to net sales and is usually represent as a percentage.

Thus, it is calculated by dividing the gross profits by sales6%

-ross Profit Ratio

0 -ross Profits ; <==

)et Sales

OR

-ross Profit Ratio

0 Sales 2 Cost of !oods sold ; <==

Sales

-ROSS PRO*#& RA&#O O* &H( )A+A)SHAHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(* 1223 1224 1225

G*).. P*)C"& 6A7 4;35:5;2 LOSS LOSS

N+& S(0+. 6B7 <18941::; <2:<12951 ;:99<::<5

G*).. P*)C"& R(&") 6AB7 9<.54G -------------- --------------

INTERPRETATION

The 0ross Profit ratio indicates the extent to which

selling prices of goods per unit may decline without resulting in

losses on operation of a firm. It reflects the efficiency with which a

firm produces its products. As the 0ross Profit is found by

deducting cost of goods sold from the net sales, higher the gross

profit ratio &0CP ratio' better the result. (ere in sugar mill, the

0ross Profit -atio in <;;> was ?@.:B6? and loss in <;;Band <;;:.

,o it shows bad 0-#,, P-#5IT -ATI# of the sugar mill.

OPERATING RATIO

#perating -atio establishes the relationship between cost of goods

sold and other operating expenses on the one hand and the sales on

the other. In other words, it measures the cost of operating per

rupee of sales. The two basic elements of this ratio are operating

cost and sales. The ratio is calculated by dividing operating costs

with the net sales and itFs generally represented as a percentage.

Operatin! Ratio

0 Operatin! Cost ; <==

)et Sales

OR

Operatin! Ratio

0 Cost of -oods Sold8 Operatin! (3penses ;<==

)et Sales

#perating cost can be found by adding operating expenses to the

cost of goods. #perating expenses consist of6%

a' Administrative and office expenses like rent, salaries to staff,

insurance, directorFs fees etc.

b' ,elling and distribution expenses like advertisement, salaries

of salesmen, etc.

OP(RA&#)- RA&#O O* &H( )A+A)SHAHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(* 1223 1224 1225

OD+*(&",A C).& 6A7 ;294<8:2 ;9511942 ;;4421;2

N+& S(0+. 6B7 <18941::; <2:<12951 ;:99<::<5

OD+*(&",A R(&") 6AB7 <.3<&"=+. :.;2&"=+. 5.;4&"=+.

INTERPRETATION

#perating -atio indicates the percentage of net sales that is

consumed by operating cost. #bviously, higher the operating ratio,

the less favorable it is, because, it would have a small margin

&#perating Profit' to cover interest, income Mtax, dividend and

reserves. There is no rule of thumb for this ratio as it may differ

from firm to firm depending upon the nature of its business and its

capital structure. (ere in sugar mill, the #P)-ATI*0 "#,T

-ATI# in <;;> was @.>@6? times increased to A.=;6? times in

<;;B. ,o it shows bad #P)-ATI*0 "#,T -ATI# of the sugar

mill.

OPERATING PROFIT RATIO

This ratio is calculated by dividing operating profit by sales.

#perating profits is calculated as6%

Operatin! Profit

0)et Sales 2 Operatin! Cost

OR

Operatin! Profit

0 )et Sales 2 6Cost of -oods Sold 8

Administrative and Office (3penses 8 Sellin! and

%istribution (3penses7

OD+*(&",A P*)C"& -(, (0.) /+ -(0-$0(&+% (.!-

Operatin! Profit Ratio

0 Operatin! Profit ;<==

Sales

TB". *(&") -(, /+ -(0-$0(&+% (.!-

Operatin! Profit Ratio = <==- Operatin! Ratio

OP(RA&#)- PRO*#& RA&#O O* &H( )A+A)SHAHR

CO-OP(R&#,( SU-AR .#""S "&%/

P(*&"-$0(* 1223 1224 1225

O.P.R(&") 58.1<&"=+. -5;.32&"=+. 52.:1&"=+.

o O.P.RATIO = (100-OPERATING RATIO)

INTERPRETATION

The operating profit ratio indicates the extent to which the selling

prices of goods per unit may decline without resulting in losses on

operations of a firm. It reflects the efficiency with which a firm

produces its products. (ere in sugar mill, the #P)-ATI*0

P-#5IT -ATI# in <;;> was :9.<@ times and there is a loss in

:;.A<. ,o it shows bad #perating Profit -atio of the sugar mill.

