Fasfa Docs

Diunggah oleh

Kira RiveraDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Fasfa Docs

Diunggah oleh

Kira RiveraHak Cipta:

Format Tersedia

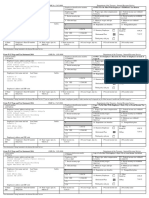

-F

2ot4-2o15 Independent

C$dff,["n%%ol.on,o'.

Student Verifi cation Worksheet

Lo Plqtq' leonordtown Pflnce Frededck Woldorf

The College of Southern Maryland's Financial Assistance Department verifies all students who have been selected for

verification by the federal processor, or when conflicting information needs to be resolved. The verification process can

take up to 6 weeks from the time the student submits the final document needed to complete the verification.

l o

tq tr6

a29ot

q-tc.

aurf

Phone Number (include area code)

In the box below, list:

1. Yourself (and your spouse)

2. Your children, if you will provide more than half of their support between July 1, 2014 and June 30, 2015.

4. Other people, if they now live with you, you provide more than half of their support AND you will continue to provide

more than half of their support between July 1, 2014 and June 30, 2015.

( ) _

ettena

lf more than twelve are in the submit additional information and student lD on the

Name of College

(lf aplicable)

WIII be Enrolled

atLeast Half

Ti me@adegreeor

e+e+er o<JOl 3\

Student lD

,il_,_]3_ l. As of the date you originally signed your FAFSA, whatwas the total in cash,

savings and checking acounts.

2. As of the date you originally signed your FAFSA, what was the net worth of

your investments, induding real estate (Do not include the value of the home you reside in)?

Net worth means cunent value minus debt

3. As of the date you originally signed your FAFSA" what uras the net worth of

your or your spouse's cunent businesses and/or

investment farms?

c

o

I

fnru" attest I have not and am not requircd to file taxes for 2013

Spouse Signature

(Optional)

Date: fl tfl tq

, l

ffi

fnn" have filed taxes. (2013 IRS issued tax return transcript required OR unchanged IRS Data RetrievalTool used)

l_l

nrue will file taxes and will submit either a 2013 IRS issued tax return transcript OR use the IRS Data RetrievalTool

(if eiigible) that is part of the FAFSA on the Web at FAFSA.gov and make no changes to the information.

Did you work at any time in 20'13?

-/

Yes (submitcopies of ALLW-2'sfor2013)

No (l did not work at any time in 2013)

By signing this worksheet, I certify that all the information rcported on this worksheet is complete and correct. I

further understand

Studenfs Signature

(Required)

doeumentation may be rcquircd in orderto complete veriftcation.

Date:

WARNING: lf you purposetully give false or misleading information on this

worksheet, vou may be fined up to $20,000, be sentenced to iail, or both.

Send All Gorreopondence to:

College of Southem Maryland " Financial Assistance Department

P.O. Box 910

*

La Plata. MD 2(n|6

"

Fax 301-93t1-789t1

Telephone: 301-9*2251,30170.3008, 301S84S131, erd. 7531, or 301-93+7531 (Direct Line)

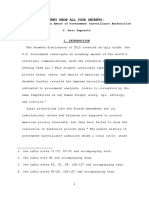

EMPTOYEE W.2 WAGE SUMMARY 2013

gogit-loarExl1

1xnqn

The ctart below indicates your 2013 voluntary payroll adiustments

which are incltded {+}, orcluded {-}, or did not affcct {?t/A}

your foderal

BRENNAN TITLE CORPORATION

wages {Box 1} and state wages.

3481 OLOWASHINGTON RO

SUITE ilXO

WALDORFMD206O2

YltLUlUIAnYflrJllSItlEItIS YTDAHO|rI{I FE0CBATWAGES ll0WAeES

PREIXHITH nS

-6Am -$.S

FEoEnAtwrrilHotlttcEreflFTtofls S 2

rDwnlrH0lDttrcExEilFlrolrs s 1

REGI'I.ARWAGES FOBzOI3 EZE.M

BFITTNEY C THOMA$SE

11602 BARD|TTOOR

gT

WALDORFMO20602

14003

PAYRoI-IsBY PAYCTIEX'

Copy C, fur employees records

Th[si nl ormafMi sbei rufmi stg| t0thherna| fevenugsni ce.l fyNafe' eq,,i edbfeata(refm,argtgencepertdty0' 0tErs$cl i 0r| mayi mdmr

Copy B, to be filed with employees FEDEML tax retum

Form W-2 Wage and Tax Statement 2013

Form W-2 Wage and Tax Statement 2013

oo32- 1o3oExt 1

I

voro

n n n n n n n r < t - n n ^ o n n I

tmpl oynrs [ame, aodrtss, and zl P c00e

BRENT{AN 1ITLE CORPORA?ION

3261 OLD WASEINGTON RD

sur f E 3040

wAr.DoRE MD 20602

Dopartment of the Trasury

-

lnlernal Fevenue Service

oMB t{0. 1545-0008

5 2 - 1 7 4 9 2 4 2 I z L A- 3 7 - 2 1 7 7

,[ps,@swpeoru

6 1 8 6 . 0 0

I Fsdenl in$trp ta( wilhhdd

5 0 5 . 6 0

empEYee

rxru-y.

Dhn siek tay

uooal secunly v{ages

6 186. 00 3 8 3 , 5 3

t 4 ul net r tmptoyee' s nam, adoress, ano l l P code

BRITTNEY C TI{OMASSET

11602 8AX.DM00R CT

WALDORF I,'D 20602

Meol care wages ang l tps

6 186. 00 a9 - 70

Social security tips I Allocated tips

, Advance EIC payment 0 uegcndeil caro benelds

I nonquailile0 plans

l5 $tate

MD

Employer's state lD No.

o6337236

t6 Slate waoes, tips, elc.

6186. 00

1 7 $tale income tax

3 8 0 . 7 8

18 Local wages, tips, elc

'19

Local income tax 20 Locality name

r Gontrol number

0032_10308X11

I

Voi d

0000000251- oo0900 |

: Employels name, address, and ZIP code

BRENNAN TTTI,E COR?ORATTON

3261 OLD WASEINSTOI{ RD

surTB 3040

WALDORF MD 24602

Deparl ment ol the Treasury

-

l nternal Revenue Servi ce

0MB l tl o, 1545-0008

Dl,r{bcrgfilicdmnwlbs

ld

ttrtployeess@blwdymflts

5 2 - 1 7 4 9 2 8 2 I 2 r 8 - 3 r - 2 1 7 7

, xps, mff cotrpEnsu

6 1 8 6 , O 0

Z l-ederal rncorne hx wltrhdd

5 0 5 . 6 0

empoyee

pnn sic* 0oy

socral secuflly lYages

6 1 8 6 . 0 0

SECUUty KX WIItrflEIU

3 8 3 . 5 3

l 2 see l nstrs. l or tsox 1

' 14

ol her I Empl oyee' s name, address, and ZIP code

BRTTTNEY C TEOI'TASSET

11602 BAT'MOOR CT

}'ALDORF UD 20602

) Medl care wages and tl ps

6 1 8 6 . 0 0

ti Meorcare lax wrtnheld

8 9 - 7 A

'

Soci al securi ty ti ps I Allocated t,ps

Advdnc EIC payment u ue0enoem carc oenenrs

ilonqua[ned plans

15 Shte

UD

Employer's slate lD ilo.

06337236

l6 Stale sages, tips, etc.

