F4 Corporate and Business Law Syllabus and Study Guide

Diunggah oleh

Selva Bavani SelwaduraiHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

F4 Corporate and Business Law Syllabus and Study Guide

Diunggah oleh

Selva Bavani SelwaduraiHak Cipta:

Format Tersedia

ACCA 2013 All rights reserved.

1

Corporate and Business

Law (MYS) (F4)

June 2013 to June 2014

This syllabus and study guide is designed to help

with planning study and to provide detailed

information on what could be assessed in

any examination session.

THE STRUCTURE OF THE SYLLABUS AND

STUDY GUIDE

Relational diagram of paper with other papers

This diagram shows direct and indirect links

between this paper and other papers preceding or

following it. Some papers are directly underpinned

by other papers such as Advanced Performance

Management by Performance Management. These

links are shown as solid line arrows. Other papers

only have indirect relationships with each other

such as links existing between the accounting and

auditing papers. The links between these are shown

as dotted line arrows. This diagram indicates where

you are expected to have underpinning knowledge

and where it would be useful to review previous

learning before undertaking study.

Overall aim of the syllabus

This explains briefly the overall objective of the

paper and indicates in the broadest sense the

capabilities to be developed within the paper.

Main capabilities

This papers aim is broken down into several main

capabilities which divide the syllabus and study

guide into discrete sections.

Relational diagram of the main capabilities

This diagram illustrates the flows and links between

the main capabilities (sections) of the syllabus and

should be used as an aid to planning teaching and

learning in a structured way.

Syllabus rationale

This is a narrative explaining how the syllabus is

structured and how the main capabilities are linked.

The rationale also explains in further detail what the

examination intends to assess and why.

Detailed syllabus

This shows the breakdown of the main capabilities

(sections) of the syllabus into subject areas. This is

the blueprint for the detailed study guide.

Approach to examining the syllabus

This section briefly explains the structure of the

examination and how it is assessed.

Study Guide

This is the main document that students, tuition

providers and publishers should use as the basis of

their studies, instruction and materials.

Examinations will be based on the detail of the

study guide which comprehensively identifies what

could be assessed in any examination session.

The study guide is a precise reflection and

breakdown of the syllabus. It is divided into sections

based on the main capabilities identified in the

syllabus. These sections are divided into subject

areas which relate to the sub-capabilities included

in the detailed syllabus. Subject areas are broken

down into sub-headings which describe the detailed

outcomes that could be assessed in examinations.

These outcomes are described using verbs

indicating what exams may require students to

demonstrate, and the broad intellectual level at

which these may need to be demonstrated

(*see intellectual levels below).

Learning Materials

ACCA's Approved Learning Partner - content (ALP-

c) is the programme through which ACCA approves

learning materials from high quality content

providers designed to support study towards ACCAs

qualifications.

ACCA has one Platinum Approved Learning Partner

content which is BPP Learning Media. In addition,

there are a number of Gold Approved Learning

Partners - content.

ACCA 2013 All rights reserved.

2

For information about ACCA's

Approved Learning Partners - content, please go

ACCA's Content Provider Directory.

The Directory also lists materials by Subscribers,

these materials have not been quality assured by

ACCA but may be helpful if used in conjunction with

approved learning materials. You will also

find details of Examiner suggested Additional

Reading which may be a useful supplement to

approved learning materials.

ACCA's Content Provider Directory can be found

here

http://www.accaglobal.com/learningproviders/alpc/c

ontent_provider_directory/search/.

Relevant articles will also be published in Student

Accountant.

INTELLECTUAL LEVELS

The syllabus is designed to progressively broaden

and deepen the knowledge, skills and professional

values demonstrated by the student on their way

through the qualification.

The specific capabilities within the detailed

syllabuses and study guides are assessed at one of

three intellectual or cognitive levels:

Level 1: Knowledge and comprehension

Level 2: Application and analysis

Level 3: Synthesis and evaluation

Very broadly, these intellectual levels relate to the

three cognitive levels at which the Knowledge

module, the Skills module and the Professional level

are assessed.