EXPENSES RATIO

)xpenses ratios indicate the relationship of various expenses to

net sales. The operating ratio reveals the average total variations in

expenses may be increasing while some is falling. (ence, expenses

ratio are calculated by dividing each items of expenses or groups

of expenses with the net sales to analyse the causes of variation of

the operating ratio. The ratio can be calculated for each individual

item of expenses or a group of items of a particular type of

expenses, like cost of sales ratio, administrative expenses ratio, and

material consumed ratio, etc. +hile interpreting the ratio, it must

be remembered that for fixed expenses like rent, the ratio will fall

if the sales increases and for a variable expenses, the ratio in

proportion to sales shall remain nearly the same.

P(*&"-$0(* +FD+,.+. *(&") = P(*&"-$0(* EFD+,.+. H922

N+& S(0+.

o ,pecific expenses ratio may be calculated as under6

C).& )C A))%. .)0% *(&") = C).& )C A))%. .)0% H922

N+& S(0+.

A%=",".&*(&"@+ & OCC"-+ EFD+,.+. R(&")

= A%=",".&*(&"@+ &OCC"-+ EFD+,.+. H922

N+& S(0+.

S+00",A (,% D".&*"/$&"), EFD+,.+. R(&")

= S+00",A & D".&*"/$&"), EFD+,.+. H922

N+& S(0+.

COS& O* -OO%S SO"% RA&#O O* &H( )A+A)SHAHR

CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

C.O.G.S. 6A7 ;:1434;92 89:929;28 <:9983:3

N+& S(0+. 6B7 <18941::; <2:<12951 ;:99<::<5

C.O.G.S. R(&")6AB7 2.4&"=+. 2.4&"=+. 2.1&"=+.

A%.#)#S&RA&#O) > O**#C( (?P()S(S RA&#O O* &H(

)A+)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%.

P(*&"-$0(*. 1223 1224 1225

A%=",".&*(&"), 6A7 14844:3; ;28:8288 ;554<<88

N+& S(0+. 6B7 <18941::; <2:<12951 ;:99<::<5

A&O.E.R(&")6AB7 <.8;8G :.298G 2.999G

INTERPRETATION

(ere in sugar mill, the Administration & #ffice )xpenses -atio in

<;;> was @.9=9E increased to A.;?9E in <;;B. ,o it shows bad

A2$I*I,T-ATI#* & )NP)*,), -ATI# of the sugar mill.

S(""#)- > %#S&R#5U&#O) (?P()S(S RA&#O O* &H(

)A+A)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%.

P(*&"-$0(*. 1223 1224 1225

S+00",A EFD. 6A7 9:5:343 98<49;3 9:91511;.8

S(0+. 6B7 <18941::; <2:<91251 ;:99<::<45

S+00",A R(&") 6AB7 2.;99G 2.134G 2.88<G

INTERPRETATION

(ere it shows good ,)11I*0 & 2I,T-I!/TI#* )NP)*,),

-ATI# of the sugar mill.

LONG TERM FINANCIAL POSITION OR TEST

OF SOLVENCY

The term solvency refers to the ability of a concern to meet its

long term obligations to meet the fixed interest, cost and payment

of long term borrowings. The long% term indebtedness of a firm

includes debenture holders, financial institutions, providing long%

term and other creditors selling goods on installments basis. The

long term financial soundness or solvency of any business is

examined by calculating ratios known as leverage or capital

structure ratio. The long%term creditors of a firm are primarily

interested in knowing the firmFs ability to pay regularly interest on

long term borrowings, repayments of the principal amount at the

maturity and the security of their loans. Accordingly, long%term

solvency ratios indicate a firmFs ability to meet the interest and

costs and repayments schedules associated with its long%term

borrowings. The followings ratios serve the purpose of

determining the solvency of the concern6%

o DEBT EQUITY RATIO

o SOLVENCY RATIO

o FIXED ASSETS TO NET WORTH RATIO

o EQUITY RATIO

DEBT EQUITY RATIO

2ebt%)uity -atio is also known as )xternal%

Internal )uity -atio is calculated to measure the relative claim of

outsiders and the owners &i.e., shareholders; against the firmFs

assets. This ratio indicates the relationship between the external

euities or the outsidersF funds and the internal euities or the

shareholdersF funds thus6

%ebt-(1uity Ratio

0 Outsiders@ *unds

Shareholders@ *unds

OR

%ebt-(1uity Ratio

0 (3ternal (1uities

#nternal (1uities

O$&."%+*. F$,%. 0 A00 D+/&L"(/"0"&"+. &) )$&."%+*.?

