Vijaya Bank Retirees (Circular-1)

Diunggah oleh

Sudhakar JainJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Vijaya Bank Retirees (Circular-1)

Diunggah oleh

Sudhakar JainHak Cipta:

Format Tersedia

VIJAYA BANK RETIREES ASSOCIATION(Regd.

)

(Affiliated to A.I.B.R.F.)

CENTRAL OFFICE

TKV MEMORIAL, P.B.NO.3673, COLLEGE P.O. MAHAKAVI BHARATHIYAR ROAD,

NEAR K.S.R.T.C. BUS STAND, KOCHI 682 035

CIRCULAR NO.1/2013

Kochi

04-02-2013

Dear Friends,

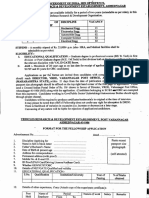

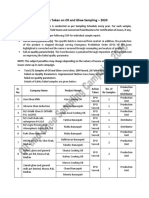

There is an increase of 67 slabs during the period from February 2013 to July 2013

DEARNESS RELIEF TO PENSIONERS 67 SLABS MORE

FROM FEBRUARY 2013. AVERAGE CONSUMER PRICE INDEX: 4976.05

Retired on or after

01.01.86 but before

01.11.92/01.07.93

Retired on or after

01.11.92/01.07.93 but

before 01.04.98

Retired on or after

01.04.98 but before

01.11.2002

Slabs over CPI 600: 1094 Slabs over CPI 1148: 957 Slabs over CPI 1684: 823

Basic Pension Amount Basic Pension Amount Basic Pension Amount

Upto Rs.1250 732.98% Upto Rs.2400 334.95% Upto Rs.3550 197.52%

Rs.1251 to

Rs.2000

Rs.9162.25

+ 601.70%

in excess of

Rs.1250/-

Rs.2401 to

Rs.3850

Rs.8038.80/-

+ 277.53%

in excess of

Rs.2400/-

Rs.3551 to

Rs.5650

Rs.7011.96

+ 164.60%

in excess of

Rs.3550/-

Rs.2001 to

Rs.2130

Rs.13675

+ 361.02%

in excess of

Rs.2000.00

Rs.3851 to

Rs.4100

Rs.12062.98

+ 162.69%

in excess of

Rs.3850/-

Rs.5651 to

Rs.6010

Rs.10468.56

+ 98.76%

in excess of

Rs.5650/-

Above

Rs.2130

Rs.14144.32

+ 185.98%

in excess of

Rs.2130/-

Above

Rs.4100

Rs.12469.70

+ 86.13%

in excess of

Rs.4100/-

Above

Rs.6010

Rs.10824.09

+ 49.38%

in excess of

Rs.6010/-

Retired on or after 01.11.2002 but before 01.11.2007

Slabs over

CPI 2288

For the previous period

From Aug. 2012 to Jan. 2013

For the current period

From Feb 2013 to July 2013

605 672

108.9% of Entire Basic Pension 120.96% Entire BasicPension

Retired on or after 01.11.2007

Slabs over

CPI 2836

For the previous period

From August 2012 to Jan. 2013

For the current period

From Feb 2013 to July 2013

468 535

70.2% of Entire Basic Pension 80.25% of Entire Basic Pension

Surviving Pre 1986 Retirees

Slabs Rate & Amount of Dearness Relief Total Amount Payable

1094 732.98% on Ex-Gratia Rs.300 = Rs.2198.94 Rs.2,498.94

We have submitted the following representation to the bank management and same is re-produced

herein below:-

The Chairman &MD Date: 27-12-2012

Vijaya Bank,

Head Office,

Bangalore

Dear Sir,

We have been representing to the Management to consider several issues relating to the pensioners.

The facilities we have sought for pensioners are available in most of the Public sector banks. However

except Identity cards for those who retired under VRS no other issue has been considered so far. We

request the management to be considerate and compassionate to those who retired from the Bank

after serving the Bank for years. While all other banks are considerate to pensioners and recognize their

service to the banks unfortunately our Bank is yet to show such consideration to them.

1. Medical Aid our Bank is extending Rs.1500/-per annum to the pensioners who retired on

superannuation. Most of the banks increased the same to Rs.2000/-and more. Further the

facility is available to those retired before attaining superannuation, when they reach the age of

60. Several bank have evolved scheme for reimbursement of medical expenses under certain

scheme. We request you to evolve a reasonable and respectable Medical Scheme for all

Pensioners.