6 1 8 6 . 0 0

7 Stale incom8 tax

3 8 0 . 7 8

l8 Local wages, tips, etc- 1

g

Local income bx 20 Loaality name

Thbi ddmal i mbbei mtuml $edt0thehl eml 8ssuSdvbe. l fvfl mrmui rcdt0fl eati l retum.eMl beremd$trol h*s*f,l i i l mavbi mmsedmwi fthhi nmmei stadl esndwfdl torewti l

.;i.if

l

iifi, i . ]

,.,,li i

.

1,

ii

,'il'

i"*

' . , ]

' geg.

oo,

lf,nqia:i$^

*S"d.ng

i a. 3+,

i zg. o1

OePt'

ot tne Treasury

-

IRS

Form 1099-R

:

y,'li

i lii

jf

'

t 6'fi ri':'i'dbW

suNTRUsr

BANKS rr, rc 4oi "i i i l "'

l : 9, . l ox

coss MAr I coDe' r i osa

ATLANTA

GA 30302

865-855-5738

90. 42

1 cross distribution--

OMB No. 1545- 01 19

2@13

Form 1099-R

Di stri buti ons

From

Pensi ons,

Annui ti es,

Reti rement

or

Profi t-Shari nq

Ptans. tRAsI

Insurance

Contracts,

etc.

2a Taxabl e amount

90. 42

zo t axabt e amount

l ot al

not determi ned

di stri buti on

PAYEFT' S federat i denti f i ci Gnl i moer

59- 3482855

0801

R E C I P I E N T'S identif icatiom u m be r-

xxx-xx-"L77

In box 2a)

4 Federal income tax wittrneta-

18. 08

5 Employee contibutions

-

/Designated Roth confibutions or

I nsur ance pTemt ums

fiiii*lFXnF,lHffiril

5 Net unreal i zed appreci ati on

rn emptoyefs securi ti es

7 Di stri buti on code(s)

I

SI I VPLE

9a Your percentage

of totit d[iiibr-ibu,on

9b Total empl oyee contri buti oni

o*"ti'tfig?$ufi_tiboo

1 1 1 st year of desi g. Fl oth conti i b

13 State/Payels state no.

I 0603166--

14 State di stri buti on

E

E

- - - - - - - - - 9U. qZ

r.opy tt

Rporl l hi s i ncome 0n your l ederal l ax rel urn. t t t ht s l 0rm

sn0ws t ederat i ncome l ax wi t hhet d i n box 4, ai l ach I hi s

f,llil,1i.ffi litll;,lj's

jntomarion

is beins rurnished

10 Amount al l ocabl e to IRB wl thj n 5 years

16 Name of l ocal i t y

17 Locat di stri buti on

t

www.trs.gov/form 1 099r

L347L47L

t s47r 47t

t347 L47 L

Department

of the Treasury -

Internal R"u"nue SurVG

From

rities,

)nt or

Depanment of the treasury -

161g;;;;;;E;;il

Form 1099-R

cnFtptra

855

- 855- 5758

ffi

+ HU

iT

tfn #:'r Hfr :q fl

rft'dnp, r-r4mrc'

*"

itfli*?g*uf

.3;=Ulri

cooe

"riose

I Gross distribution

98. 42

","e'ji:"

Distributions

From

Pensions,

Annuities.

Retirement

oi

Profit-sharino

Plans, lRAs]

Insurance

Contracts,

etc.

2a Taxabte amount

; 90, 42

2b Taxable amounl

----T"td-

not detemined

distribution

PAYER'S federat identificailon num6el

59-348?835

0801

FECIPIENT' S i denti fi catton numG

xxx-xx-2t77

uaprra gatn (rnctudect

in box 2a)

4 Federal income ta witnnelO-

; 18. 08

5 erptoyge contioutioro-

/Estgnated Roth dnfibutjon, or

rnSUran@ premiufts

fl ii I i I P hililH'ilg

d $lFlmn

il'ins il s a'le' cen'lry' and z P or ro'asn

om'lalii'

i n mpl oy6r' s

$curi l i es

I

code(s) IHA"/

SEF/

IIMPLE

8 Other

ea Your percsr:se

or totar oisGour6i--

9b Totat emptoyee contriturili!

t2 State tax withhetd

t3 State/Payer's state no.

roeoai ee

--

'riii'ilB?iii?"Lfitoo

1 1sl year of desig. Roth conkib.

__- - - - - - 90: 42 vopy z

File this copy with your state, city, or

l ocal i ncome tax rel urn. when requi red.

10 Amount ailocabte to tnnGtninTl;E

@

:'i:l:::::i___l

17 Ltral distribution

l - - - - - - - - -

Form 1099-R

PAY- EBSnamest r eet addr ess, ci l yor t oWn, p' oui n. " o, @

l !.| !!IE!l rI

BANK rAc RETTREMENT

stR.

SUNTRUST

BANKS I NC 4Oi " i i i ' ' ' '

l : g: . . ! gx

46s5 t 4ArL coue-i i 6t s

ATLANTA GA 50502

865

- 855- 5738

'I

Gross distribution

90. 42

OMB No. 1545- 01 19

2@13

Form 1099-R

Di stri buti ons

From

Pensi ons,

Annui ti es.

Reti rement

oi

Profi t-Shari nq

Ptans, l RAs]

Insurance

Contracts,

etc.

2a Taxabl e amount

90. 42

zo I axabl e amount

Tot al

not det ermi ned

di st ri but i on

PAYEB' S federat i Oenti fi cati on nui l Oer

59-3482833

0801

xxx-xx-2L77

uapt rat gat n (t ncl uded

i n box 2a)

4 Federal i ncome t a" wi t hhel d-

; 18. 08

C Empl oyee Conl f l but i ons

/Designated Foth confibutjons ol

I nsur ance pr emi ums

RECIPIENTS name. slreel adOr"r fr,l,

illll'FX*8'68R'Eor*,

WALDORF

MD TO6OZ

6 Net unreal i zed appreci ati on

i n empl oyer' s securi ti es

code(s)

1

I RA/

SI MPLE

8 Other

va your percentage

ol total di stri bunon

9b Total empl oyee contri buti ons

^*""[iTilg?4iifi[%oo' 11

1st year of desi g. Fi oth contri b.

13 State/Payer's state no.

MD

I05-08-16-6

- -

' 14

State di stri buti on

I

t - - - - - - - - - 9U: 42

uopy c

For Recipient' s

Records

I nts tntormati on i s bernq furni shed to

the l nternal Revenue Seryi ce.