EB+&B+* 0),A-&+*= )* .B)*&-&+*= )* EB+&B+* ", C)*= )C

%+/+,&$*+.? /),%.? =)*&A(A+ )* /"00..

SB(*+B)0%+*. F$,%. = E#$"&' SB(*+ C(D"&(0 I

P*+C+*+,-+ SB(*+ C(D"&(0 I C(D"&(0 R+.+*@+ I R+@+,$+

R+.+*@+ I R+.+*@+. *+D*+.+,&",A (--$=$0(&+% D*)C"&. &

.$*D0$.+. 0">+ *+.+*@+. C)* -),&",A+,-"+.? .",>",A C$,%.

+&-. J (--$=$0(&+% 0)..+. & %+C+**+% +FD+,.+..

%(5&-($U#&' RA&#O O* &H( )A+A)SHAHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

O$&."%+*. F$,%. 6A7 8343224:8 <91;3;531 84<11;:33

SB(*+B)0%+*.F$,%.6B7 98:<92151 98:<2:8;: 98<<9:9;:

D+/&-E#$"&' *(&")6AB7 ;.13&"=+. ;.85&"=+. ;.;8&"=+.

INTERPRETATION

The debt%euity ratio is calculated to measure the extent to which

debt financing has been used in a business. The ratio indicates the

proportionate claims of the owners and outsider against the firm

assets. A ratio of ?6? is considered to be satisfactory ratio although

there cannot be any rule of thumb in some businesses <6? is also

considered to be satisfactory. Thus, the 2ebt%)uity -atio of sugar

mill is not satisfactory as ratio is too high.

SOLVENCY RATIO

The ratio indicates the relationship between the total

liabilities to outsiders to total assets of a firm. This ratio is small

variant of euity ratio and can be simply calculated as ?;;%euity

ratio, i.e., continuing the example taken for the euity ratio,

solvency ratio L ?;;%AA.A> or say ==.==E. 0enerally, lower the

ratio of total assets, more satisfactory or stable is the long%term

solvency position of a firm.

The solvency ratio can be calculated as follows6%

Solvency Ratio

0 &otal "iabilities to Outsiders

&otal Assets

SO",()C' RA&#O O* &H( )A+A)SHSHR CO-

OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

T)&(0 L"(/"0"&"+. 6A7 :1:1999<8 :<4442823 859:<:815

T)&(0 A..+&. 6B7 3<2;898:1 319<<82;< ;:9592532

S)0@+,-' R(&")6AB7 2.4;8&"=+. 2.59;&"=+. 9.;<&"=+.

INTERPRETATION

*early the lower ratio of total liabilities to total assets, more

satisfactory or stable is the long term solvency position of the firm.

,o in case of the sugar mill, the ratio is low and again high which

is satisfactory.

FIXED ASSETS TO NET WORTH

RATIO

The ratio establishes the relationship between

fixed assets and shareholdersF funds i.e., ,hare "apital plus

-eserve, ,urplus and -etained )arnings. This ratio indicates the

extent to which shareholders funds are sunk into fixed assets.

0enerally, the purchase of fixed assets should be financed by

shareholdersF euity including reserves, surpluses and retained

earnings.

This ratio can be calculated as follows6%

*i3ed Assets Ratio

0 *i3ed Assets 6after depreciation7

Shareholders@ funds

*#?(% ASS(&S &O )(& +OR&H RA&#O O* &H(

)A+A)SHAHR CO-OP(RA&#,( SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

F"F+% A..+&. 6A7 11<4;9<22 11:;14843 1:92;9<59

SB(*+B)0%+*.C$,%.6B7 98:<92151 98:<2:8;2 98<<9:9;:

F"F+% A..+&. &) N+&

W)*&B R(&") 6AB7

9<8&"=+. 9<8&"=+. 935&"=+.

INTERPRETATION

This ratio indicates the extent to which shareholders

funds are sunk into the fixed assets. ,o if the ratio is less than

?;;E, it implies that ownerF funds are more than total fixed assets

and a part of working capital is provided by the shareholders and if

ratio is more than ?;;E then vice%versa. +hen the ratio is more

than ?;;E, it implies that ownersF funds are not sufficient to

finance the fixed assets and the firm has to depend upon outsiders

to finance the fixed assets. (ere in sugar mill, it is not satisfactory.