2. Holiday Homes In many banks pensioners are entitled to stay in holiday homes as in the case

of serving employees. We request you to consider the same to pensioners also.

3. Allocation of funds for welfare of retirees out of staff welfare fund In many banks substantial

amount is allotted to welfare of retirees as per the direction of Government/IBA. In our bank

substantial fund is available in the staff welfare fund. We request the bank to allot substantial

amount for the welfare of the pensioners so that bank can extend increased medical

aid/facilities to the retirees.

4. Grievance Cell IBA has advised the Banks to set up Grievance Cell to discuss

grievances/complaints of pensioners. While in most of the banks such Cells have been

established and discussions are held periodically with Retirees organizations , we regret that

our repeated request in the matter has not been considered by the Bank.

5. In certain banks pensioners are extended festival advances and also credit facilities to

pensioners on easy terms. We request the bank to consider the facilities to pensioners of our

bank.

6. Pension Pass Books We request the bank to supply Pension Pass Book to pensioners as in the

case of other banks.

7. In the past our Bank was enrolling Legal practitioners after retiring/resigning from the Bank in

the panel of advocates. Sometime back Bank took a decision to withdraw all the files from them

and stopped including such persons in the panel. In fact the Bank was in an advantageous

position while utilizing their services as they have knowledge and commitment to the Bank. We

request the Management to reconsider the issue.

Sir, we have not requested for facilities that are not available in other banks. We believe that the

contribution of the employees of our Bank have not been inferior to that in the other banks. Yet our

bank has not been considerate to them when they retire. We request the Management to be

magnanimous and humanitarian towards the retirees as in the case of other banks.

We sincerely hope that the Management will consider our request at an early date.

Yours faithfully,

Sd/-

C.Gopinathan Nair,

President

5 YEARS NOTIONAL WEIGHTAGE:-

We have received the Judgment copy of transfer petition (civil) No.1291 of 2012 against VBRA from

Honble Supreme Court. Since the said petition was dismissed by the Honble Supreme Court we have

now filed a petition for direction to the bank to allow 5 years weightage of service to the pensioners on

03-01-2013 at Honble High Court of Kerala. The case is now posted for hearing on 28-01-2013 and it is

further adjourned. The SLP filed by the bank at Honble Supreme Court is not yet posted for hearing.

INCENTIVE SCHEME FOR RETIRED STAFF ENGAGED AS RECOVERY AGENTS:-

We have received a letter from Credit-Review & Recovery Department, Head Office, Bangalore

(Ref:CD/R&R/AGM/SD/2064/2012 dated 27-11-2012). The same is reproduced herein below for the

information of our members:-

NPA of every Bank is increasing day by day across the Banking Industry. The level of NPA is touching to

its new high unless curbed immediately. Such huge increase in NPA will affect the health of the

organization.

We understand that persistent follow up with the borrowers and guarantors will yield good results in

recovery of NPA accounts. We have a Board approval policy for engaging the services of retired staff

members of Public Sector Banks as the employees of PSBs will have an experience in dealing with NPA

accounts of their respective Banks, while in employment. We intend to utilize the services of such

experience work force in reduction of NPA of the Bank.

The basic features of the scheme are as under:-

Eligibility for empanelment:-

Retired officials(both officers & clericals) of our Bank and officers of Public Sector Banks/Public Sector

Enterprises/Government departments. Officials who have retired after superannuation or on

VRS/resignation are eligible for empanelment as recovery agents. Officials leaving services on account

of Termination shall not be eligible. Preference may be given to pensioners.

Age at the entry level should not be more than 65 years. Maximum age limit is 70 years. They should

have sound physical and mental health and should be able to undertake field visits. They should possess

proper orientation in recovery matter.

Retired officials should possess a good track record and should not have any pending criminal case

against them.

Retired officials should have undergone required training and obtained certificate from IIBF/any

approved institution.

Retired Officers and Clerks of Vijaya Bank.

Retired Officers of other Public Sector Bank.