10 Amount al l ocabl e to IRR wi l hi n 5 years

15 Local tax wi thhel d

ro t \ drne oI t ocal t l y

17 Local di stri buti on

D

: - - - - - - - -

www.i rs. gov/form1

09gr

(keep for your records) Department

of the Treasury -

Internal Reu"nre S"rG

c Employe/s

AEROTEK

name, addre$, dd z|P @de I

Z. S@ itrstudims for box 12

l $

Wags, tips, oth6r ompenslioh

878.50

2 Fedel in@me tax withhetd-

57.97

12b

t $

3 Social writy wgs

878.50

,l S@ialwrity tax withheld

54.47

730,I PARKWAY DR

HANOVER, MD 21076

e ficl

l2c

a

l-c

t s

5 lrediqe wag6 ad tips

878.50

6 Medi@c tar withheld

12. 74

Sufi-

7 S@ial sdrity tips

8 Ail@ated tips

BRITTNEY C THOMASSET

11602 BARDMOOR COURT

WALDORF, MD 20602

2e

t $

hport Code: PRTP4yTI

9

It Nequalified plars

t0 Dependst @E bselits

h6 hlmdim Ebmqhished totu

nrmdRevfre WF

13 urulry RdffiEr--T#a

mruy*

dan shk !

n[ - l r - Copy B To Be Filed With

Employee's FEDERAL

Tax Retum

' l 4 o f i * %

I

- - +

l Empto!@'s sjd serunty n tnt

21&31-2177

I 5 Sbre

I

Ehploye/s $ale lD numb*

MD

I o687ss3o

$aie mg6, tip6, dc

878_50

17 Sate i@me tax

51. 91

18 Locd Eges, tips, etc.

B To Be Fited With Emptov;E

ffi

s2-1822806

AEROTEK

12.

l q

r wag6, tips, o&tsmpenstiq

878.50

Z Fedel in@me tax withheld

57.97

730.I PARKWAY DR

HANOVER, MD 21076

-

e Emp@ye s rd mre and inilial

Last name

1 o f 1

BRITTNEY C THOMASSET

,I1602

BARDMOOR COURT

WALDORF, MD 20602

2b

l $

3 Sftid *flrity wag6

878.50

4 Social setufty tax witntrEta-

54.47

12c

i$

l s

12d

5 Medire kgs and tjF

878.50

6 Medlde tax withhetd

12.74

I S@ial esrity tipi

5 AMed tips

l2e

9

l{ Nonqualifed

olans

t0 Depondont re bnefits

Copy 2 To Be Filed With

Employee's STATE, ClTy or

LOCAL Income Tax Retum

mFoyee

Sn d dv

'

Olher

I 5 State

MD

lmport Code: PRTp4yTf

Employee's wid srority numG

218-31-2177

Emptoyers $ate lD number

06875530

Ste wagreq tips, ei*

* _ _

glB.so

17$aieln(Metax

1tf

fcEa|mge;?;ffi

51. 91 |

W-2 Wage and Tax Statement 201 S.Rejssued

AEROTEK

2z

l $

tjp6, oths @pqsation

878.50

? Fod6al intMe l,ar wilhheld

57.97

7301 PARKWAY DR

HANOVFR N, | N ' 1N'

zb

t $

3 S@ials@rityMgs

878.50

4 Smialseority cx rvit-heE-

54.47

2c

t $

5 Medire wag and lips

878"50

6 Medicare tax wifhhdd

12.74

e Employee s fict nam. rna initiA

2d

l $

7 Sociel ssuritytips

t tips

1 o f

BRITTNEY C THOMASSET

11602 BARDMOOR COURT

WALDORF, MD 20602

2e

I

l0 Oependent E benefts

11 Ndnuagfiod Dlans

13

s,ylry nermo

---Tiro-fr

ry. ds $ddv-

n T-l rr' Copy 2 To Be Filed With

Employee's STATE, CIW or

LOC/{- Income Tax Retum

l4 Oher

lmport Code: PR7p4y.ff

t Employee's $cial s6drity h

218-31-2177

I 5 State

MD

Employe/s sbte lD number

06875530

l7 Sate in@ rax

lt-

LmiGles, !ps, etc.

51.91 |

878.50

20 Loelity name

W-2 Wage and Tax Statment 201

gRei$ued

ibtemenl

T@sury-lntmal Revenue Seryi@ OMB # 154+0008 Copt 2 To Be Filed With Employe,s State, Clry or L@l Tax DeDartments

I.=""J-!t

j1 R:y'lsag

_oIBj

lysoooe_ c"py z@

Departments

J

c Emdc

AERO

52-1822ffi6

| 2a Se instruaims fo box 1

l s

I Wag6, tips, gther

@mpensaiion

878.50 rEK

57.97

7301 PARKWAY DR

HANOVER, MD21076

-

e Employe s fi Et nam" ana initaG

1 o f 1

BRITTNEY C THOMASSET

11602 BARDMOOR

COURT

WALDORF, MD 20602

lmport Code: PRTp4yTt

b

l $

3scidwritywage

-

878.50

a Socid s@.ity tax wihheld

54.47

l2c

l $

t2d

5 MediE wag6 and 6As

878.50

6 Medire trax withhdd

12. 74

TSsidwritytiF

I Atlffird 0p

2e

t e t0 Dependenl @@ benefits

i n6 hmM 6bDq tun#d bh hhd

|M,aqrq@Fd!

orituffi n@

ffril?S*d

prhs hctre,s raa& d yi{

11 Norqualified plans

;ffiH

fl f-r

r vv! v I vt Lt vt r l vI r : l

IECORDS. (See Notjce to

:mdovee on trac*-l

14 Olhd

20L@litynre

t erdote's*"iawrity*G

2.18-31_2177

T :,". |

.:*l"j^"^"ra reffi

wr u- Ur o! 1c c r l u

|

___81850

t7 S'tate in@me lax

I

f S foet wages, tps,;d-

51. 91 |

Fom W-2 Wage and Tax Sbtement 2013 -

Reissued

oMB #

.1545-0008

Copy C for Employee's Re@rds

li3iJll"'ffi

Employee Reference Copy

YV.-,?.",."""":3!;"#1'* ?pl._3""""

d Control number

0000088106 v5c

Dept.

| 50002

Corp.

J

Employef use only

VVs I A A516A

Employe/s name, address, and Zlp cod6

PNC BANK NA

4100 w

't50TH

sT B7-Y832-02-1

CLEVELAND, OH 44135

e/f Employee's name, addreaa, and ZIP cods

BRITTNEY C THOMASSET

11602 BARDMOOR COURT

WALDORF, MD 20602

Employers FEO lO numbr

22-1146430

a Employee'3 SSA number

218-31-2177

I wagea, tipa, other comp.

a4' f 4 i t

2 Federal income tax withhsld

l nt nn

3 Social security wages

4175.42

4 Social Eecuilty tax withheld

258.88

Medicarc wages and tipa

L,l'r1 at

Medicare tax withheld

AN

Social security tipa AIOCated tips

l0 Depondont caro benefits

l r Nonqual i f i ed pl ana lza Seeinstuctions for box 12

DDr 3-72

14 Other

l2c

t2d

13 Sht empl Ret. plan|3rd party sick pa,

'15

State lEmployeds stato lD no

MD I 0677990 8

6 State wagss, tip6, otc.

417 1 i t

17 Stat6 income tax 8 Local wages, tips, stc-

19 Local i ncomet ax

l0 Locality namo

2013 W-2 and EARNTNGS SUMMARY

Thi s- sur mar y sect i on i s i ncl uded wi t h your l l - 2 t o hel p descr i be t hl s

port l on i n more det ai l . The reverse si de I ncl udes genl ral

i nf ormat l on t hat

{: l

t 11{

l l _: 9

f i nd hel pf ul . The f ol l owt ng ref l ect s

}our

f i nal pay st ut , -pi us

any adJustments made by your employer.

GRoSS

pAy

4,175-.42 socIAL sEcuRITy 258.88

FED. I]ICOME

TAX WITHHELD

Box 02 0F }' |-2

STATE IIICOME TAX

Box 17 0F }t-2

TOCAL IIICOME TAX

Box t9 0F l.|-2

6 2011 ADP. t NC

BRITTNEY C THOMASSET

11602 BARDMOOR COURT

WALDORF, MD 20602

402. 00

273.53

0. 00

TAX WITHHETD

Box 04 0F ll-2

MEDICARE TAX

}{ITHHEID

Box 06 0F t f -2

SUI / SDI

Box 14 0F l,l-2

60. 54

0. 00

Social Security Numbor 218-31-2177

Taxable Marital Statua:

SINGLE

Exomptions,/Allowances:

Foder al : 2

Stat6i 1

Local: 0

To change your empl oyee W-4 prof i l e i nf ormat l on

f i l e a new W-4 wi t h your-payrol l depart ment

PAGE 01 OF 01

wages, tlps, other comp.