Each subject area in the detailed study guide

included in this document is given a 1, 2, or

3 superscript, denoting intellectual level, marked at

the end of each relevant line. This gives an

indication of the intellectual depth at which an area

could be assessed within the examination. However,

while level 1 broadly equates with the Knowledge

module, level 2 equates to the Skills module and

level 3 to the Professional level, some lower level

skills can continue to be assessed as the student

progresses through each module and level. This

reflects that at each stage of study there will be a

requirement to broaden, as well as deepen

capabilities. It is also possible that occasionally

some higher level capabilities may be assessed at

lower levels.

LEARNING HOURS AND EDUCATION

RECOGNITION

The ACCA qualification does not prescribe or

recommend any particular number of learning hours

for examinations because study and learning

patterns and styles vary greatly between people and

organisations. This also recognises the wide

diversity of personal, professional and educational

circumstances in which ACCA students find

themselves.

As a member of the International Federation of

Accountants, ACCA seeks to enhance the education

recognition of its qualification on both national and

international education frameworks, and with

educational authorities and partners globally. In

doing so, ACCA aims to ensure that its qualifications

are recognized and valued by governments,

regulatory authorities and employers across all

sectors. To this end, ACCA qualifications are

currently recognized on the education frameworks in

several countries. Please refer to your national

education framework regulator for further

information.

Each syllabus contains between 23 and 35 main

subject area headings depending on the nature of

the subject and how these areas have been broken

down.

GUIDE TO EXAM STRUCTURE

The structure of examinations varies within and

between modules and levels.

The Fundamentals level examinations contain

100% compulsory questions to encourage

candidates to study across the breadth of each

syllabus.

The Knowledge module is assessed by equivalent

two-hour paper based and computer based

examinations.

The Skills module examinations are all paper based

three-hour papers. The structure of papers varies

from ten questions in the Corporate and Business

ACCA 2013 All rights reserved.

3

Law (F4) paper to four 25 mark questions in

Financial Management (F9). Individual questions

within all Skills module papers will attract between

10 and 30 marks.

The Professional level papers are all three-hour

paper based examinations, all containing two

sections. Section A is compulsory, but there will be

some choice offered in Section B.

For all three hour examination papers, ACCA has

introduced 15 minutes reading and planning time.

This additional time is allowed at the beginning of

each three-hour examination to allow candidates to

read the questions and to begin planning their

answers before they start writing in their answer

books. This time should be used to ensure that all

the information and exam requirements are properly

read and understood.

During reading and planning time candidates may

only annotate their question paper. They may not

write anything in their answer booklets until told to

do so by the invigilator.

The Essentials module papers all have a Section A

containing a major case study question with all

requirements totalling 50 marks relating to this

case. Section B gives students a choice of two from

three 25 mark questions.

Section A of both the P4 and P5 Options papers

contain one 50 mark compulsory question, and

Section B will offer a choice of two from three

questions each worth 25 marks each.

Section A of each of the P6 and P7 Options papers

contains 60 compulsory marks from two questions;

question 1 attracting 35 marks, and question 2

attracting 25 marks. Section B of both these

Options papers will offer a choice of two from three

questions, with each question attracting 20 marks.

All Professional level exams contain four

professional marks.

The pass mark for all ACCA Qualification

examination papers is 50%.

GUIDE TO EXAMINATION ASSESSMENT

ACCA reserves the right to examine anything

contained within the study guide at any examination

session. This includes knowledge, techniques,

principles, theories, and concepts as specified.

For the financial accounting, audit and assurance,

law and tax papers except where indicated

otherwise, ACCA will publish examinable

documents once a year to indicate exactly

what regulations and legislation could potentially be

assessed within identified examination sessions..

For paper based examinations regulation issued or

legislation passed on or before 30

th

September

annually, will be assessed from June 1

st

of the

following year to May 31

st

of the year after. .

Please refer to the examinable documents for the

paper (where relevant) for further information.

Regulation issued or legislation passed in

accordance with the above dates may be

examinable even if the effective date is in the future.