EQUITY RATIO

A variant to the debt%euity ratio is the proprietary ratio which is

also known as )uity -atio or ,hareholdersF to Total )uities

-atio or *et +orth to Total Assets -atio. This ratio establishes the

relationship between shareholdersF funds to total assets of the firm.

The ratio of proprietorsF funds to total funds &ProprietorsO

outsidersF funds or total funds or total assets' in an important ratio

for determining long%term solvency of a firm. The component of

this ratio is P,hareholdersF 5unds or PProprietorsF 5unds and Total

Assets. The shareholdersF funds are )uity ,hare "apital,

Preference ,hare "apital, /ndistributed Profits, -eserves and

,urpluses. #ut of this amount, accumulated losses should be

deducted. The total assets on the other hand denote total resources

of the concern.

This ratio can be calculated as under6%

(1uity Ratio

0 Shareholders@ *unds

&otal Assets

($U#&' RA&#O O* &H( )A+A)SHAHR CO-OP(RA&#,(

SU-AR .#""S "&%/

P(*&"-$0(*. 1223 1224 1225

SB(*+B)0%+*.C$,%.6A7 98<3994;3 98:<92151 98:<2:8;:

T)&(0 A..+&.6B7 355;924:: 3<2;898:1 319<<82;<

E#$"&' R(&")6AB7 2.941&"=+. 2.95<&"=+. 2.12;&"=+.

INTERPRETATION

This ratio indicates the extent to which the assets of the

company can be lost without affecting the interest of creditors of

the company. As )uity -atio represents the relationship of

ownersF funds to total assets, highest the ratio or the share of the

total capital of the company better is the long%term solvency

position of the company. Thus, the financial position of the sugar

mill is satisfactory

RATIO OF CURRENT ASSETS TO

PROPRIETORS FUNDS

The ratio is calculated by dividing the total of

current assets by amount of shareholdersF funds. This ratio

indicates the extent to which proprietorsF funds are invested in

current assets. There is no Prule of thumbF for this ratio and

depending upon the nature of the business there may be different

ratios for different firms.

This ratio can be calculated as under6%

Ratio of Current Assets to Proprietors@

*unds

0 Current Assets

Shareholders@ *unds

RA&#O O* CURR()& ASS(&S &O PROPR#(&ORS@

*U)%S O* &H( )A+A)SHAHR CO-OP(RA&#,( SU-AR

.#""S "&%/

P(*&"-$0(*. 1223 1224 1225

C.A. 6A7 823915::: ;4:2:4358 :14<5<:31

S.H. F$,%. 6B7 98:<92151 98:<2:8;: 98<<9:9;:

C.A.&) P*)D F$,%.

R(&")6AB7

133.44&"=+. 1:;.<9&"=+. 1:;.<9&"=+.

INTERPRETATION

This ratio indicates the extents to which proprietorsF

funds are invested in current assets. There is no Prule of thumbF for

this ratio and depending upon the nature of the business there may

be different ratios for different firms. (ere in sugar mill, this ratio

is satisfactory.

SUMMER TRAINING REPORT

ON

RATIO ANALYSIS

IN

T() *A+A*,(A(- "#%#P)-ATI.) ,/0A- $I11, 1T2., *A+A*,(A(-

&A PA-TIA1 -)K/I-)$)*T 5#- T() 2)0-)) #5 !."#$. &Professional'

&7)A-%<;?;'

,/!$ITT)2 T#6 % ,/!$ITT)2 !76%

RAJWINDER

KAUR

&()A2, 2)PT. #5 "#$$)-)")'

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Case Study: Nordstrom's Customer Service Culture Serves As A Control MechanismDokumen5 halamanCase Study: Nordstrom's Customer Service Culture Serves As A Control MechanismAngie RamirezBelum ada peringkat

- Job Evaluation: Foundations and ApplicationsDokumen20 halamanJob Evaluation: Foundations and ApplicationsSarani SenBelum ada peringkat

- Dessler - hrm15 - Inppt - 01Dokumen42 halamanDessler - hrm15 - Inppt - 01Kaiye KaiyeBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Case AnalysisDokumen4 halamanCase AnalysisFeljane G. Tagupa100% (2)

- Project Report On: Ethics in Recruitment and SelectionDokumen38 halamanProject Report On: Ethics in Recruitment and Selectionikjot5430Belum ada peringkat

- Introduction To Corporate Social ResponsibilityDokumen46 halamanIntroduction To Corporate Social Responsibilityikjot5430Belum ada peringkat