4175.42

2 FsdeEl income tax withhold

402.00

3 Social Eocurity wagos

4175.42

4 Social security tax withheld

258.88

5 Medicaro wagss and tips

4175.42

6 Modi caretaxwi thhetd

60.54

d Control number

0000088106 vsc

Dept.

150002

CoO.

I

Employer use only

LWs I A 65156

c Employsr's name, address, and Zlp codo

PNC BANK NA

4100 w 150TH ST B7-Y832-O2-1

CLEVELAND, OH 44135

Empl oyer' s FED l D numbet

22-11L6Aan

yuc s 0oA numol

21431-2't77

7 Social Eocurity tips U Ailocated tipa

9: l0 Dependontcare bonofits

I Nonqualified plans

2a See instructions for box 12

DDI 3.72

14 Other

26

lJ Stat emplRt. plan prd pady sick pay

e/f Employee'a name, address and Zlp codo

BRITTNEY C THOMASSET

,I1602

BARDMOOR COURT

WALDORF, MD 20602

15 Stat

MD

Employeds state lD no

0677990 8

6 State wagea, tipa, etc.

4175.42

17 Stato i ncometax

273.53

l8 Local wages, tips, etc,

19 Local i ncomstax 20 Locality nams

Federal Fi l i ng Copy

w-2

*3?;"#1 '"-

?"pJS"..,

1 Wages, tips, other comp.

4175.42

2 Foderal income tax withheld

402.00

3 Social socurity wagos

4175.42

4 social socurity t"iHd,Hf'o

5 Medicare wages and tips

4175.42

6 Medicare tax withheld

60.54

d Control number

0000088106 v5c

Dept,

t50002

Corp.

I

Employer use only

LWs I A 6515e

c Employe/s nams, addrsss, and Zlp codo

PNC BANK NA

4100 w 150TH ST B7-YB32-02-I

CLEVELAND, OH 44135

ErrProyar s rEu t u nl

22-1146430

t Employee's SSA number

218-31-2177

Social security tips Allocatod tips

| , ' , : . . ' ' : : : ' . , j : ' . . : ' : : : : : : . , , ' , ' ' . : . : i

0 Dopendentcare benefits

I Nonqualitied plans lza

3.72 DDI

14 Other a0

J Stat emplRet. planl3rd party sick pa,

o/f Employoo's name, addross and Zlp

BRITTNEY C THOMASSET

11602 BARDMOOR COURT

WALDORF, MD 20602

code

:mployCs state lD no

0677990 I

15 Stat(

MD

16 State wagos, tips, etc.

4175.42

17 State i ncometax

273.53

18 Local wages, tipa, etc.

19 Locat ancomot ax ItJ Localty namo

MD. State Fiting Copy

W-2

*3?"","#1 '"'

?.0'!.3"""

Wages, tips, other comp.

4175.42

2 Federal income tax withheld

402.00

3 Social security wa?es42 4 Social socurity tax withheld

258.88

5 Medicare wages and tips

4175.42

Medicare tax withheld

60.54

t Control number I Deot.

0000088106 vsc bsoooz

Corp.

I

Employer use only

LWs

I A 6515G

c Employer's namo, address, and Zlp code

PNC BANK NA

4100 w 150TH ST B7-Y832-02-1

CLEVELAND, OH 44135

Employe/s FED lD r

22-1146430

a Emptoyee' s ssA numbor

21a31-2177

7 Social security tips 8 Allocatod tips

0 Dependent cars bsnefits

l l Nonqual i f i ed pl ans

DDI 3. 72

14 Other tzo

t zc

J Stal 6mp]Ret. ptanl3rd pafry srck pa

o/f Employec's name, addrsss and Ztp csle

BRITTNEY C THOMASSET

I,1602 BARDMOOR COURT

WALDORF, MD 20602

15 Stat(

MD

Employe/s state lD no

0677990 8

16 State wagea, tips, otc.

4175.42

17 State incometax

273.53

18 Local waggs, t i ps, et c.

l 9 Locat ancomet ax lO Locality namo

Ci ty or Local Fi l i ng Copy

-2

*3?;"#1 0"'

2013

ffi Internal RevEnuE S ervice

arrer"

United States Department af the rreaiury

Thi s Product Contai ns Sensi ti ve Taxpayer Data

Request Dat e : 05- l - 8- 201- 4

Response Dat e: 05- L8- 2014

Tr acki ng Number : 100197393711

Tax Return Transcri Dt

SSN Pr ovi dedz 2r a- 3r - 2I 77

Tax Per i - od Endi ng: Dec. 3L, 2013

The fol l owi ng i l ems refl ect the amount as shown on the return (pR), and

the amount as adj usted (PC), i f appl i cabl e. They do not shor^r aubsequent

acti wi -trr on the account.

SSN:

SPOUSE SSN:

NAME(S) SHOWN ON RETURN: BRITTNEY C THOMASSET

ADDRESS: L1502 BARDMOOR CT

WALDORF, I VI D 20602- 31- 03- 021

FILING STATUS:

FORM NIJMBER:

CYCLE POSTED:

RECEIVED DATE:

REMITTA\ICE:

EXEMPTION NTIMBER:

DEPENDEM| ]- NAME CTRI:

DEPENDENT 1 SSN:

DEPENDEIfT 2 NAME CTRL:

DEPENDE}{I 2 SSN:

DEPENDENT 3 NAME CTRL:

DEPENDENT 3 SSN:

DEPENDENT 4 NAME CTRL:

DEPENDENT 4 SSN:

IDENTITY THEFT PERSONAL fD NUMBER:

PTI N:

PREPARER EIN:

Income

z 1 6 - 5 r - z t I I

Si ngl e

1 0 4 0

20140504

A p r . L 5 . 2 0 1 4

$o. oo

1

0 0 0 0 0 0

WAGES, SALARI ES, TI PS, ETC: . f i 1, 6, 377. 00

TAXABL E I NTEREST I NCOME: SCH B: . . . . . . 3 0 . 0 0

TAX- EXEMPT I NTEREST: . . . . S0. 00

ORDI NARY Df VI DEND I NCOME: SCH B: . . . 50. 00

QUALI FI ED DI VTDENDS: . . g0. 00

REFLI NDS OF STATE/ LOCAI TAXES: . . 50. 00

AL I MONY RECEI VED: . . . . . . 9 0 . 0 0

BUSI NESS I NCOME OR I OSS ( Schedul e C) : . . . . $0. 00

BUSI NESS I NCOME OR LOSS: SCH C PER COMPUTER: . . . 90. 00

CAPI TAI GAI N OR L OSS: ( Sc h e d u l e

D) : . . . . . . . 9 0 . 0 0

CAPI TAL GAI NS OR LOSS: SCH D PER COMPI I TER: . . . . . . S0. 00

OT HE R GA I NS OR L OS S E S ( F o r n 4 7 9 7 ) : . . . . . . . . . 5 0 . 0 0

TOTA! I RA DI STRI BI I TI ONS: . . . . . . . $ 0 . 0 0

TAXABLE I RA DI STRI BI I TI ONS: . . 50. 00

TOTAL PENSI ONS AND ANNUI TI ES: . i o. oo

TAXABLE PENSI ON/ ANNUI TY AMOUNT: . . S270. 00

RENT/ ROYALTY/ PARn{ ERSH] P/ ESTATE ( Schedut _e E) : . . . . 50. 00

RENT/RoYALTY/PARTNERSHIP/ESTATE (schedul e

E)