The term issued or passed relates to when

regulation or legislation has been formally approved.

The term effective relates to when regulation or

legislation must be applied to an entity transactions

and business practices.

The study guide offers more detailed guidance on

the depth and level at which the examinable

documents will be examined. The study guide

should therefore be read in conjunction with the

examinable documents list.

ACCA 2013 All rights reserved.

4

Syllabus

AIM

To develop knowledge and skills in the

understanding of the general legal framework, and

of specific legal areas relating to business,

recognising the need to seek further specialist legal

advice where necessary.

MAIN CAPABILITIES

On successful completion of this paper candidates

should be able to :

A Identify the essential elements of the Malaysian

legal system including the main sources of law

B Recognise and apply the appropriate legal rules

relating to the law of obligations

C Explain and apply the law relating to

employment relationships

D Distinguish between alternative forms and

constitutions of business organisations

E Recognise and compare types of capital and

the financing of companies

F Describe and explain how companies are

managed, administered and regulated

G Recognise the legal implications relating to

insolvency and corporate restructuring

H Demonstrate an understanding of governance

and ethical issues relating to business.

RELATIONAL DIAGRAM OF MAIN CAPABILITIES

Essential elements of the legal system (A)

The Law of obligations

(B)

Capital and

the

financing of

companies

(E)

Governance and ethical issues relating to business (H)

Management,

administration

and regulation

of

companies (F)

Employment law (C)

The formation and constitution of

business organisations (D)

Insolvency and

corporate

restructuring

(G)

FR (F7)

CR (P2)

CL (F4) AA (F8)

ACCA 2013 All rights reserved.

5

RATIONALE

Corporate and Business Law is essentially divided

into eight areas. The syllabus starts with an

introduction to the overall Malaysian legal system

such as the court system and sources of law,

including human rights legislation. It then leads into

the area of the law of obligations including contract

and tort, which underpin business transactions

generally.

The syllabus then covers a range of specific legal

areas relating to various aspects of business of most

concern to finance professionals. These are the law

relating to employment and the law relating to

companies. These laws include the formation and

constitution of companies, the financing of

companies and types of capital, and the day to day

management, the administration and regulation of

companies and legal aspects of insolvency and

corporate restructuring.

The final section links back to all the previous

areas. This section deals with corporate governance,

ethics and ethical behaviour relating to business

including criminal law.

DETAILED SYLLABUS

A Essential elements of the Malaysian legal

system

1. Court structure

2. Sources of law

3. Human rights

B The law of obligations

1. Formation of a contract

2. Content of contracts

3. Discharge of contract. breach of contract and

remedies

4. The law of torts

5. Professional negligence

C Employment law

1. Contract of employment

2. Dismissal and redundancy

D The formation and constitution of business

organisations

1. Law of agency

2. Conventional partnerships and limited liability

partnerships

3. Corporations and legal personality

4. Company formation

5. The company constitution

E Capital and the financing of companies

1. Share capital

2. Loan capital

3. Capital maintenance rules

F Management, administration and regulation of

companies

1. Company directors

2. Other company officers

3. Company meetings and resolutions

G Insolvency and corporate restructuring

1. Liquidation of companies

2. Corporate restructuring

H Governance and ethical issues relating to

business

1. Corporate governance

2. Fraudulent behaviour

ACCA 2013 All rights reserved.

6

APPROACH TO EXAMINING THE SYLLABUS

The syllabus is assessed by a three hour paper-

based examination.

The examination consists of seven 10 mark

questions assessing knowledge of the law, and three

10 mark application questions. All questions are

compulsory.

NOTE ON CASE LAW

Candidates should support their answers with

analysis referring to cases or examples. There is no

need to detail the facts of the case. Remember, it is

the point of law that the case establishes that is

important, although knowing the facts of cases can

be helpful as sometimes questions include scenarios

based on well-known cases. Futher it is not

necessary to quote section numbers of Acts.

ACCA 2013 All rights reserved.

7

Study Guide

A. ESSENTIAL ELEMENTS OF THE MALAYSIAN

LEGAL SYSTEM

1. Court structure

a) Explain the structure and operation of the

courts.