- Microfinancing: Joanna Buickians Narine MirzakhanyanDokumen27 halamanMicrofinancing: Joanna Buickians Narine Mirzakhanyanikjot5430Belum ada peringkat

- Amandeep Kaur MBA Ist (D) 120426141Dokumen18 halamanAmandeep Kaur MBA Ist (D) 120426141ikjot5430Belum ada peringkat

- Portfolio Management: Noorulhadi QureshiDokumen16 halamanPortfolio Management: Noorulhadi Qureshiikjot5430Belum ada peringkat

- AWESOME - Layoffs Entire Legalink Questionnaire DocumentDokumen149 halamanAWESOME - Layoffs Entire Legalink Questionnaire DocumentKarthik KannappanBelum ada peringkat

- Form e - Gip - MouDokumen2 halamanForm e - Gip - MouGarry Locquiao BravanteBelum ada peringkat

- AZCOR Manufacturing Inc., Filipinas Paso and or Arturo Zuluaga or Owner V NLRC and Candido Capulso - JasperDokumen2 halamanAZCOR Manufacturing Inc., Filipinas Paso and or Arturo Zuluaga or Owner V NLRC and Candido Capulso - JasperJames LouBelum ada peringkat

- The Effect of Flexible WorkDokumen2 halamanThe Effect of Flexible WorkAnissa LarasatiBelum ada peringkat

- Chapter III. Rights of Legitimate LaborDokumen4 halamanChapter III. Rights of Legitimate LaborOnat PagaduanBelum ada peringkat

- Executive Summary - FinalDokumen22 halamanExecutive Summary - FinalAmir AbbaszadehBelum ada peringkat

- Cirtek Ee V CirtekDokumen3 halamanCirtek Ee V CirtekDeaBelum ada peringkat

- Rodolfo vs. People GR No 146964Dokumen2 halamanRodolfo vs. People GR No 146964attyyangBelum ada peringkat

- 5c6e7d4d05e2c03b933f0a62Dokumen105 halaman5c6e7d4d05e2c03b933f0a62Devi Vara Prasad OptimisticBelum ada peringkat

- SSS Employer RegistrationDokumen70 halamanSSS Employer RegistrationCaBelum ada peringkat

- Impact of Job Stress On EmployeesDokumen11 halamanImpact of Job Stress On EmployeesTimmie Issa Bae100% (1)

- Forest Inventory and AnalysisDokumen84 halamanForest Inventory and AnalysisLUVIK AMORESBelum ada peringkat

- HR Practices in Tcs Management EssayDokumen11 halamanHR Practices in Tcs Management EssayMALATHI MBelum ada peringkat

- Slide HR Training and DevelopmentDokumen31 halamanSlide HR Training and DevelopmentSyurga FathonahBelum ada peringkat

- Canons 1-6Dokumen22 halamanCanons 1-6Ezekiel T. MostieroBelum ada peringkat

- Abueg V San DiegoDokumen1 halamanAbueg V San DiegoJohn Patrick GarciaBelum ada peringkat

- English For Written Communication Oumh1203Dokumen13 halamanEnglish For Written Communication Oumh1203JULIANA BINTI MAT NANYAN STUDENTBelum ada peringkat

- Labor Law Dau SchmidtDokumen49 halamanLabor Law Dau Schmidtανατολή και πετύχετεBelum ada peringkat

- Trafficking in Women in Israel 2003Dokumen52 halamanTrafficking in Women in Israel 2003Gordon LoganBelum ada peringkat

- CHAPTER 1. MrketingDokumen11 halamanCHAPTER 1. MrketingEricka Jean EspielBelum ada peringkat

- Module 4 of Becg Mba Sem 1Dokumen29 halamanModule 4 of Becg Mba Sem 112Twinkal ModiBelum ada peringkat

- 1578062205an Introduction To Interior Design PDFDokumen8 halaman1578062205an Introduction To Interior Design PDFQadri RamaBelum ada peringkat

- Maternity Children's Hospital Vs Sec of LAborDokumen11 halamanMaternity Children's Hospital Vs Sec of LAborKaren CapaoBelum ada peringkat

- Application For Life and Health Insurance ToDokumen5 halamanApplication For Life and Health Insurance Toimi_swimBelum ada peringkat

- District Report: N C HillsDokumen35 halamanDistrict Report: N C HillsPinak DebBelum ada peringkat

- FijiTimes - May 15 2015 PDFDokumen36 halamanFijiTimes - May 15 2015 PDFfijitimescanadaBelum ada peringkat