pER

CoMpIITER: ...50.00

RENT/ ROyAr , Tr y TNCOME/ LOSS

pER

COMPUTER: . . . . . 50. 00

ESTATE/ TRUST I NCOME/ LOSS

pER

COMpTTTER: . . . . 90. 00

PARTNERSHI P/ S. CORP I NCOME/ I OSS PER COMPUTER: . . . . . $O. OO

FARM I NCOME OR LOSS ( Schedu1e F) : . . . . 90. 00

FARM I NCOME OR LOSS ( Schedul e F) PER COMPI I TER: . . . 50. 00

UNEMPt OYMnf r f COMPENSATI ON: . . . . . . 91, 143. 00

TOTAI SOCI AL SECURI TY BENEFI TS: . . . . . S0. 00

TAXABLE SOCI AI , SECURI TY BENEFI TS: . . . . S0. 00

TAXABLE SOCI AL SECURI TY BENEFI TS PER COMPUTER: . . . . . . . . . S0. 00

OT ] I { E R I NCOME : . . . . . . . . . S 8 5 6 . 0 0

SCHEDI I LE EI C SE I NCOME PER COMPUTER: . . . . . . . S0. 00

SCI { EDULE EI C EARNED I NCOME PER COMPUTER: . - - - . . . . S0. 00

SCH EI C DI SQUAL I FI ED I NC COMPUTER: . . . . . . . . g 0 . 0 0

T OT A L I NCOME : . - . . . . . 9 1 8 , 5 4 6 . 0 0

TOTAT, TNCOME PER COMPI I PER: . . . .

$18, 546. 00

Adj ustments to Income

EDUCATOR EXPENSES: . 50. 00

EDUCATOR EXPENSES PER COMPI I | ER: - . . . . . $0. 00

RESERVI ST AND OTHER BUSI NESS EXPENSE: . . . . . . $0. 00

HEALTH SAVI NGS ACCT DEDUCTI ON: . .

. . . . . g0. 00

HEALTH SAVINGS AccT DEDUCTTON

pER

COMpTR:

.$O.OO

MOV T NG E X P E NS E S : F 3 9 0 3 :

. . . . . 9 0 . 0 0

SELF EMPLOYMENT TAX DEDUCTI ON:

. . . . . g0. 00

SEI JF EMPI JOYMENT TAX DEDUCTI ON

pER

COMPI I TER: . . . .

. . $0. 00

KEOGH/ SEP CONTRI BUTI ON DEDUCTI ON:

. $O. OO

SELF- EMP HEALT' I I I NS DEDUCTI ON: . . .

. $0. 00

EARI Y Wf THDRAWAL OF SAVI NGS PENAI , Ty:

. . . . . . $0. 00

A],IMONY PAID SSN:

AL I MONY PAI D: .

. . g 0 . 0 0

I RA DE DUCT I ON: . . -

. . . . 9 0 . 0 0

I RA DEDUCTI ON PER COMPI I TER:

. . 90. 00

STUDENT L OAN I NTEREST DEDUCTI ON: - . . . .

. . . . . 5 0 . 0 0

STUDENT LOAN I NTEREST DEDUCTI ON

pER

COMPUTER: . . . .

. . . . . . $0. 00

TUI TI ON AND FEES DEDUCTI ON:

. . . . 90. 00

TUTTI ON AND FEES DEDUCTI ON pER

COMPI TTER: . . . .

. . . . . g0. 00

, JURY DI J| Y PAY DEDUCTTON: . . .

. . $0. 00

DOMESTI C PRODUCTI ON ACTI VI TI ES DEDUCTI ON:

. $0. 00

OTHER ADJ USTMENTS:

. . . . . $ 0 . 0 0

ARCHER MSA DEDUCTI ON: . . .

. . . $ 0 . 0 0

ARCHER MSA DEDUCTIoN PER COMpUTER:

.$O.OO

TOTAI AD, J USTMENTS] . . . . .

. $ O. o O

TOTAL AD, J USTMENTS PER COMPI I 1 | ER: . . . .

. . . . . . g 0 . 0 0

A DWS T E D GROS S I Nc o ME : . . . .

. . . . . $ 1 8 , 6 4 6 . 0 0

AD, JUSTED GROSS I NCOME PER COMPTI TER: . . .

. . . . 519, 645. 00

Tax and Credi ts

6 5 - OR- OV E R:

. . . . . . . . NO

B L f ND:

. . . . . No

S P OUS E 6 5 - OR- OV E R:

. . . . . . NO

S P OUS E B T I ND:

. . . . . . . NO

STANDARD DEDUCTION PER COMPUIER: . . . .

$6, 100. OO

ADDI TI ONAI , STANDARD DEDUCTI ON

pER

COMPI JTER: . . . -

. . . . . $0. 00

TAX TABLE I NCOME

pER

COMpl r r ER: . . . .

. . 912, 5A6. 00

EXEMPTI ON AMOUNT

p ER

COMPUTER: . . . .

. . . . +: . g o o . o o

TAXABL E I NCOME:

. . . $ e , e +e . OO

TAXABLE f NCOME PER COMPI I | ER: . . . .

$e, eae. OO

TOTATJ POSTTI VE TNCOME

p ER

COMPUTER: . . . .

. . . . . Si e , 5 4 6 . 0 0

T E NT A T I V E T A X : . .

. . . . . 5 9 6 3 . 0 0

TENTATTVE TAX PER COMPUTER:

g853.00

FORM 881-4 ADDITTONAL TAX AMOUNT:

. . . $0. OO

TAX ON I NCOME LESS SOC SEC I NCOME

pER

COMPI I f ER: . . . .

. $0. 00

FORM 6 2 5 1 AL TERNATI VE MI NI MUM TAX: . .

. . . . . $ 0 . 0 0

FORM 6251 AITERNATIVE MINIMLM TAX

pER

COMpIJTER:

..$0.00

FOREI GN TAX CREDI T:

. . . g0. 00

FOREI GN TAX CREDI T PER COMPU: [ ER: . . . .

. . . . . . S0 . 0 0

FOREI GN I NCOI { E EXCLUSI ON

pER

COMP{ I | ER: . . . .

. . . . $0. 00

FOREI GN I NCOME EXCLUSI ON TAX PER COMpI I | ER:

. . . . . . $0. 00

CHr L D & DEPENDENT CARE CREDTT: . . . . .

. . $ 0 . 0 0

CHI LD & DEPENDENT CARE CREDI T

pER

COMPUTER: . . . .

. . $O. OO

CREDI T FOR EL DERL Y AND DI SABL ED: . . . .

. . . . $ 0 . 0 0

CREDI T FOR EL DERL Y AND DI SABL ED

p ER

COMPI I TER: . . .

. . . . . . $ 0 . 0 0

E DUCA T T ON CRE DI T :

. . . . . . 9 0 . 0 0

EDUCATI ON CREDI T PER COMPI I TER: . . . .

. . . 90. 00

GROSS EDUCATI ON CREDTT PER COMPI I TER: . . . .

. . . $0. 00

RETI REMEN| SAVI NGS CMTRB CREDI T: . . . .