[1]

2. Sources of law

a) Define law and distinguish types of law.

[1]

b) Explain what is meant by case law and

precedent in the context of the hierarchy of the

courts including the importance and operation

of the doctrine of binding judicial precedent.

[2]

c) Explain legislation and delegated legislation

and its importance including controls over

delegated legislation.

[2]

d) Explain the rules and presumptions used by the

courts in interpreting statutes.

[1]

3. Human rights

a) Identify the concept of human rights with

reference to the Federal Constitution, Universal

Declaration of Human Rights and the Human

Rights Commission of Malaysia Act 1999.

[2]

b) Explain the impact of human rights law on

statutory interpretation.

[2]

c) Explain the impact of human rights on the

common law.

[2]

B THE LAW OF OBLIGATIONS

1. Formation of a contract

a) Analyse the nature of a simple contract.

[2]

b) Explain the fundamental rules governing an

offer, including the distinction between offer

and invitation to treat.

[2]

c) Explain the fundamental rules governing

acceptance.

[2]

d) Explain the meaning and the need for

consideration as well as the instances when

consideration is not required.

[2]

e) Analyse the doctrine of privity and its

application in Malaysia.

[2]

f) Explain the concept of intention to create legal

relations and the relevant presumptions that

apply.

[2]

g) Explain the concept of capacity to contract and

the effect of contracts entered into by those

who do not possess such capacity.

[2]

h) Distinguish between void and voidable

contracts and state the main circumstances

when a contract may become void or

voidable.

[2]

2. Content of contracts

a) Distinguish terms from mere representations.

[2]

b) Define the various contractual terms and

explain their effect.

[1]

c) Explain the nature and effect of exclusion

clauses and evaluate their control.

[2]

3. Discharge of contract, breach of contract and

remedies

a) Explain the main events that may cause a

contract to be discharged.

b) Explain the meaning and effect of breach of

contract.

[2]

c) Explain the rules relating to the award of

damages.

[2]

d) Analyse the equitable remedies for breach of

contract under the Specific Relief Act 1950.

[2]

4. The law of torts

a) Explain the meaning of tort.

[2]

b) Identify the major torts, with emphasis on the

tort of negligence.

[2]

c) Explain the duty of care and its breach.

[2]

ACCA 2013 All rights reserved.

8

d) Explain the meaning and importance of

causation and remoteness of damage.

[2]

e) Discuss defences to an action in negligence.

[2]

5. Professional negligence

a) Explain the concept of professional negligence.

b) Explain and analyse the duty of care of

accountants and auditors.

[2]

C EMPLOYMENT LAW

1. Contract of employment

a) Distinguish between employees and the self-

employed.

[2]

b) Explain the nature of the contract of

employment and give examples of the main

duties placed on the parties to such a contract

under the Employment Act 1955.

[2]

c) Explain the main rights of employees provided

for in the Employment Act 1955

2. Dismissal and redundancy

a) Explain the concepts of termination, dismissal,

redundancy and lay-off, including constructive

dismissal.

[2]

b) Discuss the remedies available to those who

have been unjustifiably dismissed.

[2]

D THE FORMATION AND CONSTITUTION OF

BUSINESS ORGANISATIONS

1. Law of agency

a) Define the role of the agent and give examples

of such relationships paying particular regard

to partners and company directors.

[2]

b) Explain how the agency relationship is

established as well as how it may be

terminated

[2]

c) Discuss the authority of an agent.

[2]

d) Discuss the rights, duties and liabilities of a

principal and an agent.

[2]

2. Conventional partnerships and limited liability

partnerships

a) Demonstrate a knowledge of the legislation

governing a conventional partnership and a

limited liability partnership.

[1]

b) Discuss how conventional and limited liability

partnerships are established.

[2]

c) Discuss the nature of the relationship among

partners and their duties towards one another

in a conventional partnership.

[2]

d) Explain the authority of partners in relation to

partnership activity in a conventional

partnership.