Scope of Assignment:-

The recovery agents shall report to Regional Manager(through the Recovery In-charge) who shall assign

the Branches and the NPA accounts to be recovered. The scope of work of Recovery Agent shall mainly

include the following:-

Concentrate their operations to the accounts allotted to them by the respective Regional Heads;

Contacting the borrowers personally/telephonically for recoveries;

Motivating and encouraging the borrowers in settlement of low value NPAs;

Strictly follow the guidelines on Recovery of NPAs issued by the Bank from time to time;

The actions of the Recovery Agents should not be detrimental to the interest of the Bank.

The Recovery Agents shall adhere strictly to the guidelines issued by the Bank/Reserve Bank of

India/Banking Code and Standards Board of India(BCSBI) from time to time in the process of recovery.

Payment of commission:-

A. For Doubtful Assets(DA-2 DA-3 only):-

Particulars: Rate of /commission

Recovery up to 2 lakhs 3% of amount recovered

Above 2.00 lakhs 6000/-for the first 2.00lakh recovery plus 4%(ie added incentive of 1%)

Of balance amount

B. For Loss Assets/AUC account:-

Recovery upto 2 lakhs 5% of amount recovered

Above 2.00 lakhs 10,000/- for the first 2.00 lakh recovery plus 6%(i.e.added incentive of

1%)on balance amount.

We request you to intimate your members abount the scheme and advise the interested persons to

approach our nearest Branch for further details.

Thanking you,

Yours faithfully,

Sd/-

(DGM)

MADRAS HIGH COURT DECISION IN 100% DA NEUTRALISTION TO PRE NOVEMBER 2002 RETIREES:-

We reproduce Central Office Circular No.2012/1105 dated 31-12-2012 which itself is expanatory.

The Chairman,

Indian Bank Association,

Mumbai

Dear Sir,

Re:Madras High Court Decision on 100% DA Neutralisation to Pre November 2002 Retirees:-

We wish to invite your kind attention on Madras High Court decision dated 14-12-12 on Writ Petition

No.5000 of 2006 and other W.Ps filed by 81 retirees of Canara Bank,Indian Overseas Bank and Bank of

Baroda in the matter of payment of 100% DA neutralisation to pre-November 2002. While delivering

the judgement, the Court has directed the respondent banks to pay the dearness allowance at the

revised rates as per the provisions of 8

th

wage settlement to pre-November 2002 retirees with payment

of arrear in this regard from the date fixed in the settlement. The court has also stated in the judgement

that this benefit should be made available to all similarly placed retirees.

On going through the contents of the judgement, you will find that the court has pronounced the

judgement on the following principles laid down by the Supreme Court in the matter of defined benefit

pension scheme.

a) In famous case of Nakara V/s Union Bank of India, the constitutional bench of Supreme Court

has laid down the principle that any inprovement made in the existing pension scheme, the

benefits have to extended to the existing retirees too.

b) Inflation data as measured by All India Consumer Price Index affects all retirees alike. Therefore

benefit of improved formula can not be restricted to a section of retirees. It will amount to

creation of class within the class and such artificial division is not permissible under the law.

You will kindly observe the Madras High Court Decision is based on sound principles of law as laid down

by the Supreme Court in the past. We therefore request you to advise member banks to implement the

decision and pass on the benefits to all affected retirees.

At this juncture we may mention that in the year 2009, Supreme Court had delivered judgement on the

writ peition filed by retirees of 5 banks, asking banks to pass on benefit of notional service under

regulations no 29 of the pension regulations. IBA had taken very pragmatic view on this judgement and

asked member banks to pass on the benefit to all affected retirees. We are sure that IBA would take

similar stand on Madras High Court decision and give similar nature of advice to member banks.

Here we would also like to draw your kind attention on Litigation policy of Government of India which

stipulates that if decisions are based on certain laid down principles of law laid down by the Supreme

Court, appeal against the judgement should be avoided. In this case the affected people are senior

citizens of the country. We are sure IBA would take pragmatic view and avoid harship to senior citizens.

With respectful regards,

Yours faithfully

Sd/-

(S.C.JAIN)

GENERAL SECRETARY

1616-1684 Case Pending in the Supreme Court:-

The above case is pending in the Supreme Court for final disposal. As you know this case relates to

payment of arrear of pension difference and payment of commutation difference to about 1 lakh

retirees who retired between 1998 to 2002. 7

th

wage settlement fixed pension of those retired after

1998 on index of 1616 while pay of employees were fixed on index of 1684. This resulted in fixation of

pension at about 42 percent of pay instead of 50% provided in the pension regulations. This position

was corrected under 8

th

settlement and the pension was restored to 50%. However the arrears were

paid with effect from 01-05-2005 instead from the date of retirement. The amount involved in arrear

payment on this issue is fairly large running into several crores.