. . . . $0. 00

RETI REMEMT SAVI NGS CNTRB CREDI T

pER

COMPI I | ER: . . .

. . . . , g0. 00

PRI M RET SAV CNTRB: F8 8 8 0 L NGA:

. . . . . $ 0 . 0 0

SEC RET SAV CNTRB: F8880 LN6B:

. $O. Oo

TOTAI RETf REMEN| SAVI NGS CONTRI BI I TI ON: F8BB0 CMpTR:

. . $0. 00

RESI DENTI AL ENERGY CREDI T:

. . . . $0. 00

RESI DENTI AI , ENERGY CREDI T PER COMPI I | ER: . . . .

. . . . . . g0. 00

CHI LD TAX CREDI T:

. S0. 00

CHI L D TAX CREDI T PER COMPUTER: . . . .

. . . $ 0 . 0 0

A DOP T I ON CRE DI T : F 8 8 3 9 :

. . . . . . $ 0 . 0 0

ADOPTI ON CREDI T PER COMPI I | ER: . . . .

. . . . 5 0 . 0 0

FORM 8839 REFUND ADOPTI ON CREDI T AMOUNT:

. . g0. 00

DC LST TI ME HOMEBI I YERS CREDI T:

. . . .

g0. 00

DC L5T TIME HOMEBUYERS CREDIT

pER

COMprrrER: . . . .

. . $0.00

FORM 8396 MORTGAGE CERTIFICATE CREDIT:

. . . . F0.00

FORM 8396 MORTGAGE CERTI FI CATE CREDI T

pER

COMPI I TER: . . . .

. . . . . . g0. 00

F3800, F8801 AND OTTTER CREDI T AMOUNT:

. . . . . $0. 00

FORM 3800 GENERAL BUSI NESS CREDI TS:

. $0. 00

FORM 3800 GENERAL BUSINESS CREDITS

pER

COMPIITER: . . . . .

$0.00

PRI OR YR Mf N TAX CREDI T: F8 8 0 j - :

. . . . . 9 0 . 0 0

PRI OR YR MI N TAx CREDI T: F8801 PER CoMPLI I | ER:

. . . . * o. oo

F8834 ELECTRI C VEHI CI JE CREDI T AMOI I NT:

. . . . $0. 00

F8935 ELECTRTC MOTOR VEHI CLE CREDI T AMOUI i I F:

. . . $0. 00

F89l - 0 AI , TERNATI VE MOTOR VEHf CI , E CREDf T AMOI TNT:

. . . $0. 00

9I I TI 9l I Pl : : ' "'

. so. oo

r v r , * L K E U T I D : . . .

. $ 0 . 0 0

TOTAI, CREDITS PER CoMPII|ER:

. .

g0.00

I NCOME TAX AFTER CREDI TS

pER

COMPUTER: . . . .

. . . . S8G3. 00

Other Taxes

s E T A X :

. . . . $ o . o o

S E T A X P E R COMP I I | E R: . . . .

. . . . $ 0 . 0 0

SOCI AI SECURI TY AND MEDI CARE TAX ON UNREPORTED TI pS: .

. . $0. 00

socrAl , SECURTTY AND MEDTCARE TAx oN IINREPORTED Trps

pER

coMpurER: ..$o.oo

TAx oN QUALI FI ED

PLANS F5329

( PR) : . .

' ' $27

' 00

TAX ON QUA] , I FI ED

PI , ANS F5329 PER COMPUTER: . . . .

. $27. 00

I RAF TAX PER COMPUTER: . . . . " $ 0 ' 0 0

TP TAX FIGURES

(REDUCED BY IRAF) PER COMPIITER: . . . . . . $89O. OO

I MF TOTA! TAx

( REDUCED BY I RAF) PER COMPI I TER: . - - -

" " $890' 00

'

OTHER TAXES PER COMPUI ER: " "

' $0' 00

UNPAI D FI CA ON REPORTED TI PS: .

' ' ' ' $ 0 ' 0 0

o r HE R T A X E S : ' " " " $ o ' o o

RECAPTURE TAX: F8 5 l - L : . . . . . "

' $ 0 ' 0 0

HOUSEHOLD EMPLOYMEN| TAXES:

' $0' 00

HOUSEHOLD EMPLOYMENT TAXES PER COMPII|ER: "

' $0' 00

RECAPTURE TAXES:

' $0' 00

TOTAI ASSESSMEI { I PER COMPTJI ER; "

' $890' 00

TOTAL TAX LIABILITIT TP FIGURES:

' ' ' $890

' 00

TOTAI , TAX LI ABI LI TY TP FI GURES PER COMPI I : | ER: - . . .

" "$890' 00

PaymenEs

FEDERAL I NCOME TAX WI TI 1HELD: . . . .

' $1, 489' 00

COBRA PREMf UM SLI BSI DY: "$0' 00

ESTI MATED TAx PAYMENTS: . . . .

' $0' 00

OTHER PAYMENT CREDI T:

' $0' 00

MAKI NG WORK PAY AND GOV' T RET CREDI T PER COMPUTER: - . . .

' $0' 00

REFUNDABLE EDUCATION CREDIT: "$0' 00

REFUNDABLE EDUCATI ON CREDI T PER COMPI I I ER: . . . . " "$0' 00

REFUNDABLE EDUCATfON CREDIT VERIFIED: " "$0' 00

EARNED I NCOME CREDI T: "

' $0' 00

EARNED I NCOME CREDI T PER COMPUTER: . . . .

. ' ' $0' 00

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY:..

"

' $0' 00

SCHEDIJLE 8812 NONTAXABLE COMBAT PAY:. -

"$0' 00

EXCESS SOCI AL SECURI TY & RRTA TAX WI THHELD: . . . . . " " " $0' 00

scHEDUr , E 8812 TOT SS/ MEDTCARE WTTHHELD:

. . - . $0- 00

SCHEDULE 8812 ADDI TI ONAL CHf LD TAX CREDI T: " "$0' 00

SCEEDULE 8812 ADDITIONAL CHILD TAx CREDIT PER COMPUTER:

" " "$0' 00

SCHEDULE 881- 2 ADDI TI ONAL CHI LD TAX CREDI T VERI FI ED:

" "$0' 00

AMOUNT PAI D WI TH FORM 4 8 6 8 : . . . . . " " $ 0 ' 0 0

FORM 2439 REGITLATED INVESTMENT COMPANY CREDIT: "

' $0' 00

FORM 4136 CREDI T FOR FEDERAL TAx ON FUELS: "

' $0' 00

FORM 4135 CREDI T FOR FEDERAL TAX ON FUELS PER COMPUTER:

""' $0' 00

HEALTH COVERAGE TX CR: F8885:

' '

$0

' 00

FORM 8801 REFI JNDABLE CREDI T FOR PRI OR YEAR MI N. TAX: . '

" "

' $0' 00

FI RST TI ME HOME BI r yER CREDI T PER COMPI I TER: - . . . " ' $0' 00

FI RST TI ME HOME B{ f vER CREDI T: " " "$0' 00

FI RST TI ME HOME BUYER CREDI T VERI FI ED: "

' $0' 00

PRIMARY NAP FIRST TIME HOME BUYER INSTAI,LMENT AMT:

" "$0' 00

SECONDARY NAP FIRST TIME HOME BITYER INSTALLMEMT AMT:

"' $0' 00

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNI: "

' $0' 00

FORM 25s5 COMBINED EARNED INCOME AMOIJI{T PER COMPIITER:.