[2]

e) Analyse the liability of various partners for

partnership debts and liabilities in a

conventional partnership.

[2]

f) Explain the way in which conventional

partnerships may be brought to an end.

[2]

g) Explain the fundamental characteristics of a

limited liability partnership, e.g. separate legal

personality and limited liability..

[2]

h) Describe the procedure for formation and

registration of a limited liability partnership.

[2]

i) Explain the management of a limited liability

partnership.

[2]

i) Discuss the conversion of conventional

partnerships and private companies to limited

liability partnerships.

[2]

k) Explain the winding up, dissolution and striking

off procedure of a limited liability partnership.

.

[2]

3. Corporations and legal personality

a) Distinguish companies from partnerships and

sole proprietorships.

[2]

b) Explain the meaning and effect of limited

liability.

[2]

ACCA 2013 All rights reserved.

9

c) Identify and distinguish different types of

companies, especially public and private

companies.

[2]

d) Illustrate the effect of separate personality.

[2]

e) Recognise instances where separate

personality will be ignored.

[2]

4. Company formation

a) Describe the procedure for registering

companies, both public and private.

[2]

b) Explain the role and duties of company

promoters.

[2]

c) Describe the statutory books, registers, records

and returns that companies must keep or

make.

[1]

5. The company constitution

a) Explain the content and effect of the

memorandum of association.

[2]

b) Describe the contents of Table A of the fourth

schedule to the Companies Act 1965 and

explain their relevance.

[1]

c) Analyse the effect of a companys

constitutional documents.

[2]

d) Explain how the memorandum and articles of

association may be changed including the

restrictions on such alteration.

[2]

E CAPITAL AND THE FINANCING OF

COMPANIES

1. Share capital

a) Examine the different meanings of capital.

[2]

b) Illustrate the difference between various

classes of shares.

[2]

c) Explain the procedure for altering class rights

and the protection afforded to holders of class

rights.

[2]

2. Loan capital

a) State how a companys borrowing powers are

regulated under the Companies Act 1965.

[1]

b) Explain the meaning of debenture.

[2]

c) Distinguish loan capital from share capital.

[2]

d) Explain the concept of a company charge, the

differences between fixed and floating charges

and why the floating charge is a vulnerable

form of security.

[2]

e) Describe the need and procedure for registering

company charges including the effect of the

certificate of registration of the charge.

.

[2]

f) Explain the effect of non-registration of

registrable charges..

[2]

g) Explain the main rules regarding priority of

charges.

[2]

3. Capital maintenance rules

a) Explain the doctrine of maintenance of

capital.

[2]

b) Explain the main rules relating to the issue of

shares at a discount or a premium.

[2]

c) Discuss how a company may effect a reduction

of capital.

[2]

d) Discuss the prohibition on the power of

companies to purchase their own shares and to

give financial assistance for the purchase of

their own shares and the exceptions to it.

[2]

e) Examine the power of a public company to

purchase its own shares.

[2]

f) Explain the rules governing the distribution of

dividends in both public and private

companies.

[2]

ACCA 2013 All rights reserved.

10

F MANAGEMENT, ADMINISTRATION AND

REGULATION OF COMPANIES

1. Company directors

a) Explain the role of the directors in the

operation of a company.

[2]

b) Discuss the ways in which directors are

appointed, the restrictions on appointment of

directors, the circumstances in which they may

be disqualified to act as directors, and the

procedure for removal of directors from office.

[2]

c) Distinguish between the powers of the board of

directors, the managing director and individual

directors to bind their company and explain the

application of the rule in Royal British Bank v

Turquand and its exceptions.

[2]

d) Explain:

(i) the fiduciary duties (including duties of

disclosure) and the duties of care, skill and

diligence that directors owe to their companies

under common law and the Companies Act

1965;

(ii) the application of the business judgment

rule;

(iii) the instances when a company may make

loans to directors and connected persons;

and

(iv) the statutory rules that regulate substantial

property transactions between directors and

their companies.