In view of huge financial interest of retirees involved and government/IBA decision was ab-initio illegal

and contrary to the provisions of settlement many individuals and organisations approached to the

courts for justice. High Court have given decision in favour of retirees. But the bank management/IBA

have filed SLPs in the Supreme Court. SLP filled by Bank of Baroda Management and subsequently

joined by IBA is likely to be heard in the coming days. Many other petitions filed by retirees of other

bank like Canara Bank, SBM etc are getting tagged with Bank of Baroda case for final hearing. We

understand that about 750 petitioners are involved in this case.

Considering the huge financial benefits involved to large number of retirees and it is decided by AIBRF to

coordinate the legal handling of the case at Supreme Court and pledge all support to our comrades who

are fighting the case for the benefit of large number of retirees. Any individual who want to join the SLP

may contact us for guideance and support.

Thanking you,

Yours Sincerely,

Sd/-

(S.C.JAIN)

GENERAL SECRETARY

REGIONAL CONFERENCE OF MYSORE CITY:-

The Regional Conference of Vijaya Bank Retirees Association was held on 11-11-2012 at M.S.Hall Ideal

Jave Rotary School, JLB Road, Mysore.

The following representatives stood elected in the Regional Conference:-

Regional Predsident Sri.Gundappa Gowda L.N, Vice President Sri.T.Sudhakar Shetty and Sri.Mari

Gowda.M.A, Secretary Sri.N.S.Somanath, Joint Secretary Sri.S.Jayarama Prasad, Sri.Bala Sundara and

Sri.G.P.Diwakar, Treasurer Sri.Ramachandra Urs, Committee Members Sri.C.P.Vijayalakshmi,

Sri.M.N.Jayaprakash, Sri.V.S.N.Aradhya, Sri.H.P.Damodhar, Sri.B.A.Puttaswamy, Sri.K.S.Pritham Nayak

and Sri.V.R.Krishna Kumar, Special Invities Sri.Neemiraja Shetty and Sri.Gopal Shetty.

GENERAL BODY:-

Our General Body meeting of the association will be held on Sunday the 17

th

March 2013 at Hotel

Ajantha, M.G.Road, Bangalore. The Notice of the General Body will be forwarded shortly. We have

arranged an office at Bangalore and the address is given below:-

No.89,Shell House, 3

rd

floor Roof Top, J.C.Road, Bangalore 560 002. At present the office is shared with

AIBRA Karnataka State Committee and Canara Bank Retirees Association. After the General Body we will

have an Office at Bangalore also.

Website:

We are in the process of establishing a Website. The circulars and other details will be available in our

website. Once our Website is established, we wish to discontinue/reduce the mailing of circulars. Even

though we have informed our members that any of our members who wish to get the copy of the

circular, will have to inform the same to our Central Office with their staff code number. Sofar we have

received only very few letters. Please inform the information immediately.

For any details please visit AIBRF Website: http/www.aibrf.com

C.GOPINATHAN NAIR S.G.EMBRAN

President Gen:Secretary

VIJAYA BANK RETIREES ASSOCIATION(Regd.)

(Affiliated to A.I.B.R.F.)

CENTRAL OFFICE

TKV MEMORIAL, P.B.NO.3673, COLLEGE P.O. MAHAKAVI BHARATHIYAR ROAD,

NEAR K.S.R.T.C. BUS STAND, KOCHI 682 035

NOTICE

Kochi

11-02-2013

Notice is hereby given to All the members of Vijaya Bank Retirees Association that the 3

rd

General Body

Meeting of the Association shall be held on Sunday the 17

th

March 2013 at Hotel Ajantha, 22-A,

Mahatma Gandhi Road, Bangalore 560 001(Phone No.244844321(5 lines)Grams: Ajantha, Fax

(080)25584780) to transact the following:-

AGENDA

1) To adopt the report of the General Secretary

2) To adopt the statement of accounts

3) To consider all such Resolutions of which previous notice of 15 days in writing has been given by

any member of the union to the General Secretary.

4) To adopt the resolution recommended by the Central Committee.