"' "

' $0' 00

FORM 5405 TOTAL HOMEBUYERS CREDI T REPAYMENT PER COMPUTER: ""

"""$0' 00

SMALL EMPI , OYER I I EALTH I NSURANCE PER COMPUTER: . - - - """$0' 00

SMALJ, EMPLOYER HEALr I I I NSI ] RANCE PER COMPUTER

( 2) : . . . . $O. OO

FORM 2439, 8801, and OTHER CREDI T TOTAL AMf : - - . ' $0' 00

Tor Ar ' PAYMENTS: "

' $1' 489' oo

TOTAL PAYMENTS PER COMPUTER: "$1, 489' 00

Refund or Amount Owed

REFUND AMo u NT: " " ' $ - 5 9 9 ' o o

APPLI ED TO NEXT YEi AR' S ESTI MATED TAX: . .

" "$0' 00

ESTI MATED TAX PENATTY: . . . . . " " " $ 0 ' 0 0

TAX ON I NCOME LESS STATE REFUND PER COMPU1I ER: . . - - " " $0' 00

BAI , DUE/ OVER PYMI USI NG TP FI G PER COMPUTER:

. . $_599. 00

BAL DUE/ OVER PYMT USI NG COMPI I TER FI GURES: . . . . . .

" " ' $- 599' 00

FORM 8888 TOTAI REFUND PER COMPII|ER: - . . .

"

$0

' 00

Thi rd Party Desi gi nee

THIRD PARTY DESIGNEE ID NIJMBER:

AI I THORI ZATI ON I NDI CATOR: . . . . " " " " " 0

THIRD PARTY DESIGNEE NAME:.

Form 8863

-

Educati on Credi ts

(Hope and Li feti me Learni ng credi Ls)

PART III

.

AL],OWABIE EDUCATION CREDITS

GROSS EDUCATI ON CR PER COMPUTER: . . . . " " $0' 00

TOTAL EDUCATI ON CREDI T AMOUNT: " ' " ' $0' 00

TOTAL EDUCATI ON CREDI T AMOUI { : I PER COMPUTER: . . . . ""' $0' 00

Thi s Product Contai ns Sensi ti ve Taxpayer Data

Anda mungkin juga menyukai

- Accepted For Value-State Home Mtg.Dokumen14 halamanAccepted For Value-State Home Mtg.Tiyemerenaset Ma'at El98% (61)

- Selection 26 144Dokumen1 halamanSelection 26 144Anonymous fu1jUQBelum ada peringkat

- W21225760934 0 PDFDokumen2 halamanW21225760934 0 PDFAnonymous czHLQeLPB4Belum ada peringkat

- Tax InfoDokumen5 halamanTax InfoAdoumbia100% (1)

- They Know All Your SecretsDokumen45 halamanThey Know All Your Secretsbexposito5272100% (1)

- Dan Simon 2016 W2 PDFDokumen2 halamanDan Simon 2016 W2 PDFAnonymous ndTTXL80MnBelum ada peringkat

- 20 TR 08894502584200889450Dokumen2 halaman20 TR 08894502584200889450Josh JasperBelum ada peringkat

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Dokumen3 halamanAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisBelum ada peringkat

- Sally W Emanual 2008 Tax ReturnDokumen5 halamanSally W Emanual 2008 Tax ReturnJackie Page100% (2)

- TAXES w2 REGAL HospitalityDokumen2 halamanTAXES w2 REGAL Hospitalityoskar_herrera2012Belum ada peringkat

- Edgar JDokumen2 halamanEdgar Japi-585014034Belum ada peringkat

- Tax 2020 PDFDokumen7 halamanTax 2020 PDFAshley Morales100% (4)

- F 1040Dokumen2 halamanF 1040Kevin RowanBelum ada peringkat

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyBelum ada peringkat

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDokumen2 halamanW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Dokumen8 halamanJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- DDDDDokumen21 halamanDDDDRed Rapture67% (3)

- Income Tax Return For Single and Joint Filers With No DependentsDokumen3 halamanIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンBelum ada peringkat

- I Pay Statements ServncoDokumen2 halamanI Pay Statements ServncoPablito Padilla100% (2)

- Resume of Msnetty42Dokumen2 halamanResume of Msnetty42api-25122959Belum ada peringkat

- 2019 TaxReturn PDFDokumen6 halaman2019 TaxReturn PDFdavid barrow100% (2)

- Javier A Valdez 2107 BAMBOO ST. Mesquite TX 75150Dokumen2 halamanJavier A Valdez 2107 BAMBOO ST. Mesquite TX 75150javiercreatesBelum ada peringkat

- 2018 Federal Income Tax Return PDFDokumen8 halaman2018 Federal Income Tax Return PDFBrandon BachBelum ada peringkat

- 2014 TaxReturnDokumen25 halaman2014 TaxReturnNguyen Vu CongBelum ada peringkat

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDokumen6 halamanDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Dokumen2 halamanFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- Week 2 Form 1040Dokumen2 halamanWeek 2 Form 1040Linda100% (2)

- StatementDokumen2 halamanStatementLuis HarrisonBelum ada peringkat

- Joijamison 2019taxes PDFDokumen26 halamanJoijamison 2019taxes PDFrose ownes100% (1)

- TaxReturn PDFDokumen7 halamanTaxReturn PDFChristine WillisBelum ada peringkat

- Evans W-2sDokumen2 halamanEvans W-2sAlmaBelum ada peringkat

- Langford Market Corp Form W-2Dokumen4 halamanLangford Market Corp Form W-2sohcuteBelum ada peringkat

- FTF 2019-05-02 1556819863569 PDFDokumen5 halamanFTF 2019-05-02 1556819863569 PDFWilliam Davis0% (1)

- 120s Az FormDokumen19 halaman120s Az FormStacey CanaleBelum ada peringkat

- W2 2010Dokumen2 halamanW2 2010Rick Nunns100% (2)

- W2INTRV112312011Dokumen4 halamanW2INTRV112312011Scott Harrison0% (1)

- U.S. Individual Income Tax Return: Filing StatusDokumen2 halamanU.S. Individual Income Tax Return: Filing Statusapi-581728153Belum ada peringkat

- 2018 TaxReturn PDFDokumen6 halaman2018 TaxReturn PDFDavid LeeBelum ada peringkat

- Rangel Taxes 2019Dokumen38 halamanRangel Taxes 2019Josue Perez VelezBelum ada peringkat

- U.S. Individual Income Tax Return: Filing StatusDokumen2 halamanU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- File by Mail Instructions For Your 2009 Federal Tax ReturnDokumen11 halamanFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeBelum ada peringkat

- SC Tax ReturnDokumen12 halamanSC Tax ReturnCeleste KatzBelum ada peringkat

- Amara Enyia's 2017 Tax ReturnDokumen4 halamanAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Dokumen2 halamanFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waitesBelum ada peringkat

- A082000109a0298508172c001c: Contact InformationDokumen1 halamanA082000109a0298508172c001c: Contact InformationYudo KunaBelum ada peringkat

- 2014 Turbo Tax ReturnDokumen85 halaman2014 Turbo Tax ReturnBrayan Picoy ValerioBelum ada peringkat

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen10 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyBelum ada peringkat

- Federal Electronic Filing Instructions: Tax Year 2018Dokumen13 halamanFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielBelum ada peringkat