[2]

2. Other company officers

a) Explain the qualifications and the procedure for

the appointment of a company secretary, the

duties and powers of a company secretary and

when a person may be disqualified to act as a

company secretary

[2]

b) Discuss the appointment and removal

procedure relating to and the duties and

powers of, company auditors.

[2]

3. Company meetings and resolutions

a) Distinguish between types of meetings;

ordinary and extraordinary general meetings

(including meetings requisitioned or called by

members or ordered to be called by the court)

and class meetings.

[1]

b) Explain the procedure for calling such

meetings.

[2]

c) Explain the right of a member to appoint a

proxy and the rights of a proxy at a meeting.

[2]

d) Detail the procedure for conducting company

meetings.

[2]

e) Distinguish between the different types of

company resolutions.

[2]

f) Explain the rules regarding the recording of, the

presumptions associated with, and members

access to, the minutes of a companys

meetings.

G INSOLVENCY AND CORPORATE

RESTRUCTURING

1. Liquidation of companies

a) Explain the meaning of and procedure involved

in voluntary liquidation including when winding

up is deemed to have commenced and the

effects of the commencement.

[2]

b) Explain the meaning of and procedure involved

in compulsory liquidation including who may

petition for a compulsory winding up, the

grounds for the petition, when a compulsory

winding up is deemed to have commenced and

the effects of a commencement of compulsory

winding up, and a winding up order of the

court.

[2]

2. Corporate restructuring

a) Examine the importance and application of

schemes of arrangement and reconstructions

under sections 176 to 180 of the Companies

Act 1965 as an alternative to winding up.

[2]

b) Discuss the role, duties and liabilities of

receivers and managers.

[2]

ACCA 2013 All rights reserved.

11

H GOVERNANCE AND ETHICAL ISSUES

RELATING TO BUSINESS

1. Corporate governance

a) Explain the concept of corporate governance.

[2]

b) Recognize the extra-legal codes of corporate

governance.

[2]

c) Identify and explain the regulation of corporate

governance.

[2]

2. Fraudulent behaviour

a) Recognize the nature of and legal control over

insider trading taking into account the relevant

provisions in the Capital Markets and Services

Act 2007.

[2]

b) Recognize the nature of and legal control over

money laundering.

[2]

c) Recognise the nature and legal control over

corruption and bribery.

[2]

d) Discuss potential criminal activity in the

operation, management and winding up of

companies.

[2]

e) Distinguish between fraudulent and wrongful

trading.

[2]

SUMMARY OF CHANGES TO F4 (MYS)

ACCA periodically reviews it qualification syllabuses

so that they fully meet the needs of stakeholders

such as employers, students, regulatory and

advisory bodies and learning providers.

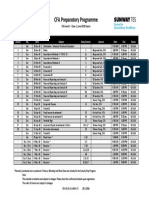

Table 1 Amendments to F4 (MYS)

The main areas that have been clarified in the

syllabus are shown in Table 1 below: (There are no

explicit additions or deletions to the syllabus).

Section and subject area Syllabus content

H2c) Fraudulent behaviour The nature and legal control over corruption and

bribery.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Ethics BookDokumen381 halamanEthics BookDrolytBelum ada peringkat

- Computation of Audit FeesDokumen4 halamanComputation of Audit FeesmarvinceledioBelum ada peringkat

- ACCA F4 To P7 Short NotesDokumen1 halamanACCA F4 To P7 Short NotesSelva Bavani SelwaduraiBelum ada peringkat

- ACCA F4 To P7 Short Notes PDFDokumen1 halamanACCA F4 To P7 Short Notes PDFSelva Bavani SelwaduraiBelum ada peringkat

- Ratio Analysis SpreadsheetDokumen1 halamanRatio Analysis Spreadsheetvinit99Belum ada peringkat

- Acca BPP Study Material 2017Dokumen5 halamanAcca BPP Study Material 2017Selva Bavani SelwaduraiBelum ada peringkat

- AREA DirectorsDokumen2 halamanAREA DirectorsSelva Bavani SelwaduraiBelum ada peringkat

- F5 AW Interactive 4966 Study GuideDokumen27 halamanF5 AW Interactive 4966 Study GuideSelva Bavani Selwadurai0% (1)

- Analysis On Sales Increase and Sales Decrease: Fig. 4.1 Average Number of Mold Produced Per YearDokumen4 halamanAnalysis On Sales Increase and Sales Decrease: Fig. 4.1 Average Number of Mold Produced Per YearSelva Bavani SelwaduraiBelum ada peringkat

- IAS 23 Borrowing CostsDokumen6 halamanIAS 23 Borrowing CostsSelva Bavani SelwaduraiBelum ada peringkat

- Wonderful Malaysia Berhad - Illustrative Financial Statements 2014Dokumen243 halamanWonderful Malaysia Berhad - Illustrative Financial Statements 2014Selva Bavani SelwaduraiBelum ada peringkat

- Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Dokumen1 halamanAkta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Selva Bavani SelwaduraiBelum ada peringkat

- IAS 16 Property, Plant and EquipmentDokumen4 halamanIAS 16 Property, Plant and EquipmentSelva Bavani SelwaduraiBelum ada peringkat

- Question 1 Consolidated Financial Statements GuideDokumen5 halamanQuestion 1 Consolidated Financial Statements GuideSelva Bavani SelwaduraiBelum ada peringkat

- Rulebook Changes For 2016 IWDokumen4 halamanRulebook Changes For 2016 IWSelva Bavani SelwaduraiBelum ada peringkat

- AnswersDokumen59 halamanAnswersSelva Bavani SelwaduraiBelum ada peringkat

- Practical Experience RequirementDokumen12 halamanPractical Experience Requirementbikal_sthBelum ada peringkat

- Chapter 1 - The Concept of Audit and Other Assurance EngagementsDokumen5 halamanChapter 1 - The Concept of Audit and Other Assurance EngagementsSelva Bavani Selwadurai50% (2)

- Chapter 2 Statutory Audit and RegulationDokumen1 halamanChapter 2 Statutory Audit and RegulationSelva Bavani SelwaduraiBelum ada peringkat

- Cfa Level 1 Jan16 v.5Dokumen1 halamanCfa Level 1 Jan16 v.5Selva Bavani SelwaduraiBelum ada peringkat

- CalendarDokumen12 halamanCalendarSelva Bavani SelwaduraiBelum ada peringkat

- Wonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Dokumen124 halamanWonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Selva Bavani SelwaduraiBelum ada peringkat

- Aca Planner 2016.ashxDokumen1 halamanAca Planner 2016.ashxSelva Bavani SelwaduraiBelum ada peringkat

- Chanakya's Quotes - Worth Reading A Million TimesDokumen1 halamanChanakya's Quotes - Worth Reading A Million TimesSelva Bavani SelwaduraiBelum ada peringkat

- Company Directors ResponsibilitiesDokumen12 halamanCompany Directors ResponsibilitiesmrlobboBelum ada peringkat

- Glossary - Companies Act FormsDokumen6 halamanGlossary - Companies Act FormsSelva Bavani SelwaduraiBelum ada peringkat

- Practical Completion Certificate Profromas v4-0Dokumen5 halamanPractical Completion Certificate Profromas v4-0marianmariusBelum ada peringkat

- Question 1 Consolidated Financial Statements GuideDokumen5 halamanQuestion 1 Consolidated Financial Statements GuideSelva Bavani SelwaduraiBelum ada peringkat

- Bank Confirmation Audit Request General 10-Jun-10Dokumen4 halamanBank Confirmation Audit Request General 10-Jun-10Selva Bavani SelwaduraiBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Part 2 - Vol 1 - Trasnet - Report of The State Capture Commission PART II Vol I 010222Dokumen506 halamanPart 2 - Vol 1 - Trasnet - Report of The State Capture Commission PART II Vol I 010222Primedia Broadcasting88% (8)

- A Bureaucrat Stole $47.4M From Ontario. Why Did It Take So Long For Anyone To NoticeDokumen3 halamanA Bureaucrat Stole $47.4M From Ontario. Why Did It Take So Long For Anyone To Noticerally123Belum ada peringkat

- Companies Act: Unit 1 Introduction To CompanyDokumen13 halamanCompanies Act: Unit 1 Introduction To CompanyPunith Kumar ReddyBelum ada peringkat

- Equatorial Realty Development, Inc. v. Mayfair Theater, IncDokumen3 halamanEquatorial Realty Development, Inc. v. Mayfair Theater, IncJm SantosBelum ada peringkat

- Assignment 2Dokumen3 halamanAssignment 2deepika snehi100% (1)

- Philippine Bus Rabbot V PeopleDokumen3 halamanPhilippine Bus Rabbot V PeopleRostum AgapitoBelum ada peringkat

- Culasi, AntiqueDokumen10 halamanCulasi, AntiquegeobscribdBelum ada peringkat

- Mental Health Act: Implementing Rules and Regulations of Republic Act No. 11036Dokumen20 halamanMental Health Act: Implementing Rules and Regulations of Republic Act No. 11036RJ BalladaresBelum ada peringkat

- Trust and Reliability: Chap 6Dokumen24 halamanTrust and Reliability: Chap 6Zain AliBelum ada peringkat

- Addition Worksheet2Dokumen2 halamanAddition Worksheet2JoyceBelum ada peringkat

- Mepa Unit 5Dokumen18 halamanMepa Unit 5Tharaka RoopeshBelum ada peringkat

- ابحاث اولي اداب مادة الترجمةDokumen3 halamanابحاث اولي اداب مادة الترجمةomarBelum ada peringkat

- تاريخ بيروت واخبار الامراء البحتريين من الغرب PDFDokumen341 halamanتاريخ بيروت واخبار الامراء البحتريين من الغرب PDFmjd1988111100% (1)

- ICICI Bank StructureDokumen13 halamanICICI Bank StructureSonaldeep100% (1)

- Unit-4 Cloud ComputingDokumen42 halamanUnit-4 Cloud ComputingBella SBelum ada peringkat

- List of 1995Dokumen6 halamanList of 1995trinz_katBelum ada peringkat

- China Banking Corporation Vs CIRDokumen3 halamanChina Banking Corporation Vs CIRMiaBelum ada peringkat

- Bca BE Permit FormDokumen4 halamanBca BE Permit Formapsapsaps1988Belum ada peringkat

- PayslipDokumen1 halamanPayslipSanthosh ChBelum ada peringkat

- Quotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Dokumen3 halamanQuotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Heidi Clemente50% (2)

- Cyber Crime PresentationDokumen20 halamanCyber Crime Presentationvipin rathi78% (9)

- Kodak Brownie HawkeyeDokumen15 halamanKodak Brownie HawkeyeLee JenningsBelum ada peringkat

- IR Practices RMG, Jute and Sugar Sectors in BDDokumen26 halamanIR Practices RMG, Jute and Sugar Sectors in BDNafiz Al SayemBelum ada peringkat

- Panitia Quran Borang Hafazan 1-5Dokumen11 halamanPanitia Quran Borang Hafazan 1-5Khairiah IsmailBelum ada peringkat

- Fin 104 S. 2019 Credit Analysis CollectionDokumen52 halamanFin 104 S. 2019 Credit Analysis CollectionJon Paul DonatoBelum ada peringkat

- EX Broker Carrier - PacketDokumen17 halamanEX Broker Carrier - PacketJor JisBelum ada peringkat

- Health Care Ethics Final 3Dokumen10 halamanHealth Care Ethics Final 3Allysa Kyle AlfonsoBelum ada peringkat

- Tysiac V Poland WebDokumen5 halamanTysiac V Poland WebNina KakauridzeBelum ada peringkat

- Citizens Charter 2015 EditedDokumen112 halamanCitizens Charter 2015 EditedRoyden delos CientosBelum ada peringkat

- Alfonso Rodriquez - The Murder of Dru SjodinDokumen14 halamanAlfonso Rodriquez - The Murder of Dru SjodinMaria AthanasiadouBelum ada peringkat