5) To discuss and adopt the amendment of the Constitution.

6) Any other issues that may be brought forward with the permission of the Chair.

7) To elect Office bearers for the ensuing term.

All members are requested to attend the meeting.

S.G.EMBRAN

General Secretary

Anda mungkin juga menyukai

- Facilities IOB RetireesDokumen4 halamanFacilities IOB RetireesbalarkBelum ada peringkat

- Promotion Study Material For BankDokumen271 halamanPromotion Study Material For BankJack Meena100% (1)

- All India Bank Employees' Association: "Prabhat Nivas"Dokumen3 halamanAll India Bank Employees' Association: "Prabhat Nivas"SAKETSHOURAVBelum ada peringkat

- All India Bank Employees' Association: "Prabhat Nivas"Dokumen3 halamanAll India Bank Employees' Association: "Prabhat Nivas"Abhinav KumarBelum ada peringkat

- United Forum of Bank Unions: Sanjeev K. BandlishDokumen3 halamanUnited Forum of Bank Unions: Sanjeev K. BandlishAbhinav KumarBelum ada peringkat

- DocumentsDokumen3 halamanDocumentsupsc.bengalBelum ada peringkat

- Banker's Digest 2014Dokumen247 halamanBanker's Digest 2014suprajaconjeti1Belum ada peringkat

- Joint Letter To IBADokumen2 halamanJoint Letter To IBAnirmalBelum ada peringkat

- Ufbu Cir 2023.8 Dated 22 06 2023Dokumen2 halamanUfbu Cir 2023.8 Dated 22 06 2023Rohit KumarBelum ada peringkat

- All India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Dokumen2 halamanAll India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Vijay IyerBelum ada peringkat

- Workmen Unions Circular DT 24 09 22Dokumen2 halamanWorkmen Unions Circular DT 24 09 22Nishant SinhaBelum ada peringkat

- Pension-Cir 10 22Dokumen2 halamanPension-Cir 10 22srinivasangsrinivasaBelum ada peringkat

- Canara Bank DetailsDokumen12 halamanCanara Bank DetailsRomil GuptaBelum ada peringkat

- Sbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemeDokumen17 halamanSbi New Health InsurSBI NEW HEALTH INSURANCE SCHEMEance SchemefmsrypBelum ada peringkat

- History of State Bank of IndiaDokumen5 halamanHistory of State Bank of IndiaanilllllBelum ada peringkat

- Joint-Circular-dt 18 04 2022Dokumen3 halamanJoint-Circular-dt 18 04 2022Tarun LumbBelum ada peringkat

- All India Bank Employees' Association: "Prabhat Nivas"Dokumen3 halamanAll India Bank Employees' Association: "Prabhat Nivas"Ganti Santosh KumarBelum ada peringkat

- Deposit SchemesDokumen7 halamanDeposit SchemesTarun GargBelum ada peringkat

- Advertisement Engagement of Advisor For Retail Credit 23102018Dokumen6 halamanAdvertisement Engagement of Advisor For Retail Credit 23102018Ankita DasBelum ada peringkat

- Corporation BankDokumen31 halamanCorporation BankShruti Das50% (2)

- Create, Grow & Serve!!!': Aomsi-SssDokumen23 halamanCreate, Grow & Serve!!!': Aomsi-SssazizBelum ada peringkat

- Soneri Bank Compensation PolicyDokumen20 halamanSoneri Bank Compensation PolicySapii MandhanBelum ada peringkat

- Bankers Digest 2015Dokumen222 halamanBankers Digest 2015Anil KumarBelum ada peringkat

- Medical Benefits To RetireesDokumen5 halamanMedical Benefits To RetireesyoganaBelum ada peringkat

- Nomination Facility For ReliefSavings BondsDokumen3 halamanNomination Facility For ReliefSavings BondsnalluriimpBelum ada peringkat

- The Rajasthan State Cooperative BankDokumen11 halamanThe Rajasthan State Cooperative BankHimanshi SinghBelum ada peringkat

- RBI CIrcular 1Dokumen11 halamanRBI CIrcular 1gauravdjain05Belum ada peringkat

- Union Bank of India (Project Report)Dokumen19 halamanUnion Bank of India (Project Report)sguldekar12350% (2)

- All India Bank Employees' Association: "Prabhat Nivas"Dokumen5 halamanAll India Bank Employees' Association: "Prabhat Nivas"santoshkumarBelum ada peringkat

- Rahul Singh 119Dokumen13 halamanRahul Singh 119Jerry SinghBelum ada peringkat

- PNB Doctor - S DelightDokumen18 halamanPNB Doctor - S DelightNishesh KumarBelum ada peringkat

- Medical Reimbursement Scheme For Bank Officers - Employees Under 10th BPS - Banking SchoolDokumen7 halamanMedical Reimbursement Scheme For Bank Officers - Employees Under 10th BPS - Banking SchoolNadeem MalekBelum ada peringkat

- Assignment: Investment ManagementDokumen12 halamanAssignment: Investment ManagementYadwinder SinghBelum ada peringkat

- Disbursement of Pension by Agency BanksDokumen25 halamanDisbursement of Pension by Agency BanksnalluriimpBelum ada peringkat

- Executive Summary: ". During MyDokumen49 halamanExecutive Summary: ". During MyAjay KaundalBelum ada peringkat

- To, Shri P. K. Purwar, Chairman and Managing Director, Bharat Sanchar Nigam Limited, New DelhiDokumen2 halamanTo, Shri P. K. Purwar, Chairman and Managing Director, Bharat Sanchar Nigam Limited, New DelhiY_AZBelum ada peringkat

- Retail Lending Policy 2010-11Dokumen25 halamanRetail Lending Policy 2010-11Bhandup YadavBelum ada peringkat

- Base SchemeDokumen19 halamanBase SchemeSandipNanawareBelum ada peringkat

- Master Circular - Disbursement of Government Pension by Agency BanksDokumen12 halamanMaster Circular - Disbursement of Government Pension by Agency BanksSrinivaasBelum ada peringkat

- E-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Dokumen7 halamanE-Circular: Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (CLSS)Ramya MaddulaBelum ada peringkat

- APLTRDokumen5 halamanAPLTRPradeep KannanBelum ada peringkat

- Pension FundDokumen22 halamanPension FundsyilaBelum ada peringkat

- Term Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Dokumen33 halamanTerm Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Tuhin KhalekuzzamanBelum ada peringkat

- "Credit Management of United Commercial Bank Limited" Which IsDokumen17 halaman"Credit Management of United Commercial Bank Limited" Which IsMahmud MishuBelum ada peringkat

- Sbi Summer Internship PresentationDokumen12 halamanSbi Summer Internship PresentationPankaj SharmaBelum ada peringkat

- Savings Bank Accounts: Objectives of The TopicDokumen17 halamanSavings Bank Accounts: Objectives of The Topicsvm kishoreBelum ada peringkat

- Performance Appraisal: Eneral Bjectives of Erformance PpraisalDokumen4 halamanPerformance Appraisal: Eneral Bjectives of Erformance PpraisalAIMAN SAMI 18389Belum ada peringkat

- Types of Bank AccountsDokumen13 halamanTypes of Bank AccountsD PBelum ada peringkat

- Assignment: Submitted ToDokumen12 halamanAssignment: Submitted ToYadwinder SinghBelum ada peringkat

- Introduction To Banking: Mishu Tripathi Assistant Professor-FinanceDokumen93 halamanIntroduction To Banking: Mishu Tripathi Assistant Professor-FinanceSindru BarbiBelum ada peringkat

- Aibea Cir 514.9Dokumen2 halamanAibea Cir 514.9Naveen MBelum ada peringkat

- PNB Personal Loan Scheme-Pnb Sahyog Covid 19Dokumen17 halamanPNB Personal Loan Scheme-Pnb Sahyog Covid 19Nishesh KumarBelum ada peringkat

- Safari - Jul 2, 2019 at 06:51Dokumen1 halamanSafari - Jul 2, 2019 at 06:51Nash JuaqueraBelum ada peringkat

- About Oriental Bank of CommerceDokumen10 halamanAbout Oriental Bank of CommerceMandeep BatraBelum ada peringkat

- Charity PolicyDokumen7 halamanCharity PolicyCookie Choko100% (1)

- Job Offer-Debt Manager-Flows-2 Wheeler LoanDokumen13 halamanJob Offer-Debt Manager-Flows-2 Wheeler LoanVijayakumar KBelum ada peringkat

- Allowances, Fee & Honourarium, Cea and Advances AllowancesDokumen11 halamanAllowances, Fee & Honourarium, Cea and Advances Allowancesronny38000Belum ada peringkat

- Damodaran Committee Report On Banking Customer ServicesDokumen21 halamanDamodaran Committee Report On Banking Customer ServicesAnant JainBelum ada peringkat

- BF SheetDokumen4 halamanBF SheetSudhakar JainBelum ada peringkat

- Revised Coal PriceDokumen5 halamanRevised Coal PriceSudhakar JainBelum ada peringkat

- Inspection Final SopDokumen25 halamanInspection Final SopSudhakar JainBelum ada peringkat

- Bottle Manpower AssessmentDokumen5 halamanBottle Manpower AssessmentSudhakar JainBelum ada peringkat

- Concerned Section Action To Be Taken Solution StepsDokumen1 halamanConcerned Section Action To Be Taken Solution StepsSudhakar JainBelum ada peringkat

- Printer CalculationDokumen6 halamanPrinter CalculationSudhakar JainBelum ada peringkat

- Extreme Energy MotivationDokumen17 halamanExtreme Energy MotivationSudhakar JainBelum ada peringkat

- Plot No.701, Industrial Area, Phase-I, Chandigarh - Phone No.0172-2679003, Email:ctu-Chd@nic - In, WWW - Chdctu.gov - inDokumen1 halamanPlot No.701, Industrial Area, Phase-I, Chandigarh - Phone No.0172-2679003, Email:ctu-Chd@nic - In, WWW - Chdctu.gov - inSudhakar JainBelum ada peringkat

- Aiims Bhopal Office Assistant Previous PaperDokumen45 halamanAiims Bhopal Office Assistant Previous PaperSudhakar Jain64% (14)

- Notification VRDE Ahmednagar JR Research Fellow Posts PDFDokumen2 halamanNotification VRDE Ahmednagar JR Research Fellow Posts PDFSudhakar JainBelum ada peringkat

- IBPS Clerk: Computer QuizDokumen2 halamanIBPS Clerk: Computer QuizSudhakar JainBelum ada peringkat

- Score More Than 70 in Technical (100% GUARANTEE) : SSC Je Mechanical 1500 Most Important Question SolvedDokumen1 halamanScore More Than 70 in Technical (100% GUARANTEE) : SSC Je Mechanical 1500 Most Important Question SolvedSudhakar JainBelum ada peringkat

- Housing For AllDokumen30 halamanHousing For AllSudhakar JainBelum ada peringkat

- Je Me Mechanical Dmrcechanical DMRCDokumen1 halamanJe Me Mechanical Dmrcechanical DMRCSudhakar JainBelum ada peringkat

- TrackDokumen1 halamanTrackSudhakar JainBelum ada peringkat

- Delhi Metro Rail Corporation Ltd. (A Joint Venture of Govt. of India & Govt. of Delhi)Dokumen1 halamanDelhi Metro Rail Corporation Ltd. (A Joint Venture of Govt. of India & Govt. of Delhi)Sudhakar JainBelum ada peringkat

- ME 10.material Science & Production EngineeringDokumen238 halamanME 10.material Science & Production Engineeringbalajigm2340Belum ada peringkat

- Pressure Classes: Ductile Iron PipeDokumen4 halamanPressure Classes: Ductile Iron PipesmithBelum ada peringkat

- What Has The Government and The Department of Health Done To Address To The Issues of Reproductive and Sexual Health?Dokumen5 halamanWhat Has The Government and The Department of Health Done To Address To The Issues of Reproductive and Sexual Health?Rica machells DaydaBelum ada peringkat

- New Book "101 Costly HR Mistakes... and How To Fix Them" by Vanessa Nelson Released To Help Employers Avoid Costly HR Mistakes and Save MillionsDokumen2 halamanNew Book "101 Costly HR Mistakes... and How To Fix Them" by Vanessa Nelson Released To Help Employers Avoid Costly HR Mistakes and Save MillionsPR.comBelum ada peringkat

- Power Divider and Combiner: EE403-Microwave Engineering MTC, EE Dep., Electromagnetic Waves GroupDokumen52 halamanPower Divider and Combiner: EE403-Microwave Engineering MTC, EE Dep., Electromagnetic Waves GroupHabibat El Rahman AshrafBelum ada peringkat

- Pyq of KTGDokumen8 halamanPyq of KTG18A Kashish PatelBelum ada peringkat

- Action Taken On Oil and Ghee Sampling - 2020Dokumen2 halamanAction Taken On Oil and Ghee Sampling - 2020Khalil BhattiBelum ada peringkat

- Tackling Food Inflation: Ashwinkumar Kokku - 67 Malcolm Pinto - 89 Samir Vele - Nitin JadhavDokumen9 halamanTackling Food Inflation: Ashwinkumar Kokku - 67 Malcolm Pinto - 89 Samir Vele - Nitin JadhavMalcolm PintoBelum ada peringkat

- PV2R Series Single PumpDokumen14 halamanPV2R Series Single PumpBagus setiawanBelum ada peringkat

- My Public Self My Hidden Self My Blind Spots My Unknown SelfDokumen2 halamanMy Public Self My Hidden Self My Blind Spots My Unknown SelfMaria Hosanna PalorBelum ada peringkat

- Dwnload Full Fundamentals of Nursing 1st Edition Yoost Test Bank PDFDokumen35 halamanDwnload Full Fundamentals of Nursing 1st Edition Yoost Test Bank PDFdetonateousellslbc100% (11)

- Careerride Com Electrical Engineering Interview Questions AsDokumen21 halamanCareerride Com Electrical Engineering Interview Questions AsAbhayRajSinghBelum ada peringkat

- Atlas of Feline Anatomy For VeterinariansDokumen275 halamanAtlas of Feline Anatomy For VeterinariansДибензол Ксазепин100% (4)

- NTJN, Full Conference Program - FINALDokumen60 halamanNTJN, Full Conference Program - FINALtjprogramsBelum ada peringkat

- Cyber Safety PP Presentation For Class 11Dokumen16 halamanCyber Safety PP Presentation For Class 11WAZ CHANNEL100% (1)

- Marketing Study of Mango JuiceDokumen18 halamanMarketing Study of Mango JuiceVijay ArapathBelum ada peringkat

- He 3 Basic Types of Descriptive Research MethodsDokumen2 halamanHe 3 Basic Types of Descriptive Research MethodsRahul SarinBelum ada peringkat

- 10 Chapter 3 Occupancy Classification AnDokumen10 halaman10 Chapter 3 Occupancy Classification AnMatt BaronBelum ada peringkat

- Form 28 Attendence RegisterDokumen1 halamanForm 28 Attendence RegisterSanjeet SinghBelum ada peringkat

- Hydrolysis and Fermentation of Sweetpotatoes For Production of Fermentable Sugars and EthanolDokumen11 halamanHydrolysis and Fermentation of Sweetpotatoes For Production of Fermentable Sugars and Ethanolkelly betancurBelum ada peringkat

- Muslim Marriage (Nikah) : Mutual Rights and ObligationsDokumen10 halamanMuslim Marriage (Nikah) : Mutual Rights and ObligationsSachin Kumar Singh100% (1)

- Dissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoDokumen44 halamanDissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoAhnafTahmidBelum ada peringkat

- Boeco BM-800 - User ManualDokumen21 halamanBoeco BM-800 - User ManualJuan Carlos CrespoBelum ada peringkat

- UgpeDokumen3 halamanUgpeOlety Subrahmanya SastryBelum ada peringkat

- Tcu Module Pe1 Lesson 1Dokumen7 halamanTcu Module Pe1 Lesson 1Remerata, ArcelynBelum ada peringkat

- E10b MERCHANT NAVY CODE OF CONDUCTDokumen1 halamanE10b MERCHANT NAVY CODE OF CONDUCTssabih75Belum ada peringkat

- Tuyet W3 Unit 2 Tenses Adverbial Clause of Time Zalo HSDokumen16 halamanTuyet W3 Unit 2 Tenses Adverbial Clause of Time Zalo HSVũ Thanh GiangBelum ada peringkat

- WeaknessesDokumen4 halamanWeaknessesshyamiliBelum ada peringkat

- Практичне 25. Щодений раціонDokumen3 halamanПрактичне 25. Щодений раціонAnnaAnnaBelum ada peringkat

- INTP Parents - 16personalitiesDokumen4 halamanINTP Parents - 16personalitiescelinelbBelum ada peringkat

- Tetra Pak Training CatalogueDokumen342 halamanTetra Pak Training CatalogueElif UsluBelum ada peringkat