- Unknown PDFDokumen4 halamanUnknown PDFomar hernandezBelum ada peringkat

- 1st A - Speech Flowchart # CasesDokumen2 halaman1st A - Speech Flowchart # Casessmuldersam100% (1)

- 2019 Louisiana Resident - 2DDokumen4 halaman2019 Louisiana Resident - 2Djamo christine100% (1)

- W-2 Preview ADPDokumen4 halamanW-2 Preview ADPRyan AllenBelum ada peringkat

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokumen8 halamanFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiBelum ada peringkat

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Dokumen21 halamanSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- Marylynn Huggins - Clifden Ut State Tax Return 2013Dokumen4 halamanMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- Taxes Amy PDFDokumen7 halamanTaxes Amy PDFJsjs JsjsjjshshBelum ada peringkat

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDokumen1 halamanForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordssageBelum ada peringkat

- US Vs Tamparong Case DigestDokumen1 halamanUS Vs Tamparong Case DigestKurt Young100% (2)

- J. German Benitez-Lopez, A092 298 255 (BIA May 29, 2014)Dokumen5 halamanJ. German Benitez-Lopez, A092 298 255 (BIA May 29, 2014)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDari EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeBelum ada peringkat

- Cres Fy2016 990Dokumen38 halamanCres Fy2016 990Lachlan MarkayBelum ada peringkat

- Dependent Student SheetDokumen4 halamanDependent Student SheetMaria GomezBelum ada peringkat

- US Tax ReturnDokumen13 halamanUS Tax Returnjamo christineBelum ada peringkat

- Yes. N.D: SJGNED "" - G - "'L - "Dokumen13 halamanYes. N.D: SJGNED "" - G - "'L - "Chapter 11 DocketsBelum ada peringkat

- Executive Order 11850 PDFDokumen2 halamanExecutive Order 11850 PDFBarbaraBelum ada peringkat

- Robert Mitchell v. Warden of Broad River, 4th Cir. (2013)Dokumen4 halamanRobert Mitchell v. Warden of Broad River, 4th Cir. (2013)Scribd Government DocsBelum ada peringkat

- In Re Grand Jury Subpoena. Donald I. Bierman, Witness-Appellee v. United States, 788 F.2d 1511, 11th Cir. (1986)Dokumen3 halamanIn Re Grand Jury Subpoena. Donald I. Bierman, Witness-Appellee v. United States, 788 F.2d 1511, 11th Cir. (1986)Scribd Government DocsBelum ada peringkat

- United States v. Kenneth Lorenzo Long, 977 F.2d 574, 4th Cir. (1992)Dokumen2 halamanUnited States v. Kenneth Lorenzo Long, 977 F.2d 574, 4th Cir. (1992)Scribd Government DocsBelum ada peringkat

- Memo of 9/11 Commission Interview of FBI Agent Doug MillerDokumen4 halamanMemo of 9/11 Commission Interview of FBI Agent Doug Miller9/11 Document ArchiveBelum ada peringkat

- United States v. Rondall Upshaw, 4th Cir. (2012)Dokumen3 halamanUnited States v. Rondall Upshaw, 4th Cir. (2012)Scribd Government DocsBelum ada peringkat

- Executive Order 13037 March 3 1997 Commission To Study Capital BudgetingDokumen2 halamanExecutive Order 13037 March 3 1997 Commission To Study Capital BudgetingApril ClayBelum ada peringkat

- FJCC Aocandconstitution c15 ActivityformDokumen1 halamanFJCC Aocandconstitution c15 ActivityformGrant NaillingBelum ada peringkat

- United States v. Ronnie Rainey, 4th Cir. (2015)Dokumen3 halamanUnited States v. Ronnie Rainey, 4th Cir. (2015)Scribd Government DocsBelum ada peringkat

- Kevin Weeks v. Social Security Administration Commissioner, 230 F.3d 6, 1st Cir. (2000)Dokumen3 halamanKevin Weeks v. Social Security Administration Commissioner, 230 F.3d 6, 1st Cir. (2000)Scribd Government DocsBelum ada peringkat

- M-K-S-T-, AXXX XXX 711 (BIA Nov. 30, 2015)Dokumen8 halamanM-K-S-T-, AXXX XXX 711 (BIA Nov. 30, 2015)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat

- Frank Cote v. Kenneth J. Seaman, 625 F.2d 1, 1st Cir. (1980)Dokumen2 halamanFrank Cote v. Kenneth J. Seaman, 625 F.2d 1, 1st Cir. (1980)Scribd Government DocsBelum ada peringkat

- Cir Vs Victorias Milling CoDokumen2 halamanCir Vs Victorias Milling ConazhBelum ada peringkat

- Rappahannock, Virginia - Request To Join ICE 287 (G) ProgramDokumen1 halamanRappahannock, Virginia - Request To Join ICE 287 (G) ProgramJ CoxBelum ada peringkat

- United States v. Soltero Lopez, 1st Cir. (1993)Dokumen9 halamanUnited States v. Soltero Lopez, 1st Cir. (1993)Scribd Government DocsBelum ada peringkat

- United States v. John James Brennan, Patrick Dello Russo, John Fusco and Solomon Kimmel, 394 F.2d 151, 2d Cir. (1968)Dokumen3 halamanUnited States v. John James Brennan, Patrick Dello Russo, John Fusco and Solomon Kimmel, 394 F.2d 151, 2d Cir. (1968)Scribd Government DocsBelum ada peringkat

- United States v. George Crute, III, 3rd Cir. (2012)Dokumen5 halamanUnited States v. George Crute, III, 3rd Cir. (2012)Scribd Government DocsBelum ada peringkat

- Proposed Rule: Low Income Housing: Housing Assistance Payments (Section 8) — Expiring Section 8 Project-Based Assistance Contracts RenewalDokumen5 halamanProposed Rule: Low Income Housing: Housing Assistance Payments (Section 8) — Expiring Section 8 Project-Based Assistance Contracts RenewalJustia.com100% (1)

- Fair Housing Act Guidelines PDFDokumen2 halamanFair Housing Act Guidelines PDFDerrickBelum ada peringkat

- 193 Myers V USDokumen2 halaman193 Myers V USannamariepagtabunanBelum ada peringkat

- United States v. James Bailey, JR., 4th Cir. (2015)Dokumen4 halamanUnited States v. James Bailey, JR., 4th Cir. (2015)Scribd Government DocsBelum ada peringkat

- Anthony R. Hambsch, III v. United States, 490 U.S. 1054 (1989)Dokumen5 halamanAnthony R. Hambsch, III v. United States, 490 U.S. 1054 (1989)Scribd Government DocsBelum ada peringkat

- National Broadcasting Co., Inc. and Chronicle Publishing Co., Petitioners, v. Olivia NIEMI, A Minor, by and Through Her Guardian Ad Litem. No. A-652Dokumen3 halamanNational Broadcasting Co., Inc. and Chronicle Publishing Co., Petitioners, v. Olivia NIEMI, A Minor, by and Through Her Guardian Ad Litem. No. A-652Scribd Government DocsBelum ada peringkat

- United States v. Greer, 4th Cir. (2007)Dokumen3 halamanUnited States v. Greer, 4th Cir. (2007)Scribd Government DocsBelum ada peringkat

- Affsuppafm 062706Dokumen27 halamanAffsuppafm 062706Jun BaguiosBelum ada peringkat

- Victor Maya Lopez, A201 177 467 (BIA Mar. 26, 2014)Dokumen4 halamanVictor Maya Lopez, A201 177 467 (BIA Mar. 26, 2014)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat